Professional Documents

Culture Documents

Cumulative Basis of Computing The Net Taxable Gifts

Cumulative Basis of Computing The Net Taxable Gifts

Uploaded by

Jessie Castañeda0 ratings0% found this document useful (0 votes)

34 views2 pagesThis document outlines the process for calculating cumulative net taxable gifts and donor tax liability for multiple donations made within a year, both before and after 2018. It shows how for each subsequent donation, the net taxable gift amount adds the prior net gifts and subtracts the annual exempt amount. The cumulative taxable amount is then used to calculate tax liability at the donor's tax rate, accounting for taxes paid from prior donations.

Original Description:

A pro-forma solution for computing the Net Taxable Gifts in a cumulative basis

Original Title

Cumulative Basis of Computing the Net Taxable Gifts

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document outlines the process for calculating cumulative net taxable gifts and donor tax liability for multiple donations made within a year, both before and after 2018. It shows how for each subsequent donation, the net taxable gift amount adds the prior net gifts and subtracts the annual exempt amount. The cumulative taxable amount is then used to calculate tax liability at the donor's tax rate, accounting for taxes paid from prior donations.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

34 views2 pagesCumulative Basis of Computing The Net Taxable Gifts

Cumulative Basis of Computing The Net Taxable Gifts

Uploaded by

Jessie CastañedaThis document outlines the process for calculating cumulative net taxable gifts and donor tax liability for multiple donations made within a year, both before and after 2018. It shows how for each subsequent donation, the net taxable gift amount adds the prior net gifts and subtracts the annual exempt amount. The cumulative taxable amount is then used to calculate tax liability at the donor's tax rate, accounting for taxes paid from prior donations.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

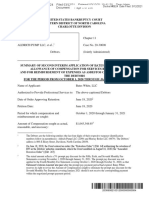

Cumulative Basis of Computing the Net

Taxable Gifts

(SUBSEQUENT DONATION WITHIN A

YEAR)

2018 onwards

DATE 3 (_______________)

DATE 1 (_______________)

Net Gift Net Gift, (Date 3)

LESS: Exempt (250.000) ADD: Prior Net

Gift Gift, (Date 1)

Net Taxable Gift ADD: Prior Net

Gift, (Date 2)

Donor’s Tax Rate 0.06 LESS: Exempt Gift (250.000)

Donor’s Tax Due Net Taxable Gift,

cumulative

Donor’s Tax Rate 0.06

DATE 2 (_______________) Donor’s Tax Due

Net Gift, (Date 2) LESS: Donor’s Tax

ADD: Prior Net Paid, (Date 2)

Gift, (Date 1) Donor’s Tax

LESS: Exempt Gift (250.000) Payable

Net Taxable Gift,

cumulative

Donor’s Tax Rate 0.06

Donor’s Tax Due

LESS: Donor’s Tax

Paid, (Date 1)

Donor’s Tax

Payable

Before 2018

DATE 1 (_______________) donation to: DATE 3 (_______________) donation to:

Net Gift Net Gift, (Date 3)

LESS: Donor’s Tax ADD: Prior Net

OVER Gift, (Date 1)

EXCESS ADD: Prior Net

Gift, (Date 2)

TIMES: Rate Total Net Gift

Tax Amount LESS: Donor’s Tax

OVER

PLUS: Tax SHALL

EXCESS

BE

Donor’s Tax Due TIMES: Rate

Tax Amount

DATE 2 (_______________) donation to: PLUS: Tax SHALL

BE

Donor’s Tax Due

Net Gift, (Date 2)

LESS: Donor’s Tax

ADD: Prior Net

paid, (Date 2)

Gift, (Date 1)

Donor’s Tax

Total Net Gift

Payable

Less: Donor’s Tax

OVER

EXCESS

TIMES: Rate

Tax Amount

PLUS: Tax SHALL

BE

Donor’s Tax Due

LESS: Donor’s Tax

paid, (Date 1)

Donor’s Tax

Payable

You might also like

- New Tax Return Transcript 2222Document7 pagesNew Tax Return Transcript 2222James Franklin67% (3)

- Chapter 17 Donor's TaxDocument7 pagesChapter 17 Donor's TaxHazel Jane Esclamada100% (3)

- Bank Reconciliation StatementDocument8 pagesBank Reconciliation StatementSyed Adnan HossainNo ratings yet

- Nevada ADA LawsuitDocument20 pagesNevada ADA LawsuitDave BiscobingNo ratings yet

- Nationwide Bank StatementDocument5 pagesNationwide Bank StatementZheng YangNo ratings yet

- Chase Business-01-24-1Document5 pagesChase Business-01-24-1Катерина КлыкNo ratings yet

- Christopher Bank StatementDocument3 pagesChristopher Bank StatementSharon JonesNo ratings yet

- IRS Demand Letter - 14 July 2022Document2 pagesIRS Demand Letter - 14 July 2022KPLC 7 NewsNo ratings yet

- Job Description: For Front Office CashierDocument3 pagesJob Description: For Front Office CashierHoanganh Setup100% (1)

- EH403 TAXATION MIDTERMS Estate and Donors - EditedDocument22 pagesEH403 TAXATION MIDTERMS Estate and Donors - Editedethel hyugaNo ratings yet

- Gsis Application Form For LoanDocument2 pagesGsis Application Form For LoanLizet RubiNo ratings yet

- Donor's Tax TRAIN LAWDocument4 pagesDonor's Tax TRAIN LAWJenMarlon Corpuz Aquino100% (1)

- Donors Tax Computation Under Train LawDocument8 pagesDonors Tax Computation Under Train LawJP PalamNo ratings yet

- Donation and Donor's TaxationDocument5 pagesDonation and Donor's Taxationyatot carbonelNo ratings yet

- Tanzania Revenue Authority: Institute of Tax AdministrationDocument44 pagesTanzania Revenue Authority: Institute of Tax AdministrationMoud KhalfaniNo ratings yet

- Donor TaxDocument20 pagesDonor TaxJhon baal S. SetNo ratings yet

- Donors To PercentageDocument24 pagesDonors To PercentageFrayladine TabagNo ratings yet

- TH THDocument12 pagesTH THmariyha PalangganaNo ratings yet

- Module 1 Lesson 3Document6 pagesModule 1 Lesson 3Rich Ann Redondo VillanuevaNo ratings yet

- Donor's TaxDocument5 pagesDonor's TaxVernnNo ratings yet

- Guidelines On Estate and Dono2Document6 pagesGuidelines On Estate and Dono2indieNo ratings yet

- DonationDocument31 pagesDonationJust JhexNo ratings yet

- Module 1 - Lesson 3 - Donor's Tax CreditDocument6 pagesModule 1 - Lesson 3 - Donor's Tax Creditohmyme sungjaeNo ratings yet

- CampaignFinanceReport Public Cf1d6326 9faa 442c A4c3 589d361ef6f6Document12 pagesCampaignFinanceReport Public Cf1d6326 9faa 442c A4c3 589d361ef6f6Parents' Coalition of Montgomery County, MarylandNo ratings yet

- Sales Tax 4th QTR 2021Document1 pageSales Tax 4th QTR 2021KingNo ratings yet

- AM No. 10-3-10 SC Proposed Special Rules On Intellectual Property Litigation (October 3, 2011)Document7 pagesAM No. 10-3-10 SC Proposed Special Rules On Intellectual Property Litigation (October 3, 2011)John B. GoodNo ratings yet

- CampaignFinanceReport Public PDFDocument11 pagesCampaignFinanceReport Public PDFParents' Coalition of Montgomery County, MarylandNo ratings yet

- Annual Compensation and Business TaxesDocument21 pagesAnnual Compensation and Business TaxesRyDNo ratings yet

- Receipts Expenditures: WarningDocument3 pagesReceipts Expenditures: WarningParents' Coalition of Montgomery County, MarylandNo ratings yet

- 06 Donors TaxDocument4 pages06 Donors Taxpatburner1108No ratings yet

- Btax302 Lesson3 DonorstaxDocument5 pagesBtax302 Lesson3 DonorstaxJr Reyes PedidaNo ratings yet

- 1 Corporate Operations - Part 3Document22 pages1 Corporate Operations - Part 3Van DinhNo ratings yet

- SOLUTIONS WPS Office 1Document2 pagesSOLUTIONS WPS Office 1rishanecezarNo ratings yet

- LW100316164 Reg0000004599669Document4 pagesLW100316164 Reg0000004599669dilanisakshiNo ratings yet

- Donor's Tax & Estate TaxDocument28 pagesDonor's Tax & Estate TaxMae Manoelle LeonaNo ratings yet

- Page 1 of 3 Statement Summary June 2022 Statement Period 6/1/2022 - 6/30/2022Document3 pagesPage 1 of 3 Statement Summary June 2022 Statement Period 6/1/2022 - 6/30/2022ola sucreNo ratings yet

- Donor'S Tax A. Definition and ConceptsDocument6 pagesDonor'S Tax A. Definition and ConceptsjessaNo ratings yet

- ILIANDocument2 pagesILIANNaipah Hadji AmerNo ratings yet

- Accounting Paper HelpDocument7 pagesAccounting Paper Helpd8xsvf8dsxNo ratings yet

- Aldrich Pump Summary of Second Interim Application of Bates White LLC ForDocument154 pagesAldrich Pump Summary of Second Interim Application of Bates White LLC ForKirk HartleyNo ratings yet

- 10 Donors TaxDocument39 pages10 Donors TaxClaira LebrillaNo ratings yet

- Progressive Maryland ReportDocument7 pagesProgressive Maryland ReportDaniel SchereNo ratings yet

- Topic: Adjustments To The Income Statement: Subtopic: Prepaid Income ObjectivesDocument2 pagesTopic: Adjustments To The Income Statement: Subtopic: Prepaid Income ObjectivesFungaiNo ratings yet

- Taxation Sia/Tabag TAX.2903-Donor's Tax OCTOBER 2020Document8 pagesTaxation Sia/Tabag TAX.2903-Donor's Tax OCTOBER 2020Bryan Christian MaragragNo ratings yet

- Donors TaxDocument8 pagesDonors Taxmaxine claire cutingNo ratings yet

- Gross To Net Pay - 50000Document1 pageGross To Net Pay - 50000api-173610472No ratings yet

- BACC497 - Midterm Revision Sheet - AK - Fall 2023-2024Document8 pagesBACC497 - Midterm Revision Sheet - AK - Fall 2023-2024bill haddNo ratings yet

- Ac00unting 2Document45 pagesAc00unting 2Hazem El SayedNo ratings yet

- Budget WsDocument2 pagesBudget Wsapi-376482253No ratings yet

- Tax Return Transcript - DISP - 102219104896Document4 pagesTax Return Transcript - DISP - 102219104896textme339No ratings yet

- GAD Briefing: May 16, 2017 2017 REALTORS® Legislative Meetings & Trade ExpoDocument45 pagesGAD Briefing: May 16, 2017 2017 REALTORS® Legislative Meetings & Trade ExpoNational Association of REALTORS®No ratings yet

- Govern The Imposition of The Donor's TaxDocument5 pagesGovern The Imposition of The Donor's TaxjuliNo ratings yet

- Accuracy Checking - US TaxationTestDocument10 pagesAccuracy Checking - US TaxationTestAmit ManyalNo ratings yet

- Receipt 1PDLUA7C3ADocument2 pagesReceipt 1PDLUA7C3ADesiderio Espinoza RojasNo ratings yet

- Digital Order SummaryDocument2 pagesDigital Order SummaryDiego Alonso Herrera HernándezNo ratings yet

- ACC 3013 Taxation RevisionDocument4 pagesACC 3013 Taxation Revisionfalnuaimi001No ratings yet

- Chapter 10 Review Updated 11th EdDocument15 pagesChapter 10 Review Updated 11th EdalmazwmbashiraNo ratings yet

- Pay Slip Template CLSURVDocument1 pagePay Slip Template CLSURVArthur Vincent CabatinganNo ratings yet

- Lecture 4 - Optimal Labor Income TaxationDocument78 pagesLecture 4 - Optimal Labor Income TaxationCem DemirogluNo ratings yet

- MPAC604 L2A FINAL TaxDocument103 pagesMPAC604 L2A FINAL TaxKanokporn TangthamvanichNo ratings yet

- Estate TaxDocument26 pagesEstate Taxkitayroselyn4No ratings yet

- PAYSLIP RevisedDocument1 pagePAYSLIP RevisedPrincess JulianneNo ratings yet

- Intacc Chap 16 ReviewerDocument8 pagesIntacc Chap 16 ReviewerJea XeleneNo ratings yet

- Floreen Pre-GeneralDocument76 pagesFloreen Pre-GeneralDaniel SchereNo ratings yet

- Alsobrooks CampaignFinanceReport Public 1.19.2022Document164 pagesAlsobrooks CampaignFinanceReport Public 1.19.2022Musyoka1No ratings yet

- 2021 Official Revenue EstimateDocument3 pages2021 Official Revenue EstimateWSYX/WTTENo ratings yet

- Broadband Bill AugustDocument1 pageBroadband Bill AugustkarthikNo ratings yet

- Midxix Republic Salary AccountDocument1 pageMidxix Republic Salary Accountsagar khareNo ratings yet

- APSPDCL kpb1 PDFDocument2 pagesAPSPDCL kpb1 PDFashoku24007No ratings yet

- US Internal Revenue Service: I1040 - 1997Document84 pagesUS Internal Revenue Service: I1040 - 1997IRSNo ratings yet

- New Credit Card Authorization FormDocument1 pageNew Credit Card Authorization FormJasdeep SinghNo ratings yet

- Final REVIEW OF RELATED LITERATUREDocument6 pagesFinal REVIEW OF RELATED LITERATUREd dwdfNo ratings yet

- TANGEDCO Online PaymentDocument1 pageTANGEDCO Online PaymentDHARANI SIVAKUMARNo ratings yet

- Rental Property Statement Tax Year: Physical Address (Street, Suburb) : Property TypeDocument14 pagesRental Property Statement Tax Year: Physical Address (Street, Suburb) : Property TypeSenapati Prabhupada DasNo ratings yet

- SW04Document8 pagesSW04Nadi Hood0% (1)

- ACR FormDocument8 pagesACR Formwrite2hannanNo ratings yet

- Private & Confidential: Outgoing TransferDocument9 pagesPrivate & Confidential: Outgoing TransferSaral JainNo ratings yet

- Tax Invoice Tax Invoice: Venturehaven Pte LTDDocument2 pagesTax Invoice Tax Invoice: Venturehaven Pte LTDisty5nntNo ratings yet

- Problems - Final ExaminationDocument3 pagesProblems - Final Examinationjhell de la cruzNo ratings yet

- SS and SSS Chap 1 To 10 (2020)Document215 pagesSS and SSS Chap 1 To 10 (2020)Dinh TranNo ratings yet

- Gmail - MyBB ReceiptDocument1 pageGmail - MyBB ReceiptZamri Rahmat SikumbangNo ratings yet

- Application For Additional Stamp Duty KarnatakaDocument2 pagesApplication For Additional Stamp Duty KarnatakamanjunathNo ratings yet

- Endowment Fund Scholarship FormDocument2 pagesEndowment Fund Scholarship FormPäťhäň ŘājāNo ratings yet

- Personal Income Tax: Tax Rates in VietnamDocument1 pagePersonal Income Tax: Tax Rates in Vietnamhằng phạmNo ratings yet

- Farcon vs. BIRDocument1 pageFarcon vs. BIRCyruss Xavier Maronilla NepomucenoNo ratings yet

- Mastercard Rules PDFDocument353 pagesMastercard Rules PDFSamir MadanNo ratings yet

- RC Nirc, Ra, Nra-Etb Nra-Netb: Taxpayer Tax Base Source of Taxable IncomeDocument7 pagesRC Nirc, Ra, Nra-Etb Nra-Netb: Taxpayer Tax Base Source of Taxable IncomeGwyneth GloriaNo ratings yet

- Front Desk Clesrk and GuestDocument2 pagesFront Desk Clesrk and GuestJman MontoyaNo ratings yet

- Budget 2024 P3 Schemes Mrunal SDDocument58 pagesBudget 2024 P3 Schemes Mrunal SDphanindraNo ratings yet