Professional Documents

Culture Documents

Form 15G PDF

Uploaded by

Legend RickOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form 15G PDF

Uploaded by

Legend RickCopyright:

Available Formats

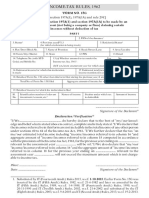

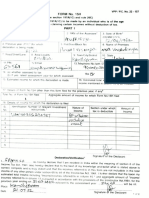

FORM NO.

15G

[See section 197A(1), 197A(1A) and rule 29C]

or firm)

Declaration under section 1g7A(1) and section 1974(1A) to be made by an individual or a person (not being a company

claiming certain incomes without deduction of tax

i

PART-I

1. Name of Assessee (Declarant) 2. PAN of the Assessee

3. Status

4. PreviousYear(P.Y.) 5. Residential Status 6. Flat/Door/Block No.

(for which declaration is being made)

lndian

7. Name of Premises 8. Road/StreeUlane 9. Area/Locality

10. Town / City / District 11. State 12. Pin

Gujarat

13. Email 14. Tele. No. (With STD Code) and M. No.

15. (a) Whether assessed to tax under the lncome-tax Act,

'1961 Yes I No.

(b) lf yes, latest assesspent year for which assessed

16. Estimated income for which this declaration is made

17. Estimated total income of the P.Y. in which income mentioned in column 16 to be included

18. Details of Form No. 15G other than this form filled during the previous year, if any

Total No. of Form No. 15G filed Aggregate amount of income for which Forrn No. 15G filed

19 Details of income for which the declaration is fil ed

Sr. ldentification number of relevant Nature of lncome Section under which tax is Amount of lncome

No. investmenUaccount, etc. deductible

*" Signature of the Declarant

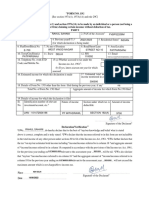

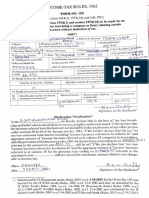

Declaration / Verification

-l

/We do hereby declare that to the best of my / our

* referred to in tfris

knowledge and belief what is stated above is correct, complete and is truly stated, l/we declare that the incomes

* that the

form are not includible in the total income of any other person u/s 60 to 64 of the lncome-tax act, 1961 . lAlle further, declare

*income / incomes referred to in Column 16 and aggregate amount of income/

tax *on my/our estimated total income, including

previous year

incomes referred to in column 18 computed in accordance with the provisions of the lncome{axAct, 1961 , forthe

*my /

ending on relevant to the assessment year-will be nil. *l / we also, declare that

18 for the

our "income / incomes referred to in Column 16 and the aggregate amount of income/incomes referred to in column

previous year ending on relevant to the assessment Year will not exceed the

maxirnum amount which is not chargeable to income tax.

Place:

** Signature of the Declarant

Date

PART - II

[To be filled by the person responsible for paying the income referred to in column 16 of Part l]

1. Name of the person responsible for paying 2.Unique ldentification No

S.K. DIST. CENTRAL CO. OP. BANK LTD.

3. PAN of the person responsible for paying AvAA/AT1019P 4. Complete Address

5. TAN of the person responsible for paying

6. Email 7. Telephone No. (with STD Code) and Mobile No.

8. Amount of income paid 9. Date on which Declaration is received (DD/MM/YY)

10.Date on which the income has been paid/credited (DD/MM|/Y)

Place:

Date: Signature of the person responsible for

paying the income referred to in Column

16 of Part I

You might also like

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- PF Form 15GDocument1 pagePF Form 15GSorabh BhargavNo ratings yet

- PF Form 15G PDFDocument1 pagePF Form 15G PDFSorabh BhargavNo ratings yet

- Income-Tax Rules, 1962Document2 pagesIncome-Tax Rules, 1962Abdul SattarNo ratings yet

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- Flat/Door/Block No. 7 7. Name of Premises 8.Rond/Street/Lane os9.Area/Locality Vaidn Hna QovDocument3 pagesFlat/Door/Block No. 7 7. Name of Premises 8.Rond/Street/Lane os9.Area/Locality Vaidn Hna QovVishwini ViswanathanNo ratings yet

- Form 15gDocument4 pagesForm 15gcontactus kannanNo ratings yet

- Report of Al Capone for the Bureau of Internal RevenueFrom EverandReport of Al Capone for the Bureau of Internal RevenueNo ratings yet

- form_15h_revised1Document2 pagesform_15h_revised1rajprince26460No ratings yet

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- Form No 15GDocument2 pagesForm No 15Gnarendra1968No ratings yet

- Form No. 15GDocument9 pagesForm No. 15Gjpsmu09No ratings yet

- INCOME-TAXDocument3 pagesINCOME-TAXarjunv_14100% (1)

- Form 15GDocument3 pagesForm 15GRahul DattoNo ratings yet

- Form No. 15H: (IT Dept. Copy)Document9 pagesForm No. 15H: (IT Dept. Copy)jpsmu09No ratings yet

- Income-Tax Rules, 1962: (See Section 197A (1), 197A (1A) and Rule 29C)Document4 pagesIncome-Tax Rules, 1962: (See Section 197A (1), 197A (1A) and Rule 29C)utuavn evNo ratings yet

- Form 15HDocument2 pagesForm 15HNithya SathyaprasathNo ratings yet

- Form 15GDocument3 pagesForm 15Gsriramdutta9No ratings yet

- New Form 15G PDFDocument2 pagesNew Form 15G PDFSoma Sundar50% (2)

- Form 15 H - 2020-21Document2 pagesForm 15 H - 2020-21Lavesh DixitNo ratings yet

- Bonds Form 15gDocument3 pagesBonds Form 15gRishi TNo ratings yet

- Form 15GDocument4 pagesForm 15GRavi SainiNo ratings yet

- Form 15H Format 1Document4 pagesForm 15H Format 1ASHISH KININo ratings yet

- LaxmanDocument2 pagesLaxmanBhimrao PhalkeNo ratings yet

- FD - Form 15 - G - Oct 2015Document6 pagesFD - Form 15 - G - Oct 2015mohantamilNo ratings yet

- PDF 4Document3 pagesPDF 47ola007No ratings yet

- PDFDocument4 pagesPDFushapadminivadivelswamyNo ratings yet

- FORM 15G DECLARATIONDocument2 pagesFORM 15G DECLARATIONRahul SahaniNo ratings yet

- Form 15 HDocument2 pagesForm 15 Hsingh ramanpreetNo ratings yet

- Form 15G WordDocument2 pagesForm 15G WordAsif NadeemNo ratings yet

- Form 15G WordDocument2 pagesForm 15G Wordsagar computerNo ratings yet

- Form 15H Declaration for Senior CitizensDocument4 pagesForm 15H Declaration for Senior CitizensraviNo ratings yet

- 15G PDFDocument2 pages15G PDFSudhendu ChauhanNo ratings yet

- BLANK IOCL Form 15GDocument3 pagesBLANK IOCL Form 15Gsaiboyshostel37No ratings yet

- Bar CodeDocument6 pagesBar CodeAkashNo ratings yet

- 15g MehandiDocument3 pages15g MehandiAjay ParidaNo ratings yet

- PPC 1H667511110 2018-19 12042019Document3 pagesPPC 1H667511110 2018-19 12042019P PalNo ratings yet

- 15h Form (1) - CompressedDocument4 pages15h Form (1) - Compressedrekha safarirNo ratings yet

- TourDocument4 pagesTourAnup SahNo ratings yet

- Adobe Scan 13 Mar 2021Document1 pageAdobe Scan 13 Mar 2021Pankaj BhamareNo ratings yet

- "Form No. 15GDocument2 pages"Form No. 15GJayvin ShiluNo ratings yet

- SanskritDocument2 pagesSanskritSAMPATH RAMESHNo ratings yet

- Form15g GH02596993Document3 pagesForm15g GH02596993Dhana LakshmiNo ratings yet

- 0031SISS: Individual 11. Gmai TomDocument1 page0031SISS: Individual 11. Gmai TomVarun reddyNo ratings yet

- Icici Form 15GDocument2 pagesIcici Form 15Grajanikant_singhNo ratings yet

- 15 G Form (Pre-Filled)Document2 pages15 G Form (Pre-Filled)Parul SinglaNo ratings yet

- Form15h GH01389401 PDFDocument3 pagesForm15h GH01389401 PDFNamme KyarakhahaiNo ratings yet

- Form-15G-3Document1 pageForm-15G-3lakshmananksme3007No ratings yet

- 15 G Form (Pre-Filled)Document2 pages15 G Form (Pre-Filled)D. Nanda KishoreNo ratings yet

- 15 G Form(Pre-filled)Document2 pages15 G Form(Pre-filled)Kiran JituriNo ratings yet

- New FORM 15H Applicable PY 2016-17Document2 pagesNew FORM 15H Applicable PY 2016-17addsingh100% (1)

- FORM 15G DECLARATIONDocument3 pagesFORM 15G DECLARATIONulhas_nakasheNo ratings yet

- AKAPS4654E 4-O1-110 Jagannath (Or Which 2022-23 - : 712223 WhetherDocument4 pagesAKAPS4654E 4-O1-110 Jagannath (Or Which 2022-23 - : 712223 WhetherDebarshi SenguptaNo ratings yet

- "Form No. 15G: AO No. AO Type Range Code Area CodeDocument2 pages"Form No. 15G: AO No. AO Type Range Code Area CodePruthvish ShuklaNo ratings yet

- 15 G Form (Pre-Filled) PDFDocument8 pages15 G Form (Pre-Filled) PDFAkshay SinghNo ratings yet

- Senior Citizen Tax FormDocument3 pagesSenior Citizen Tax FormRajanNo ratings yet

- FORM16: Signature Not VerifiedDocument5 pagesFORM16: Signature Not Verifiedmath_mallikarjun_sapNo ratings yet

- Salary Pay Slip Model PDFDocument1 pageSalary Pay Slip Model PDFAbhishek BhardwajNo ratings yet

- PL 108-27 Jobs and Growth Tax Relief Reconciliation Act of 2003Document18 pagesPL 108-27 Jobs and Growth Tax Relief Reconciliation Act of 2003Tax HistoryNo ratings yet

- SfsfgegDocument1 pageSfsfgegvishalNo ratings yet

- Form W-4 (2019) : Specific InstructionsDocument5 pagesForm W-4 (2019) : Specific Instructionsjok mongNo ratings yet

- Dr. Agarwals Eye Hospital: No. 2, Ludhiana Road, Opposite S.G.G School, Raikot, Punjab-141109Document1 pageDr. Agarwals Eye Hospital: No. 2, Ludhiana Road, Opposite S.G.G School, Raikot, Punjab-141109Hardeepsingh DhaliwalNo ratings yet

- Wahab UpdateDocument1 pageWahab UpdateSumairNo ratings yet

- Getting Paid Reinforcement Worksheet 2.3.9.A2Document2 pagesGetting Paid Reinforcement Worksheet 2.3.9.A2Lyndsey BridgersNo ratings yet

- Inter Tax FinalDocument4 pagesInter Tax FinalJil Macasaet0% (1)

- Last Pay CertificateDocument2 pagesLast Pay CertificateJayaprakash Vayakkoth Madham100% (3)

- Acc 305 2021-2022 Semester 2Document4 pagesAcc 305 2021-2022 Semester 2SharonNo ratings yet

- Tax LawDocument3 pagesTax LawAnkit KumarNo ratings yet

- Cfas - Pas 12Document2 pagesCfas - Pas 12Gio BurburanNo ratings yet

- Tax Invoice / Bill of SupplyDocument2 pagesTax Invoice / Bill of SupplyKrish JaiswalNo ratings yet

- UCC IRS Form For Discharge of Estate Tax Liens f4422Document3 pagesUCC IRS Form For Discharge of Estate Tax Liens f4422Anonymous 23VuLx100% (23)

- Roots Multiclean LTD Kovilpalayam, Pollachi: Pay Slip For The Month Of: LocationDocument1 pageRoots Multiclean LTD Kovilpalayam, Pollachi: Pay Slip For The Month Of: LocationmonishrajNo ratings yet

- Text Solutions - CH13Document18 pagesText Solutions - CH13Josef Galileo SibalaNo ratings yet

- Personal Reliefs and RebatesDocument3 pagesPersonal Reliefs and RebatesJong HannahNo ratings yet

- Fort Bonifacio Development Corporation V CIRDocument1 pageFort Bonifacio Development Corporation V CIRHoreb Felix VillaNo ratings yet

- Bar Questions 2017 TAXDocument2 pagesBar Questions 2017 TAXElaine HonradeNo ratings yet

- MGM Budget 2008Document1 pageMGM Budget 2008Stonegate Subdivision HOANo ratings yet

- GST compliant invoice template for textile businessDocument2 pagesGST compliant invoice template for textile businessAham GtyNo ratings yet

- MG 3027 TAXATION - Week 3 Personal AllowancesDocument28 pagesMG 3027 TAXATION - Week 3 Personal AllowancesSyed SafdarNo ratings yet

- Salary Slip & Transfer Confirmation: Date: Period: Bank: Account # Name: Title: Dept: Emp #Document2 pagesSalary Slip & Transfer Confirmation: Date: Period: Bank: Account # Name: Title: Dept: Emp #Adheesh SanthoshNo ratings yet

- Capital GainDocument4 pagesCapital GainqwertyNo ratings yet

- RCM FormatDocument3 pagesRCM FormatjsphdvdNo ratings yet

- 17027405959014095ASO1Document1 page17027405959014095ASO1thinklikebrilliantNo ratings yet

- mt456 Fill inDocument4 pagesmt456 Fill inOur CreationNo ratings yet

- Aft 990Document29 pagesAft 990Washington ExaminerNo ratings yet

- Uqld2915518153052999 Payment SummaryDocument1 pageUqld2915518153052999 Payment SummarylavidisNo ratings yet