Professional Documents

Culture Documents

Tuguegarao Company Liabilities

Uploaded by

Michale JacomillaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tuguegarao Company Liabilities

Uploaded by

Michale JacomillaCopyright:

Available Formats

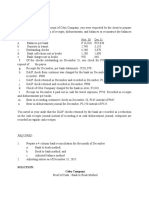

Case 7 You were able to obtain the following from the accountant of

Tuguegarao Company related to the company's liabilities as of 1

December 31, 2018:

Current liabilties:

Accounts payable 1,350,000

14% note payable issued October 1, 2017, maturing

September 30, 2019 1,250,000 2

16% note payable issued April 1, 2016, due on

April 2019 3,000,000

Interest payable ?

Noncurrent liability:

10% 2-year, note payable issued on July 1, 2018 2,000,000

The following additional information pertains to these liabilities:

a. The accounts payable balance of 1,350,000 was before any

necessary year-end adjustments relating to the following:

a1. Goods were in transit to Tuguegarao from a vendor on

December 31, 2018. The invoice cost was P75,000. The

goods were shipped FOB shipping point on Dec. 29, 2018

and were received on January 2, 2019.

a2. Goods shipped FOB destination on December 21, 2018, from 3

a vendor to Tuguegarao, were received on January 6, 2019.

The invoice cost was P37,500.

a3. On December 27, 2018, Tuguerarao wrote and recorded

checks totaling P60,000 which were mailed on Jan. 10, 2019.

b. The interest of the 14% note payable is payable every September 30.

c. On December 31, 2018, the company expects to refinance the P3M 4

note by the issuance of a long-term note payable in lump sum. The

refinancing of the P3M is at the discretion of the enterprise. Tuguegarao's

December 31, 2018 financial statements were issued on March 31, 2019.

On January 15, 2019, the entire P3M balance of the 16% note was

refinanced by the issuance of a long-term obligation payable. The interest

is payable every April 1. 5

d. The note payable of P2,000,000 is payable to Baggao Corporation. The

interest is payable quarterly. The existing loan agreement does not

carry a provision to refinance. During September, Tuguegarao was

experiencing financial difficulty and was unable to pay the periodic

interest. Baggao Company agreed at the reporting date to provide

a grace period ending at least twelve months to rectify the breach.

1. Accounts payable in the Dec. 31, 2018 SOFP.

2. Total interest expense for the year 2018.

3. Total interest payable as of December 31, 2018.

4. Total current liablities as of Dec. 31, 2018.

5. Total noncurrent liabilties as of Dec. 31, 2018.

SOLUTIONS

A/P 1,350,000

Good were in transit Shipped FOB shi 75,000

Unmailed checks 60,000

A/P, 12/31/18 1,485,000

14% 2 yrs

9/30/18 131,250

12/31/18 43,750 175000

16% 3 yrs

1/4/2018 120,000

12/31/18 360,000 480,000

10% 2 yrs

9/31/18 50,000

12/31/18 50,000 100,000

Interest Expense 12/31/18 755,000

14% N/P 43,750

16% N/P 360,000

10% N/P 100,000

Interest Expense 12/31/18 503,750

A/P 1,485,000

I/P 503,750

14% N/P 1,250,000

Current Liabilities 12/31/18 3,238,750

16% N/P issued in 4/1/16 due on 4/19 3,000,000

10% 2 yr, N/P issued on 7/1/18 2,000,000

Noncurrent Liabilities 12/31/18 5,000,000

You might also like

- FAR FPB With Answer KeysDocument16 pagesFAR FPB With Answer KeysPj ManezNo ratings yet

- AP Review LiabDocument10 pagesAP Review LiabTuya DayomNo ratings yet

- Chapter 5 - ACTIVITIESDocument9 pagesChapter 5 - ACTIVITIESSophia De GuzmanNo ratings yet

- ReviewrDocument3 pagesReviewrChristine SalvadorNo ratings yet

- This Study Resource Was: F-ACADL-01Document8 pagesThis Study Resource Was: F-ACADL-01Marjorie PalmaNo ratings yet

- LUAYON MANUFACTURING bonds issue and conversionDocument2 pagesLUAYON MANUFACTURING bonds issue and conversionMa Teresa B. CerezoNo ratings yet

- Part 10Document5 pagesPart 10chimchimcoliNo ratings yet

- Hotcake Mix Premium Expense and Liability CalculationDocument4 pagesHotcake Mix Premium Expense and Liability CalculationChristian N MagsinoNo ratings yet

- Financial Accounting Reviewer - Chapter 68Document5 pagesFinancial Accounting Reviewer - Chapter 68Coursehero PremiumNo ratings yet

- Chapter 19Document14 pagesChapter 19Chelsy SantosNo ratings yet

- Answers - Module 2Document4 pagesAnswers - Module 2bhettyna noayNo ratings yet

- Problem 1Document4 pagesProblem 1redassdawnNo ratings yet

- Audit Problem Inventories AnswerDocument6 pagesAudit Problem Inventories AnswerJames PaulNo ratings yet

- BSA2201 BDD MBCarolino M8Activityno.2Document5 pagesBSA2201 BDD MBCarolino M8Activityno.2Earl Carolino100% (1)

- DocxDocument35 pagesDocxjikee11No ratings yet

- Seiler Co Purchased 6,000,000Document1 pageSeiler Co Purchased 6,000,000Zes ONo ratings yet

- Cost accounting problems and solutionsDocument7 pagesCost accounting problems and solutionsChristine Joyce BascoNo ratings yet

- Proof of Cash Baht CompanyDocument6 pagesProof of Cash Baht CompanyCJ alandy100% (1)

- Oct 4 - LectureDocument4 pagesOct 4 - LectureCarl Dhaniel Garcia SalenNo ratings yet

- Audit of Inventories ProblemDocument5 pagesAudit of Inventories ProblemXNo ratings yet

- Liabilities: Problem 1Document8 pagesLiabilities: Problem 1Frederick AbellaNo ratings yet

- Auditing Problem - Preweek: Cordillera Career Development College College of AccountancyDocument42 pagesAuditing Problem - Preweek: Cordillera Career Development College College of AccountancyGi Ne VaNo ratings yet

- Examination About Investment 2Document2 pagesExamination About Investment 2BLACKPINKLisaRoseJisooJennieNo ratings yet

- Cost AccountingDocument4 pagesCost AccountingDeanne GuintoNo ratings yet

- This Study Resource WasDocument9 pagesThis Study Resource WasMarjorie PalmaNo ratings yet

- DocxDocument10 pagesDocxAiziel OrenseNo ratings yet

- JJJDocument12 pagesJJJCamille ManalastasNo ratings yet

- FinLiab QuizDocument8 pagesFinLiab QuizAeris StrongNo ratings yet

- Mahusay Acc227 Module 4Document4 pagesMahusay Acc227 Module 4Jeth MahusayNo ratings yet

- Practice Set 1 (Modules 1 - 3) 371Document8 pagesPractice Set 1 (Modules 1 - 3) 371Marielle CastañedaNo ratings yet

- Audit Prob Cash AnsDocument7 pagesAudit Prob Cash AnsNoreen BinagNo ratings yet

- BSA 314 Module 4 Output, Atillo Lyle CDocument10 pagesBSA 314 Module 4 Output, Atillo Lyle CJeth MahusayNo ratings yet

- CHAPTER 10 - Pre-Board Examinations-1Document35 pagesCHAPTER 10 - Pre-Board Examinations-1Mr.AccntngNo ratings yet

- B. 39,000 Stethoscopes: Results For Item 2Document20 pagesB. 39,000 Stethoscopes: Results For Item 2Kath LeynesNo ratings yet

- ProblemsDocument9 pagesProblemsMark Angelo AlvarezNo ratings yet

- RMASDocument6 pagesRMASSVTKhsiaNo ratings yet

- Chapter 16 Multiple ChoicesDocument6 pagesChapter 16 Multiple ChoicesMary DenizeNo ratings yet

- Activity in E3 - LiabilitiesDocument9 pagesActivity in E3 - LiabilitiesPaupau100% (1)

- Acquisition & Interest Date Interest Earned (NR X Face) A Interest Income (ER X BV) B Discount Amortization A-B Book Value 07/01/14 12/31/14 12/31/15Document3 pagesAcquisition & Interest Date Interest Earned (NR X Face) A Interest Income (ER X BV) B Discount Amortization A-B Book Value 07/01/14 12/31/14 12/31/15Gray JavierNo ratings yet

- PDFDocument7 pagesPDFAbegail AdoraNo ratings yet

- Cash and Cash Equivalents: Answer: CDocument142 pagesCash and Cash Equivalents: Answer: CGarp BarrocaNo ratings yet

- Audit of Receivables: Problem No. 1Document6 pagesAudit of Receivables: Problem No. 1Kathrina RoxasNo ratings yet

- This Study Resource Was: Return It After Use. Thank You and GODBLESS!Document6 pagesThis Study Resource Was: Return It After Use. Thank You and GODBLESS!Stephanie LeeNo ratings yet

- Minglana, Mitch T. BSA - 301 Quiz 2 Problem 1Document5 pagesMinglana, Mitch T. BSA - 301 Quiz 2 Problem 1Mitch MinglanaNo ratings yet

- Online teaching and learning experience from Ce gage LearningDocument4 pagesOnline teaching and learning experience from Ce gage Learningkrisha milloNo ratings yet

- Practice Set Review - Current LiabilitiesDocument12 pagesPractice Set Review - Current LiabilitiesKayla MirandaNo ratings yet

- NKNKDocument18 pagesNKNKSophia PerezNo ratings yet

- Sarmiento, Shayne Angela - Exercises-Inventories P-1Document4 pagesSarmiento, Shayne Angela - Exercises-Inventories P-1SHAYNE ANGELA SARMIENTONo ratings yet

- Chapter 1 AnswerDocument15 pagesChapter 1 AnswerKristina Kitty100% (1)

- Comprehensive LiabilitiesDocument5 pagesComprehensive LiabilitiesYnnas ModiongNo ratings yet

- FIFO Inventory CalculationsDocument3 pagesFIFO Inventory CalculationsYricaNo ratings yet

- Intangible Assets Exam QuestionsDocument3 pagesIntangible Assets Exam QuestionsBLACKPINKLisaRoseJisooJennieNo ratings yet

- Proof of Cash Cebu CompanyDocument6 pagesProof of Cash Cebu CompanyCJ alandyNo ratings yet

- Exercises and Problems on Prepaid Expenses and InsuranceDocument5 pagesExercises and Problems on Prepaid Expenses and InsuranceKathleenCusipagNo ratings yet

- Green Company consignment sales revenue 2021Document8 pagesGreen Company consignment sales revenue 2021jangjangNo ratings yet

- Audit of bonds payable and convertible bondsDocument4 pagesAudit of bonds payable and convertible bondsspur iousNo ratings yet

- Assets MCDocument19 pagesAssets MCpahuyobea cutiepatootieNo ratings yet

- Solutions Exercises CashDocument4 pagesSolutions Exercises CashPrince CalicaNo ratings yet

- Quiz 2 Problem 1Document2 pagesQuiz 2 Problem 1Jerah Marie PepitoNo ratings yet

- Auditing Problems PDFDocument106 pagesAuditing Problems PDFCharla Suan100% (1)

- Acctg334-Auditing Assurance: Concepts & Applications 2 Quiz-Employee Benefits & Accounting For Income TaxDocument12 pagesAcctg334-Auditing Assurance: Concepts & Applications 2 Quiz-Employee Benefits & Accounting For Income TaxMichale JacomillaNo ratings yet

- General TaskingDocument4 pagesGeneral TaskingMichale JacomillaNo ratings yet

- BUDGET FINAL BDocument2 pagesBUDGET FINAL BMichale JacomillaNo ratings yet

- English to Japanese translations in 20 wordsDocument1 pageEnglish to Japanese translations in 20 wordsMichale JacomillaNo ratings yet

- Audit of Prepaid ExpenseDocument1 pageAudit of Prepaid ExpenseMichale JacomillaNo ratings yet

- English to Japanese translations in 20 wordsDocument1 pageEnglish to Japanese translations in 20 wordsMichale JacomillaNo ratings yet

- Jacomilla FLELEC2 ASSIGNMENT1Document1 pageJacomilla FLELEC2 ASSIGNMENT1Michale JacomillaNo ratings yet

- English to Japanese translations in 20 wordsDocument1 pageEnglish to Japanese translations in 20 wordsMichale JacomillaNo ratings yet

- U-Masu Form: Verbs With ConjugationDocument2 pagesU-Masu Form: Verbs With ConjugationMichale JacomillaNo ratings yet

- Affidavit of Quitclaim With Indemnity Agreement With SPADocument1 pageAffidavit of Quitclaim With Indemnity Agreement With SPAArchie Osuna33% (3)

- Fitch - Tailored Debt StructuresDocument8 pagesFitch - Tailored Debt Structuresed_nycNo ratings yet

- List of Share Holders, Debenture Holders - 18022021Document2 pagesList of Share Holders, Debenture Holders - 18022021Apoorva ParikhNo ratings yet

- Raising Finance from International MarketsDocument55 pagesRaising Finance from International MarketsamujainNo ratings yet

- Loan Agreement - 20200907 - 161810Document1 pageLoan Agreement - 20200907 - 161810friendell ariasNo ratings yet

- Expected GK Questions From Atma Nirbhar Bharat Abhiyan in PDFDocument12 pagesExpected GK Questions From Atma Nirbhar Bharat Abhiyan in PDFRajesh AdlaNo ratings yet

- Sale DeedDocument22 pagesSale DeedsuhanaNo ratings yet

- Module-Leasing and Hire Purchase Calculation of Lease RentalsDocument5 pagesModule-Leasing and Hire Purchase Calculation of Lease RentalsSINDHU NNo ratings yet

- Recent Measures To Tackle NPADocument3 pagesRecent Measures To Tackle NPAJyotiNo ratings yet

- (15-00293 219-1) Exhibit May 16, 2017 Letter of CollectionDocument2 pages(15-00293 219-1) Exhibit May 16, 2017 Letter of Collectionlarry-612445No ratings yet

- Topic 8Document38 pagesTopic 8hyunsuk fhebieNo ratings yet

- Engineering Economy: Page 1 of 1Document1 pageEngineering Economy: Page 1 of 1Den CelestraNo ratings yet

- ACCT6174 - Introduction To Financial Accounting: Week 7 LiabilitiesDocument28 pagesACCT6174 - Introduction To Financial Accounting: Week 7 LiabilitiesLim MaedaNo ratings yet

- Sources of CreditDocument12 pagesSources of CreditMasud HassanNo ratings yet

- Credit Collection Module 2Document9 pagesCredit Collection Module 2Crystal Jade Apolinario RefilNo ratings yet

- The Corporation Code of The PhilippinesDocument7 pagesThe Corporation Code of The PhilippinesRicardo VelozNo ratings yet

- SocGen - On Our Minds (China) 12152021Document9 pagesSocGen - On Our Minds (China) 12152021irvinkuanNo ratings yet

- Functions of ECGCDocument20 pagesFunctions of ECGCpankul_90100% (2)

- JAIIB RBWM Memory Based Shift 1 2 3Document2 pagesJAIIB RBWM Memory Based Shift 1 2 3Venu TarigoppulaNo ratings yet

- First Information Report: (Under Section 154 CR.P.C.)Document21 pagesFirst Information Report: (Under Section 154 CR.P.C.)Sureshkumar JNo ratings yet

- Debt Snowball MethodDocument4 pagesDebt Snowball Methodjackie555No ratings yet

- Comparing P2P Lending in Singapore and IndonesiaDocument7 pagesComparing P2P Lending in Singapore and IndonesiagitaNo ratings yet

- BFI 220 Cat II - Due On 13th Nov 2023Document2 pagesBFI 220 Cat II - Due On 13th Nov 2023mahmoudfatahabukarNo ratings yet

- Financial Products For Farmers and Service Providers Report EthiopiaDocument30 pagesFinancial Products For Farmers and Service Providers Report EthiopiaBizu AtnafuNo ratings yet

- The Bank'S Right To Recover On Cheques Paid by MistakeDocument33 pagesThe Bank'S Right To Recover On Cheques Paid by MistakeLok LaserNo ratings yet

- Guided Notes - Financial GoalsDocument4 pagesGuided Notes - Financial GoalsrebaamoshyNo ratings yet

- Modes of Extiguishment of Obligations Payment: PayorDocument17 pagesModes of Extiguishment of Obligations Payment: PayorRizza Angela Mangalleno100% (1)

- Business Finance - ModuleDocument33 pagesBusiness Finance - ModuleMark Laurence FernandoNo ratings yet

- Banking On SME GrowthDocument34 pagesBanking On SME GrowthYuresh NadishanNo ratings yet

- Dvara Research Paper Analyzes Household Finance in IndiaDocument46 pagesDvara Research Paper Analyzes Household Finance in IndiaMohit GuptaNo ratings yet