Professional Documents

Culture Documents

Act 13.3 Compensation Income

Uploaded by

Skylar Gevirah0 ratings0% found this document useful (0 votes)

92 views2 pagesCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

92 views2 pagesAct 13.3 Compensation Income

Uploaded by

Skylar GevirahCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

Republic of the Philippines

Department of Education

National Capital Region

SCHOOLS DIVISION OFFICE - MALABON CITY

Maya- Maya St., Kaunlaran Village, Longos Malabon City

FUNDAMENTALS OF ACCOUNTANCY, BUSINESS AND MANAGEMENT 2 - ANSWER SHEET

Name:

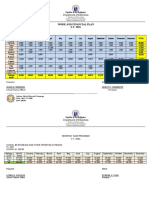

Activity 13.3 ILLUSTRATIVE PROBLEM: COMPENSATION INCOME

Refer to the BIR tax table. Determine the withholding income tax

deduction for each employee below:

a. Julie Perez is a regular employee with a monthly compensation amounting to

P27,554 and with total statutory deductions of P1,439.15

Julie Perez Income Tax Computation

Monthly Income P

Less: Statutory Deductions

Taxable Income

Monthly Tax due P

b. Marlex Baron is a marketer in a beauty company receiving a total of P30,000 a

month with statutory deduction of P1,506.30. Ms. Baron also received a

commission income amounting to P5,500 for the month.

Marlex Baron Income Tax Computation

Monthly Income P

Add: Additional Income

Less: Statutory Deductions

Taxable Income

Republic of the Philippines

Department of Education

National Capital Region

SCHOOLS DIVISION OFFICE - MALABON CITY

Maya- Maya St., Kaunlaran Village, Longos Malabon City

FUNDAMENTALS OF ACCOUNTANCY, BUSINESS AND MANAGEMENT 2 - ANSWER SHEET

Name:

Monthly Tax due P

You might also like

- LAS in Acounting 2 Week 3Document4 pagesLAS in Acounting 2 Week 3dorothytorino8No ratings yet

- LAS FABM2 QTR 2, wk5Document12 pagesLAS FABM2 QTR 2, wk5Kuro KiNo ratings yet

- ENTREP Mod5 LESSON2 - Q2W7Document13 pagesENTREP Mod5 LESSON2 - Q2W7aaaaNo ratings yet

- BM10 Q4W3 VinalonDocument4 pagesBM10 Q4W3 VinalonQuaintrell ArtsNo ratings yet

- Las #4 Fabm2Document2 pagesLas #4 Fabm2Clarisse Paola EsperaNo ratings yet

- Teacher: Section: Subject: Name:: Bitin Integrated National High SchoolDocument4 pagesTeacher: Section: Subject: Name:: Bitin Integrated National High SchoolHeesel RamosNo ratings yet

- Department of Education: Republic of The PhilippinesDocument9 pagesDepartment of Education: Republic of The PhilippinesJeweljoy PudaNo ratings yet

- AE16-IA2 - Module 2Document13 pagesAE16-IA2 - Module 2Jemalyn PiliNo ratings yet

- Las - Week 3.fabm II.Document21 pagesLas - Week 3.fabm II.Jason Tagapan GullaNo ratings yet

- LAS FABM2 QTR 2, wk4Document8 pagesLAS FABM2 QTR 2, wk4Kuro KiNo ratings yet

- Statement of Management ResponsibilityDocument2 pagesStatement of Management ResponsibilityXyza B. LimNo ratings yet

- CELCO - AIS Final RequirementDocument13 pagesCELCO - AIS Final RequirementCindy EvangelistaNo ratings yet

- Activity Sheet Week 5 6 PDFDocument3 pagesActivity Sheet Week 5 6 PDFRomnick PerfinanNo ratings yet

- Evette Jane FabroDocument2 pagesEvette Jane Fabrorealjosh21No ratings yet

- BussinessReport GianDocument2 pagesBussinessReport GianKim TumblodNo ratings yet

- Module 1. Statement of Financial PositionDocument4 pagesModule 1. Statement of Financial PositionDreMoSiJeromeNo ratings yet

- FABM2 Q2 Mod13Document29 pagesFABM2 Q2 Mod13Fretty Mae Abubo100% (3)

- LAC-Documentation-Tool 4Document3 pagesLAC-Documentation-Tool 4DenMark Tuazon-RañolaNo ratings yet

- Summative Test (BusMath)Document1 pageSummative Test (BusMath)Fatima Elsan OrillanNo ratings yet

- G11 Morgan - Busi Math 0402Document2 pagesG11 Morgan - Busi Math 0402Roy De GuzmanNo ratings yet

- Module 2 Statement of Comprehensive IncomeDocument4 pagesModule 2 Statement of Comprehensive IncomePaula DT PelitoNo ratings yet

- CV - Boac, Apple M.Document2 pagesCV - Boac, Apple M.Sto. Nino FaireNo ratings yet

- Sdo Batangas: Department of EducationDocument11 pagesSdo Batangas: Department of EducationKinn JayNo ratings yet

- Our Lady of Fatima University: College of Business and Accountancy City of San Fernando, PampangaDocument40 pagesOur Lady of Fatima University: College of Business and Accountancy City of San Fernando, PampangaMariella CatacutanNo ratings yet

- JonaDocument4 pagesJonaDecilyn JapinanNo ratings yet

- BA 101 - Taxation Quiz #1 Answer Key (Post Test Only)Document7 pagesBA 101 - Taxation Quiz #1 Answer Key (Post Test Only)Aiyana AlaniNo ratings yet

- Contextualized LM in Reading and Writing SkillsDocument7 pagesContextualized LM in Reading and Writing SkillsMary Jane V. Ramones50% (2)

- Updated ResumeDocument3 pagesUpdated ResumeJan Roger YunsalNo ratings yet

- Fabm 2: Quarter 4 - Module 5 Computing Gross Taxable Income and Tax DueDocument21 pagesFabm 2: Quarter 4 - Module 5 Computing Gross Taxable Income and Tax DueFlordilyn DichonNo ratings yet

- Biasura, Jhazreel Mae N. IA 3-Mr. Robert Clarence Lee, CPA Bsa 2BDocument3 pagesBiasura, Jhazreel Mae N. IA 3-Mr. Robert Clarence Lee, CPA Bsa 2BJhazreel BiasuraNo ratings yet

- UntitledDocument11 pagesUntitledMary Rose BuaronNo ratings yet

- Post Activity Report FormDocument5 pagesPost Activity Report FormChristopher B. AlbinoNo ratings yet

- Department of Education: Republic of The PhilippinesDocument8 pagesDepartment of Education: Republic of The PhilippinesJeweljoy PudaNo ratings yet

- Authority To Transfer Accountability For School FundsDocument3 pagesAuthority To Transfer Accountability For School Fundslegaspimichelle229No ratings yet

- Certificate of Appearance: Given This - Day ofDocument5 pagesCertificate of Appearance: Given This - Day ofFLORICEL R. PONCENo ratings yet

- BAM 127 Day 7 - TGDocument11 pagesBAM 127 Day 7 - TGPaulo BelenNo ratings yet

- LAS - Business Finance - Intro To Financial MGMTDocument6 pagesLAS - Business Finance - Intro To Financial MGMTmarissa casareno almueteNo ratings yet

- Letter of SomethingDocument1 pageLetter of SomethingAnonymous CscycwgTNo ratings yet

- Invitation Letter Developing Culture of Service Excellence 01262019Document1 pageInvitation Letter Developing Culture of Service Excellence 01262019ANgel Go CasañaNo ratings yet

- Sdo Batangas: Department of EducationDocument15 pagesSdo Batangas: Department of EducationPrincess GabaynoNo ratings yet

- Questionare First Long ExamDocument1 pageQuestionare First Long ExamMaia Besa Delastrico-AbaoNo ratings yet

- Homeroom Pta Financial-ReportDocument1 pageHomeroom Pta Financial-ReportJoanne Siman OlescoNo ratings yet

- RPMS Cover DesignsDocument35 pagesRPMS Cover DesignsMARK TORRENTENo ratings yet

- Abm 11 Module 1Document5 pagesAbm 11 Module 1Shane AnnNo ratings yet

- ABM11 BussMath Q2 Wk4 Taxable-And-Nontaxable-BenefitsDocument11 pagesABM11 BussMath Q2 Wk4 Taxable-And-Nontaxable-BenefitsArchimedes Arvie Garcia0% (1)

- Applied Economics - Quarter 1: I. Introductory ConceptDocument17 pagesApplied Economics - Quarter 1: I. Introductory ConceptJay B. VillamerNo ratings yet

- Analyses of Business TransactionsDocument6 pagesAnalyses of Business TransactionsSHIERY MAE FALCONITINNo ratings yet

- Fabm2 Learning-Activity-3 - PDFDocument5 pagesFabm2 Learning-Activity-3 - PDFCha Eun WooNo ratings yet

- LP 2ND QUARTER Business Math 2Document49 pagesLP 2ND QUARTER Business Math 2Don't mind me100% (1)

- Bam031 Sas 14 PDFDocument6 pagesBam031 Sas 14 PDFIan Eldrick Dela CruzNo ratings yet

- STVEP Entrepreneurship 10 Q1 LAS4 FINALDocument16 pagesSTVEP Entrepreneurship 10 Q1 LAS4 FINALSun Shine OalnacarasNo ratings yet

- Coc 2016Document4 pagesCoc 2016AudzkieNo ratings yet

- Invitation Government 2022aprilwebinarDocument2 pagesInvitation Government 2022aprilwebinarYom KiroNo ratings yet

- Learning Task Week 3 & 4 AccountingDocument7 pagesLearning Task Week 3 & 4 AccountingMariane Gale SuaNo ratings yet

- Business-Math Q2 W2 M2 LDS Interests-And-Commissions ALG RTPDocument5 pagesBusiness-Math Q2 W2 M2 LDS Interests-And-Commissions ALG RTPABMachineryNo ratings yet

- Printing Bus FINANCE WK 6Document12 pagesPrinting Bus FINANCE WK 6Christine DamasoNo ratings yet

- Bam031 Sas 14 PDFDocument6 pagesBam031 Sas 14 PDFIan Eldrick Dela CruzNo ratings yet

- Business-Math Q2 W3-FinalDocument17 pagesBusiness-Math Q2 W3-FinalLorieanne NavarroNo ratings yet

- MCP - Work.and-Financial - Plan Malauli Word NewDocument2 pagesMCP - Work.and-Financial - Plan Malauli Word NewGhie Yambao SarmientoNo ratings yet