Professional Documents

Culture Documents

LAS in Acounting 2 Week 3

Uploaded by

dorothytorino8Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

LAS in Acounting 2 Week 3

Uploaded by

dorothytorino8Copyright:

Available Formats

Republic of the Philippines

Department of Education

REGION IV-A CALABARZON

SCHOOLS DIVISION OFFICE OF BATANGAS PROVINCE

DR. JUAN A. PASTOR MEMORIAL NATIONAL HIGH SCHOOL

TALAIBON, IBAAN, BATANGAS

LEARNING ACTIVITY SHEET IN FUNDAMENTALS OF ACCOUNTANCY,

BUSINESS AND MANGEMENT 2

Quarter 2 Week 3: INCOME AND BUSINESS TAXATION

MELC: 1. Define income and business taxation and its principles and processes

2. Explain the principles and purposes of taxation

3. Explain the procedure in the computation of gross taxable income and tax due

Objective: After going through this module, you are expected to:

1. Define income and business taxation and its principles and processes

2. Explain the principles and processes of income and business taxation.

3. Distinguish individual from business taxation

4. Explain the procedure in the computation of taxable income and tax due

A tax is an imposition by the government upon person, property, or rights exercised within its

jurisdiction. In simple words, is the compulsory contribution that people pay to the government, which is used to pay

for expenses Taxation, on the other hand, refers to the power of the state by which the sovereign

raises revenue to defray the necessary expenses of the government.

The Basic Principles of a Sound Tax System are:

a. Fiscal adequacy-revenues should be adequate to sustain government spending.

b. Theoretical justice – taxes are fair and reasonable to the capabilities of the taxpayer to pay.

c. Administrative feasibility-tax legislation is enforced efficiently and effectively, preventing future

complications and uncertainty on the aspect of tax-paying citizens.

Purposes of taxation

1. Provides funds to support the government to improve people's general welfare.

2. Managing inflation (e.g., government to lessen the impact of upcoming rising prices.)

3. Helping to reduce the negative impacts (e.g., tobacco is taxed to prohibit smoking, imported goods

are taxed to secure domestic manufacturers)

4. Reasonable distribution of income (for example, higher tax payments are imposed towards those

who generate much)

General Process of Taxation

Business Individual

1. Fill up BIR Form 1903 supported by SEC 1.Fill up BIR Form 1902 supported by

and mayor’s business permit his or her birth certificate

2. Certificate of registration should be 2.The income of the taxpayer is subject to

renewed annually before January 31 withholding tax, deducted by the

employer

3. Printing of invoice and official receipt

should be authorized from BIR

4. Books of accounts of the business are

also registered with the BIR before use.

What is Income Taxation?

INCOME TAXES is the imposition of taxes on the income of individuals derived from compensation,

business trade, self-employed, or practice of a profession or from property less deductions

authorized by the law. The term "gross income" refers to the taxpayer's income for taxation purposes.

Address: Talaibon, Ibaan, Batangas

Telephone No.: (043) 311-2651

Email Ad: djapmnhs69@yahoo.com

Republic of the Philippines

Department of Education

REGION IV-A CALABARZON

SCHOOLS DIVISION OFFICE OF BATANGAS PROVINCE

DR. JUAN A. PASTOR MEMORIAL NATIONAL HIGH SCHOOL

TALAIBON, IBAAN, BATANGAS

WRITTEN TASK:

TASK 1. Solve the following:

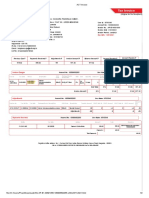

1. Juan is a father with a 1 qualified dependent, having a monthly basic salary of P25,000. With SSS

contribution P581, PHIC P312 and Pag-ibig P100. Compute for tax due for 2017 and 2020

2. Pedro is a widow with a 2 child (ages, 17 and 21), having a monthly basic salary of P35,000. With

minimis benefits of P1,201.60 monthly. He also received a 13th month salary equivalent to one

month salary. Compute for tax due for 2017 and 2020.

Address: Talaibon, Ibaan, Batangas

Telephone No.: (043) 311-2651

Email Ad: djapmnhs69@yahoo.com

Republic of the Philippines

Department of Education

REGION IV-A CALABARZON

SCHOOLS DIVISION OFFICE OF BATANGAS PROVINCE

DR. JUAN A. PASTOR MEMORIAL NATIONAL HIGH SCHOOL

TALAIBON, IBAAN, BATANGAS

3. Tiago is a single father having a annual income of P225,000. With Statutory benefits of 125,325

and bonuses and allowances of P 93,000. Compute for tax due for 2017 and 2020.

4. Pedro is single and working as a call center agent. His monthly basic salary is P30,000. Let’s say

Pedro is working graveyard and he has night allowance ,in his work. He also worked on 2 full

holidays as their team manager offered. Night differential: P4,000. Holiday pay: P3,000 Determine

the tax due for 2017 & 2020.

PERPORMANCE TASKS: Income tax:

Task 2:

1. Mrs. Jolie Sy is employed as a sales manager. Her husband is unemployed for three years now. They have

four children the eldest is 25 years old, the second is 20 years old, the third is 18 years old and the youngest

is 15 years old. Compute for the annual income tax for year 2011 given the following additional

information:Monthly salary 18,000Monthly allowance 3,000Annual Commission 120,000. Compare it with

TRAIN law.

2. Mr. Herrera is unmarried with two legal dependents. The following information is used to

determine his income tax. Compute for his annual income tax return for the year 2017 and 2018 :

Monthly salary 20,000. Monthly overtime pay 1,500. Monthly gas and food allowance 3,500

3. Mr. Dan Medina is a bank employee. He is married with four children, all in elementary and high school. His

salary isP30,000 per month and the following: Medicine allowance every 3 months 5,000.

Monthly transportation and food allowance 2,500. 13th month pay equal to his monthly salary, given once a

year. Compute for his tax due for the year end 2017 and compare it to the new TRAIN law.

4. Ms. Terry operates a convenience store while she offers bookkeeping services to her clients. In

2018, her gross sales amounted to P800,000.00, in addition to her receipts from bookkeeping

services of P300,000.00. How much is the tax due for year end 2018? If it is happen in 2017

how much will be the tax due?

5. Mr. Alvarez is a finance consultant he earned yearly as follows: Company A. P1,900,000 and

Company B.1,000,000. He also paid the following expenses during the year: Gasoline, salary,

utilities for 150,000, 120,000 and 60,000 respectively. Compute the tax due using old tax and

TRAIN law.

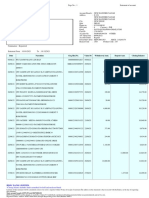

Task 3: Below are the taxable income and tax due of individual taxpayer using new train law.

Prepared individual tax due of the following taxpayer:

1. Allan gross compensation income of P543,425

Non-taxable compensation income P43,425

Total sales P83,333

Optional standard deduction P33,333

2. Bella gross business income is P500,000

Cost of sales P220,000

Operating expensesP120,000

3. Casey has a gross compensation income of P90,000 with same scenario of Bella’s business

4. Duncan is same as Allan gross compensation as well as his non-taxable income. With the

same business situation to Bella.

Address: Talaibon, Ibaan, Batangas

Telephone No.: (043) 311-2651

Email Ad: djapmnhs69@yahoo.com

Republic of the Philippines

Department of Education

REGION IV-A CALABARZON

SCHOOLS DIVISION OFFICE OF BATANGAS PROVINCE

DR. JUAN A. PASTOR MEMORIAL NATIONAL HIGH SCHOOL

TALAIBON, IBAAN, BATANGAS

Address: Talaibon, Ibaan, Batangas

Telephone No.: (043) 311-2651

Email Ad: djapmnhs69@yahoo.com

You might also like

- How To Log in To Your FRS Online AccountDocument4 pagesHow To Log in To Your FRS Online AccountSharan FosbinderNo ratings yet

- Define A Promissory NoteDocument3 pagesDefine A Promissory NoteAdan HoodaNo ratings yet

- Personal Bank Statement TemplateDocument1 pagePersonal Bank Statement TemplateBritney MendozaNo ratings yet

- The Effects of Train Law To The Saving and Spending Behavior of The Teaching and NonDocument15 pagesThe Effects of Train Law To The Saving and Spending Behavior of The Teaching and NonPrincess Angela GelliaparangNo ratings yet

- Basic Principles of A Sound Tax SystemDocument6 pagesBasic Principles of A Sound Tax SystemMelvin Franco San Gabriel60% (5)

- Week 2/ Introduction To Applied EconomicsDocument29 pagesWeek 2/ Introduction To Applied EconomicsjohnNo ratings yet

- Train Law NotesDocument9 pagesTrain Law NotesMa Angeli Gomez100% (1)

- Samplex FinalsDocument6 pagesSamplex FinalsZoe Jen RodriguezNo ratings yet

- Work Immersion Experience at The Bureau of Internal ReveniewDocument17 pagesWork Immersion Experience at The Bureau of Internal ReveniewYT. TempesTNo ratings yet

- Mc-Sse 8 Macroeconomics Group V : Fiscal PolicyDocument35 pagesMc-Sse 8 Macroeconomics Group V : Fiscal PolicyMaria Cristina ImportanteNo ratings yet

- Tax Invoice - 2555703 - 1686188896465Document1 pageTax Invoice - 2555703 - 1686188896465Ivy GaudicosNo ratings yet

- Basic Principles of A Sound Tax SystemDocument6 pagesBasic Principles of A Sound Tax SystemCrisanta MarieNo ratings yet

- 2013 New Pre-Mid Dept ExamDocument6 pages2013 New Pre-Mid Dept ExamJulie Ann PiliNo ratings yet

- Fabm 2: Quarter 4 - Module 5 Computing Gross Taxable Income and Tax DueDocument21 pagesFabm 2: Quarter 4 - Module 5 Computing Gross Taxable Income and Tax DueFlordilyn DichonNo ratings yet

- Case Study Homework Income TaxDocument3 pagesCase Study Homework Income TaxJune Maylyn Marzo100% (2)

- ABM11 BussMath Q2 Wk4 Taxable-And-Nontaxable-BenefitsDocument11 pagesABM11 BussMath Q2 Wk4 Taxable-And-Nontaxable-BenefitsArchimedes Arvie Garcia0% (1)

- Las q2 Fabm 2 Week 4Document10 pagesLas q2 Fabm 2 Week 4Mahika BatumbakalNo ratings yet

- LAS FABM2 QTR 2, wk4Document8 pagesLAS FABM2 QTR 2, wk4Kuro KiNo ratings yet

- Las - Week 3.fabm II.Document21 pagesLas - Week 3.fabm II.Jason Tagapan GullaNo ratings yet

- LAS FABM2 QTR 2, wk5Document12 pagesLAS FABM2 QTR 2, wk5Kuro KiNo ratings yet

- Final Requirement TAX Santos Daniel D.Document13 pagesFinal Requirement TAX Santos Daniel D.Joel Jr.No ratings yet

- FABM2 12 Quarter2 Week4Document9 pagesFABM2 12 Quarter2 Week4Princess DuquezaNo ratings yet

- Reacpaper TAX REFORM FOR ACCELERATION AND INCLUSIONDocument2 pagesReacpaper TAX REFORM FOR ACCELERATION AND INCLUSIONMonica RilveriaNo ratings yet

- Study of The New Income Tax Schedule of The TRAIN LawDocument16 pagesStudy of The New Income Tax Schedule of The TRAIN LawJeannie de leon82% (17)

- G12 Tan - Busi Ethics 0402Document1 pageG12 Tan - Busi Ethics 0402Roy De GuzmanNo ratings yet

- Basic Principles of A Sound Tax SystemDocument6 pagesBasic Principles of A Sound Tax SystemhppddlNo ratings yet

- Overtaxing Working, Middle Classes: Sonny Angara Philippine Daily InquirerDocument7 pagesOvertaxing Working, Middle Classes: Sonny Angara Philippine Daily InquirerGIRBERT ADLAWONNo ratings yet

- Teacher: Section: Subject: Name:: Bitin Integrated National High SchoolDocument4 pagesTeacher: Section: Subject: Name:: Bitin Integrated National High SchoolHeesel RamosNo ratings yet

- Act 13.3 Compensation IncomeDocument2 pagesAct 13.3 Compensation IncomeSkylar GevirahNo ratings yet

- Principles of A Sound Tax SystemDocument3 pagesPrinciples of A Sound Tax SystemhppddlNo ratings yet

- Tax Reform For Acceleration & Inclusion: University of Northern PhilippinesDocument4 pagesTax Reform For Acceleration & Inclusion: University of Northern PhilippinesDiana PobladorNo ratings yet

- Tax Issues and Recommended SolutionsDocument6 pagesTax Issues and Recommended SolutionsGabsNo ratings yet

- Train LawDocument44 pagesTrain LawJuan MiguelNo ratings yet

- BMGT 21 Talkshow QnADocument5 pagesBMGT 21 Talkshow QnATrisha Mae DumencelNo ratings yet

- Group 3 - Taxes in Financial PlanDocument29 pagesGroup 3 - Taxes in Financial PlanNikki RositaNo ratings yet

- February 9-15, 2014Document8 pagesFebruary 9-15, 2014Bikol ReporterNo ratings yet

- ZEAH MARIE GULTIANO Independent Study by Pair ActivityDocument4 pagesZEAH MARIE GULTIANO Independent Study by Pair Activityqxw8tknjkpNo ratings yet

- Module 2, Test 1, Test 3Document9 pagesModule 2, Test 1, Test 3Jigz GuzmanNo ratings yet

- Borgador - Assignment 3Document2 pagesBorgador - Assignment 3Neil Andre M. BorgadorNo ratings yet

- PUP - Assignment No. 3 - Income Taxation - 2nd Sem AY 2020-2021: RequiredDocument12 pagesPUP - Assignment No. 3 - Income Taxation - 2nd Sem AY 2020-2021: RequiredGabrielle Marie RiveraNo ratings yet

- Exclusions - Exemptions From Gross IncomeDocument2 pagesExclusions - Exemptions From Gross Incomedarlene floresNo ratings yet

- Applied Economics - Quarter 1: I. Introductory ConceptDocument17 pagesApplied Economics - Quarter 1: I. Introductory ConceptJay B. VillamerNo ratings yet

- Alcantara - Module 7 - 2ged SS-03Document3 pagesAlcantara - Module 7 - 2ged SS-03Janine AlcantaraNo ratings yet

- TaxationDocument2 pagesTaxationGoi Cai EnNo ratings yet

- CHAPTER 2 3 BIR and Individual TaxpayerDocument31 pagesCHAPTER 2 3 BIR and Individual TaxpayerAisha A. UnggalaNo ratings yet

- 606-Texto Del Artículo-2677-1-10-20190704Document25 pages606-Texto Del Artículo-2677-1-10-20190704jorgeNo ratings yet

- PIT in VietNamDocument3 pagesPIT in VietNamLinh ĐỗNo ratings yet

- Where Do Our Taxes Go?Document2 pagesWhere Do Our Taxes Go?Vj LadridoNo ratings yet

- Orca Share Media1613096356709 6765816501330676436Document9 pagesOrca Share Media1613096356709 6765816501330676436Mara Gianina QuejadaNo ratings yet

- Project Mam Manago KathDocument2 pagesProject Mam Manago KathejayNo ratings yet

- Taxation PPT2Document28 pagesTaxation PPT2tesicojayson13No ratings yet

- Tax Sem OuputDocument43 pagesTax Sem OuputAshlley Nicole VillaranNo ratings yet

- TAX QuizzesDocument2 pagesTAX Quizzesnichols greenNo ratings yet

- TaxationDocument5 pagesTaxationGrazel GeorsuaNo ratings yet

- Income and TaxationDocument37 pagesIncome and TaxationStephanie Mharie EugenioNo ratings yet

- 1the Effect of Amended Personal Income Taxation Under Tax Reform For Acceleration and InclusionDocument10 pages1the Effect of Amended Personal Income Taxation Under Tax Reform For Acceleration and InclusionSuelyn JumalaNo ratings yet

- Intax Quiz 11Document1 pageIntax Quiz 11BLACKPINKLisaRoseJisooJennieNo ratings yet

- Term Paper On Income and Business Taxation: BMGT 25, Bm2ADocument13 pagesTerm Paper On Income and Business Taxation: BMGT 25, Bm2AMonica NobleNo ratings yet

- Community Tax and Donor's TaxDocument27 pagesCommunity Tax and Donor's TaxMa.annNo ratings yet

- Think Out Loud - 1Document1 pageThink Out Loud - 1gregbaccayNo ratings yet

- Hand Out For ReportDocument4 pagesHand Out For ReportJocelyn Mae CabreraNo ratings yet

- Pakistan Taxation SystemDocument4 pagesPakistan Taxation SystemAdil BalochNo ratings yet

- Think Out Loud - 1Document1 pageThink Out Loud - 1gregbaccayNo ratings yet

- Chapter 7 TaxationDocument5 pagesChapter 7 TaxationAljun MorilloNo ratings yet

- Module 8 Local TaxationDocument37 pagesModule 8 Local TaxationJun Martine SalcedoNo ratings yet

- Assignment 2Document2 pagesAssignment 2ሔርሞን ይድነቃቸው0% (1)

- De 4Document4 pagesDe 4fschalkNo ratings yet

- Phil. Airlines vs. CIR, G.R. No. 198759, July 1, 2013Document8 pagesPhil. Airlines vs. CIR, G.R. No. 198759, July 1, 2013Lou Ann AncaoNo ratings yet

- Challan Form 1000Document1 pageChallan Form 1000Majid IqbalNo ratings yet

- Billed To: International Package Services InvoiceDocument12 pagesBilled To: International Package Services InvoiceBingmondoy Feln Lily Canonigo0% (1)

- IosDocument13 pagesIoskhanpattanNo ratings yet

- Annex A-RMC 26-2018Document2 pagesAnnex A-RMC 26-2018Anonymous LC5kFdtc100% (1)

- FIREEYE Supplier Request FormDocument3 pagesFIREEYE Supplier Request FormArunNo ratings yet

- Nature of Transfer TaxesDocument2 pagesNature of Transfer TaxesColleen ArcosNo ratings yet

- Solved Mustard Corporation A C Corporation Owns 15 of The StockDocument1 pageSolved Mustard Corporation A C Corporation Owns 15 of The StockAnbu jaromiaNo ratings yet

- DTC Agreement Between United Arab Emirates and KazakhstanDocument27 pagesDTC Agreement Between United Arab Emirates and KazakhstanOECD: Organisation for Economic Co-operation and DevelopmentNo ratings yet

- Airtel Bill - July 2023Document2 pagesAirtel Bill - July 2023jaideep singhNo ratings yet

- Davao - Eagle - Com JOSEPHDocument6 pagesDavao - Eagle - Com JOSEPHablay logeneNo ratings yet

- Online Tax Payment PortalDocument1 pageOnline Tax Payment PortalHarjot SinghNo ratings yet

- Written Report Special Treatment of Fringe Benefits FINAL....Document13 pagesWritten Report Special Treatment of Fringe Benefits FINAL....SANTIAGO CHESKAMAE OQUIANo ratings yet

- In 202039602017Document1 pageIn 202039602017IONOS USNo ratings yet

- Notes On Central Sales Tax PDFDocument21 pagesNotes On Central Sales Tax PDFDeepti SharmaNo ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument11 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceMonty ChaudharyNo ratings yet

- Corporate Finance Mini CaseDocument6 pagesCorporate Finance Mini CaseMashaal FNo ratings yet

- Cao 02-1991Document2 pagesCao 02-1991Joshua BasilioNo ratings yet

- Tax InvoiceDocument2 pagesTax Invoice29ajayNo ratings yet

- 2nd Semester Income Taxation Module 9 CPAR Fringe Benefits TaxDocument13 pages2nd Semester Income Taxation Module 9 CPAR Fringe Benefits Taxnicole tolaybaNo ratings yet

- ACT Invoice FOR JANDocument2 pagesACT Invoice FOR JANphani raja kumarNo ratings yet

- June PayslipDocument3 pagesJune Paysliphennieswart62No ratings yet