Professional Documents

Culture Documents

Taxation

Uploaded by

Coffee VanillaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Taxation

Uploaded by

Coffee VanillaCopyright:

Available Formats

lOMoARcPSD|29596630

Taxation

Professional Teaching (Camarines Norte State College)

Studocu is not sponsored or endorsed by any college or university

Downloaded by Coffee Vanilla (cffvnll@gmail.com)

lOMoARcPSD|29596630

Republic of the Philippines

CAMARINES NORTE STATE COLLEGE

F. Pimentel Avenue, Brgy. 2, Daet, Camarines Norte – 4600, Philippines

COLLEGE OF BUSINESS AND PUBLIC

Name of faculty: Ryan Daves F. Quiñones, CPA

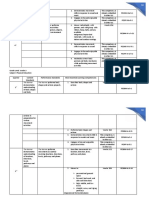

Subject: Taxation – HRM 2A

Schedule for Instruction: MW 9:30-11:00

Lesson/Topic:

Objectives

Explain the Basic Principles, Objectives, State Powers and Aspects of Taxation.

Apply the essential characteristics, Limitations and Situs of taxation.

Identify the sources of tax authority and the functions of the Bureau of Internal

Revenue.

Enumerate the categories of income and the tax rates applicable per type of

income

Discuss the Classification of income tax payers other than individual.

Identify and differentiate the categories of income.

Determine the scope and different sources of gross income.

Correctly classify gains and losses from dealings in properties if taxable under

income taxation.

Calculate correctly the number of allowable interests, rents, royalties and other

passive incomes.

Explain the Basic Principles, Objectives, State Powers and Aspects of Taxation.

Apply the essential characteristics, Limitations and Situs of taxation.

Identify the sources of tax authority and the functions of the Bureau of Internal

Revenue.

Enumerate the categories of income and the tax rates applicable per type of

income

Identify the taxpayers allowed to claim foreign tax credit

Compute the correct amount of foreign tax credit to be deducted.

Recognized allowable deductions from gross income.

Identify and differentiate different types of individual taxpayers and to compute

their taxable income and tax payable.

Differentiate the general professional partnership and ordinary partnership; to

know how to compute their taxable income and tax payable.

Distinguish Domestic from Foreign Corporations and Resident from Non-resident

Corporations; to know how to compute their taxable income and tax payable.

Distinguish estate and trust and to know how to compute the income tax on

estate and trust.

Compute the income subject to income tax

File an accurate income tax form.

Recognize the definition, nature, compositions, powers and duties of the board of

investment and investment policies.

Distinguish the creation, composition, qualification and requirement from PEZA

and BMBE

Downloaded by Coffee Vanilla (cffvnll@gmail.com)

lOMoARcPSD|29596630

Republic of the Philippines

CAMARINES NORTE STATE COLLEGE

F. Pimentel Avenue, Brgy. 2, Daet, Camarines Norte – 4600, Philippines

COLLEGE OF BUSINESS AND PUBLIC

Discussion

Taxation

Taxation is the inherent power by which the sovereign through its lawmaking body

raises revenue to defray the necessary expenses of the government.

Taxation as a power

It is the inherent power of the government to demand contributions for public purpose

Taxation as a process

It is the process by which the sovereign through its lawmaking body raises income to

defray the necessary expenses of the government.

Eminent Domain

It is the inherent power of the sovereign state to take private property for public use

upon payment of just compensation.

Police Power

is the power of the state to promote public welfare by restraining and regulating the

use of liberty and property. It is the most pervasive, the least limitable and the most

demanding of the three fundamental powers of the StPolice power is a power

coextensive with self-protection and is aptly termed the law of overruling

necessitIt is the inherent power of the sovereign state to enact laws to promote

public health, public morals, public safety and general welfare of the people.

Police Power vs. Taxation vs. Eminent Domain

Basis Police Power Taxation Eminent Domain

Extent of Power Regulates liberty and Affects only property rights

property

Power exercise by Exercised only by the government May be exercise by

whom private entities

Nature of property Property is noxious or Property is wholesome

taken intended for a

noxious purpose

Purpose as to Property taken is Property taken is for public use

property taken destroyed

Compensation Intangible altruistic Protection and Fair market value

feeling that one has public off the property

contributed to the improvements expropriated

public good/general

welfare.

As to Purpose To promote public To raise To facilitate the

welfare through revenue taking of private

regulations property for public

Downloaded by Coffee Vanilla (cffvnll@gmail.com)

lOMoARcPSD|29596630

Republic of the Philippines

CAMARINES NORTE STATE COLLEGE

F. Pimentel Avenue, Brgy. 2, Daet, Camarines Norte – 4600, Philippines

COLLEGE OF BUSINESS AND PUBLIC

use

Purposes of Taxation

The primary purpose of taxation is to raise revenue in order to satisfy government

needs.

Secondary or non-revenue purpose of Taxation (IRI-PREP)

1. Implement of Police power

2. Regulation of activities/industries

3. Implement of the power of imminent domain

4. Promotion of general welfare

5. Reduction of social inequality

6. Encourage economic growth

7. Protectionism – to protect local industries from foreign competition

Nature of the Power of taxation

1. Legislative in character*

2. Inherent attribute of sovereignty

3. The power of taxation may be the power to destroy

4. The power of taxation is bound by inherent and constitutional limitations

5. The power of taxation is comprehensive unlimited, plenary and supreme

* Only the legislature determines the (CONES) coverage, object, nature, extent and

situs of the tax to be imposed.

Taxation is inherent attribute of sovereignty. It is a power that is purely legislative.

The power to tax involves the power to destroy. But the power to tax is not the

power to destroy while this court sits. Reconcile.

The power to tax involves the power to destroy because being an enforced contribution

the subject is not at liberty to free himself from this burden. However, this power is not

absolute because it is subject to certain inherent and constitutional limitations. If the

exercise of the taxing power exceeds these limitations, then the court has the duty to

declare the same as invalid or unconstitutional, thereby preventing the destructive

nature of taxation.

Characteristics of taxation (CUPS)

1. Comprehensive – covers all persons, property, business, rights and privileges

2. Unlimited – tax does not cease to be valid merely because it regulates,

discourages or even definitely deters the activities tax.

3. Plenary - complete

4. Supreme – it is supreme in so far as the selection of the subject of taxation.

Theories of Taxation

Downloaded by Coffee Vanilla (cffvnll@gmail.com)

lOMoARcPSD|29596630

Republic of the Philippines

CAMARINES NORTE STATE COLLEGE

F. Pimentel Avenue, Brgy. 2, Daet, Camarines Norte – 4600, Philippines

COLLEGE OF BUSINESS AND PUBLIC

1. Lifeblood Theory

2. Necessity Theory

3. Benefit-Protection Theory (doctrine of symbiotic relationship)

4. Jurisdiction over subjects and objects

Lifeblood doctrine

Without revenue from taxation the government can neither exist nor endure. The

government will not survive resulting in detriment to society. Without taxes, the

government would be paralyzed for lack of motive power to activate and operate it.

Necessity Theory

The exercise of the power to tax emanates from necessity, because without taxes,

government cannot fulfill its mandate of promoting the general welfare and well-

being of the people.

Benefits receive principle

It dictates that the citizens support the State in order that they may, by means thereof,

be secured in the enjoyment of the benefits of an organized society.

It involves the power of the State to demand and receive taxes on the reciprocal duties

of support and protection between the State and its citizen.

Taxpayers should pay taxes because of the benefit received by the taxpayer from the

government.

No one is allowed to object to or resists the payment of taxes solely because no

personal benefit to him can be pointed out.

Doctrine of symbiotic relationship

Every person who is able must contribute his share in the burden of running the

government. The government for its part is expected to respond in the form of tangible

and intangible benefits intended to improve the lives of the people and enhance their

material and moral values.

Taxation arises because of the reciprocal relation of protection and support between the

State and taxpayers. The state gives protection and for it to continue giving protection, it

must be supported by the taxpayers in the form of taxes.

Rule on Jurisdiction over subjects and objects

1. Tax laws cannot operate beyond the State territorial limits.

2. The government cannot tax a particular object of taxation which is not within its

territorial jurisdiction.

3. Properties outside one’s jurisdiction do not receive any protection of the State

4. If a law is passed by Congress, it must ensure that the object and subject of

taxation are within the territorial jurisdiction of the taxing authority.

Downloaded by Coffee Vanilla (cffvnll@gmail.com)

lOMoARcPSD|29596630

Republic of the Philippines

CAMARINES NORTE STATE COLLEGE

F. Pimentel Avenue, Brgy. 2, Daet, Camarines Norte – 4600, Philippines

COLLEGE OF BUSINESS AND PUBLIC

The eclectic theory as applied to taxation means that a state tax law cannot extend

outside its territorial jurisdiction.

Taxation is territorial because it is only within the confines of its territory that a country,

state or sovereign may give protection.

Basic Principle of a sound Tax System (canons of Taxation (FAT)

1. Fiscal adequacy – sources of revenue must be sufficient to meet government

expenditures.

2. Administrative Feasibility – tax laws must be capable of effective and efficient

administration

3. Theoretical Justice – taxes must be imposed based on the taxpayer’s ability to

pay

“A tax law will retain its validity even if it is not in consonance with the principles of fiscal

adequacy and administrative feasibility. However, if a tax law runs contrary to the

principle of theoretical justice, such violation will render the law unconstitutional

considering that under the Constitution, the rule of taxation should be uniform and

equitable.”

Non-observance of the canon will not render the tax imposition invalid except to the

extent that specific constitutional or statutory limitations are impaired.

Stages/Aspects of a system of taxation (LAPR)

1. Levy or Imposition (Tax legislation) – technical term is impact of taxation; refers

to the enactment of tax laws or statutes.

2. Assessment and Collection (tax administration)

3. Payment – technical term is incidence of taxation

4. Refund

Scope of the legislative power to tax

1. Discretion as to subjects of taxation

2. Discretion as to purposes for which taxes shall be levied.

3. Discretion as to amount or rate of tax

4. Discretion as to the manner, means and agencies of collection of taxes

5. Kind of tax to be collected

6. Apportionment of the tax

7. Grant of tax exemptions and condonations

8. Power to specify or provide administrative as well as judicial remedies

Taxpayer’s Suit

It is a remedy available to a taxpayer when taxes are used for illegal activities OR when

public funds are used for projects which are not intended for public purpose.

Downloaded by Coffee Vanilla (cffvnll@gmail.com)

lOMoARcPSD|29596630

Republic of the Philippines

CAMARINES NORTE STATE COLLEGE

F. Pimentel Avenue, Brgy. 2, Daet, Camarines Norte – 4600, Philippines

COLLEGE OF BUSINESS AND PUBLIC

It is a case where the act complained of directly involves the illegal disbursement of

public funds collected through taxation.

Taxpayer’s suit may only be allowed when an act complained of, which may include a

legislative enactment, directly involves the illegal disbursement of public funds

derived from taxation.

Requisites:

1. Public funds derived from taxation are disbursed by a political subdivision or

instrumentality and in doing so, a law is violated or some irregularity is committed

2. The petitioner is directly affected by the alleged ultra vires act.

Inherent Limitations of Tax (PITIE)

1. Public purpose

2. Inherently legislative

3. Territorial

4. International Comity

5. Exemption of government entities, agencies and instrumentalities

A violation of any of the inherent limitations constitute a violation of the due process

clause.

Public Purpose

The concept of public purpose is synonymous with public interest, public benefit,

public welfare and public convenience.

Test in Determining Public Purpose

1. Duty Test – whether the thing to be furthered by the appropriation of public

revenue is something which is the duty of the State to provide.

2. Promotion of the general welfare test – whether the proceeds of the tax will

directly promote the welfare of the community in equal measure.

International Comity

Comity is respect accorded by nations to each other as co-equals. As taxation is an act

of sovereignty, such power should not be imposed upon equals out of respect.

The rule of reciprocity applies only if the property is an intangible personal

property situated in the Philippines.

Rules related to International Comity

1. Exemption from tax of foreign governments

2. Foreign government are not constituted as withholding agents

3. Exemption from tax of salaries of diplomats and officials of foreign states

Downloaded by Coffee Vanilla (cffvnll@gmail.com)

lOMoARcPSD|29596630

Republic of the Philippines

CAMARINES NORTE STATE COLLEGE

F. Pimentel Avenue, Brgy. 2, Daet, Camarines Norte – 4600, Philippines

COLLEGE OF BUSINESS AND PUBLIC

4. Zero-rating of sale or exemption of importation of goods, supplies and fuel to

international carriers.

Exemption of Government Entities from Taxation

The government cannot tax itself. This inherent limitation applies only to the State itself.

Agencies performing governmental functions are exempt from tax unless expressly

taxed, while proprietary functions are subject to tax unless expressly exempted.

May the government tax itself?

Yes. The Constitution is silent on whether Congress is prohibited from taxing the

properties of the agencies of the government. Therefore, nothing can prevent Congress

from decreeing that even instrumentalities or agencies of the government performing

governmental functions may be subject to tax.

Instrumentality

It refers “to any agency of the National Government, not integrated within the

department framework, vested with special functions or jurisdiction by law, endowed

with some if not all corporate powers, administering special funds and enjoying

operational autonomy, usually through a charter.

Exceptions to the non-delegability of the taxing power

1. The Congress may authorize the president to fix within specified limits, and

subject to such limitations and restrictions as it may impose, tariff rates, import

and export quotas, tonnage and wharfage dues and other duties or imposts

within the framework of the national development program of the government;

2. Each local government unit shall have the power to create its own sources of

revenue and to levy taxes, fees and charges subject to such guidelines and

limitations as the Congress may provide, consistent with the basic policy of local

autonomy. Such taxes, fees and charges shall accrue exclusively to the local

governments.

Flexible Tariff Clause

The power of the President upon recommendation of the NEDA to

1. Increase, reduce or remove existing protective tariff rates of import duty, but in no

case shall be higher than 100% ad valorem

2. Establish import quota or to ban importation of any commodity as may be

necessary

3. Impose additional duty on all import not exceeding 10% ad valorem whenever

necessary.

Define Situs of Taxation

Downloaded by Coffee Vanilla (cffvnll@gmail.com)

lOMoARcPSD|29596630

Republic of the Philippines

CAMARINES NORTE STATE COLLEGE

F. Pimentel Avenue, Brgy. 2, Daet, Camarines Norte – 4600, Philippines

COLLEGE OF BUSINESS AND PUBLIC

Situs of Taxation is the place of taxation. It is the place or authority that has the right to

impose and collect taxes.

All kinds of taxpayers are subject to income tax on income derived from sources within

the Philippines.

Only resident citizens and domestic corporations are liable to income tax on income

derived from sources without the Philippines.

Factors that determine the Situs of Taxation (ReCiNSuS)

1. Residence of the taxpayer

2. Citizenship of the taxpayer

3. Nature of the Tax

4. Subject matter of the tax

5. Source of Income

Rule on Situs of Property Taxes

1. Real Property taxes – Where the property is located regardless of whether the

owner is a resident or a non-resident.

2. Personal Property

a. Tangible Personal Property – where the property is physically located

although the owner resides in another jurisdiction

b. Intangible Personal Property –

GR: Situs is the domicile of the owner applying the principle of

mobilia sequuntur personam (movables follow the person)

XPN:

1. When the property has acquired a business situs in another

jurisdiction.

2. When the law provides for the situs of the subject tax.

Constitutional Limitations

1. Provisions DIRECTLY affecting taxation

1. Uniformity and equality of taxation

2. Prohibition on use of tax levied for special purpose

3. Majority vote of Congress for grant of tax exemption

4. Non-impairment of jurisdiction of the Supreme Court

5. Prohibition against imprisonment for non-payment of poll tax

6. Grant of Power to the LGU to create its own sources of revenue

7. Non-appropriation or use of public money for religious purposes

8. Grant by the Congress of authority to the president to impose tariff rates.

Downloaded by Coffee Vanilla (cffvnll@gmail.com)

lOMoARcPSD|29596630

Republic of the Philippines

CAMARINES NORTE STATE COLLEGE

F. Pimentel Avenue, Brgy. 2, Daet, Camarines Norte – 4600, Philippines

COLLEGE OF BUSINESS AND PUBLIC

9. Prohibition against taxation of religious, charitable and educational entities.

10. Prohibition against taxation of non-stock non-profit educational institution.

11. President’s veto power on appropriation, revenue, tariff bills (ART bills)

12. All ART bills, bills authorizing the increase of the public debt, bills of local

application and private bills shall originate exclusively in the House of

Representatives, but the Senate may propose or concur with amendments.

Constitutional limitations INDIRECTLY affecting taxation

1. Due Process clause

2. Equal Protection clause

3. Religious Freedom

4. Freedom of the Press and expression

5. Non-impairment of obligations of contracts

6. No taking of private property for public use without just compensation.

Poll tax or Community Tax

It is levied on persons who are residents within the territory of the taxing authority

without regard to their property, business or occupation. Only the CTC could qualify.

No person shall be imprisoned for a debt or non-payment of poll tax.

What is the required vote of Congress for granting of tax exemptions?

No law granting any tax exemption shall be passed without the concurrence of the

majority of all the members of the Congress.

In granting tax exemptions, an absolute majority of the members of Congress is

required, while in cases of withdrawal of such tax exemption, a relative majority is

sufficient.

When is tax exemption irrevocable? Revocable?

It is revocable if it is based on franchise, equity, public policy, economic policy that the

state can unilaterally revoke. It is irrevocable if it would result in violation of non-

impairment clause and when it is based on a contract whereby valuable consideration is

given.

Article VI Section 28(3), 1987 Constitution

Charitable institutions, churches, and parsonages or convents appurtenant thereto,

mosques, non-profit cemeteries, and all lands, buildings and improvements actually,

directly and exclusively used for religious, charitable or educational purposes shall be

exempt from taxation.

Rule on exemption from tax of religious, charitable and educational institutions.

Charitable institutions, churches, parsonages or convents, mosques, non-profit

cemeteries and all lands, buildings and improvements actually, directly and

Downloaded by Coffee Vanilla (cffvnll@gmail.com)

lOMoARcPSD|29596630

Republic of the Philippines

CAMARINES NORTE STATE COLLEGE

F. Pimentel Avenue, Brgy. 2, Daet, Camarines Norte – 4600, Philippines

COLLEGE OF BUSINESS AND PUBLIC

exclusively used for religious, charitable or educational purposes shall be exempt

from taxation.

What is meant by actual, direct and exclusive use of the property for charitable

purposes is the direct and immediate and actual application of the property itself to

the purposes for which the charitable institution is organized. It is not the use of income

from the property that is determinative of whether the property is used for tax exempt

purposes.

The tax exemption applies to Real Property tax only.

The test of exemption is the use of the property and not ownership.

Income from any activity conducted for profit by tax-exempt entities are subject to

income tax, including capital gains tax for sale of real property not actually used in

business by a corporation.

Requisites for a charitable institution to be exempt from Income Tax

1. A non-stock corporation or association

2. Organized exclusively for charitable purposes

3. Operated exclusively for charitable purposes

4. No part of its net income or asset shall belong to or inure to the benefit of any

member, organizer, officer or any specific person

Article XIV Section 4(3) 1987 constitution

All revenues and assets of non-stock, non-profit educational institutions used actually,

directly and exclusively for educational purposes shall be exempt from taxes and duties.

Upon the dissolution or cessation of the corporate existence of such institutions, their

assets shall be disposed of in the manner provided by law.

Rule on exemption from tax of non-stock, non-profit educational institutions

All revenues AND assets of non-stock, non-profit educational institutions used

actually, directly and exclusively for educational purposes shall be exempt from taxes

and duties. Upon the dissolution or cessation of the corporate existence of such

institutions, there assets shall be disposed of in the manner provided by law.

Proprietary educational institutions may likewise be entitled to such exemptions subject

to the limitations provided by law including restrictions on dividends and provisions for

reinvestment.

Ownership is not material in the determination of the exemption. Rather usage of the

property determines whether the property is covered by tax exemption.

Non-stock, non-profit educational institutions are exempt from income tax, real property

tax, donor’s tax, and customs duties because the provision speaks of all revenues and

assets.

Downloaded by Coffee Vanilla (cffvnll@gmail.com)

lOMoARcPSD|29596630

Republic of the Philippines

CAMARINES NORTE STATE COLLEGE

F. Pimentel Avenue, Brgy. 2, Daet, Camarines Norte – 4600, Philippines

COLLEGE OF BUSINESS AND PUBLIC

When a non-stock, non-profit educational institutions proves that it uses it revenues

actually, directly and exclusively for educational purposes, it shall be exempted

from income tax, VAT and LBT. When it also shows that it uses its assets in the form

of real property for educational purposes, it shall be exempted from RPT.

Taxation of revenues differs from the taxation of assets. When a non-stock non-profit

educational institution proves that it uses its revenues actually, directly and exclusively

for educational purposes, it shall be exempted from income tax, VAT and Local

Business Tax. On the other hand, when it also shows that it uses its assets in the form

of real property for educational purposes, it shall be exempt from real property tax.

Proving the actual use of the taxable item will result in an exemption, but the specific tax

from which the entity shall be exempted shall depend on whether the item is an item of

revenue or asset.

What is the Principle of Judicial Non-interference?

The courts cannot inquire into the wisdom of a taxing act unless there is a violation of

constitutional limitations or restrictions. The courts cannot inquire into the wisdom,

morality or expediency of policies adopted by the political departments of government in

areas which fall within their authority except only when such policies pose a clear and

present danger to the life, liberty or property of the individual.

Rational basis test

The equal protection clause recognizes a valid classification that is a classification that

has a reasonable foundation or rational basis and not arbitrary.

Notes on Equal Protection Clause

The prosecution of one guilty person while others equally guilty are not prosecuted,

however, is not by itself, a denial of equal protection of the laws.

A discriminatory purpose is not presumed, there must be a showing of a clear and

intentional discrimination.

Equality and uniformity in taxation means that all taxable articles or kinds of property of

the same class shall be taxed at the same rate.

Taxation is said to be equitable when its burden falls on those better able to pay.

It is inherent in the power to tax that a State be free to select the subjects of taxation

and it has been repeatedly held that inequalities which result from a singling out of one

particular class for taxation or exemption infringe no constitutional limitation.

Notes on Religious Freedom

A municipal license tax on sale of bibles and religious articles by non-stock, non-profit

missionary organization at minimal profit constitutes curtailment of religious freedom

and worship which is guaranteed by the Constitution.

Downloaded by Coffee Vanilla (cffvnll@gmail.com)

lOMoARcPSD|29596630

Republic of the Philippines

CAMARINES NORTE STATE COLLEGE

F. Pimentel Avenue, Brgy. 2, Daet, Camarines Norte – 4600, Philippines

COLLEGE OF BUSINESS AND PUBLIC

Rule of Strict Interpretation

A statute will not be construed as imposing a tax unless it does so expressly, clearly and

unambiguously.

Rule in the grant of power of taxation

With respect to the taxing power of the State, any ambiguity shall be resolved in favor of

the grant of taxing power of the State because the power of taxation is inherent. No

enabling law is necessary for the grant of such power.

Principle of strictissimi juris

Laws granting exemption from tax are construed strictissimi juris against the taxpayer

and liberally in favor of the taxing power. Taxation is the rule and tax exemption is the

exception.

Tax exemptions and exclusions are regarded as derogation of sovereign authority and

to be construed strictissimi juris against the person or entity claiming the exemption.

The general rule is taxation is the rule and exemption is the exception. It shall apply

when the grantee is a municipal corporation, and the property is not held in private

ownership but a public property.

Taxation is the rule and exemption is the exception. The effect of an exemption is

equivalent to an appropriation.

Exceptions to the principle of strictissimi juris

1. When the law expressly provides for liberal interpretation

2. When the grantee of tax exemption is religious or charitable institution

3. When the taxpayer falls within the purview of exemption by clear legislative intent

4. When the grantee is a municipal corporation with respect to its public property

only

5. When the imposition is special taxes relating to special cases and affecting only

special classes of persons.

6. When the grantee of tax exemption is the government, its political subdivisions or

instrumentalities

Definition of Taxes

Taxes are enforced proportional contribution from persons and property, levied by the

State by virtue of its sovereignty for the support of the government and all public needs.

Requisites of a valid tax

1. It should be uniform

2. It must be levied for public purpose

3. Person or property being taxed should be within the jurisdiction of the taxing

authority

Downloaded by Coffee Vanilla (cffvnll@gmail.com)

lOMoARcPSD|29596630

Republic of the Philippines

CAMARINES NORTE STATE COLLEGE

F. Pimentel Avenue, Brgy. 2, Daet, Camarines Norte – 4600, Philippines

COLLEGE OF BUSINESS AND PUBLIC

4. It must not impinge on the inherent and constitutional limitation on the power of

taxation

Characteristics of taxes

1. It is levied for public purpose

2. It is proportionate in character

3. It is generally payable in money

4. It is levied on persons and property

5. It is levied by the State through its law-making body

6. It is levied by the State which has jurisdiction over person and property

7. It is an enforced contribution not dependent on the will of the person taxed

Taxes vs. Toll

Basis Taxes Toll

As to purpose Taxes are levied for the support Toll is compensation for the

of the government use of another’s property

As to Taxes are determined by the Toll is determined by the cost

determination of sovereign of the property or of

amount improvement

Ass to who may Taxes may only be imposed by Toll may be imposed by the

impose the State government or private

individual

Tax vs. License fee

Tax License Fee

Imposed for revenue purposes Imposed for regulatory purposes

A tax is an exercise of the taxing power of Is an exercise of the police power of the

the state state

Amount is unlimited It is limited to the cost of regulation

Non-payment does not make the Non-payment makes the business illegal.

business illegal but may be ground for

criminal prosecution

Test in determining whether the imposition is a tax or a fee

If the generation of revenue is the primary purpose and regulation is merely incidental

the imposition is a tax; but if regulation is the primary purpose the fact that incidentally

revenue is also obtained does not make the imposition a tax.

Purpose of distinction

1. The nature of exaction determines the existence of double taxation

2. The nature of exaction determines the applicability of the tests of validity.

3. The nature of exaction determines whether an entity is exempt from payment of

such exaction.

Taxes vs. Special Assessment

Downloaded by Coffee Vanilla (cffvnll@gmail.com)

lOMoARcPSD|29596630

Republic of the Philippines

CAMARINES NORTE STATE COLLEGE

F. Pimentel Avenue, Brgy. 2, Daet, Camarines Norte – 4600, Philippines

COLLEGE OF BUSINESS AND PUBLIC

Basis Tax Special Assessment

As to definition Enforced proportional Enforced proportional

contributions from persons or contributions from owners

property of lands especially or

peculiarly benefited by

public improvements

As to subject Taxes are levied on lad, persons, Levied only on land

property, income, business, etc.

As to liability Personal liability of the taxpayer Cannot be made a

personal liability of the

person assessed

As to basis Based on necessity and partially Based solely on benefits

on benefits

As to application General application Special application only as

to a particular time and

place

Tax vs. Debt

Tax Debt

The source of the obligation is law The source of obligation is contract

Taxes are due to the government in its Debts are due to the government in its

sovereign capacity corporate capacity.

Failure to pay, other than poll tax may No imprisonment for non-payment of debt

result in imprisonment

Generally payable in money Payable in money, property or service

Not assignable Assignable

Not subject to compensation or set-off May be subject to compensation or set-off

Taxes does not draw interest unless Debt draws interest if stipulated or

delinquent delayed.

The assessment and collection of taxes may be barred by prescription.

Progressive tax vs. Regressive tax vs. Proportionate tax

Progressive tax – it is one where the tax rate increases as the tax base increase. (e.g.,

graduated tax rates for individual taxpayers)

Regressive tax – one where the tax rate decreases as the tax base increases (there

are no regressive taxes in the Philippines)

Proportionate tax – one where ta fixed percentage is applied regardless of the amount

of the income, property or other basis to be taxed. (e.g., single corporate income tax

rate imposed on the taxable net income of corporate taxpayers)

Direct taxes vs. Indirect taxes

Direct taxes – demanded from the very person who, as intended, should pay the tax

which he cannot shift to another. (Income tax, estate tax, donor’s tax)

Downloaded by Coffee Vanilla (cffvnll@gmail.com)

lOMoARcPSD|29596630

Republic of the Philippines

CAMARINES NORTE STATE COLLEGE

F. Pimentel Avenue, Brgy. 2, Daet, Camarines Norte – 4600, Philippines

COLLEGE OF BUSINESS AND PUBLIC

Indirect taxes –demanded in the first instance from one person with the expectation

that he can shift the burden to someone else, not as tax but as part of the purchase

price (VAT, excise tax, other percentage taxes & DST).

In indirect taxes, the incidence of taxation falls on one person but the burden can be

shifted or passed on to another person.

How to determine if a tax is direct or indirect?

It is direct tax when the impact or liability for the payment of the tax as well as incidence

or burden of the tax falls on the same person.

It is indirect tax when the impact or liability for payment of tax falls on one person but

the incidence or burden thereof can be shifted or passed to another.

What is meant by taxation at source?

It refers to the withholding system of collecting taxes. Under this method, the payor of

the income acts as the withholding agent of the government by deducting the tax in

advance from the income to be paid to the recipient taxpayer and remitting the same to

the BIR within the period mandated by law.

Notes on withholding taxes

Withholding tax is not a tax. It is a method of collecting income in advance from the

taxable income of the recipient of the income.

In withholding taxes, the incidence AND burden of taxation fall on the same entity, the

statutory taxpayer.

The burden of taxation is not shifted to the withholding agent who merely collects, by

withholding the tax due from income payments to entities arising from certain

transactions and remits the same to the government.

Philippine withholding tax system has no application to income derived from foreign

countries.

Who is the withholding agent for final withholding tax? For creditable withholding

tax?

The FWT should be withheld and remitted to the BIR by the withholding agent/payor

corporation.

Under the withholding tax system, whether final or creditable tax, the withholding agent

is the person who has control over the funds from which the payment of the income is

made.

When will the prescriptive period for refund of final withholding taxes

commence?

Downloaded by Coffee Vanilla (cffvnll@gmail.com)

lOMoARcPSD|29596630

Republic of the Philippines

CAMARINES NORTE STATE COLLEGE

F. Pimentel Avenue, Brgy. 2, Daet, Camarines Norte – 4600, Philippines

COLLEGE OF BUSINESS AND PUBLIC

Final withholding taxes are considered as full and final payment of the income tax due

and thus are not subject to any adjustments. Thus, the 2-year prescriptive period

commences to run from the time the refund is ascertained, i.e., the date such tax was

paid and not upon the discovery by the taxpayer of the erroneous or excessive payment

of taxes.

Are tax laws civil or penal in nature?

Tax laws are civil in nature. It is the civil liability to pay taxes that gives rise to criminal

liability.

BIR Rules and Regulations that revoke, modify or reverse a ruling or circular

GR: It shall not be given retroactive application if the revocation, modification or reversal

will be prejudicial to the taxpayer.

XPN:

1. Taxpayer acted in bad faith.

2. Taxpayer deliberately misstates or omits material facts from his return or in any

document required of him by the BIR

3. Where the facts subsequently gathered by the BIR are materially different from

the facts on which the ruling is based;

Double Taxation

It is taxing the same subject or object twice by the same taxing power within the same

taxable period for the same purpose.

Double taxation exists when the two taxes are imposed on the same subject matter for

the same purpose, by the same taxing authority, within the same jurisdiction, during the

same taxing period and the taxes must be of the same kind or character.

Elements of Double taxation

The two taxes must be imposed on the same:

1. subject matter

2. same purpose

3. same taxing authority

4. within the same jurisdiction

5. during the same taxing period

6. the taxes must be of the same kind or character.

Double taxation in the strict sense vs. Double Taxation in the broad sense

Double taxation in the strict sense refers to direct double taxation. This occurs when

the same property is taxed twice where it should be taxed but once; both taxes must be

imposed on the same property or subject matter, for the same purpose, by the same

Downloaded by Coffee Vanilla (cffvnll@gmail.com)

lOMoARcPSD|29596630

Republic of the Philippines

CAMARINES NORTE STATE COLLEGE

F. Pimentel Avenue, Brgy. 2, Daet, Camarines Norte – 4600, Philippines

COLLEGE OF BUSINESS AND PUBLIC

state or government, or taxing authority, within the same jurisdiction or taxing district,

during the same taxing period and they must be of the same kind or character.

Double taxation in the broad sense refers to indirect double taxation. It is one not

covered by direct double taxation. It is one not covered by direct double taxation

although it imposes two or more taxes.

Direct double taxation is the prohibited type while indirect double taxation is

permissible as two taxes of different nature or character are imposed by two different

taxing authorities.

Modes of eliminating Double Taxation

1. Tax credit

2. Tax deduction

3. Tax exemption

4. Tax treaty

5. Vanishing deduction

6. Application of reciprocity rule

7. Imposition of a rate lower than the normal domestic rate

Exemption Method

The income or capital which is taxable in the state of source or situs is exempted in the

state of residence, although in some instances it may be taken into account in

determining the rate of tax applicable to the taxpayer’s remaining income or capital.

Credit Method

The tax paid in the state of source is credited against the tax levied in the state of

residence.

The basic difference between the two method is that in the exemption method, the focus

is on the income or capital itself, whereas the credit method focuses upon the tax.

Most favored nation clause

The most favored nation clause is intended to established the principle of equality of

international treatment by providing that the citizens or subjects of the contracting

nations may enjoy the privileges accorded by either party to those of the most favored

nation.

International juridical double taxation means the imposition of comparable taxes in

two or more states on the same taxpayer in respect of the same subject matter and for

identical periods.

Elements of International Juridical Double Taxation

1. There are two or more States

2. There is one and the same taxpayer

Downloaded by Coffee Vanilla (cffvnll@gmail.com)

lOMoARcPSD|29596630

Republic of the Philippines

CAMARINES NORTE STATE COLLEGE

F. Pimentel Avenue, Brgy. 2, Daet, Camarines Norte – 4600, Philippines

COLLEGE OF BUSINESS AND PUBLIC

3. The same subject matter is taxed

4. The same period

Tax Credit

Tax credit is a remedy that is afforded to a taxpayer for the purpose of minimizing the

effects of international double taxation, the taxpayer having to pay income taxes to the

Philippine and foreign governments. This remedy though is available only to resident

citizens and domestic corporations whose income is derive from sources within and

without the Philippines. Resident aliens, non-resident foreign corporations are not

allowed to claim any tax credit for foreign income taxes that they have paid.

Tax credit is a remedy that is afforded to a taxpayer for the purpose of minimizing the

effects of “international double taxation”, the taxpayer having to pay income taxes to the

Philippine and foreign governments. This remedy though is available only to resident

citizens and domestic corporations whose income is derived from sources within and

without the Philippines.

Tax treaty

Tax treaty is an agreement entered into between sovereign states for purposes of

eliminating double taxation on income and capital, preventing fiscal evasion, promoting

mutual trade and investment, and according fair and equitable tax treatment to foreign

residents or nationals.

It is entered into to reconcile the national, fiscal legislations of the contracting parties

and in turn, help the taxpayer avoid simultaneous taxations in two different jurisdictions.

How does a tax treaty eliminate double taxation?

1. It sets out the respective rights to tax of the state of source or situs and of the

state of residence with regard to certain classes of income or capital.

2. The method for the elimination of double taxation applies whenever the state of

source is given a full or limited right to tax together with the state of residence.

Application of Reciprocity Rule

The reciprocity rule does not apply to tax credits. The reciprocity rule applies to non-

resident alien only if the property is intangible and the decedent is a non-resident alien.

What is an exchange of notes?

An exchange of notes is considered as an executive agreement which is binding on the

State even without Senate Concurrence. It is a record of a routine agreement that has

many similarities with private law.

Escape from Taxation

1. Shifting of tax burden

2. Tax avoidance/tax minimization

Downloaded by Coffee Vanilla (cffvnll@gmail.com)

lOMoARcPSD|29596630

Republic of the Philippines

CAMARINES NORTE STATE COLLEGE

F. Pimentel Avenue, Brgy. 2, Daet, Camarines Norte – 4600, Philippines

COLLEGE OF BUSINESS AND PUBLIC

3. Tax evasion/Tax dodging

4. Capitalization

5. Transformation

6. Exemption

Only indirect taxes may be shifted

What are the ways of shifting the tax burden?

1. Forward shifting – when the burden of tax is transferred from the manufacturer,

then to the distributor and finally to the ultimate consumer of the product; best

example is VAT.

2. Backward Shifting – when the burden is transferred from the ultimate consumer

through the factors of distribution to the factors of production.

3. Onward shifting – when tax burden is shifted two or more times either forward

or backward.

Tax avoidance or tax minimization

Tax avoidance is the use of legal means to reduce tax liability and it is the legal right of

a taxpayer to decrease the amount of what otherwise would be his taxes by means

which the law permits.

It is the exploitation by the taxpayer of legally permissible alternative tax rates or

methods of assessing taxable property or income in order to reduce or avoid tax liability.

It is tax saving device sanctioned by law and should be used by the taxpayer in GF and

arms-length.

Tax evasion or tax dodging

Tax evasion is a scheme used outside of those lawful means to escape tax liability and

when availed of, it usually subjects the taxpayer to further or additional civil or criminal

liabilities.

Willful in tax crimes means voluntary, intentional violation of a known legal duty, and bad

faith or bad purpose need not be shown.

Tax evasion is deemed complete when the violator has knowingly and willfully filed a

fraudulent return with intent to evade and defeat a part or all of the tax. An assessment

of tax deficiency is not required in a criminal prosecution for tax evasion.

Elements of tax evasion (CAE)

1. Course of action (or failure of action) which is unlawful;

2. Accompanying state of mind which is described as being evil, in bad faith, willful

or deliberate and not accidental;

3. End to be achieved, i.e., payment of less than that known by the taxpayer to be

legally due or non-payment of tax when it is shown that the tax is due;

Doctrine of Willful Blindness

Downloaded by Coffee Vanilla (cffvnll@gmail.com)

lOMoARcPSD|29596630

Republic of the Philippines

CAMARINES NORTE STATE COLLEGE

F. Pimentel Avenue, Brgy. 2, Daet, Camarines Norte – 4600, Philippines

COLLEGE OF BUSINESS AND PUBLIC

A deliberate avoidance of knowledge of a crime especially by failing to make reasonable

inquiry about a suspected wrongdoing despite being aware that it is highly improbable.

An individual or corporation can no longer say that errors on their tax returns are not

their responsibility or that it is the fault of the accountant they hired.

The taxpayer’s deliberate refusal or avoidance to verify the contents of his or her ITR

and other documents constitutes willful blindness on his or her part. It is by reason of

this doctrine that taxpayers cannot simply invoke reliance on mere representations of

their accountants or authorized representatives in order to avoid liability for failure to

pay the correct taxes.

Tax exemption

It is the privilege of not being imposed a financial burden to which others may be

subject. It is strictly construed against the taxpayer and liberally construed in favor of the

government. Taxation is the rule; tax exemption is the exception.

Tax exemption is a grant of immunity from payment of tax while assumption of tax

liability does not provide immunity from payment of tax as it merely allows the shifting

of the burden of taxation to another entity.

Rules governing compensation or set-off as applied in taxation

GR: No set-off is admissible against the demands for taxes levied for general or local

governmental purposes.

XPNs:

1. When the determination of the taxpayer’s liability is intertwined with the

resolution of the claim for tax refund of erroneously or illegally collected taxes.

2. Where both claims of the government and the taxpayer against each other have

already become due, demandable and fully liquidated.

Where both the claim of the government and the taxpayer against each other have

already become due, demandable and fully liquidated compensation takes place by

operation of law and both obligations are extinguished to their concurrent amounts.

Taxes that are already fully liquidated, due and demandable may be set-off by operation

of law and as a matter of practical convenience.

Taxes and claims for refund cannot be the subject of set-off because the government

and the taxpayer are not creditors and debtors of each other. Claims for refunds just like

debts are due from the government in its corporate capacity while taxes are due to the

government in its sovereign capacity.

While as a rule, taxes cannot be subject to compensation because the government and

the taxpayer are not creditors and debtors of each other, the Court have allowed the

offsetting of taxes where the determination of the taxpayer’s liability is intertwined with

Downloaded by Coffee Vanilla (cffvnll@gmail.com)

lOMoARcPSD|29596630

Republic of the Philippines

CAMARINES NORTE STATE COLLEGE

F. Pimentel Avenue, Brgy. 2, Daet, Camarines Norte – 4600, Philippines

COLLEGE OF BUSINESS AND PUBLIC

the resolution of the claim for tax refund of erroneously or illegally collected taxes

under S229 of the tax Code.

Tax Amnesty

Tax amnesty is a general pardon or the intentional overlooking by the State of its

authority to impose penalties on persons guilty of tax evasion or violation of revenue or

tax law. It partakes of an absolute waiver by the government of its right to collect what is

due it and to give evaders who wish to relent a chance to start with a clean slate.

Under RA 9480, they are specifically excluded from the coverage of the tax amnesty

program. The withholding agent is liable only insofar as he failed to perform his duty to

withhold the tax and remit the same to the government. The liability for the tax remains

with the taxpayer because the gain was realized and received by him. Since the liability

for the tax belongs to the taxpayer and not tot the withholding agent, only the former

may avail of the tax amnesty.

Purposes of Tax Amnesty

1. to give tax evaders who wish to relent a chance to start a clean slate; and

2. to give the government a chance to collect uncollected tax from tax evaders

without having to go through the tedious process of a tax case.

Tax pyramiding is the imposition of a tax upon another tax. It has no basis in fact or in

law.

Tax condonation or remission is when the State desists or refrains from exacting,

inflicting or enforcing something as well as to reduce what has already been taken.

Taxing Authority

Powers and duties of the BIR (ERAGE)

1. Enforcement of all forfeitures, penalties and fines

2. Recommend to the Secretary of Finance all needful rules and regulations for the

effective enforcement of the NIRC

3. Assessment and collection of all national internal revenue taxes, fees and

charges.

4. Give effect and administer the supervisory and police powers conferred to it by

the NIRC and other laws

5. Execution of judgments in all cases decided in its favor by CTA and regular

courts

What are the powers of the CIR?

1. Interpret tax laws

2. Decide tax cases

3. Make arrest and seizures

4. Prescribed real property values

5. Suspend business operations of taxpayers

Downloaded by Coffee Vanilla (cffvnll@gmail.com)

lOMoARcPSD|29596630

Republic of the Philippines

CAMARINES NORTE STATE COLLEGE

F. Pimentel Avenue, Brgy. 2, Daet, Camarines Norte – 4600, Philippines

COLLEGE OF BUSINESS AND PUBLIC

Power of the CIR which cannot be delegated (RICA)

1. Recommend promulgation of rules and regulations by the Secretary of Finance

2. Issue rulings of first impression or to reverse, revoke or modify any existing rule

by the BIR

3. Compromise or abate any tax liability

4. Assign or re-assign internal revenue officers to establishments where articles

subject to excise tax are produced or kept.

To be valid, ruling of first impression must not only be conformable with law. It must also

be issued by the CIR himself, as it is one of the non-delegable powers of the CIR.

Disclosure of Bank Deposits to the CIR

GR: Bank deposits of an individual taxpayer may not be disclosed by a commercial

bank to the CIR.

XPNs: (CIR is authorized to inquire into the bank deposits)

1. To determine the decedent’s gross estate

2. When the taxpayer has filed an application for compromise of his tax liability by

reason of financial incapacity

3. A taxpayer who authorizes the CIR to inquire into his bank deposits

4. The Philippines is under a Treaty obligation and a specific taxpayer is subject of

a request for the supply of tax information from a foreign tax authority.

Requisites of the power of the CIR to prescribed property values

1. Mandatory consultation with competent appraisers both from private and public

sectors.

2. With prior written notice to affected taxpayers

3. Automatic adjustment once every 3 years

4. Adjustment must be published in a newspaper of general circulation and posted

in provincial capital, city or municipal hall and two other conspicuous places

5. That the basis of any valuation including the records of consultation done shall

be public records open to the inquiry of any taxpayer.

Is the BIR acts of issuing rules and regulations in the exercise of judicial or quasi-

judicial power?

No. BIR’s act of issuing rules and regulations is not in the exercise of any judicial or

quasi-judicial capacity. It is in the exercise of BIR’s quasi-legislative or rule making

power.

Revenue Regulation

Issuances signed by the Secretary of Finance upon recommendation of the CIR that

specify, prescribe, or define rules and regulations for the effective enforcement of the

NIRC and related issuances.

Downloaded by Coffee Vanilla (cffvnll@gmail.com)

lOMoARcPSD|29596630

Republic of the Philippines

CAMARINES NORTE STATE COLLEGE

F. Pimentel Avenue, Brgy. 2, Daet, Camarines Norte – 4600, Philippines

COLLEGE OF BUSINESS AND PUBLIC

Requisites of a valid BIR Rules and regulations

1. Reasonable

2. Useful and necessary

3. Consistent and in harmony with the law

4. Published in the official Gazette or newspaper of general circulation

Revenue Regulation vs. Administrative Ruling

Basis Revenue Regulation Administrative Ruling

Issuing It is issued by the Secretary It is issued by the CIR if it is a ruling of first

body of Finance impression or his subordinates if the ruling is

not in the nature of first impression

Nature It is in the nature of It is the best guess of the CIR concerning

implementing rules of tax tax applications

laws

Scope It is applicable to all It is applicable to taxpayer who requested

taxpayers the ruling, except when the ruling is in the

nature of general interpretative rule

Binding It is binding upon court for It is not binding but has great weight.

Effect being a subordinate

legislation

Legislative rule vs Interpretative rule

Legislative Rule is in the matter of subordinate legislation, designed to implement a

primary legislation by providing the details thereof.

Interpretative Rule is designed to provide guidelines to the law which the

administrative agency is in charge of enforcing. General Interpretative rule applies to

all taxpayers alike, and not only to one particular taxpayer.

Income tax systems

Global tax systems

All items of income which are earned during the taxable period are lumped together

and subjected to a single set of income tax rates.

System employed where the tax systems views indifferently the tax base and generally

treats in common all categories of taxable income of the individual.

Schedular tax system

Different types of income are subjected to different set of graduated or flat rates

depending on the classification of income.

System employed where the income tax treatment varies and is made to depend on the

kind or category of taxable income of the taxpayer.

Downloaded by Coffee Vanilla (cffvnll@gmail.com)

lOMoARcPSD|29596630

Republic of the Philippines

CAMARINES NORTE STATE COLLEGE

F. Pimentel Avenue, Brgy. 2, Daet, Camarines Norte – 4600, Philippines

COLLEGE OF BUSINESS AND PUBLIC

Tax liability for income tax attaches only if there is a gain realized resulting from a

closed and completed transaction.

Income Tax

Income tax is a tax on all yearly profits arising from property, profession, trade or

business or a tax on person’s income, emoluments, profits and the like

It is a kind of tax levied upon the privilege of receiving income or profit. It is an excise

tax and not a tax on property.

Business Tax vs. Income Tax

Business Tax Income tax

Imposed on the exercise of police power Tax on all yearly profits arising form

for regulatory purposes are paid for the property, professions, trade or offices or

privilege of carrying on a business in the as a tax on a person’s income,

year the tax was paid. It is paid at the emoluments, profits and the like. It is a

beginning of the year to allow the tax on income whether net or gross

business to operate for the rest of the realized in one taxable year. It is due on

year. It is deemed a prerequisite to the or before the 15th day of the 4th month

conduct of business following the close of the taxpayer’s

taxable year and is generally regarded as

an excise tax, levied upon the right of a

person or entity to receive income or

profits.

Definition of Income

Income refers to all wealth which flows into the taxpayer other than a mere return of

capital. It includes the flows of income specifically described as gains and profits

including gains derived from the sale or disposition or other capital assets.

Capital vs. Income

Capital Income

A fund of property existing at A flow of services rendered by the capital or any other

an instant time benefit rendered by the fund of capital in relation to

such fund through a period of time.

Capital is wealth Income is a service of wealth

Not subject to income tax Subject to income tax

Requisites for income to be taxable

1. There is an income, gain or profit

2. The income, gain or profit is not exempt from income tax.

3. The income, gain or profit must be realized (actually or constructively) or

received during the taxable year

What are the criteria in imposing Philippine Income Tax?

Downloaded by Coffee Vanilla (cffvnll@gmail.com)

lOMoARcPSD|29596630

Republic of the Philippines

CAMARINES NORTE STATE COLLEGE

F. Pimentel Avenue, Brgy. 2, Daet, Camarines Norte – 4600, Philippines

COLLEGE OF BUSINESS AND PUBLIC

1. Citizenship Principle

2. Residence Principle

3. Source Principle

What are the considerations in determining whether an income is taxable?

1. Existence of Income

2. Realization of Income

3. Recognition of Income

Test to determine whether income is earned for tax purposes

1. Realization Test

2. Claim of right doctrine (Doctrine of Ownership, command or control)

3. Economic Benefit Test or Doctrine of Proprietary Interest

4. Severance test

5. All events test

Realization Tests

Under the realization principle, revenue is generally recognized when the earning

process is complete or virtually complete and an exchange has taken place.

There is no taxable income until there is a separation from capital of something of

exchangeable value, thereby supplying the realization or transmutation which would

result in the receipt of income.

Claim of right doctrine or Doctrine of Ownership or Command or control Doctrine

Taxable gain is conditioned upon the presence of a claim of right to the alleged gain

AND the absence of a definite unconditional obligation to return or repay that which

would otherwise constitute a gain.

The recipient, even if he has the obligation to return the same, has a voidable title to the

money received through mistake, thus taxable.

Economic Benefit or Doctrine of Proprietary Interest

Any income benefit to the employee that increases his net worth, whatever may have

been the mode by which it is affected is taxable.

Taking into consideration the pertinent provisions of law, income realized is taxable only

to the extent that the taxpayer is economically benefited.

Severance Test

This theory dictates income is recognized where there is a separation of something

which is of exchange value.

Downloaded by Coffee Vanilla (cffvnll@gmail.com)

lOMoARcPSD|29596630

Republic of the Philippines

CAMARINES NORTE STATE COLLEGE

F. Pimentel Avenue, Brgy. 2, Daet, Camarines Norte – 4600, Philippines

COLLEGE OF BUSINESS AND PUBLIC

Income is not deemed realized until the fruit has been plucked from the tree. Income is

recognized when there is separation of something which is of exchangeable value.

All events test

For Income or expense to accrue, this test requires the fixing of a right to income or

liability to pay and the availability of the reasonable accurate determination of such

income or liability. The amount of liability does not have to be determined exactly; it

must be determined with reasonable accuracy.

Requisites of All events test

1. Fixing of a right to income or liability to pay

2. Availability of the reasonable accurate determination of such income or liability to

warrant the inclusion of the income or expense the gross income or deductions

during the taxable year.

The all-events test states that an expense is deductible in the year the amount of

liability is determinable with reasonable accuracy.

James Doctrine

This doctrine provides that even though the law imposes a legal obligation upon an

embezzler or thief to repay the funds, the embezzled or stolen money still forms part of

the gross income since the embezzler or thief has no intention of repaying the money.

Taxable Period

Taxable period is the calendar year or fiscal year ending during such calendar year,

upon the basis of which the net income is computed for income tax purposes.

Calendar Year vs. Fiscal Year vs. Short Period

Calendar year refers to the accounting period of 12 months ending December 31.

Fiscal year means an accounting period of 12 months ending on the last day of any

month other than December.

Short Period is a period of less than 12 months; Change in accounting period

a. From fiscal to calendar year – between the close of the last fiscal year and the

following December 31; or

b. From calendar to fiscal year – between the close of the last calendar year and

the date designated as the close of the fiscal year.

Grounds for termination of taxable period

a. He hides or conceals his property

Downloaded by Coffee Vanilla (cffvnll@gmail.com)

lOMoARcPSD|29596630

Republic of the Philippines

CAMARINES NORTE STATE COLLEGE

F. Pimentel Avenue, Brgy. 2, Daet, Camarines Norte – 4600, Philippines

COLLEGE OF BUSINESS AND PUBLIC

b. Taxpayer is retiring from business subject to tax

c. He intends to leave the Philippines or remove his property therefrom

d. He performs any act tending to obstruct the proceedings for the collection of the tax

for the past or current quarter or year or renders the same totally or partly ineffective

unless such proceedings are beginning immediately

Instances when a calendar year must be adopted as the taxable year other than a

fiscal year.

1. Taxpayer is an individual

2. Taxpayer is an estate or trust

3. Taxpayer does not kept books of accounts

4. Taxpayer has no annual accounting period

5. Taxpayer’s accounting period is other than a fiscal year.

Instances when a short period or a period of less than 12 months may be adopted

by the taxpayer

1. When the corporation is dissolved

2. When the corporation changes its accounting period

3. When the CIR by authority, terminate the taxable period of a taxpayer

4. In case of final return of the decedent and such period ends at the time of his

death.

5. When the corporation is newly organized and commenced operations on any day

within a year

General Principles of Income Taxation

1. RC and DC are taxable on their income derived from sources within and without

the Philippines.

2. All other kind of taxpayers are taxable only on their income derived from sources

within the Philippines.

3. An overseas contract worker is taxable only from income derived from sources

within the Philippines.

Non-Resident Citizen

1. A citizen of the Philippines who is physically present abroad with a definite

intention to reside therein.

2. A citizen of the Philippines who reside abroad, either as an immigrant or for

employment on a permanent basis

3. A citizen of the Philippines who works and derives income abroad and whose

employment requires him to be physically present abroad most of the time

during the taxable year

4. A NRC citizen who arrives at any time during the taxable year to reside

permanently in the Philippines with respect to his income derived from sources

abroad until the date of his arrival in the Philippines.

What does the phrase “most of the time” means?

Downloaded by Coffee Vanilla (cffvnll@gmail.com)

lOMoARcPSD|29596630

Republic of the Philippines

CAMARINES NORTE STATE COLLEGE

F. Pimentel Avenue, Brgy. 2, Daet, Camarines Norte – 4600, Philippines

COLLEGE OF BUSINESS AND PUBLIC

It means at least 183 days whether continuous or broken.

Resident alien

An alien who resides in the Philippines on a more or less permanent basis (must be

actually present in the Philippines for more than 12 months from his arrival to the

country)

An alien may be considered a resident of the Philippines for Income Tax purposes if:

1. He is not a mere transient or sojourner

2. He has no definite intention as to his stay in the Philippines; or

3. His purpose is of such a nature that an extended stay may be necessary for its

accomplishment and the alien makes his home temporarily in the Philippines.

Who is a non-resident alien?

It is an individual whose residence is not within the Philippines and who is not a citizen

thereof. It may be an NRA-ETB or NRA-not ETB)

Non-resident alien engaged in trade or business in the Philippines (NRA-ETB) is

an alien deriving income in the Philippines and who stays therein for an aggregate

period of more than 180 days during the calendar year. The stay need not be

continuous.

NRA – not ETB – is an alien deriving income in the Philippines and who stays therein

for an aggregate period of 180 days or less during any calendar year.

Special aliens are now subject to the regular income tax rate as the preferential income

tax rate is no longer applicable, without prejudice to preferential rates under existing tax

treaties.

Nonresident aliens not engaged in trade or business are subject to a flat rate of 25%

based on gross income and not based on schedular tax rate.

Indicators that the NRA is ETB in the Philippines

1. stayed in the Philippines for an aggregate period of more than 180 days

2. Principle of habituality – regularly engaged in commercial business in the

Philippines regardless of the period of stay

3. Establishment of a branch, appointment of an agent and hiring of an employee

Is an offline international air carrier selling passage tickets in the Philippines,

through a general sales agent, considered as a resident foreign corporation?

Yes. Doing business in the Philippines includes appointing representatives or

distributors operating under full control of the foreign corporation, domiciled in the

Philippines or who in any calendar year stay in the country for a period totaling 180 days

or more.

Downloaded by Coffee Vanilla (cffvnll@gmail.com)

lOMoARcPSD|29596630

Republic of the Philippines

CAMARINES NORTE STATE COLLEGE

F. Pimentel Avenue, Brgy. 2, Daet, Camarines Norte – 4600, Philippines

COLLEGE OF BUSINESS AND PUBLIC

Discuss tax liability of partnerships.

Partnerships, no matter how created or organized, except general professional

partnerships and joint venture or consortiums engaged in construction or energy related

operations are taxable as corporations.

GPP shall not be subject to Income Tax. Each partner shall report as GI his distributive

share, actually or constructively received in the NI of the partnership.

For purposes of computing the distributive share of the partners, the NI of the GPP shall

be computed in the same manner as a corporation. As such, a GPP may claim either

the itemized deductions or it can opt to avail of the OSD allowed to corporations in

claiming deductions in an amount not exceeding 40% of its GI. Once availed, individual

partner is not allowed to avail of the 8% income tax rate option since share from GPP is

already net of cost and expenses.

Is co-ownership subject to income tax?

GR: a co-ownership is exempt from income tax.

XPNs:

1. When the income of the co-ownership is invested by the co-owners in other

income-producing properties or income-producing activities; or

2. When there is no attempt to divide inherited property for more than 10 years and

the said property was not under any administration proceedings nor held in trust

an unregistered partnership is deemed to exist.

Definition of Gross Income

Gross Income means all income derived from whatever source.

Income derived from whatever source, concept

All income not expressly excluded or exempted from the class of taxable income,

irrespective of the voluntary or involuntary action of the taxpayer in producing the

income and regardless of the source of income is taxable.

Fringe Benefits

Any good, service or other benefits furnished or granted by an employer to an employee

except rank-and-file employee.

Employer is the one required to pay income tax on fringe benefit.

FBT covers only the taxable fringe benefits of managerial and supervisory employees.

Tax exempt fringe benefits

1. Fringe benefits which are authorized and exempted from tax under special laws.

Downloaded by Coffee Vanilla (cffvnll@gmail.com)

lOMoARcPSD|29596630

Republic of the Philippines

CAMARINES NORTE STATE COLLEGE

F. Pimentel Avenue, Brgy. 2, Daet, Camarines Norte – 4600, Philippines

COLLEGE OF BUSINESS AND PUBLIC

2. Contributions of the employer for the benefit of the employee retirement,

insurance and hospitalization benefit plans

3. benefits given to the rank-and-file employees, whether granted under a collective

bargaining agreement or not

4. De Minimis benefits

What are the taxable fringe benefits? (HEV-HIM-THEL)

1. Housing

2. Expense Account

3. Vehicle of any kind

4. Household personnel

5. Interest foregone

6. Membership fees, dues and other expenses

7. Travel expenses

8. Holiday and vacation expenses

9. Educational assistance to employees or his dependents

10. Life or health and other non-life insurance premiums

De Minimis Benefits

Facilities or privileges furnished by an employer to his employees that are of relatively

small value and are furnished by the employer merely as a means of promoting the

health, goodwill, contentment and efficiency of his employees.

1. Monetized unused vacation leave credits of private employees not exceeding

10 days

2. Monetized value of vacation AND sick leave credits paid to government

employees (no limit as to number of credits)

3. Rice subsidy not exceeding P2,000 per month or one sack of 50-kg rice

4. Uniforms and clothing allowance not exceeding P6,000.00.

5. Actual medical assistance not exceeding P10,000 per annum

6. Laundry allowance not exceeding P300 per month

7. Gifts given during Christmas and major anniversary celebrations not exceeding

P5,000 per employee per annum

8. Daily meal allowance for overtime work not exceeding 25% of the basic minimum

wage on a per region basis

9. Benefits received by virtue of CBA and productivity incentive scheme not

exceeding P10,000.00 per employee per annum.

10. Medical cash allowance to dependents of employees not exceeding P1,500

per employee per semester or P250 per month

11. Employee achievement awards under an established written plan which does

not discriminate in favor of highly paid employees not exceeding P10,000.00

The list is exclusive.

Even if the de minimis benefits exceed their respective limits but they are still within

P90k ceiling when added to the 13 th month pay, productivity incentives and Christmas

bonus, the same remain exempt from income tax.

Downloaded by Coffee Vanilla (cffvnll@gmail.com)

lOMoARcPSD|29596630

Republic of the Philippines

CAMARINES NORTE STATE COLLEGE

F. Pimentel Avenue, Brgy. 2, Daet, Camarines Norte – 4600, Philippines

COLLEGE OF BUSINESS AND PUBLIC

The RATA of government personnel constitutes reimbursement of expenses incurred in

the performance of duties and is therefore not subject to income tax.

Taxation of De Minimis Benefits

1. All other benefits given by the employer which are not included in the

enumeration shall not be considered as de minimis benefits.

2. The amount of the de minimis benefits conforming to the prescribed ceiling shall

not be considered in determining the P90,000 ceiling of other benefits excluded

from gross income.

3. The excess of the de minimis benefits over their respective ceiling shall be

considered as part of the other benefits and the employee receiving it will be

subject to tax only on the excess over the P90,000 ceiling.

4. De minimis benefits shall constitute as a deductible expense of the employer.

Convenience of the employer rule

If the meals and lodging are furnished to the employee for the convenience or

advantage of the employer, such benefit is not taxable on the part of the employee

receiving the same.

Board and lodging furnished employees in addition to their cash compensation is held to

be supplied for the convenience of the employer and the value thereof is required to be

reported in such employee’s income tax return.

Requisites:

1. they must be furnished within the premises of the employer

2. employee is required to accept the same as a condition of his employment

What is the yardstick for determining whether a property is capital asset or

ordinary asset?