Professional Documents

Culture Documents

It S Been 2 Months Since You Took A Position As

It S Been 2 Months Since You Took A Position As

Uploaded by

Amit PandeyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

It S Been 2 Months Since You Took A Position As

It S Been 2 Months Since You Took A Position As

Uploaded by

Amit PandeyCopyright:

Available Formats

Solved: It s been 2 months since you took a position as

It’s been 2 months since you took a position as an assistant financial analyst at Caledonia

Products. Although your boss has been pleased with your work, he is still a bit hesitant about

unleashing you without supervision. Your next assignment involves both the calculation of the

cash flows associated with a new investment under consideration and the evaluation of several

mutually exclusive projects. Given your lack of tenure at Caledonia, you have been asked not

only to provide a recommendation but also to respond to a number of questions aimed at

judging your understanding of the capital- budgeting process. The memorandum you received

outlining your assignment follows:

To: The Assistant Financial Analyst

From: Mr. V. Morrison, CEO, Caledonia Products

Re: Cash Flow Analysis and Capital Rationing

We are considering the introduction of a new product. Currently we are in the 34 percent

marginal tax bracket with a 15 percent required rate of return or cost of capital. This project is

expected to last 5 years and then, because this is somewhat of a fad product, be terminated.

The following in-formation describes the new project:

a. Should Caledonia focus on cash flows or accounting profits in making its capital- budgeting

decisions? Should the company be interested in incremental cash flows, incremental profits,

total free cash flows, or total profits?

b. How does depreciation affect free cash flows?

c. How do sunk costs affect the determination of cash flows?

d. What is the project’s initial outlay?

e. What are the differential cash flows over the project’s life?

f. What is the terminal cash flow?

g. Draw a cash- flow diagram for this project.

h. What is its net present value? i. What is its internal rate of return?

j. Should the project be accepted? Why or why not?

k. In capital budgeting, risk can be measured from three perspectives. What are those three

measures of a project’s risk?

Reach out to freelance2040@yahoo.com for enquiry.

l. According to the CAPM, which measurement of a project’s risk is relevant? What

complications does reality introduce into the CAPM view of risk, and what does that mean for

our view of the relevant measure of a project’s risk?

m. Explain how simulation works. What is the value in using a simulation approach?

n. What is sensitivity analysis and what is its purpose?

It s been 2 months since you took a position as

ANSWER

https://solvedquest.com/it-s-been-2-months-since-you-took-a-position-as/

Reach out to freelance2040@yahoo.com for enquiry.

Powered by TCPDF (www.tcpdf.org)

You might also like

- Earned Value Management for the PMP Certification ExamFrom EverandEarned Value Management for the PMP Certification ExamRating: 4.5 out of 5 stars4.5/5 (15)

- Execution Excellence: Making Strategy Work Using the Balanced ScorecardFrom EverandExecution Excellence: Making Strategy Work Using the Balanced ScorecardRating: 4 out of 5 stars4/5 (1)

- Fin 370 Week 4 Team Assignment - Caledonia Products Integrative ProblemDocument7 pagesFin 370 Week 4 Team Assignment - Caledonia Products Integrative ProblemiziusherNo ratings yet

- 2010-10-26 233008 SmayerDocument6 pages2010-10-26 233008 Smayernicemann21No ratings yet

- Cost PMPDocument36 pagesCost PMPMitsubishi FA Riyadh-Saudi ArabiaNo ratings yet

- Project Cost Management: Principles, Tools, Techniques, and Best Practices for Project FinanceFrom EverandProject Cost Management: Principles, Tools, Techniques, and Best Practices for Project FinanceNo ratings yet

- Pmbok Guide 6th ErrataDocument8 pagesPmbok Guide 6th Erratamarubadi100% (1)

- C NDocument14 pagesC NSomerProjNo ratings yet

- 03-PMP Project Charter - TestDocument5 pages03-PMP Project Charter - TestIRVINNo ratings yet

- Chapter 13Document34 pagesChapter 13Kad SaadNo ratings yet

- Odule Apital Udgeting: 2. Learning Outcomes 3. Module Tasks 4. Module Overview and DiscussionDocument0 pagesOdule Apital Udgeting: 2. Learning Outcomes 3. Module Tasks 4. Module Overview and Discussionsilvi88No ratings yet

- PMP - Exam 1 - Initiating PGDocument5 pagesPMP - Exam 1 - Initiating PGdileep100% (1)

- CAMPUS Assesment Exam#26 - Answers PDFDocument44 pagesCAMPUS Assesment Exam#26 - Answers PDFOssama KheadryNo ratings yet

- PMP Exam Set 2 - Questions PDFDocument34 pagesPMP Exam Set 2 - Questions PDFmohamed88% (8)

- PMNotes Lecture3Document60 pagesPMNotes Lecture3Vishwajit NaikNo ratings yet

- PM Lec 3-4Document23 pagesPM Lec 3-4Muhammad RameezNo ratings yet

- Study Notes of Valuation: Chapter 1: IntroductionDocument9 pagesStudy Notes of Valuation: Chapter 1: Introductiondeepika gawasNo ratings yet

- All CoursesDocument11 pagesAll CoursesFirehun AlemuNo ratings yet

- 200 Sample QuestionsDocument101 pages200 Sample QuestionsOLALEKAN ODUKOYANo ratings yet

- UntitledDocument145 pagesUntitleddhirajpironNo ratings yet

- Time: 2 Hours Total Marks: 100Document1 pageTime: 2 Hours Total Marks: 100Anik ChaudharyNo ratings yet

- LSSBB - Sample Test Paper With AnswerDocument10 pagesLSSBB - Sample Test Paper With AnswerRanjith RanaNo ratings yet

- Assignment For Project Analysis and ManagementDocument3 pagesAssignment For Project Analysis and Managementzemedu abebe100% (1)

- PMP Exam QuestionsDocument31 pagesPMP Exam QuestionsAsuelimen tito100% (1)

- 50 Basic Predictive Project Management Questions: A great primer for the PMP® and CAPM® ExamsFrom Everand50 Basic Predictive Project Management Questions: A great primer for the PMP® and CAPM® ExamsNo ratings yet

- 58 QuestionsDocument16 pages58 QuestionsMuhammad El-FahamNo ratings yet

- Project Cost Management QuestionsDocument29 pagesProject Cost Management Questionsmaninambiram100% (2)

- Free PMP Practice Exam Questions - 120 Sample Test QuestionsDocument70 pagesFree PMP Practice Exam Questions - 120 Sample Test QuestionsHmbk TradeNo ratings yet

- Project SelectionDocument35 pagesProject SelectionWASEEMZAHOORNo ratings yet

- Project SelectionDocument55 pagesProject Selectionbilal khanNo ratings yet

- Capital Budgeting AssignmentDocument7 pagesCapital Budgeting AssignmentafefjqfaoNo ratings yet

- 04 Project Selection 2023Document7 pages04 Project Selection 2023Mahbub Zaman SiyamNo ratings yet

- Course 3: Capital Budgeting AnalysisDocument19 pagesCourse 3: Capital Budgeting AnalysisAlif Rachmad Haidar SabiafzahNo ratings yet

- Iiba PDF 1Document2 pagesIiba PDF 1sonam tiwariNo ratings yet

- AnswersDocument46 pagesAnswersRahil Tasawar100% (1)

- 75 QuestionsDocument51 pages75 QuestionsRahil TasawarNo ratings yet

- Exam ManagementDocument6 pagesExam ManagementOumaima Ben SaidNo ratings yet

- Free PMI-SP QuestionsDocument7 pagesFree PMI-SP QuestionsAbhishekKumarNo ratings yet

- EM302 Exam Style Questions To Practice On Curtin UniDocument5 pagesEM302 Exam Style Questions To Practice On Curtin UniDerekVunNo ratings yet

- Your Company Is Considering Investing in Its Own Transport FleetDocument2 pagesYour Company Is Considering Investing in Its Own Transport FleetAmit Pandey0% (1)

- Your Company Produces Cookies in A Two Step Process The MixingDocument1 pageYour Company Produces Cookies in A Two Step Process The MixingAmit PandeyNo ratings yet

- Zanella S Smart Shawls Inc Is A Small Business That ZanellaDocument1 pageZanella S Smart Shawls Inc Is A Small Business That ZanellaAmit PandeyNo ratings yet

- You Have Recently Been Hired by Layton Motors Inc LmiDocument1 pageYou Have Recently Been Hired by Layton Motors Inc LmiAmit PandeyNo ratings yet

- Zits LTD Makes Two Models For Rotary Lawn Mowers TheDocument1 pageZits LTD Makes Two Models For Rotary Lawn Mowers TheAmit PandeyNo ratings yet

- Xellnet Provides e Commerce Software For The Pharmaceuticals Industry XellnetDocument2 pagesXellnet Provides e Commerce Software For The Pharmaceuticals Industry XellnetAmit PandeyNo ratings yet

- You Are Employed As The Assistant Accountant in Your CompanyDocument1 pageYou Are Employed As The Assistant Accountant in Your CompanyAmit PandeyNo ratings yet

- Yummi Lik Makes Really Big Lollipops in Two Sizes Large andDocument2 pagesYummi Lik Makes Really Big Lollipops in Two Sizes Large andAmit PandeyNo ratings yet

- Xander Manufacturing Company Manufactures Blue Rugs Using Wool and DyeDocument2 pagesXander Manufacturing Company Manufactures Blue Rugs Using Wool and DyeAmit PandeyNo ratings yet

- Wildride Sports Manufactures Snowboards Its Cost of Making 24 900 BindingsDocument1 pageWildride Sports Manufactures Snowboards Its Cost of Making 24 900 BindingsAmit PandeyNo ratings yet

- Xerxes Manufacturing Company Manufactures Blue Rugs Using Wool and DyeDocument2 pagesXerxes Manufacturing Company Manufactures Blue Rugs Using Wool and DyeAmit PandeyNo ratings yet

- Wise Company Began Operations at The Beginning of 2018 TheDocument2 pagesWise Company Began Operations at The Beginning of 2018 TheAmit PandeyNo ratings yet

- X PLC Manufactures Product X Using Three Different Raw MaterialsDocument2 pagesX PLC Manufactures Product X Using Three Different Raw MaterialsAmit Pandey100% (1)

- York PLC Was Formed Three Years Ago by A GroupDocument2 pagesYork PLC Was Formed Three Years Ago by A GroupAmit PandeyNo ratings yet

- You Have Been Asked To Assist The Management of IronwoodDocument2 pagesYou Have Been Asked To Assist The Management of IronwoodAmit PandeyNo ratings yet

- Williams and Dimaggio Architects Have Been Using A Simplified CostingDocument1 pageWilliams and Dimaggio Architects Have Been Using A Simplified CostingAmit PandeyNo ratings yet

- Xy Limited Commenced Trading On 1 February With Fully PaidDocument2 pagesXy Limited Commenced Trading On 1 February With Fully PaidAmit PandeyNo ratings yet

- Watercooler Office Supply S March 31 2016 Balance Sheet Follows The BudgetDocument2 pagesWatercooler Office Supply S March 31 2016 Balance Sheet Follows The BudgetAmit PandeyNo ratings yet

- When The Fraud at Pepsico Occurred The Company Had FiveDocument2 pagesWhen The Fraud at Pepsico Occurred The Company Had FiveAmit PandeyNo ratings yet

- Wild Ride Manufactures Snowboards Its Cost of Making 1 900 BindingsDocument1 pageWild Ride Manufactures Snowboards Its Cost of Making 1 900 BindingsAmit PandeyNo ratings yet

- West Coast Designs Produces Three Products Super Deluxe and GDocument1 pageWest Coast Designs Produces Three Products Super Deluxe and GAmit PandeyNo ratings yet

- Wilson Manufacturing Inc Has Implemented Lean Manufacturing IDocument1 pageWilson Manufacturing Inc Has Implemented Lean Manufacturing IAmit PandeyNo ratings yet

- Winter Sports Manufacture Snowboards Its Cost of Making 2 100 BindingsDocument1 pageWinter Sports Manufacture Snowboards Its Cost of Making 2 100 BindingsAmit PandeyNo ratings yet

- Warren S Sporting Goods Store Sells A Variety of Sporting GoodsDocument2 pagesWarren S Sporting Goods Store Sells A Variety of Sporting GoodsAmit PandeyNo ratings yet

- Warren LTD Is To Produce A New Product in ADocument2 pagesWarren LTD Is To Produce A New Product in AAmit PandeyNo ratings yet

- Wilson Manufacturing Started in 2014 With The Following Account BalancesDocument1 pageWilson Manufacturing Started in 2014 With The Following Account BalancesAmit PandeyNo ratings yet

- Wholesome and Happy Foods Is A Farm To Family Grocery Store LocatedDocument1 pageWholesome and Happy Foods Is A Farm To Family Grocery Store LocatedAmit PandeyNo ratings yet

- Visit WWW Pearsonhighered Com Horngren To View A Link To Starbucks Corporation 2011Document1 pageVisit WWW Pearsonhighered Com Horngren To View A Link To Starbucks Corporation 2011Amit PandeyNo ratings yet

- Video Technology PLC Was Established in 1987 To Assemble VideoDocument3 pagesVideo Technology PLC Was Established in 1987 To Assemble VideoAmit PandeyNo ratings yet

- Vassar Corp Has Incurred Substantial Losses For Several Years ADocument2 pagesVassar Corp Has Incurred Substantial Losses For Several Years AAmit PandeyNo ratings yet

- IGNOU's Public Administration Material Part-5 Financial AdministrationDocument324 pagesIGNOU's Public Administration Material Part-5 Financial AdministrationPrep4Civils95% (22)

- Unit 10 Approaches To Budgeting: StructureDocument17 pagesUnit 10 Approaches To Budgeting: StructurerehanNo ratings yet

- City of Toronto Report On New StreetcarsDocument15 pagesCity of Toronto Report On New StreetcarsCityNewsTorontoNo ratings yet

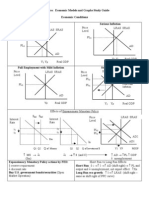

- AP Macroeconomic Models and Graphs Study GuideDocument23 pagesAP Macroeconomic Models and Graphs Study GuideAznAlexT90% (21)

- Report On AGPRDocument42 pagesReport On AGPRSaud Khan WazirNo ratings yet

- BSBFIM601 - Part B - Budget - NovoDocument18 pagesBSBFIM601 - Part B - Budget - NovoGabi Assis0% (2)

- ACCA F9 Notes by Seah Chooi KhengDocument75 pagesACCA F9 Notes by Seah Chooi KhengHuzaifa Ahmed100% (2)

- Goa Esurvey 2010 2011Document153 pagesGoa Esurvey 2010 2011Barna GanguliNo ratings yet

- f5 2014 Dec Q PDFDocument14 pagesf5 2014 Dec Q PDFawlachewNo ratings yet

- Lecture Notes: Advanced Financial Accounting and Reporting G/N/E de Leon AFAR.3014 - NGASDocument11 pagesLecture Notes: Advanced Financial Accounting and Reporting G/N/E de Leon AFAR.3014 - NGASTatianaNo ratings yet

- How To Create Invoice in ErpDocument14 pagesHow To Create Invoice in ErpitmukarramNo ratings yet

- MB 0045Document32 pagesMB 0045Kawal Preet Singh OberoiNo ratings yet

- SOP Material ManagementDocument7 pagesSOP Material Managementwasee99No ratings yet

- CommerceDocument30 pagesCommerceHasnain AlamNo ratings yet

- Job Description - Head of SupplyDocument4 pagesJob Description - Head of SupplyMbizi JosephNo ratings yet

- 16 Budgeting - Capital Expenditures, Research & Development Expenditures, and Cash - PERT-CostDocument16 pages16 Budgeting - Capital Expenditures, Research & Development Expenditures, and Cash - PERT-CostMarizMatampaleNo ratings yet

- AA025 Chapter AT9Document2 pagesAA025 Chapter AT9norismah isaNo ratings yet

- Multinational Capital BudgetingDocument26 pagesMultinational Capital BudgetingDishaNo ratings yet

- Barangay Budget Ordinance - Barangay Budget Authorization Form No. 1Document3 pagesBarangay Budget Ordinance - Barangay Budget Authorization Form No. 1Marco AglibotNo ratings yet

- Emf ImiDocument38 pagesEmf ImiKaran Veer SinghNo ratings yet

- Triune Technologies: General Ledger (GL)Document26 pagesTriune Technologies: General Ledger (GL)Saq IbNo ratings yet

- Practice Paper (Solved) : Quantitative AptitudeDocument23 pagesPractice Paper (Solved) : Quantitative AptitudeTuku SinghNo ratings yet

- Standard Costing and Flexible Budget 10Document5 pagesStandard Costing and Flexible Budget 10Lhorene Hope DueñasNo ratings yet

- Enterprise Performance Management - MCQDocument20 pagesEnterprise Performance Management - MCQSabina Saldanha72% (18)

- Review Report On DEBT FINANCING IN BANGLADESHDocument14 pagesReview Report On DEBT FINANCING IN BANGLADESHAjmain Mahatab100% (1)

- 06 - (San Juan) Philippines - Fiscal InstitutionsDocument20 pages06 - (San Juan) Philippines - Fiscal InstitutionsSharmaine LopezNo ratings yet

- RBI Credit Policy (Rough)Document15 pagesRBI Credit Policy (Rough)Nidhi NavneetNo ratings yet

- Expenditure MethodDocument15 pagesExpenditure MethodNor DalilaNo ratings yet

- Lecture 4 INVESTMENT CRITERIA FOR PROJECT APPRAISALDocument49 pagesLecture 4 INVESTMENT CRITERIA FOR PROJECT APPRAISALANH VÕ TỪNo ratings yet

- Project Proposal ExampleDocument3 pagesProject Proposal ExampleCollege08No ratings yet