Professional Documents

Culture Documents

"Form No. 15G

"Form No. 15G

Uploaded by

Prathamesh PatikOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

"Form No. 15G

"Form No. 15G

Uploaded by

Prathamesh PatikCopyright:

Available Formats

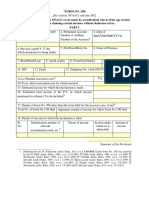

"FORM NO.

15G

[See section 197A(1), 197A(1A) and rule 29C]

Declaration under section 197A (1) and section 197A(1A) to be made by an individual or a person (not being a

company or firm) claiming certain incomes without deduction of tax.

PART I

1. Name of Assessee (Declarant) 2. PAN of the Assessee1

3. Status2 4. Previous year(P.Y.)3 5. Residential Status4

(for which declaration is being made)

6. Flat/Door/Block No. 7. Na me of Premises 8. Road/Street/Lane 9. Area/Locality

10. Town/City/District 11. Sta te 12. PIN 13. Email

14. Telephone No. (with STD 15 (a) Whether assessed to tax under the Yes No

Code) and Mobile No. Income-tax Act, 1961 : 5

(b) If yes, latest assessm ent year for which

assessed

16. Estimated income for which this declaration is made 17. Estimated total income of the P.Y. in which

income mentioned in column 16 to be included6

18. Details of Form No. 15G other than this form filed during the previous year, if any7

Total No. of Form No. 15G filed Aggregate amount of income for which Form No.15G filed

19. Details of income for which the declaration is filed

Sl. Identification number of relevant Nature of income Section under which tax is Amount of income

8

No. investment/account, etc. deductible

……………………………………….

Signature of the Declarant9

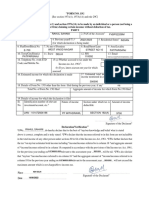

Declaration/Verification10

*I/We………………………………do hereby declare that to the best of *my/our knowledge and belief what is stated

above is correct, complete and is truly stated. *I/We declare that the incomes referred to in this form are not includible

in the total income of any other person under sections 60 to 64 of the Income-tax Act, 1961. *I/We further declare that

the tax *on my/our estimated total income including *income/incomes referred to in column 16 *and aggregate amount

of *income/incomes referred to in column 18 computed in accordance with the provisions of the Income-tax Act, 1961,

for the previous year ending on .................... relevant to the assessment year ..................will be nil. *I/We also declare

that *my/our *income/incomes referred to in column 16 *and the aggregate amount of *income/incomes referred to in

column 18 for the previous year ending on .................... relevant to the assessment year .................. will not exceed the

maximum amount which is not chargeable to income-tax.

Place: …………………………………………….. …………………………………………………………….

Signature of the Declarant9

Date: ……………………………………………..

PART II

[To be filled by the person responsible for paying the income referred to in column 16 of Part I]

1. Name of the person responsible for paying 2. Unique Identification No.11

3. PAN of the person 4. Complete Address 5. TAN of the person responsible for paying

responsible for paying

6. Email 7. Telephone No. (with STD Code) and Mobile No. 8. Amount of income paid12

9. Date on which Declaration is 10. Date on which the income has been paid/credited

received (DD/MM/YYYY)

(DD/MM/YYYY)

Place: ……………………………………………….. ………………………………………………

Signature of the person responsible for paying

Date: ………………………………………………. the income referred to in column 16 of Part I

*Delete whichever is not applicable. 1 As per provisions of section 206AA(2), the declaration under section 197A(1)

or 197A(1A) shall be invalid if the declarant fails to furnish his valid Permanent Account Number (PAN).

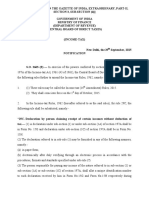

2 Declaration can be furnished by an individual under section 197A(1) and a person (other

than a company or a firm) under section 197A(1A).

3 The financial year to which the income pertains.

4 Please mention the residential status as per the provisions of section 6 of the Income-tax Act,

1961.

5

Please mention “Yes” if assessed to tax under the provisions of Income-tax Act, 1961 for any of the assessment year

out of six assessment years preceding the year in which the declaration is filed.

6

Please mention the amount of estimated total income of the previous year for which the declaration is filed including

the amount of income for which this declaration is made.

7 In case any declaration(s) in Form No. 15G is filed before filing this declaration during the previous year, mention

the total number of such Form No. 15G filed along with the aggregate amount of income for which said declaration(s)

have been filed. 8 Mention the distinctive number of shares, account number of term deposit, recurring deposit, National

Savings Schemes, life insurance policy number, employee code, etc.

9 Indicate the capacity in which the declaration is furnished on behalf of a HUF,

AOP, etc.

10 Before signing the declaration/verification, the declarant should satisfy himself

that the information furnished in this form is true, correct and complete in all respects. Any

person making a false statement in the declaration shall be liable to prosecution under

section 277 of the Income-tax Act, 1961 and on conviction be punishable-

(i) in a case where tax sought to be evaded exceeds twenty-five lakh rupees, with rigorous imprisonment

which shall not be less than six months but which may extend to seven years and with fine;

(ii) in any other case, with rigorous imprisonment which shall not be less than three months but which

may extend to two years and with fine. 11 The person responsible for paying the income referred to in column

16 of Part I shall allot a unique identification number to all the Form No. 15G received by him during a quarter

of the financial year and report this reference number along with the particulars prescribed in rule 31A(4)(vii)

of the Income-tax Rules, 1962 in the TDS statement furnished for the same quarter. In case the person has

also received Form No.15H during the same quarter, please allot separate series of serial number for Form

No.15G and Form No.15H.

12 The person responsible for paying the income referred to in column 16 of Part I shall not accept the declaration where

the amount of income of the nature referred to in sub-section (1) or sub-section (1A) of section 197A or the aggregate

of the amounts of such income credited or paid or likely to be credited or paid during the previous year in which such

income is to be included exceeds the maximum amount which is not chargeable to tax. For deciding the eligibility, he

is required to verify income or the aggregate amount of incomes, as the case may be, reported by the declarant in

columns 16 and 18.;

You might also like

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- J.K. Lasser's Your Income Tax 2019: For Preparing Your 2018 Tax ReturnFrom EverandJ.K. Lasser's Your Income Tax 2019: For Preparing Your 2018 Tax ReturnNo ratings yet

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- Internship Report On Siemens Bangladesh Limited: Submission Date: 17 May, 2016Document47 pagesInternship Report On Siemens Bangladesh Limited: Submission Date: 17 May, 2016Prajwal KadamNo ratings yet

- WhatsApp Business GuideDocument21 pagesWhatsApp Business GuideDeni Deni Deni100% (2)

- GBAD Systems Support by NSPA: Past, Present and Future of A Reliable In-Service Support SolutionDocument8 pagesGBAD Systems Support by NSPA: Past, Present and Future of A Reliable In-Service Support SolutionFRANK100% (1)

- Notes On Computation of WagesDocument6 pagesNotes On Computation of WagesNashiba Dida-AgunNo ratings yet

- Toll Brothers 2007Document14 pagesToll Brothers 2007Eesha Ü CaravanaNo ratings yet

- New Form 15G PDFDocument2 pagesNew Form 15G PDFSoma Sundar50% (2)

- PDF 4Document3 pagesPDF 47ola007No ratings yet

- Form No. 15H: (IT Dept. Copy)Document9 pagesForm No. 15H: (IT Dept. Copy)jpsmu09No ratings yet

- Bonds Form 15gDocument3 pagesBonds Form 15gRishi TNo ratings yet

- Income-Tax Rules, 1962: (See Section 197A (1), 197A (1A) and Rule 29C)Document4 pagesIncome-Tax Rules, 1962: (See Section 197A (1), 197A (1A) and Rule 29C)utuavn evNo ratings yet

- Form 15H Format 1Document4 pagesForm 15H Format 1ASHISH KININo ratings yet

- Tax Form 15H PDFDocument4 pagesTax Form 15H PDFraviNo ratings yet

- PDFDocument4 pagesPDFushapadminivadivelswamyNo ratings yet

- Form 15gDocument4 pagesForm 15gcontactus kannanNo ratings yet

- Tata Consumer ANNEXURE - 2 FORM 15HDocument5 pagesTata Consumer ANNEXURE - 2 FORM 15HAnbarasu MookiahpandianNo ratings yet

- Form 15h Revised1Document2 pagesForm 15h Revised1rajprince26460No ratings yet

- Form 15 GDocument2 pagesForm 15 GRahul SahaniNo ratings yet

- 15h Form (1) - CompressedDocument4 pages15h Form (1) - Compressedrekha safarirNo ratings yet

- 103120000000007845Document3 pages103120000000007845arjunv_14100% (1)

- Form 15GDocument3 pagesForm 15Gsriramdutta9No ratings yet

- Form 15 H - 2020-21Document2 pagesForm 15 H - 2020-21Lavesh DixitNo ratings yet

- "Form No. 15GDocument2 pages"Form No. 15GJayvin ShiluNo ratings yet

- Form No. 15GDocument9 pagesForm No. 15Gjpsmu09No ratings yet

- Form 15GDocument4 pagesForm 15GRavi SainiNo ratings yet

- New FORM 15H Applicable PY 2016-17Document2 pagesNew FORM 15H Applicable PY 2016-17addsingh100% (1)

- Form No 15GDocument2 pagesForm No 15Gnarendra1968No ratings yet

- Flat/Door/Block No. 7 7. Name of Premises 8.Rond/Street/Lane os9.Area/Locality Vaidn Hna QovDocument3 pagesFlat/Door/Block No. 7 7. Name of Premises 8.Rond/Street/Lane os9.Area/Locality Vaidn Hna QovVishwini ViswanathanNo ratings yet

- Icici Form 15GDocument2 pagesIcici Form 15Grajanikant_singhNo ratings yet

- BLANK IOCL Form 15GDocument3 pagesBLANK IOCL Form 15Gsaiboyshostel37No ratings yet

- Income-Tax Rules, 1962Document2 pagesIncome-Tax Rules, 1962Abdul SattarNo ratings yet

- 15G PDFDocument2 pages15G PDFSudhendu ChauhanNo ratings yet

- Bar CodeDocument6 pagesBar CodeAkashNo ratings yet

- 15 G Form (Pre-Filled)Document8 pages15 G Form (Pre-Filled)pankaj_electricalNo ratings yet

- FD - Form 15 - G - Oct 2015Document6 pagesFD - Form 15 - G - Oct 2015mohantamilNo ratings yet

- Form15h GH01389401 PDFDocument3 pagesForm15h GH01389401 PDFNamme KyarakhahaiNo ratings yet

- TourDocument4 pagesTourAnup SahNo ratings yet

- Form 15GDocument3 pagesForm 15GRahul DattoNo ratings yet

- PF Form 15G PDFDocument1 pagePF Form 15G PDFSorabh BhargavNo ratings yet

- PF Form 15GDocument1 pagePF Form 15GSorabh BhargavNo ratings yet

- LaxmanDocument2 pagesLaxmanBhimrao PhalkeNo ratings yet

- 15 G Form (Pre-Filled)Document2 pages15 G Form (Pre-Filled)Pawan Yadav0% (2)

- Form 15G WordDocument2 pagesForm 15G WordAsif NadeemNo ratings yet

- Form15g GH02596993Document3 pagesForm15g GH02596993Dhana LakshmiNo ratings yet

- Form 15G WordDocument2 pagesForm 15G Wordsagar computerNo ratings yet

- Form 15G PDFDocument2 pagesForm 15G PDFLegend RickNo ratings yet

- 15G FormDocument2 pages15G Formgrover.jatinNo ratings yet

- New Form 15H For Fixed Deposits Editable in PDFDocument2 pagesNew Form 15H For Fixed Deposits Editable in PDFMutual Funds Advisor ANANDARAMAN 944-529-6519No ratings yet

- PPC 1H667511110 2018-19 12042019Document3 pagesPPC 1H667511110 2018-19 12042019P PalNo ratings yet

- "Form No. 15H: Area Code Range Code AO No. AO TypeDocument2 pages"Form No. 15H: Area Code Range Code AO No. AO Typepkw007No ratings yet

- Form No 15HDocument3 pagesForm No 15HsaymtrNo ratings yet

- "Form No. 15H (See Section 197A (1C) and Rule 29C (1A) ) Declaration Under Section 197A (1C) of The Income of Sixty Years or More Claiming Certain Receipts Without Deduction of TaxDocument3 pages"Form No. 15H (See Section 197A (1C) and Rule 29C (1A) ) Declaration Under Section 197A (1C) of The Income of Sixty Years or More Claiming Certain Receipts Without Deduction of TaxRajanNo ratings yet

- New Form 15G Form 15H PDFDocument6 pagesNew Form 15G Form 15H PDFdevender143No ratings yet

- Form 15HDocument2 pagesForm 15HNithya SathyaprasathNo ratings yet

- "Form No. 15H (See Section 197A (1C) and Rule 29C (1A) ) Declaration Under Section 197A (1C) of The Income of Sixty Years or More Claiming Certain Receipts Without Deduction of TaxDocument3 pages"Form No. 15H (See Section 197A (1C) and Rule 29C (1A) ) Declaration Under Section 197A (1C) of The Income of Sixty Years or More Claiming Certain Receipts Without Deduction of TaxRajanNo ratings yet

- "FORM NO. 15G": (See Section 197A (1), 197A (1A) and Rule 29C)Document2 pages"FORM NO. 15G": (See Section 197A (1), 197A (1A) and Rule 29C)JAY SAINo ratings yet

- 15 G Form (Pre-Filled)Document2 pages15 G Form (Pre-Filled)Palaniappan Meyyappan83% (6)

- The Content and Determinants of Greenhouse Gas Emissiondisclosure Evidence From Indonesian CompaniesDocument10 pagesThe Content and Determinants of Greenhouse Gas Emissiondisclosure Evidence From Indonesian CompaniesDessy Noor FaridaNo ratings yet

- Model Fit and Comparisons For The Measure of Adolescent Coping Strategies (MACS) - Fiji Iceland and AustraliaDocument9 pagesModel Fit and Comparisons For The Measure of Adolescent Coping Strategies (MACS) - Fiji Iceland and AustraliaRaluca RalNo ratings yet

- Mustering Plan Area Green & Brown FieldDocument6 pagesMustering Plan Area Green & Brown FieldBimaNo ratings yet

- Providing in The Lord's WayDocument3 pagesProviding in The Lord's WayMichael VisayaNo ratings yet

- Publishing A WebsiteDocument6 pagesPublishing A WebsitePedro Leite (Mindset Épico)No ratings yet

- 8Document549 pages8gutenberg100% (2)

- Lawsuit Against CareerBuilderDocument15 pagesLawsuit Against CareerBuilderAnonymous 6f8RIS6No ratings yet

- ABMF3184 BF Tutorial QuestionsDocument7 pagesABMF3184 BF Tutorial QuestionsWoo Yuan BinNo ratings yet

- Basic Ms Office (Word, Excel Powerpoint)Document2 pagesBasic Ms Office (Word, Excel Powerpoint)pranjali shindeNo ratings yet

- Fundamental Equity Analysis & Analyst Recommendations - STOXX Europe Mid 200 Index ComponentsDocument401 pagesFundamental Equity Analysis & Analyst Recommendations - STOXX Europe Mid 200 Index ComponentsQ.M.S Advisors LLCNo ratings yet

- Solar Energy Books (PDF) - Infobooks - Org - 1629284193402Document18 pagesSolar Energy Books (PDF) - Infobooks - Org - 1629284193402BiiNo ratings yet

- I Thank God CDocument1 pageI Thank God Cjeremisam09No ratings yet

- Speakout Vocabulary Extra Elementary Unit 1Document2 pagesSpeakout Vocabulary Extra Elementary Unit 1t.javanshir455260% (5)

- Be Inexplicably GenerousDocument2 pagesBe Inexplicably GeneroustingrizalNo ratings yet

- Schumer's AI One PagerDocument1 pageSchumer's AI One PagerWashington ExaminerNo ratings yet

- Nintendo PPT CreativeDocument14 pagesNintendo PPT CreativeMarya Malik WaniNo ratings yet

- A Nation For Our ChildrenDocument6 pagesA Nation For Our Childrenstrength, courage, and wisdomNo ratings yet

- KTG Final Version Single PagesDocument8 pagesKTG Final Version Single PagesMary Joy Delfin GasparNo ratings yet

- Tle March 2019 PDFDocument40 pagesTle March 2019 PDFPhilBoardResultsNo ratings yet

- 8.2 Labour Law - IiDocument77 pages8.2 Labour Law - IiAviNo ratings yet

- ASO Magazine Feb. 2016Document120 pagesASO Magazine Feb. 2016Adventure Sports OutdoorsNo ratings yet

- 3e - End of Life Care-Russian PDFDocument2 pages3e - End of Life Care-Russian PDFtemp001bunnNo ratings yet

- 00 Freightliner Aeromaster Part PDFDocument184 pages00 Freightliner Aeromaster Part PDFAli ShdiefatNo ratings yet

- T5 NAT For IPv4 230328 114655Document5 pagesT5 NAT For IPv4 230328 114655LEE PEI YI YUKINo ratings yet

- ENG 2 LM Unit 2 Union BankDocument132 pagesENG 2 LM Unit 2 Union BankHendrick Lopez100% (1)