Professional Documents

Culture Documents

Independent Work For Econometrics: Student: Zehra Memmedzade Group: 1045

Uploaded by

Zəhra MəmmədzadəOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Independent Work For Econometrics: Student: Zehra Memmedzade Group: 1045

Uploaded by

Zəhra MəmmədzadəCopyright:

Available Formats

Student: Zehra Memmedzade

Group: 1045

Independent work for Econometrics

1. Take any variables (being economically related is preferred) – Y, X1, X2 and

X3. Note that Y will be your dependent variable. The data can be either cross-

sectional or time series but, number of observations must be greater than 30.

You can take any country, region, company or institution.

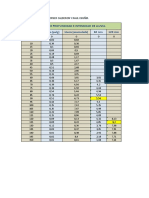

My research will be based on time-series data. Here dependent variable is GDP of France

from 1980 to 2018. İndependent variables are capital investment as percentage of GDP,

inflation rate, population growth. Number of observations is 39.

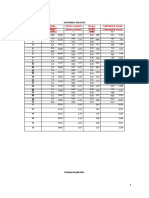

GDP of Capital investment as % of Inflation Population growth

Year France(billions) GDP % %

1980 701,29 25,75 13,6 0,44

1981 615,55 23,52 13,3 0,49

1982 584,88 23,8 12 0,52

1983 559,87 21,75 9,5 0,55

1984 530,68 21,23 7,7 0,56

1985 553,14 21,17 5,8 0,56

1986 771,47 21,76 2,5 0,57

1987 934,17 22,26 3,3 0,57

1988 1018,85 23,34 2,7 0,56

1989 1025,21 24,27 3,5 0,54

1990 1269,18 24,41 3,2 0,51

1991 1269,28 23,6 3,2 0,55

1992 1401,47 21,96 2,4 0,5

1993 1322,82 19,54 2,1 0,43

1994 1393,98 20,32 1,7 0,37

1995 1601,09 20,51 1,8 0,36

1996 1605,68 19,62 2 0,35

1997 1452,88 19,45 1,2 0,35

1998 1503,11 20,68 0,7 0,37

1999 1492,65 21,36 0,5 0,51

2000 1362,25 22,49 1,7 0,68

2001 1376,47 22,16 1,6 0,73

2002 1494,29 21,32 1,9 0,73

2003 1840,48 21,19 2,1 0,71

2004 2115,74 21,89 2,1 0,74

2005 2196,13 22,45 1,7 0,75

2006 2318,59 23,24 1,7 0,7

2007 2657,21 24,16 1,5 0,62

2008 2918,38 24,13 2,8 0,56

2009 2690,22 21,33 0,1 0,51

2010 2642,61 21,95 1,5 0,49

2011 2861,41 23,22 2,1 0,48

2012 2683,83 22,63 2 0,48

2013 2811,08 22,29 0,9 0,51

2014 2852,17 22,71 0,5 0,47

2015 2438,21 22,71 0 0,36

2016 2471,29 22,61 0,2 0,26

2017 2586,29 23,37 1 0,22

2018 2777,54 23,46 1,9 0,17

2. You will estimate two different models by using E-views. In each model there

must be at least one “log” and one “lin” independent variable:

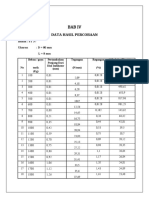

Dependent Variable: LOG(GDP_OF_FRANCE_IN_BILLION)

Method: Least Squares

Date: 05/22/20 Time: 03:30

Sample: 1980 2018

Included observations: 39

Variable Coefficient Std. Error t-Statistic Prob.

C 5.012017 0.835624 5.997930 0.0000

CAPITAL_INVESTMENT_AS

___ 0.133418 0.037830 3.526801 0.0012

INFLATION -0.136660 0.015785 -8.657838 0.0000

POPULATION_GROWTH___ -0.488516 0.360265 -1.355989 0.1838

R-squared 0.690607 Mean dependent var 7.318038

Adjusted R-squared 0.664088 S.D. dependent var 0.538623

S.E. of regression 0.312175 Akaike info criterion 0.606408

Sum squared resid 3.410861 Schwarz criterion 0.777030

Log likelihood -7.824961 Hannan-Quinn criter. 0.667626

F-statistic 26.04157 Durbin-Watson stat 0.255559

Prob(F-statistic) 0.000000

My first model is: LOG (GDP_OF_FRANCE_IN_BILLION) = 5.012017+ 0.133418 *

CAPITAL_INVESTMENT_AS___ -0.136660 * INFLATION -0.488516 *

POPULATION_GROWTH___

C = 5.012017

B1 = 0.133418

B2 = -0.136660

B3 = -0.488516

3. Interpretation of regression parameters and goodness-of-fit.

B1 = 0.133418. It means 1unit increase in capital investment per capita will cause 13.3418%

increase in GDP of France, while holding other factors fixed, in average. It is log-lin relationship.

B2 = -0.136660. It means 1% increase in inflation rate will cause 13.6660% decrease in

France’s GDP, while holding other factors fixed, in average. It is log-lin relationship.

B3= -0.488516. It means 1% increase in population growth will cause 48.8516% decrease in

France’s GDP, while holding other factors fixed, in average. It is log-lin relationship.

Goodness-of-FIT = 0.690607. It indicates that if we show percentage that 69.0607%. Therefore,

it means that 69.0607% of Dependent variable is explained by independent variables. If it is

close to 100%, it means that dependent variable is explained by independent variables so well

Dependent Variable: GDP_OF_FRANCE_IN_BILLION

Method: Least Squares

Date: 05/22/20 Time: 18:11

Sample: 1980 2018

Included observations: 39

Variable Coefficient Std. Error t-Statistic Prob.

C -12826.97 4404.537 -2.912218 0.0062

LOG(CAPITAL_INVESTMENT_AS

___) 5018.544 1433.501 3.500900 0.0013

INFLATION -178.4109 26.94292 -6.621810 0.0000

POPULATION_GROWTH___ -950.9765 618.8819 -1.536604 0.1334

R-squared 0.580492 Mean dependent var 1710.293

Adjusted R-squared 0.544534 S.D. dependent var 793.6983

S.E. of regression 535.6530 Akaike info criterion 15.50176

Sum squared resid 10042344 Schwarz criterion 15.67239

Log likelihood -298.2844 Hannan-Quinn criter. 15.56298

F-statistic 16.14366 Durbin-Watson stat 0.239371

Prob(F-statistic) 0.000001

My second model is: GDP_OF_FRANCE_IN_BILLION = -12826.97 + 5018.544 *

LOG(CAPITAL_INVESTMENT_AS___) -178.4109 * INFLATION -950.9765 *

POPULATION_GROWTH___

C= -12826.97

B1= 5018.544. It means, when capital investment increase 1 unit, GDP will increase 50.18544

units, while holding other factors fixed, in average. It is lin-log relationship.

B2= -178.4109. It means, when inflation rate increase 1%, GDP will decrease 178.4109 $, while

holding other factors fixed, in average. It is lin-lin relationship.

B3= -950.9765. It means, when population growth increase 1%, GDP will decrease 950.9765$,

while holding other factors fixed, in average. It is lin-lin relationship.

Goodness-of-FIT = 0.580492. It indicates that if we show percentage 58.0492% of France’s

GDP is explained by capital investment, inflation rate and population growth.

4. Comment on individual statistical significance of all coefficients in one model.

For the first model:

Therefore, we can test individual significance by T-test.

In our first model, t-statistical values are like this:

T-value of capital investment is 3.526801

T-value of inflation rate is -8.657838

T-value of population growth is -1.355989

a) For β 1 null hypothesis is H 0. β 1=0 means that capital investment has no effect on GDP of

France.

T=3.526801>c (critical value) at all significance levels (1%-c=2.57;5%-1.96;10%) so it is

outside of the interval, that is why, on average, while holding other factors constant, the

impact of capital investment over GDP is statistically significant. So we reject null hypothesis

at 10% of significance level.

b) For β 2 null hypothesis is H 0. β 2=0 means that inflation rate has no effect on GDP of France.

T-value of inflation rate coefficient = -8.657838

T= -8.657838 < c (critical value) at all significance levels (1%-c=2.57;5%-1.96;10%) so it is

outside of the interval, that is why, on average, while holding other factors constant, the

impact of inflation rate over GDP is statistically significant. So we reject null hypothesis at

10% of significance level.

c) T-value of population growth coefficient = -1.355989

At 1% level of significance, while holding other factors fixed, on average, we fail to reject null

hypothesis. -2,57<t<2.57, that is why on average while holding other factors fixed, the impact of

population growth over GDP is statistically insignificant.

At 5% level of significance, while holding other factors fixed, on average, we fail to reject null

hypothesis. -1,96<t<1,96 that is why on average while holding other factors fixed, the impact of

over population growth GDP is statistically insignificant.

5. Comment on joint significance of the variables in one model. Test overall

significance as well as significance of joint impact of “ X 1 and X 2 ”, “ X 1 and X 3 ”,

and “ X 2 and X 3 ”. Show clearly what your null hypothesis is, and why the

impact is “statistically significant” or “insignificant”.

To test significance of joint impact of all independent variables, we look at F (probability).

a) My first model is: LOG (GDP_OF_FRANCE_IN_BILLION) = 5.012017+ 0.133418 *

CAPITAL_INVESTMENT_AS___ -0.136660 * INFLATION -0.488516 *

POPULATION_GROWTH___

b) All variables: Null Hypothesis is that joint impact of all independent variables is

statistically insignificant. So:

H 0 :α 1=α 2=α 3 =0

H 1 : at least one is n' t 0

Dependent Variable: LOG(GDP_OF_FRANCE_IN_BILLION)

Method: Least Squares

Date: 05/22/20 Time: 03:30

Sample: 1980 2018

Included observations: 39

Variable Coefficient Std. Error t-Statistic Prob.

C 5.012017 0.835624 5.997930 0.0000

CAPITAL_INVESTMENT_

AS___ 0.133418 0.037830 3.526801 0.0012

INFLATION -0.136660 0.015785 -8.657838 0.0000

POPULATION_GROWTH

___ -0.488516 0.360265 -1.355989 0.1838

R-squared 0.690607 Mean dependent var 7.318038

Adjusted R-squared 0.664088 S.D. dependent var 0.538623

S.E. of regression 0.312175 Akaike info criterion 0.606408

Sum squared resid 3.410861 Schwarz criterion 0.777030

Log likelihood -7.824961 Hannan-Quinn criter. 0.667626

F-statistic 26.04157 Durbin-Watson stat 0.255559

Prob(F-statistic) 0.000000

To test the joint significance of all variables. According to this test we see that the F-statistics

probability is 0.000000%.

So, we reject Null Hypothesis at 100% confidence level, joint impact of all variables is significant

at 100% confidence level. It also means all variables are statistically significant

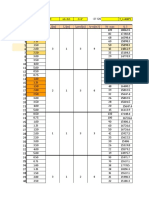

1) X 1 and X 2 - Null Hypothesis is that joint impact of capital investment and inflation rate is

statistically insignificant. So:

H 0 :α 1=α 2=0 H1: at least one isn’t 0

Wald Test:

Equation: Untitled

Test Statistic Value df Probability

F-statistic 37.60278 (2, 35) 0.0000

Chi-square 75.20556 2 0.0000

Null Hypothesis: C(2)=C(3)=0

Null Hypothesis Summary:

Normalized Restriction (= 0) Value Std. Err.

C(2) 0.133418 0.037830

C(3) -0.136660 0.015785

Restrictions are linear in coefficients.

From Wald test we can observe the probability of F-statistic is 0% and 0%

So, we reject Null Hypothesis at 100% confidence level, joint impact of capital investment and

inflation rate is significant at 100%confidence level. It means that these variables are

statistically significant.

2) X 2 and X 3 - Null Hypothesis is that joint impact of inflation rate and population growth is

statistically insignificant. So:

H 0 :α 2 =α 3 =0 H 1: at least one isn’t 0

Wald Test:

Equation: Untitled

Test Statistic Value df Probability

t-statistic 0.973806 35 0.3368

F-statistic 0.948298 (1, 35) 0.3368

Chi-square 0.948298 1 0.3302

Null Hypothesis: C(3)=C(4)

Null Hypothesis Summary:

Normalized Restriction (= 0) Value Std. Err.

C(3) - C(4) 0.351856 0.361320

Restrictions are linear in coefficients.

The probability of F-statistic is close to zero (0.3368) and 0%<1%

So, we reject Null Hypothesis at 99% confidence level, joint impact of inflation rate and

population growth is significant at 99%confidence level. It means that these variables are

statistically significant.

3) X 1 and X 3 Null Hypothesis is that joint impact of capital investment and population growth is

statistically insignificant. So:

H 0 :α 1=α 3 =0 H 1: at least one isn’t 0

Wald Test:

Equation: Untitled

Test Statistic Value df Probability

t-statistic 1.704390 35 0.0972

F-statistic 2.904946 (1, 35) 0.0972

Chi-square 2.904946 1 0.0883

Null Hypothesis: C(2)=C(4)

Null Hypothesis Summary:

Normalized Restriction (= 0) Value Std. Err.

C(2) - C(4) 0.621934 0.364901

Restrictions are linear in coefficients.

Again, the probability of F-statistic is close to zero and 0%<1%

So, we reject Null Hypothesis at 99% confidence level, joint impact of capital investment and

population growth is significant at 99%confidence level. It means that these variables are

statistically significant.

6) Examine whether there is functional misspecification problem in your models

or not. Do the same for one model. Show clearly what your null hypothesis is, and

provide comprehensive justification for your decision.

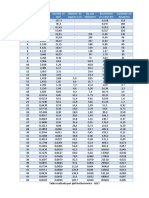

Ramsey RESET Test

Equation: UNTITLED

Specification: LOG(GDP_OF_FRANCE_IN_BILLION) C CAPITAL_INVEST

MENT_AS___ INFLATION POPULATION_GROWTH___

Omitted Variables: Squares of fitted values

Value df Probability

t-statistic 1.930008 34 0.0620

F-statistic 3.724931 (1, 34) 0.0620

Likelihood ratio 4.054465 1 0.0441

F-test summary:

Mean

Sum of Sq. df Squares

Test SSR 0.336786 1 0.336786

Restricted SSR 3.410861 35 0.097453

Unrestricted SSR 3.074075 34 0.090414

LR test summary:

Value df

Restricted LogL -7.824961 35

Unrestricted LogL -5.797728 34

Unrestricted Test Equation:

Dependent Variable: LOG(GDP_OF_FRANCE_IN_BILLION)

Method: Least Squares

Date: 05/23/20 Time: 09:33

Sample: 1980 2018

Included observations: 39

Variable Coefficient Std. Error t-Statistic Prob.

C -7.512370 6.539017 -1.148853 0.2586

CAPITAL_INVESTMENT_AS__

_ -1.110507 0.645547 -1.720257 0.0945

INFLATION 1.075322 0.628152 1.711883 0.0960

POPULATION_GROWTH___ 4.365510 2.538855 1.719480 0.0946

FITTED^2 0.633757 0.328370 1.930008 0.0620

R-squared 0.721156 Mean dependent var 7.318038

Adjusted R-squared 0.688351 S.D. dependent var 0.538623

S.E. of regression 0.300689 Akaike info criterion 0.553730

Sum squared resid 3.074075 Schwarz criterion 0.767007

Log likelihood -5.797728 Hannan-Quinn criter. 0.630252

F-statistic 21.98302 Durbin-Watson stat 0.404091

Prob(F-statistic) 0.000000

The relationship between independent and dependent variables is not always linear. To test this, we

will test it with quadratic functional form. We will also include the interaction term. Interaction basically

happens when independent variable has a different impact on the result depending on the values of

other independent variables. In order to check misspecification problem in our model we will use

Ramsey RESET Test.

H0: There is no functional form of misspecification problem

H1: there is functional form of misspecification problem

Here we need to look at the f-statistics probability which is equal to 0.0620

As our probability is less than < 0.5 it is statistically significant. So, we reject our null hypothesis H 0.

This means that, there is functional form of misspecification problem in our model.

7) Include a quadratic term (of any independent variable) to one model and interpret

the association.

Dependent Variable: LOG(GDP_OF_FRANCE_IN_BILLION)

Method: Least Squares

Date: 05/23/20 Time: 09:54

Sample: 1980 2018

Included observations: 39

Variable Coefficient Std. Error t-Statistic Prob.

C 7.424883 10.57537 0.702092 0.4874

CAPITAL_INVESTMENT_AS__

_ -0.086097 0.959786 -0.089704 0.9290

INFLATION -0.138097 0.017189 -8.033852 0.0000

POPULATION_GROWTH___ -0.458126 0.388627 -1.178833 0.2466

CAPITAL_INVESTMENT_AS__

_^2 0.004949 0.021623 0.228895 0.8203

R-squared 0.691083 Mean dependent var 7.318038

Adjusted R-squared 0.654740 S.D. dependent var 0.538623

S.E. of regression 0.316489 Akaike info criterion 0.656151

Sum squared resid 3.405613 Schwarz criterion 0.869428

Log likelihood -7.794935 Hannan-Quinn criter. 0.732673

F-statistic 19.01548 Durbin-Watson stat 0.258819

Prob(F-statistic) 0.000000

Let’s take the quadratic form of capital investment.

Model: LOG (GDP_OF_FRANCE_IN_BILLION) = 7.424883-0.086097*

CAPITAL_INVESTMENT_AS___ -0.138097 * INFLATION -0.458126 *

POPULATION_GROWTH___ + 0.004949 * CAPITAL_INVESTMENT_AS___^2

B1= -0.086097, It means 1unit increase in capital investment per capita will cause 8.6097% decrease

in GDP of France, while holding other factors fixed, in average. But probability is 0.9290 and this

number is statistically insignificant, that is why we cannot interpret the coefficient like this definitely.

8) Include an interaction term (of any independent variable) to one model and interpret

the association.

We’ll add interaction term INFLATION * POPULATION_GROWTH___

Dependent Variable: LOG(GDP_OF_FRANCE_IN_BILLION)

Method: Least Squares

Date: 05/23/20 Time: 10:21

Sample: 1980 2018

Included observations: 39

Variable Coefficient Std. Error t-Statistic Prob.

C 4.955349 0.812120 6.101749 0.0000

CAPITAL_INVESTMENT_AS___ 0.117041 0.037891 3.088893 0.0040

INFLATION 0.125260 0.149231 0.839370 0.4071

POPULATION_GROWTH___ 0.423654 0.624223 0.678690 0.5019

INFLATION*POPULATION_GROWT

H___ -0.529916 0.300326 -1.764467 0.0866

R-squared 0.716561 Mean dependent var 7.318038

Adjusted R-squared 0.683215 S.D. dependent var 0.538623

S.E. of regression 0.303157 Akaike info criterion 0.570074

Sum squared resid 3.124732 Schwarz criterion 0.783351

Log likelihood -6.116448 Hannan-Quinn criter. 0.646596

F-statistic 21.48883 Durbin-Watson stat 0.329636

Prob(F-statistic) 0.000000

Here our probability is not statistically significant with 0.0866. This means there is no interaction effect

between population growth and inflation.

You might also like

- Government Publications: Key PapersFrom EverandGovernment Publications: Key PapersBernard M. FryNo ratings yet

- Tabel CalculeDocument3 pagesTabel CalculemanoleNo ratings yet

- Uji Tarik-1 TabelDocument3 pagesUji Tarik-1 Tabeldhiezy smithNo ratings yet

- Incc-M Maio 2011Document1 pageIncc-M Maio 2011Ney Taffari VazNo ratings yet

- Book 12Document1 pageBook 12irfanNo ratings yet

- Pearl y Gompertz AlumnosDocument5 pagesPearl y Gompertz Alumnosmarco gradoNo ratings yet

- Ricky. A - (BAB I) Next-Ok!Document27 pagesRicky. A - (BAB I) Next-Ok!Yudianus SamuelNo ratings yet

- Tugas Teknik Sungai: "Perhitungan Transport Sedimen Layang Dan Sedimen Dasar Tahunan Pada Penampang Sungai Deli"Document15 pagesTugas Teknik Sungai: "Perhitungan Transport Sedimen Layang Dan Sedimen Dasar Tahunan Pada Penampang Sungai Deli"Sampoerna MildNo ratings yet

- TUGAS HIDROLOGI Gumbel Log PearsonDocument6 pagesTUGAS HIDROLOGI Gumbel Log PearsonGita ParamitaNo ratings yet

- Generar Numerso AleatoriosDocument4 pagesGenerar Numerso AleatoriosHayrton Gloria CamposNo ratings yet

- Indah Pratiwi 180407013-Tugas AdsorpsiDocument11 pagesIndah Pratiwi 180407013-Tugas Adsorpsi18-013 Indah PratiwiNo ratings yet

- Video 1 Voltaj e (V) Tiempo LN (V)Document3 pagesVideo 1 Voltaj e (V) Tiempo LN (V)Luisa Fernanda Galeano RuizNo ratings yet

- PrykRea INdicadores Avon 1.Document41 pagesPrykRea INdicadores Avon 1.Diana PalaciosNo ratings yet

- Muhammad Akbar Alviansyah - Kuis 3 MetnumDocument5 pagesMuhammad Akbar Alviansyah - Kuis 3 MetnumAkbar AlviansyahNo ratings yet

- Report Homework 1 No 8 & 11Document5 pagesReport Homework 1 No 8 & 11mrr dwi lindawatiNo ratings yet

- Notas Da Bimestral - 3º AnoDocument7 pagesNotas Da Bimestral - 3º AnoMATEUS COSTA LOUBACHNo ratings yet

- Book 1Document4 pagesBook 1irfanNo ratings yet

- Shallow Foundation Factor EU7Document3 pagesShallow Foundation Factor EU7Sokvisal MaoNo ratings yet

- Sediaan Tablet Amoksisilin Trihidrat: Formulation by DesignDocument24 pagesSediaan Tablet Amoksisilin Trihidrat: Formulation by DesignZiyad AslamNo ratings yet

- Clim DayDocument6 pagesClim Daygiacomofrancesco2016No ratings yet

- 2020-1 Diseño Flexibles, Rígidos y Articulados Monroy-Moreno-TovarDocument70 pages2020-1 Diseño Flexibles, Rígidos y Articulados Monroy-Moreno-TovarKatherin MonroyNo ratings yet

- 12Document4 pages12Angeles VirreiraNo ratings yet

- Copia de Tabla de IteracionesDocument4 pagesCopia de Tabla de IteracionesDavid SolanoNo ratings yet

- 403-General Phase Slowscan - Co - FDS - FASS - 1D - 1Document5 pages403-General Phase Slowscan - Co - FDS - FASS - 1D - 1KuthuraikaranNo ratings yet

- Steams IDocument40 pagesSteams ILoading YuriNo ratings yet

- UntitledDocument1 pageUntitledHamed basalNo ratings yet

- Espanola, Lorenzo - Linear RegressionDocument6 pagesEspanola, Lorenzo - Linear RegressionAhmed BadawiNo ratings yet

- Air Pressure, Psi XY X 2 Height of Nail Out of Board, MMDocument13 pagesAir Pressure, Psi XY X 2 Height of Nail Out of Board, MMravindra erabattiNo ratings yet

- Gabarito - 1 AP Barragens de Terra - 2021-2 - 3 QuestoDocument6 pagesGabarito - 1 AP Barragens de Terra - 2021-2 - 3 QuestoJoaquim Ferreira Costa FilhoNo ratings yet

- MSCI World Index - 1970-2017Document2 pagesMSCI World Index - 1970-2017Bogdan PușcașNo ratings yet

- Book 1Document60 pagesBook 1Evi diah phitalokANo ratings yet

- BF PresentationDocument7 pagesBF PresentationWeb NovelNo ratings yet

- N 20 Deltax 0,04 Superior 0,8 Inferior 0: F (X) 0,2+25X-200X +675X - 900X +400XDocument3 pagesN 20 Deltax 0,04 Superior 0,8 Inferior 0: F (X) 0,2+25X-200X +675X - 900X +400XDavid Leonardo OrtizNo ratings yet

- Mps Item Analysis Template TleDocument11 pagesMps Item Analysis Template TleRose Arianne DesalitNo ratings yet

- Soil Mechanics - Sample Calculations For A Sieve Analysis - University of TwenteDocument3 pagesSoil Mechanics - Sample Calculations For A Sieve Analysis - University of TwenteMaria Elena RiusNo ratings yet

- Lista 10.2023Document1 pageLista 10.2023Alin MihaiNo ratings yet

- Photoresistor:: Jurusan Fisika Fakultas Mipa Universitas Negeri SemarangDocument18 pagesPhotoresistor:: Jurusan Fisika Fakultas Mipa Universitas Negeri SemarangTito Prastyo RNo ratings yet

- Uji Normalitas: Dengan Uji Chi - KuadratDocument8 pagesUji Normalitas: Dengan Uji Chi - KuadratHendri Joyo Hadi KusumoNo ratings yet

- Mortgage Amount: Current PMT Interest Rate: Term in MonthsDocument12 pagesMortgage Amount: Current PMT Interest Rate: Term in MonthsOmer CrestianiNo ratings yet

- Suhail Assigment 1Document7 pagesSuhail Assigment 1Suhail AshrafNo ratings yet

- Tabelle Di Misura Six Team 5060Hz 2012Document2 pagesTabelle Di Misura Six Team 5060Hz 2012Cataloghi TecniciNo ratings yet

- TABELASDocument2 pagesTABELASMaicon BritoNo ratings yet

- 4-Petra - 770 South HarborDocument302 pages4-Petra - 770 South HarborJNo ratings yet

- Tablica Za Z-Vrijednosti PDFDocument1 pageTablica Za Z-Vrijednosti PDFsdbitbihacNo ratings yet

- Ce 382 HomeworkDocument4 pagesCe 382 HomeworkenesNo ratings yet

- PartyyyyDocument6 pagesPartyyyyMOH KHASAN AL FARUQ FARUQNo ratings yet

- Yc/s Yp/s Ysp/s Ym/s Yc/s (Prom)Document16 pagesYc/s Yp/s Ysp/s Ym/s Yc/s (Prom)S G.No ratings yet

- Opt. Sistem EnergiDocument8 pagesOpt. Sistem EnergiStrawwmilNo ratings yet

- Calculo Por Aproximacion Sucesiva: A M (B-A)Document24 pagesCalculo Por Aproximacion Sucesiva: A M (B-A)padmeNo ratings yet

- Calculo Por Aproximacion Sucesiva: A M (B-A)Document24 pagesCalculo Por Aproximacion Sucesiva: A M (B-A)padmeNo ratings yet

- UntitledDocument1 pageUntitledHamed basalNo ratings yet

- Ultimate Moment, Axial Load and Analysis of ColumnDocument20 pagesUltimate Moment, Axial Load and Analysis of ColumnAnggi Novi AndriNo ratings yet

- Tabla Awg by Kriss Electronics PDFDocument1 pageTabla Awg by Kriss Electronics PDFflavio5palomino5alarNo ratings yet

- Lab. ArmómicosDocument6 pagesLab. ArmómicosAlfredo Huerta ZoluagaNo ratings yet

- Tabel RDocument1 pageTabel RRico Fik UnpNo ratings yet

- Metodo CongruenciaDocument4 pagesMetodo CongruenciaLaura VivianaNo ratings yet

- Calculo de Profundidad E Intensidad de LluviaDocument3 pagesCalculo de Profundidad E Intensidad de LluviaCristhianCalderónNo ratings yet

- Universal Sompo General Insurance Co LTD: Complete Healthcare Insurance UIN: UNIHLIP21409V022021Document10 pagesUniversal Sompo General Insurance Co LTD: Complete Healthcare Insurance UIN: UNIHLIP21409V022021Naveenraj SNo ratings yet

- Serat Rayon No D (Diameter) D (Diameter) No P (Panjang) L (Lebar) PXL PXLDocument4 pagesSerat Rayon No D (Diameter) D (Diameter) No P (Panjang) L (Lebar) PXL PXLm.asepmawardiNo ratings yet

- Pardon Supervision 2017Document1 pagePardon Supervision 2017Kakal D'GreatNo ratings yet

- Slip Gauge Pg-1 PDFDocument1 pageSlip Gauge Pg-1 PDFaliNo ratings yet

- Evaluation of ITU-R Recommendation P.1546 and Consideration For New Correction FactorDocument2 pagesEvaluation of ITU-R Recommendation P.1546 and Consideration For New Correction FactoralexNo ratings yet

- Report WritingDocument34 pagesReport Writingsunru24100% (3)

- Chapter 5 Causation and Experimental DesignDocument30 pagesChapter 5 Causation and Experimental Designshanks263No ratings yet

- StatisticsDocument6 pagesStatisticsSwastik MishraNo ratings yet

- AID M AdvancedMachine WS20212022Document23 pagesAID M AdvancedMachine WS20212022HadiNo ratings yet

- Dcom203 DMGT204 Quantitative Techniques I PDFDocument320 pagesDcom203 DMGT204 Quantitative Techniques I PDFritesh MishraNo ratings yet

- Effectiveness of Mother Tongue-Based InsDocument29 pagesEffectiveness of Mother Tongue-Based InsMhelBautistaPaderesNo ratings yet

- A Proposed Model For The University Students' E-Portfolio: Omar M. K. MahasnehDocument6 pagesA Proposed Model For The University Students' E-Portfolio: Omar M. K. MahasnehAugustine DharmarajNo ratings yet

- Data Driven Approaches For Optimal Order Quantity IE-797: Submitted ByDocument76 pagesData Driven Approaches For Optimal Order Quantity IE-797: Submitted BykrishnaNo ratings yet

- MMWMini ResearchDocument2 pagesMMWMini ResearchA D. R.No ratings yet

- Eece 522 Notes - 05 CH - 3bDocument10 pagesEece 522 Notes - 05 CH - 3bkarim2005No ratings yet

- Predisposing Factors For Severe Incisor Root ResorptionDocument9 pagesPredisposing Factors For Severe Incisor Root ResorptionFace-Course RomaniaNo ratings yet

- Large-Scale Inference:: Empirical Bayes Methods For Estimation, Testing, and PredictionDocument7 pagesLarge-Scale Inference:: Empirical Bayes Methods For Estimation, Testing, and Predictionpanjc1019No ratings yet

- Probability, Statistics, and Reality: Essay Concerning The Social Dimension of ScienceDocument10 pagesProbability, Statistics, and Reality: Essay Concerning The Social Dimension of Scienceforscribd1981No ratings yet

- Chapter 2 PDFDocument13 pagesChapter 2 PDFTATATAHERNo ratings yet

- CH 01Document20 pagesCH 01HOSSEIN POORKHADEM NAMINNo ratings yet

- SHRM AnalyticsDocument8 pagesSHRM AnalyticsRaudreyNo ratings yet

- Efficiency of Image Analysis As A Direct Method in Spore Dimensions MeasurementDocument8 pagesEfficiency of Image Analysis As A Direct Method in Spore Dimensions MeasurementDr. Mustafa AlqaisiNo ratings yet

- HW1 - Problem 3.4.1: General ModelDocument6 pagesHW1 - Problem 3.4.1: General Model梁嫚芳No ratings yet

- Chapter 2 Simple Linear Regression - Jan2023Document66 pagesChapter 2 Simple Linear Regression - Jan2023Lachyn SeidovaNo ratings yet

- Factors Influencing On Consumer Buying Behaviour of Two Wheelers in Hyderabad City 1527501180Document6 pagesFactors Influencing On Consumer Buying Behaviour of Two Wheelers in Hyderabad City 1527501180Mukesh ChoudharyNo ratings yet

- Business Statistic-Correlation and RegressionDocument30 pagesBusiness Statistic-Correlation and RegressionBalasaheb ChavanNo ratings yet

- Cointegration AnalysisDocument7 pagesCointegration AnalysisJames KudrowNo ratings yet

- 12STEM3 Group5 FINALCHAPTER3Document7 pages12STEM3 Group5 FINALCHAPTER3Josh RoqueNo ratings yet

- Valores de La Función de Distribución de Poisson:: PX X e KDocument1 pageValores de La Función de Distribución de Poisson:: PX X e KRoxana MurguNo ratings yet

- Data Analytics Certification Program LearnbayDocument36 pagesData Analytics Certification Program Learnbaysaimohan SubudhiNo ratings yet

- Hypothesis Assignment FinalDocument1 pageHypothesis Assignment FinalSarah Angelica RobielosNo ratings yet

- Native and Invasive Hosts Play Different Roles in Host-Parasite NetworksDocument10 pagesNative and Invasive Hosts Play Different Roles in Host-Parasite NetworksFabíola VieiraNo ratings yet

- Chapter FsDocument93 pagesChapter FsJerome RoqueroNo ratings yet