Professional Documents

Culture Documents

Problem No.1 - Ch6 Cost Flow Assumption

Uploaded by

Foong Chan PingOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Problem No.1 - Ch6 Cost Flow Assumption

Uploaded by

Foong Chan PingCopyright:

Available Formats

ACCT1000 Quiz – Ch6 & 7

NameSection No.

Class No.

Student no.: - - - Date:

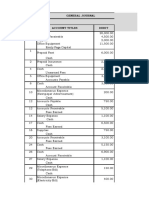

Problem No.1 – Ch6 Cost Flow Assumption

Thompson International sells stereo amplifying system. Thompson uses perpetual inventory system to

record its inventory. Below is the information relating to Thompson’s purchases and sales transactions of its

stereo systems during October 2023.

Date Explanation Units Unit Cost Total Cost

Oct 1 Inventory 100 $ 100 $ 10,000

Oct 10 Purchases 200 110 22,000

Oct 18 Purchases 300 120 36,000

Totals 600 $68,000

Date Explanation Units Unit Price Total Revenue

Oct 7 Sale 80 $150 $ 12,000

Oct 27 Sale 450 180 81,000

Totals 530 $93,000

Instructions:

a. Compute ending inventory at October 31, 2023 using FIFO and Moving-average costs

FIFO method

Date Purchases Cost of Goods Sold Balance

Oct 1 (100@100)10,000

Oct 7 (80@100)8,000 (20@100)2,000

Oct10 (200@110)22,000 (20@100)24,000

(200@110)

Oct18 (300@120)36,000 (20@100)60,000

(200@110)

(300@120)

Oct 27 (20@100)2,000 =51,200 (70@120)8,400

(200@110)22,000

(230@120)27,600

Moving-average costs method

Date Purchases Cost of Goods Sold Balance

Oct 1 (100@100)10,000

Oct 7 (80@100)8,000 (20@100)2,000

Oct 10 (200@110)22,000 24,000

Oct 18 (300@120)36,000 60,000

Oct 27 51,923 8,077

(60,000 *450/520) (60,000 *70/520)

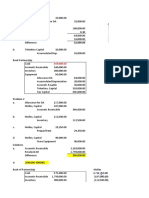

Problem No.2 - Ch7 Bank reconciliation

As of June 30, 2023, the Chopin Company had the following facts concerning cash in bank.

1. Balance per bank, $55,000.

2. Balance per books, $53,965.

3. Deposits in transit, $4,000.

4. Outstanding checks: No.305 $1,000; No.308 $2,500; No.310 $3,000.

5. Error: Check No.301 for $3,416 was correctly paid by the bank but was recorded by the company for

$3,461. This check was a payment to purchase supplies to a creditor.

6. Two bank debit memoranda are as follows:

a. NSF check from Abbie Leon for $3,000 on account.

b. A bank service charge of $10.

7. One bank credit memoranda as follows:

A note receivable for $1,450 plus interest of $75 was collected by the bank. The bank charged $25 for

this service. The interest has been accrued by Chopin Company.

Instructions

a. Prepare the bank reconciliation for Chopin Company for the month ended on June 30, 2023.

b. Prepare the adjusting entries for Chopin Company on June 30, 2023.

Chopin Company

Bank Reconciliation

June 30, 2023

Balance per Bank Statement 55,000

Add: Deposit In Transit 4,000

59,000

Less: Outstanding Checks

No.304 1,000

No.308 2,500

No. 310 3,000 6,500

Adjusted Balance as per Bank 52,500

Balance per Cash Book 53,965

Add: Notes received by bank 1,525

Error in Recording Check No.301 45 1,570

55,535

Less: NSF Check 3,000

Bank Service Charge 35 3,035

52,500

Cont’d . . . Problem No.2

GENERAL JOURNAL

Date Account Title Debit Credit

Jun 30 Cash 1,525

Notes Receivable 1,525

Jun 30 Cash 45

Accounts Payable 45

Jun 30 Accounts Receivable 3,000

Cash 3,000

Jun 30 Miscellaneous Expense 35

Cash 35

You might also like

- A Practical Guide to Forecasting Financial Market VolatilityFrom EverandA Practical Guide to Forecasting Financial Market VolatilityNo ratings yet

- Proof of CashDocument3 pagesProof of CashLorence Patrick LapidezNo ratings yet

- Bank Reconciliation ProblemsDocument2 pagesBank Reconciliation ProblemsCris Jung80% (5)

- Proof of Cash123Document5 pagesProof of Cash123rufamaegarcia07No ratings yet

- LESSON 7.3Document2 pagesLESSON 7.3crisjay ramosNo ratings yet

- Sales Journal Purcase Journal Cash Receipt Journal Cash Disbursement Journal General JournalDocument15 pagesSales Journal Purcase Journal Cash Receipt Journal Cash Disbursement Journal General JournalNathalia Alexandra PagulayanNo ratings yet

- Solutions Exercises CashDocument4 pagesSolutions Exercises CashPrince CalicaNo ratings yet

- Quiz Review CH 5 6 7Document8 pagesQuiz Review CH 5 6 7yanto ismailNo ratings yet

- Proof of Cash ProblemDocument3 pagesProof of Cash ProblemKathleen Frondozo67% (6)

- Cash, BNK Recon and AR Answer KeyDocument6 pagesCash, BNK Recon and AR Answer KeyNanya BisnestNo ratings yet

- Bank ReconciliationDocument6 pagesBank ReconciliationLorence Patrick LapidezNo ratings yet

- AC 100 Aug2006 MSDocument6 pagesAC 100 Aug2006 MSERICK MLINGWANo ratings yet

- ACC201 Group Assignment Solution T2.2022Document8 pagesACC201 Group Assignment Solution T2.2022Hoang Khanh Linh NguyenNo ratings yet

- Espanola Far 201 QuizDocument7 pagesEspanola Far 201 QuizCINDY MAE SARAH ESPANOLANo ratings yet

- Assignment 1Document12 pagesAssignment 1Ira YbanezNo ratings yet

- Bank Recon and Poc SolutionDocument4 pagesBank Recon and Poc SolutionJanine IgdalinoNo ratings yet

- Final Output Intacc PDFDocument7 pagesFinal Output Intacc PDFCj BarrettoNo ratings yet

- Worksheet With FSDocument8 pagesWorksheet With FSMilrosePaulinePascuaGudaNo ratings yet

- Audit of Cash ActivityDocument13 pagesAudit of Cash ActivityIris FenelleNo ratings yet

- Audit of Cash ActivityDocument13 pagesAudit of Cash ActivityIris FenelleNo ratings yet

- Audit Journal Entries GuideDocument7 pagesAudit Journal Entries Guidereina maica terradoNo ratings yet

- Sol. Man. - Chapter 3 - Bank Reconciliation - Ia PartDocument15 pagesSol. Man. - Chapter 3 - Bank Reconciliation - Ia PartMike Joseph E. Moran100% (3)

- Chapter 7 ProblemsDocument25 pagesChapter 7 ProblemsRhoda Claire M. Gansobin100% (1)

- Bank Reconciliation SpreadsheetDocument7 pagesBank Reconciliation Spreadsheetcrisjay ramosNo ratings yet

- Chapter 3-5 To 3-13Document9 pagesChapter 3-5 To 3-13XENA LOPEZNo ratings yet

- Bigotry Company Proof of CashDocument4 pagesBigotry Company Proof of CashGee Lysa Pascua VilbarNo ratings yet

- Module 2 ProblemsDocument15 pagesModule 2 ProblemsCristina TayagNo ratings yet

- Exercises Finalaccounts ExDocument2 pagesExercises Finalaccounts ExSounak NathNo ratings yet

- Exercise 1.1: Downpayment Present Value of Note (200,000 X 3.17 Pvoa) Total CostDocument5 pagesExercise 1.1: Downpayment Present Value of Note (200,000 X 3.17 Pvoa) Total CostKailah CalinogNo ratings yet

- Morning Co's bank reconciliation for August 31, 20x3Document3 pagesMorning Co's bank reconciliation for August 31, 20x3Janine IgdalinoNo ratings yet

- A5 Activity 2 Capital Maintenance and Transaction Approach StudentsDocument17 pagesA5 Activity 2 Capital Maintenance and Transaction Approach StudentsJOY MARIE RONATONo ratings yet

- Journal Entries, Ledger and Trial BalanceDocument8 pagesJournal Entries, Ledger and Trial BalanceDan Ryan0% (1)

- Accounting 1Document3 pagesAccounting 1Kairan CrisologoNo ratings yet

- Jansen Balance SheetDocument3 pagesJansen Balance SheetRowella Mae VillenaNo ratings yet

- Cebu Car-Tech CenterDocument17 pagesCebu Car-Tech CenterAlbert Moreno100% (2)

- Bank Recon and PCFDocument2 pagesBank Recon and PCFAiza Ordoño0% (1)

- CHAPTER2 - Bank Recon - IllustrationDocument14 pagesCHAPTER2 - Bank Recon - IllustrationReighjon Ashley C. TolentinoNo ratings yet

- Partnership Formation - SolutionsDocument5 pagesPartnership Formation - SolutionsMohammadNo ratings yet

- Requirement No. 1: PROBLEM NO. 1 - Peso CorporationDocument13 pagesRequirement No. 1: PROBLEM NO. 1 - Peso CorporationDreiu EsmeleNo ratings yet

- FM 1Document18 pagesFM 1huleNo ratings yet

- Bank ReconciliationDocument6 pagesBank ReconciliationnikNo ratings yet

- AP 5907 CashDocument8 pagesAP 5907 CashClariceLacanlaleDarasinNo ratings yet

- Exercises - Cash and ReceivablesDocument8 pagesExercises - Cash and ReceivablesjpNo ratings yet

- Quiz 1 - Audit of Cash SolutionDocument9 pagesQuiz 1 - Audit of Cash SolutionmillescaasiNo ratings yet

- Proof of CashDocument7 pagesProof of CashMARIAN POLANCONo ratings yet

- Illustration PRAC - AUD Page 13Document4 pagesIllustration PRAC - AUD Page 13The BoxNo ratings yet

- Questions On Cash Budget-2Document7 pagesQuestions On Cash Budget-2Mpolokeng HlabanaNo ratings yet

- Solution Bank ReconDocument5 pagesSolution Bank ReconCrystal NadalaNo ratings yet

- Partnership and Corporation Accounting Chapter 2 SolManDocument7 pagesPartnership and Corporation Accounting Chapter 2 SolManDavid BarletaNo ratings yet

- Bank Reconciliation: Sample ProblemsDocument39 pagesBank Reconciliation: Sample ProblemsXENA LOPEZ78% (9)

- Accounting concepts explainedDocument6 pagesAccounting concepts explainedMaringanti ShobhanaNo ratings yet

- Solution - Problems 1-8 Cash and Cash EquivalentsDocument3 pagesSolution - Problems 1-8 Cash and Cash Equivalentsanon_965241988No ratings yet

- Suggested Solutions Dec 2008Document8 pagesSuggested Solutions Dec 2008kalowekamoNo ratings yet

- MC- Bank Reconciliation and Proof of CashDocument4 pagesMC- Bank Reconciliation and Proof of CashGwen Ashley Dela PenaNo ratings yet

- Depreciation Expense, Rp. 25.000.000Document12 pagesDepreciation Expense, Rp. 25.000.000Roni SinagaNo ratings yet

- RequiredDocument15 pagesRequiredCheska Anne Mikka RoxasNo ratings yet

- Exercises Problem in Bank ReconciliationDocument2 pagesExercises Problem in Bank ReconciliationRoseiii AnnNo ratings yet

- Bank Reconciliation: QuizDocument4 pagesBank Reconciliation: QuizBrgy Baloling50% (2)

- Chapter 7Document57 pagesChapter 7scryx bloodNo ratings yet

- Tugas Siklus AjdDocument11 pagesTugas Siklus AjdChintya saragihNo ratings yet

- Narrative Report On Catch Up Friday ReadingDocument2 pagesNarrative Report On Catch Up Friday ReadingNova Mae AgraviadorNo ratings yet

- Baghouse Compressed AirDocument17 pagesBaghouse Compressed Airmanh hung leNo ratings yet

- Latihan Soal ADS Bab 14-16Document1 pageLatihan Soal ADS Bab 14-16nadea06_20679973No ratings yet

- KireraDocument3 pagesKireramurithiian6588No ratings yet

- Facts About SaturnDocument7 pagesFacts About SaturnGwyn CervantesNo ratings yet

- The Tower Undergraduate Research Journal Volume VI, Issue IDocument92 pagesThe Tower Undergraduate Research Journal Volume VI, Issue IThe Tower Undergraduate Research JournalNo ratings yet

- Ch15 Differential Momentum BalanceDocument20 pagesCh15 Differential Momentum Balance89kkNo ratings yet

- Registration Confirmation: 315VC18331 Aug 24 2009 7:47PM Devashish Chourasiya 24/05/1989 Mechanical RanchiDocument2 pagesRegistration Confirmation: 315VC18331 Aug 24 2009 7:47PM Devashish Chourasiya 24/05/1989 Mechanical Ranchicalculatorfc101No ratings yet

- Details of Nodal Officer - HD Officers of Other DepttDocument46 pagesDetails of Nodal Officer - HD Officers of Other DepttManoj KashyapNo ratings yet

- Trends and Fads in Business SVDocument2 pagesTrends and Fads in Business SVMarie-Anne DentzerNo ratings yet

- Adobe Scan 25 Dec 202Document1 pageAdobe Scan 25 Dec 202Jimit ShahNo ratings yet

- Physical Fitness Test Score CardDocument4 pagesPhysical Fitness Test Score CardChing DialomaNo ratings yet

- Dcs Ict2113 (Apr22) - LabDocument6 pagesDcs Ict2113 (Apr22) - LabMarwa NajemNo ratings yet

- StuffIt Deluxe Users GuideDocument100 pagesStuffIt Deluxe Users Guidesergio vieiraNo ratings yet

- Fif-12 Om Eng Eaj23x102Document13 pagesFif-12 Om Eng Eaj23x102Schefer FabianNo ratings yet

- RPH Sains DLP Y3 2018Document29 pagesRPH Sains DLP Y3 2018Sukhveer Kaur0% (1)

- USP-NF 1251 Weighing On An Analytical BalanceDocument7 pagesUSP-NF 1251 Weighing On An Analytical BalanceZerish InaayaNo ratings yet

- Basic Vacuum Theory PDFDocument17 pagesBasic Vacuum Theory PDFada guevarraNo ratings yet

- Net CallDocument2 pagesNet CallFerdinand Monte Jr.100% (2)

- ICT - 81 - F32A - ISO - 13485 - and - MDD - IVDD - Checklist - Rev1 - 01.05.2020 - ALAMIN (1) (Recovered)Document41 pagesICT - 81 - F32A - ISO - 13485 - and - MDD - IVDD - Checklist - Rev1 - 01.05.2020 - ALAMIN (1) (Recovered)Basma ashrafNo ratings yet

- Human Rights PDFDocument18 pagesHuman Rights PDFRohitNo ratings yet

- Phy 111 - Eos Exam 2015Document7 pagesPhy 111 - Eos Exam 2015caphus mazengeraNo ratings yet

- Einstein and Oppenheimer's Real Relationship Was Cordial and Complicated Vanity FairDocument1 pageEinstein and Oppenheimer's Real Relationship Was Cordial and Complicated Vanity FairrkwpytdntjNo ratings yet

- Glover 5e SI - Chapter 05Document30 pagesGlover 5e SI - Chapter 05novakiNo ratings yet

- ENGGBOQEstimation ReportDocument266 pagesENGGBOQEstimation ReportUTTAL RAYNo ratings yet

- Teaching Strategies in The New NormalDocument19 pagesTeaching Strategies in The New NormalEloisa Canlas - Quizon67% (3)

- RCC Chimneys - CICIND Code PDFDocument23 pagesRCC Chimneys - CICIND Code PDFVasanth KumarNo ratings yet

- Work Sample - Wencan XueDocument13 pagesWork Sample - Wencan XueWencan XueNo ratings yet

- The PersonalityDocument7 pagesThe PersonalityMeris dawatiNo ratings yet

- Guideline MD Listing and Authorization MDS-G5 PDFDocument153 pagesGuideline MD Listing and Authorization MDS-G5 PDFSyed SalmanNo ratings yet