Professional Documents

Culture Documents

Contemporary Mathematics For Business and Consumers, Third Edition

Contemporary Mathematics For Business and Consumers, Third Edition

Uploaded by

বিষাক্ত মানবOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Contemporary Mathematics For Business and Consumers, Third Edition

Contemporary Mathematics For Business and Consumers, Third Edition

Uploaded by

বিষাক্ত মানবCopyright:

Available Formats

Contemporary Mathematics for Business and Consumers, Third Edition

Robert A. Brechner

Copyright © 2003 Thomson/South-Western

Level 2

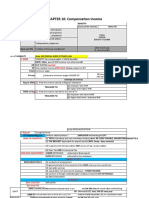

Chapter 9 - Assessment Test - Exercise 20

Striker Exporting has three warehouse employees: John Abner earns $422 per week, Anne Clark

earns $510 per week, and Todd Corbin earns $695 per week. The company's SUTA tax rate is 5.4%,

and the FUTA rate is 6.2% minus the SUTA. As usual, these taxes are paid on the

first $7,000 of each employee's earnings.

a. How much SUTA and FUTA tax does the company owe on these employees for the

first quarter of the year?

Wage limit for FUTA and SUTA taxes = $7,000.00

FUTA rate = 6.2%

SUTA rate = 5.4% - FUTA =

Gross per Gross for Wages subject to FUTA and SUTA

week first quarter (not to exceed wage limit)

Abner $422.00

Clark $510.00

Corbin $695.00

Total =

SUTA tax, first quarter =

FUTA tax, first quarter =

b. How much SUTA and FUTA tax does Striker owe for the second quarter of the year?

Amount under wage limit

subject to FUTA and SUTA

Abner

Clark

Corbin

Total =

SUTA tax, first quarter =

FUTA tax, second quarter =

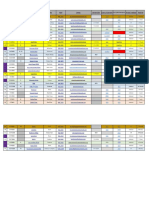

You might also like

- CH 3 HWDocument4 pagesCH 3 HWOrfa CartagenaNo ratings yet

- Complete Book P4 UDCDocument145 pagesComplete Book P4 UDCshubham0% (1)

- Final Pedrosa Excel4Document5 pagesFinal Pedrosa Excel4Madaum Elementary100% (1)

- CHAPTER 10: Compensation Income: 1. MWE Exempt! 250K RULE!Document78 pagesCHAPTER 10: Compensation Income: 1. MWE Exempt! 250K RULE!Anabel Lajara AngelesNo ratings yet

- Chapter 02 Employment Income Practice WODocument8 pagesChapter 02 Employment Income Practice WObavanthinilNo ratings yet

- Payroll Report 2019Document2 pagesPayroll Report 2019zubairniazi304No ratings yet

- Married IndividualsDocument3 pagesMarried IndividualsTet AleraNo ratings yet

- Ep60 2023Document1 pageEp60 2023Bogdan AlecsaNo ratings yet

- Basic Concept: (3 To 6 Marks)Document168 pagesBasic Concept: (3 To 6 Marks)netrathakur72No ratings yet

- Taxation Sample TestDocument1 pageTaxation Sample Testalishaon26No ratings yet

- Income Tax Calculator For FY 2022-23 & 2023-24 AY 2023-24 & 2024-25Document134 pagesIncome Tax Calculator For FY 2022-23 & 2023-24 AY 2023-24 & 2024-25Vipul SharmaNo ratings yet

- Inter CA DT JKSC Mumbai-Prof - Aagam Dalal (May 23 Nov 23)Document176 pagesInter CA DT JKSC Mumbai-Prof - Aagam Dalal (May 23 Nov 23)pradeep ozaNo ratings yet

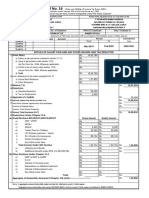

- FORM No. 16: Details of Salary Paid and Any Other Income and Tax DeductedDocument3 pagesFORM No. 16: Details of Salary Paid and Any Other Income and Tax DeductedMadhan Kumar BobbalaNo ratings yet

- For Irs For State: Origin Quick Calculator For 433f CalculationsDocument13 pagesFor Irs For State: Origin Quick Calculator For 433f CalculationsAnonymous NjNW0Gb6nNo ratings yet

- RR No. 12-2007 PDFDocument7 pagesRR No. 12-2007 PDFAbbey LiNo ratings yet

- CA Inter Income Tax Basic ConceptDocument16 pagesCA Inter Income Tax Basic Concepttauseefalam917No ratings yet

- Upto salary-JKSC Inter DT MAy 22 (Prof - Aagam Dalal)Document59 pagesUpto salary-JKSC Inter DT MAy 22 (Prof - Aagam Dalal)pritika mishraNo ratings yet

- Chapter 1Document30 pagesChapter 1Christine ChuaNo ratings yet

- CpaDocument37 pagesCparav danoNo ratings yet

- Tax Summary 2019 Ver.1Document163 pagesTax Summary 2019 Ver.1Aiko Cherrie NakamuraNo ratings yet

- Income TaxDocument79 pagesIncome TaxRaj HanumanteNo ratings yet

- Module - 2 Incomes From Salary and Income From House PropertyDocument7 pagesModule - 2 Incomes From Salary and Income From House PropertyNikitha AlpetNo ratings yet

- Dol 4 NDocument3 pagesDol 4 Njobs1526No ratings yet

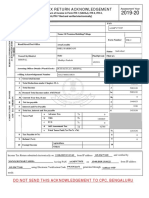

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruMukul BajajNo ratings yet

- Question Bank: Errorless Taxation by Ca Pranav Chandak at Pranav Chandak Academy, PuneDocument8 pagesQuestion Bank: Errorless Taxation by Ca Pranav Chandak at Pranav Chandak Academy, PuneSimran MeherNo ratings yet

- Form 16Document2 pagesForm 16Joyal JoseNo ratings yet

- Form16Rpt 169567-1Document3 pagesForm16Rpt 169567-1ishalshamnasNo ratings yet

- U1A OverviewDocument7 pagesU1A Overview4mggxj68cyNo ratings yet

- Page Smu/Faculty of Accounting and FinanceDocument11 pagesPage Smu/Faculty of Accounting and Financeሔርሞን ይድነቃቸውNo ratings yet

- Report Writing-03Document1 pageReport Writing-03Abdullah Al-naser EmonNo ratings yet

- Sri Lanka PAYE Income Tax TablesDocument14 pagesSri Lanka PAYE Income Tax Tableskahatadeniya0% (1)

- RR 12-2007Document9 pagesRR 12-2007Aris Basco DuroyNo ratings yet

- Tax.3408 Deductions From Gross IncomeDocument15 pagesTax.3408 Deductions From Gross IncomeJUARE MaxineNo ratings yet

- 3109 - Taxation of Non-Individual TaxpayersDocument9 pages3109 - Taxation of Non-Individual TaxpayersMae Angiela TansecoNo ratings yet

- Fee Structure Tuition Fee MBBS BDS 2023 24Document1 pageFee Structure Tuition Fee MBBS BDS 2023 24faryadali7834No ratings yet

- TaxDocument19 pagesTaxjhevesNo ratings yet

- Business Law & Taxation Income Taxation (Individuals) Compilation of NotesDocument4 pagesBusiness Law & Taxation Income Taxation (Individuals) Compilation of NotesJeremie R. PlazaNo ratings yet

- Emailing Inter Full Book DT - Youtube - Prof - Aagam Dalal-3Document126 pagesEmailing Inter Full Book DT - Youtube - Prof - Aagam Dalal-3chalu account100% (2)

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruAadityaa PawarNo ratings yet

- Legislative Compliance Rates Sheet EnclosedDocument4 pagesLegislative Compliance Rates Sheet Enclosedlarryching_884369919No ratings yet

- Full Download Solution Manual For Accounting Tools For Business Decision Making Kimmel Weygandt Kieso 5th Edition PDF Full ChapterDocument36 pagesFull Download Solution Manual For Accounting Tools For Business Decision Making Kimmel Weygandt Kieso 5th Edition PDF Full Chapterpryingly.curdlessri8zp100% (18)

- Shoe Factory Plant Manager: Gross Salary ElementsDocument2 pagesShoe Factory Plant Manager: Gross Salary ElementsSukaina SalmanNo ratings yet

- Tax.3608-1 Deductions From Gross IncomeDocument15 pagesTax.3608-1 Deductions From Gross IncomeJulienne CaitNo ratings yet

- PGDM CV DCF 20th August LectureDocument11 pagesPGDM CV DCF 20th August Lecturepratik waliwandekarNo ratings yet

- Quiz 1 - StrataxDocument3 pagesQuiz 1 - Strataxspongebob SquarepantsNo ratings yet

- Analysis of Historical PerformancesDocument6 pagesAnalysis of Historical Performancespratik waliwandekarNo ratings yet

- Contents of An Interim Financial Report: Unit OverviewDocument5 pagesContents of An Interim Financial Report: Unit OverviewRITZ BROWNNo ratings yet

- How To YourDocument45 pagesHow To YourfarjanabegumNo ratings yet

- TaxationDocument20 pagesTaxationBienna CuebillasNo ratings yet

- Excise Taxes On Alcohol ProductsDocument18 pagesExcise Taxes On Alcohol ProductsChristine ChuaNo ratings yet

- Arrears of Salary - Taxability & Relief Under Section 89Document4 pagesArrears of Salary - Taxability & Relief Under Section 89SONANo ratings yet

- 2019 Year End AdjustmentDocument86 pages2019 Year End AdjustmentATRIYO ENTERPRISESNo ratings yet

- TX02 Individual Income Taxpayer and Fringe BenefitDocument15 pagesTX02 Individual Income Taxpayer and Fringe BenefitAce DesabilleNo ratings yet

- DT RevisionDocument133 pagesDT RevisionharshallahotNo ratings yet

- Reg No. 3 4 Sol: SpecifiedDocument4 pagesReg No. 3 4 Sol: SpecifiedXjdkkdNo ratings yet

- CTC Break Up For 10.41 LPADocument2 pagesCTC Break Up For 10.41 LPAAyush Gupta 4-Year B.Tech. Electrical EngineeringNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruAishwarya VarmaNo ratings yet

- 2.4.4.10 Approved Supplier IngredientsDocument6 pages2.4.4.10 Approved Supplier Ingredientsবিষাক্ত মানবNo ratings yet

- Budget ExcelDocument7 pagesBudget Excelবিষাক্ত মানবNo ratings yet

- HashLabs V3 - Feb 2021 - Financial ProjectionsDocument260 pagesHashLabs V3 - Feb 2021 - Financial Projectionsবিষাক্ত মানবNo ratings yet

- (Name) Webex Digital Event - (Date Dec 9, 2021) - (Time 1Pm CST)Document3 pages(Name) Webex Digital Event - (Date Dec 9, 2021) - (Time 1Pm CST)বিষাক্ত মানবNo ratings yet

- Maintenance Work Orders Work Order IdDocument2 pagesMaintenance Work Orders Work Order Idবিষাক্ত মানবNo ratings yet

- Contemporary Mathematics For Business and Consumers, Third EditionDocument2 pagesContemporary Mathematics For Business and Consumers, Third Editionবিষাক্ত মানবNo ratings yet

- Contemporary Mathematics For Business and Consumers, Third EditionDocument1 pageContemporary Mathematics For Business and Consumers, Third Editionবিষাক্ত মানবNo ratings yet

- NP EX19 CT3c StaciBrunner 2Document7 pagesNP EX19 CT3c StaciBrunner 2বিষাক্ত মানবNo ratings yet