Professional Documents

Culture Documents

Solved George Is Single and Has Adjusted Gross Income of 37 000

Uploaded by

Anbu jaromiaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Solved George Is Single and Has Adjusted Gross Income of 37 000

Uploaded by

Anbu jaromiaCopyright:

Available Formats

(SOLVED) George is single and has adjusted gross income

of 37 000

George is single and has adjusted gross income of $37,000. He discovers termites in the

basement of his house and pays $6,200 to fix the damage. His insurance company will not

reimburse him for the damage.Identify the tax issue(s) posed by the facts presented. Determine

the possible tax consequences of […]

On January 1, 2011, Brenda acquires 200 shares of Disney stock for $8,000. She sells the 200

shares on September 2, 2011, for $30 per share. On September 23, 2011, Brenda acquires 400

shares of Disney stock for $10,400.Identify the tax issue(s) posed by the facts presented.

Determine the possible […]

The Readyhough Corporation was incorporated in 2003. During 2010, the corporation had

operating income of $80,000. Because of a strike at its major supplier, the corporation had an

operating loss of $60,000 in 2011. The corporation expects to rebound in 2012, forecasting

operating income of $140,000. The current interest rate […]

Jamila is involved in an auto accident during the current year that totally destroyed her car. She

purchased the car 2 years ago for $28,000. Jamila used the car in her business 75% of the time

over the past 2 years. She had properly deducted $4,000 in depreciation for the […]

GET ANSWER- https://accanswer.com/downloads/page/1168/

Ghon and Li own a home on Lake Gibran. During a heavy rainstorm, the lake overflows and

floods the basement, which is used as their family room. The entire contents of the basement

(rug, furniture, stereo, and so on) are destroyed. The insurance adjuster estimates that the

damage to the […]

Leona owns 300 shares of Ross Industries. She acquired the shares on February 17, 2009, for

$6,500. On September 17, 2011, she acquires another 200 shares of Ross for $4,800. Two

weeks later, a lawsuit is filed against Ross for patent infringement, and its stock price drops to

$19 per […]

Evita sells 2 pieces of land during the current year. She had used the first piece as a parking lot

for her pet store. (She owns the store as a sole proprietor.) The land cost Evita $45,000, and

she sells it for $28,000. The second piece is a building she […]

SEE SOLUTION>> https://accanswer.com/downloads/page/1168/

1/1

Powered by TCPDF (www.tcpdf.org)

You might also like

- 21 - 1040 (Forecast)Document153 pages21 - 1040 (Forecast)cjNo ratings yet

- Attention Filers of Form 1096:: WWW - Irs.gov/form1099 WWW - IRS.gov/orderforms Employer and Information ReturnsDocument3 pagesAttention Filers of Form 1096:: WWW - Irs.gov/form1099 WWW - IRS.gov/orderforms Employer and Information ReturnsMikhael Yah-Shah Dean: Veilour100% (1)

- Gross Income With Answer KeyDocument4 pagesGross Income With Answer KeyFallaria Paulo A.No ratings yet

- Tax InvoiceDocument1 pageTax Invoicesourabh choubeyNo ratings yet

- MidtermDocument13 pagesMidtermAlexandra Nicole IsaacNo ratings yet

- Estate and Donor'S TaxDocument10 pagesEstate and Donor'S TaxJoseph MangahasNo ratings yet

- Invoice - 873437740Document1 pageInvoice - 873437740Umar SayedNo ratings yet

- Solved The Kane Corporation Is An Accrual Basis Taxpayer State LawDocument1 pageSolved The Kane Corporation Is An Accrual Basis Taxpayer State LawAnbu jaromiaNo ratings yet

- Solved Russell Is Employed As A Prosecutor For The Town ofDocument1 pageSolved Russell Is Employed As A Prosecutor For The Town ofAnbu jaromiaNo ratings yet

- Solved Anne and Michael Own and Operate A Successful Mattress Business PDFDocument1 pageSolved Anne and Michael Own and Operate A Successful Mattress Business PDFAnbu jaromiaNo ratings yet

- Solved Richie Is A Wealthy Rancher in Texas He Operates HisDocument1 pageSolved Richie Is A Wealthy Rancher in Texas He Operates HisAnbu jaromiaNo ratings yet

- Solved Erica and Raphael Are Divorced During The Current Year BecauseDocument1 pageSolved Erica and Raphael Are Divorced During The Current Year BecauseAnbu jaromiaNo ratings yet

- Solved Minnie Owns A Qualified Annuity That Cost 78 000 The AnnuityDocument1 pageSolved Minnie Owns A Qualified Annuity That Cost 78 000 The AnnuityAnbu jaromiaNo ratings yet

- Solved Mandy Is Interested in Purchasing A New Automobile For PersonalDocument1 pageSolved Mandy Is Interested in Purchasing A New Automobile For PersonalAnbu jaromiaNo ratings yet

- Solved Will and Sandra Emmet Were Divorced This Year As PartDocument1 pageSolved Will and Sandra Emmet Were Divorced This Year As PartAnbu jaromiaNo ratings yet

- Solved Ms Reid Borrowed 50 000 From A Broker To Purchase LeroDocument1 pageSolved Ms Reid Borrowed 50 000 From A Broker To Purchase LeroAnbu jaromiaNo ratings yet

- Solved Holly Has Recognized A 9 000 STCL She Has No OtherDocument1 pageSolved Holly Has Recognized A 9 000 STCL She Has No OtherAnbu jaromiaNo ratings yet

- Solved Diane and Peter Were Divorced in 2010 The Divorce AgreementDocument1 pageSolved Diane and Peter Were Divorced in 2010 The Divorce AgreementAnbu jaromiaNo ratings yet

- Solved A Tornado Extensively Damaged The Community in Which Bodine Comp PDFDocument1 pageSolved A Tornado Extensively Damaged The Community in Which Bodine Comp PDFAnbu jaromiaNo ratings yet

- Solved Maurice Allred Is Going To Purchase Either The Stock orDocument1 pageSolved Maurice Allred Is Going To Purchase Either The Stock orAnbu jaromiaNo ratings yet

- Solved Lacy Corporation Sells Equipment and A Building During The CurreDocument1 pageSolved Lacy Corporation Sells Equipment and A Building During The CurreAnbu jaromiaNo ratings yet

- Solved Carla Was The Owner of Vacant Land That She Was PDFDocument1 pageSolved Carla Was The Owner of Vacant Land That She Was PDFAnbu jaromiaNo ratings yet

- Solved in 2002 Florence Purchased 30 Acres of Land She HasDocument1 pageSolved in 2002 Florence Purchased 30 Acres of Land She HasAnbu jaromiaNo ratings yet

- Solved Your Client Heron Corporation Has A Deficit in Accumulated eDocument1 pageSolved Your Client Heron Corporation Has A Deficit in Accumulated eAnbu jaromiaNo ratings yet

- Solved Alpine Corporation Is A Qualified Small Business Corporation Eligible To PDFDocument1 pageSolved Alpine Corporation Is A Qualified Small Business Corporation Eligible To PDFAnbu jaromiaNo ratings yet

- Solved Firm R Owned Depreciable Real Property Subject To A 300 000Document1 pageSolved Firm R Owned Depreciable Real Property Subject To A 300 000Anbu jaromiaNo ratings yet

- Solved The Outstanding Stock in Red Blue and Green Corporations EachDocument1 pageSolved The Outstanding Stock in Red Blue and Green Corporations EachAnbu jaromiaNo ratings yet

- Solved Sam A Single Taxpayer Acquired Stock in A Corporation ThatDocument1 pageSolved Sam A Single Taxpayer Acquired Stock in A Corporation ThatAnbu jaromiaNo ratings yet

- Solved Myles Etter and Crystal Santori Are Partners Who Share inDocument1 pageSolved Myles Etter and Crystal Santori Are Partners Who Share inAnbu jaromiaNo ratings yet

- Solved Determine Whether Each of The Following Taxpayers Must File ADocument1 pageSolved Determine Whether Each of The Following Taxpayers Must File AAnbu jaromiaNo ratings yet

- Solved Refer To The Facts in The Preceding Problem Three YearsDocument1 pageSolved Refer To The Facts in The Preceding Problem Three YearsAnbu jaromiaNo ratings yet

- Revenue Practice ProblemsDocument9 pagesRevenue Practice ProblemsmikeNo ratings yet

- Solved in April of The Current Year Blue Corporation Purchased AnDocument1 pageSolved in April of The Current Year Blue Corporation Purchased AnAnbu jaromiaNo ratings yet

- Inc Tax Chp. 14Document6 pagesInc Tax Chp. 14Gene'sNo ratings yet

- Inc Tax Chp. 14Document6 pagesInc Tax Chp. 14Gene'sNo ratings yet

- Solved Broward Corp Owns 1 500 Shares of Silver Fox Corporation Common PDFDocument1 pageSolved Broward Corp Owns 1 500 Shares of Silver Fox Corporation Common PDFAnbu jaromiaNo ratings yet

- Solved A What Requirements Must Be Met in Order For A PDFDocument1 pageSolved A What Requirements Must Be Met in Order For A PDFAnbu jaromiaNo ratings yet

- Solved Bonnie Opens A Computer Sales and Repair Service During The PDFDocument1 pageSolved Bonnie Opens A Computer Sales and Repair Service During The PDFAnbu jaromiaNo ratings yet

- Solved Nolan Inc Had Taxable Income of 400 000 in 2019 ItsDocument1 pageSolved Nolan Inc Had Taxable Income of 400 000 in 2019 ItsAnbu jaromiaNo ratings yet

- Solved Toy Corporation Distributes 175 000 in Cash 1 75 Per Share WDocument1 pageSolved Toy Corporation Distributes 175 000 in Cash 1 75 Per Share WAnbu jaromiaNo ratings yet

- Solved Shonda Owns 1 000 of The 1 500 Shares Outstanding in RookDocument1 pageSolved Shonda Owns 1 000 of The 1 500 Shares Outstanding in RookAnbu jaromiaNo ratings yet

- Chapter 06 - SamplesDocument3 pagesChapter 06 - SamplesJessica ZhangNo ratings yet

- Solved Twelve Years Ago Marilyn Purchased Two Lots in An UndevelopedDocument1 pageSolved Twelve Years Ago Marilyn Purchased Two Lots in An UndevelopedAnbu jaromiaNo ratings yet

- Solved Usa Corporation Hired Jesse To Install A Computer System ForDocument1 pageSolved Usa Corporation Hired Jesse To Install A Computer System ForAnbu jaromiaNo ratings yet

- MC QuestionsDocument23 pagesMC QuestionsBob Sagett0% (5)

- Solved Young Corporation Purchased Residential Real Estate Several Year Ago ForDocument1 pageSolved Young Corporation Purchased Residential Real Estate Several Year Ago ForAnbu jaromiaNo ratings yet

- Solved On January 1 Year 1 Luzak Company Issued A 120 000Document1 pageSolved On January 1 Year 1 Luzak Company Issued A 120 000Anbu jaromiaNo ratings yet

- EPS QuestionsDocument4 pagesEPS QuestionsJennifer MansourNo ratings yet

- Solved The Following Statement of Cash Flows For Shasta Inc WasDocument1 pageSolved The Following Statement of Cash Flows For Shasta Inc WasAnbu jaromiaNo ratings yet

- Solved Samuel Reese Sold 1 000 Shares of His Stock in MaroonDocument1 pageSolved Samuel Reese Sold 1 000 Shares of His Stock in MaroonAnbu jaromiaNo ratings yet

- Solved in The Current Year Jose Receives A Liquidating Property DistriDocument1 pageSolved in The Current Year Jose Receives A Liquidating Property DistriAnbu jaromiaNo ratings yet

- Individual Income Tax Problem-Tax 4001 - 1228Document4 pagesIndividual Income Tax Problem-Tax 4001 - 1228さくら樱花No ratings yet

- Solved An Investor in A 28 Tax Bracket Owns Land That PDFDocument1 pageSolved An Investor in A 28 Tax Bracket Owns Land That PDFAnbu jaromiaNo ratings yet

- Solved Garth Company Sold Goods On Account To Kyle Enterprises WithDocument1 pageSolved Garth Company Sold Goods On Account To Kyle Enterprises WithAnbu jaromiaNo ratings yet

- Solved Leonard Grant Is The Sole Shareholder of Great Yards CorporationDocument1 pageSolved Leonard Grant Is The Sole Shareholder of Great Yards CorporationAnbu jaromiaNo ratings yet

- Introduction To Accounting EXE 1Document6 pagesIntroduction To Accounting EXE 1ntxthuy04No ratings yet

- Solved Jennifer Is Single and Has The Following Income and ExpensesDocument1 pageSolved Jennifer Is Single and Has The Following Income and ExpensesAnbu jaromiaNo ratings yet

- Solved Denim Corporation Declares A Nontaxable Dividend Payable in Rights ToDocument1 pageSolved Denim Corporation Declares A Nontaxable Dividend Payable in Rights ToAnbu jaromiaNo ratings yet

- Solved On December 1 2012 Lavender Manufacturing Company A Corporation PurchasedDocument1 pageSolved On December 1 2012 Lavender Manufacturing Company A Corporation PurchasedAnbu jaromiaNo ratings yet

- Solved Simon Is Single and A Stockbroker For A Large InvestmentDocument1 pageSolved Simon Is Single and A Stockbroker For A Large InvestmentAnbu jaromiaNo ratings yet

- Solved Several Years Ago PTR Purchased Business Equipment For 50 000 PTR SDocument1 pageSolved Several Years Ago PTR Purchased Business Equipment For 50 000 PTR SAnbu jaromiaNo ratings yet

- 305 FinalDocument33 pages305 FinalsmithteeNo ratings yet

- Copy and Complete The TableDocument3 pagesCopy and Complete The TablePrapya BarmanNo ratings yet

- Solved It S True That Unexpected Inflation Redistributes Wealth From Creditors ToDocument1 pageSolved It S True That Unexpected Inflation Redistributes Wealth From Creditors ToM Bilal SaleemNo ratings yet

- Solved Hamid Owns and Lives in A Duplex He Rents TheDocument1 pageSolved Hamid Owns and Lives in A Duplex He Rents TheAnbu jaromiaNo ratings yet

- Solved Your Company Distills Kentucky Bourbon A Canadian Competitor IsDocument1 pageSolved Your Company Distills Kentucky Bourbon A Canadian Competitor IsAnbu jaromiaNo ratings yet

- Solved You Work in A Medium Sized Organization 200 300 People You HeadDocument1 pageSolved You Work in A Medium Sized Organization 200 300 People You HeadAnbu jaromiaNo ratings yet

- Solved Your Client Meade Technical Solutions Proposes To Merge With DealyDocument1 pageSolved Your Client Meade Technical Solutions Proposes To Merge With DealyAnbu jaromia100% (1)

- Solved Your Firm Represents ABC Company in The Case of ABCDocument1 pageSolved Your Firm Represents ABC Company in The Case of ABCAnbu jaromiaNo ratings yet

- Solved Your Best Friend Wants To Know Why On Earth YouDocument1 pageSolved Your Best Friend Wants To Know Why On Earth YouAnbu jaromiaNo ratings yet

- Solved Your Client Heron Corporation Has A Deficit in Accumulated eDocument1 pageSolved Your Client Heron Corporation Has A Deficit in Accumulated eAnbu jaromiaNo ratings yet

- Solved You Have Been Hired To Correct The Trial Balance inDocument1 pageSolved You Have Been Hired To Correct The Trial Balance inAnbu jaromiaNo ratings yet

- Solved Your Examination of The Records of Northland Corp Shows TheDocument1 pageSolved Your Examination of The Records of Northland Corp Shows TheAnbu jaromiaNo ratings yet

- Solved Your Client A Physician Recently Purchased A Yacht On WhichDocument1 pageSolved Your Client A Physician Recently Purchased A Yacht On WhichAnbu jaromiaNo ratings yet

- Solved You Have Been Hired To Evaluate Internal Controls For YourDocument1 pageSolved You Have Been Hired To Evaluate Internal Controls For YourAnbu jaromiaNo ratings yet

- Solved Young Corporation Purchased Residential Real Estate Several Year Ago ForDocument1 pageSolved Young Corporation Purchased Residential Real Estate Several Year Ago ForAnbu jaromiaNo ratings yet

- Solved You Go To The Dentist Twice A Year To GetDocument1 pageSolved You Go To The Dentist Twice A Year To GetAnbu jaromiaNo ratings yet

- Solved You Have Decided To Form A Group To Return TheDocument1 pageSolved You Have Decided To Form A Group To Return TheAnbu jaromiaNo ratings yet

- Solved You Are Hired As A Consultant To Determine If FraudDocument1 pageSolved You Are Hired As A Consultant To Determine If FraudAnbu jaromiaNo ratings yet

- Solved You Are The Ceo of Xyz Manufacturing Company You HaveDocument1 pageSolved You Are The Ceo of Xyz Manufacturing Company You HaveAnbu jaromiaNo ratings yet

- Solved You Are The Tax Manager in A Cpa Office OneDocument1 pageSolved You Are The Tax Manager in A Cpa Office OneAnbu jaromiaNo ratings yet

- Solved Write A Research Paper That Analyzes The Evolving Relationship BetweenDocument1 pageSolved Write A Research Paper That Analyzes The Evolving Relationship BetweenAnbu jaromiaNo ratings yet

- Solved Woodridge Usa Properties L P Bought Eighty Seven Commercial TruckDocument1 pageSolved Woodridge Usa Properties L P Bought Eighty Seven Commercial TruckAnbu jaromiaNo ratings yet

- Solved Xyz Exchanged Old Equipment For New Like Kind Equipment Xyz S AdjustedDocument1 pageSolved Xyz Exchanged Old Equipment For New Like Kind Equipment Xyz S AdjustedAnbu jaromiaNo ratings yet

- Solved Yellow Corporation A Calendar Year Taxpayer Made Estimated Tax PaymentsDocument1 pageSolved Yellow Corporation A Calendar Year Taxpayer Made Estimated Tax PaymentsAnbu jaromiaNo ratings yet

- Solved Woldenga Equipment Inc Reported The Figures Shown Below For 2017Document1 pageSolved Woldenga Equipment Inc Reported The Figures Shown Below For 2017Anbu jaromiaNo ratings yet

- Solved William Rubin President of Tri State Mining Co Sought A LoanDocument1 pageSolved William Rubin President of Tri State Mining Co Sought A LoanAnbu jaromiaNo ratings yet

- Solved With Constant Tax Rates Over Time Why Does A SingleDocument1 pageSolved With Constant Tax Rates Over Time Why Does A SingleAnbu jaromiaNo ratings yet

- Solved Which of The Following Taxpayers Must File A 2015 Return ADocument1 pageSolved Which of The Following Taxpayers Must File A 2015 Return AAnbu jaromiaNo ratings yet

- Solved Within A Given Population 22 of The People Are SmokersDocument1 pageSolved Within A Given Population 22 of The People Are SmokersAnbu jaromiaNo ratings yet

- Solved Which Standard of Scrutiny or Test Would Apply To ThisDocument1 pageSolved Which Standard of Scrutiny or Test Would Apply To ThisAnbu jaromiaNo ratings yet

- Solved William Carter A Former Officer and Employee of Wilson ConstructionDocument1 pageSolved William Carter A Former Officer and Employee of Wilson ConstructionAnbu jaromiaNo ratings yet

- Solved Who Are The Parties The Plaintiffs and The Defendant inDocument1 pageSolved Who Are The Parties The Plaintiffs and The Defendant inAnbu jaromiaNo ratings yet

- Solved Which of The Following Statements Accurately Describes An Efficient TaxDocument1 pageSolved Which of The Following Statements Accurately Describes An Efficient TaxAnbu jaromiaNo ratings yet

- Solved While Crossing A Public Highway in The City Joel WasDocument1 pageSolved While Crossing A Public Highway in The City Joel WasAnbu jaromiaNo ratings yet

- CIR Vs Baier-Nickel, GR 153793, Aug. 29, 2006Document8 pagesCIR Vs Baier-Nickel, GR 153793, Aug. 29, 2006Dario G. TorresNo ratings yet

- Special Attachment Annual Income Tax Return For Corporate: ResetDocument3 pagesSpecial Attachment Annual Income Tax Return For Corporate: ResetMusi jayaNo ratings yet

- KAAP-MHB Repair QuotationDocument1 pageKAAP-MHB Repair QuotationMohammad Maruf Uddin ManagerNo ratings yet

- Invoice - Best Ayurvedic Company in India Which Provides Best Ayurvedic ProductsDocument2 pagesInvoice - Best Ayurvedic Company in India Which Provides Best Ayurvedic ProductsSomnath PalNo ratings yet

- SalarySlipwithTaxDetailsDocument2 pagesSalarySlipwithTaxDetailsIndian LegendNo ratings yet

- 12.2 Patches Released After RUP 10 Released On 20-Aug-2017Document12 pages12.2 Patches Released After RUP 10 Released On 20-Aug-2017Srinivas GirnalaNo ratings yet

- PT Way Tech Indonesia: QUOTATION No: 02.Q1722IP - BTRDocument1 pagePT Way Tech Indonesia: QUOTATION No: 02.Q1722IP - BTRwahyunurrizkyNo ratings yet

- Commercial Property Tax Appeal ServicesDocument7 pagesCommercial Property Tax Appeal ServicescutmytaxesNo ratings yet

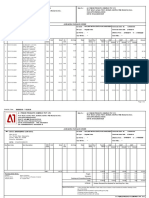

- A-1 Fence Products Company Pvt. LTDDocument2 pagesA-1 Fence Products Company Pvt. LTDDeepak PawarNo ratings yet

- Solved Rick Is A Sole Proprietor Who Has A Small BusinessDocument1 pageSolved Rick Is A Sole Proprietor Who Has A Small BusinessAnbu jaromiaNo ratings yet

- Lesson 5 Tax Planning With Reference To Capital StructureDocument37 pagesLesson 5 Tax Planning With Reference To Capital StructurekelvinNo ratings yet

- Wage and Tax Statement Wage and Tax StatementDocument1 pageWage and Tax Statement Wage and Tax StatementFabiola UrgilésNo ratings yet

- Sipl Pay Slip 238596 Dec 2022Document1 pageSipl Pay Slip 238596 Dec 2022sachinshetty205No ratings yet

- CompleteDocument2 pagesCompleteappledeja7829No ratings yet

- 2.7 United Airlines V CIRDocument6 pages2.7 United Airlines V CIRJayNo ratings yet

- LWB364 Introduction To Taxation LawDocument96 pagesLWB364 Introduction To Taxation LawHai LeNo ratings yet

- Income From House PropertyDocument34 pagesIncome From House PropertyMohd. Shadab khanNo ratings yet

- IAS 8 Tutorial Question (SS)Document2 pagesIAS 8 Tutorial Question (SS)Given RefilweNo ratings yet

- CA Final FT DetailsDocument1 pageCA Final FT DetailsPadma RajkumarNo ratings yet

- Bill Qayoom SB PDFDocument1 pageBill Qayoom SB PDFMuhammad AsifNo ratings yet

- Direct TAX: & International TaxationDocument531 pagesDirect TAX: & International Taxationavinashkives21No ratings yet

- Penal Provisions Under The Wbvat Act, 2003Document31 pagesPenal Provisions Under The Wbvat Act, 2003Anshuman ChakrabortyNo ratings yet

- Payslip - Jenalyn MAY 1 - 15Document1 pagePayslip - Jenalyn MAY 1 - 15bktsuna0201No ratings yet

- Solved DR Quinn DR Rose and DR Tanner Are Dentists WhoDocument1 pageSolved DR Quinn DR Rose and DR Tanner Are Dentists WhoAnbu jaromiaNo ratings yet