Professional Documents

Culture Documents

TFM-Practice Question-Forex-forward

TFM-Practice Question-Forex-forward

Uploaded by

ONASHI DEVNANI BBA0 ratings0% found this document useful (0 votes)

22 views1 pageThe document is a practice question from a Treasury and Funds Management course at Mohammad Ali Jinnah University. It asks the student to calculate the 3-month forward exchange rate for USD to PKR for a client expecting to receive $5 million in 3 months. Given the spot rate of 140.50 USD/PKR, 3-month KIBOR of 3.10%, 3-month LIBOR of 2.35%, and a premium of 300 basis points added to KIBOR and LIBOR, the student is asked to find the forward rate and its premium over the spot rate.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document is a practice question from a Treasury and Funds Management course at Mohammad Ali Jinnah University. It asks the student to calculate the 3-month forward exchange rate for USD to PKR for a client expecting to receive $5 million in 3 months. Given the spot rate of 140.50 USD/PKR, 3-month KIBOR of 3.10%, 3-month LIBOR of 2.35%, and a premium of 300 basis points added to KIBOR and LIBOR, the student is asked to find the forward rate and its premium over the spot rate.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

22 views1 pageTFM-Practice Question-Forex-forward

TFM-Practice Question-Forex-forward

Uploaded by

ONASHI DEVNANI BBAThe document is a practice question from a Treasury and Funds Management course at Mohammad Ali Jinnah University. It asks the student to calculate the 3-month forward exchange rate for USD to PKR for a client expecting to receive $5 million in 3 months. Given the spot rate of 140.50 USD/PKR, 3-month KIBOR of 3.10%, 3-month LIBOR of 2.35%, and a premium of 300 basis points added to KIBOR and LIBOR, the student is asked to find the forward rate and its premium over the spot rate.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

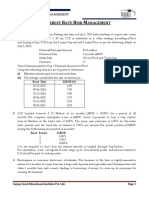

Mohammad Ali Jinnah University

Treasury and Funds Management (FN3540)

Practice Question-Forex-Forward

FALL 2020 (AM)

Instructor Name: Dr. S. M. Noaman Ahmed Shah

Date: 05-01-2021

Question:

Assume Mr. Zero is your client and he expected to receive USD 5 million after 3 months. As his banker,

you have to quote him a forward rate for 3 months. The USD/PKR spot rate is 140.50. Three months (91

days) KIBOR is 3.10% p.a. whereas LIBOR (USD) is 2.35% p.a. Assuming a premium of 300 bps in

addition to KIBOR and LIBOR, find the forward rate and its premium in basis points.

You might also like

- Exam Facts Series 52 Municipal Securities Representative Exam Study GuideFrom EverandExam Facts Series 52 Municipal Securities Representative Exam Study GuideRating: 1.5 out of 5 stars1.5/5 (2)

- Leveraged Buyouts: A Practical Introductory Guide to LBOsFrom EverandLeveraged Buyouts: A Practical Introductory Guide to LBOsRating: 5 out of 5 stars5/5 (1)

- Sample FRM Pracfrfqqtice ExamDocument24 pagesSample FRM Pracfrfqqtice ExamArunava Banerjee100% (1)

- JPM MBS PrimerDocument68 pagesJPM MBS PrimerJerry ChenNo ratings yet

- Dual Range AccrualsDocument1 pageDual Range AccrualszdfgbsfdzcgbvdfcNo ratings yet

- EFB344 Lecture07, FRAs and SwapsDocument35 pagesEFB344 Lecture07, FRAs and SwapsTibet LoveNo ratings yet

- T6-Foreign Exchange Part 3 - AnsDocument4 pagesT6-Foreign Exchange Part 3 - AnskelvinplayzgamesNo ratings yet

- Universiti Tunku Abdul Rahman Faculty of Business and FinanceDocument2 pagesUniversiti Tunku Abdul Rahman Faculty of Business and FinanceDarsina KuberakusalanNo ratings yet

- Interest Rate Risk Management - ACCADocument7 pagesInterest Rate Risk Management - ACCAadctgNo ratings yet

- Quiz 1Document2 pagesQuiz 1Abdul Wajid Nazeer CheemaNo ratings yet

- 20-10-22-CER-Lesson 04Document42 pages20-10-22-CER-Lesson 04Ravindu GamageNo ratings yet

- Forex (Full)Document71 pagesForex (Full)Lee Yong YeNo ratings yet

- Derivatives - Betting: Chapter Break UpDocument34 pagesDerivatives - Betting: Chapter Break UpJatinkatrodiyaNo ratings yet

- Present and Future Value in MacroeconomicsDocument8 pagesPresent and Future Value in MacroeconomicsMohsin NadeemNo ratings yet

- QuestionsDocument9 pagesQuestionsShaheer BaigNo ratings yet

- Assignment On Mathmatic of Finance Msc501Document2 pagesAssignment On Mathmatic of Finance Msc501Sumaya Nimat KhanNo ratings yet

- Assessment 1620157938377249199Document2 pagesAssessment 1620157938377249199Muhammad YahyaNo ratings yet

- C MOS: L 1 - Investment Environment and Investment Management ProcessDocument2 pagesC MOS: L 1 - Investment Environment and Investment Management ProcessSyrel SantosNo ratings yet

- Forwards and FuturesDocument5 pagesForwards and FuturesChirag LaxmanNo ratings yet

- Sameon-Lesson 5 ActivityDocument2 pagesSameon-Lesson 5 ActivityMary Joy SameonNo ratings yet

- International Finance Assignment FinalDocument7 pagesInternational Finance Assignment FinalDumidu Chathurange DassanayakeNo ratings yet

- MT PS With Solutions PDFDocument11 pagesMT PS With Solutions PDFWilmar AbriolNo ratings yet

- Mohammad Ali Jinnah University Karachi: (Course Outline)Document3 pagesMohammad Ali Jinnah University Karachi: (Course Outline)ABCXYZ WCNo ratings yet

- BBMF3173 Question Paper (With Suggested Ans)Document6 pagesBBMF3173 Question Paper (With Suggested Ans)Jie Wei TanNo ratings yet

- The Bernard Longe Judgment - Post Impact Analysis 120310Document5 pagesThe Bernard Longe Judgment - Post Impact Analysis 120310ProshareNo ratings yet

- MIDTERM IFM Oct2023 1Document2 pagesMIDTERM IFM Oct2023 1Triet LeNo ratings yet

- Bsba-Fm 3C: Instructor: Jan Kathleen O. LapitanDocument1 pageBsba-Fm 3C: Instructor: Jan Kathleen O. LapitanJan Kathleen LapitanNo ratings yet

- AF3301Document3 pagesAF3301manojmgcNo ratings yet

- Internship Report On Investment Operation of First Security Islami BankDocument39 pagesInternship Report On Investment Operation of First Security Islami BankRashel MahmudNo ratings yet

- Course OutlineDocument13 pagesCourse Outlinemuiz ahmadNo ratings yet

- Legal Aspects of Business: Indian Institute of Management, Rohtak Post Graduate ProgrammeDocument5 pagesLegal Aspects of Business: Indian Institute of Management, Rohtak Post Graduate ProgrammeAKANKSHA SINGHNo ratings yet

- A) The Following Is The Iphone 7 Price List and The Spot Exchange Rate For Both CountriesDocument10 pagesA) The Following Is The Iphone 7 Price List and The Spot Exchange Rate For Both CountriesDR LuotanNo ratings yet

- COMSATS University Islamabad (CUI), Lahore Campus, Pakistan: Department of Management SciencesDocument2 pagesCOMSATS University Islamabad (CUI), Lahore Campus, Pakistan: Department of Management SciencesnasirNo ratings yet

- Treasury Research News Bulletin - 25 October 2013Document2 pagesTreasury Research News Bulletin - 25 October 2013r3iherNo ratings yet

- FWDS Detailed ExampleDocument4 pagesFWDS Detailed ExampleZacks MchenyenyaNo ratings yet

- Forward Rate Agreement TopicsDocument27 pagesForward Rate Agreement Topicsdavid smithNo ratings yet

- SFM Forex Test 5Document9 pagesSFM Forex Test 5Sagar singlaNo ratings yet

- Derivative and Risk ManagementDocument4 pagesDerivative and Risk ManagementDushyant TaraNo ratings yet

- ARRC Syndicated Loan Conventions Technical AppendicesDocument18 pagesARRC Syndicated Loan Conventions Technical Appendicespatrick chauNo ratings yet

- Determinants of Signaling by Banks Through Loan Loss ProvisionsDocument9 pagesDeterminants of Signaling by Banks Through Loan Loss ProvisionsabhinavatripathiNo ratings yet

- Finnomics... ... Where Learning Peaks!!!: (Re) Interested in Futures!!!Document6 pagesFinnomics... ... Where Learning Peaks!!!: (Re) Interested in Futures!!!sonamsimsrNo ratings yet

- BTM T3 Q6Document4 pagesBTM T3 Q6Kahseng WooNo ratings yet

- Bai Tap Foreign Investment Tong HopDocument6 pagesBai Tap Foreign Investment Tong HopÁi Ly NguyễnNo ratings yet

- 2 BFM Module A Most Important Questions Part 2 CAIIB ExamDocument20 pages2 BFM Module A Most Important Questions Part 2 CAIIB Examranjanraja9712No ratings yet

- Volume 5 SFMDocument16 pagesVolume 5 SFMrajat sharmaNo ratings yet

- Yasin Yousouf Bahemia J15020141: Student Name: Student IDDocument25 pagesYasin Yousouf Bahemia J15020141: Student Name: Student IDKhaled KalamNo ratings yet

- Business Finance12 Q3 M4Document20 pagesBusiness Finance12 Q3 M4Chriztal TejadaNo ratings yet

- MBA 8135 Corporate Finance: Course Syllabus Summer 2008Document7 pagesMBA 8135 Corporate Finance: Course Syllabus Summer 2008lilbouyinNo ratings yet

- Evermaster Group - PTCDocument34 pagesEvermaster Group - PTCBadrul HakimiNo ratings yet

- Interest Rate Risk Management PDFDocument2 pagesInterest Rate Risk Management PDFHARSHALRAVALNo ratings yet

- Course Outline FM IIDocument1 pageCourse Outline FM IIMinyichel BayeNo ratings yet

- DBB2104 Unit-04Document27 pagesDBB2104 Unit-04anamikarajendran441998No ratings yet

- Hana Cahyaningrum FMDocument7 pagesHana Cahyaningrum FMHana CahyaningrumNo ratings yet

- RV 31032010Document218 pagesRV 31032010Shamanth1No ratings yet

- SAEWAEDocument3 pagesSAEWAEamitinfo_mishraNo ratings yet

- Quiz 1Document29 pagesQuiz 1Camille BagadiongNo ratings yet

- Bai Tap Foreign Investment Tong HopDocument4 pagesBai Tap Foreign Investment Tong HopVân TrươngNo ratings yet

- MB0029 Financial ManagementDocument2 pagesMB0029 Financial ManagementGP GILLNo ratings yet

- Internal Rate of Return: Disscount Rate 12% Year Cash Flow 0 - 800 1 200 2 250 3 300 4 350 5 400 NPV 240.8060420Document14 pagesInternal Rate of Return: Disscount Rate 12% Year Cash Flow 0 - 800 1 200 2 250 3 300 4 350 5 400 NPV 240.8060420ONASHI DEVNANI BBANo ratings yet

- Interest Annual Deposit (Assuming) Annual Retirement Withdrawal (Assuming) Account Balance, Beginning of Year Deposit at Beginning of YearDocument4 pagesInterest Annual Deposit (Assuming) Annual Retirement Withdrawal (Assuming) Account Balance, Beginning of Year Deposit at Beginning of YearONASHI DEVNANI BBANo ratings yet

- Atxuk-2019-Marjun Sample-Q PDFDocument12 pagesAtxuk-2019-Marjun Sample-Q PDFONASHI DEVNANI BBANo ratings yet

- Year Ending Dividends Stock Issues Repurchase of Common StockDocument25 pagesYear Ending Dividends Stock Issues Repurchase of Common StockONASHI DEVNANI BBANo ratings yet

- Using The Gordon Dividend Model. Compare The Cost of Equity Computed On The BasisDocument2 pagesUsing The Gordon Dividend Model. Compare The Cost of Equity Computed On The BasisONASHI DEVNANI BBANo ratings yet

- Advanced Taxation - United Kingdom (Atx - Uk) : Strategic Professional - OptionsDocument15 pagesAdvanced Taxation - United Kingdom (Atx - Uk) : Strategic Professional - OptionsONASHI DEVNANI BBANo ratings yet

- Is Question 1 Study TextDocument1 pageIs Question 1 Study TextONASHI DEVNANI BBANo ratings yet

- TFM Practice Questions TFC-Fall2020Document2 pagesTFM Practice Questions TFC-Fall2020ONASHI DEVNANI BBANo ratings yet

- Income From Property Tax Year 2021Document1 pageIncome From Property Tax Year 2021ONASHI DEVNANI BBANo ratings yet

- Lecture 2 (Income From Property) - Tax Year 2021Document4 pagesLecture 2 (Income From Property) - Tax Year 2021ONASHI DEVNANI BBANo ratings yet

- TFC SlidesDocument6 pagesTFC SlidesONASHI DEVNANI BBANo ratings yet

- Assignment 02 01 12 2020Document1 pageAssignment 02 01 12 2020ONASHI DEVNANI BBANo ratings yet