Professional Documents

Culture Documents

Is Question 1 Study Text

Uploaded by

ONASHI DEVNANI BBA0 ratings0% found this document useful (0 votes)

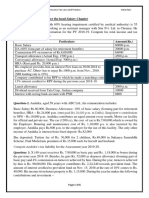

45 views1 pageMr. Arshad is an employee who submitted data on his income for tax year 2017, including a basic salary of Rs. 480,000, bonus of Rs. 240,000, and various allowances and benefits paid by his employer such as rent-free housing, vehicle usage, medical reimbursement, and utilities. He resigned due to health issues and received payments from his provident fund of Rs. 150,000 and gratuity fund of Rs. 70,000. He also purchased a company car for Rs. 285,000 and sold it for Rs. 600,000.

Original Description:

Original Title

IS QUESTION 1 STUDY TEXT

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentMr. Arshad is an employee who submitted data on his income for tax year 2017, including a basic salary of Rs. 480,000, bonus of Rs. 240,000, and various allowances and benefits paid by his employer such as rent-free housing, vehicle usage, medical reimbursement, and utilities. He resigned due to health issues and received payments from his provident fund of Rs. 150,000 and gratuity fund of Rs. 70,000. He also purchased a company car for Rs. 285,000 and sold it for Rs. 600,000.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

45 views1 pageIs Question 1 Study Text

Uploaded by

ONASHI DEVNANI BBAMr. Arshad is an employee who submitted data on his income for tax year 2017, including a basic salary of Rs. 480,000, bonus of Rs. 240,000, and various allowances and benefits paid by his employer such as rent-free housing, vehicle usage, medical reimbursement, and utilities. He resigned due to health issues and received payments from his provident fund of Rs. 150,000 and gratuity fund of Rs. 70,000. He also purchased a company car for Rs. 285,000 and sold it for Rs. 600,000.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

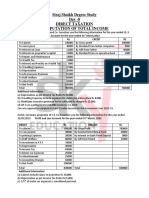

Mr. Arshad is an employee of a public listed company.

He submitted the following data for

computation of his taxable income for the tax year 2017:

Basic pay per annum 480,000

Bonus 240,000

Dearness allowance 50,000

Rent Free unfurnished accommodation 75,000

Watchman wages paid by employer 36,000

Gardner wages paid by employer 24,000

Sweeper wages paid by employer 6,000

Employer’s contribution towards recognized provident fund 24,000

Interest on Provident fund balance @18% 18,000

Company maintained car for official and private use 1300CC. The said car

was acquired three years earlier. The cost of acquisition of vehicle was

Rs. 850,000.

Reimbursement of medical expenditure 50,000

Utilities bills paid by the company :

Telephone 12,000

Electricity bills paid by employer 15,000

Gas Bills paid by employer 6,000

Water bills paid by employer 9,000

Leave fare assistance (for the first time) 50,000

Commission income for securing a contract paid by the

employer 30,000

Due to some health issue, he resigned from the job and following further sums

were paid to him:

Provident Fund recognized 150,000

Gratuity Fund unrecognized 70,000

Another company car has also been handed over to Mr. Arshad for a

consideration of Rs. 285,000 whereas the book value of the said car was

Rs. 435,200. He immediately sold the car at Rs. 600,000.

Required:

Compute the taxable income of Mr. Arshad for the tax year 2017.

You might also like

- P.Y Question Paper Income Tax Delhi UniversityDocument5 pagesP.Y Question Paper Income Tax Delhi UniversityHarsh chetiwal50% (2)

- Using The Gordon Dividend Model. Compare The Cost of Equity Computed On The BasisDocument2 pagesUsing The Gordon Dividend Model. Compare The Cost of Equity Computed On The BasisONASHI DEVNANI BBANo ratings yet

- PGBP New SlidesDocument40 pagesPGBP New SlidesSachin Jain100% (2)

- Individual b4 B PracticeDocument4 pagesIndividual b4 B Practicedavid.ellis1245No ratings yet

- Quiz 1 ActualDocument2 pagesQuiz 1 ActualAyesha MailkNo ratings yet

- 51043bos40756 cp4 PDFDocument27 pages51043bos40756 cp4 PDFraghuraman1511No ratings yet

- Taxation of IndividualsDocument18 pagesTaxation of IndividualsŁÖVË GÄMËNo ratings yet

- Contemporaray Taxation Acc: 300: PerquisitesDocument5 pagesContemporaray Taxation Acc: 300: PerquisitesALEEM MANSOORNo ratings yet

- Question CAP III AND CA MEMBERHSIP New OneDocument17 pagesQuestion CAP III AND CA MEMBERHSIP New OneSuraj ThapaNo ratings yet

- ATax - 01 Revision Salary IncomeDocument34 pagesATax - 01 Revision Salary IncomeHaseeb Ahmed ShaikhNo ratings yet

- 37524E240 Reg. NoDocument7 pages37524E240 Reg. Noshejal naikNo ratings yet

- Model Question BBS 3rd Taxation in NepalDocument6 pagesModel Question BBS 3rd Taxation in NepalAsmita BhujelNo ratings yet

- Chapter 2 Capsule SessionDocument40 pagesChapter 2 Capsule SessionKshitishNo ratings yet

- ACFrOgCPKi70npV5R8ZO4Qe-CnF8yvJMWMlGx2SIx6bqMAfZA-YZJASbPgbSy7zbg0 cxrqcx5 sDGlx7VQi8IwTtYXto39d9pXkFK7wWNgU2QXrc U6WVrwDtAG6rQO7MrVVMWrGFcak-ZPM95DDocument10 pagesACFrOgCPKi70npV5R8ZO4Qe-CnF8yvJMWMlGx2SIx6bqMAfZA-YZJASbPgbSy7zbg0 cxrqcx5 sDGlx7VQi8IwTtYXto39d9pXkFK7wWNgU2QXrc U6WVrwDtAG6rQO7MrVVMWrGFcak-ZPM95DManleen KaurNo ratings yet

- Unit 1 B&P ExamplesDocument9 pagesUnit 1 B&P ExamplesAllaretrashNo ratings yet

- P4 Taxation New Suggested CA Inter May 18Document27 pagesP4 Taxation New Suggested CA Inter May 18Durgadevi BaskaranNo ratings yet

- Solved Past Papers Income Tax Numericals of ICMAP STAGE IV - (2003 TO 2015)Document45 pagesSolved Past Papers Income Tax Numericals of ICMAP STAGE IV - (2003 TO 2015)muneeb razaNo ratings yet

- BCom Business Taxation Income Tax and Sales Tax Numerical 2018Document5 pagesBCom Business Taxation Income Tax and Sales Tax Numerical 2018AHSAN LASHARINo ratings yet

- PGBPDocument3 pagesPGBPJimmy ShergillNo ratings yet

- Rupees Salary Income:: Expenditure Claimed Against Property IncomeDocument1 pageRupees Salary Income:: Expenditure Claimed Against Property IncomeAli HassanNo ratings yet

- Profits & Gains of Business or ProfessionDocument5 pagesProfits & Gains of Business or ProfessionAnushka BiswasNo ratings yet

- Model Set SolutionDocument40 pagesModel Set SolutionRajan NeupaneNo ratings yet

- Taxation Module 3: Numerical Problems Income From Business or ProfessionDocument5 pagesTaxation Module 3: Numerical Problems Income From Business or ProfessionShankar HunnurNo ratings yet

- Day 8 TaxationDocument2 pagesDay 8 TaxationKhan Shadab -27No ratings yet

- Presentation of TaxationDocument10 pagesPresentation of TaxationMaaz SiddiquiNo ratings yet

- Offer Letter - Mandala Venkata Sai KiranDocument2 pagesOffer Letter - Mandala Venkata Sai Kirankirannaidu998560No ratings yet

- Practical Questions With HintsDocument4 pagesPractical Questions With HintsMff DeadsparkNo ratings yet

- IPCC Gr.I Paper 4 TaxationDocument10 pagesIPCC Gr.I Paper 4 TaxationAyushi RajputNo ratings yet

- CTFP Unit 2 PGBP ProblemsDocument6 pagesCTFP Unit 2 PGBP ProblemsKshitishNo ratings yet

- Question On Income From Business and Profession 2Document9 pagesQuestion On Income From Business and Profession 2Ayush BholeNo ratings yet

- Taxation NotesDocument33 pagesTaxation NotesNaina AgarwalNo ratings yet

- Ty Baf TaxationDocument4 pagesTy Baf TaxationAkki GalaNo ratings yet

- Ty Baf TaxationDocument4 pagesTy Baf TaxationAkki GalaNo ratings yet

- 54595bos43759 p4 PDFDocument33 pages54595bos43759 p4 PDFakkkNo ratings yet

- Taxation 2004 SolvedDocument18 pagesTaxation 2004 Solvedapi-3832224100% (2)

- Practice QuestionsDocument4 pagesPractice QuestionsMff DeadsparkNo ratings yet

- Tax Assignment - 1 2Document1 pageTax Assignment - 1 2mujtabamarchNo ratings yet

- Assignment MBA III: Business Taxation: TH THDocument4 pagesAssignment MBA III: Business Taxation: TH THShubham NamdevNo ratings yet

- Taxation Attempt All Questions (10 10 100)Document6 pagesTaxation Attempt All Questions (10 10 100)Mff DeadsparkNo ratings yet

- I.TAx 302Document4 pagesI.TAx 302tadepalli patanjaliNo ratings yet

- Income Tax May23 Free ResourcesDocument29 pagesIncome Tax May23 Free ResourcesPurna PatelNo ratings yet

- ATax - 04 - Property UpdatedDocument17 pagesATax - 04 - Property UpdatedHaseeb Ahmed ShaikhNo ratings yet

- Business Taxation Past Paper 2017 B.com Part 2 Punjab UniversityDocument3 pagesBusiness Taxation Past Paper 2017 B.com Part 2 Punjab UniversityAdeel AhmedNo ratings yet

- I.T.1. Notes What You Need To Know When Filling Your Income Tax Return - Year 2013Document4 pagesI.T.1. Notes What You Need To Know When Filling Your Income Tax Return - Year 2013GabrielNo ratings yet

- Income Tax II Illustration Computation of Total Income PDFDocument7 pagesIncome Tax II Illustration Computation of Total Income PDFSubramanian SenthilNo ratings yet

- Assignment # 2 Income Tax: TH TH RDDocument4 pagesAssignment # 2 Income Tax: TH TH RDHaseebPirachaNo ratings yet

- Taxation 2013 NovDocument25 pagesTaxation 2013 NovAshok 'Maelk' RajpurohitNo ratings yet

- IFS QuestionDocument6 pagesIFS QuestionHdkakaksjsbNo ratings yet

- 01 Revision Salary IncomeDocument24 pages01 Revision Salary IncomeUmer ArabiNo ratings yet

- Business TaxationDocument3 pagesBusiness TaxationatvishalNo ratings yet

- PGBP QuestionsDocument6 pagesPGBP QuestionsHdkakaksjsb100% (2)

- PerquisitesDocument29 pagesPerquisitesAmit ChaubeyNo ratings yet

- Value Added Tax Lecture Summary 2020Document72 pagesValue Added Tax Lecture Summary 2020Tatenda RamsNo ratings yet

- Bcom TaxDocument6 pagesBcom TaxAditya .cNo ratings yet

- Tax DeductionsDocument4 pagesTax DeductionsAnonymous LC5kFdtcNo ratings yet

- Balbes, Bella Ronah P. Act183: Income Taxation Prelim Exam S.Y 2020-2021 True or FalseDocument9 pagesBalbes, Bella Ronah P. Act183: Income Taxation Prelim Exam S.Y 2020-2021 True or FalseBella RonahNo ratings yet

- II PUC Accountancy Paper 2Document6 pagesII PUC Accountancy Paper 2Tarannum KNo ratings yet

- Happy Camper Park Case StudyDocument24 pagesHappy Camper Park Case StudyKathleen BuneNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2018 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2018 EditionNo ratings yet

- J.K. Lasser's Small Business Taxes 2012: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2012: Your Complete Guide to a Better Bottom LineNo ratings yet

- Internal Rate of Return: Disscount Rate 12% Year Cash Flow 0 - 800 1 200 2 250 3 300 4 350 5 400 NPV 240.8060420Document14 pagesInternal Rate of Return: Disscount Rate 12% Year Cash Flow 0 - 800 1 200 2 250 3 300 4 350 5 400 NPV 240.8060420ONASHI DEVNANI BBANo ratings yet

- Year Ending Dividends Stock Issues Repurchase of Common StockDocument25 pagesYear Ending Dividends Stock Issues Repurchase of Common StockONASHI DEVNANI BBANo ratings yet

- Interest Annual Deposit (Assuming) Annual Retirement Withdrawal (Assuming) Account Balance, Beginning of Year Deposit at Beginning of YearDocument4 pagesInterest Annual Deposit (Assuming) Annual Retirement Withdrawal (Assuming) Account Balance, Beginning of Year Deposit at Beginning of YearONASHI DEVNANI BBANo ratings yet

- Atxuk-2019-Marjun Sample-Q PDFDocument12 pagesAtxuk-2019-Marjun Sample-Q PDFONASHI DEVNANI BBANo ratings yet

- Advanced Taxation - United Kingdom (Atx - Uk) : Strategic Professional - OptionsDocument15 pagesAdvanced Taxation - United Kingdom (Atx - Uk) : Strategic Professional - OptionsONASHI DEVNANI BBANo ratings yet

- Income From Property Tax Year 2021Document1 pageIncome From Property Tax Year 2021ONASHI DEVNANI BBANo ratings yet

- TFM-Practice Question-Forex-forwardDocument1 pageTFM-Practice Question-Forex-forwardONASHI DEVNANI BBANo ratings yet

- Lecture 2 (Income From Property) - Tax Year 2021Document4 pagesLecture 2 (Income From Property) - Tax Year 2021ONASHI DEVNANI BBANo ratings yet

- TFM Practice Questions TFC-Fall2020Document2 pagesTFM Practice Questions TFC-Fall2020ONASHI DEVNANI BBANo ratings yet

- TFC SlidesDocument6 pagesTFC SlidesONASHI DEVNANI BBANo ratings yet

- Assignment 02 01 12 2020Document1 pageAssignment 02 01 12 2020ONASHI DEVNANI BBANo ratings yet