Professional Documents

Culture Documents

Baumol-Tobin Model of Money Demand

Uploaded by

Mathato ThootheOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Baumol-Tobin Model of Money Demand

Uploaded by

Mathato ThootheCopyright:

Available Formats

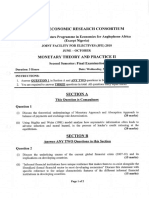

BAUMOL-TOBIN MODEL OF TRANSACTIONS

MONEY DEMAND

Propounded by Baumol (1952) and Tobin (1956) to

draw more precise implications about the variables

that determine the demand for transaction balances.

Transactions balances are a sort of inventory, which

the holders keep in order to finance transactions

usually predictable and often routine, as and when

they arise.

Money is held in transactions balances because it is

convenient to do so.

But holding transactions balances also involves an

opportunity cost in terms of foregone interest income

if money put in interest - bearing investment.

The demand for cash as an inventory can be analyzed

in two stages:

Stage 1: Agent receives an income (Y) for

transactions for a given period and decides how

much to retain as cash (R) and bonds (K):

Baumol – Tobin Model of Money Demand Page 1

Y=R+K

Where: Y = Income

R = Cash retained

K = Bonds

For the first part of the period, transactions

financed by retained cash balances.

Interest foregone by holding R cash balances:

( Y −K

2 ) ( Y −K

Y )

r

where:

r = interest rate

(Y – K)/2 = Average cash holding in first part of

transactions period

(Y- K)/Y = Proportion of income held in cash

Baumol – Tobin Model of Money Demand Page 2

Encashment costs (brokerage fees, stamp duty)

in period 1: α + βK

The total combined costs are:

Y −K Y −K

(

r 2 ) ( Y ) + α +βK

Stage 2: Agent determines amount (X) to

encash each time based on the transactions

expenditure flows in second part of the period.

For each encashment of X amount, the interest

X K

foregone will be r 2)

( Y

Brokerage costs plus interest foregone in the second

part of the transactions period l:

X K K

r 2)

( (∝+ βX )

Y + X

Where: X = Amount encashed each time

K/X = the number of encashments

Baumol – Tobin Model of Money Demand Page 3

X K

r( )

2 Y

= Interest foregone

K

(∝+ βX )

X

= Brokerage costs

Baumol – Tobin Model of Money Demand Page 4

Total transactions costs for period:

Y −K Y −K X K K

(

C=r 2 ) ( Y ) + α + βK + r 2 )

( Y +

(∝+ βX )

X

By opening up brackets:

r (Y −K )2 rXK αK

C= + α + βK + + + βK

2Y 2Y X

r (Y −K )2 rXK αK

C= + α +2 βK + +

2Y 2Y X

The optimal bond holding and encashment is

obtained by minimizing the total cost with respect to

X & K. First order conditions:

∂C rK αK

∂X = 2Y - X2 =0

rK αK

=

2Y X 2

X 2 rK =2 αKY

2 αKY

X2=

rK

Baumol – Tobin Model of Money Demand Page 5

2 αY

X2=

r

X= ( 2 αYr ) 1/2

∂C −r (Y −K ) Xr α

∂K = Y + 2β + 2Y + X =0

2 βY

r

Solving for K = Y-X-

2 βY

Therefore, R = Y-K = X + r

The optimum average transactions demand for

money for the whole of the transactions period which

is a weighted average of the optimum average cash

balances for both parts of the transactions period:

M =d

R

2 ( Y −K

Y ) +

XK

2Y

Substituting for X & R we obtain

2

αY 1 2β β

Md = ( )

2r 1/2 ( +

K r ) +2Y ()

r

Baumol – Tobin Model of Money Demand Page 6

∂ Md αY −0.5

Y 1 2β

∂α = 0.5( )

2r( 2 r )( K r )

+ >0

d

∂M

¿

∂β =

Implications for Transactions Money Demand:

An increase in brokerage costs increases the demand

∂ Md ∂ Md

for transactions cash balances: ∂α ;

>0

∂β

>0

If α = β = 0 , demand for transactions cash balances

would be equal to zero

An increase in interest rates increases the opportunity

cost of holding cash, hence reduces demand for

∂Md

transactions cash balances: ∂r

<0

Demand for money = f(brokerage costs, interest

rates)

Baumol – Tobin Model of Money Demand Page 7

You might also like

- UK and US inflation rates compared from 1973 to 2001Document6 pagesUK and US inflation rates compared from 1973 to 2001Bùi Hà LinhNo ratings yet

- Dorn BuschDocument14 pagesDorn BuschPricop IoanaNo ratings yet

- L12A-The MM Analysis - Arbitrage: Exhibit 1 Basic DataDocument7 pagesL12A-The MM Analysis - Arbitrage: Exhibit 1 Basic DatababylovelylovelyNo ratings yet

- SkewDocument34 pagesSkewnblanc88100% (4)

- EPFL College of Management of Technology Macrofinance Fall 2016 Solution to Problem Set #4Document4 pagesEPFL College of Management of Technology Macrofinance Fall 2016 Solution to Problem Set #4testingNo ratings yet

- Is-LM Open EconomyDocument16 pagesIs-LM Open EconomyAppan Kandala VasudevacharyNo ratings yet

- 6QQMN970 Tutorial 7 SolutionsDocument7 pages6QQMN970 Tutorial 7 SolutionsyuvrajwilsonNo ratings yet

- Chapter 1 Scope and Methods of EconomicsDocument59 pagesChapter 1 Scope and Methods of EconomicsMuhammad Maaz RashidNo ratings yet

- Problem Set 8-Answers PDFDocument5 pagesProblem Set 8-Answers PDFMaesha ArmeenNo ratings yet

- A Theory and Test of Credit RationingDocument24 pagesA Theory and Test of Credit RationingEdson PrataNo ratings yet

- R R D DE R E DE R R R D DE: Modigliani-Miller TheoremDocument13 pagesR R D DE R E DE R R R D DE: Modigliani-Miller TheoremPankaj Kumar BaidNo ratings yet

- EC202 Summer 2013 Exam Microeconomics QuestionsDocument7 pagesEC202 Summer 2013 Exam Microeconomics QuestionsFRRRRRRRTNo ratings yet

- Aggregate Demand I: Building The IS-LM Model: Questions For ReviewDocument10 pagesAggregate Demand I: Building The IS-LM Model: Questions For ReviewErjon SkordhaNo ratings yet

- The Barro-Gordon Model: 1 The Idea of Time InconsistencyDocument9 pagesThe Barro-Gordon Model: 1 The Idea of Time InconsistencykNo ratings yet

- Baumol-Tobin Model of Demand For MoneyDocument1 pageBaumol-Tobin Model of Demand For Moneyshruti100% (2)

- Speculative Currency Attacks ExplainedDocument4 pagesSpeculative Currency Attacks ExplainedSuhas KandeNo ratings yet

- Automation Studio User ManualDocument152 pagesAutomation Studio User ManualS Rao Cheepuri100% (1)

- Business Finance Week 2 2Document14 pagesBusiness Finance Week 2 2Phoebe Rafunsel Sumbongan Juyad100% (1)

- Modigliani-Miller Theorem ExplainedDocument4 pagesModigliani-Miller Theorem ExplainedEdrees DowarieNo ratings yet

- Meaning and Factors of Marginal Efficiency of Capital (MECDocument15 pagesMeaning and Factors of Marginal Efficiency of Capital (MECJester LabanNo ratings yet

- Solving Intertemporal Budget Constraint and Utility Maximization ProblemsDocument3 pagesSolving Intertemporal Budget Constraint and Utility Maximization ProblemssqhaaNo ratings yet

- Factors Influencing Loan to Deposit Ratio of Indonesian BanksDocument15 pagesFactors Influencing Loan to Deposit Ratio of Indonesian BanksDevi AlwiaaNo ratings yet

- Local and Global TechnopreneursDocument25 pagesLocal and Global TechnopreneursClaire FloresNo ratings yet

- Baumol's (1952) Model of The Transactions Demand For MoneyDocument2 pagesBaumol's (1952) Model of The Transactions Demand For MoneyArslan KhanNo ratings yet

- Mundell FlemingDocument40 pagesMundell FlemingAnkita Singhai100% (1)

- Difference Between Balance of Trade (BOT) & Balance of Payment (BOP)Document2 pagesDifference Between Balance of Trade (BOT) & Balance of Payment (BOP)Bhaskar KabadwalNo ratings yet

- Chapter 7 David N Hyman Eco PublicDocument32 pagesChapter 7 David N Hyman Eco PublicBendyNo ratings yet

- CH 2 Science of MacroeconomicsDocument63 pagesCH 2 Science of MacroeconomicsFirman DariyansyahNo ratings yet

- Utang Luar Negeri, Fiskal Dan Konsumsi Masyarakat - Lukkim - FEUNSDocument31 pagesUtang Luar Negeri, Fiskal Dan Konsumsi Masyarakat - Lukkim - FEUNSLukman Hakim HassanNo ratings yet

- ch11 HeteroscedasticityDocument31 pagesch11 HeteroscedasticityKhirstina CurryNo ratings yet

- Chapter 23 - Measuring A Nation's IncomeDocument22 pagesChapter 23 - Measuring A Nation's IncomeDannia PunkyNo ratings yet

- Chapter 11 Walter Nicholson Microcenomic TheoryDocument15 pagesChapter 11 Walter Nicholson Microcenomic TheoryUmair QaziNo ratings yet

- Submitted To: Mohammed Mosleh-Uddin School and Business Economics Subject: Business Statistics Course Code: BUS 511Document6 pagesSubmitted To: Mohammed Mosleh-Uddin School and Business Economics Subject: Business Statistics Course Code: BUS 511Arindam BardhanNo ratings yet

- Chapter-10 Market Risk Math Problems and SolutionsDocument6 pagesChapter-10 Market Risk Math Problems and SolutionsruponNo ratings yet

- Chapter1-2 Construction of Index NumberDocument33 pagesChapter1-2 Construction of Index NumberputrialyaaNo ratings yet

- The Coase Theorem and Property Rights - HandoutDocument3 pagesThe Coase Theorem and Property Rights - HandoutYuvanesh KumarNo ratings yet

- IS and LMDocument18 pagesIS and LMM Samee ArifNo ratings yet

- Chapter 17 - Taxes On Wealth Property and EstatesDocument18 pagesChapter 17 - Taxes On Wealth Property and Estateswatts1100% (1)

- Debraj Ray, Chapter 12 Madhavi Moni Hansraj CollegeDocument17 pagesDebraj Ray, Chapter 12 Madhavi Moni Hansraj CollegeAbhiNo ratings yet

- International experiences with environmental and economic accountingDocument48 pagesInternational experiences with environmental and economic accountingVictor FirmanaNo ratings yet

- Solved Suppose That All Social Programs Simultaneously Become More Generous inDocument1 pageSolved Suppose That All Social Programs Simultaneously Become More Generous inM Bilal SaleemNo ratings yet

- Intermediate Accounting: Prepared by University of California, Santa BarbaraDocument69 pagesIntermediate Accounting: Prepared by University of California, Santa BarbaraHenry BarlowNo ratings yet

- Classical Normal Linear Regression ModelDocument13 pagesClassical Normal Linear Regression Modelwhoosh2008No ratings yet

- Swan Diagram NotesDocument3 pagesSwan Diagram NotesGizri AlishaNo ratings yet

- Why Filipinos Don't Save: A Look at Factors That Impact Savings in The Philippines by Marishka CabreraDocument2 pagesWhy Filipinos Don't Save: A Look at Factors That Impact Savings in The Philippines by Marishka CabrerathecenseireportNo ratings yet

- External Balance and Internal BalanceDocument4 pagesExternal Balance and Internal BalanceswatiNo ratings yet

- Stie Malangkuçeçwara Malang Program Pasca Sarjana Ujian Tengah SemesterDocument13 pagesStie Malangkuçeçwara Malang Program Pasca Sarjana Ujian Tengah SemesterDwi Merry WijayantiNo ratings yet

- Adverse selection, moral hazard, and principal-agent problemsDocument2 pagesAdverse selection, moral hazard, and principal-agent problemsTom HoldenNo ratings yet

- Suppose The Government Borrows 20 Billion More Next Year ThanDocument2 pagesSuppose The Government Borrows 20 Billion More Next Year ThanMiroslav GegoskiNo ratings yet

- The Story of MacroeconomicsDocument32 pagesThe Story of MacroeconomicsMohammadTabbalNo ratings yet

- Information EconomicsDocument5 pagesInformation Economicsnikol sanchez100% (1)

- Introductory Econometrics For Finance Chris Brooks Solutions To Review - Chapter 3Document7 pagesIntroductory Econometrics For Finance Chris Brooks Solutions To Review - Chapter 3Bill Ramos100% (2)

- Econometrics Chapter # 0: IntroductionDocument19 pagesEconometrics Chapter # 0: IntroductioncoliNo ratings yet

- CH 3 Macroeconomics AAUDocument90 pagesCH 3 Macroeconomics AAUFaris Khalid100% (1)

- Chapter Six Behavioral Foundation of MacroeconomicsDocument35 pagesChapter Six Behavioral Foundation of MacroeconomicsMERSHANo ratings yet

- Theories of Dualism: (1) Social Dualism or Sociological DualismDocument9 pagesTheories of Dualism: (1) Social Dualism or Sociological DualismsheglinalNo ratings yet

- The Influence of Monetary and Fiscal Policy On Aggregate DemandDocument46 pagesThe Influence of Monetary and Fiscal Policy On Aggregate DemandLưu Kim LânNo ratings yet

- Factors Influence Tax PaymentDocument13 pagesFactors Influence Tax PaymentNuyanli PaliNo ratings yet

- What Is EconometricsDocument6 pagesWhat Is Econometricsmirika3shirin50% (2)

- CH 03 Financial Statements ExercisesDocument39 pagesCH 03 Financial Statements ExercisesJocelyneKarolinaArriagaRangel100% (1)

- Solutions - Chapter 2: Macroeconomics IIDocument28 pagesSolutions - Chapter 2: Macroeconomics IIcaritoNo ratings yet

- FinanceDocument246 pagesFinanceLuis Munguía LandinNo ratings yet

- Hedging Interest Rate RiskDocument14 pagesHedging Interest Rate RiskVictor ManuelNo ratings yet

- Monetary Theory and Practice II - Final Exam 2010Document2 pagesMonetary Theory and Practice II - Final Exam 2010Mathato ThootheNo ratings yet

- Credit Creation Process of The Banking SectorDocument1 pageCredit Creation Process of The Banking SectorMathato ThootheNo ratings yet

- Revision Questions 2020Document3 pagesRevision Questions 2020Mathato ThootheNo ratings yet

- Topic 1.3.1 The Monetary Base Model of Money SupplyDocument6 pagesTopic 1.3.1 The Monetary Base Model of Money SupplyMathato ThootheNo ratings yet

- Chapter 3Document2 pagesChapter 3RoAnne Pa Rin100% (1)

- Combined Orders (SAP Library - Production Planning and Control)Document3 pagesCombined Orders (SAP Library - Production Planning and Control)Rashid KhanNo ratings yet

- Launch of Green Tea in Uae MarketingDocument19 pagesLaunch of Green Tea in Uae MarketingIrfan Ali KhanNo ratings yet

- Chap 010Document147 pagesChap 010Khang HuynhNo ratings yet

- How To Add Message Queuing Feature - Dell IndiaDocument2 pagesHow To Add Message Queuing Feature - Dell Indiayuva razNo ratings yet

- Court of Appeals decision on Batara family land disputeDocument19 pagesCourt of Appeals decision on Batara family land disputeKhanini GandamraNo ratings yet

- Assign Controlling Areas and Company Codes for Optimal Cost AccountingDocument4 pagesAssign Controlling Areas and Company Codes for Optimal Cost Accountingatsc68No ratings yet

- IBP Cable and Pressure Transducers IncavDocument6 pagesIBP Cable and Pressure Transducers Incaveng_seng_lim3436No ratings yet

- Design Model Are Included in One Part of The Graves (2000) ModelDocument8 pagesDesign Model Are Included in One Part of The Graves (2000) ModelPourya HellNo ratings yet

- Mysql Insert Into StatementDocument8 pagesMysql Insert Into StatementsalimdzNo ratings yet

- Omnidirectional Condenser Lavalier Microphone U.S. Atr Series Lifetime Limited End-User WarrantyDocument2 pagesOmnidirectional Condenser Lavalier Microphone U.S. Atr Series Lifetime Limited End-User WarrantyEduardito De Villa CrespoNo ratings yet

- AarushDocument88 pagesAarushCgNo ratings yet

- New Position Performance Evaluation FormDocument4 pagesNew Position Performance Evaluation FormRomero SanvisionairNo ratings yet

- Carbon Cycle SEDocument7 pagesCarbon Cycle SEAlex0% (3)

- RESA 1st PBDocument9 pagesRESA 1st PBRay Mond0% (1)

- Paf-Karachi Institute of Economics & Technology Spring - 2021Document3 pagesPaf-Karachi Institute of Economics & Technology Spring - 2021Basic Knowledge Basic KnowledgeNo ratings yet

- CH 01 Intercorporate Acquisitions and Investments in Other EntitiesDocument38 pagesCH 01 Intercorporate Acquisitions and Investments in Other Entitiesosggggg67% (3)

- Easychair Preprint: Shakti Chaturvedi, Nisha Goyal and Raghava Reddy VaraprasadDocument24 pagesEasychair Preprint: Shakti Chaturvedi, Nisha Goyal and Raghava Reddy VaraprasadSneha Elizabeth VivianNo ratings yet

- 11 M-Way Search TreesDocument33 pages11 M-Way Search TreesguptharishNo ratings yet

- Correlated Report and Action Plan - FinalDocument30 pagesCorrelated Report and Action Plan - FinalOpenFileCGYNo ratings yet

- Chap 01-Introduction To AccountingDocument56 pagesChap 01-Introduction To AccountingJean CoulNo ratings yet

- KemmyDocument22 pagesKemmyKemi HamzatNo ratings yet

- For San Francisco To Become A CityDocument8 pagesFor San Francisco To Become A CityJun Mirakel Andoyo RomeroNo ratings yet

- QZ Brand GuideDocument8 pagesQZ Brand GuideahmaliicNo ratings yet

- Biosafety and Lab Waste GuideDocument4 pagesBiosafety and Lab Waste Guidebhramar bNo ratings yet

- SL 78r CK FRNC Lv2.0Document2 pagesSL 78r CK FRNC Lv2.0Huế Đà NẵngNo ratings yet