Professional Documents

Culture Documents

Commodity Outlook - January - 16 TH 2020

Uploaded by

pkkothariOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Commodity Outlook - January - 16 TH 2020

Uploaded by

pkkothariCopyright:

Available Formats

Commodity Outlook

Precious Metals | Base Metals | Energy January 16, 2020

PRECIOUS METALS

MARKET ROUNDUP

PRECIOUS METALS MARKET WATCH Precious metals rose as the dollar fell

and a U.S. report added to signs of

modest inflationary pressures,

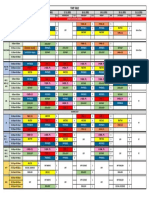

Precious Metals Contract Open High Low Close Change % Chng reinforcing expectations that interest

MCX Gold Rs. FEB20 39646 39708 39477 39611 -99 -0.2503 rates will stay low. Palladium

COMEX Gold $ FEB20 1546.8 1558.8 1546.5 1554 9.4 0.6086 surged above $2,200 an ounce to a

MCX Silver Rs. MAR20 46170 46450 45881 46389 -540 -1.1627 fresh record.

COMEX Silver $ MAR20 17.80 18.06 17.76 17.99 0.25 1.3865

IN FOCUS

LONDON FIXING

SPDR Gold Trust GLD, the world's

A.M. FIXING P.M. FIXING

largest gold-backed exchange-

Gold 1551.90 1549.00 traded fund, said its holdings

Silver Fix AM stood at 874.52 tonnes, remain

unchanged from previous

US $ INDEX business day.

Close % Change Holdings of the largest silver-

US $ INDEX 97.23 -0.1469 backed exchange-traded-fund

(ETF), New York's iShares Silver

ETF HOLDINGS AS ON PREVIOUS CLOSE Trust SLV, stood at 11,037.30

down 26.14 tonnes, from previous

ETF In tonnes Change business day.

SPDR Holding 874.52 00.00

iShares Holding 11037.30 -26.14

Gold’s blistering rally isn’t over,

according to fund managers who

FOREX MARKET WATCH see another leg up for the precious

metal. Lower-for-longer interest

Currency Open High Low Close Change % Chng rates, a weaker dollar and the U.S.

USD/INR 68.73 68.95 68.73 68.81 -0.06 0.08 presidential election will provide

multiple catalysts for gains, even

USD/JPY 109.99 110.01 109.79 109.9 0.04 -0.04

as tentative trade peace breaks out

EUR/USD 1.11 1.12 1.11 1.12 0.000 0.02

between China and the U.S. Gold

has surged by about a third since

FUNDAMENTAL OUTLOOK August 2018 and is up more than

2% this year, hovering near the

Precious metals are trading mix on COMEX today. We expect prices to trade

mix for the day, following the signing of the U.S.-China phase-one trade deal, highest in almost seven years.

with investors seeking to assess how consequential the accord will prove to

be for currency policy, relations between the two economies, and global

growth.

http://www.nirmalbang.com |Daily Commodity Outlook 1

Commodity Outlook

Precious Metals | Base Metals | Energy January 16, 2020

BASE METALS

MARKET ROUNDUP

BASE METALS MARKET WATCH Industrial metal copper slipped

from the highest closing price in

% more than eight months amid signs

Base Metals Contract Open High Low Close Change Chng that U.S. - China tensions remain

MCX Copper Rs. DEC-19 452.95 455.9 450.5 455.25 3 0.6654 high despite an interim trade deal.

6298 6309.5 6246 6287 -15 -0.2380 The agreement signed Wednesday

LME Copper $ 3M

MCX Zinc Mini

has already been criticized for

182.3 182.4 180.8 181.75 -0.05 -0.0274 failing to address difficult issues,

Rs. DEC-19

2372 2399 2356 2385 11.5 0.4845 such as U.S. claims of China’s state-

LME Zinc $ 3M

backed hacking of American

MCX Nickel Rs. DEC-19 1018.4 1051.4 1009.5 1049.5 -11.5 -1.1167

companies.

LME Nickel $ 3M 13870 14385 13715 14320 450 3.2444

MCX Lead

151.95 153.15 151.8 152.65 1.35 0.8946

Mini Rs. DEC-19 IN FOCUS

LME Lead $ 3M 1948 2007 1946 1999 51 2.6181

MCX Alum Alcoa forecast global aluminum

140.25 140.4 139.55 139.7 -0.2 -0.1423

Mini DEC-19

demand for 2020 of +1.4% to

LME

1808 1812 1798.5 1801 -8 -0.4422 +2.4%. Sees 2020 global

Aluminum 3M

SHANGHAI MARKET WATCH INDICES aluminum surplus 600,000 to 1

million metric tons. 2019 Final

Metals Close Change %Chng Index Close Change Aluminum Demand Rate

Aluminum 13460 40 0.3 Baltic Dry Index 763 -2 Estimate -0.4% to -0.2%. Saw 2019

Copper 47890 260 0.55 CRB Index 182.694 -0.9467

Aluminum Demand -0.6% to -

0.4%. In the first quarter of 2020,

Zinc 22040 190 0.87 DJ Commodity - -

Alcoa expects lower quarterly

LME WAREHOUSE STOCK results in the Bauxite segment

primarily due to lower pricing

Metals Prev. Net Total and seasonally lower volumes.

Copper 128100 -50 128050

Zinc 51800 -150 51650

Nickel 177600 984 178584

Lead 66475 -25 66450

Aluminum 1381175 -13300 1367875

FUNDAMENTAL OUTLOOK

Industrial metals are trading mix on International bourses today. We expect

prices to trade range bound to higher for the day, with nickel retreated and

copper steadied after China and the U.S. clinched an interim trade deal,

with traders assessing its impact on global growth and relations between the

two countries.

http://www.nirmalbang.com |Daily Commodity Outlook 2

Commodity Outlook

Precious Metals | Base Metals | Energy January 16, 2020

ENERGY

MARKET ROUNDUP

Crude oil erased some of the losses

ENERGY MARKET WATCH

that followed the U.S. inventory

report after the U.S. and China

Energy Contract Open High Low Close Change % Chng

inked the first phase of a broader

MCX Crude JAN-20 4126 4131 4059 4100 6 0.1452 trade pact on Wednesday.

NYM Crude FEB-20 58.2 58.36 57.36 57.81 -0.42 -0.7213

MCX Natgas JAN-19 158.1 158.1 149.4 151.3 4.9 3.1839

NYM Natgas FEB-20 2.18 2.19 2.10 2.12 -0.07 -3.0636

IN FOCUS

INDICES EXCHANGE VOLUME

American crude oil shipments to

China are poised to pick up again

Index Close Change Exchange Volume (in crores) after the two economic

Dirty Tanker Index 1340 -56 MCX 34526.03 superpowers signed a landmark

trade deal. Under the terms of the

Clear Tanker Index 752 -27 NCDEX 1371.61

agreement, U.S. energy exports to

ENERGY INDICATORS China will jump over the next

two years, with the promise of an

Date Time Energy Data Country Prior Consensus Actual additional $18.5 billion worth of

15-Jan 9.30 PM CRUDE STOCKS US 1.164 -0.75 -2.549 additional purchases in 2020 and

15-Jan 9.30 PM

GASOLINE

US 9.137 3.386 6.678

$33.9 billion in 2021.

STOCKS

DISTILLATES

15-Jan 9.30 PM

STOCKS

US 5.33 1.214 8.1713 India’s government is seeking

15-Jan 9.30 PM

Stocks at CUSHING

US -0.821 0.342 190b rupees in dividend from

OKLAHOMA

NATURAL GAS state oil companies, about 5%

16-Jan 9.00 PM US -44 -95

INVENTORY more than last year, Economic

Times reports, citing unidentified

people with knowledge of the

matter.

FUNDAMENTAL OUTLOOK

Crude oil is trading higher on NYMEX today. We expect prices to trade

range bound to mix for the day, after the U.S. and China inked the first phase

of their trade deal, recouping losses driven by data showing American

petroleum supplies rising to a four-month high.

http://www.nirmalbang.com |Daily Commodity Outlook 3

Commodity Outlook

Precious Metals | Base Metals | Energy January 16, 2020

RESEARCH TEAM

NAME DESIGNATION E-MAIL

Kunal Shah Head of Research kunal.shah@nirmalbang.com

Devidas Rajadhikary AVP. Commodity research devidas.rajadhikary@nirmalbang.com

Harshal Mehta AVP. Commodity research harshal.mehta@nirmalbang.com

Ravi D’souza Sr. Research Analyst ravi.dsouza@nirmalbang.com

Smit Bhayani Research Associate smit.bhayani@nirmalbang.com

Shrishty Agarwal Research Associate shrishty.agarwal@nirmalbang.com

Riya Singh Technical Analyst Riya.singh@nirmalbang.com

Disclaimer:

This Document has been prepared by N.B. Commodity Research (A Division of Nirmal Bang Commodities Pvt.

Ltd). The information, analysis and estimates contained herein are based on N.B. Commodities Research

assessment and have been obtained from sources believed to be reliable. This document is meant for the use of

the intended recipient only. This document, at best, represents N.B. Commodities Research opinion and is

meant for general information only. N.B. Commodities Research, its directors, officers or employees shall not in

any way be responsible for the contents stated herein. N.B. Commodities Research expressly disclaims any and

all liabilities that may arise from information, errors or omissions in this connection. This document is not to be

considered as an offer to sell or a solicitation to buy any securities. N.B. Commodities Research, its affiliates

and their employees may from time to time hold positions in securities referred to herein. N.B. Commodities

Research or its affiliates may from time to time solicit from or perform investment banking or other services for

any company mentioned in this document.

Address: Nirmal Bang Commodities Pvt. Ltd., B2, 301 / 302, 3rd Floor, Marathon Innova, Opp. Peninsula

Corporate Park, Ganpatrao Kadam Marg, Lower Parel (W), Mumbai - 400 013, India

http://www.nirmalbang.com |Daily Commodity Outlook 4

You might also like

- Long Call Repair Stratergy Me & Go Option Adjustment SchoolDocument6 pagesLong Call Repair Stratergy Me & Go Option Adjustment SchoolpkkothariNo ratings yet

- Long Call Butterfly: Montréal ExchangeDocument2 pagesLong Call Butterfly: Montréal ExchangepkkothariNo ratings yet

- Long Call Condor: Montréal ExchangeDocument3 pagesLong Call Condor: Montréal ExchangepkkothariNo ratings yet

- RepairDocument1 pageRepairpkkothariNo ratings yet

- Equity Options Strategy: Short Iron ButterflyDocument2 pagesEquity Options Strategy: Short Iron ButterflypkkothariNo ratings yet

- Long Call Calendar SpreadDocument3 pagesLong Call Calendar SpreadpkkothariNo ratings yet

- Basics of Spreading: Ratio Spreads and BackspreadsDocument20 pagesBasics of Spreading: Ratio Spreads and BackspreadspkkothariNo ratings yet

- Short Call Calendar SpreadDocument2 pagesShort Call Calendar SpreadpkkothariNo ratings yet

- Equity Collar StrategyDocument3 pagesEquity Collar StrategypkkothariNo ratings yet

- Short Call ButterflyDocument2 pagesShort Call ButterflypkkothariNo ratings yet

- Long Call: Montréal ExchangeDocument3 pagesLong Call: Montréal ExchangepkkothariNo ratings yet

- CBOE Cash Secured Puts StrategyDocument8 pagesCBOE Cash Secured Puts StrategypkkothariNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Cerebrovascular AccidentDocument29 pagesCerebrovascular AccidentMarites GalvezNo ratings yet

- 12.4.table1 Bolt Tightening TorqueDocument1 page12.4.table1 Bolt Tightening TorquevictoraghiNo ratings yet

- CatDocument35 pagesCatabbyNo ratings yet

- Road Speed LimiterDocument20 pagesRoad Speed LimiterNishantNo ratings yet

- Chapter-1 EMDDocument62 pagesChapter-1 EMDParv ChoudharyNo ratings yet

- Medical Device Risk Management - IsO 14971Document86 pagesMedical Device Risk Management - IsO 14971novdic71% (7)

- DC TrainingDocument5 pagesDC TrainingVishal PanchaalNo ratings yet

- 1Document2 pages1Santiago OrtizNo ratings yet

- 5th Edition Manual 080120Document126 pages5th Edition Manual 080120Maria TudorieNo ratings yet

- Container Details PDFDocument2 pagesContainer Details PDFVivekNo ratings yet

- Glasswool Product Brochure: ISO 27001 ISO 14001 ISO 50001 OHSAS 18001Document9 pagesGlasswool Product Brochure: ISO 27001 ISO 14001 ISO 50001 OHSAS 18001Liviu ToaderNo ratings yet

- Materials: Corrosion Susceptibility and Allergy Potential of Austenitic Stainless SteelsDocument24 pagesMaterials: Corrosion Susceptibility and Allergy Potential of Austenitic Stainless SteelssdfsfNo ratings yet

- Chief Operating Officer VP in San Diego CA Resume Mitchell WhiteDocument4 pagesChief Operating Officer VP in San Diego CA Resume Mitchell WhiteMitchellWhiteNo ratings yet

- Case Studies in Thermal EngineeringDocument7 pagesCase Studies in Thermal EngineeringtöreNo ratings yet

- Fast EthernetDocument33 pagesFast EthernetMalka RavikrishnaNo ratings yet

- List of Companies of ItalyDocument15 pagesList of Companies of ItalyDouglas KayseNo ratings yet

- Visual Analysis PaperDocument5 pagesVisual Analysis PaperAssignmentLab.comNo ratings yet

- Bio Intensive GardeningDocument13 pagesBio Intensive GardeningJAYSON GAYUMANo ratings yet

- Impactof Multinational Corporationson Developing CountriesDocument18 pagesImpactof Multinational Corporationson Developing CountriesRoman DiuţăNo ratings yet

- Space Structure SystemDocument37 pagesSpace Structure SystemAntika PutriNo ratings yet

- ST 1 - Tle 6 - Q1Document2 pagesST 1 - Tle 6 - Q1RhoseNo ratings yet

- Leica MP InstructionsDocument60 pagesLeica MP Instructionsamoebahydra100% (1)

- Overview - Talha Nibras Ali (62646)Document2 pagesOverview - Talha Nibras Ali (62646)Talha Nibras AliNo ratings yet

- Broiled Salisbury SteaksDocument29 pagesBroiled Salisbury SteaksCei mendozaNo ratings yet

- Marbore Ex D Iib+h2 Catalog 2018Document3 pagesMarbore Ex D Iib+h2 Catalog 2018TTRRTTGFNo ratings yet

- Fermenting Yogurt at Home: Brian A. Nummer, Ph.D. National Center For Home Food Preservation October 2002Document6 pagesFermenting Yogurt at Home: Brian A. Nummer, Ph.D. National Center For Home Food Preservation October 2002MohsinNo ratings yet

- Chapter 1 DrillsimDocument10 pagesChapter 1 DrillsimMehdi SoltaniNo ratings yet

- Rate Analysis (Rawalpindi) (2011)Document218 pagesRate Analysis (Rawalpindi) (2011)Ahmad Ali100% (1)

- Edan I15 Blood Gas and Chemistry Analysis System Service ManualDocument104 pagesEdan I15 Blood Gas and Chemistry Analysis System Service ManualAIINo ratings yet

- Time TableDocument1 pageTime TableAbhishek ChandraNo ratings yet