Professional Documents

Culture Documents

Solutions Exercises Cash

Uploaded by

Prince CalicaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Solutions Exercises Cash

Uploaded by

Prince CalicaCopyright:

Available Formats

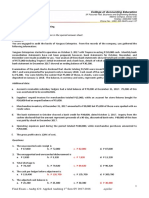

Solutions to exercises/assignment

Problem #1. Dianne Corporation

Cash on hand 80,000

Checking account 170,000

120 day certificate of deposit 600,000

BSP TB#2 1,000,000

money market fund 2,000,000

cash and cash equivalents 3,850,000 a

Problem #2. Abigail Co.

Coins and currency 17,000

check drawn by company payable to

to order of petty cash custodian

representing salary for the month 18,000 accomodation check

petty cash fund 35,000 c

Problem #3 Aira Marie Zhon Co.

Sept. 30 Oct. 31

Balance receipts disbursementsbalance

unad. Bank bal 130,560 149,951 110,098 170,413

undep. Colln- sept 30 5,200 - 5,200

oct. 31 11,256 11,256

outs.check-sept 30 - 8,007 - 8,007

oct. 31 9,821 - 9,821

erron.bank debit-Sep 600 600

oct. 31 - 900 900

err. Bank credit-sept - 1,000 1,000

oct. 31 - 3,000 - 3,000

127,353 154,007 111,612 169,748

Sept. 30 Oct. 31

Balance receipts disbursementsbalance

unad. Book bal 126,429 151,230 111,423 166,236

nsf check-sept. 30 -526.00 - 526

oct. 31 700 - 700

CM -Sept. 30 1,500 - 1,500

oct. 31 4,277 4,277

bsc-sept.30 - 50 - 50

0ct.31 65 - 65

127,353 154,007 111,612 169,748

- - -

Q#1. 111,612 b

Q#2: 11,256 b

Q#3: 9,821 a

Q#4: 127,353 a

Q#5: 169,748 d

Problem #4 Jazz Company

May-31 Jun-30

Balance receipts disbursementsbalance

unad. Bank bal 2,600,000 2,090,000 2,310,000 2,380,000

undep. Colln- may 31 300,000 - 300,000

Jun-30 500,000 500,000

outs.check-May 31 - 100,000 - 100,000

Jun-30 400,000 - 400,000

erron.bank debit-may 40,000 40,000

june

err. Bank credit-may - 60,000 60,000

june

2,780,000 2,350,000 2,650,000 2,480,000

May. 31 June. 30

Balance receipts disbursementsbalance

unad. Book bal 2,190,000 2,400,000 2,510,000 2,080,000

nsf check-may 31

jue 30 100,000 - 100,000

CM -may 600,000 - 600,000

june 550,000 550,000

bsc-May 31 - 10,000 - 10,000

june 50,000 - 50,000

2,780,000 2,350,000 2,650,000 2,480,000

- -

Q#1: 400,000 a

Q#2 500,000 b

Q#3 2,350,000 a

Q#4 2,650,000 a

Q#5 2,480,000 a

Computation of outstanding check

Outstanding check,beg 100,000

Add: checks issued, june 2,500,000

Total checks to be acknowledged 2,600,000

Total checks recorded by bank 2,200,000

outstnaind check,end 400,000

computation of deposit in transit

deposit in transit, beg. 300,000

Total deposits by book 1,800,000

Total deposits to be acknowledged 2,100,000

deposits acknowledged by bank - 1,600,000

deposit in transit,end 500,000

Problem No. 5 Dolly Inc

Balance balance

per bank per book

unadjusted balance 21,209.45 17,056.48

nsf check - 1,143.00

dm - 3,050.83

understament of cust. Check 100.00

understatement of issued check - 18.00

1242.50-1224.5

overstatement of chech

329-32.9 296.10

bsc - 39.43

proceeds of note 2500+62.5-12.5 2,550.00

deposit in transit 6,850.00

oustanding checks - 12,308.13

15,751.32 15,751.32 b

Problem #6: kathereen Company

Nov.30 Dec.31

Balance receipts disbursementsbalance

unad. Bank bal 18,500 145,000 137,000 26,500

dep in transit-nov 12,500 - 12,500

dec 20,000 20,000

outs.check-nov - 16,250 - 16,250

dec 12,500 - 12,500

eerroneous debit - 3,750 3,750

14,750 152,500 129,500 37,750

Nov.30 Dec.31

Balance receipts disbursementsbalance

unad. Book bal 16,250 150,000 128,750 37,500

nsf check-may 31

jue 30

-

uderfooted cash receipts 2,500 2,500

bsc-nov. - 1,500 - 1,500

dec 2,250 - 2,250

14,750 152,500 129,500 37,750

- -

Q#1 book disbursement 128,750 c

Q#2 Dep in transit-dec 20,000 d

Q#3 adj. cash bal-dec.31 37,750 c

Q#4. unrecorded BSC-dec.

BSC per bank 3,250

recorded by book(2500-1000) - 1,000

2,250 d

Q#5 adj.cash bal. nov.30 14,750 b

computation of unadj. Disbursement per bank

Total checks paid 133,750

bsc 3,250

Total disb. 137,000

computation of adjusted disbursement

unadjusted disb.(above) 137,000

oc-nov. given - 16,250

oc-dec.given 12,500

err. Debit-given - 3,750

Adj. disb. Per bank 129,500

bsc-nov.-given 1,500

bsc-dec. 3250-1000 - 2,250

Book disbursement 128,750 Q#1:c

Computation of deposit in transit-end

dep. In transit-beg 12,500

total deposits per books 152,500

Total deposits to be acknowledged 165,000

Total deposits acknowledged by bank - 145,000

dep. In transit,end 20,000 Q#2:d

PROBLEM # 7 Brayden Company

Sept.30 Oct.31

Balance receipts disbursementsbalance

unad. Bank bal 100,000 200,000 150,000 150,000

dep in transit-sep 5,000 - 5,000

oct 7,000 7,000

outs.check-sept - 8,000 - 8,000

oct 6,000 - 6,000

eerroneous debit

97,000 202,000 148,000 151,000

Sept.30 Oct.30

Balance receipts disbursementsbalance

unad. Book bal 91,500 194,000 146,000 139,500

nsf check-sept

oct 3,000 - 3,000

unrecorded dep 3,000 3,000

CM-sept 8,000 - 8,000

-oct 13,000 13,000

bsc-sep. - 2,500 - 2,500

oct 1,500 - 1,500

97,000 202,000 148,000 151,000

- -

Q#1: Outstanding check-sept 8,000 b

OC,beg 8,000

checks issued-oct 146,000

Total checks to be acknowledged by bank 154,000

Total checks acknowledged by bank - 148,000

Outstanding check-oct (given) 6,000

Q#2: Cash in bak balance-sept 30 97,000 a

Q#3 cash receipts-oct. 31 202,000 b

Q#4 Cash disb.-oct 31 148,000 c

Q#5 cash balance oct.31 151,000 a

You might also like

- Audit Prob Cash AnsDocument7 pagesAudit Prob Cash AnsNoreen BinagNo ratings yet

- Pak Enings HTDocument15 pagesPak Enings HTVincent SampianoNo ratings yet

- Final Exam 12 PDF FreeDocument17 pagesFinal Exam 12 PDF FreeEmey CalbayNo ratings yet

- Audit of Invest. in Equity and Debt SecuritiesDocument23 pagesAudit of Invest. in Equity and Debt SecuritiesJoseph SalidoNo ratings yet

- Far 03 - InventoryDocument7 pagesFar 03 - InventoryMark Domingo MendozaNo ratings yet

- Refresher Course: Audit of Cash and Cash EquivalentsDocument4 pagesRefresher Course: Audit of Cash and Cash EquivalentsFery Ann100% (1)

- Audprob Answer 1Document1 pageAudprob Answer 1venice cambryNo ratings yet

- Cash Shortage Computation: SolutionDocument4 pagesCash Shortage Computation: SolutionCJ alandyNo ratings yet

- 03 Bank ReconliationDocument4 pages03 Bank Reconliationsharielles /No ratings yet

- Proof of Cash Baht CompanyDocument6 pagesProof of Cash Baht CompanyCJ alandy100% (1)

- 12345Document17 pages12345xjammer0% (3)

- Encode JobDocument12 pagesEncode JobRainNo ratings yet

- Comprehensive Audit Problem (Julie&Angelo)Document8 pagesComprehensive Audit Problem (Julie&Angelo)Julie Ann Pili100% (3)

- AP-5903 - PPE & Intangibles.-Supporting Notes PDFDocument8 pagesAP-5903 - PPE & Intangibles.-Supporting Notes PDFAlbert Macapagal100% (2)

- AP Computation - Cash and Cash EquivalentsDocument16 pagesAP Computation - Cash and Cash EquivalentsErnest Andales0% (1)

- SPDocument28 pagesSPkrizzmaaaayNo ratings yet

- PPE ExerciseDocument4 pagesPPE ExerciseLlyod Francis LaylayNo ratings yet

- Aud Prob ReceivablesDocument13 pagesAud Prob ReceivablesMary Joanne Tapia0% (1)

- Part 10Document5 pagesPart 10chimchimcoliNo ratings yet

- Doubtful Accounts Expense Using Allowance MethodDocument2 pagesDoubtful Accounts Expense Using Allowance Methodwarsidi89% (9)

- Pa2 M-1415Document4 pagesPa2 M-1415Ronnelson PascualNo ratings yet

- Cash and Cash EquivDocument8 pagesCash and Cash EquivMonina Cabalag0% (1)

- Case 7 SolutionsDocument3 pagesCase 7 SolutionsMichale Jacomilla50% (2)

- Sample Auditing Problems (Proof of Cash and Correction of Error) With SolutionDocument16 pagesSample Auditing Problems (Proof of Cash and Correction of Error) With SolutionFernan Dvra100% (1)

- Inventories and Cost FlowDocument5 pagesInventories and Cost Flowalford sery CammayoNo ratings yet

- Inventory LossDocument7 pagesInventory LossEarl Hyannis ElauriaNo ratings yet

- Problem 5: QuestionsDocument6 pagesProblem 5: QuestionsTk KimNo ratings yet

- Practical Accounting 1Document11 pagesPractical Accounting 1Jomar VillenaNo ratings yet

- Seatwork 2B ASSIGNDocument5 pagesSeatwork 2B ASSIGNYzzabel Denise L. Tolentino100% (1)

- Assignment 1.2 Cash CountDocument3 pagesAssignment 1.2 Cash CountMary Rose Arguelles100% (1)

- Ay16!17!2nd Semester Acctg03 Fass 03-Questionnaire-Part 1Document6 pagesAy16!17!2nd Semester Acctg03 Fass 03-Questionnaire-Part 1Maketh.Man33% (3)

- Preweek Auditing Problems 2014 PDFDocument41 pagesPreweek Auditing Problems 2014 PDFalellieNo ratings yet

- ConsolidatedDocument18 pagesConsolidatedjikee11No ratings yet

- Finals Answer KeyDocument6 pagesFinals Answer Keymarx marolinaNo ratings yet

- AP - General ReviewDocument15 pagesAP - General ReviewVhiejhaan16100% (1)

- Loans and Receivables Sample Problems 2Document2 pagesLoans and Receivables Sample Problems 2Bryce Bihag60% (5)

- A R RoqueDocument73 pagesA R RoqueTwish BarriosNo ratings yet

- Auditing Problems Final Preboard Examination Batch 87 SET: Cpa Review School of The Philippines ManilaDocument12 pagesAuditing Problems Final Preboard Examination Batch 87 SET: Cpa Review School of The Philippines ManilaMarwin AceNo ratings yet

- CEL 1 PRAC 1 Answer KeyDocument12 pagesCEL 1 PRAC 1 Answer KeyRichel ArmayanNo ratings yet

- DocxDocument162 pagesDocxJannah Fate100% (3)

- Problems Audit of InvestmentsDocument15 pagesProblems Audit of InvestmentsKm de Leon75% (4)

- A.) Land: Problem No.1Document7 pagesA.) Land: Problem No.1MARICEL URBINANo ratings yet

- AP Problems 2016Document26 pagesAP Problems 2016RosejaneLim100% (1)

- File 7595477826281120346Document13 pagesFile 7595477826281120346sunshineNo ratings yet

- Chapter-5 Homework InventoriesDocument4 pagesChapter-5 Homework InventoriesKenneth Christian Wilbur0% (1)

- Biyaya 3Document8 pagesBiyaya 3palakol bagsakNo ratings yet

- Solution Chapter 13 ADVAC2Document24 pagesSolution Chapter 13 ADVAC2Princess50% (2)

- Buscomsubsequent EventDocument4 pagesBuscomsubsequent EventJomar Villena67% (3)

- Audit of Cash PDFDocument3 pagesAudit of Cash PDFVincent SampianoNo ratings yet

- Corporations in Financial Difficulty: Multiple Choice QuestionsDocument26 pagesCorporations in Financial Difficulty: Multiple Choice QuestionsInsatiable LifeNo ratings yet

- Problem No.1 - Ch6 Cost Flow AssumptionDocument3 pagesProblem No.1 - Ch6 Cost Flow AssumptionFoong Chan PingNo ratings yet

- Prelim Quiz 2 CMPC 313Document10 pagesPrelim Quiz 2 CMPC 313Nicole ViernesNo ratings yet

- Quiz 1 - Audit of Cash SolutionDocument9 pagesQuiz 1 - Audit of Cash SolutionmillescaasiNo ratings yet

- CPAR AP - Audit of CashDocument9 pagesCPAR AP - Audit of CashJohn Carlo CruzNo ratings yet

- Proof of CashDocument7 pagesProof of CashMARIAN POLANCONo ratings yet

- Bank Reconciliation ProblemsDocument2 pagesBank Reconciliation ProblemsCris Jung80% (5)

- Problem 1 - Dallas CorporationDocument6 pagesProblem 1 - Dallas CorporationKatherine Cabading InocandoNo ratings yet

- IAP ProblemsDocument6 pagesIAP ProblemsBianca LizardoNo ratings yet

- Module 2 ProblemsDocument15 pagesModule 2 ProblemsCristina TayagNo ratings yet

- Cash Problems SolutionDocument3 pagesCash Problems SolutionMagadia Mark JeffNo ratings yet

- Problems - Investment in Equity SecuritiesDocument10 pagesProblems - Investment in Equity SecuritiesPrince Calica100% (1)

- Module 4: International Business Environment ObjectivesDocument13 pagesModule 4: International Business Environment ObjectivesPrince CalicaNo ratings yet

- SUBJECT: Accounting 15 DESCIPTIVE TITLE: Accounting For Business Combination Instructor: Alfredo R. CabisoDocument4 pagesSUBJECT: Accounting 15 DESCIPTIVE TITLE: Accounting For Business Combination Instructor: Alfredo R. CabisoPrince CalicaNo ratings yet

- Values, Attitudes, and Job Satisfaction: Learning ObjectivesDocument5 pagesValues, Attitudes, and Job Satisfaction: Learning ObjectivesPrince CalicaNo ratings yet

- SUBJECT: Accounting 13 NC Descriptive Title: Auditing and Assurance Concepts and Applications 1Document5 pagesSUBJECT: Accounting 13 NC Descriptive Title: Auditing and Assurance Concepts and Applications 1Prince CalicaNo ratings yet

- Salvation HistoryDocument20 pagesSalvation HistoryPrince CalicaNo ratings yet

- Individual Differences, Mental Ability, and PersonalityDocument6 pagesIndividual Differences, Mental Ability, and PersonalityPrince CalicaNo ratings yet

- Module 3. Modern Theories of International TradeDocument9 pagesModule 3. Modern Theories of International TradePrince CalicaNo ratings yet

- What Is A Supply ChainDocument1 pageWhat Is A Supply ChainPrince CalicaNo ratings yet

- Module 2: Classical International Trade Theories 2.1 Learning ObjectivesDocument11 pagesModule 2: Classical International Trade Theories 2.1 Learning ObjectivesPrince CalicaNo ratings yet

- Learning, Perception and AttributionDocument8 pagesLearning, Perception and AttributionPrince CalicaNo ratings yet

- SUBJECT: Accounting 13 NC Descriptive Title: Auditing and Assurance Concepts and Applications 1Document12 pagesSUBJECT: Accounting 13 NC Descriptive Title: Auditing and Assurance Concepts and Applications 1Prince CalicaNo ratings yet

- Chapter 1-SolutionsDocument14 pagesChapter 1-SolutionsPrince CalicaNo ratings yet

- 1st Semester A.Y 2020 - 2021Document5 pages1st Semester A.Y 2020 - 2021Prince CalicaNo ratings yet

- Rudy and Frankie Case 2Document1 pageRudy and Frankie Case 2Prince CalicaNo ratings yet

- At Io N at Et: Federal Polytechnic Offa - 1000073Document1 pageAt Io N at Et: Federal Polytechnic Offa - 1000073Olajire KoredeNo ratings yet

- Problem 1 1245Document3 pagesProblem 1 1245Rhanda BernardoNo ratings yet

- Income Tax ReturnDocument5 pagesIncome Tax Returnevalle13100% (1)

- Rbi Circular Jan2023Document8 pagesRbi Circular Jan2023Udya singhNo ratings yet

- Borg Associates Introduction - Oct 2022 PDFDocument15 pagesBorg Associates Introduction - Oct 2022 PDFEmmanuel CrenneNo ratings yet

- Chapter 2Document35 pagesChapter 2Jerryline BerguiaNo ratings yet

- 327 - How Big Is Global Money Laundering - Journal of Money Laundering Control-Walker-1999Document13 pages327 - How Big Is Global Money Laundering - Journal of Money Laundering Control-Walker-1999bipeen bashyalNo ratings yet

- Public Interest (Maslahah Mursalah) (Autosaved)Document16 pagesPublic Interest (Maslahah Mursalah) (Autosaved)hussnainNo ratings yet

- Acct 4220 Additional Review Questions For Final ExamDocument5 pagesAcct 4220 Additional Review Questions For Final ExamrakutenmeeshoNo ratings yet

- QUIZ in AUDIT OF SHAREHOLDERS EQUITYDocument2 pagesQUIZ in AUDIT OF SHAREHOLDERS EQUITYLugh Tuatha DeNo ratings yet

- 10 Capital Adequacy NormsDocument23 pages10 Capital Adequacy NormsBindal HeenaNo ratings yet

- AIC Zawya ProfileDocument3 pagesAIC Zawya ProfilezammanjiNo ratings yet

- PHD Consolidated Financials - 31 December 2020Document46 pagesPHD Consolidated Financials - 31 December 2020Aly A. SamyNo ratings yet

- Crisil Ratings and Rating ScalesDocument11 pagesCrisil Ratings and Rating ScalesAnand PandeyNo ratings yet

- Required Returns and The Cost of CapitalDocument49 pagesRequired Returns and The Cost of Capitalaftab_sweet3024No ratings yet

- Finance AnalystDocument13 pagesFinance Analystshridhar bhagwatNo ratings yet

- FRM Formulas FRMDocument63 pagesFRM Formulas FRMManojNo ratings yet

- Relationship Between Exchange Rate and Inflation in Pakistan - EconomicsDocument6 pagesRelationship Between Exchange Rate and Inflation in Pakistan - EconomicslukeniaNo ratings yet

- 2,3,4 Ir Uzd PDFDocument31 pages2,3,4 Ir Uzd PDFLeonid LeoNo ratings yet

- Role of The TreasurerDocument39 pagesRole of The TreasurerWasifAhmadNo ratings yet

- BSP and Monetary PolicyDocument49 pagesBSP and Monetary PolicySimone Reyes50% (2)

- Resa Material Financial Statement AnalysisDocument12 pagesResa Material Financial Statement Analysispatrickjames.ravelaNo ratings yet

- Tutorial 3 QuestionsDocument3 pagesTutorial 3 Questionsguan junyanNo ratings yet

- Note On Precedent TransactionsDocument2 pagesNote On Precedent TransactionsTamim HasanNo ratings yet

- Prepaid Payment Instruments A Discussion On Draft Guidelines by RBIDocument11 pagesPrepaid Payment Instruments A Discussion On Draft Guidelines by RBIAshutoshNo ratings yet

- CfroiDocument2 pagesCfroiPro Resources100% (1)

- Executive SummaryDocument76 pagesExecutive Summarysimantt100% (2)

- RBI Grade B SyllabusDocument7 pagesRBI Grade B Syllabusakash debbarmaNo ratings yet

- Valuation of Bonds and Stocks Learning ObjectivesDocument19 pagesValuation of Bonds and Stocks Learning ObjectivesShaneen Angelique MoralesNo ratings yet

- Half Years Exam (Probable Questions - Answers)Document15 pagesHalf Years Exam (Probable Questions - Answers)Taz UddinNo ratings yet