Professional Documents

Culture Documents

Innocent Spouse Flowchart

Uploaded by

Hansley Templeton CookCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Innocent Spouse Flowchart

Uploaded by

Hansley Templeton CookCopyright:

Available Formats

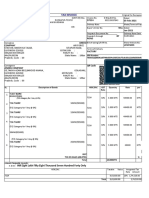

INNOCENT SPOUSE RELIEF FLOWCHART

Innocent Spouse Does IRC

START Was a joint tax

return filed? NO

status isn’t

available.

Section 66

apply? YES

Problem

Solved!

Installment

Agreement.

YES NO

Was there an under- IRC Section Taking into account all of the Innocent Consider

Brager Tax Law Group, A P.C. YES NO facts and circumstances, NO Offer in

payment of tax on 6015(f ) is the Spouse Relief collection

would it be inequitable to Compromise.

10880 Wilshire Boulevard, Suite 880 the return? only option. isn’t available. alternatives.

hold the RS liable?

Los Angeles, California 90024

NO YES

Phone: 800.380.8295

310.208.6200 NO

Are the threshold con- YES Is the RS eligible NO Does the RS qualify under

www.bragertaxlaw.com The IRS determined

ditions of Rev. Proc. the multi-factor test of

Bankruptcy.

for a streamlined

a deficiency.

2013-34 met? determination? Rev. Proc. 2013-34?

YES YES

NO

LEGEND On the date of the election, were the Consider Was the understatement of tax attrib-

parties unmarried, legally separated, NO Section utable to erroneous items of the NRS?

RS - Requesting Spouse or were they maintaining separate Items attributable to the RS do not

6015(b) or (f )

NRS - Non-Requesting Spouse households for at least one year? for relief. qualify for relief.

IRC - Internal Revenue Code

YES YES

NO YES NO

The information contained in this Was the request for relief made within Was the request for relief made within Can the IRS prove that RS did not

flowchart is provided for informa- two years from the date of the first NO two years from the date of the first know and had no reason to know of

tional purposes only and should not collection activity (with respect to the collection activity (with respect to the the understatement at the time the

be construed as legal advice on any RS) after July 22, 1998? RS) after July 22, 1998? tax return was signed?

subject matter.

YES YES

YES NO NO

Can the IRS prove that by a preponderance of the Is all or part of Taking into account all of the facts and

NO YES Innocent YES

evidence that the RS had actual knowledge of the deficiency circumstances, would it be inequitable

Spouse Relief

the items giving rise to the deficiency at the time the allocable to to hold the RS liable for the deficiency

is available!

return was signed? See IRC Section 6015(c)(3)(c). the NRS? attributable to the understatement?

©2014 Brager Tax Law Group, A P.C.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Continuity of GovernmentDocument34 pagesContinuity of GovernmentHansley Templeton Cook100% (1)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Army Vest Survivial TM-55-1680-351-10Document57 pagesArmy Vest Survivial TM-55-1680-351-10Hansley Templeton CookNo ratings yet

- Akashic Record S - The Book of Life - Edgar Cayce Readings - Edgar Cayce's A.R.E. - Edgar Cayce's A.R.EDocument5 pagesAkashic Record S - The Book of Life - Edgar Cayce Readings - Edgar Cayce's A.R.E. - Edgar Cayce's A.R.EHansley Templeton CookNo ratings yet

- THE SHADOW GOVERNMENT USES SES, SERCO, AND OPIC AS PORTALS INTO UNSPEAKABLE CORRUPTION - American Intelligence MediaDocument21 pagesTHE SHADOW GOVERNMENT USES SES, SERCO, AND OPIC AS PORTALS INTO UNSPEAKABLE CORRUPTION - American Intelligence MediaHansley Templeton Cook100% (1)

- The Censorship Disclosed in The Twitter Files Is Just The Tip of The IcebergDocument13 pagesThe Censorship Disclosed in The Twitter Files Is Just The Tip of The IcebergHansley Templeton CookNo ratings yet

- 2022 - Bac Resolution (Single Bid)Document2 pages2022 - Bac Resolution (Single Bid)Bernardo SaturinasNo ratings yet

- BS en 1333-2006Document6 pagesBS en 1333-2006Lauren Garcia100% (1)

- Rulers of Evil Useful Knowledge About Governing Bodies F TupperDocument338 pagesRulers of Evil Useful Knowledge About Governing Bodies F TupperHansley Templeton Cook100% (1)

- Harvest City Case StudyDocument3 pagesHarvest City Case StudyEashaa Saraogi100% (2)

- "Pretty Much The Last Step" - Legal Experts Say Subpoena Shows Special Counsel Closing in On TrumpDocument5 pages"Pretty Much The Last Step" - Legal Experts Say Subpoena Shows Special Counsel Closing in On TrumpHansley Templeton CookNo ratings yet

- We Want To Be On The Right Side of History - Ubisoft Partners With Police To Jail Gamers For Their In-Game SpeechDocument5 pagesWe Want To Be On The Right Side of History - Ubisoft Partners With Police To Jail Gamers For Their In-Game SpeechHansley Templeton CookNo ratings yet

- There Is No Left & Right - Austin Fitts Warns Corruption Out of Control in - Spending Machine Financed With Our Taxes - ZeroHedgeDocument4 pagesThere Is No Left & Right - Austin Fitts Warns Corruption Out of Control in - Spending Machine Financed With Our Taxes - ZeroHedgeHansley Templeton CookNo ratings yet

- MIRROR IMAGE - New Election Is Held in Germany After Previous Election Declared Void Citing - Serious Systemic Flaws - and Polling Station Glitches Just Like in Maricopa County, AZDocument9 pagesMIRROR IMAGE - New Election Is Held in Germany After Previous Election Declared Void Citing - Serious Systemic Flaws - and Polling Station Glitches Just Like in Maricopa County, AZHansley Templeton CookNo ratings yet

- 05-16-18 Wylie TestimonyDocument17 pages05-16-18 Wylie TestimonyHansley Templeton CookNo ratings yet

- Fuck The EU' - US Diplomat Victoria Nuland's Phonecall Leaked - Video - US News - The GuardianDocument5 pagesFuck The EU' - US Diplomat Victoria Nuland's Phonecall Leaked - Video - US News - The GuardianHansley Templeton CookNo ratings yet

- 1354 Athlete Cardiac Arrests, Serious Issues, 922 of Them Dead, Since COVID Injection - Real ScienceDocument205 pages1354 Athlete Cardiac Arrests, Serious Issues, 922 of Them Dead, Since COVID Injection - Real ScienceHansley Templeton CookNo ratings yet

- 2022 Ohio Voter Guide Voter Guide TORE Fucked by ND CaseDocument39 pages2022 Ohio Voter Guide Voter Guide TORE Fucked by ND CaseHansley Templeton CookNo ratings yet

- The Covert War of The 19th - and 20th - Century, and The Great Ring CodeDocument12 pagesThe Covert War of The 19th - and 20th - Century, and The Great Ring CodeHansley Templeton CookNo ratings yet

- Has American Democracy Been A Hallucination For Nearly 60 Years - ZeroHedgeDocument4 pagesHas American Democracy Been A Hallucination For Nearly 60 Years - ZeroHedgeHansley Templeton CookNo ratings yet

- Lest We Forget - The History of Mercer Law Review - UBcle HAnk MentionDocument29 pagesLest We Forget - The History of Mercer Law Review - UBcle HAnk MentionHansley Templeton CookNo ratings yet

- Master of Puppets - High Plains Reader, Fargo NDDocument32 pagesMaster of Puppets - High Plains Reader, Fargo NDHansley Templeton CookNo ratings yet

- Final Draft A-312 IgDocument28 pagesFinal Draft A-312 IgHansley Templeton CookNo ratings yet

- Ohio Supreme Court Justice Retiring, Plans To Fight Gerrymandering After Office TermDocument15 pagesOhio Supreme Court Justice Retiring, Plans To Fight Gerrymandering After Office TermHansley Templeton CookNo ratings yet

- USA and USSR Planned To Nuke The Moon Out of Existence - CSGlobeDocument3 pagesUSA and USSR Planned To Nuke The Moon Out of Existence - CSGlobeHansley Templeton CookNo ratings yet

- Carlyle-Gary v4Document7 pagesCarlyle-Gary v4Hansley Templeton CookNo ratings yet

- AI-generated Images Could Make It Almost Impossible To Detect Fake Papers - News - Chemistry WorldDocument2 pagesAI-generated Images Could Make It Almost Impossible To Detect Fake Papers - News - Chemistry WorldHansley Templeton CookNo ratings yet

- New York's Plum Island Animal Disease Center Accused of Weaponizing Ticks, Spreading LYME DiseaseDocument5 pagesNew York's Plum Island Animal Disease Center Accused of Weaponizing Ticks, Spreading LYME DiseaseHansley Templeton CookNo ratings yet

- The Budepest Memorandum 1994Document2 pagesThe Budepest Memorandum 1994Hansley Templeton CookNo ratings yet

- Facilitating Large Data Management in Research ContextsDocument23 pagesFacilitating Large Data Management in Research ContextsHansley Templeton CookNo ratings yet

- Aaron Salter, JR. Inventions, Patents and Patent Applications - Justia Patents SearchDocument2 pagesAaron Salter, JR. Inventions, Patents and Patent Applications - Justia Patents SearchHansley Templeton CookNo ratings yet

- Antifa's John Sullivan Goes On Live Stream Interview and Admits That His Father Is The Retired USAF General Who Got Caught With - Loose NukesDocument4 pagesAntifa's John Sullivan Goes On Live Stream Interview and Admits That His Father Is The Retired USAF General Who Got Caught With - Loose NukesHansley Templeton CookNo ratings yet

- Exploiting Transgenders Part 3 - The Funders & ProfiteersDocument48 pagesExploiting Transgenders Part 3 - The Funders & ProfiteersHansley Templeton CookNo ratings yet

- Why Do Some People Not Get Covid - They May Hold Key To Beating The Virus - BloombergDocument4 pagesWhy Do Some People Not Get Covid - They May Hold Key To Beating The Virus - BloombergHansley Templeton CookNo ratings yet

- Kr-Sel-Sos: Express WorldwideDocument3 pagesKr-Sel-Sos: Express WorldwideJeremia PattinussaNo ratings yet

- Reimbursement Claim Process Flow (Intellicare)Document1 pageReimbursement Claim Process Flow (Intellicare)JunnoKaiserNo ratings yet

- Ca Suraj Satija Ssguru: Financial AffairsDocument16 pagesCa Suraj Satija Ssguru: Financial AffairsTarachand SoniNo ratings yet

- Order 105Document1 pageOrder 105Aditya SubbaNo ratings yet

- Fort - Fts - The Teacher and ¿Mommy Zarry AdaptaciónDocument90 pagesFort - Fts - The Teacher and ¿Mommy Zarry AdaptaciónEvelin PalenciaNo ratings yet

- SEBIDocument29 pagesSEBImagico- maniacNo ratings yet

- Connor Sport Court International, Inc. v. Rhino Sports, Inc., Et Al - Document No. 9Document6 pagesConnor Sport Court International, Inc. v. Rhino Sports, Inc., Et Al - Document No. 9Justia.comNo ratings yet

- Abel AtlabachewDocument96 pagesAbel Atlabachewsam.kid170No ratings yet

- Your Booking at Hotel T Paviljoen DetailsDocument5 pagesYour Booking at Hotel T Paviljoen DetailsAndrew BeatonNo ratings yet

- CKYC & KRA KYC Form - CL04053Document4 pagesCKYC & KRA KYC Form - CL04053Atul ScNo ratings yet

- Department of Education: Bids and Awards Committee (BAC) MembersDocument3 pagesDepartment of Education: Bids and Awards Committee (BAC) MembersLichelle BalagtasNo ratings yet

- Jai Balaji Industries LTDDocument5 pagesJai Balaji Industries LTDco ainisiNo ratings yet

- Using Activity-Based Costing To Manage More EffectivelyDocument36 pagesUsing Activity-Based Costing To Manage More EffectivelynandiniNo ratings yet

- Renewing Our Democracy and Rebuilding Our Economy: A New BritainDocument155 pagesRenewing Our Democracy and Rebuilding Our Economy: A New BritainJAKE THE DOGNo ratings yet

- Letter To AE For Mobilization AdvanceDocument2 pagesLetter To AE For Mobilization AdvanceSumit KumarNo ratings yet

- BSNL - DEC BillDocument3 pagesBSNL - DEC BillkamleshsisodiaNo ratings yet

- Chapter - 1Document84 pagesChapter - 1Mohit PacharNo ratings yet

- Patentes KoolhaasDocument14 pagesPatentes KoolhaasJuan SebastianNo ratings yet

- Passi Cover PageDocument6 pagesPassi Cover PageEdward PagayonaNo ratings yet

- Raymond Pay Slip LatestDocument3 pagesRaymond Pay Slip LatestShamini SasetharanNo ratings yet

- Draw Result - Rs. 1500 - 86th DrawDocument4 pagesDraw Result - Rs. 1500 - 86th DrawsobiaNo ratings yet

- Access & Egress To Contractors & SuppliersDocument13 pagesAccess & Egress To Contractors & SuppliersMuhammad NazirNo ratings yet

- 2nd Merit List - BBA Hons 1st Semester 2023 - Afternoon95Document6 pages2nd Merit List - BBA Hons 1st Semester 2023 - Afternoon95Yasir Sultan100% (1)

- Government of Andhra PradeshDocument1 pageGovernment of Andhra PradeshMvnmurthy ChikkalaNo ratings yet

- Modified Standard Operating Procedure For Conciliation 18.07.2018Document2 pagesModified Standard Operating Procedure For Conciliation 18.07.2018rayudu vvsNo ratings yet

- Invoice #22093: Delhi Web HostingDocument1 pageInvoice #22093: Delhi Web HostingRahul KNo ratings yet