Professional Documents

Culture Documents

Precision Construction Entered Into The Following Transactions During A Recent

Precision Construction Entered Into The Following Transactions During A Recent

Uploaded by

Let's Talk With Hassan0 ratings0% found this document useful (0 votes)

13 views1 pagePrecision Construction made several purchases and payments in January and February. They purchased a bulldozer for $250,000 by paying $20,000 cash and financing $230,000, replaced the bulldozer's tracks for $20,000, paid $20,000 for the track repair work, replaced the bulldozer seat for $800 and paid for it, and paid $3,600 for two years of software licenses.

Original Description:

Original Title

Precision Construction Entered Into the Following Transactions During a Recent

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentPrecision Construction made several purchases and payments in January and February. They purchased a bulldozer for $250,000 by paying $20,000 cash and financing $230,000, replaced the bulldozer's tracks for $20,000, paid $20,000 for the track repair work, replaced the bulldozer seat for $800 and paid for it, and paid $3,600 for two years of software licenses.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

13 views1 pagePrecision Construction Entered Into The Following Transactions During A Recent

Precision Construction Entered Into The Following Transactions During A Recent

Uploaded by

Let's Talk With HassanPrecision Construction made several purchases and payments in January and February. They purchased a bulldozer for $250,000 by paying $20,000 cash and financing $230,000, replaced the bulldozer's tracks for $20,000, paid $20,000 for the track repair work, replaced the bulldozer seat for $800 and paid for it, and paid $3,600 for two years of software licenses.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

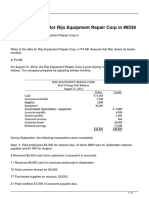

Precision Construction entered into the following

transactions during a recent #2798

Precision Construction entered into the following transactions during a recent year. January 2

Purchased a bulldozer for $250,000 by paying $20,000 cash and signing a $230,000 note due

in five years.January 3 Replaced the steel tracks on the bulldozer at a cost of $20,000,

purchased on account.January 30 Wrote a check for the amount owed on account for the work

completed onJanuary 3.February 1 Replaced the seat on the bulldozer and wrote a check for

the full $800 cost.March 1 Paid $3,600 cash for the rights to use computer software for a two-

year period.Required:1. Analyze the accounting equation effects and record journal entries for

each of the transactions.2. For the tangible and intangible assets acquired in the preceding

transactions, determine the amount of depreciation and amortization that Precision Construction

should report for the quarter ended March 31. The equipment is depreciated using the double-

declining-balance method with a useful life of five years and $40,000 residual value.3. Prepare

a journal entry to record the depreciation calculated in requirement 2.4. What advice would you

offer the company in anticipation of switching to IFRS in the future?View Solution:

Precision Construction entered into the following transactions during a recent

ANSWER

http://paperinstant.com/downloads/precision-construction-entered-into-the-following-

transactions-during-a-recent/

1/1

Powered by TCPDF (www.tcpdf.org)

You might also like

- Case Report "Stryker: In-Sourcing PCBS"Document2 pagesCase Report "Stryker: In-Sourcing PCBS"Vishakha ChopraNo ratings yet

- Letter of Award - DraftDocument5 pagesLetter of Award - DraftYap Siew HengNo ratings yet

- Using The Trial Balance Prepared For Binbutti Engineering in PartDocument1 pageUsing The Trial Balance Prepared For Binbutti Engineering in PartFreelance Worker0% (2)

- Lancet Engineering Completed The Following Transactions in The MDocument1 pageLancet Engineering Completed The Following Transactions in The MM Bilal SaleemNo ratings yet

- CH 10Document9 pagesCH 10Antonios FahedNo ratings yet

- Yoklic Corporation Currently Manufactures A Subassembly For Its Main ProductDocument1 pageYoklic Corporation Currently Manufactures A Subassembly For Its Main ProductLet's Talk With HassanNo ratings yet

- Wilm Schmidt The Owner of Wilm S Window Washing Services HadDocument1 pageWilm Schmidt The Owner of Wilm S Window Washing Services HadLet's Talk With HassanNo ratings yet

- Binbutti Engineering A Sole Proprietorship Completed The Following Transactions DuringDocument1 pageBinbutti Engineering A Sole Proprietorship Completed The Following Transactions DuringTaimour Hassan0% (1)

- The Following Events Occurred For Mitka LTD A Received Investment PDFDocument1 pageThe Following Events Occurred For Mitka LTD A Received Investment PDFLet's Talk With HassanNo ratings yet

- Webb Corporation Prepares Financial Statements in Accordance With Ifrs SelectedDocument2 pagesWebb Corporation Prepares Financial Statements in Accordance With Ifrs SelectedHassan JanNo ratings yet

- PpeDocument7 pagesPpeJasmine Marie Ng CheongNo ratings yet

- After The Success of Its First Two Months Mary GrahamDocument1 pageAfter The Success of Its First Two Months Mary GrahamFreelance WorkerNo ratings yet

- Refer To The Data For Rijo Equipment Repair Corp inDocument2 pagesRefer To The Data For Rijo Equipment Repair Corp inMiroslav Gegoski0% (1)

- On August 1 Year 3 Carleton LTD Ordered Machinery From PDFDocument1 pageOn August 1 Year 3 Carleton LTD Ordered Machinery From PDFDoreenNo ratings yet

- Wedona Energy Consultants Prepares Adjusting Entries Monthly Based On AnDocument1 pageWedona Energy Consultants Prepares Adjusting Entries Monthly Based On AnLet's Talk With Hassan100% (1)

- The Shares of Volkswagen Trade On The Frankfurt Stock ExchangeDocument1 pageThe Shares of Volkswagen Trade On The Frankfurt Stock ExchangeLet's Talk With HassanNo ratings yet

- The Payroll Register For Rice Company of Sackville Is SummarizedDocument1 pageThe Payroll Register For Rice Company of Sackville Is SummarizedLet's Talk With HassanNo ratings yet

- The Perkins Construction Company Bought A Building For 800 000 ToDocument1 pageThe Perkins Construction Company Bought A Building For 800 000 ToLet's Talk With HassanNo ratings yet

- Site Manager FCRFinalization ProcessDocument7 pagesSite Manager FCRFinalization ProcessakhilkuwarNo ratings yet

- Moncton Manufacturing LTD Had The Following Information Available On BondsDocument2 pagesMoncton Manufacturing LTD Had The Following Information Available On BondsMiroslav GegoskiNo ratings yet

- The Following Account Balances Were Included in Bromley Company S BalanceDocument1 pageThe Following Account Balances Were Included in Bromley Company S BalanceTaimur TechnologistNo ratings yet

- Palmer Cook Productions Manages and Operates Two Rock Bands TheDocument1 pagePalmer Cook Productions Manages and Operates Two Rock Bands TheLet's Talk With HassanNo ratings yet

- IAS 16 PracticeDocument3 pagesIAS 16 PracticeWaqas Younas Bandukda0% (1)

- Classification of Acquisition and Other Asset Costs at December PDFDocument1 pageClassification of Acquisition and Other Asset Costs at December PDFAnbu jaromiaNo ratings yet

- Assignment 2Document5 pagesAssignment 2Baburam AdNo ratings yet

- AAAAAAAAAAAAAADocument8 pagesAAAAAAAAAAAAAAEl - loolNo ratings yet

- The Following Transactions Related To A Machine Purchased by Vicario PDFDocument1 pageThe Following Transactions Related To A Machine Purchased by Vicario PDFTaimur TechnologistNo ratings yet

- RTP PDFDocument45 pagesRTP PDFsumanmehtaNo ratings yet

- Form No. 3ae: Audit Report Under Section 35D (4) /35E (6) of The Income-Tax Act, 1961Document2 pagesForm No. 3ae: Audit Report Under Section 35D (4) /35E (6) of The Income-Tax Act, 1961Anonymous 2evaoXKKdNo ratings yet

- T Proc Notices Notices 025 K Notice Doc 23368 106095740Document12 pagesT Proc Notices Notices 025 K Notice Doc 23368 106095740inno musiimeNo ratings yet

- Test 2 - Chap 8,10,11 & 12Document9 pagesTest 2 - Chap 8,10,11 & 12Bhushan SawantNo ratings yet

- Topic 1: Conceptual FrameworkDocument16 pagesTopic 1: Conceptual FrameworkHuỳnh Như PhạmNo ratings yet

- Nih 2655 FormDocument2 pagesNih 2655 FormVrusabh ShahNo ratings yet

- Cost Accounting 2Document3 pagesCost Accounting 2Freddy Savio D'souza0% (2)

- Comco Tool Corp Records Depreciation Annually at The End ofDocument2 pagesComco Tool Corp Records Depreciation Annually at The End ofTaimur TechnologistNo ratings yet

- Pell Corporation S Property Plant and Equipment and Accumulated Depreciation AccountsDocument1 pagePell Corporation S Property Plant and Equipment and Accumulated Depreciation AccountsLet's Talk With HassanNo ratings yet

- BESCOMMeter Transfer ProcessDocument6 pagesBESCOMMeter Transfer ProcessAstro BalluNo ratings yet

- Tsunami Inc Entered Into The Following Transactions During One Month PDFDocument1 pageTsunami Inc Entered Into The Following Transactions During One Month PDFhassan taimourNo ratings yet

- Performance Plastics Company PPC Has Been Operating For Three YearsDocument1 pagePerformance Plastics Company PPC Has Been Operating For Three YearsLet's Talk With HassanNo ratings yet

- JujuDocument46 pagesJujuvarma369vinaNo ratings yet

- HSHDocument3 pagesHSHMonny MOMNo ratings yet

- The Following Facts Pertain To A Non Cancellable Lease Agreement Between PDFDocument2 pagesThe Following Facts Pertain To A Non Cancellable Lease Agreement Between PDFTaimur TechnologistNo ratings yet

- T Murray Has Prepared The Following Bank Ledger Account ForDocument1 pageT Murray Has Prepared The Following Bank Ledger Account ForMiroslav GegoskiNo ratings yet

- LZ-PC-B01 - Subcontractor's Mang - Site Coordination ProcedureDocument15 pagesLZ-PC-B01 - Subcontractor's Mang - Site Coordination ProcedurecivilmechanicNo ratings yet

- W2.4. Almirez v. Infinite Loop Technology 481 SCRA 364Document7 pagesW2.4. Almirez v. Infinite Loop Technology 481 SCRA 364noemi alvarezNo ratings yet

- CH9 11複習考題目Document8 pagesCH9 11複習考題目邱品榛No ratings yet

- Printed From WWW - Incometaxindia.gov - in Page 1 of 2Document2 pagesPrinted From WWW - Incometaxindia.gov - in Page 1 of 2Rajshree GuptaNo ratings yet

- Bid Document 4CDocument213 pagesBid Document 4Cgaurang22No ratings yet

- AssignmentDocument4 pagesAssignmentsangay wangdiNo ratings yet

- Volume 2 of 4 - Bill of QuantitiesDocument38 pagesVolume 2 of 4 - Bill of QuantitiesDennis KigenNo ratings yet

- Explore The Unique Professional Opportunities Provided Under RERA 2016Document36 pagesExplore The Unique Professional Opportunities Provided Under RERA 2016CA. (Dr.) Rajkumar Satyanarayan AdukiaNo ratings yet

- Topic 2 - PPE - Eng - ExerciseDocument4 pagesTopic 2 - PPE - Eng - Exercisehuynhgiade1805No ratings yet

- Review Questions For B2 C1Document12 pagesReview Questions For B2 C1abuumgweno1803No ratings yet

- Draft STTRPhaseI SampleDocument32 pagesDraft STTRPhaseI SamplebrianrussNo ratings yet

- Asset Acquisition Logan Industries Purchased The Following Asset PDFDocument1 pageAsset Acquisition Logan Industries Purchased The Following Asset PDFAnbu jaromiaNo ratings yet

- b2-c1 Grande Finale Solving 2023 May (Set 2)Document17 pagesb2-c1 Grande Finale Solving 2023 May (Set 2)charlesmicky82No ratings yet

- LGU-Santa Maria CC2021Document35 pagesLGU-Santa Maria CC2021Alyssa Marie MartinezNo ratings yet

- ACP323 Audit of Iib and Ppe ReviewerDocument4 pagesACP323 Audit of Iib and Ppe ReviewerFRAULIEN GLINKA FANUGAONo ratings yet

- Selected Transactions For The Basler Corporation During Its First MonthDocument1 pageSelected Transactions For The Basler Corporation During Its First MonthBube KachevskaNo ratings yet

- Aptransco Aped Manual IIDocument315 pagesAptransco Aped Manual IISrikar Varma100% (2)

- FA - II - Project Work 2020Document3 pagesFA - II - Project Work 2020Yohanes DebeleNo ratings yet

- Pear Company PC Had Been Renting Its Office Building ForDocument1 pagePear Company PC Had Been Renting Its Office Building ForFreelance WorkerNo ratings yet

- CH 10Document9 pagesCH 10Saleh RaoufNo ratings yet

- Audit 2 - Case 2Document1 pageAudit 2 - Case 2tika_wardhaniNo ratings yet

- PpeDocument2 pagesPpeanano22No ratings yet

- Xion Supply Uses A Sales Journal A Purchases Journal ADocument1 pageXion Supply Uses A Sales Journal A Purchases Journal ALet's Talk With HassanNo ratings yet

- XM Satellite Radio Which Launched Its Satellite Radio Service inDocument1 pageXM Satellite Radio Which Launched Its Satellite Radio Service inLet's Talk With HassanNo ratings yet

- Wipro Limited Together With Its Subsidiaries and Equity Accounted InvesteesDocument1 pageWipro Limited Together With Its Subsidiaries and Equity Accounted InvesteesLet's Talk With HassanNo ratings yet

- Wright Company Leases An Asset For Five Years On DecemberDocument1 pageWright Company Leases An Asset For Five Years On DecemberLet's Talk With HassanNo ratings yet

- Wyeth Formerly American Home Products Is A Global Leader inDocument1 pageWyeth Formerly American Home Products Is A Global Leader inLet's Talk With HassanNo ratings yet

- Wilson Machine Tools Inc A Manufacturer of Fabricated Metal ProductsDocument1 pageWilson Machine Tools Inc A Manufacturer of Fabricated Metal ProductsLet's Talk With HassanNo ratings yet

- Wondra Supplies Showed The Following Selected Adjusted Balances at ItsDocument1 pageWondra Supplies Showed The Following Selected Adjusted Balances at ItsLet's Talk With HassanNo ratings yet

- Winfrey Designs Had An Unadjusted Credit Balance in Its AllowanceDocument1 pageWinfrey Designs Had An Unadjusted Credit Balance in Its AllowanceLet's Talk With HassanNo ratings yet

- Wicom Servicing Completed These Transactions During November 2014 Its FirstDocument1 pageWicom Servicing Completed These Transactions During November 2014 Its FirstLet's Talk With HassanNo ratings yet

- The Savage Corporation Purchased Three Milling Machines On January 1Document1 pageThe Savage Corporation Purchased Three Milling Machines On January 1Let's Talk With HassanNo ratings yet

- The Qantas Group Integrates A Sustainability Report With Its AnnualDocument1 pageThe Qantas Group Integrates A Sustainability Report With Its AnnualLet's Talk With HassanNo ratings yet

- The Shares of Microsoft Were Trading On Nasdaq On JanuaryDocument1 pageThe Shares of Microsoft Were Trading On Nasdaq On JanuaryLet's Talk With HassanNo ratings yet

- The Standard Deviation of A Foreign Asset in Local CurrencyDocument1 pageThe Standard Deviation of A Foreign Asset in Local CurrencyLet's Talk With Hassan100% (1)

- The Simon Machine Tools Company Is Considering Purchasing A NewDocument1 pageThe Simon Machine Tools Company Is Considering Purchasing A NewLet's Talk With HassanNo ratings yet

- The Records of Thomas Company As of December 31 2014Document1 pageThe Records of Thomas Company As of December 31 2014Let's Talk With HassanNo ratings yet

- The Rocky Mountain Publishing Company Is Considering Introducing A NewDocument1 pageThe Rocky Mountain Publishing Company Is Considering Introducing A NewLet's Talk With HassanNo ratings yet

- The Ripcord Parachute Club of Burlington Employs Three People andDocument1 pageThe Ripcord Parachute Club of Burlington Employs Three People andLet's Talk With HassanNo ratings yet

- The Precision Computer Centre Created Its Chart of Accounts AsDocument1 pageThe Precision Computer Centre Created Its Chart of Accounts AsLet's Talk With HassanNo ratings yet