Professional Documents

Culture Documents

AKAPS4654E 4-O1-110 Jagannath (Or Which 2022-23 - : 712223 Whether

Uploaded by

Debarshi SenguptaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AKAPS4654E 4-O1-110 Jagannath (Or Which 2022-23 - : 712223 Whether

Uploaded by

Debarshi SenguptaCopyright:

Available Formats

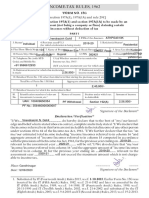

1. Name of Assessee (Declaration) 2. PAN of the Assoeseel 3.

Dete of Birty

(DDMMYYYY

JAGANNATH SENGUPTA AKAPS4654E 4-O1-110

4. Previous year (P.YP

(or which

declaratio is being made)

3.Flat/ Door/ Block No 5lE 6. Name of Premises

2022-23|

7. Road/Street/lane

CHAT8. Area/ 9.Town/City/Diatrict 10. Stato w. B.

RA MUSALMAN PARAROAD, Locality P0-SHEORAf|HULI, HocGHLY.

11. PIN 12. Email 13. Telephone No. (with STD Code) and Mobile No.

712223

81818 7413

14. (a) Whether assessed to tax Yes No

If

6) yes, latest assessment year for which asessed

15. Estimated incomefor which this declaratioai16.Bstimated total inoome of the P.Y. in whichiincome

made Rs. 5 8 , 2 5 0 mentioned in column 15 to be inclpded

Rs. 295cgg

17. Details of Form No. 1SH other than this form filed for the previous yearaifainy

Total No of Form No. 15H filed Aggregato amount oltinoome torwacaFocm No. 5H led

NIL NIL

18. Details of income for which the declaration ia led

S ldentiñcation number of Natuire af Income Sectioa under which Amount of income

No. relevant investment/account etc." tax is deductible.

A/c. No. of FD/DDP/MIP/RD

.505i4581433 (Sess) Interest 194

A 1,29cot

2. 715122 3604 I94A 29,250E

158250

° * * * * * * * * * * o * * * * * * * * * * * * * * - . .

Signahure of the Declarant

"CLARATION/VERIFICATION

a g oath Scngupla

JaganAlh g . .do hereby declare that Iam resident in India within the meaning ofsection

o ofthe Income-tax Act., 1961. I also hereby declare that to the best of my knowledge and belief what is

staied above is correct complete and is truly stated and tiat the incomes referred to in this form are not

includible in the total income of any other person under sections 60 to 64 of the Income-tax Act. 1961. I

further declare that the tax on my estimated total income including income/ incomes referred to in column

15 and aggregate amount of *income/ incomes referredto in column 17 computed in accordance with the

provisian ofthe Incomo-tax Act. 1961. for the provious year cnding on.a. .relevant to the assessment

year will be nil.

P l a c e l cr a p h u l e

**************************** ************

Jac ma hcmgupjea

************************************4y**********

Date C 02 Signature of the Declarant

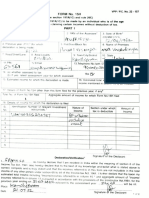

PART I

[To be filled by the person responsiblefor paying the income referred to in column 15 of Part I

1. Name ofthe person responsible for paying 2.Unique ldenification No.

Indian Bank, sheoraphuli Branch

3. PAN ofthe person responsible for 4. Complete Address 5.TANofThe Person responsible

paying 181A, G T. Road, Sheoraphuli, | for Paying

AACCA8464F CALAO6266B

Dist-Hooghly-712223(W.B.)

1"

6. E-mail 7. Telephone No. (with STD Code) and Mobile 8. Amount ofincome paid

br_aheoraphuli@allahabadbank.in (033)2632 1379

9. Date on which Declaration'is received 10. Date on which the income has been paid/credit

(DD/MM/YYYY) (DD/MM/YYYYY

Plc "'********'****'' '*''''''****'*****"'*****''*'**

Sigmature of the person responsible for paying

Dale.. income refered to in column 15 ofPart I

Delete whichever is not applicable.

I. As per provision of section 206AA (2), the declarazion under sectioa 197A(IC) shall be iavalid ifthe deciaran fails to fumish

his valid Permanent Accouat Nunber (PAN).

2 Declaration can be furnished by a reuideas individual who s oftbeo f60 year ar more at any time during the previous yecar

3. The financlal year to which the incorne pertaias.

4Pease mention "Yes"if assessed to tax under tbe provisions ofLncome-u Aa, 1961 br any ofthe assessment year out ofsix

sssesTent years precod ing the year a which the deciaracioo s led

i e r i n a tia smin nf metimatd tal incme of the orevious vear fbr whic the deciaraian is Mled inchluding the

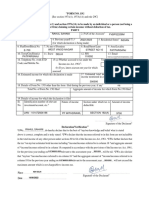

PANT-1

1. Name of Assessee (Declaration) 2. PAN of thbe 3. Date of Birty?

Asseesee DDMMYYYY)

SOMA SENGUPTA EJZPS 8835M 02-0/-/16l|

4. Previous year (P.Y)" (for which S.Flat/Door/ Block No LslE 6. Name of Premises

declarationis being made)2022-23

7. Road/Street/lane CHATH 8. Area / Locality

9.Town/City/District 10. State, B.

MUSALMAN PARA ROAD, P0- SHEORAPAULI, HOOGHLY

11.PIN 712223 12. Email 13. Telephone No. (with STD Code)and Mobile No.

14. (a) Whether assessod to tax": Yes

6289253664

No

(b)Lf yes, latest assessment yearfor which asessed

15. Estimated income for which this declarationi 16.Estimated total inoome of the P.Y. in which income

made s.158.cce mentioned in colmn 15 to be included

Rs.158ece

17. Details

of Form No. 1SH other than this form filed for the

previousyearH{ any

Total No of Form No. 15H filed |Aggregato amount oltnoome tor which Focm No.15H filed

NIL NIL

18. Details of income for which the declaratioo i iled

S ldentiication number of Nature of Inoome Sectioa under whichAmount of income

No. relevant investment/accountetc."| tx is dedhuctible

A/c. No. of FD/DDP/MIP/RD

.7I52956OScsS) Interest 194A

2. 7/5 2/8 62916 194A

3. 7/8222 653 194A

ToTAL I58c0c

** *********** e********.* .

Signature of the Declarant

A ScinquPta

otaDECLARATION/VERIFICATION

*******************

...do hereby declare that l am resident in India within the meaning of section

o of the Income-tax Act., 1961. I alsohereby declare that to the best of my knowledge and belief what is

stated above is correct complete and is truly stated and tHat the incomes

referred to in this form are not

includible in the total income of any other person under sections 60 to 64 of the

Income-tax Act. 1961. I

further declare that the tax on my estimated total income

15 and aggregate amount of

including income/ incomes referred to in colummn

income/ incomes referred to in column 17 computed in accordance with the

provisionof the Income-tax Act. 1961. for the previous year ending on.odA..relevant to the assessment

year ..t.will be nil.

lace:She craphul

Soxna S e n U ta

Date. - - 2022 ************** **°*°*************r**

Signature of the Declarant

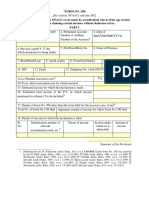

PART I

[To be filled by the person responsible for paying the income referred to in column 15 of Part I ]

1. Name of the person responsible for 2. Unique ldenifíication No.

paying

Indian Bank, sheoraphuli Branch

3. PAN of the person responsibie for 4. Complete Address S. TAN ofThe Person responsible

paying 1814, G T. Road, Sheoraphuli, for Paying

AACCA8464F Dist-Hooghly-712223 (W.B.) CALA06266B

6. E-mail 7. Telephone No.(with STD Code) and Mobile 8. Amount of income paid "

br_sheoraphuli@allahabadbank.in (033)2632 1379

9. Date on which Declaration'is rocelved 10. Date on which the income has been paid/credit

(DD/MM /YYYY) (DD/MM/YYYYY

Plac: ******'***********'**********''°°°°*** **************s*soese************************mopsssnsnrsep.*

Signature of the person responsible for paying

Dale. *** ******** *********************"

the income referred to in column 15 of Part

Delee which.ever is not applicable.

.As perprovisionofsection 206AA (2),the declaration under section 197A(IC) ahall be luvalid ifthe declarant fals to fumish

his velid Pemanent Account Number (PAN).

2 Declaraiion can be furmished by a reuident

indi vidual who is of the ngs of 60 yaars or more at any time during the previous year.

3. The financlal year o which thé incone

pertains.

4 Please menion "Yes"ifaseased to tax under tbe provisions oflacome-tax Act, i1961 for any of the assesunent year out ofsix

&ssessment years procoding the year in which the declaration is iled

You might also like

- Employment Claims without a Lawyer: A Handbook for Litigants in Person, Revised 2nd editionFrom EverandEmployment Claims without a Lawyer: A Handbook for Litigants in Person, Revised 2nd editionNo ratings yet

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1From EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1No ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Advanced AccountingDocument14 pagesAdvanced AccountingBehbehlynn67% (3)

- Income Tax (Memory-Test-2)Document8 pagesIncome Tax (Memory-Test-2)Ella Marie LopezNo ratings yet

- Form15g GH02596993Document3 pagesForm15g GH02596993Dhana LakshmiNo ratings yet

- 15G PDFDocument2 pages15G PDFSudhendu ChauhanNo ratings yet

- 15h Form (1) - CompressedDocument4 pages15h Form (1) - Compressedrekha safarirNo ratings yet

- PPC 1H667511110 2018-19 12042019Document3 pagesPPC 1H667511110 2018-19 12042019P PalNo ratings yet

- 103120000000007845Document3 pages103120000000007845arjunv_14100% (1)

- PDF 4Document3 pagesPDF 47ola007No ratings yet

- Form 15 GDocument2 pagesForm 15 GRahul SahaniNo ratings yet

- Flat/Door/Block No. 7 7. Name of Premises 8.Rond/Street/Lane os9.Area/Locality Vaidn Hna QovDocument3 pagesFlat/Door/Block No. 7 7. Name of Premises 8.Rond/Street/Lane os9.Area/Locality Vaidn Hna QovVishwini ViswanathanNo ratings yet

- Form 15GDocument4 pagesForm 15GRavi SainiNo ratings yet

- 15 G Form (Pre-Filled)Document2 pages15 G Form (Pre-Filled)prathameskaNo ratings yet

- Form15h GH01389401 PDFDocument3 pagesForm15h GH01389401 PDFNamme KyarakhahaiNo ratings yet

- BLANK IOCL Form 15GDocument3 pagesBLANK IOCL Form 15Gsaiboyshostel37No ratings yet

- TourDocument4 pagesTourAnup SahNo ratings yet

- Form 15GDocument3 pagesForm 15Gsriramdutta9No ratings yet

- Income-Tax Rules, 1962: (See Section 197A (1), 197A (1A) and Rule 29C)Document4 pagesIncome-Tax Rules, 1962: (See Section 197A (1), 197A (1A) and Rule 29C)utuavn evNo ratings yet

- Tax Form 15H PDFDocument4 pagesTax Form 15H PDFraviNo ratings yet

- Adobe Scan 13 Mar 2021Document1 pageAdobe Scan 13 Mar 2021Pankaj BhamareNo ratings yet

- LaxmanDocument2 pagesLaxmanBhimrao PhalkeNo ratings yet

- 15 G Form (Pre-Filled)Document2 pages15 G Form (Pre-Filled)Kiran JituriNo ratings yet

- Form 15gDocument4 pagesForm 15gcontactus kannanNo ratings yet

- PDFDocument4 pagesPDFushapadminivadivelswamyNo ratings yet

- Bar CodeDocument6 pagesBar CodeAkashNo ratings yet

- 15 G Form (Pre-Filled)Document2 pages15 G Form (Pre-Filled)royprithvi37No ratings yet

- 15 G Form (Pre-Filled)Document8 pages15 G Form (Pre-Filled)pankaj_electricalNo ratings yet

- FD - Form 15 - G - Oct 2015Document6 pagesFD - Form 15 - G - Oct 2015mohantamilNo ratings yet

- New Form 15G PDFDocument2 pagesNew Form 15G PDFSoma Sundar50% (2)

- Form 15H Format 1Document4 pagesForm 15H Format 1ASHISH KININo ratings yet

- Form 15G 3Document1 pageForm 15G 3lakshmananksme3007No ratings yet

- Form 15h Revised1Document2 pagesForm 15h Revised1rajprince26460No ratings yet

- Form 15GDocument3 pagesForm 15GRahul DattoNo ratings yet

- 0031SISS: Individual 11. Gmai TomDocument1 page0031SISS: Individual 11. Gmai TomVarun reddyNo ratings yet

- Form 15 HDocument2 pagesForm 15 Hsingh ramanpreetNo ratings yet

- Form No. 15H: (IT Dept. Copy)Document9 pagesForm No. 15H: (IT Dept. Copy)jpsmu09No ratings yet

- 15 G Form (Pre-Filled)Document2 pages15 G Form (Pre-Filled)D. Nanda KishoreNo ratings yet

- Form 15 H - 2020-21Document2 pagesForm 15 H - 2020-21Lavesh DixitNo ratings yet

- Form 15G PDFDocument2 pagesForm 15G PDFLegend RickNo ratings yet

- 15 G Form (Pre-Filled)Document2 pages15 G Form (Pre-Filled)Parul SinglaNo ratings yet

- Form 15G WordDocument2 pagesForm 15G WordAsif NadeemNo ratings yet

- Form No 15GDocument2 pagesForm No 15Gnarendra1968No ratings yet

- Form No. 15GDocument9 pagesForm No. 15Gjpsmu09No ratings yet

- Income-Tax Rules, 1962Document3 pagesIncome-Tax Rules, 1962Jalpa TrivediNo ratings yet

- Bonds Form 15gDocument3 pagesBonds Form 15gRishi TNo ratings yet

- Form 15G WordDocument2 pagesForm 15G Wordsagar computerNo ratings yet

- 15 G Form (Pre-Filled)Document2 pages15 G Form (Pre-Filled)Shashank KSNo ratings yet

- TAX SAVING Form 15g Revised1 SBTDocument2 pagesTAX SAVING Form 15g Revised1 SBTrkssNo ratings yet

- SanskritDocument2 pagesSanskritSAMPATH RAMESHNo ratings yet

- PF Form 15G PDFDocument1 pagePF Form 15G PDFSorabh BhargavNo ratings yet

- PF Form 15GDocument1 pagePF Form 15GSorabh BhargavNo ratings yet

- 15g MehandiDocument3 pages15g MehandiAjay ParidaNo ratings yet

- Form No. 15G: 7. Name of Premises AhmemdabadDocument3 pagesForm No. 15G: 7. Name of Premises AhmemdabadhmpfaceNo ratings yet

- 15 G Form (Pre-Filled) PDFDocument8 pages15 G Form (Pre-Filled) PDFAkshay SinghNo ratings yet

- Income-Tax Rules, 1962Document2 pagesIncome-Tax Rules, 1962Abdul SattarNo ratings yet

- 15 G Form (Pre-Filled)Document2 pages15 G Form (Pre-Filled)Palaniappan Meyyappan83% (6)

- Unloved Bull Markets: Getting Rich the Easy Way by Riding Bull MarketsFrom EverandUnloved Bull Markets: Getting Rich the Easy Way by Riding Bull MarketsNo ratings yet

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Comparative Taxation: Some Basic PointsDocument17 pagesComparative Taxation: Some Basic Pointshaidersh05No ratings yet

- NUB-Taxation Review-Week 1-Tax RemediesDocument8 pagesNUB-Taxation Review-Week 1-Tax RemediesemmanvillafuerteNo ratings yet

- Topic 8 - PERSONAL RELIEFS AND REBATESDocument14 pagesTopic 8 - PERSONAL RELIEFS AND REBATESSarannyaRajendraNo ratings yet

- Ey Personal Tax Immigration Guide 05 April 2023Document1,751 pagesEy Personal Tax Immigration Guide 05 April 2023ashish poddarNo ratings yet

- Latest Provisions TDS and CSDocument74 pagesLatest Provisions TDS and CShimesh amibrokerNo ratings yet

- ReSA B42 TAX First PB Exam - Questions, Answers - SolutionsDocument18 pagesReSA B42 TAX First PB Exam - Questions, Answers - SolutionsPearl Mae De VeasNo ratings yet

- Exclsuions Corp Mcit Iaet NewDocument149 pagesExclsuions Corp Mcit Iaet NewMaanNo ratings yet

- Lapisan Gross UpDocument15 pagesLapisan Gross UpRizki ArvitaNo ratings yet

- BIR Form Deadline Quarterly Tax ReturnsDocument6 pagesBIR Form Deadline Quarterly Tax Returnsdianne caballeroNo ratings yet

- Section 192 Relatin Gto TDS On Salary - Section 192 Says That Every Person Who Is Responsible For Paying Any Income Chargeable Under The HeadDocument46 pagesSection 192 Relatin Gto TDS On Salary - Section 192 Says That Every Person Who Is Responsible For Paying Any Income Chargeable Under The HeadAtul SharmaNo ratings yet

- Nepal Budget 2076-77 (2019-20)Document38 pagesNepal Budget 2076-77 (2019-20)Menuka SiwaNo ratings yet

- Lecture Notes XIII Selected Topics On Philippine TaxationDocument9 pagesLecture Notes XIII Selected Topics On Philippine TaxationSar CaermareNo ratings yet

- Tax Calculator (Salaried Person) : Monthly SalaryDocument5 pagesTax Calculator (Salaried Person) : Monthly SalarySheeraz Ahmed MemonNo ratings yet

- 78728bos63016 p3Document34 pages78728bos63016 p3dileepkarumuri93No ratings yet

- JPSP 2022 434Document18 pagesJPSP 2022 434Florie May HizoNo ratings yet

- Tax Evasion Part 1Document12 pagesTax Evasion Part 1henfaNo ratings yet

- RMC No 67-2012Document5 pagesRMC No 67-2012evilminionsattackNo ratings yet

- 105 IMPSA Construction Corporation vs. CIR (CTA EB Case No. 685, May 24, 2011)Document10 pages105 IMPSA Construction Corporation vs. CIR (CTA EB Case No. 685, May 24, 2011)Alfred GarciaNo ratings yet

- Foreign-Affiliate-Issues-in-Troubled TimesDocument17 pagesForeign-Affiliate-Issues-in-Troubled TimesMelly AnastasyaNo ratings yet

- Cir V SMLCDocument18 pagesCir V SMLCTracey FraganteNo ratings yet

- Propotional Taxation and Its Role of The Government Revenue 2017 HargeisaDocument56 pagesPropotional Taxation and Its Role of The Government Revenue 2017 HargeisaYousuf abdirahmanNo ratings yet

- Q1 Taxation Review Taxation FundamentalsDocument10 pagesQ1 Taxation Review Taxation Fundamentalsfinn heartNo ratings yet

- Case Digest Atty CabaneiroDocument11 pagesCase Digest Atty CabaneiroChriselle Marie DabaoNo ratings yet

- Shubham 1764 Taxation Law Project On Black Money, Tax Evasion & Tax AvoidanceDocument37 pagesShubham 1764 Taxation Law Project On Black Money, Tax Evasion & Tax AvoidanceShubham100% (1)

- In Brief: Recent DevelopmentsDocument7 pagesIn Brief: Recent DevelopmentsScar IceNo ratings yet

- Tax Avoidance and Tax EvasionDocument6 pagesTax Avoidance and Tax EvasionBhavanaNo ratings yet

- Transfer and Business Tax 2014 Ballada PDFDocument26 pagesTransfer and Business Tax 2014 Ballada PDFCamzwell Kleinne HalyieNo ratings yet

- Ey Indonesia - Tax Alert - Omnibus - E-Blast PDFDocument11 pagesEy Indonesia - Tax Alert - Omnibus - E-Blast PDFlarryNo ratings yet