Professional Documents

Culture Documents

Aluminium LTD

Uploaded by

Waseim khan Barik zaiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Aluminium LTD

Uploaded by

Waseim khan Barik zaiCopyright:

Available Formats

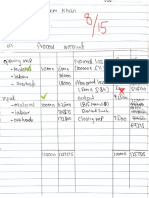

Q.

6 Aluminium Limited (AL) is engaged in the manufacture of product GH which requires

one unit of a single raw material PQR. The manufacturing of PQR is currently

outsourced under a contract which is expiring shortly.

The management of AL has decided to setup an in-house manufacturing facility for

production of PQR instead of renewing the existing contract of supply on its expiry. In

this respect, following two proposals at current prices have been forwarded for

evaluation:

Proposal 1 Proposal 2

Purchase cost (including setup cost) Rs. 3,500,000 Rs. 5,000,000

Useful life (Note) 3 years 5 years

Residual value (Note) Nil Rs.1,000,000

Annual production capacity 10,000 units 9,000 units

Plant operation cost Rs. 90,000 per month Rs. 70,000 per month

Annual maintenance cost Rs. 1,380,000 Rs. 1,200,000

Note: Under proposal 1, on carrying out a major overhaul at a cost of Rs. 1,300,000

(at current price) at the end of year 2, useful life and residual value of the plant would

increase to 5 years and Rs. 500,000 (at current price) respectively.

Other information:

(i) Existing demand of GH is 7,500 units which is expected to increase by 5% every

year.

(ii) In case of any shortage of PQR, it would be purchased from the market at a price of

Rs. 550 per unit at current price.

(iii) Variable cost of production at current price under proposal 1 and proposal 2 are

Rs. 400 per unit and Rs. 380 per unit respectively.

(iv) Depreciation would be charged on a straight line basis. Accounting depreciation is

assumed to be the same as tax depreciation. For Depreciation Purpose use residual

value at year 2 price level

(v) Inflation rate is estimated to be 6% per annum which is applicable from year 1.

(vi) Applicable tax rate is 30% and is payable in the year in which liability arises.

(vii) AL’s cost of capital is 14%.

Assume that except stated otherwise, all cash flows arise at year-end.

Required:

By using net present value (NPV) method, recommend the best course of action to the

management of AL. (20)

You might also like

- Marginal - Absorption Costing - Practice Questions With SolutionsDocument11 pagesMarginal - Absorption Costing - Practice Questions With Solutionsaishabadar88% (17)

- Modern Pharma Is Considering The Manufacture of A New Drug, Floxin, For Which The FollowingDocument7 pagesModern Pharma Is Considering The Manufacture of A New Drug, Floxin, For Which The FollowingbansalparthNo ratings yet

- RT#3 CAF-9 AA - SolutionDocument3 pagesRT#3 CAF-9 AA - SolutionWaseim khan Barik zaiNo ratings yet

- Small Paper Globe: Craft Templates For Paper Globes With Continents and Countries, Diameter Ø 5,9 Inches (15 CM)Document4 pagesSmall Paper Globe: Craft Templates For Paper Globes With Continents and Countries, Diameter Ø 5,9 Inches (15 CM)kiki19841984No ratings yet

- Project FinanceDocument19 pagesProject FinancejahidkhanNo ratings yet

- Su - 018Document5 pagesSu - 018AbdulAzeemNo ratings yet

- Cost and Management AccountingDocument4 pagesCost and Management AccountingHooriaNo ratings yet

- ECON F315 - FIN F315 - Compre QP PDFDocument3 pagesECON F315 - FIN F315 - Compre QP PDFPrabhjeet Kalsi100% (1)

- Cat QuestionDocument1 pageCat QuestionNickson ulamiNo ratings yet

- Skans School of Accountancy Cost & Management AccountingDocument3 pagesSkans School of Accountancy Cost & Management AccountingmaryNo ratings yet

- Chap 4 - IAS 36 (Questions)Document4 pagesChap 4 - IAS 36 (Questions)Kamoke LibraryNo ratings yet

- FM TestDocument5 pagesFM TestSamir JainNo ratings yet

- Business Finance Decisions: Certified Finance and Accounting Professional Stage ExaminationDocument5 pagesBusiness Finance Decisions: Certified Finance and Accounting Professional Stage ExaminationSyed Muhammad JawwadNo ratings yet

- Break-Even Analysis and New Design Economics - Ii: (Draw Profit Volume Diagram)Document7 pagesBreak-Even Analysis and New Design Economics - Ii: (Draw Profit Volume Diagram)Garima PalNo ratings yet

- Cost and Management AccountingDocument4 pagesCost and Management AccountingRamzan AliNo ratings yet

- Caf 8 Cma Autumn 2018Document4 pagesCaf 8 Cma Autumn 2018Hassnain SardarNo ratings yet

- 1c183capital Budgeting AssignmentDocument6 pages1c183capital Budgeting Assignmentaman27842No ratings yet

- Finance Cap 2Document19 pagesFinance Cap 2Dj babuNo ratings yet

- Cost and Management AccountingDocument5 pagesCost and Management AccountingZaib Khan0% (1)

- CVP Analy & Dec Making ProblemsDocument4 pagesCVP Analy & Dec Making ProblemsRahul SinghNo ratings yet

- 4a. Capital BudgetingDocument6 pages4a. Capital BudgetingShubhrant ShuklaNo ratings yet

- IRR of The ProjectDocument9 pagesIRR of The Projectsamuel kebedeNo ratings yet

- DM DCFDocument2 pagesDM DCFAJAY GOYALNo ratings yet

- Capital Budgeting Exercise1Document14 pagesCapital Budgeting Exercise1rohini jha0% (1)

- Cost Accounting and Financial Management: All Questions Are CompulsoryDocument4 pagesCost Accounting and Financial Management: All Questions Are CompulsorySudist JhaNo ratings yet

- Mar 13Document4 pagesMar 13smalaika18203No ratings yet

- F 17 - MacDocument4 pagesF 17 - MacIqra JawedNo ratings yet

- Management Accounting: Final ExaminationDocument3 pagesManagement Accounting: Final ExaminationAbdulAzeemNo ratings yet

- PGP CF 2019 Additional Practice Questions - Nov 2019Document4 pagesPGP CF 2019 Additional Practice Questions - Nov 2019Deepannita ChakrabortyNo ratings yet

- Index: Chapter-1 Basic Concept of Dicision MakingDocument271 pagesIndex: Chapter-1 Basic Concept of Dicision MakingAnkit Jung RayamajhiNo ratings yet

- Capital Expenditure DecisionsDocument2 pagesCapital Expenditure DecisionsSundarNo ratings yet

- Capital BudgetingDocument6 pagesCapital Budgetingkaf_scitNo ratings yet

- Cleanoorja Systems PVT LTDDocument35 pagesCleanoorja Systems PVT LTDganesh zoreNo ratings yet

- CAF 3 CMA Autumn 2022Document5 pagesCAF 3 CMA Autumn 2022QasimNo ratings yet

- Caf 8 Cma Spring 2019Document5 pagesCaf 8 Cma Spring 2019Jawad AzizNo ratings yet

- Case StudiesDocument47 pagesCase StudiesVIVEK KUMARNo ratings yet

- Past Paper - BFDDocument73 pagesPast Paper - BFDarifgillcaNo ratings yet

- Business Finance DecisionsDocument4 pagesBusiness Finance DecisionsCISA PwCNo ratings yet

- Capital BudgetingDocument3 pagesCapital BudgetingavinishNo ratings yet

- 54543bos43717ipcc p3q PDFDocument6 pages54543bos43717ipcc p3q PDFPuneet VyasNo ratings yet

- Costing FM Mock Test May 2019Document20 pagesCosting FM Mock Test May 2019Roshinisai VuppalaNo ratings yet

- Winter Exam-2012: Management AccountingDocument4 pagesWinter Exam-2012: Management AccountingSamina IrshadNo ratings yet

- Cost and Management Accounting Mid Term Exam: Date: 2 Total Marks: 100 Marks Instructio NsDocument4 pagesCost and Management Accounting Mid Term Exam: Date: 2 Total Marks: 100 Marks Instructio NsmaryNo ratings yet

- 3 - IAS 36 QuestionDocument2 pages3 - IAS 36 Questionsandeshjhanbia021No ratings yet

- Management Accounting: Final Examination (Transitional Scheme)Document5 pagesManagement Accounting: Final Examination (Transitional Scheme)AbdulAzeemNo ratings yet

- Cost Accounting: T I C A PDocument4 pagesCost Accounting: T I C A PShehrozSTNo ratings yet

- MC1Document3 pagesMC1deepalish88No ratings yet

- Management Accounting: Final ExaminationsDocument4 pagesManagement Accounting: Final ExaminationsAbdulAzeemNo ratings yet

- Capital Budgeting 5Document9 pagesCapital Budgeting 5Sarvesh SharmaNo ratings yet

- Paper - 2: Strategic Financial Management Questions Project Planning and Capital BudgetingDocument33 pagesPaper - 2: Strategic Financial Management Questions Project Planning and Capital BudgetingShyam virsinghNo ratings yet

- Domestic LPG Stove (Project Report)Document6 pagesDomestic LPG Stove (Project Report)Prashant KhaireNo ratings yet

- Ca Inter May 2023 ImpDocument23 pagesCa Inter May 2023 ImpAlok TiwariNo ratings yet

- CMA Past Paper 2022Document17 pagesCMA Past Paper 2022Iqramunir IqramunirNo ratings yet

- Caf-8 Cma PDFDocument5 pagesCaf-8 Cma PDFMuqtasid AhmedNo ratings yet

- Assignment EconDocument2 pagesAssignment EconRefisa JiruNo ratings yet

- Capital Budgeting Exercise1Document14 pagesCapital Budgeting Exercise1Bigbi Kumar100% (1)

- 3 Decision MakingDocument6 pages3 Decision MakingAnushka DharangaonkarNo ratings yet

- Capital Budgeting PzfNff6tTADocument2 pagesCapital Budgeting PzfNff6tTARising ThunderNo ratings yet

- Relevant Costing TestDocument3 pagesRelevant Costing TestJames MartinNo ratings yet

- GIFT - CAF 8 Master Questions With Solutions & Marks - Caf 8 Sir Saud Tariq ST AcademyDocument36 pagesGIFT - CAF 8 Master Questions With Solutions & Marks - Caf 8 Sir Saud Tariq ST AcademyShehrozSTNo ratings yet

- Article 6 of the Paris Agreement: Drawing Lessons from the Joint Crediting MechanismFrom EverandArticle 6 of the Paris Agreement: Drawing Lessons from the Joint Crediting MechanismNo ratings yet

- Asia in the Global Transition to Net Zero: Asian Development Outlook 2023 Thematic ReportFrom EverandAsia in the Global Transition to Net Zero: Asian Development Outlook 2023 Thematic ReportNo ratings yet

- RT#2 CAF-9 AA - SolutionDocument4 pagesRT#2 CAF-9 AA - SolutionWaseim khan Barik zaiNo ratings yet

- R0019 M Waseem Khan - 163582 - 0Document8 pagesR0019 M Waseem Khan - 163582 - 0Waseim khan Barik zaiNo ratings yet

- RT#3 CAF-9 AA - Question PaperDocument2 pagesRT#3 CAF-9 AA - Question PaperWaseim khan Barik zaiNo ratings yet

- RT#1 CAF-9 AA CH#1 - SolutionDocument2 pagesRT#1 CAF-9 AA CH#1 - SolutionWaseim khan Barik zaiNo ratings yet

- RT#1 AA CH#1 - Question PaperDocument1 pageRT#1 AA CH#1 - Question PaperWaseim khan Barik zaiNo ratings yet

- RT#2 CAF-9 AA - Question PaperDocument3 pagesRT#2 CAF-9 AA - Question PaperWaseim khan Barik zaiNo ratings yet

- SC ExamplesDocument2 pagesSC ExamplesWaseim khan Barik zaiNo ratings yet

- Production Double EntriesDocument8 pagesProduction Double EntriesWaseim khan Barik zaiNo ratings yet

- RT#4 CAF-9 AA - Question PaperDocument3 pagesRT#4 CAF-9 AA - Question PaperWaseim khan Barik zaiNo ratings yet

- R0019 M Waseem Khan - 170648 - 0Document15 pagesR0019 M Waseem Khan - 170648 - 0Waseim khan Barik zaiNo ratings yet

- R0019 M Waseem Khan - 170648 - 0Document15 pagesR0019 M Waseem Khan - 170648 - 0Waseim khan Barik zaiNo ratings yet

- Question No .1: The Professionals'Academy of Commerce Audit and AssuranceDocument2 pagesQuestion No .1: The Professionals'Academy of Commerce Audit and AssuranceWaseim khan Barik zaiNo ratings yet

- R0019 M Waseem Khan - 163582 - 0Document8 pagesR0019 M Waseem Khan - 163582 - 0Waseim khan Barik zaiNo ratings yet

- R0019 M Waseem Khan - 180821 - 0Document18 pagesR0019 M Waseem Khan - 180821 - 0Waseim khan Barik zaiNo ratings yet

- Labour: Question 1 Spring 2003Document5 pagesLabour: Question 1 Spring 2003Waseim khan Barik zaiNo ratings yet

- RT#3 CAF-9 AA - Question PaperDocument2 pagesRT#3 CAF-9 AA - Question PaperWaseim khan Barik zaiNo ratings yet

- Question 2Document1 pageQuestion 2Waseim khan Barik zaiNo ratings yet

- ExamplesDocument7 pagesExamplesWaseim khan Barik zaiNo ratings yet

- R0019 M Waseem Khan - 158884 - 0Document2 pagesR0019 M Waseem Khan - 158884 - 0Waseim khan Barik zaiNo ratings yet

- CVP of One Product of Many ProductsDocument1 pageCVP of One Product of Many ProductsWaseim khan Barik zaiNo ratings yet

- Example Process Account With Closing WIPDocument1 pageExample Process Account With Closing WIPWaseim khan Barik zaiNo ratings yet

- R0019 M Waseem Khan - 176898 - 0Document2 pagesR0019 M Waseem Khan - 176898 - 0Waseim khan Barik zaiNo ratings yet

- Short Term Decision Making - TestDocument2 pagesShort Term Decision Making - TestWaseim khan Barik zaiNo ratings yet

- Test#7 Process CostingDocument1 pageTest#7 Process CostingWaseim khan Barik zaiNo ratings yet

- Practice Material Budgeting and ForecastingDocument4 pagesPractice Material Budgeting and ForecastingWaseim khan Barik zaiNo ratings yet

- Singer LTD SolutionDocument2 pagesSinger LTD SolutionWaseim khan Barik zaiNo ratings yet

- Short Term Decision Making - SolutionDocument2 pagesShort Term Decision Making - SolutionWaseim khan Barik zaiNo ratings yet

- Cost of Opening WIP:: Other InformationDocument2 pagesCost of Opening WIP:: Other InformationWaseim khan Barik zaiNo ratings yet

- Ross 12e PPT Ch02Document25 pagesRoss 12e PPT Ch02Giang HoàngNo ratings yet

- N6 Cost and Management Accounting June 2019Document11 pagesN6 Cost and Management Accounting June 2019needmoregapareNo ratings yet

- Financial Management Class Part 2-KasetsartDocument66 pagesFinancial Management Class Part 2-KasetsartKong KrcNo ratings yet

- Global Corporate Strategy AssessmentDocument13 pagesGlobal Corporate Strategy AssessmentAbdul Hadi100% (1)

- Amare Harris - Portfolio ResumeDocument2 pagesAmare Harris - Portfolio Resumeapi-539200504No ratings yet

- Assessment of Vat AdministrationDocument30 pagesAssessment of Vat Administrationshimelis100% (1)

- Home Décor and Furnishings: Sector AnalysisDocument9 pagesHome Décor and Furnishings: Sector AnalysisVatsala KapurNo ratings yet

- Dragon Oil Is An Upstream OilDocument8 pagesDragon Oil Is An Upstream OilCream FamilyNo ratings yet

- Cfas Pas 41 AgricultureDocument4 pagesCfas Pas 41 AgricultureMeg sharkNo ratings yet

- Assignment Banking-1Document8 pagesAssignment Banking-1Al RafiNo ratings yet

- A Study On Buying Behaviour Customer Sat PDFDocument3 pagesA Study On Buying Behaviour Customer Sat PDFIbrahim BashaNo ratings yet

- PGP in Product Management 1Document11 pagesPGP in Product Management 1Manali JainNo ratings yet

- MTH302 Short Notes (Mid - Term) Lecture 1 To 22Document13 pagesMTH302 Short Notes (Mid - Term) Lecture 1 To 22gbNo ratings yet

- Application Account Payables Title: Retainage Invoice: OracleDocument24 pagesApplication Account Payables Title: Retainage Invoice: OraclesureshNo ratings yet

- Investor Relations With Stock Regulations & Strategy For Stock Volume and Price IncreaseDocument53 pagesInvestor Relations With Stock Regulations & Strategy For Stock Volume and Price IncreaselulenduNo ratings yet

- Integration 1. Backward IntegrationDocument5 pagesIntegration 1. Backward IntegrationMae ann LomugdaNo ratings yet

- Marketplace: Publisher GuideDocument43 pagesMarketplace: Publisher Guidechandra100% (1)

- Myntra - Media StrategyDocument13 pagesMyntra - Media StrategyPiyush KumarNo ratings yet

- PETRONAS Lubricants (India) Pvt. LTD.: Tax InvoiceDocument2 pagesPETRONAS Lubricants (India) Pvt. LTD.: Tax InvoiceWasim AhmedNo ratings yet

- PROJECT REPORT Kartik BhardwajDocument63 pagesPROJECT REPORT Kartik BhardwajKartik BhardwajNo ratings yet

- Intermediate Accounting Reporting and Analysis 2nd Edition Wahlen Test Bank 1Document102 pagesIntermediate Accounting Reporting and Analysis 2nd Edition Wahlen Test Bank 1willie100% (47)

- Bond Prices and YieldsDocument60 pagesBond Prices and YieldsSaurabh GroverNo ratings yet

- Cta 2D CV 08315 D 2014feb17 AssDocument15 pagesCta 2D CV 08315 D 2014feb17 AssRecca GeorfoNo ratings yet

- 04-Chap2-Chart of Accounts-2022-2023-S1Document1 page04-Chap2-Chart of Accounts-2022-2023-S1Lilly ChanNo ratings yet

- Chapter 14 AKM Kieso - Jawab SoalDocument6 pagesChapter 14 AKM Kieso - Jawab SoalNABILAH KHANSA 1911000089No ratings yet

- Verified Data of SunnyDocument12 pagesVerified Data of SunnyajayNo ratings yet

- Release 6.0 BSB07 Business Services Training Package Header InformationDocument141 pagesRelease 6.0 BSB07 Business Services Training Package Header Informationrsdiamz100% (1)

- Richard Wyckoff Method - How Stock Price Trends Are Driven Primarily by Institutional Operators Who Manipulate Stock Prices in Their FavorDocument18 pagesRichard Wyckoff Method - How Stock Price Trends Are Driven Primarily by Institutional Operators Who Manipulate Stock Prices in Their FavorAM405100% (8)

- dc2020-02-0002 DOE RA 11361Document24 pagesdc2020-02-0002 DOE RA 11361Nina Rachell RodriguezNo ratings yet