Professional Documents

Culture Documents

Understanding Crossing of Cheques

Uploaded by

Rishabh jain0 ratings0% found this document useful (0 votes)

25 views13 pagesShjepepelwlwlwlwkskdjrjdkrkrkekkkekekrjjfjfjfkksklsldkdldrkrkrjkrkdoeoeoeiddkjdjrkdkdkekwkekekekejrrjtjjtnrmdsklwlroyiiskskfiroskfkjoskzn

Original Title

71a22a11-b499-4b56-b85f-6ff0b9fc086d,3333. Crossing of Cheques

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentShjepepelwlwlwlwkskdjrjdkrkrkekkkekekrjjfjfjfkksklsldkdldrkrkrjkrkdoeoeoeiddkjdjrkdkdkekwkekekekejrrjtjjtnrmdsklwlroyiiskskfiroskfkjoskzn

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

25 views13 pagesUnderstanding Crossing of Cheques

Uploaded by

Rishabh jainShjepepelwlwlwlwkskdjrjdkrkrkekkkekekrjjfjfjfkksklsldkdldrkrkrjkrkdoeoeoeiddkjdjrkdkdkekwkekekekejrrjtjjtnrmdsklwlroyiiskskfiroskfkjoskzn

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 13

CROSSING OF CHEQUES

9/30/202 BBA 201 BL 1

0

Topics to be covered

Introduction of Crossing Cheques

Essentials of General Crossing

Essentials of Special Crossing

9/30/202 BBA 201 BL 2

0

What is “CROSSING” a Cheque?

“Crossing” a cheque is a way of making even more certain that the

money is paid to the correct person and not to someone else. By

“crossing” the cheque in the ways that follow, you give the bank

extra instructions about how it is to be paid. This is called limiting

its negotiability.

9/30/202 BBA 201 BL 3

0

• If you draw a line to cross out the words “or bearer”, then you

are telling the bank that the money cannot just be paid out to

anyone who happens to present the cheque. It must be paid out

to the person named on the “Pay” line.

• It is possible to get around this by

“endorsing” the cheque. This means that the person to whom

the cheque is made out signs the back thus giving their

permission for it to be presented for payment.

9/30/202 BBA 201 BL 4

0

Definition of General Crossing

• Sec 123 of the Negotiable Instruments Act 1881 defines

general crossing as follows:

“Where a cheque bears across its face, an addition of the words;

„and company‟ or any abbreviation thereof. Between two

parallel transverse lines or of two parallel transverse lines

simply, either with or without the words „not negotiable‟, that

addition shall be deemed to be a „crossing, and the cheque

shall be deemed to be crossed generally.”

9/30/202 BBA 201 BL 5

0

Essentials of General Crossing

1. Two lines are of paramount importance in

crossing.

2. The lines must be drawn parallel and transverse. It

means that they should be arranged in a crosswise

direction. They should not be straight lines.

3. The lines are generally drawn on the left hand side .

4. The words „not negotiable‟ may be added to a

crossing.

5. The words „and Company‟ may be written in

between the lines.

9/30/202 BBA 201 BL 6

0

The following do not constitute a

crossing within the meaning of Sec 123

9/30/202 BBA 201 BL 7

0

Significance of General Crossing

1. The effect of general crossing is that it gives a direction

to the paying banker.

2. The direction is that the paying banker should not pay

the cheque at the counter.

3. If a crossed cheque is paid at the counter in contravention

of the crossing:

9/30/202 BBA 201 BL 8

0

a. He has no right to debit his customers

account, since , it will constitute a breach of his customer‟s

mandate,

b. He will be liable to the drawer for any loss, which he

may suffer,

c. He will be liable to the true owner of the cheque who may

be the third party.

4. The main intention of crossing a cheque is to give

protection to it.

9/30/202 BBA 201 BL 9

0

9/30/202 BBA 201 BL 10

0

SPECIAL CROSSING

Sec 124 of the Negotiable Instruments Act of 1881

defines

“where a cheque bears across its face, an addition of

the name of a banker, with or without the words

„Not Negotiable‟, that addition shall be deemed a

crossing, and the cheque shall be deemed to be

crossed specially, and to be crossed to that banker”

9/30/202 BBA 201 BL 11

0

Essentials of Special Crossing

1. Two parallel transverse lines are not at all essential

for a special crossing.

2. The name of a banker must be necessarily specified

across the face of the cheque. The name of the banker

itself constitutes special crossing.

3. It must appear on the left hand side, preferably

on the corner.

4. The two parallel transverse lines and the words „not

negotiable be adedd to a special crossing.

9/30/202 BBA 201 BL 12

0

Summary

A cheque is said to be crossed when two transverse parallel lines with or without any

words are drawn across its face. A crossing is a direction to the paying banker to pay

the money generally to the banker or a particular banker as the case may be and not to

the holder at the counter.

9/30/202 BBA 201 BL 13

0

You might also like

- Crossing of Cheques 1223537775987301 9Document16 pagesCrossing of Cheques 1223537775987301 9siddharthasaha8570No ratings yet

- Crossing of Cheques 1223537775987301 9Document22 pagesCrossing of Cheques 1223537775987301 9Prateek Lakhmani100% (1)

- Crossing of ChequesDocument14 pagesCrossing of ChequesNikitha C P100% (1)

- Crossing Cheques ExplainedDocument29 pagesCrossing Cheques ExplainedQurrat AneesNo ratings yet

- Crossing Cheques SafelyDocument14 pagesCrossing Cheques SafelyD PNo ratings yet

- Crossing of ChequesDocument22 pagesCrossing of Chequessagarg94gmailcomNo ratings yet

- Crossing of ChequesDocument5 pagesCrossing of ChequesvskvarmaNo ratings yet

- Crossing of ChequesDocument22 pagesCrossing of ChequesNayan BhalotiaNo ratings yet

- Banking CIADocument17 pagesBanking CIAkeerthi93No ratings yet

- Different Kinds of Crossing of Cheques Payments of Crossed ChequeDocument6 pagesDifferent Kinds of Crossing of Cheques Payments of Crossed ChequeNithin MNo ratings yet

- 0304 Crossing of ChequesDocument8 pages0304 Crossing of ChequesJitendra VirahyasNo ratings yet

- Dishonour of ChequesDocument17 pagesDishonour of Chequeschirag78775% (4)

- BT Crossing N Making of EndorsementDocument5 pagesBT Crossing N Making of EndorsementBoobalan RNo ratings yet

- What is Crossing of ChequesDocument6 pagesWhat is Crossing of ChequesMuhammad Shifaz MamurNo ratings yet

- Duties & Obligations of A Paying BankerDocument34 pagesDuties & Obligations of A Paying BankerKalyani YellapantulaNo ratings yet

- Endorsement and Crossing PDFDocument8 pagesEndorsement and Crossing PDFGerman CastillaNo ratings yet

- Double CrossingDocument2 pagesDouble CrossingSeema MaheshNo ratings yet

- BANKING UNIT 16 The ChequeDocument9 pagesBANKING UNIT 16 The ChequeDaniel MukelabaiNo ratings yet

- Crossing of ChequesDocument5 pagesCrossing of ChequesRavneet KaurNo ratings yet

- Individual Assignment 4 - NEGOTIABLE INSTRUMENTSDocument2 pagesIndividual Assignment 4 - NEGOTIABLE INSTRUMENTSFarah HamdanNo ratings yet

- Cheques: Features of A ChequeDocument12 pagesCheques: Features of A ChequebushrajaleelNo ratings yet

- Company Ccce 9Document10 pagesCompany Ccce 9Archana YadavNo ratings yet

- ChequesDocument5 pagesChequesRAJ BHAGATNo ratings yet

- Business Laws: QuestionsDocument5 pagesBusiness Laws: QuestionsLakshay GargNo ratings yet

- Cheques 1Document8 pagesCheques 1hippop kNo ratings yet

- Types of Cheque CrossingDocument7 pagesTypes of Cheque CrossingMuhammadUmarNazirChishti100% (1)

- Banking InstrumentsDocument31 pagesBanking Instrumentssunny_live0992% (36)

- Types of Cheque Crossings ExplainedDocument2 pagesTypes of Cheque Crossings ExplainedfaisalbiztekzNo ratings yet

- CrossingDocument3 pagesCrossingadithyaviswan78No ratings yet

- Crossing of ChequeDocument2 pagesCrossing of ChequeAbhijeet KumarNo ratings yet

- Types of cheque crossingsDocument2 pagesTypes of cheque crossingsAnupamaNo ratings yet

- Collecting BankerDocument26 pagesCollecting BankerTeja RaviNo ratings yet

- Topik 5 Instrumen Boleh NiagaDocument36 pagesTopik 5 Instrumen Boleh Niagalionheart8888No ratings yet

- Banking Law 2Document18 pagesBanking Law 2ShiyaNo ratings yet

- Crossing of Cheques BankingDocument12 pagesCrossing of Cheques BankingTANAYA KETKARNo ratings yet

- Negotiable Instrument ActDocument4 pagesNegotiable Instrument ActRahulNo ratings yet

- Crossing ChequesDocument17 pagesCrossing ChequesVivek Kumar JainNo ratings yet

- Notes LAW416: ChequesDocument6 pagesNotes LAW416: ChequesFatin HulwaniNo ratings yet

- 190101059-Banking and Insurance LawDocument13 pages190101059-Banking and Insurance LawHardik YadavNo ratings yet

- Why Cross A ChequeDocument2 pagesWhy Cross A ChequeChandru McancyNo ratings yet

- DPB 3023 - Negotiable InstrumentsDocument28 pagesDPB 3023 - Negotiable InstrumentsNur Afiza0% (1)

- Understanding the Types and Characteristics of ChequesDocument14 pagesUnderstanding the Types and Characteristics of ChequesRohit jainNo ratings yet

- Unit-Ii Negotiable InstrumentsDocument65 pagesUnit-Ii Negotiable InstrumentsRAYSPEAR0% (1)

- Negotiable Instrument Act PDFDocument64 pagesNegotiable Instrument Act PDFHarsh PorwalNo ratings yet

- NI Act Cheque, Endorsement, CrossingDocument6 pagesNI Act Cheque, Endorsement, CrossingJAS 0313No ratings yet

- Kinds of BankinginstinstrumentsDocument5 pagesKinds of BankinginstinstrumentsJaiminBarotNo ratings yet

- ChequesDocument2 pagesChequesVejerla PriyankaNo ratings yet

- Types of Cheques and Endorsements ExplainedDocument21 pagesTypes of Cheques and Endorsements ExplainedSabbir HossainNo ratings yet

- Promissory Note, Bill of Exchange and Cheque DefinedDocument2 pagesPromissory Note, Bill of Exchange and Cheque DefinedAdnan EfadNo ratings yet

- Business Law Question N AnswersDocument24 pagesBusiness Law Question N AnswersKalpita Chaudhari-Vartak100% (1)

- Md. Jahirul Islam: ID NO. 19 FIN 010 Department of Finance and Banking University of BarishalDocument37 pagesMd. Jahirul Islam: ID NO. 19 FIN 010 Department of Finance and Banking University of BarishalMD HAFIZUR RAHMANNo ratings yet

- BBM Notes on Cheques and CrossingDocument9 pagesBBM Notes on Cheques and CrossingFrancis Njihia Kaburu100% (1)

- Letter of Credit Guidelines 2014Document10 pagesLetter of Credit Guidelines 2014BrandonNo ratings yet

- Bcom III BTP M 4Document58 pagesBcom III BTP M 4irshad_cbNo ratings yet

- Crossing of ChequesDocument48 pagesCrossing of ChequesinxxxsNo ratings yet

- Law of Negotiable Instrument (Law 416)Document8 pagesLaw of Negotiable Instrument (Law 416)Sarah M'dinNo ratings yet

- Bill of exchange, promissory note and cheque regulationsDocument10 pagesBill of exchange, promissory note and cheque regulationsThéotime HabinezaNo ratings yet

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- Mastering Credit - The Ultimate DIY Credit Repair GuideFrom EverandMastering Credit - The Ultimate DIY Credit Repair GuideRating: 1 out of 5 stars1/5 (1)

- Assumptions of Capital Asset Pricing ModelDocument3 pagesAssumptions of Capital Asset Pricing ModelRishabh jainNo ratings yet

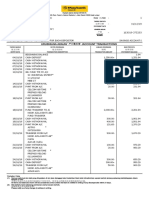

- Received With Thanks ' 6,891.00 Through Payment Gateway Over The Internet FromDocument3 pagesReceived With Thanks ' 6,891.00 Through Payment Gateway Over The Internet FromRishabh jainNo ratings yet

- Research Project Report FinalDocument31 pagesResearch Project Report FinalRishabh jainNo ratings yet

- BL Tutorial Sheet 2Document2 pagesBL Tutorial Sheet 2Rishabh jainNo ratings yet

- Mubiri Joleen Thesis PDFDocument51 pagesMubiri Joleen Thesis PDFMa.liza Dagpin BagatuaNo ratings yet

- Received With Thanks ' 2,631.37 Through Payment Gateway Over The Internet FromDocument2 pagesReceived With Thanks ' 2,631.37 Through Payment Gateway Over The Internet FromRishabh jainNo ratings yet

- Received With Thanks ' 6,891.00 Through Payment Gateway Over The Internet FromDocument3 pagesReceived With Thanks ' 6,891.00 Through Payment Gateway Over The Internet FromRishabh jainNo ratings yet

- Mubiri Joleen Thesis PDFDocument51 pagesMubiri Joleen Thesis PDFMa.liza Dagpin BagatuaNo ratings yet

- Customer Satisfaction and Service Quality in Hotel IndustryDocument5 pagesCustomer Satisfaction and Service Quality in Hotel IndustryPreetham KarthikNo ratings yet

- q1 HRM Ensures The Smooth Functioning of An OrganisationDocument11 pagesq1 HRM Ensures The Smooth Functioning of An OrganisationRishabh jainNo ratings yet

- Received With Thanks ' 2,631.37 Through Payment Gateway Over The Internet FromDocument2 pagesReceived With Thanks ' 2,631.37 Through Payment Gateway Over The Internet FromRishabh jainNo ratings yet

- ASTUDYOFCUSTOMERSATISFACTIONTOWARDSHOTELINDUSTRYINjournal Insa1dec15mrrDocument8 pagesASTUDYOFCUSTOMERSATISFACTIONTOWARDSHOTELINDUSTRYINjournal Insa1dec15mrrlloydmarkagris143No ratings yet

- Received With Thanks ' 6,891.00 Through Payment Gateway Over The Internet FromDocument3 pagesReceived With Thanks ' 6,891.00 Through Payment Gateway Over The Internet FromRishabh jainNo ratings yet

- A Study of Consumer Buying Behaviour of Haldirams Snacks in Pune RegionDocument36 pagesA Study of Consumer Buying Behaviour of Haldirams Snacks in Pune RegionSurbhi SharmaNo ratings yet

- IHCL Sustainability Report 2006-07Document121 pagesIHCL Sustainability Report 2006-07Rishabh jainNo ratings yet

- Customer Satisfaction and Service Quality in Hotel IndustryDocument5 pagesCustomer Satisfaction and Service Quality in Hotel IndustryPreetham KarthikNo ratings yet

- N Mims Research Paper Govind Srivastav ADocument14 pagesN Mims Research Paper Govind Srivastav AVirenderSinghNo ratings yet

- Mubiri Joleen Thesis PDFDocument51 pagesMubiri Joleen Thesis PDFMa.liza Dagpin BagatuaNo ratings yet

- Research Project Report FinalDocument31 pagesResearch Project Report FinalRishabh jainNo ratings yet

- Digital MarketingDocument10 pagesDigital MarketingRishabh jainNo ratings yet

- ASTUDYOFCUSTOMERSATISFACTIONTOWARDSHOTELINDUSTRYINjournal Insa1dec15mrrDocument8 pagesASTUDYOFCUSTOMERSATISFACTIONTOWARDSHOTELINDUSTRYINjournal Insa1dec15mrrlloydmarkagris143No ratings yet

- Directors Appointment, Qualifications, Powers and Limits on RemunerationDocument12 pagesDirectors Appointment, Qualifications, Powers and Limits on RemunerationRishabh jainNo ratings yet

- 08 - Chapter 5Document72 pages08 - Chapter 5Rishabh jainNo ratings yet

- Data (RM) 1Document6 pagesData (RM) 1Rishabh jainNo ratings yet

- ,14. Types of CompaniesDocument12 pages,14. Types of CompaniesRishabh jainNo ratings yet

- Characteristics and Types of Negotiable InstrumentsDocument10 pagesCharacteristics and Types of Negotiable InstrumentsRishabh jainNo ratings yet

- Chapter - 4 Research MethodologyDocument16 pagesChapter - 4 Research MethodologyRishabh jainNo ratings yet

- ,13 Companies Act, 2013Document21 pages,13 Companies Act, 2013Rishabh jainNo ratings yet

- Types of ChannelsDocument42 pagesTypes of ChannelssagarNo ratings yet

- Exercises - ManufacturingDocument7 pagesExercises - ManufacturingRiana CellsNo ratings yet

- Movie Analysis (Revilla & Sanchez)Document2 pagesMovie Analysis (Revilla & Sanchez)Ceej RevsNo ratings yet

- Companies Act Borrowing PowersDocument11 pagesCompanies Act Borrowing PowersSaptak RoyNo ratings yet

- Prime Bank LimitedDocument29 pagesPrime Bank LimitedShouravNo ratings yet

- Description: S&P/BMV Total Mexico Esg Index (MXN)Document7 pagesDescription: S&P/BMV Total Mexico Esg Index (MXN)tmayur21No ratings yet

- 163019-375293 20191231 PDFDocument6 pages163019-375293 20191231 PDFAmran KeloNo ratings yet

- Finance Chapter 18Document35 pagesFinance Chapter 18courtdubs100% (1)

- Investment and Risk Management Chapter 2 Concepts in ReviewDocument6 pagesInvestment and Risk Management Chapter 2 Concepts in ReviewAnn Connie PerezNo ratings yet

- Marketing AgreementDocument6 pagesMarketing AgreementdcdavisNo ratings yet

- Basic Accounting Notes (Finale)Document33 pagesBasic Accounting Notes (Finale)Chreann Rachel100% (3)

- The value of B if interest is compounded semi-annually is 1,260,875.183Document58 pagesThe value of B if interest is compounded semi-annually is 1,260,875.183nonononowayNo ratings yet

- Lesson 4 Written Assignment: Every Question)Document8 pagesLesson 4 Written Assignment: Every Question)Uyên Phương Phạm0% (1)

- Vetan Deyak Praptra Vittiya Niyam Sangrah, Khand-5, Bhag-1 See Chapter 6 Para-108, Chapter 7 Para-131Document9 pagesVetan Deyak Praptra Vittiya Niyam Sangrah, Khand-5, Bhag-1 See Chapter 6 Para-108, Chapter 7 Para-131Madan ChaturvediNo ratings yet

- Accounting for Tax Amnesty Assets and LiabilitiesDocument13 pagesAccounting for Tax Amnesty Assets and LiabilitiesHeriyanto MonmonNo ratings yet

- Ajanta PharmaDocument18 pagesAjanta Pharmaumesh.raoNo ratings yet

- Merger Is A Voluntary Amalgamation of Two Firms On Roughly Equal Terms Into One New Legal EntityDocument6 pagesMerger Is A Voluntary Amalgamation of Two Firms On Roughly Equal Terms Into One New Legal EntityLawal Idris AdesholaNo ratings yet

- FABM 1.module 5 PDFDocument34 pagesFABM 1.module 5 PDFSHIERY MAE FALCONITINNo ratings yet

- Stock MarketsDocument8 pagesStock MarketsKrishnarao PujariNo ratings yet

- NTCC Final Report by Riya JainDocument16 pagesNTCC Final Report by Riya Jainriya jainNo ratings yet

- Cashflow Forecasting Using Montecarlo SimulationDocument111 pagesCashflow Forecasting Using Montecarlo SimulationDavid Esteban Meneses RendicNo ratings yet

- Inflation Reduction Act 2022Document273 pagesInflation Reduction Act 2022Maria MeranoNo ratings yet

- Monetary System - Practice ExDocument3 pagesMonetary System - Practice ExGia HânNo ratings yet

- IQRA UniversityDocument15 pagesIQRA UniversityOsama bin adnanNo ratings yet

- Black BookDocument41 pagesBlack BookMoazza QureshiNo ratings yet

- SeptemberDocument202 pagesSeptembermohanrajk879No ratings yet

- Library Template2Document3,229 pagesLibrary Template2Mehfooz AliNo ratings yet

- Diane chptr1 DoneDocument13 pagesDiane chptr1 DoneRosemenjelNo ratings yet

- International Business Management: AssignmentDocument16 pagesInternational Business Management: AssignmentkeshavNo ratings yet

- Citizens Surety v. CA, GR L-48958, June 28, 1988 (Reviewed)Document1 pageCitizens Surety v. CA, GR L-48958, June 28, 1988 (Reviewed)Steve UyNo ratings yet

- Families That Rule The WorldDocument5 pagesFamilies That Rule The WorldAries0104No ratings yet