Professional Documents

Culture Documents

7707 Grade 11 December 2020 PDF

Uploaded by

Saeed MahmoodOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

7707 Grade 11 December 2020 PDF

Uploaded by

Saeed MahmoodCopyright:

Available Formats

1

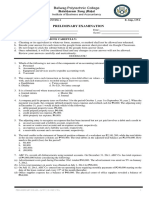

Beaconhouse School System

Bahria Town Senior Campus

Online December Assignment 2020

Student Name Class: XI C

Section

Total Marks: 56

Subject: Accounting (7707) Time allowed: 1 Hour

Instructions for December Assignment:

• • Assignment must be HANDWRITTEN.

• • Assignment must be student’s original work.

• • This assignment will be graded

• • Kindly write the following details at the beginning of each answer sheet:

• i. Name of Student

• ii. Class/ Section

• iii. Name of Subject Teacher

• iv. Subject

• • . Answer all questions.

• • Late submissions will not be marked.

How to submit the assignment:

i Assignment should be neatly handwritten on any lined paper. (You can simply

write down the MCQ number (if any) and its correct option)

ii Download a Cam Scanner on your phone from app store or play store

iii Scan your assignment answer sheet

iv Convert it to pdf format and make a single file to be uploaded.

v Upload the answer sheet only on Google Classroom. (In case you are unable to

upload it on your Google Classroom share it with your teacher on his/her email address

available on Google Classroom).

vi It is important that a student writes “Submitted” on the Google

Classroom stream/Class comments once the assignment has been turned in.

BBSC-2020 Online December Assignment /Accounting 7707 XI C

2

1 Amira maintains a petty cash book using the imprest system. The imprest amount of

$200 is restored on the first day of each month. On 1 January 2020 Amira had a

balance of $65 in her petty cash.

All payments of less than $100 are made from petty cash.

On 1 January 2020, Amira owed $85 to Rizwan, a credit supplier.

Amira provided the following information for January 2020.

January 1 The petty cash imprest was restored from the business bank account.

3 Purchased stationery for cash, $24

7 Paid travelling expenses, $49

14 Paid Rizwan the amount outstanding on his account

19 Purchased goods on credit from Rizwan, $200 less 10% trade discount

22 Paid taxi fare, $18

28 Returned goods to Rizwan which had been purchased on 19 January,

list price $40

29 Paid postage, $11

REQUIRED

a) Prepare Amira’s petty cash book for the month of January 2020, on the page

opposite.

Balance the petty cash book and bring down the balance on 1 February 2020.

BBSC-2020 Online December Assignment /Accounting 7707 XI C

3

BBSC-2020 Online December Assignment /Accounting 7707 XI C

4

Amira’s supplier, Rizwan, maintains a full set of accounting records.

REQUIRED

(b) Prepare the account of Amira as it would appear in the ledger of Rizwan.

Balance the account and bring down the balance on 1 February 2020.

Rizwan

Amira account

Date Details $ Date Details $

[6]

Amira usually pays Rizwan by cash or cheque.

REQUIRED

b) State two other methods which Amira could use to pay Rizwan from her bank

account.

............................................................................................................................... [1]

2 GM is a sole trader.

GM prepared a trial balance on 31 January 2020. The totals of the debit and credit

sides differed.

This difference was placed in a suspense account.

GM later discovered the following errors.

1 The total of the discount received column in the cash book for January, $135, had

been credited to the commission receivable account.

BBSC-2020 Online December Assignment /Accounting 7707 XI C

5

2 $200 received from the sale of fittings (net book value $150) had been correctly

debited but had been credited to the fixtures and fittings account.

3 Cash drawings, $40, had been correctly debited but had been credited to the

purchases account.

4 The total of the analysis column for cleaning in the petty cash book, $73, had been

transferred to both the cleaning account and the office expenses account.

5 The purchase of equipment, $575, had been credited to the equipment repairs

account. The bank account had been correctly credited.

6 No entries had been made for a cheque payment for office expenses, $90.

7 A cheque, $69, paid to Simone had been posted to the account of Simon.

Required:

a) Prepare journal entries to correct errors 1, 2, 3 and 4. [8]

Narratives are not required.

GM

Journal

Error Detail Debit Credit

Number

$ $

b) Prepare the suspense account considering all errors. Include the original difference

on the trial balance, as a balancing figure.

BBSC-2020 Online December Assignment /Accounting 7707 XI C

6

GM

Suspense account

Date Details $ Date Details $

[4]

c) Complete the following table by placing a tick (ü) in the correct column to indicate

how each of the errors would affect GM's capital.

The first one has been completed as an example.

Ignore depreciation of non-current assets.

Error Increases Decreases No effect

number capital capital on capital

3

[4]

(d) State three advantages to GM of operating as a sole trader.

1..........................................................................................................................................

............................................................................................................................................

2..........................................................................................................................................

BBSC-2020 Online December Assignment /Accounting 7707 XI C

7

............................................................................................................................................

3..........................................................................................................................................

....................................................................................................................................... [3]

[Total: 19]

3 Adil provided the following information.

For the year to 31 January 2020 $

Profit for the year 27 900

Revenue 186 000

Credit purchases 93 075

At 31 January 2020

Non-current assets at book value 43 700

Inventory 9 340

Trade receivables 14 010

Trade payables 9 435

Bank overdraft 2 240

Bank loan (repayable 2023) 6 000

All goods are sold on credit terms.

REQUIRED

a) Calculate the following ratios. Show your workings.

BBSC-2020 Online December Assignment /Accounting 7707 XI C

8

The bank overdraft limit is $2500.

The trade payables turnover for the year to 31 January 2019 was 35 days.

REQUIRED

BBSC-2020 Online December Assignment /Accounting 7707 XI C

9

b) Advise Adil whether or not he should delay paying trade payables in order to reduce

the bank overdraft. Justify your answer by considering the effect on both the bank

balance and the trade payables.

c) Suggest three other actions which Adil could take to reduce the bank overdraft.

d) (i) State two reasons why Adil should produce an annual income statement.

BBSC-2020 Online December Assignment /Accounting 7707 XI C

10

(ii) State two reasons why Adil should apply the money measurement principle.

BBSC-2020 Online December Assignment /Accounting 7707 XI C

You might also like

- Configuration Example: SAP Electronic Bank Statement (SAP - EBS)From EverandConfiguration Example: SAP Electronic Bank Statement (SAP - EBS)Rating: 3 out of 5 stars3/5 (1)

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- CPA FAR F-1 NotesDocument25 pagesCPA FAR F-1 NotesRob Ricco100% (4)

- MC 5 Dissolution P2Document3 pagesMC 5 Dissolution P2Jenny BernardinoNo ratings yet

- General Ledger Useful SQL ScriptsDocument26 pagesGeneral Ledger Useful SQL ScriptsSrihari GullaNo ratings yet

- Palepu AVB Edisi 5 - CH 3Document16 pagesPalepu AVB Edisi 5 - CH 3angelNo ratings yet

- 7707 XC Mye 20-21 PDFDocument10 pages7707 XC Mye 20-21 PDFSaeed MahmoodNo ratings yet

- Adjusting Entries PracticeDocument11 pagesAdjusting Entries Practiceback4peaceNo ratings yet

- Cu 7en L¿?o Ne: Ti? P Yauc UyteDocument5 pagesCu 7en L¿?o Ne: Ti? P Yauc UyteIan BurnieNo ratings yet

- 7707 MYE 20-21 Grade 9 PDFDocument10 pages7707 MYE 20-21 Grade 9 PDFSaeed MahmoodNo ratings yet

- Accounting Past PaperDocument13 pagesAccounting Past PaperSolaarNo ratings yet

- Test Paper Ca FoundDocument5 pagesTest Paper Ca FoundSarangapani KaliyamoorthyNo ratings yet

- Quiz 2 DeliveryDocument20 pagesQuiz 2 DeliveryAli Zain ParharNo ratings yet

- NCE Business Entrepreneurship Education Section B 2021 2022Document12 pagesNCE Business Entrepreneurship Education Section B 2021 2022rianaalyNo ratings yet

- Paper6 CmaDocument8 pagesPaper6 CmaRon WeasleyNo ratings yet

- Screenshot 2023-02-21 at 1.23.27 AMDocument12 pagesScreenshot 2023-02-21 at 1.23.27 AMGracy AroraNo ratings yet

- Review of Accounting CycleDocument4 pagesReview of Accounting CycleBrit NeyNo ratings yet

- Accounting Group Work 2.Document4 pagesAccounting Group Work 2.Glaze MorazNo ratings yet

- XI Account QPDocument7 pagesXI Account QPtanushsoni37No ratings yet

- 21.11.23 CA-FOUNDATION MOCK TEST PAPER ACCOUNTS Dec. 23Document5 pages21.11.23 CA-FOUNDATION MOCK TEST PAPER ACCOUNTS Dec. 23RohitNo ratings yet

- Intermediate Accounting 1Document14 pagesIntermediate Accounting 1cpacpacpa100% (1)

- The Bhawanipur Education Society College Department of CommerceDocument3 pagesThe Bhawanipur Education Society College Department of CommerceAyush PathakNo ratings yet

- Monthly Test - October 2021 Grade 9 (Cambridge) Accounting: Admission NumberDocument9 pagesMonthly Test - October 2021 Grade 9 (Cambridge) Accounting: Admission NumberMohamed MubarakNo ratings yet

- Monthly Test - October 2021 Grade 9 (Cambridge) Accounting: Admission NumberDocument9 pagesMonthly Test - October 2021 Grade 9 (Cambridge) Accounting: Admission NumberNethuki JayasinhaNo ratings yet

- Instructions To Students: Annual Examinations For Schools 2019Document8 pagesInstructions To Students: Annual Examinations For Schools 2019parapara11No ratings yet

- Mock 2 QuestionsDocument10 pagesMock 2 QuestionsalibanaylaNo ratings yet

- S3 MYE QP 2019-20 (Final)Document13 pagesS3 MYE QP 2019-20 (Final)XinYi ChenNo ratings yet

- qUIZ - FS TO PCTBDocument5 pagesqUIZ - FS TO PCTBGalang, Princess T.No ratings yet

- Accounting ExamDocument5 pagesAccounting ExamAccounting SerbizNo ratings yet

- Caf 1 Ia Spring 2021Document6 pagesCaf 1 Ia Spring 2021Abdul Jabbar Pechuho0% (1)

- Paper6 - Set1 PracticalDocument8 pagesPaper6 - Set1 PracticalMohammed IrfanNo ratings yet

- Accountancy Sample Paper 2Document8 pagesAccountancy Sample Paper 2mcrekhaaNo ratings yet

- 0452 s19 QP 13 PDFDocument24 pages0452 s19 QP 13 PDFmarryNo ratings yet

- Oct Nov 2023 (13) - QDocument12 pagesOct Nov 2023 (13) - QMarie Xavier - FelixNo ratings yet

- A Journal Entry Is Only Partially PostedDocument2 pagesA Journal Entry Is Only Partially PostedJoko BudimanNo ratings yet

- Cambridge O Level: Accounting 7707/12Document12 pagesCambridge O Level: Accounting 7707/12Geerish BissessurNo ratings yet

- Accounting Quetion Paper 2022Document12 pagesAccounting Quetion Paper 2022Almeida Carlos MassingueNo ratings yet

- Chapter 2 Question Review Updated 11th EdDocument9 pagesChapter 2 Question Review Updated 11th EdKim FloresNo ratings yet

- (FINBUS2) (BUS-AC1) Financial Accounting 1 (Nov2013) v5Document6 pages(FINBUS2) (BUS-AC1) Financial Accounting 1 (Nov2013) v5mNo ratings yet

- 07-06-2020 CA Foundation Accounts Test QuestionDocument4 pages07-06-2020 CA Foundation Accounts Test QuestionDhananjay DaveNo ratings yet

- Cambridge O Level: Accounting 7707/11Document12 pagesCambridge O Level: Accounting 7707/11Tapiwa MT (N1c3isH)No ratings yet

- Sessional 2 Paper Sample 3Document3 pagesSessional 2 Paper Sample 3Fami FamzNo ratings yet

- Pilot Test 2023Document6 pagesPilot Test 2023bapeboiz1510No ratings yet

- Quiz No. 1-AFAR-08 AFAR-09ADocument7 pagesQuiz No. 1-AFAR-08 AFAR-09Asharielles /No ratings yet

- 2022 S1 2nd Sem Bookkeeping and Accounts Final ExamDocument18 pages2022 S1 2nd Sem Bookkeeping and Accounts Final ExamXuen Khun TanNo ratings yet

- SUMMATIVE 4thDocument3 pagesSUMMATIVE 4thCattleya78% (9)

- Cambridge International AS & A Level: Accounting 9706/12Document12 pagesCambridge International AS & A Level: Accounting 9706/12FarrukhsgNo ratings yet

- Quiz 2 3 Sample 3 PaperDocument6 pagesQuiz 2 3 Sample 3 PaperFami FamzNo ratings yet

- Quiz Chapter 4 - Chapter 8Document11 pagesQuiz Chapter 4 - Chapter 8Fäb RiceNo ratings yet

- GR 9 June Exam 2023Document11 pagesGR 9 June Exam 2023Rolandi ViljoenNo ratings yet

- Quiz #1Document5 pagesQuiz #1octaviaNo ratings yet

- CAFC - Accountancy - Revision NotesDocument19 pagesCAFC - Accountancy - Revision Notesrmercy323No ratings yet

- Exercises P Class2-2022Document9 pagesExercises P Class2-2022Angel MéndezNo ratings yet

- Chapter 2 Problems and SolutionDocument25 pagesChapter 2 Problems and SolutionBracu 2023No ratings yet

- Practice Questions Code 313, With AnswersDocument19 pagesPractice Questions Code 313, With AnswersChang QiNo ratings yet

- CSEC POA Control AccountsDocument18 pagesCSEC POA Control AccountsDoreth BridgemanNo ratings yet

- Reviewer BfarDocument4 pagesReviewer BfarBheatriceNo ratings yet

- Accounting Assignment 1Document7 pagesAccounting Assignment 1vj4249No ratings yet

- M7B Adjusting Process Overview and Accrued IncomeDocument3 pagesM7B Adjusting Process Overview and Accrued IncomeCharles Eli AlejandroNo ratings yet

- Midterm Examination Suggested AnswersDocument9 pagesMidterm Examination Suggested AnswersJoshua CaraldeNo ratings yet

- Inclass Ex CH 9 FA21Document4 pagesInclass Ex CH 9 FA21Thomas TermoteNo ratings yet

- Section A (Multiple Choice) : A. Extracting Balances From The Ledger Accounts To Produce A Trial BalanceDocument9 pagesSection A (Multiple Choice) : A. Extracting Balances From The Ledger Accounts To Produce A Trial BalanceMagnolia KhineNo ratings yet

- ACT15 Prelim ExamDocument8 pagesACT15 Prelim ExamPaw VerdilloNo ratings yet

- Businesses in The Tertiary Sector Spend Millions of Dollars Each Year On Social Media andDocument6 pagesBusinesses in The Tertiary Sector Spend Millions of Dollars Each Year On Social Media andSaeed MahmoodNo ratings yet

- Beaconhouse School System: Attendance For The Month of December-2019Document1 pageBeaconhouse School System: Attendance For The Month of December-2019Saeed MahmoodNo ratings yet

- 9 Ledger WSDocument4 pages9 Ledger WSSaeed MahmoodNo ratings yet

- Lesson Plans: Subject: Accounting (7707) Teacher's Name: Saeed Mahmood Class: X C For 2 Week of January 2020Document15 pagesLesson Plans: Subject: Accounting (7707) Teacher's Name: Saeed Mahmood Class: X C For 2 Week of January 2020Saeed MahmoodNo ratings yet

- 9 Revision OADocument12 pages9 Revision OASaeed MahmoodNo ratings yet

- Beaconhouse School System: Attendance For The Month of December-2019Document1 pageBeaconhouse School System: Attendance For The Month of December-2019Saeed MahmoodNo ratings yet

- Beaconhouse School System: Attendance For The Month of December-2019Document2 pagesBeaconhouse School System: Attendance For The Month of December-2019Saeed MahmoodNo ratings yet

- Beaconhouse School System: Attendance For The Month of December-2019Document1 pageBeaconhouse School System: Attendance For The Month of December-2019Saeed MahmoodNo ratings yet

- Beaconhouse School System: Attendance For The Month of December-2019Document1 pageBeaconhouse School System: Attendance For The Month of December-2019Saeed MahmoodNo ratings yet

- 7707 Manufacturing Accounts PDFDocument21 pages7707 Manufacturing Accounts PDFSaeed MahmoodNo ratings yet

- 7100 Consumer Credit PDFDocument16 pages7100 Consumer Credit PDFSaeed MahmoodNo ratings yet

- Final Quality AssuranceDocument39 pagesFinal Quality AssuranceSaeed MahmoodNo ratings yet

- Marketing Research SubjectiveDocument2 pagesMarketing Research SubjectiveSaeed MahmoodNo ratings yet

- Chapter 1Document29 pagesChapter 1Saeed MahmoodNo ratings yet

- Chapter Twenty-Four: International Marketing ResearchDocument20 pagesChapter Twenty-Four: International Marketing ResearchSaeed MahmoodNo ratings yet

- Hina Naveed Sumission#4 Nishat Power LTDDocument10 pagesHina Naveed Sumission#4 Nishat Power LTDSaeed MahmoodNo ratings yet

- Chapter Eleven: Sampling: Design and ProceduresDocument28 pagesChapter Eleven: Sampling: Design and ProceduresSaeed MahmoodNo ratings yet

- Revenue Growth AnalysisDocument6 pagesRevenue Growth AnalysisSaeed MahmoodNo ratings yet

- Nishat ISDocument11 pagesNishat ISSaeed MahmoodNo ratings yet

- Nishat Submission 3Document10 pagesNishat Submission 3Saeed MahmoodNo ratings yet

- Operating Fixed Assets Capital Work in Progress Major Spare Parts and Stand by EquipmentsDocument5 pagesOperating Fixed Assets Capital Work in Progress Major Spare Parts and Stand by EquipmentsSaeed MahmoodNo ratings yet

- Transcript 1820115Document2 pagesTranscript 1820115Wasifa Tahsin AraniNo ratings yet

- Luyong - 4TH Q - Fabm1Document3 pagesLuyong - 4TH Q - Fabm1Jonavi LuyongNo ratings yet

- Assigned Activities From IM 1Document3 pagesAssigned Activities From IM 1Marcus MonocayNo ratings yet

- Management AccountingDocument2 pagesManagement AccountingVampire0% (1)

- Royce Credit and Financial Services, Inc.: MemorandumDocument11 pagesRoyce Credit and Financial Services, Inc.: MemorandumDPMC BANTAYNo ratings yet

- Cash 1Document15 pagesCash 1Tin PortuzuelaNo ratings yet

- Result of DUDocument2 pagesResult of DUAbhishekNarangNo ratings yet

- Prob 6 Debit and Credits Accounts PayableDocument4 pagesProb 6 Debit and Credits Accounts PayablePirvuNo ratings yet

- ADM 4345 - Strategy and ControlDocument8 pagesADM 4345 - Strategy and ControlJamalNo ratings yet

- Useful Reports Tcode in SAP FIDocument2 pagesUseful Reports Tcode in SAP FIfaiqalikhanNo ratings yet

- DocxDocument22 pagesDocxElaine Joyce GarciaNo ratings yet

- Quiz 8 - Hyperinflation Current Cost AccountingDocument3 pagesQuiz 8 - Hyperinflation Current Cost AccountingCaballero, Charlotte MichaellaNo ratings yet

- C. Allowance B. No: Mcqs/page/2Document5 pagesC. Allowance B. No: Mcqs/page/2Javed IqbalNo ratings yet

- Harmonizing Accounting Differences Across The CountriesDocument22 pagesHarmonizing Accounting Differences Across The Countriesankzzy100% (1)

- Chapter18 - Answer PDFDocument25 pagesChapter18 - Answer PDFJONAS VINCENT SamsonNo ratings yet

- Acccob3 Long Quiz 4 CoverageDocument55 pagesAcccob3 Long Quiz 4 CoverageCaila Joice FavorNo ratings yet

- Chapter 3 - Adjusting The AccountsDocument49 pagesChapter 3 - Adjusting The AccountsTâm Lê Hồ HồngNo ratings yet

- Exercises For Midterm PDFDocument10 pagesExercises For Midterm PDFThanh HằngNo ratings yet

- BGR Annual Report 2020Document180 pagesBGR Annual Report 2020Sam vermNo ratings yet

- Khandelwal Agencies Pvt. LTD.: GST - InvoiceDocument6 pagesKhandelwal Agencies Pvt. LTD.: GST - InvoiceSabuj SarkarNo ratings yet

- MpaccDocument1 pageMpaccapi-488515559No ratings yet

- Revisions in The CPA Licensure ExaminationDocument6 pagesRevisions in The CPA Licensure ExaminationXyrille CatapNo ratings yet

- Tanzania - Agricultural Inputs Support Project Ps - Project Appraisal ReportDocument22 pagesTanzania - Agricultural Inputs Support Project Ps - Project Appraisal ReportDullah PanduNo ratings yet

- Chapter 6 Audit Responsibilities and ObjectivesDocument22 pagesChapter 6 Audit Responsibilities and ObjectivesJenne LeeNo ratings yet

- Audit Summary ReportDocument2 pagesAudit Summary Reportas rginorNo ratings yet

- Time To Change Introductory AccountingDocument5 pagesTime To Change Introductory AccountingthoritruongNo ratings yet