Professional Documents

Culture Documents

Solved The Kane Corporation Is An Accrual Basis Taxpayer State Law

Uploaded by

Anbu jaromiaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Solved The Kane Corporation Is An Accrual Basis Taxpayer State Law

Uploaded by

Anbu jaromiaCopyright:

Available Formats

(SOLVED) The Kane Corporation is an accrual basis

taxpayer State law

The Kane Corporation is an accrual basis taxpayer. State law requires that Kane acquire

workers’ compensation insurance from a third-party carrier or maintain a self-funded workers’

compensation insurance plan. Kane has decided to create a selffundedworkers’ compensation

plan and pay $6 per month (the state minimum) into the fund for […]

On July 1, 2011, Andaria borrows $30,000 from the First Financial Bank. The loan is for 1 year

at an annual interest rate of 10%. How much interest can Andaria deduct under each of the

following situations?a. The bank deducts the interest from the loan proceeds.b. The $30,000

loan proceeds […]

Matilda owns a condominium on the beach in Rehoboth, Delaware. During the current year, she

incurs the following expenses related to the property:Mortgage interest …… $8,000Property taxes

……. 1,750Utilities ……….. 1,050Maintenance fees ……. 600Repairs ……….. 350Depreciation

(unallocated) .. 3,200 Determine the amount of Matilda’s deductions in each of the

followingcases:

Mel and Helen own a beachfront home in Myrtle Beach, S.C. During the year, they rented the

house for 5 weeks (35 days) at $800 per week and used the house for personal purposes 65

days. The costs of maintaining the house for the year were:Mortgage interest …. $5,500Real

property […]

GET ANSWER- https://accanswer.com/downloads/page/1181/

Lee and Sally own a winter retreat in Harlingen, Texas, that qualifies as their secondhome. This

year they spent 40 days in their cabin. Because of its ideal location, itis easy to rent at $120 a

day and was rented for 80 days this year. The total upkeepcosts of the […]

As a hobby, Jane creates and sells oil paintings. During the current year, her sales total $8,000.

How is the tax treatment of her hobby different from the treatment of a trade or business, ifa.

Her business expenses total $5,600?b. Her business expenses total $10,000?c. Assume that

Jane itemizes her […]

Ying pays an adviser $300 to help manage her investments and provide investment advice. The

adviser’s fee is not directly related to any particular investment owned by Ying. She owns

$40,000 worth of municipal bonds that pay her $2,400 in interest and $20,000 worth of bonds

that pay her taxable […]

SEE SOLUTION>> https://accanswer.com/downloads/page/1181/

1/1

Powered by TCPDF (www.tcpdf.org)

You might also like

- Salary Structure CalculatorDocument7 pagesSalary Structure CalculatorMakesh Gopalakrishnan0% (1)

- Billing Address: Tax InvoiceDocument1 pageBilling Address: Tax InvoiceShivani SinghNo ratings yet

- eFPS Payment DetailsDocument3 pageseFPS Payment DetailsPoofNo ratings yet

- Syllabus Grad SCH Public Fiscal AdministrationDocument3 pagesSyllabus Grad SCH Public Fiscal AdministrationANGELITA U. ALONZO100% (6)

- Solved A What Requirements Must Be Met in Order For A PDFDocument1 pageSolved A What Requirements Must Be Met in Order For A PDFAnbu jaromiaNo ratings yet

- Solved Minnie Owns A Qualified Annuity That Cost 78 000 The AnnuityDocument1 pageSolved Minnie Owns A Qualified Annuity That Cost 78 000 The AnnuityAnbu jaromiaNo ratings yet

- Solved Ms Reid Borrowed 50 000 From A Broker To Purchase LeroDocument1 pageSolved Ms Reid Borrowed 50 000 From A Broker To Purchase LeroAnbu jaromiaNo ratings yet

- Solved Determine Whether Each of The Following Taxpayers Must File ADocument1 pageSolved Determine Whether Each of The Following Taxpayers Must File AAnbu jaromiaNo ratings yet

- Solved Richie Is A Wealthy Rancher in Texas He Operates HisDocument1 pageSolved Richie Is A Wealthy Rancher in Texas He Operates HisAnbu jaromiaNo ratings yet

- Solved Stan Rented An Office Building To Clay For 3 000 PerDocument1 pageSolved Stan Rented An Office Building To Clay For 3 000 PerAnbu jaromiaNo ratings yet

- Solved Joey and Camilla Are Married and Have Three Children AgesDocument1 pageSolved Joey and Camilla Are Married and Have Three Children AgesAnbu jaromiaNo ratings yet

- Solved Marcy Tucker Received The Following Items This Year Determine ToDocument1 pageSolved Marcy Tucker Received The Following Items This Year Determine ToAnbu jaromiaNo ratings yet

- CH 4 & 5 Extra Practic Summer 2023Document9 pagesCH 4 & 5 Extra Practic Summer 2023Ruth KatakaNo ratings yet

- Solved Maurice Allred Is Going To Purchase Either The Stock orDocument1 pageSolved Maurice Allred Is Going To Purchase Either The Stock orAnbu jaromiaNo ratings yet

- Solved State Whether Each of The Following Payments Is A TaxDocument1 pageSolved State Whether Each of The Following Payments Is A TaxAnbu jaromiaNo ratings yet

- Solved Sixteen Years Ago Ms Cole Purchased A 500 000 Insurance PolicyDocument1 pageSolved Sixteen Years Ago Ms Cole Purchased A 500 000 Insurance PolicyAnbu jaromiaNo ratings yet

- Solved Simon Is Single and A Stockbroker For A Large InvestmentDocument1 pageSolved Simon Is Single and A Stockbroker For A Large InvestmentAnbu jaromiaNo ratings yet

- Solved Trevor Corporation Had 2 900 000 in Total Liabilities and 4 300 000 inDocument1 pageSolved Trevor Corporation Had 2 900 000 in Total Liabilities and 4 300 000 inAnbu jaromiaNo ratings yet

- Solved On January 1 of The Current Year Scott Borrows 80 000Document1 pageSolved On January 1 of The Current Year Scott Borrows 80 000Anbu jaromiaNo ratings yet

- Solved Mandy Is Interested in Purchasing A New Automobile For PersonalDocument1 pageSolved Mandy Is Interested in Purchasing A New Automobile For PersonalAnbu jaromiaNo ratings yet

- Solved A Tornado Extensively Damaged The Community in Which Bodine Comp PDFDocument1 pageSolved A Tornado Extensively Damaged The Community in Which Bodine Comp PDFAnbu jaromiaNo ratings yet

- Solved Refer To The Preceding Problem and Assume That Mrs NunnDocument1 pageSolved Refer To The Preceding Problem and Assume That Mrs NunnAnbu jaromiaNo ratings yet

- 441 CHP 14 On Line in Class Problems Day 21Document17 pages441 CHP 14 On Line in Class Problems Day 21KNVS Siva KumarNo ratings yet

- Solved Jennifer Is Single and Has The Following Income and ExpensesDocument1 pageSolved Jennifer Is Single and Has The Following Income and ExpensesAnbu jaromiaNo ratings yet

- Solved This Year FGH Partnership Generated 600 000 Ordinary Business Income FGHDocument1 pageSolved This Year FGH Partnership Generated 600 000 Ordinary Business Income FGHAnbu jaromiaNo ratings yet

- Solved Jurisdiction Z Levies An Excise Tax On Retail Purchases ofDocument1 pageSolved Jurisdiction Z Levies An Excise Tax On Retail Purchases ofAnbu jaromiaNo ratings yet

- Solved Myles Etter and Crystal Santori Are Partners Who Share inDocument1 pageSolved Myles Etter and Crystal Santori Are Partners Who Share inAnbu jaromiaNo ratings yet

- Solved Henrietta Transfers Cash of 75 000 and Equipment With A FairDocument1 pageSolved Henrietta Transfers Cash of 75 000 and Equipment With A FairAnbu jaromiaNo ratings yet

- Solved Earl Is A Student at Aggie Tech He Receives ADocument1 pageSolved Earl Is A Student at Aggie Tech He Receives AAnbu jaromiaNo ratings yet

- Solved Diane and Peter Were Divorced in 2010 The Divorce AgreementDocument1 pageSolved Diane and Peter Were Divorced in 2010 The Divorce AgreementAnbu jaromiaNo ratings yet

- Solved An Investor in A 28 Tax Bracket Owns Land That PDFDocument1 pageSolved An Investor in A 28 Tax Bracket Owns Land That PDFAnbu jaromiaNo ratings yet

- Solved Toy Corporation Distributes 175 000 in Cash 1 75 Per Share WDocument1 pageSolved Toy Corporation Distributes 175 000 in Cash 1 75 Per Share WAnbu jaromiaNo ratings yet

- Solved George Is Single and Has Adjusted Gross Income of 37 000Document1 pageSolved George Is Single and Has Adjusted Gross Income of 37 000Anbu jaromiaNo ratings yet

- Midterm Examination 2Document5 pagesMidterm Examination 2Timbas TNo ratings yet

- Solved Erica and Raphael Are Divorced During The Current Year BecauseDocument1 pageSolved Erica and Raphael Are Divorced During The Current Year BecauseAnbu jaromiaNo ratings yet

- Solved in The Current Year Jose Receives A Liquidating Property DistriDocument1 pageSolved in The Current Year Jose Receives A Liquidating Property DistriAnbu jaromiaNo ratings yet

- IND 13 CHP 14 8B Class Text HW Problems SolutionsDocument6 pagesIND 13 CHP 14 8B Class Text HW Problems SolutionsRespect InfinityNo ratings yet

- Solved Drake Inc A U S Corporation Operates A Branch Sales OfficeDocument1 pageSolved Drake Inc A U S Corporation Operates A Branch Sales OfficeAnbu jaromiaNo ratings yet

- Inc Tax Chp. 14Document6 pagesInc Tax Chp. 14Gene'sNo ratings yet

- Inc Tax Chp. 14Document6 pagesInc Tax Chp. 14Gene'sNo ratings yet

- Solved Shannon Signs A 100 000 Contract To Develop A Plan ForDocument1 pageSolved Shannon Signs A 100 000 Contract To Develop A Plan ForAnbu jaromiaNo ratings yet

- Solved MR and Mrs BL Led A Joint Tax Return ReportingDocument1 pageSolved MR and Mrs BL Led A Joint Tax Return ReportingAnbu jaromiaNo ratings yet

- Solved MR and Mrs Lund and Their Two Children Ben andDocument1 pageSolved MR and Mrs Lund and Their Two Children Ben andAnbu jaromiaNo ratings yet

- Chapter 06 - SamplesDocument3 pagesChapter 06 - SamplesJessica ZhangNo ratings yet

- Solved Paris Corporation Holds A 100 000 Unrealized Net Capital GainDocument1 pageSolved Paris Corporation Holds A 100 000 Unrealized Net Capital GainAnbu jaromiaNo ratings yet

- Solved Which of The Following Taxpayers Must File A 2015 Return ADocument1 pageSolved Which of The Following Taxpayers Must File A 2015 Return AAnbu jaromiaNo ratings yet

- Solved Firm R Owned Depreciable Real Property Subject To A 300 000Document1 pageSolved Firm R Owned Depreciable Real Property Subject To A 300 000Anbu jaromiaNo ratings yet

- Solved Hank Carries A 100 000 Insurance Policy On His Life PremiumsDocument1 pageSolved Hank Carries A 100 000 Insurance Policy On His Life PremiumsAnbu jaromiaNo ratings yet

- Solved James Smithern Has Asked For A 3 500 Loan From BeardDocument1 pageSolved James Smithern Has Asked For A 3 500 Loan From BeardM Bilal SaleemNo ratings yet

- Carol Wong Is The President and Major Shareholder of CWDocument2 pagesCarol Wong Is The President and Major Shareholder of CWCharlotteNo ratings yet

- Chapter+7 Part+I Before+class+notes+ PDFDocument10 pagesChapter+7 Part+I Before+class+notes+ PDFhr4hzz79kdNo ratings yet

- Solved Lake Corporation Has Some Severe Cash Flow Problems You Are TheDocument1 pageSolved Lake Corporation Has Some Severe Cash Flow Problems You Are TheAnbu jaromiaNo ratings yet

- Tutorial Solution Chap 5Document4 pagesTutorial Solution Chap 5Nurul AriffahNo ratings yet

- Solved Carmen and Carlos Who Have Filed Joint Tax Returns For PDFDocument1 pageSolved Carmen and Carlos Who Have Filed Joint Tax Returns For PDFAnbu jaromiaNo ratings yet

- Solved Your Client Heron Corporation Has A Deficit in Accumulated eDocument1 pageSolved Your Client Heron Corporation Has A Deficit in Accumulated eAnbu jaromiaNo ratings yet

- Solved Refer To The Facts in The Preceding Problem Three YearsDocument1 pageSolved Refer To The Facts in The Preceding Problem Three YearsAnbu jaromiaNo ratings yet

- Scan 0060Document2 pagesScan 0060Zeyad El-sayedNo ratings yet

- Solved Alpine Corporation Is A Qualified Small Business Corporation Eligible To PDFDocument1 pageSolved Alpine Corporation Is A Qualified Small Business Corporation Eligible To PDFAnbu jaromiaNo ratings yet

- Solved Curtis Is 50 Years Old and Has An Individual RetirementDocument1 pageSolved Curtis Is 50 Years Old and Has An Individual RetirementAnbu jaromiaNo ratings yet

- Solved Bonnie Opens A Computer Sales and Repair Service During The PDFDocument1 pageSolved Bonnie Opens A Computer Sales and Repair Service During The PDFAnbu jaromiaNo ratings yet

- Taxation - Assignment #1 Winter 2021: UestionsDocument8 pagesTaxation - Assignment #1 Winter 2021: UestionsAssignment &ExamsNo ratings yet

- Real Estate Investing 101: Best Way to Buy a House and Save Big, Top 20 TipsFrom EverandReal Estate Investing 101: Best Way to Buy a House and Save Big, Top 20 TipsNo ratings yet

- The Pros & Cons of Homeownership #3: Inflation Protection: Financial Freedom, #209From EverandThe Pros & Cons of Homeownership #3: Inflation Protection: Financial Freedom, #209No ratings yet

- Solved Your Company Distills Kentucky Bourbon A Canadian Competitor IsDocument1 pageSolved Your Company Distills Kentucky Bourbon A Canadian Competitor IsAnbu jaromiaNo ratings yet

- Solved You Work in A Medium Sized Organization 200 300 People You HeadDocument1 pageSolved You Work in A Medium Sized Organization 200 300 People You HeadAnbu jaromiaNo ratings yet

- Solved Your Client Meade Technical Solutions Proposes To Merge With DealyDocument1 pageSolved Your Client Meade Technical Solutions Proposes To Merge With DealyAnbu jaromia100% (1)

- Solved Your Firm Represents ABC Company in The Case of ABCDocument1 pageSolved Your Firm Represents ABC Company in The Case of ABCAnbu jaromiaNo ratings yet

- Solved Your Best Friend Wants To Know Why On Earth YouDocument1 pageSolved Your Best Friend Wants To Know Why On Earth YouAnbu jaromiaNo ratings yet

- Solved Your Client Heron Corporation Has A Deficit in Accumulated eDocument1 pageSolved Your Client Heron Corporation Has A Deficit in Accumulated eAnbu jaromiaNo ratings yet

- Solved You Have Been Hired To Correct The Trial Balance inDocument1 pageSolved You Have Been Hired To Correct The Trial Balance inAnbu jaromiaNo ratings yet

- Solved Your Examination of The Records of Northland Corp Shows TheDocument1 pageSolved Your Examination of The Records of Northland Corp Shows TheAnbu jaromiaNo ratings yet

- Solved Your Client A Physician Recently Purchased A Yacht On WhichDocument1 pageSolved Your Client A Physician Recently Purchased A Yacht On WhichAnbu jaromiaNo ratings yet

- Solved You Have Been Hired To Evaluate Internal Controls For YourDocument1 pageSolved You Have Been Hired To Evaluate Internal Controls For YourAnbu jaromiaNo ratings yet

- Solved Young Corporation Purchased Residential Real Estate Several Year Ago ForDocument1 pageSolved Young Corporation Purchased Residential Real Estate Several Year Ago ForAnbu jaromiaNo ratings yet

- Solved You Go To The Dentist Twice A Year To GetDocument1 pageSolved You Go To The Dentist Twice A Year To GetAnbu jaromiaNo ratings yet

- Solved You Have Decided To Form A Group To Return TheDocument1 pageSolved You Have Decided To Form A Group To Return TheAnbu jaromiaNo ratings yet

- Solved You Are Hired As A Consultant To Determine If FraudDocument1 pageSolved You Are Hired As A Consultant To Determine If FraudAnbu jaromiaNo ratings yet

- Solved You Are The Ceo of Xyz Manufacturing Company You HaveDocument1 pageSolved You Are The Ceo of Xyz Manufacturing Company You HaveAnbu jaromiaNo ratings yet

- Solved You Are The Tax Manager in A Cpa Office OneDocument1 pageSolved You Are The Tax Manager in A Cpa Office OneAnbu jaromiaNo ratings yet

- Solved Write A Research Paper That Analyzes The Evolving Relationship BetweenDocument1 pageSolved Write A Research Paper That Analyzes The Evolving Relationship BetweenAnbu jaromiaNo ratings yet

- Solved Woodridge Usa Properties L P Bought Eighty Seven Commercial TruckDocument1 pageSolved Woodridge Usa Properties L P Bought Eighty Seven Commercial TruckAnbu jaromiaNo ratings yet

- Solved Xyz Exchanged Old Equipment For New Like Kind Equipment Xyz S AdjustedDocument1 pageSolved Xyz Exchanged Old Equipment For New Like Kind Equipment Xyz S AdjustedAnbu jaromiaNo ratings yet

- Solved Yellow Corporation A Calendar Year Taxpayer Made Estimated Tax PaymentsDocument1 pageSolved Yellow Corporation A Calendar Year Taxpayer Made Estimated Tax PaymentsAnbu jaromiaNo ratings yet

- Solved Woldenga Equipment Inc Reported The Figures Shown Below For 2017Document1 pageSolved Woldenga Equipment Inc Reported The Figures Shown Below For 2017Anbu jaromiaNo ratings yet

- Solved William Rubin President of Tri State Mining Co Sought A LoanDocument1 pageSolved William Rubin President of Tri State Mining Co Sought A LoanAnbu jaromiaNo ratings yet

- Solved With Constant Tax Rates Over Time Why Does A SingleDocument1 pageSolved With Constant Tax Rates Over Time Why Does A SingleAnbu jaromiaNo ratings yet

- Solved Which of The Following Taxpayers Must File A 2015 Return ADocument1 pageSolved Which of The Following Taxpayers Must File A 2015 Return AAnbu jaromiaNo ratings yet

- Solved Within A Given Population 22 of The People Are SmokersDocument1 pageSolved Within A Given Population 22 of The People Are SmokersAnbu jaromiaNo ratings yet

- Solved Which Standard of Scrutiny or Test Would Apply To ThisDocument1 pageSolved Which Standard of Scrutiny or Test Would Apply To ThisAnbu jaromiaNo ratings yet

- Solved William Carter A Former Officer and Employee of Wilson ConstructionDocument1 pageSolved William Carter A Former Officer and Employee of Wilson ConstructionAnbu jaromiaNo ratings yet

- Solved Who Are The Parties The Plaintiffs and The Defendant inDocument1 pageSolved Who Are The Parties The Plaintiffs and The Defendant inAnbu jaromiaNo ratings yet

- Solved Which of The Following Statements Accurately Describes An Efficient TaxDocument1 pageSolved Which of The Following Statements Accurately Describes An Efficient TaxAnbu jaromiaNo ratings yet

- Solved While Crossing A Public Highway in The City Joel WasDocument1 pageSolved While Crossing A Public Highway in The City Joel WasAnbu jaromiaNo ratings yet

- RNHT223Document2 pagesRNHT223AE MDHalliNo ratings yet

- Week 4 Course Material For Income TaxationDocument12 pagesWeek 4 Course Material For Income TaxationAshly MateoNo ratings yet

- Value Added Tax Returns Form 002Document5 pagesValue Added Tax Returns Form 002JUDY OSUSUNo ratings yet

- 2019 Train Tax Tables and Bir Income Tax RatesDocument2 pages2019 Train Tax Tables and Bir Income Tax RatesAljohn SebucNo ratings yet

- Jio November Invoice Receipt-Arvind Kumar SharmaDocument4 pagesJio November Invoice Receipt-Arvind Kumar SharmaArvind SharmaNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/Villagehealth with wealthNo ratings yet

- Bachelor'S Degree Programme Term-End Examination December, 2017 Elective Course: Commerce Eco-011: Elements of Income TaxDocument6 pagesBachelor'S Degree Programme Term-End Examination December, 2017 Elective Course: Commerce Eco-011: Elements of Income TaxAnkit KumarNo ratings yet

- TacDocument16 pagesTacAllaine ParkerNo ratings yet

- 72814cajournal Feb2023 11Document1 page72814cajournal Feb2023 11S M SHEKARNo ratings yet

- Asad PsidDocument1 pageAsad Psidعمر عمیNo ratings yet

- Fiscal Policy of BangladeshDocument16 pagesFiscal Policy of BangladeshMdSumonMiaNo ratings yet

- Taxpayers Account Management Program (Tamp)Document8 pagesTaxpayers Account Management Program (Tamp)mark liezerNo ratings yet

- Importance of Tax in EconomyDocument7 pagesImportance of Tax in EconomyAbdul WahabNo ratings yet

- Tally 196 Greevani ImpexDocument1 pageTally 196 Greevani Impexpsuraj2808No ratings yet

- Wockhardt Ltd..Document125 pagesWockhardt Ltd..LoveSahilSharmaNo ratings yet

- HRA Form (Revised)Document1 pageHRA Form (Revised)Arunabha_GNo ratings yet

- Salary Slip Conneqt Business SolutionDocument1 pageSalary Slip Conneqt Business Solutionbittu yoNo ratings yet

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDocument1 pageBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountRavi KumarNo ratings yet

- Tax Invoice: Total 1Document1 pageTax Invoice: Total 1talwar.lucky@gmail.comNo ratings yet

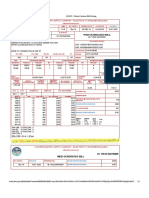

- LESCO - Online Customer Bill Printing PDFDocument1 pageLESCO - Online Customer Bill Printing PDFGulshion Malik100% (1)

- Hindu Undivided Family (HUF) Tax Benefits: 1. What Is A HUF?Document4 pagesHindu Undivided Family (HUF) Tax Benefits: 1. What Is A HUF?ashankarNo ratings yet

- OD426741449627129100Document1 pageOD426741449627129100SethuNo ratings yet

- Kinds of Income and Income Tax of Individuals: Take NoteDocument7 pagesKinds of Income and Income Tax of Individuals: Take NoteKen RaquinioNo ratings yet

- Incom Tax Proclamation EnglishDocument65 pagesIncom Tax Proclamation EnglishNegash JaferNo ratings yet

- LastthreemonthPayslip 2Document7 pagesLastthreemonthPayslip 2delicata.benNo ratings yet

- The Following Is River Tours Limited S Unadjusted Trial Balance atDocument2 pagesThe Following Is River Tours Limited S Unadjusted Trial Balance atMiroslav GegoskiNo ratings yet