Professional Documents

Culture Documents

FC Requirement New17

Uploaded by

Zahed Ibrahim0 ratings0% found this document useful (0 votes)

6 views1 pageThe scrutiny committee will ensure the following documents are submitted before raising a foreign loan proposal:

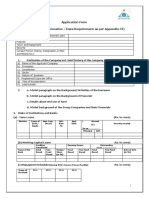

1) Application form and documents showing the company's registration, capital structure, and authorization.

2) Registration with the Board of Investment maintaining a debt-equity ratio of at least 70:30.

3) Documents related to the proposed loan including feasibility reports, financial analyses, and credit rating.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe scrutiny committee will ensure the following documents are submitted before raising a foreign loan proposal:

1) Application form and documents showing the company's registration, capital structure, and authorization.

2) Registration with the Board of Investment maintaining a debt-equity ratio of at least 70:30.

3) Documents related to the proposed loan including feasibility reports, financial analyses, and credit rating.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views1 pageFC Requirement New17

Uploaded by

Zahed IbrahimThe scrutiny committee will ensure the following documents are submitted before raising a foreign loan proposal:

1) Application form and documents showing the company's registration, capital structure, and authorization.

2) Registration with the Board of Investment maintaining a debt-equity ratio of at least 70:30.

3) Documents related to the proposed loan including feasibility reports, financial analyses, and credit rating.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

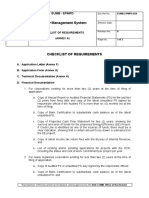

The scrutiny committee for foreign roan decided that

the committee secretariat will

ensure the following checklist before a proposal is raised

in the meeting of scrutiny

committee:

a) Application form duly filled in.

b) certificate of lncorporation and certificate of commencements from RJSC, Bangladesh.

c) Memorandum & Articles of Association (certified copy).

d) Form-X, Form-Xll and Form-XV from RJSC as a proof bf authorized capltal, paid

up capital,

shareholding structure, etc. Please nofe that the paid

up capitat shoutd be at least J0% of

authorized capital.

e) Latest registration (full set) from Board of lnvestment (Bol)

with the inclusion of proposed

loan/deferred payment maintaining debt-equity ratio

of at least 70:30.

D Term sheeuloan Agreemenvsuppry Agreement between

the parties.

s) Board's Resolution related to the proposed loan/deferred payment.

h) Up-to-date feasibility report in details.

i) Up-to-date financial analysis in details which includes

lnternal Rate of Return (lRR), Break-

Even Analysis, Payback Period, Debt-Equity ratio of

the project, Debt service coverage

Ratio (DSCR) analysis for both Base case and sensitivity

cases (5% increase in cost of

production, So/o decrease in sales, etc.) with

all others.

i) Last Year Audited Balance sheef. Please be informed thated1gj-g debt-equity

ratiobased

on Audited Batance sheef (inctuding propos ed amount)

shoutd be at least 70:30.

k) Up-to-date Credit Rating Report of the company.

r) The utilization certificate from nominated bank containing

the justification of the estimated

price/quotation of the capital machineries, spare parts,

etc.(summary of the capital

machineries (imported or to be imported) for the purpose

of the proposed loan/deferred

payment) submitted by the borrower in comparison

with the latest market price with

supporting documents (for example: Proforma lnvoice,

Bill of Lading, Llc copy, etc.).

Please note that refinance/reimbursement of local currency

liabilities using foreign currency

loan is highly discouraged.

m) Track record of the past foreign loans/deferred payments (if

any) with approval letter and

bank certificate of all transactions, utilizations and outstanding.

n) clB certificate of the company and its sponsors/Directors from

the nominated bank. The

CIB certificate will clearly specify the recent date of searching

clB online and the status in

general. ;

o) Relevant CIB enquiry forms(Enquiry Form-1 & 2) and

under taking from sponsors/Directors

duly filled in for cotlection of up-to-date CIB report from

Bangladesh Bank.

p) Credential of the Sponsors/Directors.

q) Environmental Clearance Certificate from Directorate of Environment.

You might also like

- BIDA Application Front PageDocument1 pageBIDA Application Front PageZahed IbrahimNo ratings yet

- FC RequireDocument7 pagesFC RequireZahed IbrahimNo ratings yet

- Process - Flow - Narrative - Window BDocument6 pagesProcess - Flow - Narrative - Window BrickmortyNo ratings yet

- Quality Management System: Eumb - EpmpdDocument3 pagesQuality Management System: Eumb - EpmpdCecile DuguitNo ratings yet

- Chapter 20 - Audit of NBFCDocument4 pagesChapter 20 - Audit of NBFCRakhi SinghalNo ratings yet

- Chapter 20 - Audit of NBFC PDFDocument4 pagesChapter 20 - Audit of NBFC PDFRakhi SinghalNo ratings yet

- Abhivrudhi - Scheme Guidelines: Parameter Guideline AbhivrudhiDocument4 pagesAbhivrudhi - Scheme Guidelines: Parameter Guideline AbhivrudhianuragmwwNo ratings yet

- Loan Application Checklist - Le Sme Above 10 Million Naira LoanDocument3 pagesLoan Application Checklist - Le Sme Above 10 Million Naira LoanOluwatosin OgunjinmiNo ratings yet

- Renewal of Special License by A Foreign Contractor ApplicationDocument18 pagesRenewal of Special License by A Foreign Contractor ApplicationLenin Rey PolonNo ratings yet

- Annexure I Standardised Format For LCDocument5 pagesAnnexure I Standardised Format For LCNishit MarvaniaNo ratings yet

- Change of Business Name & Status Form - 10192017Document21 pagesChange of Business Name & Status Form - 10192017successonthemaking100% (1)

- Guidelines For Financing To Housing Builders/Developers: State Bank of Pakistan, KarachiDocument6 pagesGuidelines For Financing To Housing Builders/Developers: State Bank of Pakistan, KarachiAnush VedhNo ratings yet

- IFB For PNHRP Package 2A Rehabilitation of National Bridges Behrain Kalam N 95 12 BridgesDocument1 pageIFB For PNHRP Package 2A Rehabilitation of National Bridges Behrain Kalam N 95 12 BridgesChand RajaNo ratings yet

- Get File AttachmentDocument2 pagesGet File AttachmentArchana PalliyaliNo ratings yet

- DRMC BoqDocument16 pagesDRMC BoqE.F. AlamilloNo ratings yet

- Format Stock Audit ReportDocument12 pagesFormat Stock Audit ReportabcNo ratings yet

- Mr,.#Fllfterac: Finance CorporationDocument8 pagesMr,.#Fllfterac: Finance CorporationJahangir SajfdarNo ratings yet

- External Commercial Borrowings - IndiaDocument4 pagesExternal Commercial Borrowings - IndiaPPPnewsNo ratings yet

- Checklist of Eligibility & Technical Components During Opening of Bids (Infrastructure)Document5 pagesChecklist of Eligibility & Technical Components During Opening of Bids (Infrastructure)bobosNo ratings yet

- Annexure Ii Standardised Format For BGDocument5 pagesAnnexure Ii Standardised Format For BGNishit Marvania100% (1)

- Loan Application FormDocument9 pagesLoan Application FormrohitNo ratings yet

- Annexure XVI Review FormatDocument3 pagesAnnexure XVI Review FormatRehana KaziNo ratings yet

- Red Is CountingDocument15 pagesRed Is CountingMich GuarinoNo ratings yet

- Check List LOANDocument12 pagesCheck List LOANshushanNo ratings yet

- Details of The Approved Facillties:: Ref: Prime/HO/SME/10/2585Document4 pagesDetails of The Approved Facillties:: Ref: Prime/HO/SME/10/2585jehanNo ratings yet

- Red Is CountingDocument17 pagesRed Is CountingKarlNo ratings yet

- FeeructureDocument10 pagesFeeructureKhabre SuperfastNo ratings yet

- Guidelines For Non Oil Export Stimulation Facility October 2017Document8 pagesGuidelines For Non Oil Export Stimulation Facility October 2017edos izedonmwenNo ratings yet

- Appendix O - 5 - Pre Post Approval Checklist - Small Medium EnterpriseDocument4 pagesAppendix O - 5 - Pre Post Approval Checklist - Small Medium Enterpriserotimi olalekan fataiNo ratings yet

- Red Is CountingDocument15 pagesRed Is CountingHihihiNo ratings yet

- PP Module 3 Dec19 NSDocument171 pagesPP Module 3 Dec19 NSKrishnaNo ratings yet

- Requirements For New Banking LicenseDocument6 pagesRequirements For New Banking LicenseGabriel EtimNo ratings yet

- Instructions LTFFDocument13 pagesInstructions LTFFKidsNo ratings yet

- 03 Ldmed NDSC Presentation Final PDFDocument12 pages03 Ldmed NDSC Presentation Final PDFAttyGalva22No ratings yet

- Letter of Credit Appraisal NoteDocument8 pagesLetter of Credit Appraisal NoteNimitt ChoudharyNo ratings yet

- Geodetic Scope of WorkDocument24 pagesGeodetic Scope of WorkKris Aileen CortezNo ratings yet

- Common Document Obtaining Local and Foreign Industrial Credit FacilityDocument4 pagesCommon Document Obtaining Local and Foreign Industrial Credit FacilityAarajita ParinNo ratings yet

- Pexd3 AnnexDocument10 pagesPexd3 AnnexChadNo ratings yet

- BSP MORB - Appendix 33 To Section 102 (As Amended by BSP C1105 s2020) PDFDocument12 pagesBSP MORB - Appendix 33 To Section 102 (As Amended by BSP C1105 s2020) PDFVictor GalangNo ratings yet

- Loan Checklist - List of Compliances For A Loan TransactionDocument6 pagesLoan Checklist - List of Compliances For A Loan TransactionDinesh GadkariNo ratings yet

- Checklist For Direct Loan Applicants 2017Document3 pagesChecklist For Direct Loan Applicants 2017Twae RoseNo ratings yet

- Compendium PDFDocument18 pagesCompendium PDFbitmesrNo ratings yet

- Forreign Borrowings ProcedureDocument5 pagesForreign Borrowings ProcedureAli RazeenNo ratings yet

- PCAB License (PCAB Categories)Document8 pagesPCAB License (PCAB Categories)Gie Bernal CamachoNo ratings yet

- Term Sheet-Ktm New - EditedDocument2 pagesTerm Sheet-Ktm New - EditedArjun BhattaNo ratings yet

- Bond Checklist PDFDocument4 pagesBond Checklist PDFSatyajit NathNo ratings yet

- Registration of Corporations Stock Corporation Basic RequirementsDocument27 pagesRegistration of Corporations Stock Corporation Basic RequirementsRhyz Taruc-ConsorteNo ratings yet

- Checklist 2021 (Infra) - 1Document3 pagesChecklist 2021 (Infra) - 1Johannes Gregorii LagueNo ratings yet

- ChecklistDocument2 pagesChecklistRizafe RamosNo ratings yet

- SC CF 32 Completion of DA 70 External ManualDocument10 pagesSC CF 32 Completion of DA 70 External ManualDeon Von SchaefferNo ratings yet

- Standard Pre Disbursement Conditions PDFDocument6 pagesStandard Pre Disbursement Conditions PDFVipen MahajanNo ratings yet

- Eligibility Requirements For InfraDocument3 pagesEligibility Requirements For InfraangelllNo ratings yet

- Rediscounting/Erediscounting System December 2020Document23 pagesRediscounting/Erediscounting System December 2020MedyNo ratings yet

- Detailed Procedure For Listing of Privately Placed DebenturesDocument11 pagesDetailed Procedure For Listing of Privately Placed Debenturesaniket guptaNo ratings yet

- Bank Branch Audit PrgrammeDocument41 pagesBank Branch Audit PrgrammeMeenaxi SoniNo ratings yet

- Low Interest Loan - Business Support For NYSC Graduates - BOIDocument5 pagesLow Interest Loan - Business Support For NYSC Graduates - BOIsamuel olasupoNo ratings yet

- Sme Loan Application Guideline Product Name Product Description Targeted Cash Flow-Based Lending: This Offers An AvenueDocument3 pagesSme Loan Application Guideline Product Name Product Description Targeted Cash Flow-Based Lending: This Offers An AvenueChima ChukwuNo ratings yet

- Bank Concurrent AuditDocument15 pagesBank Concurrent AuditcaonkarsinghNo ratings yet

- Progress Report on Establishing a Regional Settlement Intermediary and Next Steps: Implementing Central Securities Depository-Real-Time Gross Settlement Linkages in ASEAN+3From EverandProgress Report on Establishing a Regional Settlement Intermediary and Next Steps: Implementing Central Securities Depository-Real-Time Gross Settlement Linkages in ASEAN+3No ratings yet

- Financial Reporting and Auditing in Sovereign Operations: Technical Guidance NoteFrom EverandFinancial Reporting and Auditing in Sovereign Operations: Technical Guidance NoteNo ratings yet

- BG Request To PubaliDocument2 pagesBG Request To PubaliZahed IbrahimNo ratings yet

- SCB LeeterDocument3 pagesSCB LeeterZahed IbrahimNo ratings yet

- BR - PAL - HAL and PDYLDocument2 pagesBR - PAL - HAL and PDYLZahed IbrahimNo ratings yet

- Sammut BonnicistrategicmanagementDocument5 pagesSammut BonnicistrategicmanagementZahed IbrahimNo ratings yet

- Disbursement Request Letter NBLDocument4 pagesDisbursement Request Letter NBLZahed IbrahimNo ratings yet

- Request For CM LC LimitDocument2 pagesRequest For CM LC LimitZahed IbrahimNo ratings yet

- Disbursement Letter-BML Uttara FinanceDocument2 pagesDisbursement Letter-BML Uttara FinanceZahed IbrahimNo ratings yet

- Objectives of Corporate Finance:: Rationality of These ModelDocument4 pagesObjectives of Corporate Finance:: Rationality of These ModelZahed IbrahimNo ratings yet

- SCB STL Disbursement RequestDocument25 pagesSCB STL Disbursement RequestZahed IbrahimNo ratings yet

- Disbursement Request LetterDocument2 pagesDisbursement Request LetterZahed IbrahimNo ratings yet

- CP Guideline of BBDocument14 pagesCP Guideline of BBZahed IbrahimNo ratings yet

- Excess LC Limit-HSBCDocument2 pagesExcess LC Limit-HSBCZahed IbrahimNo ratings yet

- Assets: Page 1 of 7Document7 pagesAssets: Page 1 of 7Zahed IbrahimNo ratings yet

- Excel Tutorials2gDocument4 pagesExcel Tutorials2gZahed IbrahimNo ratings yet

- Ch02 - IS in The Enterprise - 8e - 2Document29 pagesCh02 - IS in The Enterprise - 8e - 2Zahed IbrahimNo ratings yet

- Accounting Information Systems: An OverviewDocument35 pagesAccounting Information Systems: An OverviewZahed IbrahimNo ratings yet

- Corporate Bond Raising ProcessDocument3 pagesCorporate Bond Raising ProcessZahed IbrahimNo ratings yet

- Template Guarantee DeedDocument26 pagesTemplate Guarantee DeedZahed IbrahimNo ratings yet

- ATR4518R6v07: Antenna SpecificationsDocument2 pagesATR4518R6v07: Antenna Specificationsanna.bNo ratings yet

- 5000mah Mi Power Bank 2 - PDFDocument6 pages5000mah Mi Power Bank 2 - PDFManuel Jesús Fernández lavadoNo ratings yet

- Science 7 - Q2 - M7Document16 pagesScience 7 - Q2 - M7RAMOS ERLYN P.No ratings yet

- DDEV SPICES PVT LTD (Product List)Document1 pageDDEV SPICES PVT LTD (Product List)jaymin zalaNo ratings yet

- DAMPNESSDocument21 pagesDAMPNESSChukwu SolomonNo ratings yet

- What Does She/He Look Like?: Height Build AGEDocument18 pagesWhat Does She/He Look Like?: Height Build AGEHenrich Garcia LimaNo ratings yet

- Transmission Lines SMART EDGE VILLARUEL For April 2024 v1Document89 pagesTransmission Lines SMART EDGE VILLARUEL For April 2024 v1mayandichoso24No ratings yet

- Martins Taylorb Os 10742 Final Opinion 2 11 2022 02898337xd2c78Document9 pagesMartins Taylorb Os 10742 Final Opinion 2 11 2022 02898337xd2c78Live 5 NewsNo ratings yet

- Design and Details of Elevated Steel Tank PDFDocument10 pagesDesign and Details of Elevated Steel Tank PDFandysupaNo ratings yet

- Contemporary ImageDocument43 pagesContemporary ImageProf. L100% (1)

- Full Carrino Plaza Brochure and Application (General)Document8 pagesFull Carrino Plaza Brochure and Application (General)tanis581No ratings yet

- ESR 2538 ChemofastDocument14 pagesESR 2538 ChemofastEduardo Antonio Duran SepulvedaNo ratings yet

- PBL 2 Case PresentationDocument12 pagesPBL 2 Case PresentationRamish IrfanNo ratings yet

- Phoenix Contact DATA SHEETDocument16 pagesPhoenix Contact DATA SHEETShivaniNo ratings yet

- Learning Activity Sheet General Chemistry 2 (Q4 - Lessons 7 and 8) Electrochemical ReactionsDocument11 pagesLearning Activity Sheet General Chemistry 2 (Q4 - Lessons 7 and 8) Electrochemical Reactionsprincess3canlasNo ratings yet

- Drake Family - Work SampleDocument1 pageDrake Family - Work Sampleapi-248366250No ratings yet

- EHEDG Guidelines by Topics 04 2013Document2 pagesEHEDG Guidelines by Topics 04 2013renzolonardi100% (1)

- Recommended Practice For Corrosion Management of Pipelines in Oil & Gas Production and TransportationDocument123 pagesRecommended Practice For Corrosion Management of Pipelines in Oil & Gas Production and Transportationsaifoa100% (2)

- Osh e MeerDocument3 pagesOsh e MeerfatduckNo ratings yet

- Nursing Care Plan: Assessment Diagnosis Planning Interventions Rationale EvaluationDocument11 pagesNursing Care Plan: Assessment Diagnosis Planning Interventions Rationale EvaluationDa NicaNo ratings yet

- GeoSS Event Seminar 12 July 2012 - SlidesDocument15 pagesGeoSS Event Seminar 12 July 2012 - SlidesNurmanda RamadhaniNo ratings yet

- Chemical Analysis and Mechancial Test Certificate: Yield Strength Tensile Strength ElongationDocument1 pageChemical Analysis and Mechancial Test Certificate: Yield Strength Tensile Strength ElongationDigna Bettin CuelloNo ratings yet

- 224 Chinese Healing ExercisesDocument4 pages224 Chinese Healing ExercisesKiné Therapeut-manuelle Masseur GabiNo ratings yet

- Case Exercise On Layer Unit (2000 Birds)Document2 pagesCase Exercise On Layer Unit (2000 Birds)Priya KalraNo ratings yet

- J. Bleger ArtDocument10 pagesJ. Bleger Artivancristina42No ratings yet

- Om Deutz 1013 PDFDocument104 pagesOm Deutz 1013 PDFEbrahim Sabouri100% (1)

- Periodontology Question BankDocument44 pagesPeriodontology Question BankVanshika Jain100% (6)

- Why Men Want Sex and Women Need Love by Barbara and Allen Pease - ExcerptDocument27 pagesWhy Men Want Sex and Women Need Love by Barbara and Allen Pease - ExcerptCrown Publishing Group62% (34)

- Report Text: General ClassificationDocument7 pagesReport Text: General Classificationrisky armala syahraniNo ratings yet

- Carbo Hi DratDocument11 pagesCarbo Hi DratILHAM BAGUS DARMA .NNo ratings yet