Professional Documents

Culture Documents

Espanola Far 201 Quiz

Uploaded by

CINDY MAE SARAH ESPANOLACopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Espanola Far 201 Quiz

Uploaded by

CINDY MAE SARAH ESPANOLACopyright:

Available Formats

ESPANOLA, CINDY MAE SARAH L.

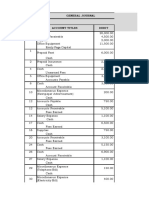

SECOND BANK Date

Dec. 1 Balance 100,000 Dec. 1 Check No. 771 20,000 Dec.

6 Deposit 30,000 4 772 5,000

12 Deposit 40,000 6 773 35,000

24 Deposit 50,000 10 774 15,000

31 Deposit 60,000 14 775 30,000

18 776 25,000

24 777 40,000

Balance 280,000 170,000

Total Bal. 110,000

REQUIRED:

a. Prepare a bank reconciliation statement on December 31.

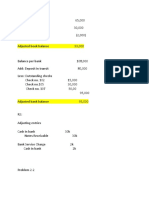

SENSIBLE COMPANY

BANK RECONCILIATION

DECEMBER 31, 20A

Book Balance 110,000

Add: Credit Memo from collected notes 45,000

Total 155,000

Less: Debit Memo (Service charge) (5,000)

NSF Check (10,000)

Book Error (52,000 - 25,000) (27,000) (42,000)

Adjusted Book Balance 113,000

Bank Balance 135,000

Add: Deposit in Transit 60,000

Bank error 8,000 68,000

Total 203,000

Less: Outstanding Checks

No. 770 (20,000)

No. 775 (30,000)

No. 777 (40,000) (90,000)

Adjusted Bank Balance 113,000

Checks Deposits Balance

1 Balance 130,000

check No. 768 10,000 120,000

1 771 20,000 100,000

4 772 5,000 95,000

6 773 35,000 30,000 90,000

12 774 15,000 40,000 115,000

12 776 52,000 63,000

24 1,042 8,000 50,000 105,000

28 NSF Check 10,000 DM 45,000 CM 140,000

28 Service Charge 5,000 DM 135,000

Total Bal.

b. Prepare adjusting entries on December 31.

Dec. 31 Cash in Bank 45,000

Bank Service Charge 5,000

Notes Receivable 50,000

31 Service Charge 5,000

Accounts Receivable 10,000

Accounts Payable 27,000

Cash in Bank 42,000

Bank Reconciliation (January 31)

Bank Balance 300,000

Add: Deposit in Transit 600,000

Total 900,000

Deduct Outstanding Checks:

No. 114 (240,000)

No. 115 (160,000)

No. 116 (60,000) (460,000)

Adjusted Bank Balance 440,000

Bank Statement for the month of February

THIRD BANK

Checks Deposit Date Balance

Balance forwarded Jan. 31 300,000

240,000 600,000 Feb. 1 660,000

2,000,000 3 2,660,000

200,000 5 2,460,000

900,000 400,000 7 1,960,000

160,000 9 1,800,000

1,000,000 10 2,800,000

500,000 13 2,300,000

1,200,000 16 3,500,000

1,300,000 21 4,800,000

550,000 23 4,250,000

5,000 SC 24 4,245,000

1,000,000 550,000 27 3,795,000

800,000 270,000 CM 28 3,265,000 Total Bank Bal.

REQUIRED:

a. Prepare bank reconciliation on February 28, showing the book balance before

and after adjustment.

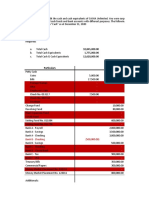

XAVIER COMPANY

BANK RECONCILIATION

FEBRUARY 26, 20A

Book Balance 2,840,000

Add: Credit Memo (collected notes) 270,000

Total 3,110,000

Less: Debit Memo (SC) (5,000)

Adjusted Book Balance 3,105,000

Bank Balance 3,265,000

Add: Deposit in Transit 450,000

Total 3,715,000

Less: Outstanding Checks

No. 116 (60,000)

122 (180,000)

124 (120,000)

125 (250,000) (610,000)

Adjusted Bank Balance 3,105,000

Credit Memo (February 28)

Face of the note 250,000

Interest on the note 30,000

Maturity value of the note 280,000

Collection charge (10,000)

Credit to your account 270,000

Cash Journals of Xavier Company

Cash Receipt Journals Cash Disbursemnet Journal

Date Debit Cash Check No. Credit Cash

Feb. 2 2,000,000 117 200,000

6 400,000 118 900,000

9 800,000 119 800,000

10 200,000 120 500,000

15 1,200,000 121 550,000

20 1,300,000 122 180,000 OC

24 550,000 123 1,000,000

28 450,000 DIT 124 120,000 OC

125 250,000 OC

Balance 6,900,000 4,500,000

Total Book Bal. 2,840,000

b. Prepare journal entries to record the adjustments that are

indicated by the bank reconciliation.

Feb. 28 Cash in Bank 270,000

Service Charge 10,000

Notes Receivable 250,000

Interest Income 30,000

28 Service Charge 5,000

Cash in Bank 5,000

REQUIRED:

a. Prepare bank reconciliation on December 31.

Book Balance

Add: Credit Memo (proceeds of bank loan)

Total

Less: Debit Memo

Book Error (200,000 - 20,000)

Adjusted Book Balance

Bank Balance

Add: Deposit in Transit (undeposited collection)

Bank Error (another entity charged the Alpha Co.)

Omitted from bank statement

Total

Less: Outstanding Check

Correction of error arising from crediting Omega Company deposit to Alpha Company

Adjusted Book Balance

b. Prepare Dec. 31 Cash

Discount on Notes Payable

Notes Payable

to record adjustment of notes payable

31 Petty Cash Expense

Cash

to record petty cash expense

31 Accounts Payable

Cash

to record payment of accounts payable

ALPHA COMPANY

BANK RECONCILIATION STATEMENT

FOR THE MONTH ENDED DECEMBER 31,2020

4,990,000

eeds of bank loan) 516,000

5,506,000

0 - 20,000) (180,000)

5,326,000

5,500,000

undeposited collection) 300,000

er entity charged the Alpha Co.) 50,000

k statement 150,000 500,000

6,000,000

(544,000)

arising from crediting Omega Company deposit to Alpha Company (130,000) (674,000)

5,326,000

516,000

on Notes Payable 84,000

es Payable 600,000

adjustment of notes payable

h Expense 10,000

h 10,000

petty cash expense

Payable 180,000

h 18,000

payment of accounts payable

You might also like

- Chase Bank Statement TemplateLab ComDocument1 pageChase Bank Statement TemplateLab ComhanhNo ratings yet

- INTERMEDIATE ACCOUNTING Vol. 1 (2021 Edition) - Valix, Peralta & Valix - XLSX Chapter 2Document8 pagesINTERMEDIATE ACCOUNTING Vol. 1 (2021 Edition) - Valix, Peralta & Valix - XLSX Chapter 2Rodolfo Manalac100% (1)

- Ch. 02 Bank Reconciliation Intermediate Accounting Volume 1 2021 Edition ValixDocument7 pagesCh. 02 Bank Reconciliation Intermediate Accounting Volume 1 2021 Edition ValixNathalie GetinoNo ratings yet

- Module 2 ProblemsDocument15 pagesModule 2 ProblemsCristina TayagNo ratings yet

- (CB MODULE) Module 3 - Problem 3.1 To 3.20 Answer Keys (Pages 156 To 167)Document29 pages(CB MODULE) Module 3 - Problem 3.1 To 3.20 Answer Keys (Pages 156 To 167)Grace Alipoyo Fortuito-tanNo ratings yet

- 232 Rudrapriya DiwanDocument59 pages232 Rudrapriya DiwanKashish GamreNo ratings yet

- Sol. Man. - Chapter 3 - Bank Reconciliation - Ia PartDocument15 pagesSol. Man. - Chapter 3 - Bank Reconciliation - Ia PartMike Joseph E. Moran100% (3)

- Proof of Cash ProblemDocument3 pagesProof of Cash ProblemKathleen Frondozo67% (6)

- Procedure Insurance ClaimDocument2 pagesProcedure Insurance Claimrahul kumarNo ratings yet

- Solution - Problems 1-8 Cash and Cash EquivalentsDocument3 pagesSolution - Problems 1-8 Cash and Cash Equivalentsanon_965241988No ratings yet

- Bank Reconciliation ProblemsDocument2 pagesBank Reconciliation ProblemsCris Jung80% (5)

- A R RoqueDocument73 pagesA R RoqueTwish BarriosNo ratings yet

- Cfas Bsa1b Bank Recon ActivityDocument4 pagesCfas Bsa1b Bank Recon ActivityKristan EstebanNo ratings yet

- Bank Reconciliation: Sample ProblemsDocument39 pagesBank Reconciliation: Sample ProblemsXENA LOPEZ78% (9)

- Your Finance Agreement Arranged Through Right PDFDocument12 pagesYour Finance Agreement Arranged Through Right PDFSchipor Danny MagdaNo ratings yet

- Bank Recon Sample ProblemsDocument4 pagesBank Recon Sample ProblemsKathleen100% (1)

- Bank Recon Solutions Exercise 2 3Document7 pagesBank Recon Solutions Exercise 2 3Kevin James Sedurifa OledanNo ratings yet

- Bank ReconciliationDocument2 pagesBank Reconciliationapi-3727562No ratings yet

- Introduction To E-CommerceDocument32 pagesIntroduction To E-CommerceV.F.MUHAMMED ISMAIL THOUHEEDNo ratings yet

- TOC in Procurement - Albert - 16 TOCPA - April 2015 - South Africa - With CorrectionDocument48 pagesTOC in Procurement - Albert - 16 TOCPA - April 2015 - South Africa - With CorrectionJelena Fedurko100% (2)

- E. Commerce. INFORMEDocument16 pagesE. Commerce. INFORMEJudith MoranNo ratings yet

- Accounts ReceivablesDocument93 pagesAccounts Receivablesshaik amjadNo ratings yet

- AtmDocument19 pagesAtmKrishna Chandran PallippuramNo ratings yet

- Solutions To 2 1 To 2 5Document5 pagesSolutions To 2 1 To 2 5Away To PonderNo ratings yet

- Assignment 1Document12 pagesAssignment 1Ira YbanezNo ratings yet

- Soal AKM 2015Document24 pagesSoal AKM 2015Siti Armayani RayNo ratings yet

- Computations AE 04 2Document17 pagesComputations AE 04 2Julienne UntalascoNo ratings yet

- ACTIVITYDocument3 pagesACTIVITYAerwyna AfarinNo ratings yet

- Quiz Part 2 (Bank Reconciliation)Document2 pagesQuiz Part 2 (Bank Reconciliation)YameteKudasaiNo ratings yet

- Audit of CCE - Answers To Module From Sir MarkieDocument25 pagesAudit of CCE - Answers To Module From Sir MarkieMarkie GrabilloNo ratings yet

- Valix Bank ReconDocument5 pagesValix Bank ReconEloiNo ratings yet

- PT Kirana - Jawaban QuizDocument2 pagesPT Kirana - Jawaban QuizJesselin VemberainNo ratings yet

- CHAPTER2 - Bank Recon - IllustrationDocument14 pagesCHAPTER2 - Bank Recon - IllustrationReighjon Ashley C. TolentinoNo ratings yet

- Chapter 3 (Problem 3-5-13) PDFDocument9 pagesChapter 3 (Problem 3-5-13) PDFBaby MushroomNo ratings yet

- Book of Accounts Practice SetDocument60 pagesBook of Accounts Practice SetMylene SalvadorNo ratings yet

- Chapter 3 (IA Proof Od Cash) PDFDocument6 pagesChapter 3 (IA Proof Od Cash) PDFBaby MushroomNo ratings yet

- Sol. Man. - Chapter 3 - Bank Reconciliation - Ia Part 1aDocument16 pagesSol. Man. - Chapter 3 - Bank Reconciliation - Ia Part 1aMiguel AmihanNo ratings yet

- Bank Reconcialiation ProblemDocument10 pagesBank Reconcialiation ProblemChatlyn Kaye MediavilloNo ratings yet

- AK Audit of Cash ACP103Document3 pagesAK Audit of Cash ACP103km dummieNo ratings yet

- Accounting 1Document3 pagesAccounting 1Kairan CrisologoNo ratings yet

- Requirement No. 1: PROBLEM NO. 1 - Peso CorporationDocument13 pagesRequirement No. 1: PROBLEM NO. 1 - Peso CorporationDreiu EsmeleNo ratings yet

- FM 1Document18 pagesFM 1huleNo ratings yet

- Post. Date Description Ref. Debit CreditDocument6 pagesPost. Date Description Ref. Debit CreditkinantiiNo ratings yet

- Proof of CashDocument3 pagesProof of CashLorence Patrick LapidezNo ratings yet

- Problem 2-1 A. Book BalanceDocument2 pagesProblem 2-1 A. Book BalanceElizabethNo ratings yet

- Chapter 2-3, 2-6Document3 pagesChapter 2-3, 2-6XENA LOPEZNo ratings yet

- Bank Reconciliation PDFDocument3 pagesBank Reconciliation PDFEunjina MoNo ratings yet

- Bank Reconciliation PDFDocument3 pagesBank Reconciliation PDFJerald Jay CatacutanNo ratings yet

- Bank ReconciliationDocument6 pagesBank Reconciliationclarisse jaramillaNo ratings yet

- Practice Problems2Document48 pagesPractice Problems2vipinkala1100% (1)

- AP 5907 CashDocument8 pagesAP 5907 CashClariceLacanlaleDarasinNo ratings yet

- Proof of Cash123Document5 pagesProof of Cash123rufamaegarcia07No ratings yet

- Book 1Document4 pagesBook 1almira garciaNo ratings yet

- The Following Information Is Made Available While Checking The Cash Accounts of Aeron Company On December 31, 2019Document2 pagesThe Following Information Is Made Available While Checking The Cash Accounts of Aeron Company On December 31, 2019Regina Mae CatamponganNo ratings yet

- UntitledDocument3 pagesUntitledJames Eldrin O PadillaNo ratings yet

- 058 - Afiatika Ayyi Shawaaba - Akuntansi 2020IDocument8 pages058 - Afiatika Ayyi Shawaaba - Akuntansi 2020Iafiatika ayyiNo ratings yet

- Audit of Cash ActivityDocument13 pagesAudit of Cash ActivityIris FenelleNo ratings yet

- Audit of Cash ActivityDocument13 pagesAudit of Cash ActivityIris FenelleNo ratings yet

- Audit: Cash-and-Cash Equivalent: Problem 1Document12 pagesAudit: Cash-and-Cash Equivalent: Problem 1Idh skyNo ratings yet

- Problem 3.1: (Requirement 1) Bank Reconciliation StatementDocument30 pagesProblem 3.1: (Requirement 1) Bank Reconciliation StatementMarvin MarianoNo ratings yet

- Assignment 2 ACFAR 1231 Bank ReconciliationDocument3 pagesAssignment 2 ACFAR 1231 Bank ReconciliationkakaoNo ratings yet

- Bank ReconciliationDocument6 pagesBank ReconciliationLorence Patrick LapidezNo ratings yet

- Auditing - MIDTERM EXAMDocument9 pagesAuditing - MIDTERM EXAMmoNo ratings yet

- Form Kosong-1Document12 pagesForm Kosong-1Toold 75No ratings yet

- Ia 2Document2 pagesIa 2Nadine SofiaNo ratings yet

- Lesley Dela Cruz Clearners Worksheet Sept 30, 2020 Trial Balance Adjustments Debit Credit DebitDocument7 pagesLesley Dela Cruz Clearners Worksheet Sept 30, 2020 Trial Balance Adjustments Debit Credit DebitJasmine ActaNo ratings yet

- Bank Recon Home ActivitiesDocument2 pagesBank Recon Home ActivitiesZero OneNo ratings yet

- Sample Exercise On Bank ReconciliationDocument1 pageSample Exercise On Bank ReconciliationRichie Marie AndicoyNo ratings yet

- Exercises - Cash and ReceivablesDocument8 pagesExercises - Cash and ReceivablesjpNo ratings yet

- Financial ManagementDocument18 pagesFinancial ManagementCyril EstandarteNo ratings yet

- Resume Ogechi UkachuDocument3 pagesResume Ogechi UkachuSlahuddin KhanNo ratings yet

- Business Processes - Part 1Document15 pagesBusiness Processes - Part 1Malinda NayanajithNo ratings yet

- Rishitha Dance RecieptDocument1 pageRishitha Dance RecieptGS HarshithNo ratings yet

- Web3 Beyond The HypeDocument11 pagesWeb3 Beyond The Hypesubham_sjmNo ratings yet

- Golden Ice Bistro Social Media Marketing ProposalDocument11 pagesGolden Ice Bistro Social Media Marketing ProposalMumbiNo ratings yet

- Indemnity FormDocument1 pageIndemnity Formnirupam deshwalNo ratings yet

- Topic - Travelling and Transportation in UkraineDocument1 pageTopic - Travelling and Transportation in Ukrainechernikka daryaNo ratings yet

- Mobile Broadcasting: Communication PrinciplesDocument23 pagesMobile Broadcasting: Communication PrinciplesSemi SmdNo ratings yet

- GshshahDocument113 pagesGshshahCiarie SalgadoNo ratings yet

- Placement Report For The A Y 2018-20 - NewDocument5 pagesPlacement Report For The A Y 2018-20 - Newallabout beingsmartNo ratings yet

- Consolidated Statement: Summary of Account's HoldingsDocument2 pagesConsolidated Statement: Summary of Account's HoldingsAlexis RieraNo ratings yet

- 1556955039349Document6 pages1556955039349Suresh RawatNo ratings yet

- CrherreraaDocument182 pagesCrherreraaanbago123No ratings yet

- DocsDocument2 pagesDocsMohsin ShaikhNo ratings yet

- OP56Document2 pagesOP56Divya GoyalNo ratings yet

- GCAP - EnglishDocument2 pagesGCAP - EnglishJITENDRANo ratings yet

- SAP Service CloudDocument2 pagesSAP Service CloudLucía MartínezNo ratings yet

- Ericsson's GSM System Model: SS Switching System AUC HLR MXE MINDocument9 pagesEricsson's GSM System Model: SS Switching System AUC HLR MXE MINtelcoNo ratings yet