Professional Documents

Culture Documents

Engineering Economics: Lectures 2 Topics

Engineering Economics: Lectures 2 Topics

Uploaded by

Lahiru Kosala Bandara LindamullaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Engineering Economics: Lectures 2 Topics

Engineering Economics: Lectures 2 Topics

Uploaded by

Lahiru Kosala Bandara LindamullaCopyright:

Available Formats

Engineering Economics

Lectures 2 Topics:

• Project Life Cycle Concepts and

Cost Estimating

• Learning Curve

• Breakeven Analysis

Saleh Abu Dabous 401301 1

Projects Life Cycle

• Similar to human projects go through life cycle.

– A process through which a project is implemented

from cradle to grave.

• Project life cycle can be decomposed into

several stages (phases).

• Each phase of the life cycle has duration.

– The project reach a peak point and then terminate.

Saleh Abu Dabous 401301 2

•The following figure illustrate the typical phases that

a product, goods, or services progress through over

its life cycle (Text Book).

Saleh Abu Dabous 401301 3

Projects Life Cycle Costing:

• Life-cycle costing is the concept of designing

products, goods and services with a full

recognition of the associated costs over the

various phases of their life cycles.

• Life cycle costing key concepts:

– The later a design change is made, the higher the

cost.

– Decisions made early in the life cycle tend to ‘lock

in’ costs that will be incurred later.

Saleh Abu Dabous 401301 4

• Costs are committed early in the project life cycle:

- In the following figure, nearly 70% – 90% of all costs are set (decided) during

the design phase while only 10% - 30% of cumulative life cycle cost have been

spent (Text Book).

Saleh Abu Dabous 401301 5

• Downstream (late in the life cycle) project changes are more costly and upstream

(early in the life cycle) are easier and less costly.

Saleh Abu Dabous 401301 6

Project Cost Estimating

Cost Estimating is the process of

collecting, analyzing, and summarizing

data in order to prepare and educated

projection of the anticipated cost of a

project.

Saleh Abu Dabous 401301 7

• Difficulties in Estimation:

Cost estimating is a difficult task since it is not

easy to foresee future economic consequences.

The following are some aspects that make cost

estimating a challenging task:

– One-of-a-kind estimates:

• First time projects are difficult to estimate their

costs. Consider difficulties faced by space

agencies while developing cost estimates for the

first time missions.

• Normally, new products cost estimates are

developed using data from similar products with

known costs (estimate by analogy).

Saleh Abu Dabous 401301 8

• Difficulties in Estimation:

– Time and effort available:

• Cost estimating is constrained by time and the

availability of person-power.

• To develop detailed estimates resources must be

planned.

– Estimator expertise:

• The more experienced and knowledgeable the

estimator is, the more accurate the estimate will

be.

Saleh Abu Dabous 401301 9

Types of Cost Estimate

• Three general types of estimates can be

defined:

1) Rough estimates (Order-of-magnitude

estimates):

– An estimate made without detailed engineering

data.

– Used for project’s initial feasibility, planning and

evaluation phases.

– Quick and easy estimate.

– Accuracy: -30% to +60%.

Saleh Abu Dabous 401301 10

2) Budget estimates:

– Used for budgeting purpose at the conceptual

or preliminary design stages of a project.

– Budget refers to owner budget and not to the

budget as a project control document.

– These estimates are more detailed and require

more resources than the rough estimates.

– Prepared using flow sheets, layouts and

equipment details.

– Accuracy: -15% to +20%.

Saleh Abu Dabous 401301 11

3) Detailed estimates:

– Used during project’s detailed design and

contract bidding phase.

– Prepared using detailed quantitative models,

specification sheets and vendor quotes.

– Require the most time and resources to develop

and thus more accurate than rough or budget

estimate.

– Accuracy: -3% to +5%.

Saleh Abu Dabous 401301 12

Cost Estimating Models

• Cost estimating models can be used at

rough, budget and detailed levels.

• Rough estimates are used with rough data

and detailed estimate are used with

detailed data.

• Cost estimating models:

Per-Unit, Segmenting, Cost Indexes, and

Power-Sizing.

Saleh Abu Dabous 401301 13

1) Per-Unit Model:

• This model uses per unit factor, such as cost per

square foot, to develop the estimate desired.

• Simplistic and used to develop order of

magnitude estimates.

• For example if you are interested in building

2000 square foot floor plan house. A contractor

may quote a $65 per square foot for your house.

The house total cost = 2000 x 65 = $130,000.

Saleh Abu Dabous 401301 14

2) Segmental Model:

• An estimate is decomposed into its individual

components. Cost estimates are made at those

lower levels, and then the estimate is aggregated

(added) back together.

• Scheme developed from decomposing cost

elements is known as work breakdown structure.

Saleh Abu Dabous 401301 15

Define WBS for Products (House)

1.0

House

1.1 1.2 1.3 1.4

Concrete Roofing Electrical Interior

1.1.1 Foundations 1.2.1 Felt 1.3.1 House Wiring 1.4.1Wall

1.1.2 Side Walks 1.2.2 Shingles 1.3.2 Garage Wiring 1.4.2 Cabinets

1.1.3 Patio 1.2.3 Roof Caps 1.3.3 Outlet/Switches 1.4.3 Trim

1.1.4 Landscaping 1.3.4 Service Cable 1.4.4 Carpet

1.6

1.5 1.3.5 Fixtures 1.4.5 Exterior Brick

Framing Window / Doors

1.7

1.6.1 Windows

Plumbing

1.5.1 Exterior Walls

1.5.2 Interior Walls

1.6.2 Exterior Doors

1.7.1 Waste Lines

1.5.3 Trusses 1.6.3 Interior Doors 1.7.2 Water lines

Saleh Abu Dabous 401301 16

Example:

You are the production engineer for Clean Lawn Corp. The

company is planning to develop a new lawn mower called the

Grass Eater. The accounting department contacted you to

estimate the cost of the material that will makeup the new

mower. The material cost will be used, along with estimates

for labour and overhead to evaluate the potential of this new

model.

Solution:

You Use a segmenting approach to develop estimates. To

develop the estimate, decompose the design specifications

into its components, estimate the material costs for each

components, and then add these costs up to obtain the

material overall estimate.

Saleh Abu Dabous 401301 17

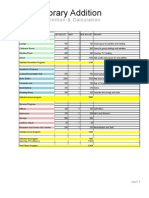

After studying the design and the specification, you divide the

mower into the following major subsystem: chassis, drive

train, controls, and cutting and collecting system.

The total material cost estimate of $163.45 is estimated by

adding the estimates of the four major components.

Saleh Abu Dabous 401301 18

3) Cost Indexes:

• Cost indexes are historical records of engineering

(and other) elements.

• Cost indexes reflect relative price change in either

individual cost items (labour, material, utilities) or

group of costs (consumer prices, producer prices)

• Indexes can be used to update historical costs

with the basic ratio relationship given in the

following equation:

Cost at time A Index valu e at time A

Cost at time B Index valu e at time B

Saleh Abu Dabous 401301 19

Example:

An engineer is interested in estimating the annual labour and

material costs for a new production facility. She was able to

obtain the following cost data:

• Labour costs:

– Labour cost index was at 124 ten years ago and is 188

today.

– Annual labour costs for a similar facility were $575,500 ten

years ago.

• Materials

– Material cost index value was at 544 three years ago and

is 715 today.

– Annual material costs for a similar facility were $2,455,000

three years ago.

Saleh Abu Dabous 401301 20

Solution:

Labour:

Annual cost today Index valu e today

Annual cost 10 years ago Index valu e 10 years ago

Annual cost today = 188/124 x $575,500 = $871,800

Material:

Annual cost today Index valu e today

Annual cost 3 years ago Index valu e 3 years ago

Annual cost today = 715/544 x $2,455,000 = $3,227,000

Saleh Abu Dabous 401301 21

- Location Indexes:

• Some factors affect cost in different locations:

1. Transport cost

2. Labour supply and local productivity

3. Codes and local inspection

• Published indices of local construction costs in

major cities can be used to account for these

elements.

Cost at location A Index for location A

Cost at location B Index for location B

Saleh Abu Dabous 401301 22

4) Power-Sizing Model:

• Used to estimate the cost of industrial plants and

equipments.

• The model scales up or scales down known costs.

• The power-sizing model use the exponent (x), called the

power-sizing exponent to represent economics of scale in

size or capacity:

x

Cost of equipment A Size (capicity) of equipment A

Cost of equipment B Size (capicity) of B

Where cost of A and B are the same point in time (same

dollar basis)

Saleh Abu Dabous 401301 23

• The power sizing exponent values for plants and

equipments of many types are found in several sources

such as reference books and technical journals.

• The following table gives this exponent for some

industrial facilities and equipments (Text Book).

Saleh Abu Dabous 401301 24

Example – Order of Magnitude:

A 300-mlpd (million liters per day) water treatment

plant is proposed to be built in 2020 for Sharjah,

UAE. A 200-mlpd plant using the same treatment

process was built in 2013 in Jeddah, Saudia Arabia

for $60,000,000. Make an order of magnitude

estimate based on the following additional

information and assumptions.

1. Poor site condition in Jeddah required an additional

$4,000,000 for foundations, which is not anticipated for

Sharjah.

2. Assume the size exponent m = 0.67.

3. Assume inflation will persist at an average 0.5 % per

month.

Saleh Abu Dabous 401301 25

4. Assume the location index for Jeddah is 1.17 and is

1.24 for Sharjah.

5. A new high-pressure filter process will be added at

Sharjah at an additional cost of $5,000,000.

6. The contingency cost due to labour availability will be

reduced by the amount of 1% of total construction

cost because of the availability skilled labour in

Sharjah.

On the basis of the above conditions, estimate the

cost for the new project.

Saleh Abu Dabous 401301 26

Solution:

1. Typical cost excluding the additional cost due to poor

site conditions in Jeddah

$60 million - $4 million = $ 56 million

2. Adjustment for capacity based on the exponential law

yields

($56)(300/200)0.67 = (56) (1.5)0.67 = $73.480 million

3. Adjustment for inflation leads to the cost in 2018 dollars

as: ($73.480)(1.005)84 = $111.717 million

4. Adjustment for location index gives

($111.717)(1.24/1.17) = $118.401 million

5. Adjustment for the additional filter at Sharjah plant gives

$118.401 million + $5 million = $123.401 million

Saleh Abu Dabous 401301 27

6. Reduction in contingency cost yields:

($123.401)(1-0.01) = $122.167 million

The order of magnitude estimate for the new project is

$122.167 million.

Saleh Abu Dabous 401301 28

• Classification of the different cost

concepts:

– Fixed costs are constant regardless of the level of output

or productivity. In contrast variable costs depend on the

level of output or activity.

– Marginal cost is the cost for one more unit, while average

cost is the total cost divided by the number of units.

– Sunk cost is money already spent as a result of past

decision.

• Sunk cost should be disregarded in our engineering

economic analysis because current decisions cannot

change the past.

Saleh Abu Dabous 401301 29

• Classification of the different cost

concepts:

– Opportunity cost is associated with using a

resource in one activity instead of another.

• Every time we use a business resource (equipment,

dollar, manpower, etc.) in one activity we give up the

opportunity to use the same resource in that time in

some other activity.

– Incremental costs refer to the principle that when

one makes a choice among a set of competing

alternatives, the emphasis should be on the

differences between those alternatives.

Saleh Abu Dabous 401301 30

Learning Curve

– As the number of repetition increases,

performance becomes faster

– Learning Curve Rate: A percentage or rate at

which output is increased due to repetition:

– Estimating time in repetitive tasks:

TN=TInitial x Nb

• TN = time required for Nth unit of production

• TInitial = time required for the first unit of production

• N = number of completed units

• b = learning curve exponent = log (learning curve as

decimal)/log 2.0

Saleh Abu Dabous 401301 31

Example:

Time to produce first unit: 32 minutes

Learning curve rate: 80%

Time to produce 100th unit: ?

Solution:

T100=T1 x Nlog 0.80 / log 2.0

= 32.0 x 100-0.3219

= 7.27 minutes

Saleh Abu Dabous 401301 32

Example:

Estimate the overall labour cost for a task with a

learning curve rate of 85%. The task reaches a

steady state after 16 units of 5 minutes per unit.

The task consists of 20 units and require 2

workers. The worker rate = $22/hour

Solution:

T16=T1 x Nlog 0.85 / log 2.0

5.0 = T1 x 16-0.2345

T1 = 9.6 minutes

Saleh Abu Dabous 401301 33

Calculate the time requirements for each unit (Unit 1

to 20) using: TN = 9.6 x N -0.2345

The total time for the task is 119.8 minutes (2 hours)

Total labour cost = 2 hours x $22/hour x 2 workers

= $88

Saleh Abu Dabous 401301 34

Breakeven Analysis

• Breakeven analysis attempts to reflect the

cost and revenue performances.

• One objective: Find the breakeven quantity

for a decision variable to achieve specific

profit.

• This quantity is the breakeven point, QBE.

• To do that: Analyze the revenue and cost

performance to estimate QBE.

Saleh Abu Dabous 401301 35

Cost Models – Fixed Costs

• Fixed Costs – Cost that do not vary with

production or activity levels:

– Costs of buildings;

– Insurance;

– Fixed Overhead;

– Equipment capital recovery….etc.

• If no level of activity, fixed costs continue:

– Shut down the activity to eliminate fixed costs;

Saleh Abu Dabous 401301 36

Cost Models-Variable Costs

• Variable Costs change with the level of

activity:

– More activity – greater variable costs;

– Less activity – lower variable costs;

• Variable costs are impacted by efficiency

of operation, improved designs, quality,

safety, and higher sales volume.

Saleh Abu Dabous 401301 37

Cost Models-Variable Costs

• Costs that vary with the level of activity:

– Direct Labor – wages;

– Materials;

– Marketing;

– Advertising;

– Warranty;

– Etc.

Saleh Abu Dabous 401301 38

Breakeven Analysis

• Revenue is total amount of money

collected from selling products or services.

• At a specific quantity Q, the revenue and

the total cost relations intersect:

– This is the breakeven point QBE

• Revenue and cost relations can be linear

or nonlinear.

Saleh Abu Dabous 401301 39

Total Costs

• Total Cost = Fixed Costs + Variable Costs;

TC = FC + VC

where VC can be linear or nonlinear.

Saleh Abu Dabous 401301 40

Linear Breakeven

BE point

changes

when the

VC is

lowered

Figure 16-2 Effect on the breakeven point when the variable cost per unit is reduced.

Saleh Abu Dabous 401301 41

Linear Breakeven

• Profit Relationships:

Profit = Revenue – Total Cost

P = R – TC

P = R –{FC + VC}

• If revenue and total cost are linear, the QBE can

be derived by equating revenues to total costs:

R = TC

Saleh Abu Dabous 401301 42

Linear Breakeven

R = TC

rQBE = FC + VC = FC + vQBE

where r is revenue per unit and v is variable

cost per unit

QBE = FC / (r – v)

Saleh Abu Dabous 401301 43

Example:

A Corporation assembles up to 30 trailers per month for 18 wheel

trucks. Production has dropped to 25 units per month over the last 5

months due to a worldwide economic slow down in transportation

services. The following information is available.

Fixed costs FC = $750,000 per month

Variable cost per unit v = $35,000

Revenue per unit r = $75,000

(a) How does the reduced production level of 25 units per month

compare with the current breakeven point?

(b) What is the current profit level per month for the facility?

(c) What is the difference between the revenue and variable cost per

trailer that is necessary to break even at a monthly production level of

15 units, if fixed costs remain constant?

Saleh Abu Dabous 401301 44

Solution:

(a) Use the equation to determine the breakeven number of units. All

dollar amounts are in $1000 units.

QBE = FC / (r – v) = 750 / (75 – 35) = 18.75 units per month

The following figure is a plot of R and TC lines. The breakeven

value is 18.75, or 19 in integer trailer units. The reduced production

level of 25 units is above the breakeven value.

Saleh Abu Dabous 401301 45

Solution:

(b) To estimate profit in $1000 at Q = 25 units per month:

Profit = R - TC = rQ - (FC + vQ)

= (r - v)Q - FC

= (75 - 35)25 - 750

= $250

There is a profit of $250,000 per month currently.

(c) To determine the required difference r - v, use the equation with

profit = 0, Q = 15, and FC = $750,000. In $1000 units,

0 = (r - v)(15) - 750

r - v = 750/15 = $50 per unit

The spread between r and v must be $50,000. If v stays at $35,000,

the revenue per trailer must increase from $75,000 to $85,000 just

to break even at a production level of Q =15 per month.

Saleh Abu Dabous 401301 46

You might also like

- ITES & BPO - Opportunity To Move Up The Value ChainDocument30 pagesITES & BPO - Opportunity To Move Up The Value Chainsgurwe03100% (4)

- Central CityDocument5 pagesCentral Cityyani gemuel gatchalian100% (1)

- Specification and Estimation: Innovative WorkDocument11 pagesSpecification and Estimation: Innovative WorkSibi NvnNo ratings yet

- 22 Earned Value PDFDocument68 pages22 Earned Value PDFSureshKumar100% (1)

- Nature ViewDocument4 pagesNature ViewRituja RaneNo ratings yet

- Project Management Complete OutlinesDocument13 pagesProject Management Complete OutlinesMohd ZainNo ratings yet

- Rough Cost EstimateDocument31 pagesRough Cost EstimateRajan Ranjan100% (2)

- Life Cycle of Civil Engineering ProjectsDocument28 pagesLife Cycle of Civil Engineering ProjectsMarvin Bryant MedinaNo ratings yet

- Feasibility Study - EngDocument107 pagesFeasibility Study - EngyakarimNo ratings yet

- Business Analyst Resume SampleDocument16 pagesBusiness Analyst Resume SampleAndy NguyenNo ratings yet

- 498 Quality Plan Pressure VesselDocument20 pages498 Quality Plan Pressure Vesseldharwin100% (5)

- Guidelines for Estimating Greenhouse Gas Emissions of ADB Projects: Additional Guidance for Clean Energy ProjectsFrom EverandGuidelines for Estimating Greenhouse Gas Emissions of ADB Projects: Additional Guidance for Clean Energy ProjectsNo ratings yet

- Final Draft Project Management AssignmenDocument20 pagesFinal Draft Project Management AssignmenAmy SyahidaNo ratings yet

- Developing Owner Cost EstimateDocument113 pagesDeveloping Owner Cost EstimateTalitha FauziarNo ratings yet

- Project Management Lecturenote c5 CostDocument35 pagesProject Management Lecturenote c5 CostTâm ĐặngNo ratings yet

- Practical Project Management: Learning to Manage the Professional, Second EditionFrom EverandPractical Project Management: Learning to Manage the Professional, Second EditionRating: 2.5 out of 5 stars2.5/5 (2)

- Estimation 8th 110215Document19 pagesEstimation 8th 110215Hammad Bashir GondalNo ratings yet

- Fundamentals of Project Management: Lecture 5: Project Scope Management Course Instructor: Owais TahirDocument29 pagesFundamentals of Project Management: Lecture 5: Project Scope Management Course Instructor: Owais TahirYasi EemoNo ratings yet

- CPM - PDF 1Document44 pagesCPM - PDF 1LokeshNo ratings yet

- Internship Report Detailed 3GN16CV082 PDFDocument32 pagesInternship Report Detailed 3GN16CV082 PDFprasanna100% (2)

- Value Engineering in Project FINALDocument14 pagesValue Engineering in Project FINALRaval ShivamNo ratings yet

- Itil 4 Foundation Cheat SheetDocument4 pagesItil 4 Foundation Cheat SheetMiel Ndrainibe100% (2)

- Branches of AccountingDocument15 pagesBranches of AccountingIsrael Liwliwa67% (3)

- EMBA, Project Management, Monitoring and IsDocument41 pagesEMBA, Project Management, Monitoring and Isaron khanNo ratings yet

- 1topic 4 Cost Planning QTS513Document31 pages1topic 4 Cost Planning QTS513Ayomide AdediranNo ratings yet

- BT4 PP Lecture EstimateDocument64 pagesBT4 PP Lecture Estimatelucky dolphinNo ratings yet

- CVL 222Document14 pagesCVL 222Majd KlNo ratings yet

- Ganga DraftDocument9 pagesGanga DraftAmarshanaNo ratings yet

- Fundamentals of Project Control: Conceptual PlanningDocument22 pagesFundamentals of Project Control: Conceptual PlanningHasanNo ratings yet

- Week3Document26 pagesWeek3saqib khanNo ratings yet

- Construction Management Chapter 4Document33 pagesConstruction Management Chapter 4thapitcherNo ratings yet

- Chapter 4Document24 pagesChapter 4Murre MoneyNo ratings yet

- PM592 W8 Final Exam Study GuideDocument17 pagesPM592 W8 Final Exam Study GuideJoham Jamil ZakaiNo ratings yet

- PM ESTIMATES ShareDocument46 pagesPM ESTIMATES ShareGurucharan BhatNo ratings yet

- Chapter I - Introduction To Project ManagemenetDocument9 pagesChapter I - Introduction To Project ManagemenetHadi HamzehNo ratings yet

- Section C - Process Engineers & Design Procedure Rev 2Document22 pagesSection C - Process Engineers & Design Procedure Rev 2NevlinNo ratings yet

- Topic 06 - Estimate IntroDocument95 pagesTopic 06 - Estimate IntroYra Kaina Shane TumimbangNo ratings yet

- Part 3 EstimationDocument27 pagesPart 3 EstimationMuller MuleyNo ratings yet

- Building EconomicsDocument42 pagesBuilding EconomicsRiya VermaNo ratings yet

- Project ControlDocument22 pagesProject ControlNeven Ahmed HassanNo ratings yet

- Project Scope Management: Engr. Bilal Ayub Ce & M Dept, Nit-Scee NUST H-12Document23 pagesProject Scope Management: Engr. Bilal Ayub Ce & M Dept, Nit-Scee NUST H-12Ahsan HameedNo ratings yet

- Project Management: Chapters 3-4Document56 pagesProject Management: Chapters 3-4E Kay MutemiNo ratings yet

- Kyambogo University: Faculty of EngineeringDocument25 pagesKyambogo University: Faculty of Engineeringmpairwe cliffort100% (1)

- EE305 Course Project - Spring 2023Document8 pagesEE305 Course Project - Spring 2023khan aliNo ratings yet

- Systems of Taking Quantities and Estimating: Presentation By: V SemesterDocument14 pagesSystems of Taking Quantities and Estimating: Presentation By: V SemestersambhaviNo ratings yet

- Estimation: BY Prof. TIWARE V.SDocument29 pagesEstimation: BY Prof. TIWARE V.SCareer SetcaNo ratings yet

- QS - 02.01 - Fundamentals of Quantity TakeoffDocument36 pagesQS - 02.01 - Fundamentals of Quantity TakeoffMelian RebamontanNo ratings yet

- Estimation #1Document7 pagesEstimation #1Baban A.BapirNo ratings yet

- EVPM Presentation EH Format PDFDocument19 pagesEVPM Presentation EH Format PDFajayikayodeNo ratings yet

- Lec04.1 Basic Cocomo To StudentsDocument45 pagesLec04.1 Basic Cocomo To StudentsJuwieNo ratings yet

- Lec-7 - Estimation and Its TypesDocument33 pagesLec-7 - Estimation and Its TypesvsvsasasNo ratings yet

- Lecture 6 and 7Document20 pagesLecture 6 and 7عبدالرحمن الحازميNo ratings yet

- P M Block Two 2012Document27 pagesP M Block Two 2012Abdul KadirNo ratings yet

- BSS010-3 - PM - Luton - 2013 - Week 4Document43 pagesBSS010-3 - PM - Luton - 2013 - Week 4Koni DoNo ratings yet

- Module 3Document29 pagesModule 3AHMED ALI S ALAHMADINo ratings yet

- Lecture 7Document40 pagesLecture 7Tamer MohamedNo ratings yet

- Ce155-2 Lecture 1 Quantity Surveying IntroductionDocument11 pagesCe155-2 Lecture 1 Quantity Surveying IntroductionMark PulongbaritNo ratings yet

- COURSE Project (25%) : Electromechanical Motion Devices EE 321Document10 pagesCOURSE Project (25%) : Electromechanical Motion Devices EE 321Assma MohamedNo ratings yet

- Best Practices Awards Nomination Form: This Submission Is For (Please Check One) : Use Separate Form For Each SubmissionDocument16 pagesBest Practices Awards Nomination Form: This Submission Is For (Please Check One) : Use Separate Form For Each SubmissiondennykvgNo ratings yet

- Lec 05Document52 pagesLec 05radwa.mo768No ratings yet

- 2.1 Project ProgrammeDocument9 pages2.1 Project Programmeharmonijayasejahtera.hendraNo ratings yet

- Lecture 3-Engineering EconomicsDocument66 pagesLecture 3-Engineering EconomicsMohannad IsmailNo ratings yet

- Quantity SurveyingDocument8 pagesQuantity Surveyingshahid aliNo ratings yet

- Project Planning Part 1Document24 pagesProject Planning Part 1vinniieeNo ratings yet

- LN C1Document61 pagesLN C1Sivanesh KumarNo ratings yet

- Town Library Addition: Program Definition & CalculationDocument6 pagesTown Library Addition: Program Definition & CalculationJonathan HopkinsNo ratings yet

- Chapter 4 ProblemsDocument11 pagesChapter 4 ProblemsLahiru Kosala Bandara LindamullaNo ratings yet

- Engineering Economics: Lectures 3 Topics: 1) Time Value of Money 2) Interest Concepts 3) Cash Flow Diagram (CFD)Document21 pagesEngineering Economics: Lectures 3 Topics: 1) Time Value of Money 2) Interest Concepts 3) Cash Flow Diagram (CFD)Lahiru Kosala Bandara LindamullaNo ratings yet

- Roof Specification For Solar PAnel Fixing PDFDocument2 pagesRoof Specification For Solar PAnel Fixing PDFLahiru Kosala Bandara LindamullaNo ratings yet

- Sunlock Manual PDFDocument30 pagesSunlock Manual PDFLahiru Kosala Bandara LindamullaNo ratings yet

- Solid Waste Management in Srilanka: 1. Legislation On SWMDocument6 pagesSolid Waste Management in Srilanka: 1. Legislation On SWMLahiru Kosala Bandara LindamullaNo ratings yet

- Generic PosterDocument1 pageGeneric PosterOem VersionNo ratings yet

- Praveen ResumeDocument3 pagesPraveen Resumepraveenjoshi554No ratings yet

- Chapter 1Document31 pagesChapter 1Anh Thư NgôNo ratings yet

- DBMSDocument9 pagesDBMSMohit SainiNo ratings yet

- Hul Final2Document34 pagesHul Final2Ahsan Abdul Rashid KhanNo ratings yet

- Multi Business StrategyDocument30 pagesMulti Business StrategyEka DarmadiNo ratings yet

- Break Even Analysis FMDocument6 pagesBreak Even Analysis FMRahul RajwaniNo ratings yet

- Assignment - DFIN402 - MBA 4 - Set-1 and 2 - Sep - 2023Document3 pagesAssignment - DFIN402 - MBA 4 - Set-1 and 2 - Sep - 2023nagakoushicksahybNo ratings yet

- Karunakar Jha Resume1Document3 pagesKarunakar Jha Resume1Vikas AhlawatNo ratings yet

- Aqar 2018 19Document154 pagesAqar 2018 19Zoeb MerchantNo ratings yet

- Lesson 6: Health Management Information SystemDocument5 pagesLesson 6: Health Management Information SystemMa. Brittany Stacy Le BerongoyNo ratings yet

- Analysis of Dangote Organization Free Essay Sample OnDocument10 pagesAnalysis of Dangote Organization Free Essay Sample OnSunday Ngbede ocholaNo ratings yet

- Annual Report - 2021 (Part2)Document309 pagesAnnual Report - 2021 (Part2)john morawoNo ratings yet

- Enterprise System Engineering: Course Code: SWE - 304Document8 pagesEnterprise System Engineering: Course Code: SWE - 304syed hasnainNo ratings yet

- Performance ManagerDocument28 pagesPerformance Managersylvioss@gmail.com100% (1)

- Business PlanDocument20 pagesBusiness PlanRalyn Cando AquindeNo ratings yet

- 05 Training and Development, Kusalavainternational LTDDocument72 pages05 Training and Development, Kusalavainternational LTDRAKESH100% (1)

- Mahindra N MahindraaDocument22 pagesMahindra N MahindraaPakiza ShaikhNo ratings yet

- Caso 9 - Desp e Econ Frete MaritimoDocument3 pagesCaso 9 - Desp e Econ Frete MaritimoAdriel VicenteNo ratings yet

- Annual Report Year 2010 PDFDocument182 pagesAnnual Report Year 2010 PDFzafarNo ratings yet

- Experiment No 14Document4 pagesExperiment No 14Harsh NavgaleNo ratings yet

- How To Write A Validation Protocol - PharmaguidelineDocument1 pageHow To Write A Validation Protocol - PharmaguidelineMahmoud MahmoudNo ratings yet

- Griffith University: Oughton Managing Cccupational Risk in Creative IndustryDocument14 pagesGriffith University: Oughton Managing Cccupational Risk in Creative IndustryrifaldiNo ratings yet