Professional Documents

Culture Documents

Assignment 02 01 12 2020

Assignment 02 01 12 2020

Uploaded by

ONASHI DEVNANI BBA0 ratings0% found this document useful (0 votes)

12 views1 page1. Bank A buys a 6-month treasury bill issued on June 18th 2020 that matures on December 18th 2020 with a face value of PKR 5000.

2. The treasury bill was issued at a yield of 6.6% and Bank A purchased it at a slightly lower yield of 6.57%.

3. The summary asks to calculate the issue price, purchase price, tax carry cost if held to maturity, selling price if sold on October 31st 2020, annual holding period yields for both scenarios, and determine which scenario provides the better yield.

Original Description:

Original Title

Assignment-02-01-12-2020

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1. Bank A buys a 6-month treasury bill issued on June 18th 2020 that matures on December 18th 2020 with a face value of PKR 5000.

2. The treasury bill was issued at a yield of 6.6% and Bank A purchased it at a slightly lower yield of 6.57%.

3. The summary asks to calculate the issue price, purchase price, tax carry cost if held to maturity, selling price if sold on October 31st 2020, annual holding period yields for both scenarios, and determine which scenario provides the better yield.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

12 views1 pageAssignment 02 01 12 2020

Assignment 02 01 12 2020

Uploaded by

ONASHI DEVNANI BBA1. Bank A buys a 6-month treasury bill issued on June 18th 2020 that matures on December 18th 2020 with a face value of PKR 5000.

2. The treasury bill was issued at a yield of 6.6% and Bank A purchased it at a slightly lower yield of 6.57%.

3. The summary asks to calculate the issue price, purchase price, tax carry cost if held to maturity, selling price if sold on October 31st 2020, annual holding period yields for both scenarios, and determine which scenario provides the better yield.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

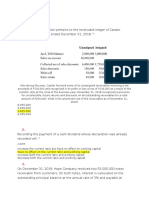

Treasury and Funds Management-AM (FN3540)

Assignment-02 (submission 01-12-2020)

Q. Bank “A” buys a 6 months T-Bill on 18th July 2020 at a yield of

6.57% p.a. The T-Bill was issued on 18th June 2020 at a yield of 6.60

%p.a. and matures on 18th December 2020 with a face value of PKR

5000.

1. Calculate the “issue price and purchase price” of the T-Bill.

2. If the T-Bill is held to maturity, what is the “Tax Carry Cost,”

supposing that the tax adjustment date is 31st December 2020 {use

money market rates of tax adjustment for the period of 1st October –

31st December 2020 as 8.76%p.a. whereas assume withholding tax

rate on the profit of T-Bill as 20%}.

3. If the Bank “H” decides to sell the T-Bill on 31st October 2020 at a

yield of 5% p.a., Calculate its “selling price.”

4. Calculate the “Annual Holding Period Yields” in the cases of “2”

(holding till maturity) and “3” (selling on 31st October 2020).

5. Analyze both the “Annual Holding Period Yields” calculated in “4”

and comment which case is a better case “2” or “3”?

You might also like

- San Beda College Alabang Homework Exercise-Act851RDocument4 pagesSan Beda College Alabang Homework Exercise-Act851RJomel BaptistaNo ratings yet

- Using The Gordon Dividend Model. Compare The Cost of Equity Computed On The BasisDocument2 pagesUsing The Gordon Dividend Model. Compare The Cost of Equity Computed On The BasisONASHI DEVNANI BBANo ratings yet

- SABADO TANONG - (December 3, 2022)Document1 pageSABADO TANONG - (December 3, 2022)Alexander BuenoNo ratings yet

- Intermediateaccounting2 Debt Investments - Fafvoci 793 1665904389Document2 pagesIntermediateaccounting2 Debt Investments - Fafvoci 793 1665904389Annie MalinaoNo ratings yet

- 02 Notes Loans and Bonds Payables and Debt Restructuring PDFDocument6 pages02 Notes Loans and Bonds Payables and Debt Restructuring PDFKlomoNo ratings yet

- Cash Budget ExampleDocument2 pagesCash Budget ExampleWaseim khan Barik zaiNo ratings yet

- Acc100 Supp PDFDocument11 pagesAcc100 Supp PDFLebohang NgubaneNo ratings yet

- Auditing Problem 1 22 22 PDFDocument26 pagesAuditing Problem 1 22 22 PDFKate NuevaNo ratings yet

- ACC 201-Review Questions FIDocument3 pagesACC 201-Review Questions FIAlbert AcheampongNo ratings yet

- Far FinalDocument24 pagesFar FinalJon MickNo ratings yet

- IA 2 Quiz #1 - Investment in BondsDocument2 pagesIA 2 Quiz #1 - Investment in BondsSkeeter Britney CostaNo ratings yet

- MINI CASE 3-Deferred Tax - A201 - StudentDocument3 pagesMINI CASE 3-Deferred Tax - A201 - Studentdini sofiaNo ratings yet

- Practice Sheet CH - Fundamentals (IOC & IOD)Document3 pagesPractice Sheet CH - Fundamentals (IOC & IOD)vaibhavbananiNo ratings yet

- Idt (Old) Icai RTP Nov 2020Document22 pagesIdt (Old) Icai RTP Nov 2020Ram Baran MauryaNo ratings yet

- Corporate Finance and Capital BudgetingDocument3 pagesCorporate Finance and Capital BudgetingRAHUL kumarNo ratings yet

- CBE June 2021 - QDocument10 pagesCBE June 2021 - QNguyễn Hồng NgọcNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument22 pages© The Institute of Chartered Accountants of IndiaShobhit JalanNo ratings yet

- Week 3 NotesDocument8 pagesWeek 3 NotescalebNo ratings yet

- SQB - Chapter 8 QuestionsDocument8 pagesSQB - Chapter 8 Questionsracso0% (1)

- Assignment Ch.8Document1 pageAssignment Ch.8drcobratroveNo ratings yet

- PL S18 FM WebDocument7 pagesPL S18 FM WebIQBAL MAHMUDNo ratings yet

- Quiz Discontinued OperationDocument2 pagesQuiz Discontinued OperationRose0% (1)

- A222 Takehome AssignmentDocument3 pagesA222 Takehome AssignmentjiehajamilNo ratings yet

- CA Inter Accounts Suggested Ans Nov23 Castudynotes ComDocument31 pagesCA Inter Accounts Suggested Ans Nov23 Castudynotes ComShivaram ShivaramNo ratings yet

- CIA1Document9 pagesCIA1course hero0% (1)

- Suggested Answers Global Financial Reporting StandardsDocument49 pagesSuggested Answers Global Financial Reporting StandardsNagabhushanaNo ratings yet

- Intangibles: Problem 1Document7 pagesIntangibles: Problem 1Jeric Lagyaban AstrologioNo ratings yet

- Amount Owed by The Business AccountingDocument3 pagesAmount Owed by The Business Accountingelsana philipNo ratings yet

- AccountsDocument347 pagesAccountsharshrathore17579No ratings yet

- Exam 1 Practice Questions Summer 2017Document8 pagesExam 1 Practice Questions Summer 2017Sandip AgarwalNo ratings yet

- Questions Accounting For Departments: Revision Test Paper Cap-Ii: Advanced AccountingDocument27 pagesQuestions Accounting For Departments: Revision Test Paper Cap-Ii: Advanced AccountingcasarokarNo ratings yet

- Accounting 2020 P1 Info BookDocument9 pagesAccounting 2020 P1 Info BookodiantumbaNo ratings yet

- Financial InstrumentsDocument11 pagesFinancial InstrumentsangelicamadscNo ratings yet

- Mbad 511Document5 pagesMbad 511peter wambuaNo ratings yet

- MTP1 May2022 - Paper 5 Advanced AccountingDocument24 pagesMTP1 May2022 - Paper 5 Advanced AccountingYash YashwantNo ratings yet

- Test Series: March 2022 Mock Test Paper 1 Intermediate: Group - Ii Paper - 5: Advanced AccountingDocument7 pagesTest Series: March 2022 Mock Test Paper 1 Intermediate: Group - Ii Paper - 5: Advanced AccountingShrwan SinghNo ratings yet

- Soal Asis Ak2 Pertemuan 1Document2 pagesSoal Asis Ak2 Pertemuan 1Aisya Fadhilla ShamaraNo ratings yet

- Sample Problem AdjustingDocument17 pagesSample Problem AdjustingHanna Mae CatudayNo ratings yet

- Soal GSLC-13 Advanced AccountingDocument7 pagesSoal GSLC-13 Advanced AccountingEunice ShevlinNo ratings yet

- Revision Paper - 2023Document12 pagesRevision Paper - 2023chaanNo ratings yet

- CLASSROOM EXERCISES ON CURRENT LIABILITIES 1st Term SY2018-2019 PDFDocument3 pagesCLASSROOM EXERCISES ON CURRENT LIABILITIES 1st Term SY2018-2019 PDFRedNo ratings yet

- Full Syllabus Test 1 q1672987668Document11 pagesFull Syllabus Test 1 q1672987668Sachin SHNo ratings yet

- SA PCC-Group-I May 2010Document99 pagesSA PCC-Group-I May 2010NagarajuNeeliNo ratings yet

- Play Time Toy CompanyDocument2 pagesPlay Time Toy CompanyAlejo valenzuelaNo ratings yet

- Income Tax Assessment and Procedure - 1Document3 pagesIncome Tax Assessment and Procedure - 1amaljacobjogilinkedinNo ratings yet

- MTP 2 Idt 2019Document10 pagesMTP 2 Idt 2019kartikNo ratings yet

- Soal Latihan LiabilitiesDocument2 pagesSoal Latihan Liabilitieskpop 123No ratings yet

- FR Question Paper 81655199552Document3 pagesFR Question Paper 81655199552Nakul GoyalNo ratings yet

- Far1 Artt Ias 8 & 33 Test QPDocument1 pageFar1 Artt Ias 8 & 33 Test QPHassan TanveerNo ratings yet

- May 2020 Financial Accounting Paper 1.1Document18 pagesMay 2020 Financial Accounting Paper 1.1MahediNo ratings yet

- AAFR Mock Q. Paper Final (S-20)Document6 pagesAAFR Mock Q. Paper Final (S-20)Ummar FarooqNo ratings yet

- Chartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalDocument81 pagesChartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalPrashant Sagar GautamNo ratings yet

- RTP Dec 2020 QnsDocument13 pagesRTP Dec 2020 QnsbinuNo ratings yet

- Financial Accounting 3.2Document7 pagesFinancial Accounting 3.2Tawanda HerbertNo ratings yet

- Chapter 14 - Supplementary QuestionDocument1 pageChapter 14 - Supplementary QuestionRaj PatelNo ratings yet

- Accounting I Nov 2019 Exam Final PaperDocument8 pagesAccounting I Nov 2019 Exam Final Paper2603803No ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Pawn Shop Revenues World Summary: Market Values & Financials by CountryFrom EverandPawn Shop Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- Internal Rate of Return: Disscount Rate 12% Year Cash Flow 0 - 800 1 200 2 250 3 300 4 350 5 400 NPV 240.8060420Document14 pagesInternal Rate of Return: Disscount Rate 12% Year Cash Flow 0 - 800 1 200 2 250 3 300 4 350 5 400 NPV 240.8060420ONASHI DEVNANI BBANo ratings yet

- Interest Annual Deposit (Assuming) Annual Retirement Withdrawal (Assuming) Account Balance, Beginning of Year Deposit at Beginning of YearDocument4 pagesInterest Annual Deposit (Assuming) Annual Retirement Withdrawal (Assuming) Account Balance, Beginning of Year Deposit at Beginning of YearONASHI DEVNANI BBANo ratings yet

- Atxuk-2019-Marjun Sample-Q PDFDocument12 pagesAtxuk-2019-Marjun Sample-Q PDFONASHI DEVNANI BBANo ratings yet

- Year Ending Dividends Stock Issues Repurchase of Common StockDocument25 pagesYear Ending Dividends Stock Issues Repurchase of Common StockONASHI DEVNANI BBANo ratings yet

- Advanced Taxation - United Kingdom (Atx - Uk) : Strategic Professional - OptionsDocument15 pagesAdvanced Taxation - United Kingdom (Atx - Uk) : Strategic Professional - OptionsONASHI DEVNANI BBANo ratings yet

- Is Question 1 Study TextDocument1 pageIs Question 1 Study TextONASHI DEVNANI BBANo ratings yet

- TFM-Practice Question-Forex-forwardDocument1 pageTFM-Practice Question-Forex-forwardONASHI DEVNANI BBANo ratings yet

- Income From Property Tax Year 2021Document1 pageIncome From Property Tax Year 2021ONASHI DEVNANI BBANo ratings yet

- Lecture 2 (Income From Property) - Tax Year 2021Document4 pagesLecture 2 (Income From Property) - Tax Year 2021ONASHI DEVNANI BBANo ratings yet

- TFM Practice Questions TFC-Fall2020Document2 pagesTFM Practice Questions TFC-Fall2020ONASHI DEVNANI BBANo ratings yet

- TFC SlidesDocument6 pagesTFC SlidesONASHI DEVNANI BBANo ratings yet