Professional Documents

Culture Documents

Problem 2-1 A. Book Balance

Uploaded by

Elizabeth0 ratings0% found this document useful (0 votes)

6 views2 pagesOriginal Title

Reconciliation

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views2 pagesProblem 2-1 A. Book Balance

Uploaded by

ElizabethCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

Problem 2-1

a. Book balance 65,000

Proceeds of a note collected by bank 30,000

Bank service charge (2,000)

Adjusted balance 93,000

Bank balance 108,000

Deposit in transit 80,000

Outstanding checks:

Check No. 102 (15,000)

Check No. 105 (30,000)

Check No. 107 (50,000) (95,000)

Adjusted balance 93,000

b. Adjusting Entries:

Cash in bank 30,000

Accounts Receivable 30,000

Bank service charge 2,000

Cash in bank 2,000

Problem 2-2

a. Book balance 110,000

Credit memo 45,000

Debit memos:

Check No. 776 (27,000)

NSF check (10,000)

Bank service charge (5,000) (42,000)

Adjusted balance 113,000

Bank balance 135,000

Deposit in transit 60,000

Outstanding checks:

Check No. 775 (30,000)

Check No. 777 (40,000)

Check No. 770 (20,000) (90,000)

Error – Check No. 1042 8,000

Adjusted balance 113,000

b. Adjusting Entries

Cash in bank 45,000

Collection fee 5,000

Notes Receivable 50,000

Accounts payable 27,000

Cash in bank 27,000

Accounts Receivable 10,000

Cash in bank 10,000

Bank service charge 5,000

Cash in bank 5,000

Problem 2-3

a. Bank balance 3,265,000

Deposits in transit:

Feb. 9 800,000

Feb. 10 200,000

Feb. 28 450,000 1,450,000

Outstanding checks:

Check No. 116 (60,000)

Check No. 122 (180,000)

Check No. 124 (120,000)

Check No. 125 (250,000) (610,000)

Adjusted balance 4,105,000

Book balance (Squeeze) 3,640,000

Note collected by bank 270,000

Service charge (5,000)

Unrecorded deposit (Feb. 10) 1,000,000

Unrecorded check no. 119 (800,000)

Adjusted balance 4,105,000

b. Adjusting Entries

Cash 270,000

Collection fee 10,000

Notes Receivable 250,000

Interest income 30,000

Bank service charge 5,000

Cash in bank 5,000

You might also like

- Bank ReconciliationDocument6 pagesBank Reconciliationclarisse jaramillaNo ratings yet

- Assignment 2Document2 pagesAssignment 2Bernadeth Adelaine DomingoNo ratings yet

- Timing Difference: Check Payment (Receivable) But Not Yet Deposited by PayeeDocument6 pagesTiming Difference: Check Payment (Receivable) But Not Yet Deposited by PayeeannyeongNo ratings yet

- Solution - Problems 1-8 Cash and Cash EquivalentsDocument3 pagesSolution - Problems 1-8 Cash and Cash Equivalentsanon_965241988No ratings yet

- ReconciliationDocument6 pagesReconciliationElizabethNo ratings yet

- Ch. 02 Bank Reconciliation Intermediate Accounting Volume 1 2021 Edition ValixDocument7 pagesCh. 02 Bank Reconciliation Intermediate Accounting Volume 1 2021 Edition ValixNathalie GetinoNo ratings yet

- Bank Recon Solutions Exercise 2 3Document7 pagesBank Recon Solutions Exercise 2 3Kevin James Sedurifa OledanNo ratings yet

- Problem 2 12Document2 pagesProblem 2 12Rhanda Bernardo67% (3)

- Cfas Bsa1b Bank Recon ActivityDocument4 pagesCfas Bsa1b Bank Recon ActivityKristan EstebanNo ratings yet

- Bank Reconcialiation ProblemDocument10 pagesBank Reconcialiation ProblemChatlyn Kaye MediavilloNo ratings yet

- Solutions To 2 1 To 2 5Document5 pagesSolutions To 2 1 To 2 5Away To PonderNo ratings yet

- Valix Bank ReconDocument5 pagesValix Bank ReconEloiNo ratings yet

- Balance Per Book 110,000.00 Balance Per BookDocument6 pagesBalance Per Book 110,000.00 Balance Per BookChristine Mae GaloNo ratings yet

- Requirement No. 1: PROBLEM NO. 1 - Peso CorporationDocument13 pagesRequirement No. 1: PROBLEM NO. 1 - Peso CorporationDreiu EsmeleNo ratings yet

- Chapter 2 - Problem SolvingDocument20 pagesChapter 2 - Problem SolvingMaria Licuanan100% (1)

- Chapter 2 Problem SolvingDocument20 pagesChapter 2 Problem SolvingJohn LucaNo ratings yet

- AK Audit of Cash ACP103Document3 pagesAK Audit of Cash ACP103km dummieNo ratings yet

- AP 5907 CashDocument8 pagesAP 5907 CashClariceLacanlaleDarasinNo ratings yet

- Espanola Far 201 QuizDocument7 pagesEspanola Far 201 QuizCINDY MAE SARAH ESPANOLANo ratings yet

- Audit of CCE - Answers To Module From Sir MarkieDocument25 pagesAudit of CCE - Answers To Module From Sir MarkieMarkie GrabilloNo ratings yet

- UntitledDocument5 pagesUntitledShevina Maghari shsnohsNo ratings yet

- ACTIVITYDocument3 pagesACTIVITYAerwyna AfarinNo ratings yet

- Bank ReconciliationDocument9 pagesBank ReconciliationKailah Calinog100% (3)

- IA Chapter 1 To 3Document12 pagesIA Chapter 1 To 3Blue SkyNo ratings yet

- Audit QuizDocument5 pagesAudit QuizCatherine Dela VegaNo ratings yet

- Computations AE 04 2Document17 pagesComputations AE 04 2Julienne UntalascoNo ratings yet

- Cash and Cash Equivalents Module Answer KeyDocument26 pagesCash and Cash Equivalents Module Answer KeyMarianne ElemosNo ratings yet

- Cash and Cash EquivalentsDocument4 pagesCash and Cash Equivalentsinto the unknownNo ratings yet

- Corrected Problem 1 Bank ReconciliationDocument5 pagesCorrected Problem 1 Bank ReconciliationRAMIREZ, KRISHA R.No ratings yet

- Bank Reconciliations PROBLEMS With Solutions PDFDocument5 pagesBank Reconciliations PROBLEMS With Solutions PDFlei vera100% (1)

- Samplepractice Exam 15 October 2020 Questions and AnswersDocument6 pagesSamplepractice Exam 15 October 2020 Questions and AnswersMartha Nicole MaristelaNo ratings yet

- Problems Chapter 1Document16 pagesProblems Chapter 1Jomar PenaNo ratings yet

- Sol To Bank Recon Problem 1 3Document9 pagesSol To Bank Recon Problem 1 3Michael JimNo ratings yet

- UntitledDocument3 pagesUntitledJames Eldrin O PadillaNo ratings yet

- Unit 2 Audit of CashDocument18 pagesUnit 2 Audit of CashGiulia TabaraNo ratings yet

- Unit 2 Audit of Cash and Cash EquivalentsDocument26 pagesUnit 2 Audit of Cash and Cash Equivalentsjethro carlobosNo ratings yet

- IA Chapter-1-3Document7 pagesIA Chapter-1-3Christine Joyce EnriquezNo ratings yet

- Sol. Man. - Chapter 3 - Bank Reconciliation - Ia Part 1aDocument16 pagesSol. Man. - Chapter 3 - Bank Reconciliation - Ia Part 1aMiguel AmihanNo ratings yet

- ACGA 504/ HCGA 507 General Accounting - Part 2Document17 pagesACGA 504/ HCGA 507 General Accounting - Part 2Eliza BethNo ratings yet

- Intacc Problems Empleo and RoblesDocument44 pagesIntacc Problems Empleo and RoblesChristen HerceNo ratings yet

- Bank Reconciliation: Basic ProblemsDocument25 pagesBank Reconciliation: Basic ProblemsAndrea FontiverosNo ratings yet

- Audit: Cash-and-Cash Equivalent: Problem 1Document12 pagesAudit: Cash-and-Cash Equivalent: Problem 1Idh skyNo ratings yet

- Updates in Financial Reporting StandardsDocument171 pagesUpdates in Financial Reporting StandardsBuenaventura, Elijah B.No ratings yet

- Module 2 ProblemsDocument15 pagesModule 2 ProblemsCristina TayagNo ratings yet

- Sol To BNK RecDocument10 pagesSol To BNK RecEDGAR ORDANELNo ratings yet

- Adjusted Bank Balance 7,750,000Document3 pagesAdjusted Bank Balance 7,750,000fabyunaaaNo ratings yet

- Chapter 3 Problems SolvingDocument4 pagesChapter 3 Problems SolvingToni Francesca MarquezNo ratings yet

- Chap03 ProblemsDocument11 pagesChap03 ProblemsLindsay MacasoNo ratings yet

- Sol. Man. - Chapter 3 - Bank Reconciliation - Ia PartDocument15 pagesSol. Man. - Chapter 3 - Bank Reconciliation - Ia PartMike Joseph E. Moran100% (3)

- SOLUTIONS - Metrobank Etc.Document3 pagesSOLUTIONS - Metrobank Etc.Avarel DPNo ratings yet

- Bank Recon Sample ProblemsDocument4 pagesBank Recon Sample ProblemsKathleen100% (1)

- CHAPTER2 - Bank Recon - IllustrationDocument14 pagesCHAPTER2 - Bank Recon - IllustrationReighjon Ashley C. TolentinoNo ratings yet

- Exercises Module 2Document12 pagesExercises Module 2jpNo ratings yet

- Bank Reconciliation PDFDocument3 pagesBank Reconciliation PDFEunjina MoNo ratings yet

- Chapter 2-3, 2-6Document3 pagesChapter 2-3, 2-6XENA LOPEZNo ratings yet

- Bank Reconciliation PDFDocument3 pagesBank Reconciliation PDFJerald Jay CatacutanNo ratings yet

- Chapter 13-Cash ControlDocument25 pagesChapter 13-Cash ControlShaila MarceloNo ratings yet

- Graded Online Exercise - CashDocument11 pagesGraded Online Exercise - Cashneo leeNo ratings yet

- PharmallyDocument3 pagesPharmallyElizabethNo ratings yet

- Chapter 9 Taxation of CorporationsDocument4 pagesChapter 9 Taxation of CorporationsElizabethNo ratings yet

- Cheer DanceDocument15 pagesCheer DanceElizabethNo ratings yet

- Book CritiqueDocument2 pagesBook CritiqueElizabethNo ratings yet

- Facts About Omega-3 Fatty Acids: How They Help Your HealthDocument40 pagesFacts About Omega-3 Fatty Acids: How They Help Your HealthElizabethNo ratings yet

- Computation of Deposits in Transit:: Outstanding Checks, Oct 31Document4 pagesComputation of Deposits in Transit:: Outstanding Checks, Oct 31ElizabethNo ratings yet

- Chapter 10 ForecastingDocument2 pagesChapter 10 ForecastingElizabethNo ratings yet

- Chapter 11 Addressing Working Capital Policies and Management of ShortDocument2 pagesChapter 11 Addressing Working Capital Policies and Management of ShortElizabethNo ratings yet

- How Can Operating Cycle Be ReducedDocument2 pagesHow Can Operating Cycle Be ReducedElizabethNo ratings yet

- Financial Forecasting For Strategic GrowthDocument2 pagesFinancial Forecasting For Strategic GrowthElizabethNo ratings yet

- NCDDP Af Sub-Manual - CBFM, Aug2021Document142 pagesNCDDP Af Sub-Manual - CBFM, Aug2021Michelle ValledorNo ratings yet

- DHC Budget Snapshot 2023 24Document15 pagesDHC Budget Snapshot 2023 24Jigar ShahNo ratings yet

- MouthfreshenerdprDocument22 pagesMouthfreshenerdprSumit SharmaNo ratings yet

- SK Illustrative Problems - For All SessionsDocument6 pagesSK Illustrative Problems - For All SessionsLea Mae JenNo ratings yet

- Dispute FormDocument1 pageDispute Formuzair muhdNo ratings yet

- Solution 1-5 1Document4 pagesSolution 1-5 1Dan Edison RamosNo ratings yet

- CV Rudi Pasaribu UpdateDocument5 pagesCV Rudi Pasaribu UpdateDitto Dwi PurnamaNo ratings yet

- 11.25.2017 Accounting For Income TaxDocument5 pages11.25.2017 Accounting For Income TaxPatOcampo0% (1)

- Indian Income Tax Return Acknowledgement 2020-21: Esappo445Q Mohan Prathap PandianDocument4 pagesIndian Income Tax Return Acknowledgement 2020-21: Esappo445Q Mohan Prathap PandianVignesh KanagarajNo ratings yet

- Appraisal ReportDocument193 pagesAppraisal ReportDicky BhaktiNo ratings yet

- Public Sector Accounting and Finance: Ac403 - Lecture 4Document24 pagesPublic Sector Accounting and Finance: Ac403 - Lecture 4Mcdonald NyatangaNo ratings yet

- Beepedia Weekly Current Affairs (Beepedia) 16th-22nd December 2023Document39 pagesBeepedia Weekly Current Affairs (Beepedia) 16th-22nd December 2023BRAJ MOHAN KUIRYNo ratings yet

- KAMM Notes Taxation Bar 2021Document115 pagesKAMM Notes Taxation Bar 2021Bai MonadinNo ratings yet

- SIMPLE and COMPOUND INTEREST 11Document69 pagesSIMPLE and COMPOUND INTEREST 11Jay QuinesNo ratings yet

- World Bank (IBRD & IDA)Document5 pagesWorld Bank (IBRD & IDA)prankyaquariusNo ratings yet

- Course Guide: AGW 610/3 Finance and Accounting For Management Graduate School of Business Universiti Sains MalaysiaDocument7 pagesCourse Guide: AGW 610/3 Finance and Accounting For Management Graduate School of Business Universiti Sains MalaysiasamhensemNo ratings yet

- Year Project A Project B: Total PV NPVDocument19 pagesYear Project A Project B: Total PV NPVChin EENo ratings yet

- 347Document2 pages347TarkimNo ratings yet

- S4H 966 Sample Configuration TrackerDocument129 pagesS4H 966 Sample Configuration TrackerCleber CardosoNo ratings yet

- CFAS Handout 01 - Corporation - Updated 01.21.2020Document23 pagesCFAS Handout 01 - Corporation - Updated 01.21.2020VanessaNo ratings yet

- 0304 Boudreau Beyond HRDocument17 pages0304 Boudreau Beyond HRasha_tatapudiNo ratings yet

- Tutorial - Chapter 11 - Monetary Policy - QuestionsDocument4 pagesTutorial - Chapter 11 - Monetary Policy - QuestionsNandiieNo ratings yet

- Insurance For Specific EventsDocument1 pageInsurance For Specific Eventsihsan nawawiNo ratings yet

- Chapter 17 Capital Structure-TestbankDocument12 pagesChapter 17 Capital Structure-TestbankLâm Thanh Huyền NguyễnNo ratings yet

- Solved Rollo and Andrea Are Equal Owners of Gosney Company DuringDocument1 pageSolved Rollo and Andrea Are Equal Owners of Gosney Company DuringAnbu jaromiaNo ratings yet

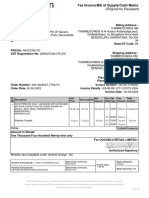

- InvoiceDocument2 pagesInvoiceTHIMMEGOWDA H MNo ratings yet

- Fund Rankings Sovereign Wealth Fund InstituteDocument3 pagesFund Rankings Sovereign Wealth Fund Institutelohenci_sammyNo ratings yet

- 2307 For EBS Private Individual Percenateg TaxDocument4 pages2307 For EBS Private Individual Percenateg TaxAGrace MercadoNo ratings yet

- Fin Ca2 FinalDocument6 pagesFin Ca2 FinalVaishali SonareNo ratings yet

- Blue Print 3-5 Years Multi Finance: Marmin MurgiantoDocument6 pagesBlue Print 3-5 Years Multi Finance: Marmin MurgiantoRicky NovertoNo ratings yet