Professional Documents

Culture Documents

Calculate Annual Taxes and Withholding for Employee

Uploaded by

RyD0 ratings0% found this document useful (0 votes)

50 views5 pagesOriginal Title

Quizzer on Withholding of Annual Tax Compensation Income

Copyright

© © All Rights Reserved

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document0 ratings0% found this document useful (0 votes)

50 views5 pagesCalculate Annual Taxes and Withholding for Employee

Uploaded by

RyDYou are on page 1of 5

TAXATION

QUIZZER ON WITHHOLDING OF ANNUAL TAX COMPENSATION INCOME

QUIZZER SOLUTION:

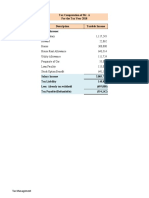

Ruiz Moore is an office employee earning Jan-Nov December Annual

62,500 basic pay per month. During the period Basic Pay 687,500 62,500 750,000

of January to November 2020, Ruiz earned the Late and absences 8,935 (8,935)

following: Overtime pay 2,140 1,640 3,780

Taxable allowances 38,500 3,500 42,000

• Basic pay, 687,500 where late and Rice subsidy 19,800 1,800 21,600

absences of 8,935 is not yet deducted. Christmas cash gift 10,000 10,000

• Overtime pay, 2,140 and taxable 13th month pay 62,500 62,500

allowances of 3,500 per month. Gross compensation income 880,945 (1)

• Rice subsidy of 1,800 per month. Less: Rice subsidy (21,600)

• SSS, PHIC, HDMF contributions totalled Christmas cash gift (5,000)

20,212.50 for all 11 months. 13th month pay (62,500)

Other benefits (5,000)

Withholding tax for all 11 months totalled Statutory deductions 20,212.50 1,837.50 (22,050)

110,581.47. Taxable compensation income 764,795 (1)

During December, the following were earned Annual tax due:

alongside the 62,500 basic pay for the month:

Minimum tax due 30,000.00

• Overtime of 1,640, taxable allowance of Tax on excess

3,500 and rice subsidy of 1,800. (764,795 – 400,000) x 25% 91,198.75

• Christmas cash gift, 10,000. Income tax due for the year 121,198.75 (2)

• 13th month pay, 62,500 Less: Tax withheld from Jan-Nov (110,581.47)

Tax payable for December 10,617.28 (3)

Compute the following:

1. Ruiz’s annual gross and taxable

compensation income

2. Income tax due for the year

3. Tax payable for December

ANNUAL CALCULATION OF TAXES

ANNUAL TAX vs WITHHOLDING TAX

You might also like

- BM414 Financial Decision Making 40Document15 pagesBM414 Financial Decision Making 40MD. SHAKIL100% (1)

- Chapter Thirteen SolutionsDocument18 pagesChapter Thirteen Solutionsapi-3705855No ratings yet

- Tax SecretsDocument3 pagesTax Secretshrpufnstuf100% (10)

- Questions & Answers: 2 SalariesDocument26 pagesQuestions & Answers: 2 SalariesSabyasachi Ghosh67% (3)

- MP2 FAQ April15Document3 pagesMP2 FAQ April15rieann09No ratings yet

- Cat Module 1 Answer KeysDocument27 pagesCat Module 1 Answer KeysLexden MendozaNo ratings yet

- Lecture 1 and Lecture 2 Quiz Answer Section: Ramon Magsaysay Memorial CollegesDocument6 pagesLecture 1 and Lecture 2 Quiz Answer Section: Ramon Magsaysay Memorial Collegesbelinda dagohoyNo ratings yet

- Obn - Gwox - Issue 34 (March 2021)Document1 pageObn - Gwox - Issue 34 (March 2021)Nate TobikNo ratings yet

- Instructions For Form 1099-B: Future DevelopmentsDocument12 pagesInstructions For Form 1099-B: Future DevelopmentsScott Homuth100% (1)

- FINA 4221 Corporate Finance Problem Set 1Document2 pagesFINA 4221 Corporate Finance Problem Set 1mahirahmed510% (1)

- Annual Compensation and Business TaxesDocument21 pagesAnnual Compensation and Business TaxesRyDNo ratings yet

- f6vnm 2007 Dec ADocument6 pagesf6vnm 2007 Dec APhạm Hùng DũngNo ratings yet

- M12 Tax ActivityDocument6 pagesM12 Tax ActivityJanna RodriguezNo ratings yet

- Fabm2 Q2 W4 5Document8 pagesFabm2 Q2 W4 5maeesotoNo ratings yet

- CAF 06 - TaxationDocument7 pagesCAF 06 - TaxationKhurram ShahzadNo ratings yet

- SSF Not Listed-Monthly Salary Sheet With TDS Calculation 2076-2077Document29 pagesSSF Not Listed-Monthly Salary Sheet With TDS Calculation 2076-2077samNo ratings yet

- PSBA REFRESHER TAXATION QUIZDocument10 pagesPSBA REFRESHER TAXATION QUIZEdnalyn CruzNo ratings yet

- Dit Sem V SolnDocument10 pagesDit Sem V Solnmaaz11052020No ratings yet

- I. Sources of Fund A. EquityDocument20 pagesI. Sources of Fund A. EquityJoshell Roz RamasNo ratings yet

- FABM 2 Module 9 Income Tax DueDocument11 pagesFABM 2 Module 9 Income Tax DueJOHN PAUL LAGAO100% (1)

- Problems On Individual Taxation AY 2020-21 StudentsDocument9 pagesProblems On Individual Taxation AY 2020-21 StudentsAminul Islam RubelNo ratings yet

- STT - Mock - Test - S-24 - Suggested AnswersDocument8 pagesSTT - Mock - Test - S-24 - Suggested AnswersabdullahNo ratings yet

- Islamic Banking - Profit Calculation On Deposits Home AssignmentDocument1 pageIslamic Banking - Profit Calculation On Deposits Home AssignmentSyed Qasim GhaniNo ratings yet

- TM PQsDocument9 pagesTM PQsAnooshayNo ratings yet

- BUS 142 - Exercises CH 11Document10 pagesBUS 142 - Exercises CH 11Jess IcaNo ratings yet

- Calculating PAYE (Pay As You Earn) : Please Read Page 10 - 11 of The Student ManualDocument3 pagesCalculating PAYE (Pay As You Earn) : Please Read Page 10 - 11 of The Student Manualjadeaa54345No ratings yet

- Review Questions For Final Exam ACC210Document13 pagesReview Questions For Final Exam ACC210AaaNo ratings yet

- DBH Finance PLC.: Current Month (BDT) Cumulative (BDT) ParticularsDocument1 pageDBH Finance PLC.: Current Month (BDT) Cumulative (BDT) ParticularsHossainmoajjemNo ratings yet

- Lagrimas, Sarah Nicole S. - PC&OL PART 2Document3 pagesLagrimas, Sarah Nicole S. - PC&OL PART 2Sarah Nicole S. LagrimasNo ratings yet

- Intermediate Accounting 3: PROBLEM 1-11Document3 pagesIntermediate Accounting 3: PROBLEM 1-11Gemmalyn JulatonNo ratings yet

- Assignment 4 - SolutionsDocument2 pagesAssignment 4 - SolutionsstoryNo ratings yet

- Calculating Present Value of Restructured NoteDocument5 pagesCalculating Present Value of Restructured NoteClarisse AnnNo ratings yet

- MMW - Activity 7Document2 pagesMMW - Activity 7Hazel TanongNo ratings yet

- Tutanes, Ma. Angelita 3BAM5ADocument2 pagesTutanes, Ma. Angelita 3BAM5AMaxGel De VeraNo ratings yet

- Income From Salaries: Rs. Rs. Rs. SCH - NoDocument3 pagesIncome From Salaries: Rs. Rs. Rs. SCH - NoBilalNo ratings yet

- Questions & Answers - Salary IncomeDocument14 pagesQuestions & Answers - Salary IncomeKiran BendeNo ratings yet

- Accrued Liability Asnwer KeyDocument4 pagesAccrued Liability Asnwer KeyNecitas Cortez PanuganNo ratings yet

- Tax On CompensationDocument26 pagesTax On Compensationtyrone inocenteNo ratings yet

- Eva StatisticsDocument3 pagesEva StatisticsBaron Mumo MuiaNo ratings yet

- Latihan Soal Chapter 21 - Yoga Cipta Nugraha - 1181002067 - Sesi 12Document7 pagesLatihan Soal Chapter 21 - Yoga Cipta Nugraha - 1181002067 - Sesi 12Yoga Cipta NugrahaNo ratings yet

- M 14 IPCC Taxation Guideline AnswersDocument14 pagesM 14 IPCC Taxation Guideline Answerssantosh barkiNo ratings yet

- Alinaz Spa and Beauty7374Document10 pagesAlinaz Spa and Beauty7374Mallik DCNo ratings yet

- NVC FinanceDocument4 pagesNVC FinanceĐặng Hồng NhungNo ratings yet

- Self Employed Tax ContributionDocument4 pagesSelf Employed Tax ContributionLe-Noi AndersonNo ratings yet

- (Answers) R1 20200924153547prl3 - Final - ExamDocument21 pages(Answers) R1 20200924153547prl3 - Final - ExamArslan HafeezNo ratings yet

- Income Statement For The Year Ended, December, 31, 2016: Pt. ZaliaDocument4 pagesIncome Statement For The Year Ended, December, 31, 2016: Pt. ZaliaNofi Nurlaila0% (1)

- Appendix D Accounting For Deferred Income TaxesDocument2 pagesAppendix D Accounting For Deferred Income TaxesLan Hương Trần ThịNo ratings yet

- Template 2 Task 3 Calculation Worksheet - BSBFIM601Document17 pagesTemplate 2 Task 3 Calculation Worksheet - BSBFIM601Writing Experts0% (1)

- Prelim Topic 1 2ansDocument6 pagesPrelim Topic 1 2ansKenneth Forro TorresNo ratings yet

- Salary IllustrationDocument10 pagesSalary IllustrationSarvar Pathan100% (1)

- Impusto A La Renta 2022 P. N. V Cat.Document18 pagesImpusto A La Renta 2022 P. N. V Cat.STEFANIA ANGGIE ALVAREZ SILESNo ratings yet

- 2021 - FM Past Paper SolutionDocument3 pages2021 - FM Past Paper SolutionInox HassanNo ratings yet

- DO IT Salary Income With SolutionDocument3 pagesDO IT Salary Income With SolutionAnsary LabibNo ratings yet

- Government Grant ActivitiesDocument5 pagesGovernment Grant Activitiesjoong wanNo ratings yet

- Cash Management: Sale of EquipmentDocument4 pagesCash Management: Sale of EquipmentjohnNo ratings yet

- Manny Company: Required: Compute For The Balances of The Following On December 31, 2X14Document4 pagesManny Company: Required: Compute For The Balances of The Following On December 31, 2X14MauiNo ratings yet

- Government Rank and File Employee Summary of Compensation and Benefits in 2020Document4 pagesGovernment Rank and File Employee Summary of Compensation and Benefits in 2020kate bautistaNo ratings yet

- Year 2021 2022 2023 2024 2025 Opening Balance Projected Cash Flow StatementDocument1 pageYear 2021 2022 2023 2024 2025 Opening Balance Projected Cash Flow StatementLailanie NuñezNo ratings yet

- Ca Ipcc Taxation Guideline Answer For May 2016 ExamDocument8 pagesCa Ipcc Taxation Guideline Answer For May 2016 Examileshrathod0No ratings yet

- 2015 Annual Accomplishment ReportDocument8 pages2015 Annual Accomplishment ReportAngelica Aquino GasmenNo ratings yet

- Casibang OEDocument2 pagesCasibang OEKrung KrungNo ratings yet

- Sample FsDocument3 pagesSample FsLocel Maquiran LamosteNo ratings yet

- Paper 4Document16 pagesPaper 4Kali KhannaNo ratings yet

- MT Test Review-Taxation 1-Win 2024Document4 pagesMT Test Review-Taxation 1-Win 2024Mariola AlkuNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Truth in Lending NotesDocument2 pagesTruth in Lending NotesRyDNo ratings yet

- Philippine Competition Act NotesDocument5 pagesPhilippine Competition Act NotesRyDNo ratings yet

- Truth in Lending Portfolio RequirementDocument1 pageTruth in Lending Portfolio RequirementRyDNo ratings yet

- DPA Portfolio RequirementDocument1 pageDPA Portfolio RequirementRyDNo ratings yet

- AMLA NotesDocument5 pagesAMLA NotesRyDNo ratings yet

- Bank Secrecy Law NotesDocument3 pagesBank Secrecy Law NotesRyDNo ratings yet

- Bank Secrecy Law Portfolio RequirementDocument1 pageBank Secrecy Law Portfolio RequirementRyDNo ratings yet

- Truth in Lending Portfolio RequirementDocument1 pageTruth in Lending Portfolio RequirementRyDNo ratings yet

- 01 PdicDocument51 pages01 PdicRyDNo ratings yet

- Bouncing Checks Portfolio RequirementDocument1 pageBouncing Checks Portfolio RequirementRyDNo ratings yet

- HOW TO CALCULATE THE NUMBER OF BASKETS A WEAVER CAN FINISH IN A WEEK USING FRACTIONS, DECIMALS AND PERCENTAGESDocument9 pagesHOW TO CALCULATE THE NUMBER OF BASKETS A WEAVER CAN FINISH IN A WEEK USING FRACTIONS, DECIMALS AND PERCENTAGESRyDNo ratings yet

- PDIC NotesDocument5 pagesPDIC NotesRyDNo ratings yet

- Quizzer On Withholding of Monthly Tax Compensation IncomeDocument10 pagesQuizzer On Withholding of Monthly Tax Compensation IncomeRyDNo ratings yet

- PDIC Portfolio RequirementDocument1 pagePDIC Portfolio RequirementRyDNo ratings yet

- Illustrative Problem On Adjusted Bank MethodDocument15 pagesIllustrative Problem On Adjusted Bank MethodRyDNo ratings yet

- Withholding Tax On Monthly Compensation IncomeDocument11 pagesWithholding Tax On Monthly Compensation IncomeRyDNo ratings yet

- Notes in Judicial Department (Philippine Constitution)Document19 pagesNotes in Judicial Department (Philippine Constitution)RyD100% (1)

- Discussion On FractionsDocument9 pagesDiscussion On FractionsRyDNo ratings yet

- VAT BackgroundDocument6 pagesVAT BackgroundRyDNo ratings yet

- How to determine VATDocument5 pagesHow to determine VATRyDNo ratings yet

- Withholding Tax On Annual Compensation IncomeDocument7 pagesWithholding Tax On Annual Compensation IncomeRyDNo ratings yet

- Notes in Executive Department (Philippine Constitution)Document14 pagesNotes in Executive Department (Philippine Constitution)RyDNo ratings yet

- Compensation IncomeDocument21 pagesCompensation IncomeRyDNo ratings yet

- Three Powers of TaxationDocument24 pagesThree Powers of TaxationRyDNo ratings yet

- Notes in Writ of Habeas Data (Philippine Law)Document5 pagesNotes in Writ of Habeas Data (Philippine Law)RyDNo ratings yet

- Legislative Dept Powers & LimitsDocument20 pagesLegislative Dept Powers & LimitsRyDNo ratings yet

- Notes in Writ of Amparo (Philippine Law)Document13 pagesNotes in Writ of Amparo (Philippine Law)RyDNo ratings yet

- Anti Money Laundering Act (Philippine Law)Document11 pagesAnti Money Laundering Act (Philippine Law)RyDNo ratings yet

- Accounting Textbook Solutions - 50Document19 pagesAccounting Textbook Solutions - 50acc-expertNo ratings yet

- Bab 3 (Inggris)Document21 pagesBab 3 (Inggris)Nadira Fadhila HudaNo ratings yet

- APTC form-40-A-GPFDocument2 pagesAPTC form-40-A-GPFvijay_dilse100% (1)

- Shabnam Ahuja - JanDocument2 pagesShabnam Ahuja - JanLove LoveNo ratings yet

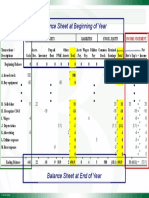

- Balance Sheet at Beginning of Year: Cash FlowDocument1 pageBalance Sheet at Beginning of Year: Cash FlowluisNo ratings yet

- Team Energy Corporation Vs CIRDocument3 pagesTeam Energy Corporation Vs CIRMark Gilverton Buenconsejo Ignacio67% (3)

- Financial Management Strategy-MBA-731: Work-SheetDocument8 pagesFinancial Management Strategy-MBA-731: Work-SheetEyuael SolomonNo ratings yet

- McqsDocument2 pagesMcqsMuhammad AhmedNo ratings yet

- Ratio-rate-speed-G 7Document2 pagesRatio-rate-speed-G 7tripti aggarwalNo ratings yet

- Chapter 18 Part 1Document61 pagesChapter 18 Part 1Hannah KatNo ratings yet

- Incremental Analysis: Summary of Questions by Objectives and Bloom'S Taxonomy True-False StatementsDocument43 pagesIncremental Analysis: Summary of Questions by Objectives and Bloom'S Taxonomy True-False StatementsMarcus MonocayNo ratings yet

- Labor Exercise - Cost AccountingDocument3 pagesLabor Exercise - Cost AccountingKolins ChakmaNo ratings yet

- Irem Vol IiDocument67 pagesIrem Vol IiVeera ChaitanyaNo ratings yet

- Problems in TAX Collection in PakistanDocument20 pagesProblems in TAX Collection in PakistanAmjad HussainNo ratings yet

- Corporate Reporting Paper 3.1march 2023Document28 pagesCorporate Reporting Paper 3.1march 2023JAMAN SOUTH MUNICIPAL HEALTH DIRECTORATENo ratings yet

- Accounting For Manufacturing OperationsDocument49 pagesAccounting For Manufacturing Operationsgab mNo ratings yet

- Reviewer-IN-FAR - Lecture Notes Financial Accounting and Reporting 1-10 Reviewer-IN-FAR - Lecture Notes Financial Accounting and Reporting 1-10Document4 pagesReviewer-IN-FAR - Lecture Notes Financial Accounting and Reporting 1-10 Reviewer-IN-FAR - Lecture Notes Financial Accounting and Reporting 1-10Jocelyn TejerosNo ratings yet

- Debt Restructuring SummaryDocument5 pagesDebt Restructuring SummaryLady PilaNo ratings yet

- Multiple Choice - Problems Part 1: A. Percentage TaxDocument8 pagesMultiple Choice - Problems Part 1: A. Percentage TaxheyheyNo ratings yet

- Bba 407 - Management AccountingDocument10 pagesBba 407 - Management AccountingSimanta KalitaNo ratings yet

- Akuntansi 1Document1 pageAkuntansi 1Bintang FitriNo ratings yet

- Korbel Foundation College Inc.: (Messenger)Document2 pagesKorbel Foundation College Inc.: (Messenger)Jeanmay CalseñaNo ratings yet

- Cost AccountingDocument122 pagesCost Accountingkaran kNo ratings yet

- Lesson 1 Working Capital MGTDocument6 pagesLesson 1 Working Capital MGTklipordNo ratings yet

- Final Exam Preparation Auditing II: Condition Yang Terjadi Dan Mempengaruhi Akun-Akun Sebelum TanggalDocument5 pagesFinal Exam Preparation Auditing II: Condition Yang Terjadi Dan Mempengaruhi Akun-Akun Sebelum TanggalAlvira FajriNo ratings yet