Professional Documents

Culture Documents

Ottey Corporation Issued 4 Million of 10 Year 7 Callable Convertible PDF

Uploaded by

Freelance WorkerOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ottey Corporation Issued 4 Million of 10 Year 7 Callable Convertible PDF

Uploaded by

Freelance WorkerCopyright:

Available Formats

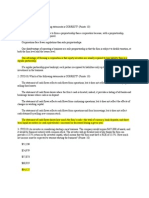

Ottey Corporation issued 4 million of 10 year 7 callable

convertible #1347

Ottey Corporation issued $4 million of 10-year, 7% callable convertible subordinated debentures

on January 2, 2014. The debentures have a face value of $1,000, with interest payable

annually. The current conversion ratio is 14:1, and in two years it will increase to 18:1. At the

date of issue, the bonds were sold at 98 to yield a 7.2886% effective interest rate. Bond

discount is amortized using the effective interest method. Ottey's effective tax was 25%. Net

income in 2014 was $7.5 million, and the company had 2 million shares outstanding during the

entire year. For simplicity, ignore the requirement to record the debentures' debt and equity

components separately.

Instructions

(a) Prepare a schedule to calculate both basic and diluted earnings per share for the year

ended December 31, 2014.

(b) Discuss how the schedule would differ if the security were convertible preferred shares.

(c) Assume that Ottey Corporation experienced a substantial loss instead of income for the

fiscal year ending December 31, 2014. How would you respond to the argument made by a

friend who states: "The interest expense from the conversion of the debentures is not actually

saved, and there is no income tax to be paid on the additional income that is assumed to have

been created from the conversion of the debentures."

Ottey Corporation issued 4 million of 10 year 7 callable convertible

ANSWER

http://paperinstant.com/downloads/ottey-corporation-issued-4-million-of-10-year-7-callable-

convertible/

1/1

Powered by TCPDF (www.tcpdf.org)

You might also like

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- The Pros and Cons of Closed-End Funds: How Do You Like Your Income?: Financial Freedom, #136From EverandThe Pros and Cons of Closed-End Funds: How Do You Like Your Income?: Financial Freedom, #136No ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- Completed Exam - Wall Street PrepDocument12 pagesCompleted Exam - Wall Street PrepBhagwan BachaiNo ratings yet

- FIN 370 Final Exam 30 Questions With AnswersDocument11 pagesFIN 370 Final Exam 30 Questions With Answersassignmentsehelp0% (1)

- Finman Final Exam ProblemDocument10 pagesFinman Final Exam ProblemJayaAntolinAyusteNo ratings yet

- Beams - Intercom Profit Transaction - BondsDocument12 pagesBeams - Intercom Profit Transaction - BondsAnggit Ponco100% (1)

- Test Bank - Income Taxation-CparDocument5 pagesTest Bank - Income Taxation-CparStephanie Ann TubuNo ratings yet

- Entrepreneurship: Executive Summary, Environment Analysis, and Business DescriptionDocument26 pagesEntrepreneurship: Executive Summary, Environment Analysis, and Business DescriptionJenny Barbacena100% (1)

- ACCA F9 Financial Management Solved Past PapersDocument304 pagesACCA F9 Financial Management Solved Past PapersSalmancertNo ratings yet

- AEC 205 - EXAM 1 1-21-22 PSBA Test I - TheoriesDocument5 pagesAEC 205 - EXAM 1 1-21-22 PSBA Test I - TheoriesLaisa DejumoNo ratings yet

- Ratio AnalysisDocument66 pagesRatio AnalysisRenny WidyastutiNo ratings yet

- The Main Departments in A Hotel or Resort The Main Departments in A Hotel or ResortDocument39 pagesThe Main Departments in A Hotel or Resort The Main Departments in A Hotel or ResortNa'im MasrurohNo ratings yet

- Ush Teks 2019-2020Document6 pagesUsh Teks 2019-2020api-362170860100% (1)

- Z Supermarket Technology UseDocument20 pagesZ Supermarket Technology UseRidawati LimpuNo ratings yet

- CH 12Document48 pagesCH 12Nguyen Ngoc Minh Chau (K15 HL)No ratings yet

- Summary of William H. Pike & Patrick C. Gregory's Why Stocks Go Up and DownFrom EverandSummary of William H. Pike & Patrick C. Gregory's Why Stocks Go Up and DownNo ratings yet

- Account Statement For Account:0141000108051555: Branch DetailsDocument7 pagesAccount Statement For Account:0141000108051555: Branch DetailsStratosFair StoreNo ratings yet

- Bmssa - Marc - S1 - Stud - M2 - Multiple Nuclei Theory - (Vidya, Likith, Renuka)Document12 pagesBmssa - Marc - S1 - Stud - M2 - Multiple Nuclei Theory - (Vidya, Likith, Renuka)YogeshNo ratings yet

- Final Examination Questions Cover Financial, Treasury and Forex ManagementDocument5 pagesFinal Examination Questions Cover Financial, Treasury and Forex ManagementKaran NewatiaNo ratings yet

- FIN3701 Tutorial 2 QuestionsDocument4 pagesFIN3701 Tutorial 2 QuestionsYeonjae SoNo ratings yet

- Questions and Problems: BasicDocument4 pagesQuestions and Problems: BasicNafeun AlamNo ratings yet

- Advanced: Recoveymihod - CODocument6 pagesAdvanced: Recoveymihod - COBONNo ratings yet

- CH 10Document3 pagesCH 10pablozhang1226No ratings yet

- 780 MS Financial Accounting XIIDocument9 pages780 MS Financial Accounting XIIAjay YadavNo ratings yet

- FIN 370 Final Exam - AssignmentDocument11 pagesFIN 370 Final Exam - AssignmentstudentehelpNo ratings yet

- Corporate finance and investment exam questionsDocument3 pagesCorporate finance and investment exam questionschingyho100% (1)

- Test 3Document4 pagesTest 3Camden MillingtonNo ratings yet

- ACCT 221 Chapter 2Document29 pagesACCT 221 Chapter 2Shane Hundley100% (1)

- MAS Handout - Risk and Returns, Cost of Capital, Capital Structure and Leverage PDFDocument5 pagesMAS Handout - Risk and Returns, Cost of Capital, Capital Structure and Leverage PDFDivine VictoriaNo ratings yet

- Clinch The Deal QuizDocument6 pagesClinch The Deal QuizNiraj_Murarka_5987No ratings yet

- Financial Management: Acca Revision Mock 3Document13 pagesFinancial Management: Acca Revision Mock 3krishna gopalNo ratings yet

- ExamView - Homework CH 4Document9 pagesExamView - Homework CH 4Brooke LevertonNo ratings yet

- Question # 1. "The Success and Failure of A Corporation Depends On The Relationship Between ItsDocument5 pagesQuestion # 1. "The Success and Failure of A Corporation Depends On The Relationship Between ItsQavi ShaikhNo ratings yet

- Whitley Company Is Considering Two Capital Investments Both Investments Have PDFDocument1 pageWhitley Company Is Considering Two Capital Investments Both Investments Have PDFhassan taimourNo ratings yet

- Day 1Document11 pagesDay 1Abdullah EjazNo ratings yet

- CengageNOWv2 - Online Teaching and Learning Resource From Cengage LearningDocument15 pagesCengageNOWv2 - Online Teaching and Learning Resource From Cengage LearningSwapan Kumar SahaNo ratings yet

- Finance Midterm QuestionsDocument3 pagesFinance Midterm QuestionsAnonymous x4LL5ecNCRNo ratings yet

- Capital Budgeting and Dividend Policy TutorialsDocument7 pagesCapital Budgeting and Dividend Policy TutorialsThuỳ PhạmNo ratings yet

- STR 581 Capstone Final Examination, Part Two - Transweb E TutorsDocument10 pagesSTR 581 Capstone Final Examination, Part Two - Transweb E Tutorstranswebetutors3No ratings yet

- Fi515 Test 2Document4 pagesFi515 Test 2joannapsmith33No ratings yet

- Paper - 2: Strategic Financial Management Questions Sensitivity AnalysisDocument27 pagesPaper - 2: Strategic Financial Management Questions Sensitivity AnalysisRaul KarkyNo ratings yet

- International Financial Management 11Document23 pagesInternational Financial Management 11胡依然100% (1)

- Forex Qs AnsDocument5 pagesForex Qs AnsChoudhristNo ratings yet

- Сем 3 (задание 1)Document18 pagesСем 3 (задание 1)Максим НовакNo ratings yet

- Financial ManagementDocument2 pagesFinancial Managementbakayaro92No ratings yet

- North South University School of Business and Economics Executive MBA Program EMB 510: Foundations of Accounting and FinanceDocument10 pagesNorth South University School of Business and Economics Executive MBA Program EMB 510: Foundations of Accounting and FinanceMamun KhanNo ratings yet

- FIN5342PS1Document3 pagesFIN5342PS1Samantha Hwey Min Ding100% (1)

- Test Bank For Advanced Accounting 14th Edition Joe Ben Hoyle Thomas Schaefer Timothy DoupnikDocument8 pagesTest Bank For Advanced Accounting 14th Edition Joe Ben Hoyle Thomas Schaefer Timothy Doupnikacetize.maleyl.hprj100% (46)

- CH 14Document6 pagesCH 14Saleh RaoufNo ratings yet

- Finman FinalsDocument4 pagesFinman FinalsJoana Ann ImpelidoNo ratings yet

- Financial Management: Page 1 of 4Document4 pagesFinancial Management: Page 1 of 4Bizness Zenius HantNo ratings yet

- Problem Set For Exam 1 - SolutionsDocument4 pagesProblem Set For Exam 1 - SolutionsInesNo ratings yet

- Chapter 18Document17 pagesChapter 18Adnan TousifNo ratings yet

- Long-Term Assets Skyline College Lecture NotesDocument54 pagesLong-Term Assets Skyline College Lecture Noteskalley minogNo ratings yet

- Exam Practice QuestionsDocument6 pagesExam Practice Questionssir bookkeeperNo ratings yet

- Document 1113 9704Document52 pagesDocument 1113 9704javierwarrenqswgiefjynNo ratings yet

- Fin 571 Sample ExamDocument5 pagesFin 571 Sample ExamKhamil Kaye GajultosNo ratings yet

- Fundamentals of Advanced Accounting 5Th Edition Hoyle Test Bank Full Chapter PDFDocument52 pagesFundamentals of Advanced Accounting 5Th Edition Hoyle Test Bank Full Chapter PDFDaisyHillyowek100% (11)

- FinalDocument5 pagesFinalmehdiNo ratings yet

- AL Financial Management May Jun 2016Document4 pagesAL Financial Management May Jun 2016hyp siinNo ratings yet

- Ch12 - Planning For Capital InvestmentDocument18 pagesCh12 - Planning For Capital InvestmentNhi PhạmNo ratings yet

- Assignment - FinalDocument5 pagesAssignment - FinalapoorvkrNo ratings yet

- Instructions. Choose The BEST Answer For Each of The Following ItemsDocument4 pagesInstructions. Choose The BEST Answer For Each of The Following ItemsDiomela BionganNo ratings yet

- 01 Icai Case Study QuestionDocument16 pages01 Icai Case Study QuestionFAMLITNo ratings yet

- Exam Revision Q'sDocument14 pagesExam Revision Q'skeely100% (1)

- Vencap Inc Is A Venture Capital Financier It Estimates ThatDocument1 pageVencap Inc Is A Venture Capital Financier It Estimates ThatFreelance WorkerNo ratings yet

- Using The Information Shown in Exercise 3 29 Produce An IncomeDocument1 pageUsing The Information Shown in Exercise 3 29 Produce An IncomeFreelance WorkerNo ratings yet

- Waterford University Offers An Mba Program That Is Widely RespectedDocument1 pageWaterford University Offers An Mba Program That Is Widely RespectedFreelance WorkerNo ratings yet

- Wal Mart Stores Leases Most of Its Office Warehouse and RetailDocument1 pageWal Mart Stores Leases Most of Its Office Warehouse and RetailFreelance WorkerNo ratings yet

- Walker S Inspection Services Is in Its Second Month of OperationsDocument1 pageWalker S Inspection Services Is in Its Second Month of OperationsFreelance WorkerNo ratings yet

- Using Your Answer To Problem 1 7b Prepare An Income StatementDocument1 pageUsing Your Answer To Problem 1 7b Prepare An Income StatementFreelance WorkerNo ratings yet

- Using The Trial Balance Prepared in Part 3 of ProblemDocument1 pageUsing The Trial Balance Prepared in Part 3 of ProblemFreelance WorkerNo ratings yet

- Using The Trial Balance Prepared For Binbutti Engineering in PartDocument1 pageUsing The Trial Balance Prepared For Binbutti Engineering in PartFreelance Worker0% (2)

- Using Your Answer From Exercise 1 21 Prepare An Income StatementDocument1 pageUsing Your Answer From Exercise 1 21 Prepare An Income StatementFreelance WorkerNo ratings yet

- Using The Trial Balance Prepared For Techno Wizards in PartDocument1 pageUsing The Trial Balance Prepared For Techno Wizards in PartFreelance WorkerNo ratings yet

- Valor Ventures Prepares Adjusting Entries Monthly The Following Information ConcernsDocument1 pageValor Ventures Prepares Adjusting Entries Monthly The Following Information ConcernsFreelance WorkerNo ratings yet

- Volkswagen Group Ag Manufactures Passenger Cars and Commercial Vehicles andDocument1 pageVolkswagen Group Ag Manufactures Passenger Cars and Commercial Vehicles andFreelance WorkerNo ratings yet

- Using The Information in Problem 3b Complete The Requirements AssumingDocument1 pageUsing The Information in Problem 3b Complete The Requirements AssumingFreelance WorkerNo ratings yet

- Using The Trial Balance Prepared For X Factor Accounting in PartDocument1 pageUsing The Trial Balance Prepared For X Factor Accounting in PartFreelance WorkerNo ratings yet

- Using The Ledger Balances and Additional Data Shown On TheDocument1 pageUsing The Ledger Balances and Additional Data Shown On TheFreelance WorkerNo ratings yet

- Using The Information Provided in Part 1 of Problem 1bDocument1 pageUsing The Information Provided in Part 1 of Problem 1bFreelance WorkerNo ratings yet

- Using Your Answer To Problem 1 7a Prepare An Income StatementDocument1 pageUsing Your Answer To Problem 1 7a Prepare An Income StatementFreelance WorkerNo ratings yet

- Using The Information in Qs 8 Through Qs 10 PrepareDocument1 pageUsing The Information in Qs 8 Through Qs 10 PrepareFreelance WorkerNo ratings yet

- Van Line Company A Small Electronics Repair Firm Expects An AnnualDocument1 pageVan Line Company A Small Electronics Repair Firm Expects An AnnualFreelance WorkerNo ratings yet

- Using The Information in Qs 5 Through Qs 7 PrepareDocument1 pageUsing The Information in Qs 5 Through Qs 7 PrepareFreelance WorkerNo ratings yet

- Using The Ledger Balances and Additional Data Shown On TheDocument1 pageUsing The Ledger Balances and Additional Data Shown On TheFreelance WorkerNo ratings yet

- U S Steel Corporation Derives Most Revenues From Manufacturing ADocument1 pageU S Steel Corporation Derives Most Revenues From Manufacturing AFreelance WorkerNo ratings yet

- Using The Information Provided in Part 1 of Problem 1Document1 pageUsing The Information Provided in Part 1 of Problem 1Freelance WorkerNo ratings yet

- U S Requirement of Reporting Comprehensive Income Does Not Exist inDocument1 pageU S Requirement of Reporting Comprehensive Income Does Not Exist inFreelance WorkerNo ratings yet

- Using The Information in Problem 3a Complete The Requirements AssumingDocument1 pageUsing The Information in Problem 3a Complete The Requirements AssumingFreelance WorkerNo ratings yet

- Using The Information in Problem 3 9a Complete The Following in ProblemDocument1 pageUsing The Information in Problem 3 9a Complete The Following in ProblemFreelance WorkerNo ratings yet

- Using The Information in Problem 3 9b Complete The Following in ProblemDocument1 pageUsing The Information in Problem 3 9b Complete The Following in ProblemFreelance WorkerNo ratings yet

- Using The Information in Exercise 7 A Present The Journal EntriesDocument1 pageUsing The Information in Exercise 7 A Present The Journal EntriesFreelance WorkerNo ratings yet

- Using The Information in Exercise 9 Complete The Requirements AssumingDocument1 pageUsing The Information in Exercise 9 Complete The Requirements AssumingFreelance WorkerNo ratings yet

- Using The General Journal Entries Prepared in Problem 2 3b CompleteDocument1 pageUsing The General Journal Entries Prepared in Problem 2 3b CompleteFreelance WorkerNo ratings yet

- BSBSUS501 Sample Sustainability PolicyDocument2 pagesBSBSUS501 Sample Sustainability Policytauqeer akbarNo ratings yet

- Intro To Work Study by ILODocument437 pagesIntro To Work Study by ILOBella TorresNo ratings yet

- The Impacts of Road Infrastructure On Economic DevelopmentDocument5 pagesThe Impacts of Road Infrastructure On Economic DevelopmentFarai T MapurangaNo ratings yet

- BDA Advises Quasar Medical On Sale of Majority Stake To LongreachDocument3 pagesBDA Advises Quasar Medical On Sale of Majority Stake To LongreachPR.comNo ratings yet

- Chap 009Document50 pagesChap 009Sarojini Gopaloo100% (1)

- UNIT 5 Launching A New VentureDocument20 pagesUNIT 5 Launching A New VentureArti ChauhanNo ratings yet

- Global Employment OutlookDocument14 pagesGlobal Employment OutlookPustaka Perumahan dan Kawasan Permukiman (PIV PKP)No ratings yet

- Conduent Overview - 2Document16 pagesConduent Overview - 2Seshagiri VempatiNo ratings yet

- Will Life Be Worth Living in A World Without Work? Technological Unemployment and The Meaning of LifeDocument33 pagesWill Life Be Worth Living in A World Without Work? Technological Unemployment and The Meaning of LifeabiramiNo ratings yet

- YJ Oil and Gas Industry - ApexMinds - SynopsisDocument2 pagesYJ Oil and Gas Industry - ApexMinds - SynopsisSarahJTGNo ratings yet

- LaborDocument4 pagesLaborAMIDA ISMAEL. SALISANo ratings yet

- Investor Perceptions of Mutual FundsDocument81 pagesInvestor Perceptions of Mutual FundsHanu DonNo ratings yet

- Accounting Information SystemDocument8 pagesAccounting Information SystemDayanara Basuel100% (1)

- HDMF Mplaf-Stl SampleDocument2 pagesHDMF Mplaf-Stl SampleHarold Quindica DaronNo ratings yet

- Myanmar Special Economic Zone Rule (Eng)Document104 pagesMyanmar Special Economic Zone Rule (Eng)THAN HAN100% (1)

- CBSE Class 12 Accountancy Syllabus 2023 24Document8 pagesCBSE Class 12 Accountancy Syllabus 2023 24kankariya1424No ratings yet

- Parishodh Journal ISSN NO:2347-6648Document8 pagesParishodh Journal ISSN NO:2347-6648DEEPANo ratings yet

- Share-Based Payment PDFDocument3 pagesShare-Based Payment PDFlemonjuice rileyNo ratings yet

- The Internal Environment SWOT AnalysisDocument3 pagesThe Internal Environment SWOT AnalysisMirta SaparinNo ratings yet

- AC A Global Strategy For Shaping The Post COVID 19 WorldDocument60 pagesAC A Global Strategy For Shaping The Post COVID 19 WorldMAMANo ratings yet

- Incentives and Control SystemDocument3 pagesIncentives and Control SystemEl Shaira RizzoNo ratings yet

- Culture & Environment of Global MarketsDocument44 pagesCulture & Environment of Global MarketsMansi A KathuriaNo ratings yet

- Financial Regulatory Framework Multiple Choice QuestionsDocument13 pagesFinancial Regulatory Framework Multiple Choice QuestionsNaziya TamboliNo ratings yet