Professional Documents

Culture Documents

Akm 3 Weeks 3

Uploaded by

Rohmad0 ratings0% found this document useful (0 votes)

6 views3 pagesThe document contains information and calculations related to accounting for construction contracts using different methods. It provides details of costs, billings, and profit/loss calculations for multiple construction projects using the percentage-of-completion and completed-contract methods. Specifically, it shows how gross profit, billings in excess of costs, and loss amounts are determined for unfinished and completed contracts under each accounting treatment.

Original Description:

akuntansi menengah

Original Title

AKM 3 WEEKS 3

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document contains information and calculations related to accounting for construction contracts using different methods. It provides details of costs, billings, and profit/loss calculations for multiple construction projects using the percentage-of-completion and completed-contract methods. Specifically, it shows how gross profit, billings in excess of costs, and loss amounts are determined for unfinished and completed contracts under each accounting treatment.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views3 pagesAkm 3 Weeks 3

Uploaded by

RohmadThe document contains information and calculations related to accounting for construction contracts using different methods. It provides details of costs, billings, and profit/loss calculations for multiple construction projects using the percentage-of-completion and completed-contract methods. Specifically, it shows how gross profit, billings in excess of costs, and loss amounts are determined for unfinished and completed contracts under each accounting treatment.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

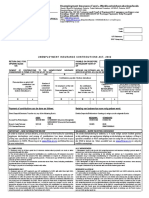

BRIEF EXERCISE 18-8

Repossessed Merchandise 275

Loss on Repossession 61*

Deferred Gross Profit ($560 X 40%) 224

Installment Accounts Receivable 560

*[$275 – ($560 – $224)]

EXERCISE 18-9

(a) Computation of Gross Profit to Be Recognized under Completed Contract Method.

No computation necessary. No gross profit to be recognized prior to completion of

contract.

Computation of Billings on Uncompleted Contract in Excess of Related Costs under

Completed-Contract Method.

Construction costs incurred during the year $1,185,800

Partial billings on contract (30% X $6,300,000) (1,890,000)

$ (704,200)

(b) Computation of Gross Profit to Be Recognized under Percentage-of Completion Method.

Total contract price $6,300,000

Total estimated cost ($1,185,800 + $4,204,200) 5,390,000

Estimated total gross profit from contract 910,000

Percentage-of-completion ($1,185,800/$5,390,000) 22%

Gross profit to be recognized during the year $ 200,200

($910,000 X 22%)

Computation of Billings on Uncompleted Contract in Excess of Related Costs and

Recognized Profit under Percentage-of-Completion Method.

Construction costs incurred during the year $1,185,800

Gross profit to be recognized during the year (above) 200,200

Total charged to construction-in-process 1,386,000

Partial billings on contract (30% X $6,300,000 (1,890,000)

$ (504,000)

EXERCISE 18-10

DERRICK ADKINS CONSTRUCTION COMPANY

Partial Income Statement

Year Ended December 31, 2007

________________________________________________________________

Revenue from long-term contracts (Project 3) $500,000

Costs of construction (Project 3) 330,000

Gross profit 170,000

Loss on long-term contract (Project 1) * (30,000)

*Computation of loss (Project 1)

Contract costs through 12/31/07 $450,000

Estimated costs to complete 140,000 Total estimated costs 590,000

Total contract price 560,000

Loss recognized in 2007 $ (30,000)

DERRICK ADKINS CONSTRUCTION COMPANY

Partial Balance Sheet

December 31, 2007

_________________________________________________________________

Current assets:

Accounts receivable $90,000

($1,080,000 – $990,000)

Inventories

Construction in process ($450,000 – $30,000) $420,000*

Less: Billings 360,000

Unbilled contract costs (Project 1) 60,000

Current liabilities:

Billings ($220,000) in excess of contract

costs ($126,000) (Project 2) 94,000

*The loss of $30,000 was subtracted from the construction in process account.

You might also like

- Chapter 7 - Teacher's Manual - Afar Part 1Document24 pagesChapter 7 - Teacher's Manual - Afar Part 1Angelic100% (3)

- Chapter 7 Construction ContractsDocument10 pagesChapter 7 Construction Contractsleshz zynNo ratings yet

- Construction Contracts: 1. False 6. True 2. False 7. True 3. False 8. False 4. True 9. False 5. True 10. TRUEDocument25 pagesConstruction Contracts: 1. False 6. True 2. False 7. True 3. False 8. False 4. True 9. False 5. True 10. TRUEjuennaguecoNo ratings yet

- IA Quiz ImadeDocument4 pagesIA Quiz ImadeKuro ZetsuNo ratings yet

- Book 1Document50 pagesBook 1Md YeasinNo ratings yet

- Global kons-COns ContractDocument2 pagesGlobal kons-COns ContractSandeep GyawaliNo ratings yet

- Acctg523-B1-Practice Midterm-W2022-SolutionDocument8 pagesAcctg523-B1-Practice Midterm-W2022-Solutionmakan94883No ratings yet

- ACC1100 S1 2018 Exam SolutionDocument15 pagesACC1100 S1 2018 Exam SolutionFarah PatelNo ratings yet

- Solutions To QuestionsDocument16 pagesSolutions To QuestionsAndi Advan Jr.No ratings yet

- Pembahasan: A. Membuat Analisis Kontrak Dan Estimasi Gross Profit Setiap Tahun 2018 2019Document64 pagesPembahasan: A. Membuat Analisis Kontrak Dan Estimasi Gross Profit Setiap Tahun 2018 201917HARISA SETYA HANDININo ratings yet

- Step 1: Identify The Contract With The Customer: AcctranDocument8 pagesStep 1: Identify The Contract With The Customer: AcctranPrecy Joy TrimidalNo ratings yet

- Day 3 - Lecture Examples - Chapter 6Document5 pagesDay 3 - Lecture Examples - Chapter 6NikolaNikoloskiNo ratings yet

- LTCC Work BookDocument49 pagesLTCC Work BookHannah NolongNo ratings yet

- Long-Term Construction ContractsDocument9 pagesLong-Term Construction ContractsRoi Martin A. De VeyraNo ratings yet

- Managerial Final Project Study NotesDocument8 pagesManagerial Final Project Study NotesShawn KPNo ratings yet

- Entity Y: Problem 4: Activity 2Document11 pagesEntity Y: Problem 4: Activity 2Christine Eunice RaymondeNo ratings yet

- QUESTION 6 Financial Reporting May 2021 KOLIDocument6 pagesQUESTION 6 Financial Reporting May 2021 KOLILaud ListowellNo ratings yet

- CV 4201 Lecture RT1 On Financial Planning (1) - Jan 07Document10 pagesCV 4201 Lecture RT1 On Financial Planning (1) - Jan 07zzz_monsterNo ratings yet

- BBF 321Document10 pagesBBF 321sipanjegivenNo ratings yet

- Long-Term Construction Contracts & FranchiseDocument6 pagesLong-Term Construction Contracts & FranchiseBryan ReyesNo ratings yet

- AC4301 FinalExam 2020-21 SemA AnsDocument9 pagesAC4301 FinalExam 2020-21 SemA AnslawlokyiNo ratings yet

- Review 2Document3 pagesReview 2Tracy LeeNo ratings yet

- Construction ContractsDocument17 pagesConstruction ContractsCeline Marie AntonioNo ratings yet

- Construction Contracts: IAS 11 - DefinitionDocument7 pagesConstruction Contracts: IAS 11 - DefinitionfreekamalNo ratings yet

- Japhet S. Pasadilla Accounting For Special Transactions PROBLEM 1: Benson ConstructionDocument2 pagesJaphet S. Pasadilla Accounting For Special Transactions PROBLEM 1: Benson ConstructionpompomNo ratings yet

- F 2 Nov 09 Specimen AnswersDocument9 pagesF 2 Nov 09 Specimen AnswersRobert MunyaradziNo ratings yet

- AC13 Provisions, Contingencies and Other Liabilities Additional Guide ProblemsDocument2 pagesAC13 Provisions, Contingencies and Other Liabilities Additional Guide ProblemsDianaNo ratings yet

- Acc AssignmentDocument8 pagesAcc AssignmentKashémNo ratings yet

- Mock Answers Far-1 Autumn 2022Document13 pagesMock Answers Far-1 Autumn 2022rana m harisNo ratings yet

- QuizDocument4 pagesQuizRinconada Benori ReynalynNo ratings yet

- Assessment 3 SolutionsDocument3 pagesAssessment 3 SolutionsMmaleema LedwabaNo ratings yet

- Solutions To Exercises Exercise 18-1-15Document50 pagesSolutions To Exercises Exercise 18-1-15Aiziel OrenseNo ratings yet

- Date General Journal Debit CreditDocument14 pagesDate General Journal Debit CreditJalaj GuptaNo ratings yet

- Practice QuestionsDocument19 pagesPractice QuestionsAbdul Qayyum Qayyum0% (2)

- 69796bos55750 p1Document34 pages69796bos55750 p1Dj babuNo ratings yet

- CHAPTER 10 - Long-Term Construction Contracts Solutions To Problems Problem 10 - 1Document6 pagesCHAPTER 10 - Long-Term Construction Contracts Solutions To Problems Problem 10 - 1Maurice AgbayaniNo ratings yet

- Construction Contracts: Problem 1: True or FalseDocument45 pagesConstruction Contracts: Problem 1: True or FalseMs VampireNo ratings yet

- Revenue Recognition: Optional Assignment Characteristics TableDocument10 pagesRevenue Recognition: Optional Assignment Characteristics TableAhmad HuzeinNo ratings yet

- 15 Job and Contract CostingDocument6 pages15 Job and Contract CostingLakshay SharmaNo ratings yet

- 4 2008 Dec ADocument5 pages4 2008 Dec ALai Hui Ing100% (1)

- Lecture 08Document11 pagesLecture 08Mohamed HanyNo ratings yet

- Ias11 Ie 1-12Document5 pagesIas11 Ie 1-12rachelNo ratings yet

- Construction Contracts: International Accounting Standard 11Document5 pagesConstruction Contracts: International Accounting Standard 11Babu babuNo ratings yet

- Exams - CT0322078 Accounting For Managers Class ADocument8 pagesExams - CT0322078 Accounting For Managers Class AOng Urn WeeNo ratings yet

- CommercialMetals SolutionDocument5 pagesCommercialMetals SolutionFalguni ShomeNo ratings yet

- Solutions To Assign. - Prob 4 Construction ContractsDocument8 pagesSolutions To Assign. - Prob 4 Construction ContractsmhikeedelantarNo ratings yet

- Far Tutor 3Document4 pagesFar Tutor 3Rian RorresNo ratings yet

- CA IPCC Accounting Guideline Answers May 2015Document24 pagesCA IPCC Accounting Guideline Answers May 2015Prashant PandeyNo ratings yet

- 73264bos59105 Inter P1aDocument12 pages73264bos59105 Inter P1aRaish QURESHINo ratings yet

- Mock SFM Answer MarchDocument12 pagesMock SFM Answer MarchMenuka SiwaNo ratings yet

- FINC 301 Assignment 2023 1Document8 pagesFINC 301 Assignment 2023 1kd5d26xw5rNo ratings yet

- Alphabet Reports Fouth Quarter ResultsDocument11 pagesAlphabet Reports Fouth Quarter ResultsTim MooreNo ratings yet

- FINA 3330 - Notes CH 9Document2 pagesFINA 3330 - Notes CH 9fische100% (1)

- Bac 202 Second CatDocument2 pagesBac 202 Second CatBrian MutuaNo ratings yet

- Acct1101 Final Examination SEMESTER 2, 2020Document13 pagesAcct1101 Final Examination SEMESTER 2, 2020Yahya ZafarNo ratings yet

- Chapter 5 - A2, B1, & 59Document5 pagesChapter 5 - A2, B1, & 59詹鎮豪No ratings yet

- (' in Crores) Less: Total Contract Price: © The Institute of Chartered Accountants of IndiaDocument12 pages(' in Crores) Less: Total Contract Price: © The Institute of Chartered Accountants of IndiaYashNo ratings yet

- SolMan Empleo Robles Intangible AssetDocument18 pagesSolMan Empleo Robles Intangible AssetJohanna Raissa CapadaNo ratings yet

- Tax Questions & SolutionsDocument126 pagesTax Questions & SolutionsTawanda Tatenda Herbert100% (8)

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Lemon v. KurtzmanDocument82 pagesLemon v. Kurtzman0419lucasNo ratings yet

- National Agreement Summary: Mcdonald'S & SdaDocument11 pagesNational Agreement Summary: Mcdonald'S & SdaButt HurtyNo ratings yet

- Alteration of MOADocument2 pagesAlteration of MOAVishnu Teja AnnamrajuNo ratings yet

- Spec Pro Page 2 of 6Document39 pagesSpec Pro Page 2 of 6mccm92No ratings yet

- Police PatrolDocument130 pagesPolice PatrolEcho EchoNo ratings yet

- David Misch Probable Cause AffidavitDocument2 pagesDavid Misch Probable Cause AffidavitNational Content DeskNo ratings yet

- Surety's Liability Under The Indian Contract Act, 1857Document15 pagesSurety's Liability Under The Indian Contract Act, 1857Joshu AbrahamNo ratings yet

- Afjrotc Creed: Before Self, and Excellence in All We DoDocument1 pageAfjrotc Creed: Before Self, and Excellence in All We DoKatlynn McCannNo ratings yet

- Proposal For The Crestwood Plaza Redevelopment Area by UrbanStreet - Crestwood, MODocument52 pagesProposal For The Crestwood Plaza Redevelopment Area by UrbanStreet - Crestwood, MOnextSTL.comNo ratings yet

- Ifrs 9 Financial Instruments Using Models in Impairment - AshxDocument38 pagesIfrs 9 Financial Instruments Using Models in Impairment - Ashxwan nur anisahNo ratings yet

- The Revolt in BarbadosDocument3 pagesThe Revolt in BarbadosConrad SawyersNo ratings yet

- Quizzer Cash and Cash EquivalentsDocument10 pagesQuizzer Cash and Cash EquivalentsJoshua TorillaNo ratings yet

- 01 Baguio Country Club Corp. v. National Labor Relations CommissionDocument4 pages01 Baguio Country Club Corp. v. National Labor Relations CommissionGina RothNo ratings yet

- K C Chakrabarty: Mobile Commerce, Mobile Banking - The Emerging ParadigmDocument7 pagesK C Chakrabarty: Mobile Commerce, Mobile Banking - The Emerging ParadigmLinny ElangoNo ratings yet

- Form - U17 - UIF - Payment AdviceDocument2 pagesForm - U17 - UIF - Payment Advicesenzo scholarNo ratings yet

- Civil Law (And Practical Exercises) 2022 Bar SyllabusDocument45 pagesCivil Law (And Practical Exercises) 2022 Bar SyllabusAndrew M. AcederaNo ratings yet

- No Shortchanging ActDocument11 pagesNo Shortchanging ActDesiree Ann GamboaNo ratings yet

- Trans Action Overseas Corporation Vs SecDocument2 pagesTrans Action Overseas Corporation Vs SecJCNo ratings yet

- Insensatez: How InsensitiveDocument3 pagesInsensatez: How Insensitivejuilo100% (1)

- I WANT THIS. NYCTCM Catalog 2017-2018 PDFDocument55 pagesI WANT THIS. NYCTCM Catalog 2017-2018 PDFLisa BraffNo ratings yet

- Entrepreneurship Quarter 2 - Module 9: Senior High SchoolDocument11 pagesEntrepreneurship Quarter 2 - Module 9: Senior High SchoolFelipe Balinas100% (1)

- Petition in Support of RomaniaDocument3 pagesPetition in Support of RomaniaVladLeventeViskiNo ratings yet

- Workplace PensionsDocument1 pageWorkplace PensionscoloradoresourcesNo ratings yet

- Manipgct0001116 1698909745Document2 pagesManipgct0001116 1698909745taniyasarungbamNo ratings yet

- DEED OF ABSOLUTE SALE OF MEMORIAL LOT'bienvenido SanchezDocument2 pagesDEED OF ABSOLUTE SALE OF MEMORIAL LOT'bienvenido SanchezJaime Gonzales73% (15)

- Presentation On Home Loan DocumentationDocument16 pagesPresentation On Home Loan Documentationmesba_17No ratings yet

- Request For Dismissal Form Civ 110Document2 pagesRequest For Dismissal Form Civ 110soyjairoNo ratings yet

- CHECKLIST OF STATUTORY AUDIT OF NBFC's - CA Rajput JainDocument3 pagesCHECKLIST OF STATUTORY AUDIT OF NBFC's - CA Rajput JainnitinNo ratings yet

- All India Bank Officers AssociationDocument14 pagesAll India Bank Officers AssociationIndiranNo ratings yet

- Lect. 3 Mens ReaDocument16 pagesLect. 3 Mens Reakimmii NBKNo ratings yet