Professional Documents

Culture Documents

Practice Problems 01: NPV Calculation for 5 Years

Uploaded by

ইয়াসিন খন্দকার রাতুলOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Practice Problems 01: NPV Calculation for 5 Years

Uploaded by

ইয়াসিন খন্দকার রাতুলCopyright:

Available Formats

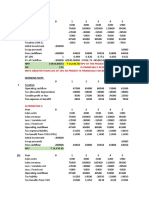

Practice Problems 01

Cost 350000

Installation 110000

Total 460000

N (years) 5

Discount rate 10%

SL. Depreciation 92000

Operating expense 83000

Sales 265000

Recovery NWC 73000

Tax rate 40%

Salvage value 85000

Bt (Book value of fixed capital) 0

Initial Outlay 533000

Annual after tax OCF

(S-C)(1-Tc)+TcD 146000

Terminal year after tax non OCF

Salv.+Recovery of WC-(Salv.-Bt)*T 124000

Years 0 1 2 3 4 5

Initial Outlay -533000

CF 146000 146000 146000 146000 270000

Discount factor 0.909091 0.826446 0.751315 0.683013 0.620921

Discounted CF -533000 132727.3 120661.2 109692 99719.96 167648.8

NPV 97449.11

You might also like

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Problem No 12: Beginning of 3rd Yr End of 2nd Yr Subsidy at Beginning of 2nd Yr at End of 1st YrDocument3 pagesProblem No 12: Beginning of 3rd Yr End of 2nd Yr Subsidy at Beginning of 2nd Yr at End of 1st YrNeoNo ratings yet

- Payback Period, NPV and PI CalculationsDocument13 pagesPayback Period, NPV and PI CalculationsVedashree MaliNo ratings yet

- Cup Pa Mania ProjectDocument4 pagesCup Pa Mania ProjectDurgaprasad VelamalaNo ratings yet

- Form and Registration Fees 500 Admission Fees 2,000 Caution Money 1,500Document6 pagesForm and Registration Fees 500 Admission Fees 2,000 Caution Money 1,500ইয়াসিন খন্দকার রাতুলNo ratings yet

- Group4 SectionA SampavideoDocument5 pagesGroup4 SectionA Sampavideokarthikmaddula007_66No ratings yet

- 322 Assignment 2 SubmissionDocument9 pages322 Assignment 2 SubmissionMirza Mushahid BaigNo ratings yet

- CF Assignment 1 Group 4Document41 pagesCF Assignment 1 Group 4Radha DasNo ratings yet

- Paper 2Document5 pagesPaper 2dua95960No ratings yet

- Seminar XIIDocument67 pagesSeminar XIINeko IvanishviliNo ratings yet

- Finance II Cours 8 2021Document53 pagesFinance II Cours 8 2021Fiveer FreelancerNo ratings yet

- Summary of Operating Assumptions (For Example)Document5 pagesSummary of Operating Assumptions (For Example)Krishna SharmaNo ratings yet

- LeasingDocument14 pagesLeasingSana SarfarazNo ratings yet

- Alternative 1Document10 pagesAlternative 1Sreyas S KumarNo ratings yet

- Taxation (WN1) : NPV 14434.84672557 NPV 14434.85 IRR 12.63%Document12 pagesTaxation (WN1) : NPV 14434.84672557 NPV 14434.85 IRR 12.63%Sreyas S KumarNo ratings yet

- Bhimsen CaseDocument2 pagesBhimsen CaseNikhil Gauns DessaiNo ratings yet

- Final CaseDocument25 pagesFinal CaseSakshi SharmaNo ratings yet

- Case01 02Document24 pagesCase01 02Sakshi SharmaNo ratings yet

- Particulars Year 0 Year 1 To 10Document2 pagesParticulars Year 0 Year 1 To 10rajakosuri429No ratings yet

- A. CF - 500 Tine 5 Years Discount Rate 10% PV $310.46 B. PV $1,895.39 C. Time 50 Years PV $4,957.41 D. Time 100 Years PV $4,999.64Document11 pagesA. CF - 500 Tine 5 Years Discount Rate 10% PV $310.46 B. PV $1,895.39 C. Time 50 Years PV $4,957.41 D. Time 100 Years PV $4,999.64Hoàng QuânNo ratings yet

- CuppaMania NPV AnalysisDocument2 pagesCuppaMania NPV AnalysisdeepaksikriNo ratings yet

- Investment 80000 Cost Reduction 22000 Life 5 Salvage 20000 Tax 21% Discounting Rate 10%Document7 pagesInvestment 80000 Cost Reduction 22000 Life 5 Salvage 20000 Tax 21% Discounting Rate 10%Sneha DasNo ratings yet

- Investment Cash Flow AnalysisDocument2 pagesInvestment Cash Flow AnalysisSurbhi KambojNo ratings yet

- Determining Cash Flows for Investment AnalysisDocument19 pagesDetermining Cash Flows for Investment AnalysisJack mazeNo ratings yet

- SampaSoln EXCELDocument4 pagesSampaSoln EXCELRasika Pawar-HaldankarNo ratings yet

- MADocument11 pagesMANurbergen YeleshovNo ratings yet

- Marking SchemeDocument5 pagesMarking SchemeEric BYIRINGIRONo ratings yet

- Answer - Capital BudgetingDocument19 pagesAnswer - Capital Budgetingchowchow123No ratings yet

- ExcerciseDocument10 pagesExcercisehafizulNo ratings yet

- Quiz 3032Document4 pagesQuiz 3032PG93No ratings yet

- Case Study 1Document7 pagesCase Study 1Trisha Mae Mendoza MacalinoNo ratings yet

- FIN341 Excel Demo - Chapter 11Document23 pagesFIN341 Excel Demo - Chapter 11mai tharatharnNo ratings yet

- Proforma StatmentsDocument4 pagesProforma StatmentsMehar AttaullahNo ratings yet

- McReath Original SolutionDocument2 pagesMcReath Original SolutionSuchi0% (1)

- Assignment 3 Feb MBA 1Document17 pagesAssignment 3 Feb MBA 1shahzad aliNo ratings yet

- MockDocument5 pagesMockamna noorNo ratings yet

- Peony Coffee - Clc62a-V6Document9 pagesPeony Coffee - Clc62a-V6Thuy Duong DONo ratings yet

- 215Document4 pages215Rand AlqamNo ratings yet

- EKOMIGKUIS14MEIDocument5 pagesEKOMIGKUIS14MEImeri erlinaNo ratings yet

- Financial risk and valuation analysis using WACC and APV methodsDocument10 pagesFinancial risk and valuation analysis using WACC and APV methodsYeeyuan ChongNo ratings yet

- Allegro (ATC) C.ADocument8 pagesAllegro (ATC) C.Arubakhalid67No ratings yet

- Spread Sheet ModelingDocument9 pagesSpread Sheet ModelingAbhay BaraNo ratings yet

- Electricity Bill Advertising: Software RentDocument5 pagesElectricity Bill Advertising: Software RentHasiburNo ratings yet

- Interim Financial Reporting Chapter 45 ProblemsDocument7 pagesInterim Financial Reporting Chapter 45 ProblemsRey Joyce AbuelNo ratings yet

- Interim Financial Reporting: Problem 45-1: True or FalseDocument7 pagesInterim Financial Reporting: Problem 45-1: True or FalseMarjorieNo ratings yet

- Interim Financial Reporting: Problem 45-1: True or FalseDocument7 pagesInterim Financial Reporting: Problem 45-1: True or FalseXyverbel Ocampo RegNo ratings yet

- TAX ANSWER-R4Tanyag KeyDocument5 pagesTAX ANSWER-R4Tanyag KeyCheska JaplosNo ratings yet

- FR AssDocument10 pagesFR Asssimon mtNo ratings yet

- Answer Key Discussion of Sir Paul of PreweekDocument2 pagesAnswer Key Discussion of Sir Paul of PreweekElaine Joyce GarciaNo ratings yet

- Estimating Equity FCFDocument5 pagesEstimating Equity FCFSomlina MukherjeeNo ratings yet

- Sample Restaurant Training ProposalDocument7 pagesSample Restaurant Training ProposalSenami ZambaNo ratings yet

- Solution Capital Budgeting AssignmentDocument8 pagesSolution Capital Budgeting AssignmentAryamanNo ratings yet

- Capital BudgetngDocument8 pagesCapital BudgetngSufian AhmadNo ratings yet

- Financial WorksheetDocument4 pagesFinancial WorksheetCarla GonçalvesNo ratings yet

- ACYFMG2 Quiz 2 QuestionsDocument41 pagesACYFMG2 Quiz 2 QuestionsArnold BernasNo ratings yet

- 123Document2 pages123Novie AriyantiNo ratings yet

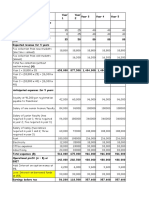

- Corporate Income Tax Computations Over 3 YearsDocument61 pagesCorporate Income Tax Computations Over 3 YearsMay Grethel Joy Perante100% (1)

- Scenario Summary: Changing CellsDocument10 pagesScenario Summary: Changing Cellsjerrynguyen291No ratings yet

- Mock Marking SchemeDocument5 pagesMock Marking SchemeEric BYIRINGIRONo ratings yet

- FM2 Assignment 4 - Group 5Document7 pagesFM2 Assignment 4 - Group 5TestNo ratings yet

- Payoffs & Profits: Strategy Stock Prices Plan A All Stocks Plan B All Options Plan C Call Plus OptionsDocument4 pagesPayoffs & Profits: Strategy Stock Prices Plan A All Stocks Plan B All Options Plan C Call Plus Optionsইয়াসিন খন্দকার রাতুলNo ratings yet

- Speculation Based On Expected Appreciation: AnswerDocument7 pagesSpeculation Based On Expected Appreciation: Answerইয়াসিন খন্দকার রাতুলNo ratings yet

- Measuring Exposure To Exchange Rate FluctuationsDocument38 pagesMeasuring Exposure To Exchange Rate Fluctuationsইয়াসিন খন্দকার রাতুলNo ratings yet

- The International Financial Environment: Multinational Corporation (MNC)Document46 pagesThe International Financial Environment: Multinational Corporation (MNC)Navkiran KinniNo ratings yet

- Presentation On Leaseback TopicDocument6 pagesPresentation On Leaseback Topicইয়াসিন খন্দকার রাতুলNo ratings yet

- Column1 Time Period Time Until Payment (Years) Cash Flows Column2 A. 8% Coupon Bond 1 0.5 40 1.05 2 1 40 1.05 3 1.5 40 1.05 4 2 1040 1.05 TotalDocument4 pagesColumn1 Time Period Time Until Payment (Years) Cash Flows Column2 A. 8% Coupon Bond 1 0.5 40 1.05 2 1 40 1.05 3 1.5 40 1.05 4 2 1040 1.05 Totalইয়াসিন খন্দকার রাতুলNo ratings yet

- Exchange Rate Risk ManagementDocument36 pagesExchange Rate Risk Managementইয়াসিন খন্দকার রাতুলNo ratings yet

- Government Influence On Exchange Rates Through InterventionDocument47 pagesGovernment Influence On Exchange Rates Through Interventionইয়াসিন খন্দকার রাতুলNo ratings yet

- Government Influence On Exchange Rates Through InterventionDocument47 pagesGovernment Influence On Exchange Rates Through Interventionইয়াসিন খন্দকার রাতুলNo ratings yet

- Profitrability IndexDocument1 pageProfitrability Indexইয়াসিন খন্দকার রাতুলNo ratings yet

- Enhanced 05Document48 pagesEnhanced 05renad_No ratings yet

- Sensitivity AnalysisDocument2 pagesSensitivity Analysisইয়াসিন খন্দকার রাতুলNo ratings yet

- Practice Problems 01: NPV Calculation for 5 YearsDocument1 pagePractice Problems 01: NPV Calculation for 5 Yearsইয়াসিন খন্দকার রাতুলNo ratings yet

- NPVDocument3 pagesNPVইয়াসিন খন্দকার রাতুলNo ratings yet

- NPVDocument3 pagesNPVইয়াসিন খন্দকার রাতুলNo ratings yet

- Sensitivity AnalysisDocument2 pagesSensitivity Analysisইয়াসিন খন্দকার রাতুলNo ratings yet

- Profitrability IndexDocument1 pageProfitrability Indexইয়াসিন খন্দকার রাতুলNo ratings yet