Professional Documents

Culture Documents

7707 MYE 20-21 Grade 9 PDF

Uploaded by

Saeed MahmoodOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

7707 MYE 20-21 Grade 9 PDF

Uploaded by

Saeed MahmoodCopyright:

Available Formats

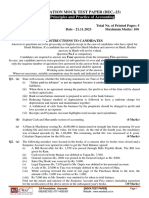

1

Beaconhouse School System

Bahria Town Senior Campus

Online December Assessments 2020

Student Name Class/ IX C

Section

Total Marks: 50

Subject: Accounting (7707) Time allowed: 1 Hour

Instructions

1. Cameras must be on.

2. Assignment must be hand written and in a single pdf file.

3. Kindly submit the assessment on time late submission would not be accepted

4. Time allowed is 1 Hour. Ten extra minutes for uploading the assignment.

5. Attempt all questions

6. Write down your Name, class and section at the top of each page of your hand written work.

BBSC-2020 Online December Assessment/Accounting 7707 IX C

2

Section A

Encircle the correct option

1. A trader prepares financial statements each year.

What do these assist the trader to do?

A calculate the amount owing to suppliers

B calculate the cash drawings

C calculate the bank balance

D make decisions about the future

2. What is the accounting equation?

A assets = capital – liabilities

B capital = assets + liabilities

C capital = assets – liabilities

D liabilities = capital + assets

3. Oliver is a trader. His ledger contain an account of Sunway Wholesalers showing a

debit balance of $6742.

What does this mean?

A Goods, $6742, are to be delivered to Oliver.

B Oliver has sent a cheque, $6742, to Sunway Wholesalers.

C Oliver owes Sunway Wholesalers $6742.

D Sunway Wholesalers owe Oliver $6742.

4. Peter is a customer of Paul. On 1 May Peter owed Paul $250.

Transactions during May were as follows.

$

sales 1470

cheques received 930

sales returns 100

What was the debit balance on Peter’s account in the books of Paul on 1 June?

A $440 B $460 C $690 D $710

5. Why does a business prepare a trial balance?

A to calculate the profit or loss

B to check the arithmetical accuracy of the ledger

C to check the cash and bank balances

D to show the financial position of the business

BBSC-2020 Online December Assessment/Accounting 7707 IX C

3

6. Tim’s gross profit was $32 000. Opening inventory was $8000, purchases were $52

000 and closing inventory was $10 000.

How much were the sales?

A $18 000 B $50 000 C $82 000 D $102 000

7. Which is a liability of a business?

A amount owing by credit customers

B amount owing to credit suppliers

C long term loan to employee

D property tax paid in advance

8. A business bought a computer for office use and paid by cheque.

How will the business record the transaction?

account to be debited account to be credited

A bank office equipment

B office equipment bank

C bank purchases

D purchases bank

9. What is prepared to show the trading results for a financial year?

A capital account

B income statement

C statement of financial position

D trial balance

10. The owner of a business takes goods for his own use.

How is this recorded?

account to be debited account to be credited

A drawings inventory

B drawings purchases

C inventory drawings

D purchases drawings

BBSC-2020 Online December Assessment/Accounting 7707 IX C

4

SECTION B

The balances given below were taken from the books of A.Arif on 1 July 2016.

$

Amna Shahbaz 1000 Cr

Fatima Tu Zahra 640 Dr

Bank 1500 Dr

Cash 150 Dr

The following transections took place during July 2016.

July 3 Bought Stationery $160 on credit from Boss Supplies.

4 Received a cheque from Fatima for the amount due.

8 Bought stationery $100 by cash

11 Bought goods on credit from Amna $840.

12 Bought stationery $ 86 by cheque.

15 Returned goods to Amna.

20 Paid Amna $550 by cheque.

23 Returned stationery worth $12 to Boss Supplies.

25 Fatima bought goods worth $ 1770 on credit.

30 Fatima Returned goods, $200

Required:

1 Prepare only the following ledger accounts and only balance the Bank Amna

Shahbaz and Fatim Tu Zahra accounts at 31 July 2016. Bring down the balances at

1 August 2016. Pay Attention to dates and details.

Cash Account

Date Detail $ Date Detail $

BBSC-2020 Online December Assessment/Accounting 7707 IX C

5

Bank Account

Date Detail $ Date Detail $

Stationery Account

Date Detail $ Date Detail $

Amna Shahbaz Account

Date Detail $ Date Detail $

BBSC-2020 Online December Assessment/Accounting 7707 IX C

6

Fatima Tu Zahra Account

Date Detail $ Date Detail $

[14]

2 (a) State two reasons why a trader may prepare a trial balance.

1 .........................................................................................................................................

............................................................................................................................................

2 .........................................................................................................................................

....................................................................................................................................... [2]

Deepa is a trader. She extracted the following balances from her books of account on

31 December 2015.

$

Fixtures and fittings 17 000

Sales 72 000

Sales returns 3 100

Purchases 36 800

Purchases returns 2 260

Drawings 5 200

Bank Overdraft 2 700

Inventory at 1 January 2015 12 450

Rent paid 2 400

Wages 21 810

Discount allowed 1 000

BBSC-2020 Online December Assessment/Accounting 7707 IX C

7

Other operating expenses 10 100

Trade Receivables 1 570

Trade Payables 4 210

Capital ?

(b) Prepare Deepa’s trial balance at 31 December 2015.

Deepa

Trial Balance at 31 December 2015

Debit Credit

$ $

[5]

BBSC-2020 Online December Assessment/Accounting 7707 IX C

8

Deepa’s inventory at 31 December 2015 was valued as $ 14 540

(c) Prepare Deepa’s Income Statement for the year ended 31 December 2015.

Deepa

Income Statement for the year ended 31 December 2015

$ $

BBSC-2020 Online December Assessment/Accounting 7707 IX C

9

[10]

3 (a) State two types of assets.

1......................................................................................................................................

2..................................................................................................................................... [2]

Boris is in business as a sole trader. The following figures are available on 30 April

2018.

$

Profit for the year 15 600

Returns inwards 7 800

Returns outwards 6 200

Inventory at 30 April 2018 22 500

8% Bank loan (repayable 31 July 2020) 60 000

Bank loan interest paid 2 400

Bank 3 000 debit

Trade receivables 39 600

Trade payables 23 200

Premises (cost) 34 000

Computer equipment (cost) 20 000

Fixtures and fittings (cost) 4 500

Administration expenses 30 000

Carriage 11 500

Drawings 25 200

Capital 50 000

(b) Prepare Boris’s Statement of Financial Position at 30 April 2018.

Boris

Statement of financial position at 30 April 2018

$ $

BBSC-2020 Online December Assessment/Accounting 7707 IX C

10

[07]

BBSC-2020 Online December Assessment/Accounting 7707 IX C

You might also like

- 21St Century Computer Solutions: A Manual Accounting SimulationFrom Everand21St Century Computer Solutions: A Manual Accounting SimulationNo ratings yet

- Accounting MCQ s16 qp12Document12 pagesAccounting MCQ s16 qp12Wafi Bin Hassan The InevitableNo ratings yet

- Account and Finacial AssigmentDocument8 pagesAccount and Finacial Assigmentefrata AlemNo ratings yet

- Grade 11 AccoountsDocument10 pagesGrade 11 AccoountsJane MalhanganaNo ratings yet

- 7707 Grade 11 December 2020 PDFDocument10 pages7707 Grade 11 December 2020 PDFSaeed MahmoodNo ratings yet

- Olevel Specimen MCQDocument3 pagesOlevel Specimen MCQAbid faisal AhmedNo ratings yet

- 7707 XC Mye 20-21 PDFDocument10 pages7707 XC Mye 20-21 PDFSaeed MahmoodNo ratings yet

- Pilot TestDocument4 pagesPilot TestTrang Nguyễn QuỳnhNo ratings yet

- Pilot Test 2023Document6 pagesPilot Test 2023bapeboiz1510No ratings yet

- Cambridge O Level: Accounting 7707/12Document12 pagesCambridge O Level: Accounting 7707/12Jack KowmanNo ratings yet

- 0452 s20 QP 11 PDFDocument12 pages0452 s20 QP 11 PDFHan Thi Win KoNo ratings yet

- Elimination Questions Elimination QuestionsDocument4 pagesElimination Questions Elimination QuestionsasffghjkNo ratings yet

- Cash and Cash EquivalentDocument6 pagesCash and Cash EquivalentNicole RC Del RosarioNo ratings yet

- F23 B01 Midterm Review QuestionsDocument9 pagesF23 B01 Midterm Review QuestionsDaniel OladejoNo ratings yet

- Pilot TestDocument5 pagesPilot Testkhanhhung1112004No ratings yet

- BSMM 8110 First Quiz Winter 2020 SolutionsDocument4 pagesBSMM 8110 First Quiz Winter 2020 SolutionsHibibiNo ratings yet

- Level III NewDocument5 pagesLevel III NewElias TesfayeNo ratings yet

- Ap2904 Cash and Cash EquivalentsDocument8 pagesAp2904 Cash and Cash EquivalentsMa Yra YmataNo ratings yet

- Ap2904 Cash and Cash EquivalentsDocument8 pagesAp2904 Cash and Cash EquivalentsMa Yra YmataNo ratings yet

- Problem Set 1Document6 pagesProblem Set 1Arvin Operania TolentinoNo ratings yet

- 10 Other Business DocumentDocument3 pages10 Other Business DocumentFrieda Twamonomuntu TaapopiNo ratings yet

- POA XI Prelim Paper (Paper I) 2019Document13 pagesPOA XI Prelim Paper (Paper I) 2019amirNo ratings yet

- Audit of CashDocument9 pagesAudit of CashRizzel SubaNo ratings yet

- ACCO TestDocument6 pagesACCO TestvrindadevigtmNo ratings yet

- f3 Accounting Study Pack Term 2 Week 6 Lesson 1-2021Document13 pagesf3 Accounting Study Pack Term 2 Week 6 Lesson 1-2021Iss MeNo ratings yet

- Cambridge Ordinary Level: Cambridge Assessment International EducationDocument12 pagesCambridge Ordinary Level: Cambridge Assessment International EducationBEeNaNo ratings yet

- Cambridge O Level: Accounting 7707/11Document12 pagesCambridge O Level: Accounting 7707/11Tapiwa MT (N1c3isH)No ratings yet

- Cambridge Ordinary LevelDocument12 pagesCambridge Ordinary LevelAlexNo ratings yet

- Nau Accounting Skills Assessment Practice Exam & KeyDocument6 pagesNau Accounting Skills Assessment Practice Exam & KeyJanine AnzanoNo ratings yet

- Acc MCQ TestDocument12 pagesAcc MCQ TestTanzimNo ratings yet

- SolutionDocument12 pagesSolutionnayna sharminNo ratings yet

- Chapter 1 - Activity WorksheetDocument3 pagesChapter 1 - Activity WorksheetHillary MoreyNo ratings yet

- Pilot Test 2023Document7 pagesPilot Test 2023trthuytrang004No ratings yet

- CAFC - Accountancy - Revision NotesDocument19 pagesCAFC - Accountancy - Revision Notesrmercy323No ratings yet

- Accounting Exercise (Y10) - 9 - 1 - 23Document4 pagesAccounting Exercise (Y10) - 9 - 1 - 23gaiyun209No ratings yet

- ACC 2103 Practise QuestionsDocument7 pagesACC 2103 Practise Questionsfalnuaimi001No ratings yet

- Cambridge O Level: Accounting 7707/13Document12 pagesCambridge O Level: Accounting 7707/13hafak27227No ratings yet

- Cambridge IGCSE: Accounting 0452/11Document12 pagesCambridge IGCSE: Accounting 0452/11Khaled AhmedNo ratings yet

- Accounts AS p-1 Mock 2023Document5 pagesAccounts AS p-1 Mock 20236vnh5z7fnjNo ratings yet

- Book KeepingDocument6 pagesBook KeepingALE MEDIANo ratings yet

- Quiz Chapter 4 - Chapter 8Document11 pagesQuiz Chapter 4 - Chapter 8Fäb RiceNo ratings yet

- ACCT1101 Wk3 Tutorial 2 SolutionsDocument7 pagesACCT1101 Wk3 Tutorial 2 SolutionskyleNo ratings yet

- Practice Questions Vol2Document8 pagesPractice Questions Vol2Angelica PostreNo ratings yet

- Cambridge O Level: Accounting 7707/01Document10 pagesCambridge O Level: Accounting 7707/01Syed AsharNo ratings yet

- Soal UTS SMT 1 AkP (12-10-21)Document22 pagesSoal UTS SMT 1 AkP (12-10-21)Bayu PrasetyoNo ratings yet

- Mocule1 Quiz 202Document4 pagesMocule1 Quiz 202yowatdafrickNo ratings yet

- 2nd Summative TestDocument2 pages2nd Summative Testje-ann montejoNo ratings yet

- 21.11.23 CA-FOUNDATION MOCK TEST PAPER ACCOUNTS Dec. 23Document5 pages21.11.23 CA-FOUNDATION MOCK TEST PAPER ACCOUNTS Dec. 23RohitNo ratings yet

- Acc 422Document20 pagesAcc 422Charles WilleNo ratings yet

- Prelim Exam - Answer KeyDocument13 pagesPrelim Exam - Answer KeyJustin Manaog67% (3)

- Pembahasan Soal AC Part 1Document34 pagesPembahasan Soal AC Part 1suci monalia putriNo ratings yet

- 03 Quiz 1Document9 pages03 Quiz 1Camille MadlangbayanNo ratings yet

- MockDocument2 pagesMockfa6613323No ratings yet

- Take Home - Final Exam Part 1Document12 pagesTake Home - Final Exam Part 1Recto Malayo Sr.No ratings yet

- PAULA GOZUN - Activity 2 Accounting For Cash-receivables-InventoriesDocument9 pagesPAULA GOZUN - Activity 2 Accounting For Cash-receivables-InventoriesPaupauNo ratings yet

- Acc101 Aug 2020 QNDocument15 pagesAcc101 Aug 2020 QNОзода АбдумуминоваNo ratings yet

- Af101 MST S1 2019Document12 pagesAf101 MST S1 2019Malia i Lutu Leonia Kueva Losalu100% (2)

- Accounting MCQsDocument7 pagesAccounting MCQssaeedqk100% (7)

- Businesses in The Tertiary Sector Spend Millions of Dollars Each Year On Social Media andDocument6 pagesBusinesses in The Tertiary Sector Spend Millions of Dollars Each Year On Social Media andSaeed MahmoodNo ratings yet

- Beaconhouse School System: Attendance For The Month of December-2019Document1 pageBeaconhouse School System: Attendance For The Month of December-2019Saeed MahmoodNo ratings yet

- Lesson Plans: Subject: Accounting (7707) Teacher's Name: Saeed Mahmood Class: X C For 2 Week of January 2020Document15 pagesLesson Plans: Subject: Accounting (7707) Teacher's Name: Saeed Mahmood Class: X C For 2 Week of January 2020Saeed MahmoodNo ratings yet

- 9 Ledger WSDocument4 pages9 Ledger WSSaeed MahmoodNo ratings yet

- 9 Revision OADocument12 pages9 Revision OASaeed MahmoodNo ratings yet

- Beaconhouse School System: Attendance For The Month of December-2019Document2 pagesBeaconhouse School System: Attendance For The Month of December-2019Saeed MahmoodNo ratings yet

- Beaconhouse School System: Attendance For The Month of December-2019Document1 pageBeaconhouse School System: Attendance For The Month of December-2019Saeed MahmoodNo ratings yet

- Beaconhouse School System: Attendance For The Month of December-2019Document1 pageBeaconhouse School System: Attendance For The Month of December-2019Saeed MahmoodNo ratings yet

- Beaconhouse School System: Attendance For The Month of December-2019Document1 pageBeaconhouse School System: Attendance For The Month of December-2019Saeed MahmoodNo ratings yet

- 7707 XC Mye 20-21 PDFDocument10 pages7707 XC Mye 20-21 PDFSaeed MahmoodNo ratings yet

- Final Quality AssuranceDocument39 pagesFinal Quality AssuranceSaeed MahmoodNo ratings yet

- Chapter Twenty-Four: International Marketing ResearchDocument20 pagesChapter Twenty-Four: International Marketing ResearchSaeed MahmoodNo ratings yet

- 7707 Manufacturing Accounts PDFDocument21 pages7707 Manufacturing Accounts PDFSaeed MahmoodNo ratings yet

- Chapter Eleven: Sampling: Design and ProceduresDocument28 pagesChapter Eleven: Sampling: Design and ProceduresSaeed MahmoodNo ratings yet

- Marketing Research SubjectiveDocument2 pagesMarketing Research SubjectiveSaeed MahmoodNo ratings yet

- 7100 Consumer Credit PDFDocument16 pages7100 Consumer Credit PDFSaeed MahmoodNo ratings yet

- Chapter 1Document29 pagesChapter 1Saeed MahmoodNo ratings yet

- Nishat Submission 3Document10 pagesNishat Submission 3Saeed MahmoodNo ratings yet

- Hina Naveed Sumission#4 Nishat Power LTDDocument10 pagesHina Naveed Sumission#4 Nishat Power LTDSaeed MahmoodNo ratings yet

- Nishat ISDocument11 pagesNishat ISSaeed MahmoodNo ratings yet

- Revenue Growth AnalysisDocument6 pagesRevenue Growth AnalysisSaeed MahmoodNo ratings yet

- Operating Fixed Assets Capital Work in Progress Major Spare Parts and Stand by EquipmentsDocument5 pagesOperating Fixed Assets Capital Work in Progress Major Spare Parts and Stand by EquipmentsSaeed MahmoodNo ratings yet