Professional Documents

Culture Documents

Cash Budget Example

Uploaded by

Waseim khan Barik zaiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cash Budget Example

Uploaded by

Waseim khan Barik zaiCopyright:

Available Formats

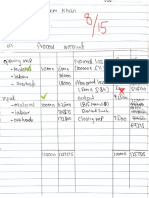

Example 1

Smart Limited has prepared a forecast for the quarter ending December 31, 20X9, which is based

on the following projections:

i. Sales for the period October 20X9 to January 20X0 has been projected as under:

October 20X9 7,500,000

November 20X9 9,900,000

December 20X9 10,890,000

January 20X0 10,000,000

Cash sale is 20% of the total sales. The company earns a gross profit at 20% of sales. It intends to

increase sales prices by 10% from November 1, 20X9. Effect of increase in sales price has been

incorporated in the above figures.

All debtors are allowed 45 days credit and are expected to settle promptly.

The opening balances on October 1, 20X9 are projected as under

Trade debts – related to September 5,600,000

Trade debts – related to August 3,000,000

Based on the given information, preparation a month-wise cash budget for the quarter ending

December 31, 20X9.

Cash collection from sales

Example 2

Zinc Limited (ZL) is engaged in trading business. Following data has been extracted from ZL’s

business plan for the year ended 30 September 20X2:

Sales Rs. ‘000

Actual:

Sales Rs

January 20X2 85,000

February 20X2 95,000Sales Rs. ‘000

Forecast:

Sales RS

March 20X2 55,000

April 20X2 60,000

May 20X2 65,000

June 20X2 75,000

Following information is also available:

Cash sale is 20% of the total sales. ZL earns a gross profit of 25% of sales and uniformly

maintains stocks at 80% of the projected sale of the following month.

60% of the debtors are collected in the first month subsequent to sale whereas the

remaining debtors are collected in the second month following sales.

80% of the customers deduct income tax @ 3.5% at the time of payment.

In January 20X2, ZL paid Rs. 2 million as 25% advance against purchase of packing machinery.

The machinery was delivered and installed in February 20X2 and was to be operated on test run

for two months. 50% of the purchase price was agreed to be paid in the month following

installation and the remaining amount at the end of test run.

Creditors are paid one month after purchases.

Administrative and selling expenses are estimated at 16% and 24% of the sales respectively and

are paid in the month in which they are incurred. ZL had cash and bank balances of Rs. 100

million as at 29 February 20X2.

Requirement:

A month-wise cash budget for the quarter ending 31 May 20X2.

Example 3

Sadiq Limited (SL) is in the process of preparation of budget for the year ending 31 December

2018. Following are the extracts from the statement of profit or loss for the year ended 31

December 2017:

RS

Sales (30% cash sales) 7,500

Cost of goods sold (4,000)

Gross profit 3,500

Operating expenses (1,250)

Net profit before tax 2,250

Raw material inventory as on 1 January 2017 amounted to Rs. 152 million. There were no

opening and closing inventories of work in process and finished goods.

SL follows FIFO method for valuation of inventories.

Following are the projections to be used in the preparation of the budget:

i. Selling price would be reduced by 5%. Further, credit period offered to customers would

be reduced from 45 days to 30 days. As a result, volumes of cash and credit sales are

expected to increase by 10% and 5% respectively.

ii. Ratio of manufacturing cost was 5:3:2 for raw material, direct labor and factory

overheads respectively.

Raw material inventory would be maintained at 30 days of consumption.

Up to 31 December 2017, it was maintained at 45 days of consumption.

v. Raw material prices would increase by 10%.

vii. The existing policy of payment to raw material suppliers in 30 days is to be changed to

15 days.

The budgeted net cash inflows/(outflows) for the year ending 31 December 2018 (Assuming

there are 360 days in a year).

Inflows from Sales

Payment to supplier

You might also like

- Sales Financing Revenues World Summary: Market Values & Financials by CountryFrom EverandSales Financing Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- BudgetingDocument9 pagesBudgetingshobi_300033% (3)

- WCM NotesDocument2 pagesWCM NotesTharunNo ratings yet

- Budget Questions Hac1Document5 pagesBudget Questions Hac1odedeyi aishat0% (1)

- MN20501 Lecture 7 Review Exercise - Updated 19 DecDocument4 pagesMN20501 Lecture 7 Review Exercise - Updated 19 Decsamvrab1919No ratings yet

- Advanced AccountingDocument6 pagesAdvanced AccountingMarisa CaraganNo ratings yet

- Operational Budget Assignment IIIDocument7 pagesOperational Budget Assignment IIIzeritu tilahunNo ratings yet

- KorpratsiDocument4 pagesKorpratsidelgermurun deegiiNo ratings yet

- Shrawan Bhadra Aswin Kartik: Problem 1Document17 pagesShrawan Bhadra Aswin Kartik: Problem 1notes.mcpu100% (1)

- Fac611s - Financial Accounting 201 - 2nd Opp - July 2019Document6 pagesFac611s - Financial Accounting 201 - 2nd Opp - July 2019Lizaan CloeteNo ratings yet

- Business Budgets and Budgetary Control: Sma - AbsDocument4 pagesBusiness Budgets and Budgetary Control: Sma - AbsSai SumanNo ratings yet

- Cash Budget . Feb 2020: Q 1 Calgon ProductsDocument11 pagesCash Budget . Feb 2020: Q 1 Calgon Products신두No ratings yet

- Chapter 7 AssignmentDocument27 pagesChapter 7 Assignmentsanskritishukla2020No ratings yet

- Required: Using These Data, Construct The December 31, Year 5 Balance Sheet For Your AnalysisDocument3 pagesRequired: Using These Data, Construct The December 31, Year 5 Balance Sheet For Your AnalysisJARED DARREN ONGNo ratings yet

- Questions Accounting For Departments: Revision Test Paper Cap-Ii: Advanced AccountingDocument27 pagesQuestions Accounting For Departments: Revision Test Paper Cap-Ii: Advanced AccountingcasarokarNo ratings yet

- Ex06 - Comprehensive BudgetingDocument14 pagesEx06 - Comprehensive BudgetingANa Cruz100% (2)

- Receivables ProblemsDocument4 pagesReceivables ProblemsLarpii MonameNo ratings yet

- CH 23 Exercises ProblemsDocument4 pagesCH 23 Exercises ProblemsAhmed El KhateebNo ratings yet

- FM Revision Q BankDocument10 pagesFM Revision Q BankOmkar VaigankarNo ratings yet

- Op Budget SampleDocument2 pagesOp Budget SampleAngelica MalpayaNo ratings yet

- Financial ManagementDocument16 pagesFinancial ManagementManish FloraNo ratings yet

- Budget PreparationDocument2 pagesBudget PreparationAAAAANo ratings yet

- 54940bosmtpsr2 Inter p1 QDocument6 pages54940bosmtpsr2 Inter p1 QAryan GurjarNo ratings yet

- CA Inter MTP 2 M'19 PDFDocument149 pagesCA Inter MTP 2 M'19 PDFSunitha SuniNo ratings yet

- Tutorial Week13Document2 pagesTutorial Week13Anis AshsiffaNo ratings yet

- HW 15-2 Task Budget Prep MCQ StudDocument5 pagesHW 15-2 Task Budget Prep MCQ StudКсения НиколоваNo ratings yet

- Numerical SDocument11 pagesNumerical Sbarnwal_bikashNo ratings yet

- 5.1 - AUDIT ON RECEIVABLES (Problems)Document10 pages5.1 - AUDIT ON RECEIVABLES (Problems)LorraineMartinNo ratings yet

- Chartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalDocument81 pagesChartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalPrashant Sagar GautamNo ratings yet

- RTP Dec 2020 QnsDocument13 pagesRTP Dec 2020 QnsbinuNo ratings yet

- Adjusting EntriesDocument6 pagesAdjusting EntriesJanna PleteNo ratings yet

- DU B.com (H) First Year (Financial Acc.) - Q Paper 2010Document7 pagesDU B.com (H) First Year (Financial Acc.) - Q Paper 2010mouryastudypointNo ratings yet

- Working CapitalDocument12 pagesWorking CapitalYasin Misvari T MNo ratings yet

- Mozammil 029Document4 pagesMozammil 029Iqbal Shan LifestyleNo ratings yet

- Intangibles: Problem 1Document7 pagesIntangibles: Problem 1Jeric Lagyaban AstrologioNo ratings yet

- Budgeting (Profit Planning) : Professor: John Anthony M. Labay, CPA, MBADocument6 pagesBudgeting (Profit Planning) : Professor: John Anthony M. Labay, CPA, MBAsharielles /No ratings yet

- FN 601 Financial Management Lecture 4 - Working Capital Management Review and Assignment QuestionsDocument5 pagesFN 601 Financial Management Lecture 4 - Working Capital Management Review and Assignment QuestionsBaraka100% (1)

- Budgets Exercises StudentDocument5 pagesBudgets Exercises Studentديـنـا عادل0% (1)

- Corporate Reporting Quest PDFDocument12 pagesCorporate Reporting Quest PDFGodsonNo ratings yet

- Cash BudgetDocument4 pagesCash BudgetSANDEEP SINGH0% (1)

- Working Capital Management: Problem Solving 3 QuestionsDocument4 pagesWorking Capital Management: Problem Solving 3 QuestionsMina MooNo ratings yet

- ACC 111 Review Materials For Final Exam COPY To StudentsDocument4 pagesACC 111 Review Materials For Final Exam COPY To StudentsCondoriano BatumbakalNo ratings yet

- ReceivablesDocument36 pagesReceivablesElla MalitNo ratings yet

- Assignment QuestionsDocument32 pagesAssignment Questionspratik panchalNo ratings yet

- Assessment 1 - Assignment 1 Part BDocument3 pagesAssessment 1 - Assignment 1 Part BTen Nine100% (1)

- Modul Akuntansi Manajemen II 2019-2020-Converted-Converted - 209630662Document30 pagesModul Akuntansi Manajemen II 2019-2020-Converted-Converted - 209630662hendy DidoNo ratings yet

- 63926bos51394finalold p1Document42 pages63926bos51394finalold p1marshadNo ratings yet

- Management Accounting SundayDocument5 pagesManagement Accounting SundayAhsan MaqboolNo ratings yet

- MFAB Oct 2020-Practice Set 1-Isb-V1Document2 pagesMFAB Oct 2020-Practice Set 1-Isb-V1Shashank GuptaNo ratings yet

- Tut 6 BudgetDocument4 pagesTut 6 Budgetchuah ming enNo ratings yet

- Cfas Fs PreparationDocument3 pagesCfas Fs PreparationEvelina Del RosarioNo ratings yet

- Unithibs LTDDocument4 pagesUnithibs LTDRobert Daniel AquinoNo ratings yet

- Revision Test Paper: Cap-Ii: Advanced Accounting: Questions Accounting For DepartmentsDocument153 pagesRevision Test Paper: Cap-Ii: Advanced Accounting: Questions Accounting For Departmentsshankar k.c.No ratings yet

- Old QPDocument4 pagesOld QPRiteshHPatelNo ratings yet

- Financial AccountingDocument2 pagesFinancial AccountingKartik GurmuleNo ratings yet

- DCF Problems PGDM Tri 4Document3 pagesDCF Problems PGDM Tri 4pratik waliwandekarNo ratings yet

- Secondary Market Financing Revenues World Summary: Market Values & Financials by CountryFrom EverandSecondary Market Financing Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Pawn Shop Revenues World Summary: Market Values & Financials by CountryFrom EverandPawn Shop Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Consumer Lending Revenues World Summary: Market Values & Financials by CountryFrom EverandConsumer Lending Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- RT#1 CAF-9 AA CH#1 - SolutionDocument2 pagesRT#1 CAF-9 AA CH#1 - SolutionWaseim khan Barik zaiNo ratings yet

- RT#2 CAF-9 AA - Question PaperDocument3 pagesRT#2 CAF-9 AA - Question PaperWaseim khan Barik zaiNo ratings yet

- RT#2 CAF-9 AA - SolutionDocument4 pagesRT#2 CAF-9 AA - SolutionWaseim khan Barik zaiNo ratings yet

- Question 2Document1 pageQuestion 2Waseim khan Barik zaiNo ratings yet

- ExamplesDocument7 pagesExamplesWaseim khan Barik zaiNo ratings yet

- Question No .1: The Professionals'Academy of Commerce Audit and AssuranceDocument2 pagesQuestion No .1: The Professionals'Academy of Commerce Audit and AssuranceWaseim khan Barik zaiNo ratings yet

- RT#3 CAF-9 AA - SolutionDocument3 pagesRT#3 CAF-9 AA - SolutionWaseim khan Barik zaiNo ratings yet

- R0019 M Waseem Khan - 158884 - 0Document2 pagesR0019 M Waseem Khan - 158884 - 0Waseim khan Barik zaiNo ratings yet

- SC ExamplesDocument2 pagesSC ExamplesWaseim khan Barik zaiNo ratings yet

- Aluminium LTDDocument1 pageAluminium LTDWaseim khan Barik zaiNo ratings yet

- Short Term Decision Making - SolutionDocument2 pagesShort Term Decision Making - SolutionWaseim khan Barik zaiNo ratings yet

- Production Double EntriesDocument8 pagesProduction Double EntriesWaseim khan Barik zaiNo ratings yet

- CVP of One Product of Many ProductsDocument1 pageCVP of One Product of Many ProductsWaseim khan Barik zaiNo ratings yet

- Singer LTD SolutionDocument2 pagesSinger LTD SolutionWaseim khan Barik zaiNo ratings yet

- Grand Test - Question PaperDocument3 pagesGrand Test - Question PaperWaseim khan Barik zaiNo ratings yet

- Test#7 Process CostingDocument1 pageTest#7 Process CostingWaseim khan Barik zaiNo ratings yet

- CMAC Section A, B Mid-Term Q.PaperDocument5 pagesCMAC Section A, B Mid-Term Q.PaperWaseim khan Barik zaiNo ratings yet

- Short Term Decision Making - TestDocument2 pagesShort Term Decision Making - TestWaseim khan Barik zaiNo ratings yet

- Financial Accounting & Reporting II: Certificatein Accountingand Finance Stage ExaminationsDocument3 pagesFinancial Accounting & Reporting II: Certificatein Accountingand Finance Stage ExaminationsWaseim khan Barik zaiNo ratings yet

- Cost of Opening WIP:: Other InformationDocument2 pagesCost of Opening WIP:: Other InformationWaseim khan Barik zaiNo ratings yet

- IFRS-9 SolutionDocument2 pagesIFRS-9 SolutionWaseim khan Barik zaiNo ratings yet

- The Professionals' Academy of Commerce: Financial Accounting & Reporting-II IFRS-8Document1 pageThe Professionals' Academy of Commerce: Financial Accounting & Reporting-II IFRS-8Waseim khan Barik zaiNo ratings yet

- IFRS-9 Financial InstrumentsDocument1 pageIFRS-9 Financial InstrumentsWaseim khan Barik zaiNo ratings yet

- FAR-II Test IFRS-16 (AB)Document2 pagesFAR-II Test IFRS-16 (AB)Waseim khan Barik zaiNo ratings yet

- Ifrs 9Document4 pagesIfrs 9Waseim khan Barik zaiNo ratings yet

- HP Blueprint - PsDocument87 pagesHP Blueprint - PsRangabashyam100% (2)

- Rights Issue Learning ObjectiveDocument14 pagesRights Issue Learning ObjectiveSrinivas ReddyNo ratings yet

- Macroeconomics EC2065 CHAPTER 7 - BANKING, FINANCE, AND THE MONEY MARKETDocument44 pagesMacroeconomics EC2065 CHAPTER 7 - BANKING, FINANCE, AND THE MONEY MARKETkaylaNo ratings yet

- Oligopoly 8Document32 pagesOligopoly 8adriz89100% (1)

- Adjusting Iron CondorsDocument21 pagesAdjusting Iron CondorsRamon CastellanosNo ratings yet

- G.kritika - A Summer Internship Project PDFDocument70 pagesG.kritika - A Summer Internship Project PDFSrinivas Charan MudirajNo ratings yet

- 7.2 Financial Ratio AnalysisDocument31 pages7.2 Financial Ratio AnalysisteeeNo ratings yet

- PSO Risk and Return AnalysisDocument3 pagesPSO Risk and Return AnalysisKhushbakht FarrukhNo ratings yet

- NEWTHESISDocument64 pagesNEWTHESISReivalf DueNo ratings yet

- Hershey's Lecturer BookDocument19 pagesHershey's Lecturer BookAbdel CowoNo ratings yet

- PEST AnalysisDocument8 pagesPEST AnalysisAkash AgrawalNo ratings yet

- Cambridge International AS & A Level: ECONOMICS 9708/23Document4 pagesCambridge International AS & A Level: ECONOMICS 9708/23ayanda muteyiwaNo ratings yet

- Financial Ratios NestleDocument23 pagesFinancial Ratios NestleSehrash SashaNo ratings yet

- Bonds Valuation 2017 STUDocument4 pagesBonds Valuation 2017 STUAnissa GeddesNo ratings yet

- M 14 IPCC Cost FM Guideline AnswersDocument12 pagesM 14 IPCC Cost FM Guideline Answerssantosh barkiNo ratings yet

- Questions of CGSDocument4 pagesQuestions of CGSaneel72No ratings yet

- Pillar 3 Disclosure RequirementsDocument70 pagesPillar 3 Disclosure Requirementsvandana005No ratings yet

- Retail Business Plan: Get Bagged .. .Tag A Bag..!Document13 pagesRetail Business Plan: Get Bagged .. .Tag A Bag..!gurpreet gillNo ratings yet

- Marketing Strategies Term Project OutlineDocument3 pagesMarketing Strategies Term Project OutlinesaaaruuuNo ratings yet

- Business Math Profit or LossDocument1 pageBusiness Math Profit or LossAnonymous DmjG6o100% (2)

- SM 12 Economics English 201617Document196 pagesSM 12 Economics English 201617GAMENo ratings yet

- Icici Prudential Asset Management Company LTD.: Revision and Practice Test Kit Version 3Document21 pagesIcici Prudential Asset Management Company LTD.: Revision and Practice Test Kit Version 3Neeraj KumarNo ratings yet

- The Gold Market-OutlineDocument5 pagesThe Gold Market-OutlineMartin SeruggaNo ratings yet

- Hungry Bird Street Fast Food Corner: By: Ravi SoniDocument21 pagesHungry Bird Street Fast Food Corner: By: Ravi SoniRavi SoniNo ratings yet

- Tata Motors: Supply Chain Analysis SC Cycles Location of Push/ Pull BoundaryDocument7 pagesTata Motors: Supply Chain Analysis SC Cycles Location of Push/ Pull BoundaryLaxmi PriyaNo ratings yet

- Kia Motors Corporation 231 Yangjae-Dong, Seocho-Gu, Seoul, 137-938, Korea Tel: 82-2-3464-5668 / Fax: 82-2-3464-5964Document14 pagesKia Motors Corporation 231 Yangjae-Dong, Seocho-Gu, Seoul, 137-938, Korea Tel: 82-2-3464-5668 / Fax: 82-2-3464-5964Abhishek SinghNo ratings yet

- College Accounting A Contemporary Approach 4th Edition Haddock Solutions ManualDocument16 pagesCollege Accounting A Contemporary Approach 4th Edition Haddock Solutions Manualeugenedermot52n3ny100% (31)

- EDEXCEL GSCE Business Studies - Unit 1 KeywordsDocument14 pagesEDEXCEL GSCE Business Studies - Unit 1 Keywordsalanood100% (1)

- Partner Promo FAQ - Microsoft 365 Business Voice and Audio Conferencing PromotionsDocument8 pagesPartner Promo FAQ - Microsoft 365 Business Voice and Audio Conferencing PromotionsedwinjuaniasNo ratings yet

- Sole Traders QuestionsDocument5 pagesSole Traders QuestionsJawad Hasan0% (1)