Professional Documents

Culture Documents

LAS FABM2 QTR 2, wk4

Uploaded by

Kuro KiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

LAS FABM2 QTR 2, wk4

Uploaded by

Kuro KiCopyright:

Available Formats

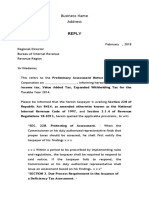

Republic of the Philippines

Department of Education

REGION V

SCHOOLS DIVISION OF MASBATE PROVINCE

CATAINGAN NATIONAL HIGH SCHOOL

LEARNING ACTIVITY

SHEET (LAS) QTR 2, Wk.4

Learner's Information:

Name of Learner:

Grade 12- ABM

Grade Level: S.Y. 2020 - 2021

EDWIN P. ABAL

Name of Teacher: T-III

Learning Area: FUNDAMENTALS OF ACCOUNTING, BUSINESS AND

LEARNING ACTIVITY SHEETMANAGEMENT

No. _____ 2

Address: Poblacion, Cataingan, Masbate

Telephone No.: (056) 578-3469

Republic of the Philippines

Department of Education

REGION V

SCHOOLS DIVISION OF MASBATE PROVINCE

CATAINGAN NATIONAL HIGH SCHOOL

FUNDAMENTALS OF ACCOUNTING, BUSINESS AND MANAGEMENT 2

QUARTER 2, WEEK 4

Name of Student : ______________________________________

Learning Area/Grade Level : ______________________________

Date : ___________________________

Subject Teacher : Mr. Edwin P. Abal, T-III

I – INTRODUCTORY CONCEPT

INCOME AND BUSINESS TAXATION

It is often quoted that there are only two permanent things in this world, CHANGE and

TAXES. Paying taxes is one of the basic resposibilities of every individual.

This topic introduces the basic concepts and fundamentals of income taxation on individuals

deriving income from compensation, business and other sources. For any income earner

who may be an entrepreneur, a practicing professional, a self-employed service contractor

or any person holding multiple jobs, knowledge of taxation is imperative.

Ther ordinary citizens engaged in legitimate trade or business no matter the size, should

have a professiona, knowledge-based approach to paying the correct kind and amount of

taxes. The best references will be the Nationa Internal Revenue Code of the Philippines, RA

8424 (Tax Reform Act of 1997), Tax Reform for Acceleration (Rev. Reg No. 8-2018) Tax

Reform Acceleration and Inclusion “TRAIN” Law and the Revenue Regulations subsequently

issued by the Bureau of Internal Revenue (BIR). Thus, if a responsible citizen generating

income wants to help improve society and bring our country to even greater heights,

knowledge and compliance with taxation rules and regulations are very essential.

Definition of Taxation :

1. Taxation = is the process by which the government, through our lawmakers, raises

income to pay it’s necessary expenses. Our Congress, through our senators and

congressman, enacts tax laws. Tax laws give our government the authority to collect

the necessary taxes from it’s constituents.

2. Taxation = is the process or means by which a sovereign state raises income by

imposing a charge upon persons, properties or rights to enable it to defray the

necessary expenses in discharging the government’s functions.

Address: Poblacion, Cataingan, Masbate

Telephone No.: (056) 578-3469

Republic of the Philippines

Department of Education

REGION V

SCHOOLS DIVISION OF MASBATE PROVINCE

CATAINGAN NATIONAL HIGH SCHOOL

Definition of TAXES :

1. TAXES = are the enforced proportional contributions from persons, properties or

rights by the lawmaking body of the state for the support of the government and all

public needs.

BASIC PRINCIPLES OF A SOUND TAX SYSTEM

1. Fiscal Adequacy :

The government should make sure that the amount of revenue collected is

enough to shoulder it’s different expenses. This would entail proper planning

and budgeting jon the part of our government officials concerned.

2. Theoretical Justice :

The burden of taxation should jbe proportionate to the ability of the taxpayer

to pay it. It should be noted that proportionality does not necessarily mean

equality in the amount of taxes to be paid. Persons who are earning different

amounts of income should not be forced to pay the same amount of income

taxes.

3. Administrative Feasibility :

The tax laws being promulgated by the government should be capable of just

and equitable administration. These must be clear to the taxpayers and can

be easily implemented by the tax authorities.

THREE INHERENT POWERS OF THE GOVERNMENT

1. Eminent Domain

This is the power of the government to take private property, upon payment

of just compensation, to be used for a public purpose.

The state can buy a certain private property, at it’s proper fair market value,

if they see the need for it to be converted to a public road or as a site for a

public hospital. The private citizen cannot refuse as long as the government

could prove that it is indeed for a public purpose.

2. Police Power

Address: Poblacion, Cataingan, Masbate

Telephone No.: (056) 578-3469

Republic of the Philippines

Department of Education

REGION V

SCHOOLS DIVISION OF MASBATE PROVINCE

CATAINGAN NATIONAL HIGH SCHOOL

This is the power of the government to make laws that will promote public

health, morals, safety, and welfare of the people. It can prohibit certain

activities and products if they feel that is detrimental to the people.

3. Taxation

The power of the government to collect taxes that will be used to finance the

different projects needed by the people.

INCOME TAXATION

The two biggest classification of income taxpayers are individuals and corporations.

For income tax purposes, individuals can be further classified into four, namely:

a. Resident citizen = is a Filipino citizen and lives or resides in the Philippines.

b. Non-resident citizens = is a Filipino citizen but does not reside in the Philippines.

c. Resident Alien = is a citizen of another foreign country but resides in the

Philippines during the taxable year.

d. Non-resident Alien (NRA) = is a citizen of another foreign country and does not

reside in the Philippines.

They can be further classified as one who is either:

1. Engaged in trade or business (NRA-ETB)

2. Not engaged in trade or business (NRA-NETB)

A Non-Resident alien individual is considered to be engaged in trade or

business if he or she shall go here in the Philippines and stay here for a total

period of more than 180 days during the calendar year. If this qualification is

not met by a non-resident alien, he or she will be considered as not engaged

in trade or business.

It should be noted that only resident citizens are taxable on income derived

from sources within and outside the Philippines. The other three are to be

taxed on income arising from sources within the Philippines. As an effect,

OFW’s are taxable only on their income arising from sources within the

Philippines. As non-resident citizens, the Philippine government will no longer

collect additional income taxes from their salaries abroad.

Address: Poblacion, Cataingan, Masbate

Telephone No.: (056) 578-3469

Republic of the Philippines

Department of Education

REGION V

SCHOOLS DIVISION OF MASBATE PROVINCE

CATAINGAN NATIONAL HIGH SCHOOL

KINDS OF INCOME

Individuals can earn from at least three kinds of income :

1. Compensation Income = this is the income received by employees working for

different companies. This is usually in the form of salaries, bonuses and allowances.

2. Business Income = this is the income generated by entrepreneurs (business) or by

different professionals like lawyers, doctors, and accountants (professional income).

They do not work as employees of other people.

3. Passive Income = these are income generated by different investments made by the

individual.

For purposes of compensation income and business income taken together will be

called as Gross Income, the following formula will be used.

GROSS INCOME – ALLOWABLE DEDUCTIONS = TAXABLE INCOME

The taxable income will then be subjected to tax rate, to compute for the income tax

payable to the Bureau of Internal Revenue (BIR).

II – LEARNING SKILLS

Define income and business taxation and it’s principles and processes. ABM_FABM12-IIj-15

III – ACTIVITIES –

Exercise – Identify the classification of the follwing individuals whether they are resident

citizens (RC), non-resident citizens (NRC), resident aliens (RA), non-resident aliens engaged

in trade or business (NRA-ETB), or Non-resident aliens not engaged in trade or business

(NRA-NETB) in 2015.

1. __________. Von Harold, a Filipino who was born in Cataingan, is now working as an

Accountant in one of the leading broadcasting company in Canada.

2. __________. Wendy, a Korean national, has been living and working here in the

Philippines since 1994.

3. __________. Jeddy, a Filipino residing in Quezon City visited Hongkong for a three

day leisure trip.

4. __________.Janzel Mae, an American member of a famous international band,

performed in a two day concert held in Cebu and Manila.

Address: Poblacion, Cataingan, Masbate

Telephone No.: (056) 578-3469

Republic of the Philippines

Department of Education

REGION V

SCHOOLS DIVISION OF MASBATE PROVINCE

CATAINGAN NATIONAL HIGH SCHOOL

5. __________. Jay Jasper, a Swedish national and a resident of Panama, stayed here in

the Philippines from February 2015 to December 2015. He is working on a certain

project for a local company.

6. Which is the power of the government to collect taxes that will be used to finance

the different projects needed by the people. ____________.

7. Which is the burden of taxation should be proportionate to the ability of the

taxpayer to pay it. ______________.

8. Which is the income generated by entrepreneurs. They do not work as employees of

other people. ____________.

9. “TRAIN” LAW stands for. ______________________________________________.

10. Gross Income minus Allowable Deductions equals. _________________________.

IV – ANSWER KEY

1. Non-resident citizen (NRC) 2. Resident alien (RA) 3. Resident citizen (RC)

4. Non-resident alien (NRA)

5. N0n-Resident Aliens (NRA-ETB) 6. Taxation 7. Theoretical Justice 8. Business

income

9. Tax Reform for Acceleration and Inclusion. 10. Taxable Income

V – REFERENCE

DepEd Textbook : Fundamentals of Accounting, Business and Management 2 by J.

Beticon et al.

Fundamentals of Accounting, Business and Managemet 2 by Ma. Elenita Balatbat

Cabrera, BBA, MBA, CPA, CMA.

Prepared by :

Edwin P. Abal, T-III

Subject Teacher

Address: Poblacion, Cataingan, Masbate

Telephone No.: (056) 578-3469

Republic of the Philippines

Department of Education

REGION V

SCHOOLS DIVISION OF MASBATE PROVINCE

CATAINGAN NATIONAL HIGH SCHOOL

Address: Poblacion, Cataingan, Masbate

Telephone No.: (056) 578-3469

Republic of the Philippines

Department of Education

REGION V

SCHOOLS DIVISION OF MASBATE PROVINCE

CATAINGAN NATIONAL HIGH SCHOOL

Address: Poblacion, Cataingan, Masbate

Telephone No.: (056) 578-3469

You might also like

- Next Level Tax Course: The only book a newbie needs for a foundation of the tax industryFrom EverandNext Level Tax Course: The only book a newbie needs for a foundation of the tax industryNo ratings yet

- LAS FABM2 QTR 2, wk5Document12 pagesLAS FABM2 QTR 2, wk5Kuro KiNo ratings yet

- Las - Week 3.fabm II.Document21 pagesLas - Week 3.fabm II.Jason Tagapan GullaNo ratings yet

- LAS in Acounting 2 Week 3Document4 pagesLAS in Acounting 2 Week 3dorothytorino8No ratings yet

- Las q2 Fabm 2 Week 4Document10 pagesLas q2 Fabm 2 Week 4Mahika BatumbakalNo ratings yet

- Alcantara - Module 7 - 2ged SS-03Document3 pagesAlcantara - Module 7 - 2ged SS-03Janine AlcantaraNo ratings yet

- Tax101 Module1 General Principle of Taxation PDFDocument14 pagesTax101 Module1 General Principle of Taxation PDFCarl's Aeto DomingoNo ratings yet

- Taxation-for-Development-Narrative-Report Final ReportDocument40 pagesTaxation-for-Development-Narrative-Report Final ReportJackNo ratings yet

- FABM2 12 Quarter2 Week4Document9 pagesFABM2 12 Quarter2 Week4Princess DuquezaNo ratings yet

- Module 1 - Part 2Document4 pagesModule 1 - Part 2trixie maeNo ratings yet

- Pha 066 Module 9 SGDocument14 pagesPha 066 Module 9 SGHannah yssa seguerraNo ratings yet

- Learning Activity 1.1 - Due 8.10Document3 pagesLearning Activity 1.1 - Due 8.10Mhekylha's AñepoNo ratings yet

- MODULE 1 - TAXATION Lesson 2Document9 pagesMODULE 1 - TAXATION Lesson 2Euviel ConsignaNo ratings yet

- Basic Principles of A Sound Tax SystemDocument6 pagesBasic Principles of A Sound Tax SystemhppddlNo ratings yet

- PUBLIC FISCAL ADMINISTRATION - docxSUMDocument20 pagesPUBLIC FISCAL ADMINISTRATION - docxSUMRenalyn FortezaNo ratings yet

- TaxationDocument115 pagesTaxationCoffee VanillaNo ratings yet

- G12 Tan - Busi Ethics 0402Document1 pageG12 Tan - Busi Ethics 0402Roy De GuzmanNo ratings yet

- Block - 3FMA - Group4Document10 pagesBlock - 3FMA - Group4jay diazNo ratings yet

- TaxationDocument5 pagesTaxationGrazel GeorsuaNo ratings yet

- Batangas State University: Taxation and Land ReformDocument4 pagesBatangas State University: Taxation and Land ReformMeynard MagsinoNo ratings yet

- BA 101 - Taxation Quiz #1 Answer Key (Post Test Only)Document7 pagesBA 101 - Taxation Quiz #1 Answer Key (Post Test Only)Aiyana AlaniNo ratings yet

- Income Taxation Module (Mid-Term)Document32 pagesIncome Taxation Module (Mid-Term)Joseph Anthony RomeroNo ratings yet

- Narrative Report On Revenue and Tax Structure by Albert Jerome CasihanDocument11 pagesNarrative Report On Revenue and Tax Structure by Albert Jerome CasihanHealth Planning Unit CHD-MMNo ratings yet

- Additional Learning Activities About Taxation and Land ReformDocument5 pagesAdditional Learning Activities About Taxation and Land ReformSandra GabasNo ratings yet

- TaxationDocument4 pagesTaxationaldeahannahchrisaNo ratings yet

- Lesson Plan TaxesDocument2 pagesLesson Plan TaxesmanilynNo ratings yet

- Taxation Theory and Structure DefinitionDocument8 pagesTaxation Theory and Structure DefinitionMilette CaliwanNo ratings yet

- Reacpaper TAX REFORM FOR ACCELERATION AND INCLUSIONDocument2 pagesReacpaper TAX REFORM FOR ACCELERATION AND INCLUSIONMonica RilveriaNo ratings yet

- Section: Readings in Philippine HistoryDocument10 pagesSection: Readings in Philippine HistoryJomar CatacutanNo ratings yet

- Financial Management in Education Institutions: Rosalie J. MacalosDocument32 pagesFinancial Management in Education Institutions: Rosalie J. MacalosJerome MonferoNo ratings yet

- Pa 103 Philippine Administrative Thoughts and Institutions Module 4 MidtermDocument14 pagesPa 103 Philippine Administrative Thoughts and Institutions Module 4 MidtermLö Räine AñascoNo ratings yet

- DL PA 231-Public Fiscal AdministrationDocument7 pagesDL PA 231-Public Fiscal AdministrationYnohtna AsogadnabNo ratings yet

- Effectiveness of TAX REFORM FOR Acceleration and Inclusion (Train) ActDocument2 pagesEffectiveness of TAX REFORM FOR Acceleration and Inclusion (Train) ActJoyce LumangaNo ratings yet

- Taxation For DevelopmentDocument23 pagesTaxation For DevelopmentHRDS Region 3No ratings yet

- Legal Aspects of Educational FinanceDocument2 pagesLegal Aspects of Educational FinanceCristobal RabuyaNo ratings yet

- Essay in English-1Document5 pagesEssay in English-1Remelda Putri NurdiantyNo ratings yet

- Week 6 - EDITEDDocument3 pagesWeek 6 - EDITEDjoshua seanNo ratings yet

- Public Finance: ANSWER: The Example of This Is When The People FindDocument8 pagesPublic Finance: ANSWER: The Example of This Is When The People FindGian Paula MonghitNo ratings yet

- TaxationDocument14 pagesTaxationMatthew GonzalesNo ratings yet

- AETAX1 Module 1Document20 pagesAETAX1 Module 1Jerome CatalinoNo ratings yet

- Income Taxation - ModuleDocument15 pagesIncome Taxation - ModuleJuniper Murro BayawaNo ratings yet

- Lesson 1 FinalsDocument24 pagesLesson 1 FinalsGracielle EspirituNo ratings yet

- Principles of A Sound Tax SystemDocument3 pagesPrinciples of A Sound Tax SystemhppddlNo ratings yet

- Income and Business Taxation: GradeDocument9 pagesIncome and Business Taxation: GradeTinny Casana100% (1)

- Basic Principles of A Sound Tax SystemDocument6 pagesBasic Principles of A Sound Tax SystemCrisanta MarieNo ratings yet

- Mc-Sse 8 Macroeconomics Group V : Fiscal PolicyDocument35 pagesMc-Sse 8 Macroeconomics Group V : Fiscal PolicyMaria Cristina ImportanteNo ratings yet

- Position Paper RevisedDocument8 pagesPosition Paper RevisedMA. CRISSANDRA BUSTAMANTENo ratings yet

- TaxationDocument5 pagesTaxationChristian Kyle AlejandroNo ratings yet

- Skill Development Programme Roll No - 7914Document65 pagesSkill Development Programme Roll No - 7914Pushkaraj ShindeNo ratings yet

- Chapter 7 TaxationDocument5 pagesChapter 7 TaxationAljun MorilloNo ratings yet

- Lesson 11 Income and Business TaxationDocument51 pagesLesson 11 Income and Business TaxationGelai BatadNo ratings yet

- 2015 Bar Examination Questions in Taxation LawDocument48 pages2015 Bar Examination Questions in Taxation LawMelvin PernezNo ratings yet

- The Effects of Train Law To The Saving and Spending Behavior of The Teaching and NonDocument15 pagesThe Effects of Train Law To The Saving and Spending Behavior of The Teaching and NonPrincess Angela GelliaparangNo ratings yet

- Research Paper About Taxation in The PhilippinesDocument5 pagesResearch Paper About Taxation in The Philippinesp0lolilowyb3100% (1)

- Taxation PPT2Document28 pagesTaxation PPT2tesicojayson13No ratings yet

- SSRN Id4433959Document7 pagesSSRN Id4433959June AlvarezNo ratings yet

- Basic Principles of A Sound Tax SystemDocument6 pagesBasic Principles of A Sound Tax SystemMelvin Franco San Gabriel60% (5)

- Fundamentals of Accountancy, Business and Management 1: 3 Quarter 2 Sem 2021-2022 Learning Activity Sheet 1Document11 pagesFundamentals of Accountancy, Business and Management 1: 3 Quarter 2 Sem 2021-2022 Learning Activity Sheet 1Angel MarinoNo ratings yet

- Module 5: Contemporary Economic Issues Facing The Filipino EntreprenuersDocument5 pagesModule 5: Contemporary Economic Issues Facing The Filipino EntreprenuersMadelyn ArimadoNo ratings yet

- Hrpta Project Proposal 2021 2022Document4 pagesHrpta Project Proposal 2021 2022Kuro Ki100% (1)

- Department of Education: I. Program TitleDocument5 pagesDepartment of Education: I. Program TitleKuro KiNo ratings yet

- Department of Education: Mean Percentile ScoreDocument1 pageDepartment of Education: Mean Percentile ScoreKuro KiNo ratings yet

- Sim Week 4Document15 pagesSim Week 4Kuro KiNo ratings yet

- Sim Week 5Document17 pagesSim Week 5Kuro KiNo ratings yet

- Daily Lesson Log DLL FormatDocument2 pagesDaily Lesson Log DLL FormatKuro KiNo ratings yet

- Revised MCM Progress 2022 SieDocument21 pagesRevised MCM Progress 2022 SieKuro KiNo ratings yet

- Applied Economics: I. Direction: Write The Letter of Your BEST AnswerDocument2 pagesApplied Economics: I. Direction: Write The Letter of Your BEST AnswerKuro KiNo ratings yet

- Carol Ipcrf 2021-2022Document45 pagesCarol Ipcrf 2021-2022Kuro KiNo ratings yet

- Excess Augmentation June 2022Document1 pageExcess Augmentation June 2022Kuro KiNo ratings yet

- Nene R. Merioles, Ceso V: Republic of The Philippines Department of Education Region V Division of MasbateDocument1 pageNene R. Merioles, Ceso V: Republic of The Philippines Department of Education Region V Division of MasbateKuro KiNo ratings yet

- MCM Liquidation RENEWAL ESP - PLACERDocument5 pagesMCM Liquidation RENEWAL ESP - PLACERKuro KiNo ratings yet

- Department of Education: School'S Technical Assistance PlanDocument1 pageDepartment of Education: School'S Technical Assistance PlanKuro KiNo ratings yet

- Module 3 - Q1Document18 pagesModule 3 - Q1Kuro KiNo ratings yet

- General Instructions To Examinees Professional Regulation CommissionDocument1 pageGeneral Instructions To Examinees Professional Regulation CommissionHerald PadillaNo ratings yet

- List of Students - Humss 2 (2022-2023)Document7 pagesList of Students - Humss 2 (2022-2023)Kuro KiNo ratings yet

- School Form 1 (SF 1)Document6 pagesSchool Form 1 (SF 1)Kuro KiNo ratings yet

- Input Data Sheet For SHS E-Class Record: Learners' NamesDocument5 pagesInput Data Sheet For SHS E-Class Record: Learners' NamesKuro KiNo ratings yet

- Merchandiser Mandays Template NOV 1-15,2021Document7 pagesMerchandiser Mandays Template NOV 1-15,2021Kuro KiNo ratings yet

- Certificate of Signatures 2020 FillinDocument1 pageCertificate of Signatures 2020 FillinKuro KiNo ratings yet

- Control Sa Doktrina at Sinusubok (K31C) : Manggagawa Assigned Number Dcode/Distrito 01047Document5 pagesControl Sa Doktrina at Sinusubok (K31C) : Manggagawa Assigned Number Dcode/Distrito 01047Kuro KiNo ratings yet

- Narrative ReportDocument2 pagesNarrative ReportKuro KiNo ratings yet

- Senior High School Student Permanent Record: Republic of The Philippines Department of EducationDocument4 pagesSenior High School Student Permanent Record: Republic of The Philippines Department of EducationKuro KiNo ratings yet

- Activities I. Learning QuestionsDocument2 pagesActivities I. Learning QuestionsKuro KiNo ratings yet

- Story Map: Acquiring My First Language Setting CharactersDocument4 pagesStory Map: Acquiring My First Language Setting CharactersKuro KiNo ratings yet

- Answer w3-4Document9 pagesAnswer w3-4Kuro KiNo ratings yet

- School Safety Assessment Tool: (SSAT)Document1 pageSchool Safety Assessment Tool: (SSAT)Kuro KiNo ratings yet

- Rate Is 20-35%.: Dela Cruz - Pastrana Taxation Law Review - Atty. Lumbera - FinalsDocument16 pagesRate Is 20-35%.: Dela Cruz - Pastrana Taxation Law Review - Atty. Lumbera - FinalsSharmane PastranaNo ratings yet

- Income From House Property Notes For CA CSCMA StudentsDocument28 pagesIncome From House Property Notes For CA CSCMA StudentsSantosh Chavan100% (1)

- Buckwold 19ePPT Ch20revisedDocument25 pagesBuckwold 19ePPT Ch20revisedJenniferNo ratings yet

- Reply For Hashim KhanDocument2 pagesReply For Hashim Khanhamza awan0% (1)

- CIR Vs Citytrust Investment Philippines, G.R. No. 139786, 140857, September 27, 2006Document9 pagesCIR Vs Citytrust Investment Philippines, G.R. No. 139786, 140857, September 27, 2006christie joiNo ratings yet

- Atlas Copco (India) Limited: NoticeDocument12 pagesAtlas Copco (India) Limited: NoticedivyaniNo ratings yet

- Unit 2 Tax NotesDocument49 pagesUnit 2 Tax NotesP RajputNo ratings yet

- Taxaation Sankalp'Document12 pagesTaxaation Sankalp'Sankalp PariharNo ratings yet

- In Re ZialcitaDocument6 pagesIn Re ZialcitaJunnieson BonielNo ratings yet

- Budget Analysis-2012 - T.P Ostwal & AssociatesDocument115 pagesBudget Analysis-2012 - T.P Ostwal & AssociatesvaidheiNo ratings yet

- CPAR Income Tax of Individuals (Batch 93) - HandoutDocument36 pagesCPAR Income Tax of Individuals (Batch 93) - HandoutJuan Miguel UngsodNo ratings yet

- Q & A Pol & PilDocument60 pagesQ & A Pol & PilMarvin CabantacNo ratings yet

- Module 01 - General Principles of TaxationDocument19 pagesModule 01 - General Principles of TaxationblueplaneskiesNo ratings yet

- Module No 6 - Intro To Regular Income TaxDocument4 pagesModule No 6 - Intro To Regular Income TaxLysss EpssssNo ratings yet

- Reply On PANDocument6 pagesReply On PANPaul Casaje89% (18)

- CIR v. Baier NickelDocument17 pagesCIR v. Baier Nickelmceline19No ratings yet

- Cia15 Study Guide 4 Bac 103 Taxation Income Taxation SfernandoDocument23 pagesCia15 Study Guide 4 Bac 103 Taxation Income Taxation Sfernando5555-899341No ratings yet

- TDS For Overseas Agents When There Is No PE in IndiaDocument9 pagesTDS For Overseas Agents When There Is No PE in Indiasanket.tatedNo ratings yet

- G.R. No. 213943Document15 pagesG.R. No. 213943lantern san juanNo ratings yet

- Chapter 1 PDFDocument13 pagesChapter 1 PDFVaibhav BansalNo ratings yet

- Tax NoteDocument170 pagesTax NoteHamza HafeezNo ratings yet

- UPES Admission ProcessDocument5 pagesUPES Admission ProcessSandeep ChoudhuryNo ratings yet

- Tata Consultancy Services Payslip August 2017Document2 pagesTata Consultancy Services Payslip August 2017Ajay Chowdary Ajay Chowdary79% (14)

- Taxation CasesDocument15 pagesTaxation CasesJayzell Mae FloresNo ratings yet

- 194Q TDS On Purchase of GoodsDocument25 pages194Q TDS On Purchase of GoodsPallavi SharmaNo ratings yet

- Syllabus Ay 2021 2022 Ba 101 Taxation Income TaxationDocument16 pagesSyllabus Ay 2021 2022 Ba 101 Taxation Income TaxationQuinnie CervantesNo ratings yet

- Cta - Eb - CV - 01614 - D - 2018jul31 - Ass - No Loa in en Banc DecisionDocument19 pagesCta - Eb - CV - 01614 - D - 2018jul31 - Ass - No Loa in en Banc DecisionAvelino Garchitorena Alfelor Jr.No ratings yet

- Art Bell After Dark Newsletter 1995-09 - SeptemberDocument16 pagesArt Bell After Dark Newsletter 1995-09 - SeptemberSnorkledorfNo ratings yet

- Chapter 10Document4 pagesChapter 10Judith Salome Basquinas0% (1)

- BIR Form No. 1700Document2 pagesBIR Form No. 1700mijareschabelita2No ratings yet