Professional Documents

Culture Documents

Fundamental Concepts of Risk and The Risk Management Process

Uploaded by

btsvt1307 phOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fundamental Concepts of Risk and The Risk Management Process

Uploaded by

btsvt1307 phCopyright:

Available Formats

FUNDAMENTAL CONCEPTS OF RISK AND THE RISK MANAGEMENT PROCESS

“Risk is the possibility of an event occurring that will have an impact on the achievement

of objectives.” Impact and likelihood affect risk measurement. Additionally, risk brings either

harm or opportunities.

As an employee of a publicly listed corporation, it is probable to encounter operational

risk. This risk is concerned with carrying out business operations on a day-to day basis.

Moreover, it is the risk of loss from a failure of internal business and control processes

Operational risk can affect every stakeholder but I will take creditors, external

stakeholders, and employees, internal stakeholders. As operational risks relate to daily operations

of the company, both creditors and employees can feel the possibility that their interest will not

be catered. And for the result, they may take actions against the company to ensure gaining their

interest.

Employees are concerned with their jobs so failure in business operations can harm and

threaten it. Part of it is the salaries and benefits. On the other hand, creditors are particular with

the risk of default which will lead them in providing restrictive provisions in debt covenant.

The problems with operational risk can be managed and mitigated by adopting proper

policies and utilizing effective procedures in operations. As operational risk is also seen as the

risk of business operations failing due to human error, the company should establish a policy

regarding employee performance and its measurement. Part of this, the first thing the

management should do is to ensure that it hired highly trained and experienced employees to

perform duties effectively. After the hiring, assigning them to right tasks is important.

Policy on proper management of equipment failure should also be implemented because

even with the presence of technology, equipments are not guaranteed to always run perfectly.

Regular maintenance and addressing small issues promptly is established as part of this policy.

Another procedure to be adopted is to promulgate proper risk assessment system. This

starts with risk and uncertainty identification. Next is to know the degree of effects of each risk.

Last is the evaluation and control of these risks.

The fact that operational risks can harm the organization makes it an opportunity to

develop risk management programs. Developing operational risk management processes and

programs should be viewed as an organizational imperative tool to aiding smooth business

operations. These programs include business continuity, information security, and compliance

measurement.

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

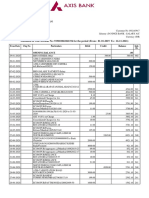

- Statement of Axis Account No:919010061861194 For The Period (From: 01-01-2019 To: 16-11-2021)Document4 pagesStatement of Axis Account No:919010061861194 For The Period (From: 01-01-2019 To: 16-11-2021)udi969No ratings yet

- Fast, Cheap and Viral - Aashish ChopraDocument143 pagesFast, Cheap and Viral - Aashish ChopraJai SuryaNo ratings yet

- Batch Management Determination FEFO, LEFO, FIFO & LIFODocument38 pagesBatch Management Determination FEFO, LEFO, FIFO & LIFOamit chinage100% (1)

- Global City Reaction PaperDocument3 pagesGlobal City Reaction Paperbtsvt1307 ph100% (1)

- Inbound Cross DockDocument135 pagesInbound Cross DockSonaliNo ratings yet

- Strategic PlanningDocument12 pagesStrategic Planningbtsvt1307 phNo ratings yet

- Views About SelfDocument15 pagesViews About Selfbtsvt1307 phNo ratings yet

- The History of The Universe: Summary and Reaction PaperDocument2 pagesThe History of The Universe: Summary and Reaction Paperbtsvt1307 phNo ratings yet

- Current State of ICTDocument2 pagesCurrent State of ICTbtsvt1307 phNo ratings yet

- Financial Markets and InstitutionsDocument21 pagesFinancial Markets and InstitutionsDaryl PanganibanNo ratings yet

- Financial and Management Accounting Sample Exam Questions: MBA ProgrammeDocument16 pagesFinancial and Management Accounting Sample Exam Questions: MBA ProgrammeFidoNo ratings yet

- Guia Usa Nataly Largo 772134549015Document7 pagesGuia Usa Nataly Largo 772134549015samadhi sierraNo ratings yet

- Group 6's Case Study On Toyota (Presentation)Document16 pagesGroup 6's Case Study On Toyota (Presentation)Abhay NarendranNo ratings yet

- Project On PC and Laptop Industry of IndiaDocument11 pagesProject On PC and Laptop Industry of IndiaPrithiraj MahantaNo ratings yet

- Selamawit NibretDocument75 pagesSelamawit NibretYishak KibruNo ratings yet

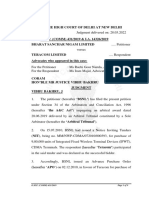

- Carandang v. DesiertoDocument2 pagesCarandang v. DesiertoJORLAND MARVIN BUCUNo ratings yet

- Boehler Welding QLine OverviewDocument4 pagesBoehler Welding QLine OverviewcarlosNo ratings yet

- Topic: Feasibility Plan Submitted By: Junaid Qadir Submit To: Sir Khuram Amin Subject:. Entrepreneurship Roll No:. MCOF19M010Document6 pagesTopic: Feasibility Plan Submitted By: Junaid Qadir Submit To: Sir Khuram Amin Subject:. Entrepreneurship Roll No:. MCOF19M010Faaiz YousafNo ratings yet

- Bharat Sanchar Nigam Limited Versus Teracom Limited 413962Document9 pagesBharat Sanchar Nigam Limited Versus Teracom Limited 413962saket bansalNo ratings yet

- Investor Presentation: Primegurukul Pvt. LTDDocument30 pagesInvestor Presentation: Primegurukul Pvt. LTDShreekant SharmaNo ratings yet

- What Would You Say Was The Highlight of Your Product Marketing CareerDocument2 pagesWhat Would You Say Was The Highlight of Your Product Marketing CareerAyodeji AkinolaNo ratings yet

- Ivend Retail For SAP Business One - Product PresentationDocument40 pagesIvend Retail For SAP Business One - Product PresentationCitiXsys TechnologiesNo ratings yet

- Deed of Absolute Sale (Scrap Vehicles)Document3 pagesDeed of Absolute Sale (Scrap Vehicles)Gerard Martin CamiñaNo ratings yet

- Evaluation Sheet PDFDocument3 pagesEvaluation Sheet PDFramanNo ratings yet

- SR-1 Leave Application FormDocument1 pageSR-1 Leave Application FormUma Maheswararao0% (1)

- Footwear Design in Fusion 360Document17 pagesFootwear Design in Fusion 360TonyNo ratings yet

- BiddoctbmDocument43 pagesBiddoctbmdabasashishipsNo ratings yet

- 3.7 Tackle The Test: Multiple-Choice QuestionsDocument4 pages3.7 Tackle The Test: Multiple-Choice QuestionsAntonia Tascon Z.No ratings yet

- (Midterm-Second Week) Maam CJ Chris Ramtom: Technical English 1 (Investigative Report Writing and Presentation) Cdi 5Document7 pages(Midterm-Second Week) Maam CJ Chris Ramtom: Technical English 1 (Investigative Report Writing and Presentation) Cdi 5Givehart Mira BanlasanNo ratings yet

- Kelompok 9 Closing EntriesDocument17 pagesKelompok 9 Closing EntriesrizkiNo ratings yet

- Transaction Price - Problems (1) - Sarmiento, Jefferson D.Document3 pagesTransaction Price - Problems (1) - Sarmiento, Jefferson D.jefferson sarmientoNo ratings yet

- ProposalDocument14 pagesProposalMiki AberaNo ratings yet

- 4 Step To EpiphanyDocument71 pages4 Step To Epiphanythikhjn2011No ratings yet

- Srinath Rao: PersonalDocument3 pagesSrinath Rao: PersonalSrinath RaoNo ratings yet

- Unit 203 Principles of Manufacturing Technology: Level: 2 Credit Value: 7 Uan: K/503/0175 Unit AimDocument4 pagesUnit 203 Principles of Manufacturing Technology: Level: 2 Credit Value: 7 Uan: K/503/0175 Unit AimEóin O CeranaighNo ratings yet