Professional Documents

Culture Documents

15 G Form (Pre-Filled)

Uploaded by

Kiran JituriOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

15 G Form (Pre-Filled)

Uploaded by

Kiran JituriCopyright:

Available Formats

PAN : ASCPJ8267G

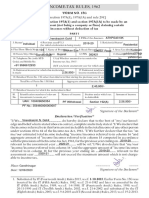

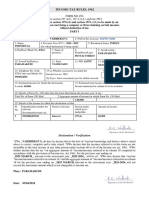

FORM NO. 15G

[See Section 197A(1),197(1A)and Rule 29C]

Declaration under section 197A(1) and section 197A(1A)to be made by an individual or a person(not being a

company or firm) claiming certain incomes without deduction of tax.

PART I

1. Name of Assessee (Declarant) RATNA JITURI 2. Permanent Account Number or Aadhaar Number of the Assessee 1 :

ASCPJ8267G

3. Status2 4. Previous Year(P.Y.)3 5. Residential Status4

(for which declaration is being made) 2023-2024

6. Flat/Door/Block No. 7. Name of Premises 8. Road/Street/Lane 9. Area/Locality

MIG 2/82 4th cross karnataka housing board colony near siddeshwar

temple

10. Town/City/District 11. State 12. PIN 13. Email

JITURIRATNA30@GMAIL.COM

Belagavi Karnataka 590016

14. Telephone No. (with STD Code) and Mobile No. 15.(a) Whether assessed to tax under the Income Tax act ,19615

919740297539 Yes No

❒ ❒

(b) If Yes, latest assessment year for which assessed.

16. Estimated Income for which this declaration is made 17. Estimated total income of the PY in which income mentioned in column 16

to be included.6

18. Details of Form No.15G other than this form filed for the previous year,if any7

Total No.of Form No.15G filed Aggregate amount of income for which Form No.15G filed.

19. Details of Income for which the declaration is filed

Sl. Identification number of Nature of Income Section under which Amount of income

No relevant investment/account tax is deductible

8

,etc.

© HDFC BANK LTD

CUST ID: 166133727

1 © FD NO : 50300938187897 Interest 194A

......................................................

Signature of declarant9

Mandatory : To be filled by the Branch

Checklist for Form 15G (For individual less than 60 years)

I have checked and confirm the below Tick ( ✔ or ✕ )

Customer is less than 60 years (if >= 60 years than fill form 15H)

PAN No. is updated in Bank Records against the Cust Id of customer

Copy of PAN Card attached ( if not updated in the system)

Customer has signed in six places (indicated by)

Fields marked © are mandatory to be filled

Name of the Emp _______________________ Emp. Code _____________

Emp. Sign ___________________________ Date ____________________

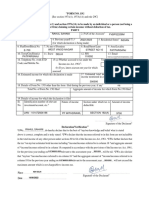

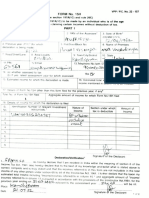

Declaration / Verification10

* I/ We ................................................. do hereby declare that to the best of *my/ our knowledge and belief what is stated above is correct, complete and is truly stated. *I/ We declare that the incomes referred to

in this form are not includible in the total income of any other person under sections 60 to 64 of the Income-tax Act, 1961. *I/ We further declare that the tax *on/ our estimated total income including *income/

incomes referred to in column 16 *and aggregate amount of *income/ incomes referred to in column 18 computed in accordance with the provisions of the Income-tax Act, 1961, for the previous year ending on

31st Mar 2024 relevant to the assessment year 2024-2025 will be nil. *I/ We also declare that *my/ our *income/ incomes referred to in column 16 *and the aggregate amount of *income/ incomes referred to in

column 18 for the previous year ending on 31st Mar 2024 relevant to the assessment year 2024-2025 will not exceed the maximum amount which is not chargeable to income-tax.

Place: ..................................................

Date: ..................................................

......................................................

Signature of declarant9

PART II

[To be filled by the person responsible for paying the income referred to in column 16 of part I]

1. Name of the Person responsible for paying. 2. Unique Identification No.11

HDFC BANK LTD

3. Pan of the Person 4. Complete Address 5. TAN of the person responsible for paying

responsible for paying. AAACH2702H HDFC Bank House, Senapati Bapat Marg, MUMH03189E

Lower Parel, Mumbai, Maharashtra - 400013

6. Email : support@hdfcbank.com 7. Telephone No. (with STD code) and Mobile No. 8. Amount of income

paid 12

9. Date on which Declaration is received(DD/MM/YYYY) 10. Date on which the income has been

Paid/credited(DD/MM/YYYY)

....................................................................

Signature of the person responsible for

Place: ............................................. paying the income referred to in

Date: ............................................. Column 16 of Part I

Notes:

*

Delete whichever is not applicable

1

As per provisions of section 206AA(2), the declaration under section 197A(1) or 197A(1A) shall be invalid if the declarant fails to furnish his valid

Permanent Account Number (PAN).

2

Declaration can be furnished by an individual under section 197A(1) and a person (other than a company or a firm) under section 197A(1A).

3

The financial year to which the income pertains.

4

Please mention the residential status as per the provisions of section 6 of the Income-tax Act, 1961.

5

Please mention "Yes" if assessed to tax under the provisions of Income-tax Act, 1961 for any of the assessment year out of six assessment years

preceding the year in which the declaration is filed.

6

Please mention the amount of estimated total income of the previous year for which the declaration is filed including the amount of income for which

this declaration is made.

7

In case any declaration(s) in Form No. 15G is filed before filing this declaration during the previous year, mention the total numer of such Form No.

15G filed along with the aggregate amount of income for which said declaration(s) have been filed.

8

Mention the distinctive number of shares, account number of term deposit, recurring deposit, Naitonal Savings Scheme, life insurance policy number,

employee code, etc.

9

Indicate the capacity in which the declaration is furnished on behalf of a HUF, AOP, etc.

10

Before signing the declaration/ verification, the declarant should satisfy himself that the information furnished in this form is true, correct and complete

in all respects. Any person making a false statement in the declaration shall be liable to prosecution under section 277 of the Income-tax Act, 1961 and

on conviction be punishable-

(i) in a case where tax sought to be evaded exceeds twenty-five lakh rupees, with rigorous imprisonment which shall not be less than six months but

which may extend to seven years and with fine.

(ii) in any other case, rigorous imprisonment which shall not be less than three months but which may extend to two years and with fine.

11

The person responsible for paying the income referred to in column 16 of Part I shall allot a unique identification number to all the Form No. 15G

received by him during a quarter of the financial year and report this reference number along with the particulars prescribed in rule 31A(4)(vii) of the

Income-tax Rules, 1962 in the TDS statement furnished for the same quarter. In case the person has also received Form No. 15H during the same

quarter, please allot separate series of serial number for Form No. 15G and Form No. 15H.

12

The person responsible for paying the income referred to in column 16 of Part I shall not accept the declaration where the amount of income of the

nature referred to in sub-section (1) or sub-section (1A) of section 197A or the aggregate of the amounts of such income credited or paid or likely to be

credited or paid during the previous year in which such income is to be included exceeds the maximum amount which is not chargeable to tax. For

deciding the eligibility, he is required to verify income or the aggregate amount of incomes, as the case may be, reported by the declarant in columns

16 and 18.

You might also like

- 15 G Form (Pre-Filled)Document2 pages15 G Form (Pre-Filled)prathameskaNo ratings yet

- 15 G Form (Pre-Filled)Document2 pages15 G Form (Pre-Filled)Parul SinglaNo ratings yet

- 15 G Form (Pre-Filled)Document2 pages15 G Form (Pre-Filled)Shashank KSNo ratings yet

- 15 G Form (Pre-Filled)Document2 pages15 G Form (Pre-Filled)D. Nanda KishoreNo ratings yet

- 15 G Form (Pre-Filled) PDFDocument8 pages15 G Form (Pre-Filled) PDFAkshay SinghNo ratings yet

- Bar CodeDocument6 pagesBar CodeAkashNo ratings yet

- 15 G Form (Pre-Filled)Document2 pages15 G Form (Pre-Filled)royprithvi37No ratings yet

- Form 15GDocument4 pagesForm 15GRavi SainiNo ratings yet

- Form 15GDocument3 pagesForm 15Gsriramdutta9No ratings yet

- 15 G Form (Pre-Filled)Document3 pages15 G Form (Pre-Filled)Ravi JammulaNo ratings yet

- Form15g GH02596993Document3 pagesForm15g GH02596993Dhana LakshmiNo ratings yet

- Form 15gDocument4 pagesForm 15gcontactus kannanNo ratings yet

- 103120000000007845Document3 pages103120000000007845arjunv_14100% (1)

- Form No 15GDocument2 pagesForm No 15Gnarendra1968No ratings yet

- Form 15 HDocument2 pagesForm 15 Hsumeet khannaNo ratings yet

- 15G PDFDocument2 pages15G PDFSudhendu ChauhanNo ratings yet

- Income-Tax Rules, 1962: (See Section 197A (1), 197A (1A) and Rule 29C)Document4 pagesIncome-Tax Rules, 1962: (See Section 197A (1), 197A (1A) and Rule 29C)utuavn evNo ratings yet

- Form 15 GDocument2 pagesForm 15 GRahul SahaniNo ratings yet

- Form No. 15GDocument9 pagesForm No. 15Gjpsmu09No ratings yet

- Form No. 15H: (IT Dept. Copy)Document9 pagesForm No. 15H: (IT Dept. Copy)jpsmu09No ratings yet

- Form 15G WordDocument2 pagesForm 15G WordAsif NadeemNo ratings yet

- Form15h GH01389401 PDFDocument3 pagesForm15h GH01389401 PDFNamme KyarakhahaiNo ratings yet

- Form 15G 3Document1 pageForm 15G 3lakshmananksme3007No ratings yet

- SanskritDocument2 pagesSanskritSAMPATH RAMESHNo ratings yet

- PPC 1H667511110 2018-19 12042019Document3 pagesPPC 1H667511110 2018-19 12042019P PalNo ratings yet

- FD - Form 15 - G - Oct 2015Document6 pagesFD - Form 15 - G - Oct 2015mohantamilNo ratings yet

- Form 15G WordDocument2 pagesForm 15G Wordsagar computerNo ratings yet

- TourDocument4 pagesTourAnup SahNo ratings yet

- 15h Form (1) - CompressedDocument4 pages15h Form (1) - Compressedrekha safarirNo ratings yet

- 2024 07 1 13 10 18 15GH - AcknowledgeDocument2 pages2024 07 1 13 10 18 15GH - AcknowledgeKajal SamaniNo ratings yet

- PF Form 15GDocument1 pagePF Form 15GSorabh BhargavNo ratings yet

- PF Form 15G PDFDocument1 pagePF Form 15G PDFSorabh BhargavNo ratings yet

- 0031SISS: Individual 11. Gmai TomDocument1 page0031SISS: Individual 11. Gmai TomVarun reddyNo ratings yet

- Bonds Form 15gDocument3 pagesBonds Form 15gRishi TNo ratings yet

- Flat/Door/Block No. 7 7. Name of Premises 8.Rond/Street/Lane os9.Area/Locality Vaidn Hna QovDocument3 pagesFlat/Door/Block No. 7 7. Name of Premises 8.Rond/Street/Lane os9.Area/Locality Vaidn Hna QovVishwini ViswanathanNo ratings yet

- Form No. 15G: Declaration/VerificationDocument2 pagesForm No. 15G: Declaration/VerificationMadhu MohanNo ratings yet

- Form 15H Format 1Document4 pagesForm 15H Format 1ASHISH KININo ratings yet

- New Form 15G PDFDocument2 pagesNew Form 15G PDFSoma Sundar50% (2)

- UntitledDocument1 pageUntitledGeethu KadariNo ratings yet

- Income-Tax Rules, 1962Document2 pagesIncome-Tax Rules, 1962Abdul SattarNo ratings yet

- 15 G Form (Pre-Filled)Document8 pages15 G Form (Pre-Filled)pankaj_electricalNo ratings yet

- Form 15 H - 2020-21Document2 pagesForm 15 H - 2020-21Lavesh DixitNo ratings yet

- PDF 4Document3 pagesPDF 47ola007No ratings yet

- PDFDocument4 pagesPDFushapadminivadivelswamyNo ratings yet

- Adobe Scan 13 Mar 2021Document1 pageAdobe Scan 13 Mar 2021Pankaj BhamareNo ratings yet

- Form 15 HDocument2 pagesForm 15 Hsingh ramanpreetNo ratings yet

- Tax Form 15H PDFDocument4 pagesTax Form 15H PDFraviNo ratings yet

- AKAPS4654E 4-O1-110 Jagannath (Or Which 2022-23 - : 712223 WhetherDocument4 pagesAKAPS4654E 4-O1-110 Jagannath (Or Which 2022-23 - : 712223 WhetherDebarshi SenguptaNo ratings yet

- Form 15 GDocument2 pagesForm 15 GSiddharthNo ratings yet

- Income-Tax Rules, 1962Document3 pagesIncome-Tax Rules, 1962Jalpa TrivediNo ratings yet

- Form 15GDocument3 pagesForm 15GRahul DattoNo ratings yet

- LaxmanDocument2 pagesLaxmanBhimrao PhalkeNo ratings yet

- 15 G Form (Pre-Filled)Document2 pages15 G Form (Pre-Filled)Pawan Yadav0% (2)

- Form 15G PDFDocument2 pagesForm 15G PDFLegend RickNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- Employment Claims without a Lawyer: A Handbook for Litigants in Person, Revised 2nd editionFrom EverandEmployment Claims without a Lawyer: A Handbook for Litigants in Person, Revised 2nd editionNo ratings yet

- Rethink Property Investing, Fully Updated and Revised Edition: Become Financially Free with Commercial Property InvestingFrom EverandRethink Property Investing, Fully Updated and Revised Edition: Become Financially Free with Commercial Property InvestingNo ratings yet

- Make Money With Dividends Investing, With Less Risk And Higher ReturnsFrom EverandMake Money With Dividends Investing, With Less Risk And Higher ReturnsNo ratings yet

- Employees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of RegistrationDocument3 pagesEmployees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of RegistrationmohanNo ratings yet

- Mitc - Blank-Format - SampleDocument3 pagesMitc - Blank-Format - SampleRavi yadavNo ratings yet

- PP Tutorial 8 Question 2Document2 pagesPP Tutorial 8 Question 2DASHYEN A L MURUGIAHNo ratings yet

- The Worlds 500 Largest Asset Managers Year End 2013Document32 pagesThe Worlds 500 Largest Asset Managers Year End 2013Joao PatricioNo ratings yet

- Contract of Guarantee and It'S Precarious Position in Contract Laws: An Insight Into The Indian ConundrumDocument26 pagesContract of Guarantee and It'S Precarious Position in Contract Laws: An Insight Into The Indian ConundrumPRANOY GOSWAMINo ratings yet

- A Joint Venture Between Allahabad Bank, Sompo Japan Nipponkoa Insurance Inc., Indian Overseas Bank, Karnataka Bank and Dabur InvestmentsDocument2 pagesA Joint Venture Between Allahabad Bank, Sompo Japan Nipponkoa Insurance Inc., Indian Overseas Bank, Karnataka Bank and Dabur Investmentscommission sompoNo ratings yet

- Managed CareDocument33 pagesManaged CareHihiNo ratings yet

- Employees State Insurance Corporation Temporary Identity CertificateDocument1 pageEmployees State Insurance Corporation Temporary Identity CertificateRamanjaneyulu Reddy0% (2)

- Capital Ins. - Surety, Inc. vs. Plastic Era Co. and CA.,Gr. No. L-22375, July 18,1975Document12 pagesCapital Ins. - Surety, Inc. vs. Plastic Era Co. and CA.,Gr. No. L-22375, July 18,1975Beltran KathNo ratings yet

- Federal Register 16 A UnitDocument1,379 pagesFederal Register 16 A Unitacademo misirNo ratings yet

- Financial Literacy: Building and Enhancing New Literacies Across The CurriculumDocument11 pagesFinancial Literacy: Building and Enhancing New Literacies Across The CurriculumJasper Mortos VillanuevaNo ratings yet

- ATM RAHAT MOHAMMAD - Passport ImageDocument37 pagesATM RAHAT MOHAMMAD - Passport ImageJony IslamNo ratings yet

- Construction Defects: Casualty Loss Reserve SeminarDocument53 pagesConstruction Defects: Casualty Loss Reserve SeminarniluNo ratings yet

- Motor Two Wheelers Package Policy Schedule Cum Certificate of InsuranceDocument2 pagesMotor Two Wheelers Package Policy Schedule Cum Certificate of InsuranceAbhisek KumarNo ratings yet

- Kansas Public Employees Retirement System 611 S Kansas Ave Suite 100 TOPEKA KS 66603 - 3869Document4 pagesKansas Public Employees Retirement System 611 S Kansas Ave Suite 100 TOPEKA KS 66603 - 3869ChuckNo ratings yet

- The Venture-Capital Duediligence QuestionnaireDocument35 pagesThe Venture-Capital Duediligence QuestionnaireRas AltNo ratings yet

- A Study On Factors Influencing Claims in General Insurance Business in IndiaDocument13 pagesA Study On Factors Influencing Claims in General Insurance Business in IndiaSuhas SiddarthNo ratings yet

- Comparison of Life Insurance ProductsDocument4 pagesComparison of Life Insurance ProductsPrithvi NathNo ratings yet

- Chapter Three: Financial Institutions and OperationsDocument122 pagesChapter Three: Financial Institutions and OperationsYismawNo ratings yet

- ProvisionsDocument5 pagesProvisionsAngelshine LacanlaleNo ratings yet

- Allama Iqbal Open University, Islamabad: WarningDocument3 pagesAllama Iqbal Open University, Islamabad: WarningDanial QureshiNo ratings yet

- Sampoorna Surkasha Claim Form Employer Employee Non EdliDocument2 pagesSampoorna Surkasha Claim Form Employer Employee Non EdlisreenathNo ratings yet

- Final IC 38 - IA - Common - EnglishDocument104 pagesFinal IC 38 - IA - Common - Englishsayali kthalkarNo ratings yet

- MD India Forms & Policy DocumentDocument42 pagesMD India Forms & Policy DocumentYagantiGaneshRaghuveerNo ratings yet

- Lesson 2Document96 pagesLesson 2Trần Hữu Kỳ DuyênNo ratings yet

- New Equipment Inspection ChecklistDocument6 pagesNew Equipment Inspection ChecklistNate100% (2)

- For Claim Registration, Please Call On Toll Free Number 1800 2 666Document4 pagesFor Claim Registration, Please Call On Toll Free Number 1800 2 666RehaanNo ratings yet

- Sandra Sanon 5-13-2021 Allstate 5Document3 pagesSandra Sanon 5-13-2021 Allstate 5Abi MelekNo ratings yet

- Malayan Insurance V CADocument2 pagesMalayan Insurance V CAPer-Vito DansNo ratings yet

- Semi Final Exam For Tax 1Document6 pagesSemi Final Exam For Tax 1Gregorio ReyNo ratings yet