Professional Documents

Culture Documents

03 PROOF OF CASH Problem Solving Section 1 Solution 2

Uploaded by

Erika Faith HalladorOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

03 PROOF OF CASH Problem Solving Section 1 Solution 2

Uploaded by

Erika Faith HalladorCopyright:

Available Formats

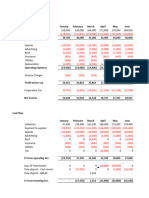

Book July

June 30 Receipts Disbursement July 31

Beg. Bal ( 1,000,000) ( 4,000,000) ( 3,600,000) ( 1,400,000)

CM - Note Collected by bank:

June ( 300,000) ( (300,000)

July ( 500,000) ( 500,000)

DM - Service Charge:

June ( (4,000) ( (4,000)

July ( 1,000) ( (1,000)

DM - NSF

June ( (100,000) ( (100,000)

July ( - )

Adjusted book balance ( 1,196,000) ( 4,200,000) ( 3,497,000) ( 1,899,000)

Bank July

March 31 Receipts Disbursement April 30

Beg. Bal ( 1,650,000) ( 3,500,000) ( 2,500,000) ( 2,650,000)

Deposits in transit:

June ( 400,000) ( (400,000)

July (squeezed) ( 1,100,000) ( 1,100,000)

Outstanding checks:

June ( (854,000) ( (854,000)

July (squeezed) ( 1,851,000) ( (1,851,000)

Adjusted bank balance ( 1,196,000) ( 4,200,000) ( 3,497,000) ( 1,899,000)

DIT, beg ( 400,000)

Add: Total deposits (4,000,000-300,000) ( 3,700,000)

Less: deposits acknowledge by bank ((3,500,000 - 500,000) ( 3,000,000)

DIT, ending ( 1,100,000)

OC, beg ( 854,000)

Add: Total checks drawn (3,600,000-4,000-100,000) ( 3,496,000)

Less: checks paid by bank ((2,500,000-1,000) ( 2,499,000)

OC, end ( 1,851,000)

Note: only book reconciling item require adjusting entries.

1. To record the service charge

Service charge ( 1,000)

Cash in bank ( 1,000)

2. To record proceeds from bank loan

Cash in bank ( 500,000)

Note payable - bank 500,000

You might also like

- RFBT03 17 Revised Corporation Code of The PhilippinesDocument115 pagesRFBT03 17 Revised Corporation Code of The PhilippinesKrissy PepsNo ratings yet

- This Study Resource WasDocument4 pagesThis Study Resource Wasmonmon kim100% (4)

- Proof of CashDocument7 pagesProof of CashMARIAN POLANCONo ratings yet

- Proof of Cash: By: LailaneDocument19 pagesProof of Cash: By: LailaneGianJoshuaDayrit100% (1)

- Bigotry Company Proof of CashDocument4 pagesBigotry Company Proof of CashGee Lysa Pascua VilbarNo ratings yet

- Dodla Dairy Limited: #8-2-293/82/A, Plot No.270-Q, Road No.10-C, Jubilee Hills Hyderabad-500033Document1 pageDodla Dairy Limited: #8-2-293/82/A, Plot No.270-Q, Road No.10-C, Jubilee Hills Hyderabad-500033yamanura hNo ratings yet

- Sol. Man. - Chapter 3 - Bank Reconciliation - Ia PartDocument15 pagesSol. Man. - Chapter 3 - Bank Reconciliation - Ia PartMike Joseph E. Moran100% (3)

- Simple InterestDocument20 pagesSimple InterestEngel QuimsonNo ratings yet

- Proof of Cash ProblemDocument3 pagesProof of Cash ProblemKathleen Frondozo67% (6)

- Feu Notes 231Document7 pagesFeu Notes 231Naiv Yer NagaliNo ratings yet

- Enron Company ScandalDocument16 pagesEnron Company ScandalAbaynesh ShiferawNo ratings yet

- Chapter 3-5 To 3-13Document9 pagesChapter 3-5 To 3-13XENA LOPEZNo ratings yet

- Proof of Cash: Irene Mae C. Guerra, CPADocument17 pagesProof of Cash: Irene Mae C. Guerra, CPAjeams vidalNo ratings yet

- Proof of CashDocument20 pagesProof of CashKristen StewartNo ratings yet

- MAS-04 Relevant CostingDocument10 pagesMAS-04 Relevant CostingPaupauNo ratings yet

- Case Study 1 - Blades Pty LTDDocument5 pagesCase Study 1 - Blades Pty LTDAli BasyaNo ratings yet

- Proof of Cash Problem 3-1Document5 pagesProof of Cash Problem 3-1Coleen Lara SedillesNo ratings yet

- Basic Accounting GuideDocument76 pagesBasic Accounting GuideBSA3Tagum MariletNo ratings yet

- Proof of CashDocument11 pagesProof of CashAndrea FontiverosNo ratings yet

- Corporation Code - de Leon PDFDocument1,114 pagesCorporation Code - de Leon PDFBelteshazzarL.Cabacang100% (1)

- Running Head: Bim in Hong Kong Construction Industry 1Document82 pagesRunning Head: Bim in Hong Kong Construction Industry 1bonnieNo ratings yet

- This Study Resource Was: 17 Proof of CashDocument6 pagesThis Study Resource Was: 17 Proof of CashXNo ratings yet

- INTERMEDIATE ACCOUNTING Vol. 1 (2021 Edition) - Valix, Peralta & Valix - XLSX Chapter 3Document4 pagesINTERMEDIATE ACCOUNTING Vol. 1 (2021 Edition) - Valix, Peralta & Valix - XLSX Chapter 3Rodolfo ManalacNo ratings yet

- Proof of Cash by Lailane PPTXDocument19 pagesProof of Cash by Lailane PPTXAnna Marie RevisadoNo ratings yet

- Atikah Beauty SalonDocument15 pagesAtikah Beauty SalonEko Firdausta TariganNo ratings yet

- Proof of CashDocument9 pagesProof of CashEDGAR ORDANELNo ratings yet

- 03 PROOF OF CASH Problem Solving Solution Sheet1Document1 page03 PROOF OF CASH Problem Solving Solution Sheet1Erika Faith HalladorNo ratings yet

- Proof of CashDocument6 pagesProof of CashAlexander ONo ratings yet

- Chapter 3 (IA Proof Od Cash) PDFDocument6 pagesChapter 3 (IA Proof Od Cash) PDFBaby MushroomNo ratings yet

- Chapter 3-5Document6 pagesChapter 3-5XENA LOPEZNo ratings yet

- Proofofcashbylailanepptxpdf PDF FreeDocument19 pagesProofofcashbylailanepptxpdf PDF Freedanica gomezNo ratings yet

- Chapter 3 (Problem 3-5-13) PDFDocument9 pagesChapter 3 (Problem 3-5-13) PDFBaby MushroomNo ratings yet

- Proof of Cash: By: LailaneDocument19 pagesProof of Cash: By: LailaneHeart Erica AbagNo ratings yet

- Cash Problems SolutionDocument3 pagesCash Problems SolutionMagadia Mark JeffNo ratings yet

- Computation of Deposits in Transit:: Outstanding Checks, Oct 31Document4 pagesComputation of Deposits in Transit:: Outstanding Checks, Oct 31ElizabethNo ratings yet

- 2033 AkunDocument4 pages2033 AkunMelani CarolineNo ratings yet

- 03 PROOF OF CASH Multiple Choice Section 1 Solution 9 12Document1 page03 PROOF OF CASH Multiple Choice Section 1 Solution 9 12Erika Faith HalladorNo ratings yet

- Solution Manual Ch. 1 19Document55 pagesSolution Manual Ch. 1 19Aira Mae TaborNo ratings yet

- 03 PROOF OF CASH Problem Solving Section 1 Solution 3Document2 pages03 PROOF OF CASH Problem Solving Section 1 Solution 3Erika Faith HalladorNo ratings yet

- Proof of Cash - 02Document19 pagesProof of Cash - 02Royu BreakerNo ratings yet

- Proof of Cash123Document5 pagesProof of Cash123rufamaegarcia07No ratings yet

- Assignment 3Document4 pagesAssignment 3Bernadeth Adelaine DomingoNo ratings yet

- Cabael-Ae109-Proof of CashDocument4 pagesCabael-Ae109-Proof of CashJanine MadriagaNo ratings yet

- Assignment 1.3 Proof of CashDocument16 pagesAssignment 1.3 Proof of CashRya Miguel AlbaNo ratings yet

- Proof of Cash: By: LailaneDocument19 pagesProof of Cash: By: LailaneKyle BrianNo ratings yet

- Proof of Cash by LailaneDocument19 pagesProof of Cash by Lailanenaruto uzumakiNo ratings yet

- Bank ReconciliationDocument6 pagesBank ReconciliationLorence Patrick LapidezNo ratings yet

- Proof of Cash (AutoRecovered)Document4 pagesProof of Cash (AutoRecovered)Portia SupedaNo ratings yet

- Proofofcash 223Document2 pagesProofofcash 223Maliha KansiNo ratings yet

- Bank Reconciliation - Illustrative Problem 2Document2 pagesBank Reconciliation - Illustrative Problem 2Ralph Ernest HulguinNo ratings yet

- Pretest - Cash and ReceivablesDocument5 pagesPretest - Cash and ReceivablesMycah AliahNo ratings yet

- Quiz 2Document3 pagesQuiz 2Van MateoNo ratings yet

- ACCT103 Supplementary Notes Cash and Cash EquivalentsDocument1 pageACCT103 Supplementary Notes Cash and Cash EquivalentsChrislyn Janna BeljeraNo ratings yet

- Proof of CashDocument3 pagesProof of CashLorence Patrick LapidezNo ratings yet

- 03 PROOF OF CASH Multiple Choice Section 1 Solution 6 8Document2 pages03 PROOF OF CASH Multiple Choice Section 1 Solution 6 8Erika Faith HalladorNo ratings yet

- ACC124, Assignment-02-26Document1 pageACC124, Assignment-02-26Valerie SandicoNo ratings yet

- FInancial Accounting and Reporting1C6Document19 pagesFInancial Accounting and Reporting1C6Yen YenNo ratings yet

- Solutions Bank Recon and ARDocument10 pagesSolutions Bank Recon and ARJaycel Yam-Yam VerancesNo ratings yet

- Solutions - Bank Recon and ARDocument10 pagesSolutions - Bank Recon and ARJaycel Yam-Yam VerancesNo ratings yet

- Adjusted Balance Metho1Document1 pageAdjusted Balance Metho1Clarish HolleroNo ratings yet

- Principal Borrowing CostDocument3 pagesPrincipal Borrowing Costjustine reine cornicoNo ratings yet

- Adadasd 2321Document4 pagesAdadasd 2321Prime JavateNo ratings yet

- Quiz 1 - Audit of Cash SolutionDocument9 pagesQuiz 1 - Audit of Cash SolutionmillescaasiNo ratings yet

- Solution To Quiz 1Document2 pagesSolution To Quiz 1Carmi FeceroNo ratings yet

- ACC124, Assignment-02-27Document1 pageACC124, Assignment-02-27Valerie SandicoNo ratings yet

- Module 6 IAS 23 BORROWING COST ILLUSTRATIONDocument3 pagesModule 6 IAS 23 BORROWING COST ILLUSTRATIONsiobhan margaretNo ratings yet

- Answer Sample Problems Cash1-12Document4 pagesAnswer Sample Problems Cash1-12Anonymous wwLoDau1aNo ratings yet

- RFBT03-07 - Law On Pledge, Mortgage and AntichresisDocument36 pagesRFBT03-07 - Law On Pledge, Mortgage and AntichresisElaine Joyce GarciaNo ratings yet

- Secret-Notes BY Cayetano: Accountancy (University of Northern Philippines)Document99 pagesSecret-Notes BY Cayetano: Accountancy (University of Northern Philippines)Erika Faith HalladorNo ratings yet

- RFBT03-07 - Law On Pledge, Mortgage and AntichresisDocument36 pagesRFBT03-07 - Law On Pledge, Mortgage and AntichresisElaine Joyce GarciaNo ratings yet

- RFBT03-11 - Law On PartnershipDocument77 pagesRFBT03-11 - Law On PartnershipjovelioNo ratings yet

- RFBT03-11 - Law On PartnershipDocument77 pagesRFBT03-11 - Law On PartnershipjovelioNo ratings yet

- 03 PROOF OF CASH Multiple Choice Section 1 Solution 9 12Document1 page03 PROOF OF CASH Multiple Choice Section 1 Solution 9 12Erika Faith HalladorNo ratings yet

- Summarized Notes: Let'S Go!Document7 pagesSummarized Notes: Let'S Go!Naiv Yer NagaliNo ratings yet

- TELEGRAMDocument7 pagesTELEGRAMNicole SurcaNo ratings yet

- Partnership: TCC TacDocument5 pagesPartnership: TCC TacErika Faith HalladorNo ratings yet

- Empirical Methods: Uva - Instructions-Take-Home-Assignment-2018-2019Document4 pagesEmpirical Methods: Uva - Instructions-Take-Home-Assignment-2018-2019Jason SpanoNo ratings yet

- Research Proposal of Role of Cooperatives On Women EmpowermentDocument9 pagesResearch Proposal of Role of Cooperatives On Women EmpowermentSagar SunuwarNo ratings yet

- IME PRINT FinalDocument18 pagesIME PRINT FinalNauman LiaqatNo ratings yet

- International Brand Strategy - Duffy, SeánDocument352 pagesInternational Brand Strategy - Duffy, SeánЗолзаяа БатжаргалNo ratings yet

- Notes On Letter of CreditDocument17 pagesNotes On Letter of CreditDileep MainaliNo ratings yet

- 07.2 UPDATED Capital Investment DecisionsDocument6 pages07.2 UPDATED Capital Investment DecisionsMilani Joy LazoNo ratings yet

- CitizenM Hotel InnovationDocument9 pagesCitizenM Hotel InnovationDydda 7No ratings yet

- Project Cooperative BankDocument33 pagesProject Cooperative BankPradeepPrinceraj100% (1)

- Capital and Return On CapitalDocument38 pagesCapital and Return On CapitalThái NguyễnNo ratings yet

- KaleeswariDocument14 pagesKaleeswariRocks KiranNo ratings yet

- CPG SampleDocument43 pagesCPG SampleRabindra Rajbhandari100% (2)

- Math ActivityDocument3 pagesMath ActivityCristena NavarraNo ratings yet

- Key Result AreaDocument3 pagesKey Result AreaVARSHANo ratings yet

- The Accounting Principles Board - ASOBATDocument14 pagesThe Accounting Principles Board - ASOBATblindleapNo ratings yet

- Gems Jewellery Industry in ChinaDocument103 pagesGems Jewellery Industry in ChinaPrachur Singhal100% (1)

- Inclusionary Housing: A Case Study On New York CityDocument8 pagesInclusionary Housing: A Case Study On New York CityNandana L SNo ratings yet

- Chapter Eleven SolutionsDocument60 pagesChapter Eleven SolutionsaishaNo ratings yet

- GMR Infrastructure LimitedDocument35 pagesGMR Infrastructure LimitedAmrut BhattNo ratings yet

- Operating ExposureDocument33 pagesOperating ExposureAnkit GoelNo ratings yet

- pp2 FinalDocument118 pagespp2 FinalRohan ToraneNo ratings yet

- Kertas 2 - Information Transer - Set ADocument3 pagesKertas 2 - Information Transer - Set AtiyeesanNo ratings yet

- Case 1: Robin Hood: Archana Warrier BPS 4305 - 007 BochlerDocument2 pagesCase 1: Robin Hood: Archana Warrier BPS 4305 - 007 BochlerchenlyNo ratings yet

- Re-Engineering Agricultural Education For Sustainable Development in NigeriaDocument5 pagesRe-Engineering Agricultural Education For Sustainable Development in NigeriaPremier PublishersNo ratings yet