Professional Documents

Culture Documents

Accounting Certification Practice Test

Accounting Certification Practice Test

Uploaded by

Alc DinuCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting Certification Practice Test

Accounting Certification Practice Test

Uploaded by

Alc DinuCopyright:

Available Formats

Accounting Practice Test

Accounting Practice Test

Accounting Practice Test

Table of Contents

Accounting Practice Test............................................................................................................................... 3

Accounting Practice Test Answer Sheet....................................................................................................... 8

Accounting Training Unlimited ~ www.atunlimited.com ~ info@atunlimited.com Page 2

Accounting Practice Test

Accounting Practice Test

1. The separate entity assumption permits businesses to record property and equipment as

assets that will provide benefits in future periods.

A) True

B) False

2. The matching principle is being applied when the cost of equipment is depreciated over

its useful life.

A) True

B) False

3. In its conceptual framework, the FASB concluded that financial reporting rules should

concentrate on providing information that is helpful to

A) Current and potential investors and creditors in making investment and credit decisions.

B) Company management and owners.

C) Tax Authorities.

D) Regulating Agencies.

4. Keeping the personal assets of the owner of a business separate from the assets of the

firm is an example of

A) following the going concern assumption.

B) applying the realization principle.

C) following the separate entity assumption.

D) applying the conservatism convention.

5. Depreciating equipment over its useful life is an example of

A) following the objectivity assumption.

B) applying the matching principle.

C) applying the realization principle.

D) applying the conservatism convention.

6. The experience of other firms in the same line of business may be used in estimating

losses from uncollectible accounts for a new firm.

A) True

B) False

Accounting Training Unlimited ~ www.atunlimited.com ~ info@atunlimited.com Page 3

Accounting Practice Test

7. When there is a partial collection of a balance previously written off, the reinstatement

entry will be for the entire amount of the write-off.

A) True

B) False

8. The method that must be used to record bad debt losses for tax purposes is the

A) allowance method based on a percent of net credit sales.

B) allowance method based on an aging of accounts receivable.

C) allowance method based on a percent of total accounts receivable outstanding.

D) direct charge-off method.

9. A firm reported net credit sales of $450,000 during the year and has a balance of $40,000

in its Accounts Receivable account at year-end. Prior to adjustments, Allowance for

Doubtful Accounts has a debit balance of $200. The firm estimates its losses from

uncollectible accounts to be one-half of 1 percent of net credit sales. The entry to record the

estimated losses from uncollectible accounts will include a credit to Allowance for Doubtful

Accounts for

A) $4,500.

B) $2,450.

C) $2,250.

D) $1,800.

10. When the allowance method of recognizing losses from uncollectible accounts is used,

the entry to record the write-off of a specific account consists of a debit to

A) Uncollectible Accounts Expense and a credit to Accounts Receivable.

B) Allowance for Doubtful Accounts and a credit to Accounts Receivable.

C) Uncollectible Accounts Expense and a credit to Allowance for Doubtful Accounts.

D) Accounts Receivable and a credit to Allowance for Doubtful Accounts.

11. If the proceeds of a discounted note are less than the face amount, the difference is

debited to Interest Expense.

A) True

B) False

12. If the amount of a note is not collected at maturity, the accountant should debit

Uncollectible Accounts Expense and credit Notes Receivable.

A) True

B) False

Accounting Training Unlimited ~ www.atunlimited.com ~ info@atunlimited.com Page 4

Accounting Practice Test

13. The amount of cash paid at maturity date on a $9,000 face value, 60-day note bearing

interest at 6% is

A) $9,720

B) $9,090

C) $9,000

D) $7,200

14. When a company issues a promissory note, the accountant records an entry that

includes a credit to Note Payable for the

A) face value of the note.

B) face value of the note plus the interest that will accrue.

C) face value less the interest that will accrue.

D) maturity value of the note.

15. The Interest Income account

A) usually has a credit balance.

B) is usually shown in the Current Assets section of the balance sheet.

C) is debited when the firm records the effects of a dishonored note receivable.

D) is credited when the firm accepts a note receivable from a customer.

16. Under the gross profit method of estimating inventory, the ending inventory is

determined by subtracting the estimated cost of goods sold from the cost of goods available

for sale.

A) True

B) False

17. Many retail stores take a periodic inventory at retail values, using the sales price marked

on the merchandise.

A) True

B) False

18. The weighted average cost of an inventory item is calculated by

A) dividing the sum of the unit cost on the purchase invoices by the number of units

purchased.

B) dividing the cost of goods available for sale by the number of units on the ending inventory.

C) dividing the cost of goods available for sale by the number of units available during the

period.

D) dividing the cost of goods sold by the number of units available during the period.

Accounting Training Unlimited ~ www.atunlimited.com ~ info@atunlimited.com Page 5

Accounting Practice Test

19. Which of the following is NOT a way to apply the lower of cost or market rule?

A) by item

B) by size

C) in total

D) by group

20. An increase above the initial retail price of merchandise is

A) net profit.

B) gross profit.

C) markup.

D) markon.

21. For financial accounting purposes, when an asset is traded in for a similar asset, a gain is

reported if the trade-in allowance exceeds the book value of the asset traded in.

A) True

B) False

22. The modified accelerated cost recovery system (MACRS) is acceptable for financial

accounting purposes because it matches the costs of assets with the revenues produced by

those assets.

A) True

B) False

23. The book value of an asset is

A) the market value of the asset.

B) the portion of the asset's cost that has not yet been charged to expense.

C) the acquisition cost shown in the asset account less the estimated salvage value.

D) the replacement cost of the asset.

24. Equipment that cost $20,000 was sold for $12,000 cash. Accumulated depreciation on

the asset was $14,000. The entry to record the sale includes a credit to the Equipment

account for

A) $6,000.

B) $12,000

C) $20,000.

D) $14,000.

25. Which of the following is NOT a class under MACRS for personal property?

Accounting Training Unlimited ~ www.atunlimited.com ~ info@atunlimited.com Page 6

Accounting Practice Test

A) 5 year class

B) 7 year class

C) 10 year class

D) 27.5 year class

26. Investments by a partner are credited to that partner's capital account.

A) True

B) False

27. The dissolution of a partnership and the formation of a new partnership may have no

noticeable effect on the continuing operations of the business.

A) True

B) False

28. The entry to record the investment of cash in a partnership by one partner would

consist of a debit to

A) the partner's capital account and a credit to Cash.

B) Cash and a credit to an account called Partners' Equities.

C) Cash and a credit to the partner's capital account.

D) Cash and a credit to the partner's drawing account.

29. The entry to record a partner's salary allowance consists of a debit to

A) the partner's capital account and a credit to Cash.

B) Salaries Expense and a credit to the partner's drawing account.

C) Income Summary and a credit to the partner's capital account.

D) Income Summary and a credit to the partner's drawing account.

30. All of the following are included on the statement of partners' equities except

A) withdrawals.

B) additional investments.

C) salary allowances.

D) share of net income or net loss.

Accounting Training Unlimited ~ www.atunlimited.com ~ info@atunlimited.com Page 7

Accounting Practice Test

Accounting Practice Test Answer Sheet

Name:

(Please Print)

1. B 16. A

2. A 17. A

3. A 18. C

4. C 19. B

5. B 20. C

6. A 21. B

7. B 22. B

8. D 23. B

9. C 24. C

10. B 25. D

11. A 26. A

12. B 27. A

13. B 28. C

14. A 29. C

15. A 30. C

Accounting Training Unlimited ~ www.atunlimited.com ~ info@atunlimited.com Page 8

You might also like

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Stephen Elias, Bethany K. Laurence - Bankruptcy For Small Business Owners - How To File For Chapter 7-Nolo (2010)Document612 pagesStephen Elias, Bethany K. Laurence - Bankruptcy For Small Business Owners - How To File For Chapter 7-Nolo (2010)anassNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionNo ratings yet

- James Wood ForestDocument2 pagesJames Wood Forestangel WebbNo ratings yet

- ACTG21C - Midterm ExamDocument8 pagesACTG21C - Midterm ExamJuanito TanamorNo ratings yet

- Acb239 Practice Final Exam Questions and AnswersDocument15 pagesAcb239 Practice Final Exam Questions and AnswersAshley Danielle NaquinNo ratings yet

- ACC 290 Final Exam AnswersDocument12 pagesACC 290 Final Exam AnswerszeshansidraNo ratings yet

- 6801 - Accounting Process PDFDocument5 pages6801 - Accounting Process PDFSheila Mae PioquintoNo ratings yet

- Accounting 101 FinalsDocument16 pagesAccounting 101 FinalsDanilo Diniay Jr100% (1)

- Principle of Accounting I Final ExamDocument3 pagesPrinciple of Accounting I Final ExamAbrha Giday100% (5)

- Wiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)From EverandWiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)No ratings yet

- CAE 2 Financial Accounting and Reporting: L-NU AA-23-02-01-18Document8 pagesCAE 2 Financial Accounting and Reporting: L-NU AA-23-02-01-18Amie Jane Miranda100% (1)

- Quickbooks Online Certification Practice TestDocument9 pagesQuickbooks Online Certification Practice TestErika Mie Ulat100% (1)

- Adjusting Entry Multiple Choice Question and Answer KeyDocument9 pagesAdjusting Entry Multiple Choice Question and Answer Keygnzg.bela50% (2)

- Bookkeeper Certification Practice TestDocument8 pagesBookkeeper Certification Practice TestLindcelle Jane Dalope100% (1)

- Level Three Theory (Knowledge) ChoiceDocument17 pagesLevel Three Theory (Knowledge) ChoiceYaa Rabbii100% (1)

- Second Grading Examination - Key AnswersDocument21 pagesSecond Grading Examination - Key AnswersAmie Jane Miranda100% (1)

- 1ST Exam Fabm1Document3 pages1ST Exam Fabm1rose gabonNo ratings yet

- Par Cor Accounting Cup - Average Round QuestionsDocument6 pagesPar Cor Accounting Cup - Average Round QuestionsShin YaeNo ratings yet

- Accounting MCQsDocument12 pagesAccounting MCQsLaraib AliNo ratings yet

- BFAR Qualifying Exam ReviewerDocument18 pagesBFAR Qualifying Exam ReviewerHappy MagdangalNo ratings yet

- SalaryDocument13 pagesSalaryErik Treasuryvala100% (1)

- 26u9ofk7l - FAR - FINAL EXAMDocument18 pages26u9ofk7l - FAR - FINAL EXAMLyra Mae De BotonNo ratings yet

- Test Financial AcountingDocument12 pagesTest Financial Acountingtouria100% (1)

- Activity No. 1 CA 2022 Financial Accounting and Reepeorting Far PCVDocument8 pagesActivity No. 1 CA 2022 Financial Accounting and Reepeorting Far PCVPrecious mae BarrientosNo ratings yet

- Part-2 Accounting QuestionsDocument7 pagesPart-2 Accounting QuestionslokeshNo ratings yet

- Chapter 4 - Article 1231-1241Document30 pagesChapter 4 - Article 1231-1241Jane CANo ratings yet

- Second Grading ExaminationDocument17 pagesSecond Grading ExaminationAmie Jane MirandaNo ratings yet

- Hidden DivergenceDocument5 pagesHidden DivergenceAccess LimitedNo ratings yet

- Accounting Fundamentals Practice TestDocument8 pagesAccounting Fundamentals Practice Testpetitfm0% (1)

- ACC 280 Final ExamDocument4 pagesACC 280 Final Examanon_624482436No ratings yet

- ACCT 2251 Practice FinalDocument20 pagesACCT 2251 Practice FinalHạnhNekoNo ratings yet

- FINALS EXAM - FinAcctg SetADocument4 pagesFINALS EXAM - FinAcctg SetAJennifer RasonabeNo ratings yet

- Ss 2 Objective Type BDocument6 pagesSs 2 Objective Type BUkoh OwoidohoNo ratings yet

- Cost-Accounting (Set 1)Document23 pagesCost-Accounting (Set 1)manglarohit423No ratings yet

- Cup 1 (Basic Accounting)Document4 pagesCup 1 (Basic Accounting)Hannah AbeloNo ratings yet

- Accouting ExamDocument7 pagesAccouting ExamThien PhuNo ratings yet

- REVIEWERDocument9 pagesREVIEWERHanns Lexter PadillaNo ratings yet

- Eco MCQDocument9 pagesEco MCQthis.is.goldensnowflakesNo ratings yet

- UntitledDocument10 pagesUntitledShravan A NekkarekaduNo ratings yet

- ACTG21C - Midterm Exam QuestionsDocument6 pagesACTG21C - Midterm Exam QuestionsJuanito TanamorNo ratings yet

- Far ReviewerDocument18 pagesFar RevieweremmanuelanecesitoNo ratings yet

- A191 BKAL1013 Tutorial 4 AnswersheetDocument11 pagesA191 BKAL1013 Tutorial 4 AnswersheetMan yeeNo ratings yet

- Quiz BeeDocument15 pagesQuiz Beejoshua100% (1)

- Theory of Debits & CreditsDocument4 pagesTheory of Debits & CreditsLiwliwa BrunoNo ratings yet

- March 2020 Insight Part IDocument88 pagesMarch 2020 Insight Part INifezNo ratings yet

- Sample Quiz Question 3Document7 pagesSample Quiz Question 3Sonam Dema DorjiNo ratings yet

- MC 0065 Financial Management and Accounting: Model Question Paper Subject Code: Subject Name: Credits: 4 Marks: 140Document16 pagesMC 0065 Financial Management and Accounting: Model Question Paper Subject Code: Subject Name: Credits: 4 Marks: 140jaypmauryaNo ratings yet

- Accounting (@JohnASTU)Document38 pagesAccounting (@JohnASTU)bezib7987No ratings yet

- 1 - Accounting ProcessDocument4 pages1 - Accounting ProcessJevanie CastroverdeNo ratings yet

- September 2021 Examinations: Joint Universities Preliminary Examinations BoardDocument15 pagesSeptember 2021 Examinations: Joint Universities Preliminary Examinations BoardBabawale KehindeNo ratings yet

- 6881 - Accounting ProcessDocument4 pages6881 - Accounting ProcessMaximusNo ratings yet

- Accounting and Finance Mock ExamDocument35 pagesAccounting and Finance Mock ExamAbdisen TeferaNo ratings yet

- Acctg 12 Premid Exam QuestionnaireDocument11 pagesAcctg 12 Premid Exam QuestionnaireJanet AnotdeNo ratings yet

- Accounting TestDocument15 pagesAccounting TestBenson WencenslausNo ratings yet

- Management-Accounting (Set 1)Document22 pagesManagement-Accounting (Set 1)Arul kumarNo ratings yet

- Financial Accounting & Reporting ReviewerDocument21 pagesFinancial Accounting & Reporting ReviewerRosemarie GoNo ratings yet

- ACC2010 Sample Final ExamDocument19 pagesACC2010 Sample Final ExamHarjot SinghNo ratings yet

- Accounting and Auditing MCQs Part-1 by Alisha Mahajan PDFDocument58 pagesAccounting and Auditing MCQs Part-1 by Alisha Mahajan PDFJamodvipulNo ratings yet

- Model Exit Exam Unity University A.ADocument36 pagesModel Exit Exam Unity University A.AMOLALIGNNo ratings yet

- Model Exit Exam 3Document36 pagesModel Exit Exam 3mearghaile4No ratings yet

- Theory of Accounts (No Ak)Document10 pagesTheory of Accounts (No Ak)Irish Joy AlaskaNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- MA 2.1-Financial StatementDocument57 pagesMA 2.1-Financial Statementvini2710100% (1)

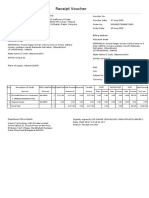

- Receipt Voucher: Xiaomi Technology India Private LimtiedDocument1 pageReceipt Voucher: Xiaomi Technology India Private LimtiedPankaj LohaniNo ratings yet

- Application To Adjudicating Authority - Form I AnnexureDocument3 pagesApplication To Adjudicating Authority - Form I AnnexureadityatnnlsNo ratings yet

- ISCA Insolvency Update 2017Document8 pagesISCA Insolvency Update 2017terencebctanNo ratings yet

- MAS CompiledDocument5 pagesMAS CompiledadorableperezNo ratings yet

- Primer - Quick and Easy Primer On Paying Your Taxes (BIR Issuance)Document11 pagesPrimer - Quick and Easy Primer On Paying Your Taxes (BIR Issuance)Diane JulianNo ratings yet

- SPM W4 130318150 Cindy Alexandra KP CDocument1 pageSPM W4 130318150 Cindy Alexandra KP Ccindy alexandraNo ratings yet

- Share MarketrDocument69 pagesShare Marketrduckman2009No ratings yet

- 21Document15 pages21AngelManuelCabacunganNo ratings yet

- Ibc ProjectDocument17 pagesIbc ProjectRaman PatelNo ratings yet

- AmcDocument9 pagesAmcerode els erodeNo ratings yet

- SBI Clerk Mains 2023 Exam PDF @crossword2022Document196 pagesSBI Clerk Mains 2023 Exam PDF @crossword2022Kannan KannanNo ratings yet

- Memorial For Petitioner PDFDocument28 pagesMemorial For Petitioner PDFdevil_3565No ratings yet

- Process Payments & ReceiptsDocument12 pagesProcess Payments & ReceiptsAnne FrondaNo ratings yet

- Adrian, T. & Brunnermeier, M. (2008) CoVaRDocument53 pagesAdrian, T. & Brunnermeier, M. (2008) CoVaRMateo ReinosoNo ratings yet

- Intellectual Capital A Human Capital PerspectiveDocument10 pagesIntellectual Capital A Human Capital PerspectivePedro GonçalvesNo ratings yet

- Statement of Income: P&L Account Can Also Be Named AsDocument5 pagesStatement of Income: P&L Account Can Also Be Named Asanand sanilNo ratings yet

- 2018 16-October Part-4 MemorandumDocument6 pages2018 16-October Part-4 MemorandumLucky NetshamutavhaNo ratings yet

- Home First Finance Company India Ltd. Notice of EGM 25-Aug-2020Document11 pagesHome First Finance Company India Ltd. Notice of EGM 25-Aug-2020Varun ChaudhariNo ratings yet

- Accounting For Receivables Accounts ReceivableDocument18 pagesAccounting For Receivables Accounts Receivablelocomotingkenya.co.keNo ratings yet

- B1 LicenseComparisonChartDocument9 pagesB1 LicenseComparisonChartcamperhpNo ratings yet

- Security Analysis and Portfolio Management Prof: C.S. Mishra Department of VGSOM Indian Institute of Technology, KharagpurDocument29 pagesSecurity Analysis and Portfolio Management Prof: C.S. Mishra Department of VGSOM Indian Institute of Technology, KharagpurviswanathNo ratings yet

- 2 - Case 8 QuestionsDocument1 page2 - Case 8 QuestionsSandip Agarwal0% (1)

- 3.03 Key TermsDocument95 pages3.03 Key Termsapi-262218593No ratings yet

- Solved Jennings Operated A Courier Service To Collect and Deliver MoneyDocument1 pageSolved Jennings Operated A Courier Service To Collect and Deliver MoneyAnbu jaromiaNo ratings yet