Professional Documents

Culture Documents

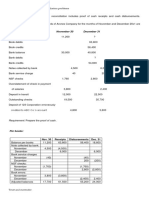

Computation of Deposits in Transit:: Outstanding Checks, Oct 31

Uploaded by

Elizabeth0 ratings0% found this document useful (0 votes)

38 views4 pages1) The document contains multiple bank reconciliation problems for different companies with details on book and bank balances, deposits, withdrawals, outstanding checks, and adjusting entries.

2) Problem 3-7 contains details on the balance sheet of Bedlam Company for November and December, including beginning and ending book and bank balances, receipts, disbursements, adjusting entries for bank charges and notes recorded as cash.

3) The adjusted book and bank balances for Bedlam Company are equal at the beginning and end of each month after considering deposits in transit, outstanding checks, and other reconciling items.

Original Description:

Original Title

proof of cash

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1) The document contains multiple bank reconciliation problems for different companies with details on book and bank balances, deposits, withdrawals, outstanding checks, and adjusting entries.

2) Problem 3-7 contains details on the balance sheet of Bedlam Company for November and December, including beginning and ending book and bank balances, receipts, disbursements, adjusting entries for bank charges and notes recorded as cash.

3) The adjusted book and bank balances for Bedlam Company are equal at the beginning and end of each month after considering deposits in transit, outstanding checks, and other reconciling items.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

38 views4 pagesComputation of Deposits in Transit:: Outstanding Checks, Oct 31

Uploaded by

Elizabeth1) The document contains multiple bank reconciliation problems for different companies with details on book and bank balances, deposits, withdrawals, outstanding checks, and adjusting entries.

2) Problem 3-7 contains details on the balance sheet of Bedlam Company for November and December, including beginning and ending book and bank balances, receipts, disbursements, adjusting entries for bank charges and notes recorded as cash.

3) The adjusted book and bank balances for Bedlam Company are equal at the beginning and end of each month after considering deposits in transit, outstanding checks, and other reconciling items.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 4

PROBLEM 3-1 SASSY COMPANY PROBLEM 3-2 BEEHIVE COMPANY

Bank Reconciliation, June 30

November 30:

Balance per book, Oct 31 600,000

Balance per book 1,000,000

Book debits 2,200,000

Note collected 300,000

Book credits (1,800,000)

NSF check (100,000)

Balance per book, Nov. 30 1,000,000

Service charge (4,000)

Adjusted book balance 1,196,000

Balance per bank, Oct 31 (Squeeze) 400,000

Bank credits 2,500,000

Balance per bank 1,650,000

Bank debits (1,970,000)

Deposits in transit 400,000

Balance per bank, Nov. 30 930,000

Outstanding checks (854,000)

Adjusted bank balance 1,196,000

Deposits in transit, Oct 31 300,000

Book debits 2,200,000

July 31:

Understated collection 90,000 2,290,000

Computation of book balance:

Bank credits 2,500,000

Balance, June 30 1,000,000

Credit memo (100,000) (2,400,000)

Book debits, July 4,000,000

Deposits in transit, Nov. 30 190,000

Book credits (3,600,000)

Book balance, July 31 1,400,000

Outstanding checks, Oct 31 (Squeeze) 100,000

Book credits 1,800,000

Computation of bank balance:

Understated check 270,000 2,070,000

Balance, June 30 1,650,000

Bank debits 1,970,000

Bank credits, July 3,500,000

Debit memo (200,000) (1,770,000)

Bank debits (2,500,000)

Outstanding checks, Nov. 30 400,000

Bank balance, July 31 2,650,000

Bank Reconciliation, November 30:

Computation of deposits in transit:

Balance per book 1,000,000

Deposits in transit, June 30 400,000

Understated collection 90,000

Book debits 4,000,000

Understated check (270,000)

Credit memo (300,000) 3,700,000

Adjusted book balance 820,000

Bank credits 3,500,000

Credit memo (500,000) (3,000,000)

Balance per bank 930,000

Deposits in transit, July 31 1,100,000

Deposits in transit 190,000

Outstanding checks (400,000)

Computation of outstanding checks:

Check of Beeline Company 200,000

Outstanding checks, June 30 854,000

Erroneous credit (100,000)

Book credits 3,600,000

Adjusted bank balance 820,000

Debit memo (104,000) 3,496,000

Bank debits 2,500,000

Adjusting Entries, Nov. 30:

Debit memo (1,000) (2,499,000)

Cash in bank 90,000

Outstanding checks, July 31 1,851,000

Accounts Receivable 90,000

Accounts Payable 270,000

Bank Reconciliation, July 31

Cash in bank 270,000

Book balance, July 31 1,400,000

Proceeds of bank loan 500,000

Bank Reconciliation, October 31:

Service charge (1,000)

Balance per bank 400,000

Adjusted book balance 1,899,000

Deposits in transit 300,000

Outstanding checks (100,000)

Bank balance, July 31 2,650,000

Adjusted bank balance 600,000

Deposits in transit 1,100,000

Outstanding checks (1,851,000)

Balance per book 600,000

Adjusted bank balance 1,899,000

Adjusted book balance 600,000

Adjusting Entries, July 31:

Cash in bank 500,000

Loans receivable 500,000

Bank service charge 1,000

Cash in bank 1,000

PROBLEM 3-3 FABULOUS COMPANY PROBLEM 3-4 FLAMBOYANT COMPANY

Balance per book, Oct 31 990,000

July 31: Book debits 710,000

Book balance, July 1 1,270,000 Book credits (1,200,000)

Book debits 3,400,000 Balance per book, Nov. 30 500,000

Book credits (4,200,000)

Book balance, July 31 470,000 Balance per bank, Oct 31 1,100,000

Bank credits 500,000

Bank balance, July 1 (squeeze) 1,720,000 Bank debits (1,000,000)

Bank credits 5,000,000 Balance per bank, Nov. 30 600,000

Bank debits (4,020,000)

Bank balance, July 31 2,700,000 Deposits in transit, beg 45,000

Book debits 710,000

Bank Reconciliation, July 31: Cash receipt (100,000)

Bank balance, July 31 2,700,000 Deposits outs. (45,000) 565,000

Deposits in transit 400,000 Bank credits 500,000

Outstanding checks: Error (10,000) (490,000)

No. 107 650,000 Deposits in transit, Nov 30 120,000

No. 108 500,000 (1,150,000)

Adjusted bank balance 1,950,000 Outstanding checks, beg 125,000

Book credits 1,200,000

Book balance, July 31 470,000 Debit memo (5,000) 1,195,000

Note collected 1,500,000 Bank debits 1,000,000

Service charge (20,000) Debit memo (60,000) (940,000)

Adjusted book balance 1,950,000 Outstanding checks, Nov 30 380,000

Adjusting Entries, July 31: Bank Reconciliation, November 30:

Cash in bank 1,500,000 Book balance 500,000

Notes Receivable 1,500,000 Book error (100,000)

Bank service charge 20,000 NSF check (50,000)

Cash in bank 20,000 Service charge (10,000)

Adjusted book balance 340,000

Bank Reconciliation, July 1:

Bank balance, July 1 1,720,000 Bank balance 600,000

Deposits in transit 500,000 Deposits in transit 120,000

Outstanding checks (950,000) Outstanding checks (380,000)

Adjusted bank balance 1,270,000 Adjusted bank balance 340,000

Book balance, July 1 1,270,000 Adjusting Entry:

Adjusted book balance 1,270,000

Accounts Receivable 10,000

Service charge 10,000

Notes receivable 100,000

Cash in bank 120,000

PROBLEM 3-7 BEDLAM COMPANY

November 30 Receipts Disbursements December 31

Balance per book 2,032,000 2,568,000 1,440,000 3,160,000

Bank service charge

November (2,000) (2,000)

December 4,000 (4,000)

Note recorded as cash

receipt

November (200,000) 200,000

December (300,000) (300,000)

Adjusted book balance 1,830,000 2,468,000 1,442,000 2,856,000

November 30 Receipts Disbursements December 31

Balance per bank 1,890,000 2,090,000 1,080,000 2,900,000

Deposits in transit

November 80,000 (80,000)

December 498,000 498,000

Outstanding checks

November (180,000) (180,000)

December 592,000 (592,000)

Adjusted bank balance 1,830,000 2,468,000 1,442,000 2,856,000

Adjusting Entries, December 31:

Bank service charge 4,000

Notes Receivable 300,000

Cash in bank 304,000

PROBLEM 3-8 JARGON COMPANY

September 30 Receipts Disbursements October 31

Balance per book 1,900,000 1,400,000 2,400,000 900,000

Collections of A/R

September 30,000 (30,000)

October 50,000 50,000

NSF check

September (60,000) (60,000)

October 40,000 (40,000)

Overstated check

September 90,000 (90,000)

October (120,000) 120,000

Adjusted book balance 1,960,000 1,330,000 2,260,000 1,030,000

September 30 Receipts Disbursements October 31

Balance per bank 2,100,000 1,200,000 2,500,000 800,000

Deposits in transit

September 130,000 (130,000)

October 260,000 260,000

Outstanding checks

September (270,000) (270,000)

October 30,000 (30,000)

Adjusted bank balance 1,960,000 1,330,000 2,260,000 1,030,000

Adjusting Entries, October 31:

Cash in bank 50,000

Accounts Receivable 50,000

Accounts Receivable 40,000

Cash in bank 40,000

Cash in bank 120,000

Salaries Payable 120,000

You might also like

- Proof of CashDocument6 pagesProof of CashAlexander ONo ratings yet

- INTERMEDIATE ACCOUNTING Vol. 1 (2021 Edition) - Valix, Peralta & Valix - XLSX Chapter 3Document4 pagesINTERMEDIATE ACCOUNTING Vol. 1 (2021 Edition) - Valix, Peralta & Valix - XLSX Chapter 3Rodolfo ManalacNo ratings yet

- Assignment 1.3 Proof of CashDocument16 pagesAssignment 1.3 Proof of CashRya Miguel AlbaNo ratings yet

- Proof of CashDocument9 pagesProof of CashEDGAR ORDANELNo ratings yet

- Proof of CashDocument7 pagesProof of CashMARIAN POLANCONo ratings yet

- Assignment 3Document4 pagesAssignment 3Bernadeth Adelaine DomingoNo ratings yet

- PS-2 (Proof of Cash)Document1 pagePS-2 (Proof of Cash)jazonvaleraNo ratings yet

- Solution Manual Ch. 1 19Document55 pagesSolution Manual Ch. 1 19Aira Mae TaborNo ratings yet

- Proof of Cash Problem 3-1Document5 pagesProof of Cash Problem 3-1Coleen Lara SedillesNo ratings yet

- Problem 4-32 Answer ADocument2 pagesProblem 4-32 Answer AShaira BugayongNo ratings yet

- Quiz 2Document7 pagesQuiz 2Fiona MiralpesNo ratings yet

- AE 111 Midterm Summative Assessment 2 SolutionsDocument6 pagesAE 111 Midterm Summative Assessment 2 SolutionsDjunah ArellanoNo ratings yet

- Cash Problems SolutionDocument3 pagesCash Problems SolutionMagadia Mark JeffNo ratings yet

- Bigotry Company Proof of CashDocument4 pagesBigotry Company Proof of CashGee Lysa Pascua VilbarNo ratings yet

- Solution To Quiz 1Document2 pagesSolution To Quiz 1Carmi FeceroNo ratings yet

- Quiz 1 - Audit of Cash SolutionDocument9 pagesQuiz 1 - Audit of Cash SolutionmillescaasiNo ratings yet

- Proof of Cash CelticsDocument3 pagesProof of Cash CelticsCJ alandyNo ratings yet

- Proof of CashDocument11 pagesProof of CashAndrea FontiverosNo ratings yet

- 112.BankReconciliation and Proof of CashDocument1 page112.BankReconciliation and Proof of CashPrincess Escovidal50% (2)

- Proofofcash 223Document2 pagesProofofcash 223Maliha KansiNo ratings yet

- Proof of Cash (AutoRecovered)Document4 pagesProof of Cash (AutoRecovered)Portia SupedaNo ratings yet

- Toaz - Info Cash PRDocument16 pagesToaz - Info Cash PRNil Justeen GarciaNo ratings yet

- Beehive Company Bank Reconciliation For The Month of OctoberDocument2 pagesBeehive Company Bank Reconciliation For The Month of OctoberGilner PomarNo ratings yet

- Lecture Notes On Bank Reconciliation - Proof of Cash - 000Document1 pageLecture Notes On Bank Reconciliation - Proof of Cash - 000judel ArielNo ratings yet

- Answer Sample Problems Cash1-12Document4 pagesAnswer Sample Problems Cash1-12Anonymous wwLoDau1aNo ratings yet

- This Study Resource Was: 17 Proof of CashDocument6 pagesThis Study Resource Was: 17 Proof of CashXNo ratings yet

- Zodiac Company: Balance Per Book, April 30Document5 pagesZodiac Company: Balance Per Book, April 30Rhea Sismo-anNo ratings yet

- Quiz No. 1Document10 pagesQuiz No. 1Gerry Carabbacan100% (2)

- Question 1: SolutionDocument15 pagesQuestion 1: Solutiondebate ddNo ratings yet

- Proof of Cash and Bank Recon StatementDocument7 pagesProof of Cash and Bank Recon StatementJean BritoNo ratings yet

- Proof of CashDocument2 pagesProof of CashJanella PatriziaNo ratings yet

- Inacc 1 Chap 3 Act PDFDocument12 pagesInacc 1 Chap 3 Act PDFSharmin Reula50% (2)

- Padernal BSA 1A SW Problem 3 11Document1 pagePadernal BSA 1A SW Problem 3 11Fly ThoughtsNo ratings yet

- Proof of Cash ProblemDocument3 pagesProof of Cash ProblemKathleen Frondozo67% (6)

- Problem 3-3 Ajusted Book Balance Checks Drawn: Bank Statement Balance Per BankDocument3 pagesProblem 3-3 Ajusted Book Balance Checks Drawn: Bank Statement Balance Per BankNika Bautista100% (2)

- Proof of CashDocument20 pagesProof of CashKristen StewartNo ratings yet

- Proof of Cash123Document5 pagesProof of Cash123rufamaegarcia07No ratings yet

- Padernal BSA 1A SW Problem 3 2Document3 pagesPadernal BSA 1A SW Problem 3 2Fly ThoughtsNo ratings yet

- Proof of CashDocument25 pagesProof of CashSoria Sophia AnnNo ratings yet

- Sol. Man. - Chapter 3 - Bank Reconciliation - Ia PartDocument15 pagesSol. Man. - Chapter 3 - Bank Reconciliation - Ia PartMike Joseph E. Moran100% (3)

- Bak ReconDocument1 pageBak ReconFlorimar Lagda100% (1)

- Quiz 2B - Bank Reconciliation and Proof of CashDocument5 pagesQuiz 2B - Bank Reconciliation and Proof of CashLorence Ibañez100% (2)

- Bank Reconciliation - Illustrative Problem 2Document2 pagesBank Reconciliation - Illustrative Problem 2Ralph Ernest HulguinNo ratings yet

- RAMIREZ, BSA CompanyDocument2 pagesRAMIREZ, BSA CompanyMarie Ramirez100% (1)

- FInancial Accounting and Reporting1C6Document19 pagesFInancial Accounting and Reporting1C6Yen YenNo ratings yet

- 03 PROOF OF CASH Problem Solving Section 1 Solution 2Document1 page03 PROOF OF CASH Problem Solving Section 1 Solution 2Erika Faith HalladorNo ratings yet

- Proof of CashDocument3 pagesProof of CashLorence Patrick LapidezNo ratings yet

- Quiz 2Document3 pagesQuiz 2Van MateoNo ratings yet

- Proofofcashbylailanepptxpdf PDF FreeDocument19 pagesProofofcashbylailanepptxpdf PDF Freedanica gomezNo ratings yet

- Problem 59Document1 pageProblem 59YukidoNo ratings yet

- Problem 1Document13 pagesProblem 1Ghaill CruzNo ratings yet

- Chapter 3 (IA Proof Od Cash) PDFDocument6 pagesChapter 3 (IA Proof Od Cash) PDFBaby MushroomNo ratings yet

- Tugas Kas PiutangDocument14 pagesTugas Kas PiutangDeby Nailatun FitriyahNo ratings yet

- Proof of Cash ProblemDocument4 pagesProof of Cash ProblemHtiduj Oretubag50% (4)

- 1 Review CceDocument10 pages1 Review CceJobelle Candace Flores AbreraNo ratings yet

- Solutions Bank Recon and ARDocument10 pagesSolutions Bank Recon and ARJaycel Yam-Yam VerancesNo ratings yet

- Solutions - Bank Recon and ARDocument10 pagesSolutions - Bank Recon and ARJaycel Yam-Yam VerancesNo ratings yet

- Proof of CashDocument22 pagesProof of CashYen RabotasoNo ratings yet

- EntrepreneurshipDocument1 pageEntrepreneurshipElizabethNo ratings yet

- Chapter 9 Taxation of CorporationsDocument4 pagesChapter 9 Taxation of CorporationsElizabethNo ratings yet

- PharmallyDocument3 pagesPharmallyElizabethNo ratings yet

- Problem 2Document2 pagesProblem 2ElizabethNo ratings yet

- Partial Productivity GrowthDocument1 pagePartial Productivity GrowthElizabethNo ratings yet

- Chapter 8 Taxation On IndividualsDocument6 pagesChapter 8 Taxation On IndividualsElizabethNo ratings yet

- SCRIPTDocument2 pagesSCRIPTElizabethNo ratings yet

- Book CritiqueDocument2 pagesBook CritiqueElizabethNo ratings yet

- Perform An Environmental Analysis of Current StrategiesDocument2 pagesPerform An Environmental Analysis of Current StrategiesElizabethNo ratings yet

- Cheer DanceDocument15 pagesCheer DanceElizabethNo ratings yet

- Characteristics of Different TaxonDocument10 pagesCharacteristics of Different TaxonElizabethNo ratings yet

- 10 19Document1 page10 19ElizabethNo ratings yet

- Facts About Omega-3 Fatty Acids: How They Help Your HealthDocument40 pagesFacts About Omega-3 Fatty Acids: How They Help Your HealthElizabethNo ratings yet

- Problem 10-7 Fall CompanyDocument2 pagesProblem 10-7 Fall CompanyElizabethNo ratings yet

- Problem 10-1 Amiable CompanyDocument2 pagesProblem 10-1 Amiable CompanyElizabethNo ratings yet

- Chapter 2 - Relationship of Financial Objectives To Organizational Strategy and Other Organization ObjectivesDocument1 pageChapter 2 - Relationship of Financial Objectives To Organizational Strategy and Other Organization ObjectivesElizabethNo ratings yet

- Problem 10-5 Winter CompanyDocument2 pagesProblem 10-5 Winter CompanyElizabethNo ratings yet

- AccountingDocument2 pagesAccountingElizabethNo ratings yet

- 10-11 To 10-18Document2 pages10-11 To 10-18ElizabethNo ratings yet

- Problem 2-1 A. Book BalanceDocument2 pagesProblem 2-1 A. Book BalanceElizabethNo ratings yet

- ReconciliationDocument6 pagesReconciliationElizabethNo ratings yet

- Quiz 1 Cash and Cash Equivalents p1Document2 pagesQuiz 1 Cash and Cash Equivalents p1ElizabethNo ratings yet

- Problem 1Document1 pageProblem 1ElizabethNo ratings yet

- Chapter 11 Addressing Working Capital Policies and Management of ShortDocument2 pagesChapter 11 Addressing Working Capital Policies and Management of ShortElizabethNo ratings yet

- How Can Operating Cycle Be ReducedDocument2 pagesHow Can Operating Cycle Be ReducedElizabethNo ratings yet

- Problem 2Document1 pageProblem 2ElizabethNo ratings yet

- Futsal QuizDocument1 pageFutsal QuizElizabethNo ratings yet

- Chapter 10 ForecastingDocument2 pagesChapter 10 ForecastingElizabethNo ratings yet

- Chapter 9 Financial Forecasting For Strategic GrowthDocument2 pagesChapter 9 Financial Forecasting For Strategic GrowthElizabethNo ratings yet

- Retail Clothing Store ProjectDocument20 pagesRetail Clothing Store ProjectAbdul RehmanNo ratings yet

- Synthesising Supply Chain Processes Based On GSCF FrameworkDocument17 pagesSynthesising Supply Chain Processes Based On GSCF FrameworkManuel RuizNo ratings yet

- BPME3073 Group Assignment RP (A131) GuidelinesDocument10 pagesBPME3073 Group Assignment RP (A131) GuidelinesTeguh HardiNo ratings yet

- Unit 2 Paper 2 QuestionsDocument5 pagesUnit 2 Paper 2 QuestionsStacy Ben50% (2)

- Increased Decreased: Sample: Cash in Bank Account Was DebitedDocument3 pagesIncreased Decreased: Sample: Cash in Bank Account Was DebitedAtty Cpa100% (2)

- Strategy, Organization Design and EffectivenessDocument16 pagesStrategy, Organization Design and EffectivenessJaJ08No ratings yet

- Case Study Measuring ROI in Interactive SkillsDocument18 pagesCase Study Measuring ROI in Interactive SkillsAbhay KumarNo ratings yet

- 2008 IOMA Derivatives Market Survey - For WCDocument83 pages2008 IOMA Derivatives Market Survey - For WCrush2arthiNo ratings yet

- The Other Face of Managerial AccountingDocument20 pagesThe Other Face of Managerial AccountingModar AlzaiemNo ratings yet

- MGT420 - Chapter 3Document44 pagesMGT420 - Chapter 32023813994No ratings yet

- Topic: Partnershi P FormationDocument63 pagesTopic: Partnershi P FormationAllen Hendrick SantiagoNo ratings yet

- Auditor's Response P2P CycleDocument8 pagesAuditor's Response P2P CycleMarwin AceNo ratings yet

- Economic Theory Business Management: Module-1 Introduction: Managerial EconomicsDocument6 pagesEconomic Theory Business Management: Module-1 Introduction: Managerial EconomicsDivya SNo ratings yet

- Session 26 - Income TaxDocument23 pagesSession 26 - Income TaxUnnati RawatNo ratings yet

- Basic Accounting PPT 3Document270 pagesBasic Accounting PPT 3Iti JhawarNo ratings yet

- Leather CompanyDocument59 pagesLeather Companysree hariNo ratings yet

- Economic CartoonsDocument39 pagesEconomic Cartoonsmartivola100% (1)

- PH 24 Franchising ModelDocument3 pagesPH 24 Franchising ModelminaevilNo ratings yet

- Channel DynamicsDocument5 pagesChannel DynamicsGhani Thapa20% (5)

- The Birth of The Gods and The Origins of Agriculture, ReviewDocument20 pagesThe Birth of The Gods and The Origins of Agriculture, ReviewSamuel100% (1)

- Q4/21 Preview & 2022-2023 Commodity Prices Deck Update: Global Equity ResearchDocument23 pagesQ4/21 Preview & 2022-2023 Commodity Prices Deck Update: Global Equity ResearchForexliveNo ratings yet

- Notes - PartnershipDocument56 pagesNotes - PartnershipsudhirbazzeNo ratings yet

- TWTR Final-Selected-Metrics-and-FinancialsDocument3 pagesTWTR Final-Selected-Metrics-and-FinancialsBonnie DebbarmaNo ratings yet

- Cash Flow Management of Banijya BankDocument19 pagesCash Flow Management of Banijya BankPrashant McFc Adhikary0% (1)

- Sample Question PaperDocument16 pagesSample Question PaperAmit GhodekarNo ratings yet

- Contract Costing 4 Problems and SolutionDocument9 pagesContract Costing 4 Problems and Solutioncnagadeepa60% (5)

- Strategic Marketing - MKT 460 Section 2: Submitted ToDocument34 pagesStrategic Marketing - MKT 460 Section 2: Submitted ToRifat ChowdhuryNo ratings yet

- Raman MittalDocument2 pagesRaman MittalSuresh BabuNo ratings yet

- Edited by Foxit Reader Copyright (C) by Foxit Software Company, 2005-2007 ForDocument1 pageEdited by Foxit Reader Copyright (C) by Foxit Software Company, 2005-2007 ForChristopher RoyNo ratings yet

- Frequently Asked Questions in ManagementDocument230 pagesFrequently Asked Questions in ManagementsiddharthzalaNo ratings yet