Professional Documents

Culture Documents

Sim Week 4

Uploaded by

Kuro KiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sim Week 4

Uploaded by

Kuro KiCopyright:

Available Formats

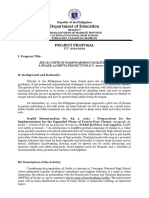

Republic of the Philippines

Department of Education

REGION V

SCHOOLS DIVISION OF MASBATE PROVINCE

CATAINGAN NATIONAL HIGH SCHOOL

SELF - INSTRUCTIONAL

MATERIAL (SIM) No.4

Learner's Information:

Name of Learner:

Grade 12- ABM

Grade Level: S.Y. 2020 - 2021

EDWIN P. ABAL

Name of Teacher: T-III

Learning Area: FUNDAMENTALS OF ACCOUNTING, BUSINESS AND

MANAGEMENT 2

1.) OBJECTIVES:

Address: Poblacion, Cataingan, Masbate

Telephone No.: (056) 578-3469

Republic of the Philippines

Department of Education

REGION V

SCHOOLS DIVISION OF MASBATE PROVINCE

CATAINGAN NATIONAL HIGH SCHOOL

Content – Statement of Changes in Equity (SCE)

Content Standard – The learners demonstrate an understanding of….the forms of business

organization, namely; single proprietorship, partnership, and corporation, and the structure of

a Statement of Changes in Equity of a single proprietorship that will equip him/her in the

preparation of the said financial report.

Performance Standard – The learners shall be able to…. Solve exercises and problems that

require preparation of a Statement of an Statement of Changes in Equity for a Single

Proprietorship.

Learning Competencies :

The learners shall be able to… A. ) Identify the different forms of business organization . Code :

ABM_FABM12-Ie-8 B.) Prepare an Statement of Changes in Equity for a single proprietorship.

Code : ABM_FABM12-Ie-9.

Specific Learning Objectives : At the end of the lesson, the learners shall be able to identify the

different forms of business organization.

ACTIVITIES/DISCUSSIONS :

BUSINESS ENTITY CONCEPT:

Business entity concept is a prevailing assumption in accounting. It states that the transactions of the business (as a

separate entity) must be distinguished and differentiated from the transactions of the owners. Business

transactions must be captured in the financial statements of the reporting entity. Personal transactions, on the other

hand, must be kept in the records of the owners.

FORMS OF BUSINESS ORGANIZATIONS:

There are three major types of business organizations in the Philippines, based on classification of ownership.

These business organizations are sole proprietorship, partnerships, and corporations.

SOLE PROPRIETORSHIPS :

A sole proprietorship is a business organization owned by one person. It is also called a single

proprietorship. The owner of the sole proprietorship is the proprietor. In most cases, the

proprietor is also the general manager of a sole proprietorship. As general manager, he

oversees the day-to-day operations of the sole proprietorship. A sole proprietor is more

involved than other business owners. Sole proprietorships are relatively easy to organize.

Business registration for sole proprietorships starts with the business name registration at the

Department of Trade and Industry. Next, the potential sole proprietor obtains local clearances

such as Barangay Clearance and Mayor’s Permit. Finally, the potential sole proprietor now

registers with the Bureau of Internal Revenue, Social Security System and Philippine Health

Insurance Corporation.

Major disadvantages of a sole proprietorship include limited source of capital, proprietor’s

unlimited liability and business entity’s limited existence. In sole proprietorships, the sole

proprietor is the major source of financing available for the business. Business loans may,

however, be obtained from banks. But due to the credit concentration to the sole proprietor,

banks usually charge high interest rates or lend only a limited amount to a sole proprietor.

Another major disadvantage of sole proprietorship is the unlimited liability of the sole

proprietor.

Address: Poblacion, Cataingan, Masbate

Telephone No.: (056) 578-3469

Republic of the Philippines

Department of Education

REGION V

SCHOOLS DIVISION OF MASBATE PROVINCE

CATAINGAN NATIONAL HIGH SCHOOL

Bankruptcy occurs when the sole proprietorship is unable to pay its debts. In the Philippines, in

case the assets of the sole proprietorship are not enough to cover its existing liabilities,

creditors can run after the personal assets of the sole proprietor (e.g., personal car, personal

house, and /or personal property). This makes the liability of the sole proprietor unlimited.

Lastly, sole proprietorships have limited life. A sole proprietorship generally exists with the sole

proprietor. This puts a limitation to the existence of the sole proprietorship compared to

corporations.

Common examples of sole proprietorships are franchised enterprises. These enterprises include

food stalls commonly found inside malls and other areas with high foot traffic. Another example

of this type of entity is individuals rendering professional services, such as lawyers, physicians,

dentists, and accountants.

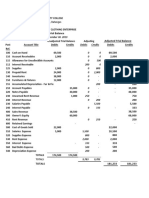

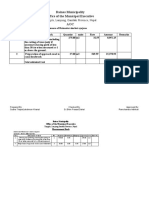

ILLUSTRATIVE CASE : UY LAW OFFICE

The bookkeeper of Uy Law Office prepared a worksheet that will make the preparation of

financial statements easier. The worksheet can be found below :

ILLUSTRATIVE CASE : UY LAW OFFICE

COD

E ACCOUNTS Unadjusted Adjustment Adjusted SCI SFP

Debit Credit Debit Credit Debit Credit Debit Credit Debit Credit

588,50

1001 CASH 588,500 0 588,500

1002 ACCOUNTS RECEIVABLE 75,000 75,000 75,000

1003 OFFICE SUPPLIES 5,000 3,000 2,000 2,000

110,00

1004 PREPAID RENT 120,000 10,000 0 110,000

1005 OFFICE EQUIPMENT 36,000 36,000 36,000

1006 ACCUMULATED DEPRECIATION-

OFFICE EQUIPMENT 1,000 1,000 1,000

2001 ACCOUNTS PAYABLE 25,000 25,000 25,000

100,00 100,00

2002 NOTES PAYABLE-BANK 100,000 0 0

2003 UNEARNED REVENUES 35,000 35,000 35,000

2004 INTEREST PAYABLE 500 500 500

500,00 500,00

3001 JAN UY, CAPITAL 500,000 0 0

3002 JAN UY, WITHDRAWAL 25,000 25,000 25,000

247,50

4001 PROFESSIONAL FEES 247,500 0 247,500

5001 SALARIES EXPENSE 15,000 15,000 15,000

5002 RENT EXPENSE 10,000 10,000 10,000

5003 UTILITIES EXPENSE 8,000 8,000 8,000

5004 REPRESENTATION EXPENSE 25,000 25,000 25,000

5005 OFFICE SUPPLIES EXPENSE 3,000 3,000 3,000

5006 DEPRECIATION EXPENSE 1,000 1,000 1,000

5007 INTEREST EXPENSE 500 500 500

5008 PERMIT AND LICENSES EXPENSE 10,000 10,000 10,000

909,00 909,00 661,50

TOTAL 907,500 907,500 14,500 14,500 0 0 72,500 247,500 836,500 0

NET INCOME 175,000

175,00

Address: Poblacion, Cataingan, Masbate

Telephone No.: (056) 578-3469

Republic of the Philippines

Department of Education

REGION V

SCHOOLS DIVISION OF MASBATE PROVINCE

CATAINGAN NATIONAL HIGH SCHOOL

836,50

TOTAL 247,500 247,500 836,500 0

STATEMENT OF CHANGES IN EQUITY FOR SOLE PROPRIETORSHIP:

Example :

Mr. Snackstore Food Cart

Statement of Changes in Equity

For the Year Ended December 31, 2014

Mr. A Equity, Beginning 100,000

Add: Additional Investment 10,000

Net Income 25,000 35,000

Total 135,000

Less : Mr. A, Drawings (20,000)

Mr. A Equity, Ending 115,000

The Equity beginning is the opening balance of the owner’s equity account. This is the ending

balance of the equity account in the previous year. In the above case, this pertains to any

capital infusion made by the owner for the year. Net income on the other hand, pertains to the

amount earned by the sole proprietorship for the year. This amount is taken from the

statement of comprehensive income. After net income, drawings is deducted from the balance.

Drawing represents the owner’s return of investment. Finally, equity ending represents the

balance of the owner’s equity at the end of the year. In the above case, 115,000 represents the

equity balance of Mr. A as of December 31, 2014. Recall that capital or equity account is real

account. This means that the balance will be carried forward to the succeeding year. This makes

115,000 the balance as of December 31, 2014 and January 01, 2015.

PROCEDURES IN CONSTRUCTING STATEMENT OF CHANGES IN EQUITY – SOLE

PROPRIETORSHIP: Sample: Uy Law Office

1. Draft the Heading

UY LAW OFFICE

Statement of Changes in Equity

For the Year Month December 31, 2015

2. Determine the beginning balance of equity (capital)

In the above case, there is no beginning balance of the capital (equity) since Uy Law

Office started it’s operations in the current year. In the event of the subsequent year,

the bookkeeper or accountant will trace the beginning balance from the previous year’s

SCE.

3. Determine the amount of investment (initial or additional)

Since 2015 is the first year of operations for Uy Law Office, the SCE should bear line item

“initial investment” instead of “Additional Investment”. Additional investment would be

used for succeeding years of operations. The amount of the initial investment can be

traced to the general ledger account or T-Accounts as shown below.

Address: Poblacion, Cataingan, Masbate

Telephone No.: (056) 578-3469

Republic of the Philippines

Department of Education

REGION V

SCHOOLS DIVISION OF MASBATE PROVINCE

CATAINGAN NATIONAL HIGH SCHOOL

JAN UY, CAPITAL - 3001

Dec. 01 500,000

Below is the partially completed statement of changes in equity for the case:

UY LAW OFFICE

Statement of Changes in Equity

For the Month Ended December 31, 2015

Initial Investment P 500,000

4. Determine the amount of the Net Income

The bookkeeper or the accountant determines the amount of the net income. This is

usually done by referencing to the statement of comprehensive income. This is the

reason why the statement of comprehensive income is first constructed before the SCE.

Sample of Uy Law Office Statement of Comprehensive Income:

UY LAW OFFICE

Statement of Comprehensive Income

For the Month Ended December 31, 2015

Professional Fees 247,500

Operating Expenses :

Representation expense 25,000

Salaries expense 15,000

Rent expense 10,000

Permit and Licenses expense 10,000

Utilities expense 8,000

Office supplies expense 3,000

Depreciation expense 1,000

Interest expense 500 72,500

NET INCOME 175,000

Refer to the partially completed SCE of Uy Law Office below :

UY LAW OFFICE

Statement of Changes in Equity

For the Year Ended December 31, 2015

Initial Investment P 500,000

Add : NET INCOME 175,000

A case of NET LOSS happens when total expenses are greater than revenues. In case of NET

LOSS, the corresponding amount is deducted to arrive at the ending capital or equity balance,

as opposed to being added. This is because NET LOSS decreases the equity of the owner to the

business.

5. Determine the balance of the drawing (withdrawal) account.

Address: Poblacion, Cataingan, Masbate

Telephone No.: (056) 578-3469

Republic of the Philippines

Department of Education

REGION V

SCHOOLS DIVISION OF MASBATE PROVINCE

CATAINGAN NATIONAL HIGH SCHOOL

After determining the balance of the net income, the accountant then determines the

balance of the owner’s drawing account. This can be done by referring to the ledger

balance or T-account of the withdrawal account. The T-account for the drawing of Jan

Uy is shown below:

JAN UY, DRAWING- 3002

Dec. 17 25,000

Below is the partially completed SCE of Uy Law Office:

UY LAW OFFICE

Statement of Changes in Equity

For the Year Ended December 31, 2015

Initial Investment P 500,000

Add : Net Income 175,000

Less : Jan Uy – Withdrawal/Drawings (25,000)

6. Determine the ending balance of the capital or owner’s equity account. After

determining balance investments, net income (or net loss), and withdrawal, the

accountant now determines the ending balance of the equity account. This is done by

footing (mathematically) the partially completed SCE. The competed SCE of Uy Law

Office is shown below:

UY LAW OFFICE

Statement of Changes in Equity

For the Year Ended December 31, 2015

Initial Investment P 500,000

Add : Net Income 175,000

Less : Jan Uy – Withdrawal ( 25,000)

Jan Uy, Capital, Ending P 650,000

==========

The ending balance of the equity or capital account coincides with the ledger balance of the

said account in the post-closing trial balance. Uy Law Office’s post-closing trial balance is shown

below. Notice that the P 650,000 ending equity balance coincides with that in the post-closing

trial balance.

UY LAW OFFICE

Post-Closing Trial Balance

December 31, 2015

DEBIT CREDIT

1001 CASH 588,500

1002 CASH ACCOUNTS RECEIVABLE 75,000

1003 OFFICE SUPPLIES 2,000

1004 PREPAED RENT 110,000

Address: Poblacion, Cataingan, Masbate

Telephone No.: (056) 578-3469

Republic of the Philippines

Department of Education

REGION V

SCHOOLS DIVISION OF MASBATE PROVINCE

CATAINGAN NATIONAL HIGH SCHOOL

1005 OFFICE EQUIPMENT 36,000

1006 ACCUMULATED DEPRECIATION-

OFFICE EQUIPMENT 1,000

2001 ACCOUNTS PAYABLE 25,000

2002 NOTES PAYABLE 100,000

2003 UNEARNED REVENUES 35,000

2004 INTEREST PAYABLE 500

3001 JAN UY, CAPITAL 650,000

Totals 811,500 811,500

======= =======

EXERCISES :

1. In 2015, Denmark, the owner of Denmark Trading has a beginning capital balance of

504,000. During the year, Denmark Trading earned a net income of 50,400.

Furthermore, Denmark withdrew 37,800 from Denmark Trading for his personal use.

Requirements :

1. How much is the balance of Denmark’s ending capital as of December 31, 2015.

2. Prepare a statement of changes in owner’s equity for Denmark Trading.

2. Canada Foods is owned by Mr. C. Anada. Mr C. Anada’s capital balance as of January 1,

2015 is 300,000. During the year, he infused additional capital of 37,500. Also, Canada

Foods incurred a net loss of 30,000. Furthermore, Mr. Anada withdrew 22,500 during

2015.

1. How much is the balance of Mr. Anada’s capital balance as of December 31, 2015?

2. Prepare a statement of changes in owner’s equity for Canada’s Foods.

3. Holland Law Firm is owned by Atty. Holland. The balance of Atty. Hollang capital balance

as of January 1, 2015 is 1,800,000. During the year, he invested additional cash of

450,000 in the business. Also, Holland Law Firm earned 168,750 of net income. Finally,

he withdrew 112,500.

1. How much is the balance of Atty. Holland’s capital balance as of December 31, 2015?

2. Prepare a statement of changes in owner’s equity for Holland Law Firm.

4. Emerald Architects is owned by Architect Emerald. During 2015, Architect Emerald

invested additional drafting supplies of 140,000. Also, Emerald Architects earned a net

income of 105,000. He also withdrew 70,000. Finally, his ending capital is 455,000 as of

December 31, 2015.

1. How much is Architect Emerald beginning capital balance as of January 01, 2015?

2. Prepare a statement of changes in owner’s equity for Emerald Architect.

5. Danube Paralegal Services provides paralegal consultancy to several clients. Danube

Paralegal Services is owned by Private Inspector Dan Ube. Ube’s capital balance as of

January 01, 2015 is 360,000. Due to a cash shortage problem, he invested additional

cash of 180,000. Furthermore, Danube Paralegal Services earned a net income of

135,000. His capital balance as of December 31, 2015 is 585,000.

1. How much is Danube’s withdrawal for the year?

Address: Poblacion, Cataingan, Masbate

Telephone No.: (056) 578-3469

Republic of the Philippines

Department of Education

REGION V

SCHOOLS DIVISION OF MASBATE PROVINCE

CATAINGAN NATIONAL HIGH SCHOOL

2. Prepare a statement of changes in owner’s equity for Danube’s Paralegal

Services.

QUESTIONS :

1. Identify the key elements of a statement of changes in owner’s equity.

2. Discuss the sole proprietorship as a form of business organization.

3. What are the advantages and disadvantages of a sole proprietorship?

4. Define the key elements of a statement of changes in owner’s equity.

5. What item is responsible for the primary increase in the capital account?

ENRICHMENT ACTIVITY :

1. Identify the procedures in constructing a statement of changes in owner’s equity.

PARTNERSHIP – The Philippine Civil Code defines partnership as a contract where :

….two or more persons bind themselves to ontribute money, property, or industry to a

common fund, with the intention of dividing the profits among themselves (Philippine Civil

Code, 1949).

Based on the definition above, a Partnership involves two or more persons in

agreement. These persons are called Partners. Their agreement is contained in a dovument

called Articles of Partnerships. Finally, the ultimate goal of the partners is to divide profit among

themselves.

A key advantage of a partnership is the ease of organization, as compared to a

corporation. The Civil Code states that a partnership may be in any form, subject to specific

exceptions. This means that the contract of partnership may be oral or in writing, as a ggeneral

rule. Another advantage of the partnership is the entity’s larger source of capital and expertise,

as compared to a sole proprietorship. Since more people are involved in the entity, it is

expected that larger sources of funds are also available. This is because the source of funds in a

sole proprietorship is only one, while in a partnership the source of funds may be greater. Also,

each partner may contribute his or her expertisse in managing the partnership. In contrast to a

partnership, a sole proprietorship will only have as the person the sole proprietor ultimately in

charge of the entity.

Major disadvantages of partnership include unliited liability, limited exisgence and

mutual agency of the partners. Generally, a partner’s liability in the partnership can extend to

his or her personal properties, similar to a sole proprietor. However, the unlimited liability of a

partner is subject to exceptions ( the concept of a limited partner). Partnership also have

limited existence. Generally, any change in the partnership may dissolve the entity. The most

ommon reason for a partnership’s dissolution is the death of one partner. If the remaining

(alive) partners decide to continue the partnership, the old partnership (with the deceased

partner) is dissolved and a new partnership (among the living partners) is then formed. Finally,

mutual agency may also form as a disadvantage to a partnership. Mutual agency means that

Address: Poblacion, Cataingan, Masbate

Telephone No.: (056) 578-3469

Republic of the Philippines

Department of Education

REGION V

SCHOOLS DIVISION OF MASBATE PROVINCE

CATAINGAN NATIONAL HIGH SCHOOL

each partner may bind the partnership and the other partners in business-related matters. For

example, if one partner obtains a business loan in behalf of the partnership, the partnership

and the other partners are

bound by the said loan. This may pose a disadvantage to other partners if one partner will

execute a business-related decision, without consulting first the other partners. Common

examples of partnerships are legal (law) firms and accounting or auditing firms.

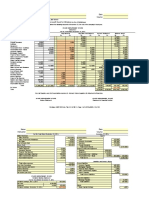

STATEMENT OF CHANGES IN PARTNERS’ EQUITY (CAPITAL):

A statement of changes in partners’ equity (capital) is prepared for partnerships after

preparing the statement of comprehensive income. The said statement will have identical line

items with the SCE of sole proprietorships. These line items include equity, net

income,additional investments, withdrawals, and the ending capital. However, the major

difference of a partnerships SCE to a sole proprietor’s SCE is the heading reserved for each

partner’s interest. A sample statement of changes in partners capital is shown below:

ABC PARTNERSHIP

Statement of Changes in Partners’ Capital (Equity)

For the Period Ended December 31, 2014

Amoranto Bersola Cada Total

Partners Equity, January 1, 2014 1,000,000 500,000 300,000 1,800,000

Add :

Share in Net Income (note A) 200,000 400,000 500,000 1,100,000

Additional Investments 500,000 - - 500,000

Less :

Withdrawals - (200,000) ( 50,000 ) ( 250,000 )

Partners’ Equity, December 31, 2014 1,700,000 700,000 750,000 3,150,000

=============================================

ABC PARTNERSHIP

Note A – Schedule of Net Income Distribution

For the Period Ended December 31, 2014

Amoranto Bersola Cada Total

Salaries 12,000 240,000 240,000 492,000

Interest 120,000 60,000 36,000 216,000

Bonus - 32,000 156,000 188,000

Remainder : 68,000 68,000 68,000 204,000

Share in Net Income 200,000 400,000 500,000 1,100,000

A schedule of net income distribution supports the SCE of a partnership. Typically, partners give

themselves salaries for their respective work done in the partnership.

Partners may also agree to give interest to their investments. Usually, a certain percentage (e.g.

12%) is agreed among partners. The basis of the interest may be the beginning capital (as in the

case above) or the average capital (time factored).

Also, a bonus may be given to partners who are also managers of the entity as a form of

incentive for positive operations. Bonuses are generally given when the entity earns net

Address: Poblacion, Cataingan, Masbate

Telephone No.: (056) 578-3469

Republic of the Philippines

Department of Education

REGION V

SCHOOLS DIVISION OF MASBATE PROVINCE

CATAINGAN NATIONAL HIGH SCHOOL

income. If the entity incurs a net loss, then no bonus is given since there are no positive

operations or results, hence no incentive must be given to the partners-managers.

Last, the remainder of the net income is to be divided. Usually, partners may agree an arbitrary

ratio(e.g. 2:3:5 or 20%, 30% and 50%) for the remainder. As shown in the above case, partners

may also agree to divide the remainder equally.

CORPORATION – The Corporation Code of the Philippines (1980) defines the word Corporation

as :

“ artificial being created by operation of law, having the right of succession and the

powers, attributes, and properties expressly authorized by law or incident to it’s existence.”

Corporation as a Artificial Being :

In the eyes of the law, a corporation is a being independent of it’s owners. A corporation will

have a name and a “birth” date (incorporation date) just like a normal person.

As an Artificial Being, a corporation has rights, powers, and attributes. An example of a right of

the corporation is to acquire a property in it’s own name. For example, ABC Corporation owned

by Mr. Abelardo B. Catacutan can acquire a piece of land for its office building. The land title

can be in the name of ABC Corporation and not in the name of Mr. Abelardo B. Catacutan.

The name, powers, objectives, and registered address of a corpoation are included in a

document called the Articles of Incorporation.

STOCKS AND STOCKS CERTIFICATES – A corporation unit of ownership is called a STOCK. Every

corporation is authorized to issue a certain number of stock. This authorized stock is the

maximum amount of stock that can be issued by a corporation. The stock or unit of corporate

ownership is represented by a stock certificate. A stock certificate is a piece of paper

representing the ownership of one stock of the corporation. Oftentimes, it has an amount on its

face called a Par Value. Par Value is synonymous to the amount of money printed in Philippine

bills. It signifies the amount of the stock at face value. If the authorized stock is the maximum

amount of stock that a corporation can issue, then subscribed capital is the amount of money

for which certain individuals have promised to pay to the corporation for their ownership. It is

required by the Corporation Code of the Philippines (1980) that 25% of the authorized capital

must be suscribed. Paid up capital refers to that portion of capital for which the corresponding

sum of money has been received. It is required by the Corporation Code (1980) that 25% of the

subscribed capital must be paid up. Stockholders are the owners of stocks evidenced by their

stock certificates.

Mini-Case Study:

Anna, Bea, Cathy, Delia and Edith wanted to put up a corporation. They decided to have

100,000 shares as the maximum shares to be issued by their Corporation. Furthermore, they

decided to include a P10 par value for each share.

Case 1 : How much is the authorized capital?

Authorized capital is 1,000,000. It is computed as P10 par value multiplied by 100,000

shares. The authorized capital is the maximum number of shares that a corporation may issue.

Address: Poblacion, Cataingan, Masbate

Telephone No.: (056) 578-3469

Republic of the Philippines

Department of Education

REGION V

SCHOOLS DIVISION OF MASBATE PROVINCE

CATAINGAN NATIONAL HIGH SCHOOL

Case 2 : How much must be subscribed of the authorized capital?

Subscribed capital must be P250,000. This is computed as 25% of the P1,000,000

authorized capital. Again, it is required by the Corporation Code that 25% of the authorized

capital must be subscribed. Subscribed capital pertains to the portion of the authorized capital

promised to be paid.

Case 3 : How much must be paid up of the subscribed capital?

Paid up capital must at least be P62,500. This is computed as 25% of the 250,000

subscribed capital. Again, it is required by the Corporation Code that at least 25% of the

subscribed capital must be paid up.

STOCKHOLDERS : TYPES and RIGHTS

Owners of a corporation are called stockholders (also called shareholders). Generally,

stockholders will have rights to vote to dividends and to new stock issues.

Right to vote pertains to the stockholders ability to participate in the significant decision

making agenda of the corporation through voting. Voting in a corporation is generally

proportional to the number of shares held by the stockholders.

Right to dividends pertain to the stockholder’s ability to receive the distribution of excess

profits from current and previous years. Dividends are generally considered as returns on the

amount invested in the stocks. Generally, dividends are declared per unit of share held by the

stockholders. For example, ABC Corporation declares dividends of P1.5 per share in 2015.

Consequently, Mary Consuelo holds 100,000 shares of ABC Corpoaration. Mary Consuelo

receives dividends of P150,000 (100,000 shares multiplied by P1.5) from ABC Corporation.

Right to new stock issues is also called Pre-emptive rights. Pre-emptive right is to existing

stockholders to prevent the dilution of corporate ownership. For example: ABC Corporation is

owned by Anthony (20%), Bryan (20%), Christian (20%), Donald (20%) and Edward (20%). In

2015 , ABC Corporation issues new 100,000 shares. The 100,000 shares will be first offered to

Anthony, Bryan, Christian, Donald and Edward.The said offer will be 20,000 stocks each

(100,000 stocks multipied by 20% ownership). This is to preserve their original ownership

percentage in the corporation. They may decide to purchase or not the offered shares. What is

important is that the cororation first offered the new issue of stocks to it’s existing stockholders

whether or not the stockholders will exercise their pre-emptive right is beyond the control of

the corporation.

Stocks (and stockholders) can either be Common or Preferred. Common stocks have all the

regular rights of a stockholder (vote, dividends and pre-emption). Preferred stocks, however,

are said to be “preferred” in terms of dividends. Preferred stocks are given priority over

common stocks when it comes to dividends. Usually, preferred stocks have a required dividend

for each year. The required dividend is usually a percentage of the preferred stocks.

Mini-Case Study :

Agnes Company has two types of stockholders. Common stockholders with paid up

capital of P1,000,000 and Preferred stockholders with paid up capital of P10,000,000. Preferred

shares are to be given preferential dividends of 8%. In 2015, the board of directors declared

dividends to the stockholders.

Address: Poblacion, Cataingan, Masbate

Telephone No.: (056) 578-3469

Republic of the Philippines

Department of Education

REGION V

SCHOOLS DIVISION OF MASBATE PROVINCE

CATAINGAN NATIONAL HIGH SCHOOL

Case 1 : How much will common and preferred stockholders receive if Agnes company

declares dividends of P810,000?

It must be noted that preferred stockholders should receive first their preferential dividends of

P800,000 (10,000,000 multiplied by 8%). The remaining P10,000 should go to common

stockholders.

Case 2 : How much will common and preferred stockholders receive if Agnes Company

declares dividends of P2,000,000?

It must be noted that preferred stockholders should receive first their preferential dividends of

P800,000. The remaining P1,200,000 (2,000,000 dividends declared less P800,00 preferred

dividends) will go to the common stockholders.

Notice that case 1 is favorable to preferred stockholders while case 2 is favorable to

common stockholders. Common stockholders face higher risks than preferred stockholders. But

if the circumstances are favorable (e.g. higher net income), common stockholders may also

obtain higher benefits.

ADVANTAGES AND DISADVANTAGES :

The major advantage of a corporation is the centralization of management through the board

of directors. The board of directors exercises oversight functions over the corporation. They

further protect the interest of the stockholders. All major decisions in the corporation must be

approved by jthem beforehand. The directors composing the board will bring with them the

expertise they have gained throughout their respective careers, as they lead the corporation.

Corporate organizations also have a longer existence. Generally, corporation in the Philippines

are given a life of 50 years, subject to renewal. Unlike Partnerships and sole proprietorships,

corporations may withstand their original owners. Specifically, ownership of a corporation may

be inherited by respective heirs of the original owners. A corporation is given a separat

personality from their shareholders. By extension, it is distinct and different with the

stockholders. Furthermore, the liabilities of it may not extend to the stockholders, unlike in sole

proprietorships and partnerships. Stockholders are only liable to the extent of their original

investment in the corporation.

The major disadvantage of a corporation is it’s stringent requiremnents for registration.

Registering a corporate entity in the Philippines will take a significantly longer period of time

than organizing a sole proprietorship or partnership. Also, corporations are subjected to heavy

government regulations through the Securities and Exchange Commission.

Corporation are also subjected to “double taxation”. The income of the corporation in itself will

be subjected to a corporate tax of 30%. Also, if the corporation decides to declare dividends to

its stockholders, the the dividends are again subjected to a withholding tax. It can be noted that

a corporation’s income is doubly taxed as it passes from the corporation to the stockholders.

Address: Poblacion, Cataingan, Masbate

Telephone No.: (056) 578-3469

Republic of the Philippines

Department of Education

REGION V

SCHOOLS DIVISION OF MASBATE PROVINCE

CATAINGAN NATIONAL HIGH SCHOOL

CORPORATE STATEMENT OF CHANGES IN EQUITY :

An example of a corporate statement of changes in equity is shown below:

BASIL CORPORATION

Statement of Changes in Equity

For the Year Ended, December 31, 2015

Common Additional Retatined

Stock Paid-in-Capital Earnings Total

Balance, January 01, 2015 1,000,000 100,000 200,000 1,300,000

Add: Additional stock issuance 100,000 10,000 - 110,000

Net Income for 2015 - - 150,000 150,000

Total 1,100,000 110,000 350,000 1,560,000

Less : Dividends for 2015 - - (100,000) (100,000)

Balance, December 31, 2015 1,100,000 110,000 250,000 1,460,000

========= ======== ========== ========

COMMON STOCK

This column shows the shares issued by the company. Furthermore, this contains the number

of shares issued by the company multiplied by the par value.

ADDITIONAL PAID-IN CAPITAL

This column shows the amount of money received by the company from the issuance of shares,

in excess of the par. For example, during the current year. Basil Corporation issues 10,000

shares (P10 par) for P11 pesos; the par value of 100,000 will go to the common stock column,

While the excess of 10,000 (issue price of P11 less P10, multiplied by 10,000 shares) will go to

the additional paid-in capital column.

RETAINED EARNINGS

This account contains all the net income and net loss incurred by the corporation for the

current and previous years. If the corporation decides to pay dividends to stockholders, then

the dividends are taken from this account.

EXERCISES

1. Which of the following are the major types of business organizations?

a. Sole proprietorship c. corporation

b. Partnership d. all of the choices

2. How many owners a partnership has/have?

a. One c. two but not more than five

b. More than one d. five and above

3. How are owners in a partnership called?

a. Sole proprietors c. shareholders/stockholders

b. Partners d. None of the choices

4. How are owners in a corporation called?

a. Sole proprietors c. shareholders/stockholders

b. Partners d. none of the choices

Address: Poblacion, Cataingan, Masbate

Telephone No.: (056) 578-3469

Republic of the Philippines

Department of Education

REGION V

SCHOOLS DIVISION OF MASBATE PROVINCE

CATAINGAN NATIONAL HIGH SCHOOL

5. Which of the following is subjected to the most regulations?

a. Sole proprietorships c Corporations

b. Partnerships d. none of the choices

6. Which of the following is most related to the saying “two heads are better than

one”?

a. Sole proprietorships c. Corporations

b. Partnerships d. none of the choices

7. Presented below are possible advantages and disadvantages. You are to determine

in the first column whether the item pertains to the advantages or disadvantages.

On the second column, you are to determine the related business organization. Item

1 is given as sample.

ADVANTAGE

INFORMATION OR BUSINESS

DISADVANTAGE ORGANIZATION

1. In the event of bankruptcy, business

creditors can run after the personal SOLE

DISADVANTAGE PROPRIETORSHIP

assets of the owners.

and PARTNERSHIP

2. Involvement of more persons in the

business, hence more sources of

expertise as compared to the most simple

business organization.

3. Transferrability of ownerships.

4. Limited Life

5. Business organization as a juridical or

separate person.

6. Corporate existence of 50 years,

renewable.

7. Most limited source of funding.

8. Most regulated business organization.

9. Double taxation

10. Limited Liability

11. Unlimited Liability

QUESTIONS :

Address: Poblacion, Cataingan, Masbate

Telephone No.: (056) 578-3469

Republic of the Philippines

Department of Education

REGION V

SCHOOLS DIVISION OF MASBATE PROVINCE

CATAINGAN NATIONAL HIGH SCHOOL

1. Discuss a partnership as a form of business organization. What are the advantages

and disadvantages?

2. Discuss a corporation as a form of business organization. What are the advantages

and disadvantages?

3. What are the two types or stocks? Define each.

4. What are the three rights of a stockholders? Define each.

5. Define Partnership and Corporation.

ENRICHMENT ACTIVITY :

1. How a partnership and corporation is organized?

2. What is the nature of a partnership and corporation?

3. Why is it that a corporation is the most regulated form of business organization?

Address: Poblacion, Cataingan, Masbate

Telephone No.: (056) 578-3469

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- WorksheetDocument37 pagesWorksheetKim FloresNo ratings yet

- MGT 101Document13 pagesMGT 101MuzzamilNo ratings yet

- Accounting SystemDocument36 pagesAccounting SystemMaeNo ratings yet

- AE 25 Module 1 Lesson 1Document99 pagesAE 25 Module 1 Lesson 1Queeny Mae Cantre ReutaNo ratings yet

- F7 (FR) Workbook (Mix)Document6 pagesF7 (FR) Workbook (Mix)Aye Myat ThawtarNo ratings yet

- Task-1 Master Budget With Profit ProjectionsDocument5 pagesTask-1 Master Budget With Profit ProjectionsbabluanandNo ratings yet

- Book 1Document2 pagesBook 1Mercedita EsparesNo ratings yet

- FOA ExamDocument3 pagesFOA ExamyeshaNo ratings yet

- Exam Finals Manon-OgDocument14 pagesExam Finals Manon-OgJM RoxasNo ratings yet

- mgt101 Questions With AnswersDocument11 pagesmgt101 Questions With AnswersKinza LaiqatNo ratings yet

- Notes BfarDocument4 pagesNotes BfarJoyce Ramos100% (2)

- 6 Months Debtors Aging Reports: Date: 19/01/2022 Gan SDN BHD (Chor Kai En)Document3 pages6 Months Debtors Aging Reports: Date: 19/01/2022 Gan SDN BHD (Chor Kai En)karenNo ratings yet

- Act 110 Bonus Activity (Dimalawang)Document10 pagesAct 110 Bonus Activity (Dimalawang)Kilwa DyNo ratings yet

- Module 3Document11 pagesModule 3Its Nico & SandyNo ratings yet

- Module 3Document11 pagesModule 3Its Nico & SandyNo ratings yet

- Preparation of 10Document5 pagesPreparation of 10Shean VasilićNo ratings yet

- V Litton Worksheet AdjDocument1 pageV Litton Worksheet AdjDing Costa100% (1)

- Unit 1 - QuestionsDocument4 pagesUnit 1 - QuestionsMohanNo ratings yet

- Activity 6.1: Business Name FS Frequency Store Hours Payroll Previous Period Period Ending Employee Number Employee NameDocument30 pagesActivity 6.1: Business Name FS Frequency Store Hours Payroll Previous Period Period Ending Employee Number Employee NameDaniel CabasaNo ratings yet

- AnsweredASS16 AccountingDocument6 pagesAnsweredASS16 Accountingvomawew647No ratings yet

- Consolidation FP ExampleDocument4 pagesConsolidation FP ExampleYoooNo ratings yet

- Consolidation FP ExampleDocument4 pagesConsolidation FP ExampleYAUHANo ratings yet

- JID2196Document5 pagesJID2196natashasani76No ratings yet

- Alternative AssessmentDocument5 pagesAlternative AssessmentKaneki KenNo ratings yet

- Management Accounting QBDocument31 pagesManagement Accounting QBrising dragonNo ratings yet

- AFM Case Study MbaDocument2 pagesAFM Case Study MbaN . pavanNo ratings yet

- Accounting Equation ch4Document13 pagesAccounting Equation ch4Ebony Ann delos SantosNo ratings yet

- Accounting Equation ch5Document19 pagesAccounting Equation ch5Ebony Ann delos SantosNo ratings yet

- Work SheetDocument3 pagesWork SheetsuperwafiNo ratings yet

- QuizDocument2 pagesQuizaprilbetito02No ratings yet

- Consolidation FP ExampleDocument4 pagesConsolidation FP ExampleSuryaRaoNo ratings yet

- Quiz SolutionDocument3 pagesQuiz SolutionKim Patrick VictoriaNo ratings yet

- Model Paper AnswersDocument12 pagesModel Paper AnswersShenali NupehewaNo ratings yet

- Fee BillDocument1 pageFee BillKhanpk11No ratings yet

- Sample Question MCom 2019 PatternDocument6 pagesSample Question MCom 2019 PatternPRATIKSHA CHAUDHARINo ratings yet

- ChalanDocument1 pageChalanMuhammad huzaifaNo ratings yet

- Assignment Financial AccountingDocument4 pagesAssignment Financial AccountingJatin SinghalNo ratings yet

- EE Practice Qs Foreign Currency - AnswersDocument6 pagesEE Practice Qs Foreign Currency - AnswersTham Ru JieNo ratings yet

- Essentials of Accounting For Governmental and Not-For-Profit Organizations 12th Edition Copley Solutions Manual 1Document37 pagesEssentials of Accounting For Governmental and Not-For-Profit Organizations 12th Edition Copley Solutions Manual 1elizabeth100% (35)

- Fund Flow Statement WorksheetDocument3 pagesFund Flow Statement WorksheetAnish AroraNo ratings yet

- Form Kosong-1Document12 pagesForm Kosong-1Toold 75No ratings yet

- Jawaban CH 5 - TM 11Document3 pagesJawaban CH 5 - TM 11ahmad shinigamiNo ratings yet

- Chapter II Quiz No. 2Document7 pagesChapter II Quiz No. 2Ravenna Dela CruzNo ratings yet

- 1302 - ACC - English - FinalDocument4 pages1302 - ACC - English - Finalthanushka harshanaNo ratings yet

- Chapter 10 CLDocument14 pagesChapter 10 CLNicho Deven HamawiNo ratings yet

- DPC9 1203320148457561 05032024234910Document2 pagesDPC9 1203320148457561 05032024234910dk031353No ratings yet

- FY25 House Education BudgetDocument16 pagesFY25 House Education BudgetTrisha Powell CrainNo ratings yet

- Final AccountsDocument18 pagesFinal AccountsAkella kavya SharmaNo ratings yet

- Practica en Aspel-CoiDocument32 pagesPractica en Aspel-CoilizbethNo ratings yet

- Solution Manual For Essentials of Accounting For Governmental and Not For Profit Organizations 14th Edition Paul CopleyDocument14 pagesSolution Manual For Essentials of Accounting For Governmental and Not For Profit Organizations 14th Edition Paul CopleyCameronHerreracapt100% (39)

- Financial Accounting (Bbaw2103)Document10 pagesFinancial Accounting (Bbaw2103)tachaini2727No ratings yet

- Financial Statement HandoutDocument3 pagesFinancial Statement Handoutrafeeq50% (2)

- NBS-7026A Workshop 2 Answers - AccountingDocument3 pagesNBS-7026A Workshop 2 Answers - Accountingizudominic03No ratings yet

- Zabala Auto Supply Worksheet JANUARY 31, 2021 Unadjusted Trial Balance DebitDocument24 pagesZabala Auto Supply Worksheet JANUARY 31, 2021 Unadjusted Trial Balance DebitIphegenia DipoNo ratings yet

- Bachelor of Management With Honours (Bim)Document11 pagesBachelor of Management With Honours (Bim)Aizat Ahmad100% (3)

- MGT101 Financial Accounting Lecturewise Questions Answersfor Final Term Exam PreparationDocument35 pagesMGT101 Financial Accounting Lecturewise Questions Answersfor Final Term Exam PreparationShoaib AkhtarNo ratings yet

- ASS16 AccountingDocument6 pagesASS16 Accountingvomawew647No ratings yet

- T AccountsDocument6 pagesT AccountsJae LucienNo ratings yet

- Bookkeeping T-AccountsDocument5 pagesBookkeeping T-AccountsWenibet SilvanoNo ratings yet

- Department of Education: Mean Percentile ScoreDocument1 pageDepartment of Education: Mean Percentile ScoreKuro KiNo ratings yet

- Department of Education: I. Program TitleDocument5 pagesDepartment of Education: I. Program TitleKuro KiNo ratings yet

- Sim Week 5Document17 pagesSim Week 5Kuro KiNo ratings yet

- LAS FABM2 QTR 2, wk4Document8 pagesLAS FABM2 QTR 2, wk4Kuro KiNo ratings yet

- Hrpta Project Proposal 2021 2022Document4 pagesHrpta Project Proposal 2021 2022Kuro Ki100% (1)

- LAS FABM2 QTR 2, wk5Document12 pagesLAS FABM2 QTR 2, wk5Kuro KiNo ratings yet

- Applied Economics: I. Direction: Write The Letter of Your BEST AnswerDocument2 pagesApplied Economics: I. Direction: Write The Letter of Your BEST AnswerKuro KiNo ratings yet

- Daily Lesson Log DLL FormatDocument2 pagesDaily Lesson Log DLL FormatKuro KiNo ratings yet

- Activities I. Learning QuestionsDocument2 pagesActivities I. Learning QuestionsKuro KiNo ratings yet

- MCM Liquidation RENEWAL ESP - PLACERDocument5 pagesMCM Liquidation RENEWAL ESP - PLACERKuro KiNo ratings yet

- Carol Ipcrf 2021-2022Document45 pagesCarol Ipcrf 2021-2022Kuro KiNo ratings yet

- Excess Augmentation June 2022Document1 pageExcess Augmentation June 2022Kuro KiNo ratings yet

- Revised MCM Progress 2022 SieDocument21 pagesRevised MCM Progress 2022 SieKuro KiNo ratings yet

- List of Students - Humss 2 (2022-2023)Document7 pagesList of Students - Humss 2 (2022-2023)Kuro KiNo ratings yet

- Department of Education: School'S Technical Assistance PlanDocument1 pageDepartment of Education: School'S Technical Assistance PlanKuro KiNo ratings yet

- Merchandiser Mandays Template NOV 1-15,2021Document7 pagesMerchandiser Mandays Template NOV 1-15,2021Kuro KiNo ratings yet

- General Instructions To Examinees Professional Regulation CommissionDocument1 pageGeneral Instructions To Examinees Professional Regulation CommissionHerald PadillaNo ratings yet

- Senior High School Student Permanent Record: Republic of The Philippines Department of EducationDocument4 pagesSenior High School Student Permanent Record: Republic of The Philippines Department of EducationKuro KiNo ratings yet

- Input Data Sheet For SHS E-Class Record: Learners' NamesDocument5 pagesInput Data Sheet For SHS E-Class Record: Learners' NamesKuro KiNo ratings yet

- Certificate of Signatures 2020 FillinDocument1 pageCertificate of Signatures 2020 FillinKuro KiNo ratings yet

- School Form 1 (SF 1)Document6 pagesSchool Form 1 (SF 1)Kuro KiNo ratings yet

- Module 3 - Q1Document18 pagesModule 3 - Q1Kuro KiNo ratings yet

- Control Sa Doktrina at Sinusubok (K31C) : Manggagawa Assigned Number Dcode/Distrito 01047Document5 pagesControl Sa Doktrina at Sinusubok (K31C) : Manggagawa Assigned Number Dcode/Distrito 01047Kuro KiNo ratings yet

- Answer w3-4Document9 pagesAnswer w3-4Kuro KiNo ratings yet

- School Safety Assessment Tool: (SSAT)Document1 pageSchool Safety Assessment Tool: (SSAT)Kuro KiNo ratings yet

- Nene R. Merioles, Ceso V: Republic of The Philippines Department of Education Region V Division of MasbateDocument1 pageNene R. Merioles, Ceso V: Republic of The Philippines Department of Education Region V Division of MasbateKuro KiNo ratings yet

- Narrative ReportDocument2 pagesNarrative ReportKuro KiNo ratings yet

- Story Map: Acquiring My First Language Setting CharactersDocument4 pagesStory Map: Acquiring My First Language Setting CharactersKuro KiNo ratings yet

- TAX OutlineDocument42 pagesTAX Outlineabmo33No ratings yet

- Financial and Managerial Accounting 9th Edition Needles Solutions ManualDocument14 pagesFinancial and Managerial Accounting 9th Edition Needles Solutions Manualdonnamargareta2g5100% (26)

- Personal Real Nominal McqsDocument6 pagesPersonal Real Nominal Mcqsasfandiyar100% (3)

- Professional Summary: Vikneswary S.SalwamDocument10 pagesProfessional Summary: Vikneswary S.Salwamalena encantadiaNo ratings yet

- 24 000 Annual Income (Loss)Document6 pages24 000 Annual Income (Loss)Rian EsperanzaNo ratings yet

- Cornerstone - RDC (220617)Document7 pagesCornerstone - RDC (220617)Oladamola OyabambiNo ratings yet

- Jebv Vol 3 Issue 1 2023 4Document20 pagesJebv Vol 3 Issue 1 2023 4Journal of Entrepreneurship and Business VenturingNo ratings yet

- Mentorrd DM DSDocument2 pagesMentorrd DM DSJohnsey RoyNo ratings yet

- Practice Problem Set 01 - With SolutionDocument14 pagesPractice Problem Set 01 - With SolutionAntonNo ratings yet

- Acreaty Ghana Executive SearchDocument9 pagesAcreaty Ghana Executive SearchEugene EdiforNo ratings yet

- Stop Smoking ConsultingDocument16 pagesStop Smoking ConsultingKazim AdilNo ratings yet

- Individual MKT304Document21 pagesIndividual MKT304ducbmhs163293No ratings yet

- MGCR 211 Introduction To Financial Accounting Summer 2019 Assignment 2-Answer SheetDocument7 pagesMGCR 211 Introduction To Financial Accounting Summer 2019 Assignment 2-Answer SheetAnoosha SiddiquiNo ratings yet

- Rainas Municipality Office of The Municipal Executive AOC: Tinpiple, Lamjung, Gandaki Province, NepalDocument10 pagesRainas Municipality Office of The Municipal Executive AOC: Tinpiple, Lamjung, Gandaki Province, NepalLaxu KhanalNo ratings yet

- Tax Final TaxDocument19 pagesTax Final TaxSittie Aisah AmpatuaNo ratings yet

- Bus - Ethics - q3 - Mod3 - Code of Ethics in Business - FinalDocument29 pagesBus - Ethics - q3 - Mod3 - Code of Ethics in Business - FinalJessebel Dano Anthony100% (16)

- Internship Report of AryanDocument30 pagesInternship Report of AryanVaibhav MawalNo ratings yet

- (Bọp Đã Điền) BSBHRM411 AssignmentDocument44 pages(Bọp Đã Điền) BSBHRM411 AssignmenthsifjpobNo ratings yet

- M2Topic1 Strategic Project Management NEWDocument10 pagesM2Topic1 Strategic Project Management NEWMelisa May Ocampo AmpiloquioNo ratings yet

- Institutional Theory and Environmental Pressures: The Moderating Effect of Market Uncertainty On Innovation and Firm PerformanceDocument12 pagesInstitutional Theory and Environmental Pressures: The Moderating Effect of Market Uncertainty On Innovation and Firm PerformanceayuNo ratings yet

- Unit 2 A Marketplace of Ideas BusinessDocument3 pagesUnit 2 A Marketplace of Ideas Businesshồng quân trươngNo ratings yet

- MIL CPI IW May 2021 EDocument1 pageMIL CPI IW May 2021 EAmit BharambeNo ratings yet

- Pob Form 3Document6 pagesPob Form 3yuvita prasadNo ratings yet

- AS NZS ISO 14001-1996 Environmental Management Systems - SpeDocument24 pagesAS NZS ISO 14001-1996 Environmental Management Systems - SpeKrunalNo ratings yet

- Assistant Director/Director Materials ManagementDocument2 pagesAssistant Director/Director Materials Managementapi-121668770No ratings yet

- Pas 16 Property, Plant, and Equipment: I. NatureDocument2 pagesPas 16 Property, Plant, and Equipment: I. NatureR.A.No ratings yet

- 5.007 SAFETY RECOGNITION AND INCENTIVE PROGRAMS (SRIPs)Document5 pages5.007 SAFETY RECOGNITION AND INCENTIVE PROGRAMS (SRIPs)Ahmed TrabelsiNo ratings yet

- Online Advertising Research in Advertising Journals A ReviewDocument19 pagesOnline Advertising Research in Advertising Journals A Reviewsofia muhammadNo ratings yet

- Pemeriksaan Full Paper Icms-2023 UnrikaDocument7 pagesPemeriksaan Full Paper Icms-2023 UnrikaendtsnackNo ratings yet

- List of External and Internal Issues - ISO 14001 - Version 1Document2 pagesList of External and Internal Issues - ISO 14001 - Version 1sotoye80% (5)