Professional Documents

Culture Documents

Solved Jennifer Is Single and Has The Following Income and Expenses

Uploaded by

Anbu jaromiaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Solved Jennifer Is Single and Has The Following Income and Expenses

Uploaded by

Anbu jaromiaCopyright:

Available Formats

(SOLVED) Jennifer is single and has the following income

and expenses

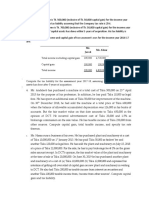

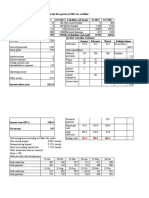

Jennifer is single and has the following income and expenses:Salary $76,000Interest income

5,000Dividend income 9,000Long-term capital gain 10,000Short-term capital loss

14,000Deductions for AGI 3,000Deductions from AGI 9,000Calculate Jennifer’s taxable income

and income tax liability.

Jason and Jill are married and have a six-year-old daughter. During the year, they sell one acre

of land for $80,000. Three years ago, they paid $70,000 for two acres of land. Their other

income and deductions are as follows:Jill’s commissions $82,000 Jason’s salary 46,000

Dividend income 5,000 Interest income […]

Erin, a single taxpayer, has a taxable income of $103,000 in the current year before considering

the following capital gains and losses:Short-term capital gain $ 3,000 Long-term capital gain

22,000 Unrecaptured Section 1250 gain 14,000 In addition, Erin has an $8,000 long-term

capital loss carryover from last year.What are the […]

Polly has the following capital gains and losses for the current year: Short-term capital gain $

1,000 Short-term capital loss 8,000 Long-term capital gain 5,000 Collectibles gain 16,000

Collectibles loss 3,000 What is the effect of the capital gains and losses on Polly’s taxable

income and her income tax liability? […]

GET ANSWER- https://accanswer.com/downloads/page/1152/

Rikki has the following capital gains and losses for the current year:Short-term capital gain . $

1,000Long-term capital gain . 11,000Long-term capital loss .. 3,000Collectibles gain ….

8,000Collectibles loss ….. 2,000What is the effect of the capital gains and losses on Rikki’s

taxable income and her income tax liability? Assume […]

Pedro purchases 50 shares of Piper Company stock on February 19, 2008, at a cost of $4,300.

He sells the 50 shares on July 2, 2011, for $9,000. On March 14, 2011, Pedro purchases 100

shares of Troxel stock for $9,700. He sells the Troxel shares on December 18, 2011, […]

Aziza is the sole owner of Azi’s Fast Pizza. During the current year, Azi’s replaces its fleet of

delivery vehicles. Aziza’s son purchases one of the old vehicles for $500, its tax basis to Azi’s.

Similar vehicles are sold for $4,000. What tax problem is posed by this situation? Explain […]

SEE SOLUTION>> https://accanswer.com/downloads/page/1152/

1/1

Powered by TCPDF (www.tcpdf.org)

You might also like

- Solved in The Current Year Jose Receives A Liquidating Property DistriDocument1 pageSolved in The Current Year Jose Receives A Liquidating Property DistriAnbu jaromiaNo ratings yet

- Solved Joey and Camilla Are Married and Have Three Children AgesDocument1 pageSolved Joey and Camilla Are Married and Have Three Children AgesAnbu jaromiaNo ratings yet

- Solved Toy Corporation Distributes 175 000 in Cash 1 75 Per Share WDocument1 pageSolved Toy Corporation Distributes 175 000 in Cash 1 75 Per Share WAnbu jaromiaNo ratings yet

- Solved Bonnie Opens A Computer Sales and Repair Service During The PDFDocument1 pageSolved Bonnie Opens A Computer Sales and Repair Service During The PDFAnbu jaromiaNo ratings yet

- Solved Simon Is Single and A Stockbroker For A Large InvestmentDocument1 pageSolved Simon Is Single and A Stockbroker For A Large InvestmentAnbu jaromiaNo ratings yet

- Exam 2 Practice ProblemsDocument12 pagesExam 2 Practice ProblemsumerubabNo ratings yet

- TuteDocument2 pagesTutekna123450% (2)

- Fundamentals of Accounting - Accruals Amd PrepaymentsDocument5 pagesFundamentals of Accounting - Accruals Amd PrepaymentsRealGenius (Carl)No ratings yet

- Solved Ms Reid Borrowed 50 000 From A Broker To Purchase LeroDocument1 pageSolved Ms Reid Borrowed 50 000 From A Broker To Purchase LeroAnbu jaromiaNo ratings yet

- Solved The Kane Corporation Is An Accrual Basis Taxpayer State LawDocument1 pageSolved The Kane Corporation Is An Accrual Basis Taxpayer State LawAnbu jaromiaNo ratings yet

- Chapter 05 SolutionsDocument7 pagesChapter 05 SolutionsShahnawaz KhanNo ratings yet

- Solved Erica and Raphael Are Divorced During The Current Year BecauseDocument1 pageSolved Erica and Raphael Are Divorced During The Current Year BecauseAnbu jaromiaNo ratings yet

- Solved The Webster Company Has Just Paid A Dividend of 5 25Document1 pageSolved The Webster Company Has Just Paid A Dividend of 5 25Anbu jaromiaNo ratings yet

- Solved Carmen and Carlos Who Have Filed Joint Tax Returns For PDFDocument1 pageSolved Carmen and Carlos Who Have Filed Joint Tax Returns For PDFAnbu jaromiaNo ratings yet

- Solved Your Client Heron Corporation Has A Deficit in Accumulated eDocument1 pageSolved Your Client Heron Corporation Has A Deficit in Accumulated eAnbu jaromiaNo ratings yet

- Solved Indigo Inc A Personal Service Corporation Has The Following TypesDocument1 pageSolved Indigo Inc A Personal Service Corporation Has The Following TypesAnbu jaromiaNo ratings yet

- Solved Henrietta Transfers Cash of 75 000 and Equipment With A FairDocument1 pageSolved Henrietta Transfers Cash of 75 000 and Equipment With A FairAnbu jaromiaNo ratings yet

- Tax 4001 Exam Practice SolutionsDocument10 pagesTax 4001 Exam Practice SolutionsggjjyyNo ratings yet

- Solved Kress Products Corporate Charter Authorized The Firm To Sell 800 000Document1 pageSolved Kress Products Corporate Charter Authorized The Firm To Sell 800 000Anbu jaromiaNo ratings yet

- Solved The Boyle Brothers Own and Operate A Microbrewery The PartnershDocument1 pageSolved The Boyle Brothers Own and Operate A Microbrewery The PartnershAnbu jaromiaNo ratings yet

- CH 4 & 5 Extra Practic Summer 2023Document9 pagesCH 4 & 5 Extra Practic Summer 2023Ruth KatakaNo ratings yet

- Solved Drake Inc A U S Corporation Operates A Branch Sales OfficeDocument1 pageSolved Drake Inc A U S Corporation Operates A Branch Sales OfficeAnbu jaromiaNo ratings yet

- Solved A What Requirements Must Be Met in Order For A PDFDocument1 pageSolved A What Requirements Must Be Met in Order For A PDFAnbu jaromiaNo ratings yet

- TaxationDocument3 pagesTaxationMohit LambaNo ratings yet

- Practice Final Acct 1Document12 pagesPractice Final Acct 1hannahkellum08No ratings yet

- Last Assignment (Najeeb)Document7 pagesLast Assignment (Najeeb)Najeeb KhanNo ratings yet

- FIN220 Tutorial Chapter 2Document37 pagesFIN220 Tutorial Chapter 2saifNo ratings yet

- Passive Income ActivityDocument2 pagesPassive Income ActivityMarielle Dela Torre LubatNo ratings yet

- Solved The Outstanding Stock in Red Blue and Green Corporations EachDocument1 pageSolved The Outstanding Stock in Red Blue and Green Corporations EachAnbu jaromiaNo ratings yet

- Solved Jurisdiction Z Levies An Excise Tax On Retail Purchases ofDocument1 pageSolved Jurisdiction Z Levies An Excise Tax On Retail Purchases ofAnbu jaromiaNo ratings yet

- Homework - Set - 10 - Spring 2013Document4 pagesHomework - Set - 10 - Spring 2013bizinichiNo ratings yet

- Assignment 2: Part 1: Preparing Financial Statements (50 Marks Total)Document4 pagesAssignment 2: Part 1: Preparing Financial Statements (50 Marks Total)Julia KristelNo ratings yet

- Tax Assignment For FinalDocument4 pagesTax Assignment For FinalEnaiya IslamNo ratings yet

- Question BankDocument21 pagesQuestion BankIan ChanNo ratings yet

- Acc324 MidsDocument8 pagesAcc324 MidsAccounting GuyNo ratings yet

- Solved Shannon Signs A 100 000 Contract To Develop A Plan ForDocument1 pageSolved Shannon Signs A 100 000 Contract To Develop A Plan ForAnbu jaromiaNo ratings yet

- Domestic Corporation Dividend Withholding TaxDocument4 pagesDomestic Corporation Dividend Withholding TaxLFGS FinalsNo ratings yet

- Western Leyte College of Ormoc, Inc. Prelim Exam in Taxation I October 10, 2020Document2 pagesWestern Leyte College of Ormoc, Inc. Prelim Exam in Taxation I October 10, 2020Marc William SorianoNo ratings yet

- Solved Parent Corporation S Current Year Taxable Income Included 100 000 Net Income FromDocument1 pageSolved Parent Corporation S Current Year Taxable Income Included 100 000 Net Income FromAnbu jaromia0% (1)

- Act Lesson4Document5 pagesAct Lesson4Johnloyd daracanNo ratings yet

- Accounting Equation Chapter SummaryDocument6 pagesAccounting Equation Chapter SummaryRamainne Ronquillo100% (1)

- Solved Lake Corporation Has Some Severe Cash Flow Problems You Are TheDocument1 pageSolved Lake Corporation Has Some Severe Cash Flow Problems You Are TheAnbu jaromiaNo ratings yet

- Exercise 3. Cash Flows Statements and WorkingDocument8 pagesExercise 3. Cash Flows Statements and WorkingQuang Dũng NguyễnNo ratings yet

- 1)Document2 pages1)Tom BinfieldNo ratings yet

- SAMPLE MidtermDocument2 pagesSAMPLE MidtermPatricia Ann GuetaNo ratings yet

- Eshetu Gelagay Ind Ass Acc - For ManagersDocument12 pagesEshetu Gelagay Ind Ass Acc - For ManagersabiyNo ratings yet

- BT-211-Module-05-1Document12 pagesBT-211-Module-05-1Franz PampolinaNo ratings yet

- Jesswani, John Joseph - ACCT 102 (Module 1, Review Assessment)Document3 pagesJesswani, John Joseph - ACCT 102 (Module 1, Review Assessment)JJ JesswaniNo ratings yet

- Daftar Akun - CAP003Document5 pagesDaftar Akun - CAP003Haryantie AgoesNo ratings yet

- University of Zimbabwe 2020 July/August Examinations: Faculty: CommerceDocument9 pagesUniversity of Zimbabwe 2020 July/August Examinations: Faculty: CommercePanashe BotaNo ratings yet

- HI 5020 Corporate Accounting: Session 8b Intra-Group TransactionsDocument16 pagesHI 5020 Corporate Accounting: Session 8b Intra-Group TransactionsFeku RamNo ratings yet

- Income Tax Quiz - 101623Document2 pagesIncome Tax Quiz - 101623Chrystal Mae PitocNo ratings yet

- Answers Practice Questions # 1Document18 pagesAnswers Practice Questions # 1mustafa hasan100% (1)

- Solved Garth Company Sold Goods On Account To Kyle Enterprises WithDocument1 pageSolved Garth Company Sold Goods On Account To Kyle Enterprises WithAnbu jaromiaNo ratings yet

- ME-Tut 4Document2 pagesME-Tut 4Shekhar SinghNo ratings yet

- TaxationDocument7 pagesTaxationRahul Singh DeoNo ratings yet

- Assignment Chapter 1Document5 pagesAssignment Chapter 1Mark CalimlimNo ratings yet

- 3.0 General Principles of Income Tax and Gross IncomeDocument53 pages3.0 General Principles of Income Tax and Gross Incomedreample1003No ratings yet

- Solved Your Client Meade Technical Solutions Proposes To Merge With DealyDocument1 pageSolved Your Client Meade Technical Solutions Proposes To Merge With DealyAnbu jaromia100% (1)

- Solved Your Company Distills Kentucky Bourbon A Canadian Competitor IsDocument1 pageSolved Your Company Distills Kentucky Bourbon A Canadian Competitor IsAnbu jaromiaNo ratings yet

- Solved You Work in A Medium Sized Organization 200 300 People You HeadDocument1 pageSolved You Work in A Medium Sized Organization 200 300 People You HeadAnbu jaromiaNo ratings yet

- Solved Young Corporation Purchased Residential Real Estate Several Year Ago ForDocument1 pageSolved Young Corporation Purchased Residential Real Estate Several Year Ago ForAnbu jaromiaNo ratings yet

- Solved Your Best Friend Wants To Know Why On Earth YouDocument1 pageSolved Your Best Friend Wants To Know Why On Earth YouAnbu jaromiaNo ratings yet

- Solved You Have Been Hired To Evaluate Internal Controls For YourDocument1 pageSolved You Have Been Hired To Evaluate Internal Controls For YourAnbu jaromiaNo ratings yet

- Solved Your Firm Represents ABC Company in The Case of ABCDocument1 pageSolved Your Firm Represents ABC Company in The Case of ABCAnbu jaromiaNo ratings yet

- Solved Your Client Heron Corporation Has A Deficit in Accumulated eDocument1 pageSolved Your Client Heron Corporation Has A Deficit in Accumulated eAnbu jaromiaNo ratings yet

- Solved You Have Decided To Form A Group To Return TheDocument1 pageSolved You Have Decided To Form A Group To Return TheAnbu jaromiaNo ratings yet

- Solved Your Client A Physician Recently Purchased A Yacht On WhichDocument1 pageSolved Your Client A Physician Recently Purchased A Yacht On WhichAnbu jaromiaNo ratings yet

- Solved Your Examination of The Records of Northland Corp Shows TheDocument1 pageSolved Your Examination of The Records of Northland Corp Shows TheAnbu jaromiaNo ratings yet

- Solved Woodridge Usa Properties L P Bought Eighty Seven Commercial TruckDocument1 pageSolved Woodridge Usa Properties L P Bought Eighty Seven Commercial TruckAnbu jaromiaNo ratings yet

- Solved You Have Been Hired To Correct The Trial Balance inDocument1 pageSolved You Have Been Hired To Correct The Trial Balance inAnbu jaromiaNo ratings yet

- Solved Your Colleague Picks Up The 2012 Annual Report of MicrosoftDocument1 pageSolved Your Colleague Picks Up The 2012 Annual Report of MicrosoftAnbu jaromiaNo ratings yet

- Solved You Are The Tax Manager in A Cpa Office OneDocument1 pageSolved You Are The Tax Manager in A Cpa Office OneAnbu jaromiaNo ratings yet

- Solved You Have An Employee Who Has A Chemical Imbalance inDocument1 pageSolved You Have An Employee Who Has A Chemical Imbalance inAnbu jaromiaNo ratings yet

- Solved You Go To The Dentist Twice A Year To GetDocument1 pageSolved You Go To The Dentist Twice A Year To GetAnbu jaromiaNo ratings yet

- Solved Write A Research Paper That Analyzes The Evolving Relationship BetweenDocument1 pageSolved Write A Research Paper That Analyzes The Evolving Relationship BetweenAnbu jaromiaNo ratings yet

- Solved You Are Hired As A Consultant To Determine If FraudDocument1 pageSolved You Are Hired As A Consultant To Determine If FraudAnbu jaromiaNo ratings yet

- Solved Yellow Corporation A Calendar Year Taxpayer Made Estimated Tax PaymentsDocument1 pageSolved Yellow Corporation A Calendar Year Taxpayer Made Estimated Tax PaymentsAnbu jaromiaNo ratings yet

- Solved William Rubin President of Tri State Mining Co Sought A LoanDocument1 pageSolved William Rubin President of Tri State Mining Co Sought A LoanAnbu jaromiaNo ratings yet

- Solved With The Recent Changes in The Tax Law Definition ofDocument1 pageSolved With The Recent Changes in The Tax Law Definition ofAnbu jaromiaNo ratings yet

- Solved Xyz Exchanged Old Equipment For New Like Kind Equipment Xyz S AdjustedDocument1 pageSolved Xyz Exchanged Old Equipment For New Like Kind Equipment Xyz S AdjustedAnbu jaromiaNo ratings yet

- Solved You Are The Ceo of Xyz Manufacturing Company You HaveDocument1 pageSolved You Are The Ceo of Xyz Manufacturing Company You HaveAnbu jaromiaNo ratings yet

- Solved Woldenga Equipment Inc Reported The Figures Shown Below For 2017Document1 pageSolved Woldenga Equipment Inc Reported The Figures Shown Below For 2017Anbu jaromiaNo ratings yet

- Solved Within A Given Population 22 of The People Are SmokersDocument1 pageSolved Within A Given Population 22 of The People Are SmokersAnbu jaromiaNo ratings yet

- Solved Which Standard of Scrutiny or Test Would Apply To ThisDocument1 pageSolved Which Standard of Scrutiny or Test Would Apply To ThisAnbu jaromiaNo ratings yet

- Solved White S Printing LTD S Year End Is February 28 The AccountingDocument1 pageSolved White S Printing LTD S Year End Is February 28 The AccountingAnbu jaromiaNo ratings yet

- Solved With Constant Tax Rates Over Time Why Does A SingleDocument1 pageSolved With Constant Tax Rates Over Time Why Does A SingleAnbu jaromiaNo ratings yet

- Solved William Carter A Former Officer and Employee of Wilson ConstructionDocument1 pageSolved William Carter A Former Officer and Employee of Wilson ConstructionAnbu jaromiaNo ratings yet

- Some Costing Questions PDFDocument85 pagesSome Costing Questions PDFHarshit AggarwalNo ratings yet

- Friedrich Ulrich Maximilian Johann Count of LuxburgDocument4 pagesFriedrich Ulrich Maximilian Johann Count of LuxburgjohnpoluxNo ratings yet

- MOSP Final Project - ITC - Group7 - SectionCDocument29 pagesMOSP Final Project - ITC - Group7 - SectionCArjun JainNo ratings yet

- Nature, Scope and Practice of Managerial EconomicsDocument10 pagesNature, Scope and Practice of Managerial Economics버니 모지코No ratings yet

- DLF - Building India: Achintya PR Ankit Uttam Arun Ks Manish Watharkar Nishigandha Pankaj Kumar Prashant PatroDocument143 pagesDLF - Building India: Achintya PR Ankit Uttam Arun Ks Manish Watharkar Nishigandha Pankaj Kumar Prashant PatroAshish AggarwalNo ratings yet

- Import Purchase ProcedureDocument20 pagesImport Purchase ProcedureAbdul KhaderNo ratings yet

- Capstone Research Paper - Ferrari 2015 Initial Public OfferingDocument9 pagesCapstone Research Paper - Ferrari 2015 Initial Public OfferingJames A. Whitten0% (1)

- Zero Base BudgetingDocument15 pagesZero Base BudgetingSumitasNo ratings yet

- Unit 10 - Assignment 2 (LO3&LO4) (Essam Hamad) (19011285)Document11 pagesUnit 10 - Assignment 2 (LO3&LO4) (Essam Hamad) (19011285)Essam HamadNo ratings yet

- Ra 11058 OshlawDocument17 pagesRa 11058 OshlawArt CorbeNo ratings yet

- Intro To Tax ManagementDocument55 pagesIntro To Tax ManagementJam HailNo ratings yet

- Agribusiness MarketingDocument3 pagesAgribusiness Marketingpalash80100% (1)

- GAAP: Generally Accepted Accounting PrinciplesDocument7 pagesGAAP: Generally Accepted Accounting PrinciplesTAI LONGNo ratings yet

- How communities changed before, during, and after the pandemicDocument3 pagesHow communities changed before, during, and after the pandemicMJ San PedroNo ratings yet

- PNBDocument73 pagesPNBTushat GoelNo ratings yet

- GE MatrixDocument34 pagesGE MatrixKeshav BhatiaNo ratings yet

- Inclusive Growth and Gandhi's Swaraj ComparedDocument18 pagesInclusive Growth and Gandhi's Swaraj ComparedRubina PradhanNo ratings yet

- Thanos Industries Case StudyDocument48 pagesThanos Industries Case StudyWJ TanoNo ratings yet

- An Introduction To Marxism - Its Origins, Key Ideas, and Contemporary RelevanceDocument2 pagesAn Introduction To Marxism - Its Origins, Key Ideas, and Contemporary RelevancemikeNo ratings yet

- Credit Card PresentationDocument24 pagesCredit Card Presentationpradeep367380% (5)

- NCA Rawalpindi-Fee StructureDocument1 pageNCA Rawalpindi-Fee StructureSyed Ali SajjadNo ratings yet

- Mandara Report 2019Document59 pagesMandara Report 2019Tony MumvuriNo ratings yet

- Audit 2023Document18 pagesAudit 2023queenmutheu01No ratings yet

- Module Guide: Module BM3309 International Business Semester: October 2015Document40 pagesModule Guide: Module BM3309 International Business Semester: October 2015Nor Ashikin IsmailNo ratings yet

- Government Accounting ManualDocument9 pagesGovernment Accounting ManualGabriel PonceNo ratings yet

- MO QuestionDocument2 pagesMO Questionlingly justNo ratings yet

- 14 Sustainable TourismDocument17 pages14 Sustainable TourismIwan Firman WidiyantoNo ratings yet

- Trading The Ichimoku WayDocument4 pagesTrading The Ichimoku Waysaa6383No ratings yet

- The Management of Employee Benefits and ServicesDocument37 pagesThe Management of Employee Benefits and ServicesImy AbrenillaNo ratings yet

- Chapter 11 Partnership FormationDocument10 pagesChapter 11 Partnership FormationJo Faula BelleNo ratings yet