Professional Documents

Culture Documents

Form 15 H

Uploaded by

sumeet khannaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form 15 H

Uploaded by

sumeet khannaCopyright:

Available Formats

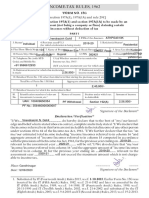

FORM NO.

15H

[See section 197A(1C) and rule 29C]

Declaration under section 197A(1C) to be made by an individual who is of the age of sixty years or more claiming certain incomes without deduction of tax.

without deduction of tax.

PART-I

1. Name of Assessee (Declarant) : RANGASWAMY RAMJI JT1 2. PAN of the Assessee : 3.Date of Birth(DD/MM/YYYY):

AABPR4278E 24-05-1953

4. Previous Year (P.Y) (For which declaration is being made : 5. Flat/Door/Block No. : A-105,BRAHMA,KESHAV PADA, 6.Name of Premises: P K RD,MULUND (W)

2022-2023

7. Road/Street/Lane : 8. Area/Locality : 9. Town/City/District : 10. State :

MUMBAI MAHARASHTRA

11. PIN : 400080 12. Email : p3.ramji6993@gmail.com 13. Telephone No. (with STD Code) and Mobile No.

:919768845312

14 (a) Whether assessed to tax under the Income-tax Act, 1961

Yes No

(b) If yes, latest assessment year for which assessed2022-23

15.Estimated income for which this declaration is made : 59389.0 16. Estimated total income of the P.Y. in which income mentioned in column 15

to be included : 200000.0

17. Details of Form No.15H other than this form filed for the previous year, if any:

Total No. of Form No. 15H filed Aggregate amount of income for which Form No.15H filed

1 59389.0

18. Details of income for which the declaration is filed

SI. No Identification number of relevant Nature of income Section under which tax is deductible Amount of income (INR)

investment/account, etc.

1 623813045248 Interest on deposits 194A 12953.0

Form is generated through Internet banking.

Thus, signature of the customer is not required

....................................................

Signature of the Declarant

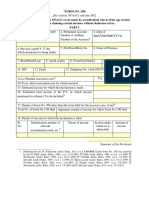

Declaration/Verification

*I RANGASWAMY RAMJI JT1 do hereby declare that I am resident in India within the meaning of section 6 of the Income-tax Act, 1961. I also hereby declare that to the best of my knowledge and

belief what is stated above is correct, complete and is truly stated and that the incomes referred to in this form are not includible in the total income of any other person under sections 60 to 64 of

theIncome-tax Act, 1961. I further declare that the tax on my estimated total income including *income/incomes referred to in column 15 *and aggregate amount of *income/incomes referred to in

column 17 computed in accordance with the provisions of the Income-tax Act, 1961, forthe previous year ending on31st March,2023 relevant to the assessment year 2023-2024 will be nil.

Place:....................

Date:13/11/2022

Form is generated through Internet banking.

Thus, signature of the customer is not required

...................................................

Signature of the Declarant

PART-II

[To be filled by the person responsible for paying the income referred to in column 15 of Part I]

1. Name of the person responsible for paying : ICICI BANK Limited 2. Unique Identification No. :

3. PAN of the person 4. Complete Address : ICICI Bank Towers, Bandra-Kurla 5. TAN of the person responsible

responsible for paying : AAACI1195H Complex, Mumbai – 400 051 for paying :

6. Email : 7. Telephone No. (with STD Code) 8. Amount of income paid:

and Mobile No. :

9. Date on which Declaration is received 10. Date on which the income has been paid/credited

(DD/MM/YYYY) : 13/11/2022 (DD/MM/YYYY) :

Place:....................

Date:13/11/2022

.......................................................

Signature of the person responsible for paying

the income referred to in Column 15 of Part I

*Delete whichever is not applicable.

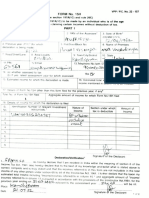

1.As per provisions of section 206AA(2), the declaration under section 197A(1C) shall be invalid if the declarant fails to furnish his valid Permanent Account Number (PAN).

2.Declaration can be furnished by a resident individual who is of the age of 60 years or more at any time during the previous year.

3.The financial year to which the income pertains.

4.Please mention “Yes” if assessed to tax under the provisions of Income-tax Act, 1961 for any of the assessment year out of six assessment

years preceding the year in which the declaration is filed.

5.Please mention the amount of estimated total income of the previous year for which the declaration is filed including the amount of income

for which this declaration is made.

6.In case any declaration(s) in Form No. 15H is filed before filing this declaration during the previous year, mention the total number of such

Form No. 15H filed along with the aggregate amount of income for which said declaration(s) have been filed.

7.Mention the distinctive number of shares, account number of term deposit, recurring deposit, National Savings Schemes, life insurance

policy number, employee code, etc.

8.Before signing the declaration/verification, the declarant should satisfy himself that the information furnished in this form is true, correct and

complete in all respects. Any person making a false statement in the declaration shall be liable to prosecution under section 277 of the

Income-tax Act, 1961 and on conviction be punishable-

(i) in a case where tax sought to be evaded exceeds twenty-five lakh rupees, with rigorous imprisonment which shall not be less than six

months but which may extend to seven years and with fine;

(ii) in any other case, with rigorous imprisonment which shall not be less than three months but which may extend to two years and with fine.

9.The person responsible for paying the income referred to in column 15 of Part I shall allot a unique identification number to all the Form No.

15H received by him during a quarter of the financial year and report this reference number along with the particulars prescribed in rule

31A(4)(vii) of the Income-tax Rules, 1962 in the TDS statement furnished for the same quarter. In case the person has also received Form

No.15G during the same quarter, please allot separate series of serial number for Form No.15H and Form No.15G.

10.The person responsible for paying the income referred to in column 15 of Part I shall not accept the declaration where the amount of

income of the nature referred to in section 197A(1C) or the aggregate of the amounts of such income credited or paid or likely to be credited

or paid during the previous year in which such income is to be included exceeds the maximum amount which is not chargeable to tax after

allowing for deduction(s) under Chapter VI-A, if any, or set off of loss, if any, under the head “income from house property” for which the

declarant is eligible. For deciding the eligibility, he is required to verify income or the aggregate amount of incomes, as the case may be,

reported by the declarant in columns 15 and 17.

You might also like

- How to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionFrom EverandHow to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionNo ratings yet

- Judicial Affidvit Manager'Document6 pagesJudicial Affidvit Manager'Rosana Villordon SoliteNo ratings yet

- People v. ManantanDocument1 pagePeople v. ManantanPrinsesaJuu100% (1)

- GR. No. 187056Document4 pagesGR. No. 187056Joyjoy C LbanezNo ratings yet

- Resolution MR On PrescriptionDocument3 pagesResolution MR On PrescriptionLzl BastesNo ratings yet

- Cacho V People Digest 1Document2 pagesCacho V People Digest 1Onireblabas Yor OsicranNo ratings yet

- Integrated Microelectronics V PionillaDocument2 pagesIntegrated Microelectronics V PionillaTrxc MagsinoNo ratings yet

- Ang v. TeodoroDocument2 pagesAng v. TeodoroDeterminedlawstudent FuturelawyerNo ratings yet

- Bryan vs. Eastern & Australian S.S. Co.Document2 pagesBryan vs. Eastern & Australian S.S. Co.Anonymous 33LIOv6LNo ratings yet

- Wages in The Late Medieval AgesDocument22 pagesWages in The Late Medieval Ages李赟No ratings yet

- Rules of Evidence Reviewer 2nd ExamDocument11 pagesRules of Evidence Reviewer 2nd ExamRascille LaranasNo ratings yet

- Pilapil Vs IbayDocument2 pagesPilapil Vs IbayCarlota Nicolas VillaromanNo ratings yet

- UntitledDocument1 pageUntitledGeethu KadariNo ratings yet

- 2024 07 1 13 10 18 15GH - AcknowledgeDocument2 pages2024 07 1 13 10 18 15GH - AcknowledgeKajal SamaniNo ratings yet

- Form 15 GDocument2 pagesForm 15 GSiddharthNo ratings yet

- 15 G Form (Pre-Filled)Document2 pages15 G Form (Pre-Filled)Kiran JituriNo ratings yet

- Form No. 15G: Declaration/VerificationDocument2 pagesForm No. 15G: Declaration/VerificationMadhu MohanNo ratings yet

- 15 G Form (Pre-Filled)Document2 pages15 G Form (Pre-Filled)prathameskaNo ratings yet

- 15 G Form (Pre-Filled)Document2 pages15 G Form (Pre-Filled)Shashank KSNo ratings yet

- Bar CodeDocument6 pagesBar CodeAkashNo ratings yet

- 15 G Form (Pre-Filled)Document2 pages15 G Form (Pre-Filled)D. Nanda KishoreNo ratings yet

- Form15g GH02596993Document3 pagesForm15g GH02596993Dhana LakshmiNo ratings yet

- Form15h GH01389401 PDFDocument3 pagesForm15h GH01389401 PDFNamme KyarakhahaiNo ratings yet

- 15 G Form (Pre-Filled)Document2 pages15 G Form (Pre-Filled)Parul SinglaNo ratings yet

- Form No 15GDocument2 pagesForm No 15Gnarendra1968No ratings yet

- 15G PDFDocument2 pages15G PDFSudhendu ChauhanNo ratings yet

- 15 G Form (Pre-Filled) PDFDocument8 pages15 G Form (Pre-Filled) PDFAkshay SinghNo ratings yet

- 15 G Form (Pre-Filled)Document2 pages15 G Form (Pre-Filled)royprithvi37No ratings yet

- 15h Form (1) - CompressedDocument4 pages15h Form (1) - Compressedrekha safarirNo ratings yet

- Form 15GDocument4 pagesForm 15GRavi SainiNo ratings yet

- Form 15G 3Document1 pageForm 15G 3lakshmananksme3007No ratings yet

- Form 15 GDocument2 pagesForm 15 GRahul SahaniNo ratings yet

- TourDocument4 pagesTourAnup SahNo ratings yet

- Form 15G WordDocument2 pagesForm 15G Wordsagar computerNo ratings yet

- 15 G Form (Pre-Filled)Document3 pages15 G Form (Pre-Filled)Ravi JammulaNo ratings yet

- PPC 1H667511110 2018-19 12042019Document3 pagesPPC 1H667511110 2018-19 12042019P PalNo ratings yet

- Income-Tax Rules, 1962Document3 pagesIncome-Tax Rules, 1962Jalpa TrivediNo ratings yet

- Form No. 15H: (IT Dept. Copy)Document9 pagesForm No. 15H: (IT Dept. Copy)jpsmu09No ratings yet

- Form 15G WordDocument2 pagesForm 15G WordAsif NadeemNo ratings yet

- Form 15GDocument3 pagesForm 15Gsriramdutta9No ratings yet

- PDF 4Document3 pagesPDF 47ola007No ratings yet

- Form 15 H - 2020-21Document2 pagesForm 15 H - 2020-21Lavesh DixitNo ratings yet

- 103120000000007845Document3 pages103120000000007845arjunv_14100% (1)

- Bonds Form 15gDocument3 pagesBonds Form 15gRishi TNo ratings yet

- Flat/Door/Block No. 7 7. Name of Premises 8.Rond/Street/Lane os9.Area/Locality Vaidn Hna QovDocument3 pagesFlat/Door/Block No. 7 7. Name of Premises 8.Rond/Street/Lane os9.Area/Locality Vaidn Hna QovVishwini ViswanathanNo ratings yet

- Form 15gDocument4 pagesForm 15gcontactus kannanNo ratings yet

- PDFDocument4 pagesPDFushapadminivadivelswamyNo ratings yet

- SanskritDocument2 pagesSanskritSAMPATH RAMESHNo ratings yet

- 15 G Form (Pre-Filled)Document2 pages15 G Form (Pre-Filled)Pawan Yadav0% (2)

- Adobe Scan 13 Mar 2021Document1 pageAdobe Scan 13 Mar 2021Pankaj BhamareNo ratings yet

- 0031SISS: Individual 11. Gmai TomDocument1 page0031SISS: Individual 11. Gmai TomVarun reddyNo ratings yet

- Form 15H Format 1Document4 pagesForm 15H Format 1ASHISH KININo ratings yet

- Form No. 15GDocument9 pagesForm No. 15Gjpsmu09No ratings yet

- Tax Form 15H PDFDocument4 pagesTax Form 15H PDFraviNo ratings yet

- Income-Tax Rules, 1962: (See Section 197A (1), 197A (1A) and Rule 29C)Document4 pagesIncome-Tax Rules, 1962: (See Section 197A (1), 197A (1A) and Rule 29C)utuavn evNo ratings yet

- 15 G Form (Pre-Filled)Document8 pages15 G Form (Pre-Filled)pankaj_electricalNo ratings yet

- e879ac9e-39e8-4815-8460-a4e25ca2512fDocument9 pagese879ac9e-39e8-4815-8460-a4e25ca2512frakesh naskarNo ratings yet

- Form No. 15G: 7. Name of Premises AhmemdabadDocument3 pagesForm No. 15G: 7. Name of Premises AhmemdabadhmpfaceNo ratings yet

- Dividend IntimationDocument21 pagesDividend IntimationRutuja SNo ratings yet

- Form 15 HDocument2 pagesForm 15 Hsingh ramanpreetNo ratings yet

- AMNPR3273M - Issue Letter - 1054531107 (1) - 23072023Document3 pagesAMNPR3273M - Issue Letter - 1054531107 (1) - 23072023prakash reddyNo ratings yet

- Individual Return IT-Gha (2023) 1Document2 pagesIndividual Return IT-Gha (2023) 1monir7898No ratings yet

- Babu SinghDocument1 pageBabu SinghRohitNo ratings yet

- FD - Form 15 - G - Oct 2015Document6 pagesFD - Form 15 - G - Oct 2015mohantamilNo ratings yet

- Income-Tax Rules, 1962Document2 pagesIncome-Tax Rules, 1962Abdul SattarNo ratings yet

- Declaration/VerificationDocument2 pagesDeclaration/VerificationArbaz KhanNo ratings yet

- E-TDS Return Preparation SoftwareDocument37 pagesE-TDS Return Preparation Softwareshabs4uroseNo ratings yet

- Tdsincometax (210621)Document3 pagesTdsincometax (210621)Pallavi SharmaNo ratings yet

- AKAPS4654E 4-O1-110 Jagannath (Or Which 2022-23 - : 712223 WhetherDocument4 pagesAKAPS4654E 4-O1-110 Jagannath (Or Which 2022-23 - : 712223 WhetherDebarshi SenguptaNo ratings yet

- Trading Together: Reviving Middle East and North Africa Regional Integration in the Post-Covid EraFrom EverandTrading Together: Reviving Middle East and North Africa Regional Integration in the Post-Covid EraNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Rent Agreement 22-23Document7 pagesRent Agreement 22-23sumeet khannaNo ratings yet

- 5 Profile 666 2022Document12 pages5 Profile 666 2022sumeet khannaNo ratings yet

- 7T4EZYDocument5 pages7T4EZYsumeet khannaNo ratings yet

- BlackrockDocument16 pagesBlackrocksumeet khannaNo ratings yet

- SNPL RULES 2022 - NovDocument8 pagesSNPL RULES 2022 - Novsumeet khannaNo ratings yet

- Mouldtech Engineering GST 2022 11 19 15 41 19Document3 pagesMouldtech Engineering GST 2022 11 19 15 41 19sumeet khannaNo ratings yet

- LOA DhateraDocument2 pagesLOA Dhaterasumeet khannaNo ratings yet

- United States v. Nestor Fernando Manrique, A/K/A Freddy, 959 F.2d 1155, 1st Cir. (1992)Document6 pagesUnited States v. Nestor Fernando Manrique, A/K/A Freddy, 959 F.2d 1155, 1st Cir. (1992)Scribd Government DocsNo ratings yet

- CHR Charges.172152610Document2 pagesCHR Charges.172152610DEBDEEP SINHANo ratings yet

- 56 Trends in Organized Crime/Voi. 8, No. 4, Summer 2005Document4 pages56 Trends in Organized Crime/Voi. 8, No. 4, Summer 2005CitraNo ratings yet

- Placemark Investments v. Prudential InvestmentsDocument6 pagesPlacemark Investments v. Prudential InvestmentsPatent LitigationNo ratings yet

- MTD DoyleDocument17 pagesMTD DoyleLindsey KaleyNo ratings yet

- Drafting Project SynopsisDocument5 pagesDrafting Project SynopsisbhanwatiNo ratings yet

- Requirments in Buying A GunDocument3 pagesRequirments in Buying A GunKenneth Ray AgustinNo ratings yet

- Coram: Hon'ble Member (Judicial) Shri V.P. Singh Hon'ble Member (Technical) Shri Rajesh SharmaDocument13 pagesCoram: Hon'ble Member (Judicial) Shri V.P. Singh Hon'ble Member (Technical) Shri Rajesh SharmaWaterways ShipyardNo ratings yet

- Digitally Signed by Trupti Sadanand Bamne Date: 2021.12.14 19:51:27 +0530Document12 pagesDigitally Signed by Trupti Sadanand Bamne Date: 2021.12.14 19:51:27 +0530Avery UnderwoodNo ratings yet

- Apr 25th 2015Document80 pagesApr 25th 2015Sammy OmbiroNo ratings yet

- St. Charles County Marina Files Federal Lawsuit Nearly Month After FireDocument7 pagesSt. Charles County Marina Files Federal Lawsuit Nearly Month After FireMonica Celeste RyanNo ratings yet

- Deed of Undertaking Real EstateDocument62 pagesDeed of Undertaking Real EstatePcl Nueva VizcayaNo ratings yet

- Evidence 2 Alam CatDocument5 pagesEvidence 2 Alam CatBast Lōgïc PrõNo ratings yet

- Instant Download Managerial Accounting Canadian 9th Edition Garrison Solutions Manual PDF Full ChapterDocument7 pagesInstant Download Managerial Accounting Canadian 9th Edition Garrison Solutions Manual PDF Full ChapterMarcusAndersonsftg100% (8)

- PPC SectionsDocument3 pagesPPC SectionsAqash EclairNo ratings yet

- PDF 1 A Maldicao Aurea - CompressDocument10 pagesPDF 1 A Maldicao Aurea - CompressJonathas RodriguesNo ratings yet

- QARZ E Hasana FormDocument6 pagesQARZ E Hasana FormtoobaNo ratings yet

- Case Law Update: QuarterlyDocument13 pagesCase Law Update: QuarterlyWasif MehmoodNo ratings yet

- Ohio Nurse Was Worked To Death, Lawsuit ClaimsDocument10 pagesOhio Nurse Was Worked To Death, Lawsuit ClaimsFindLawNo ratings yet