Professional Documents

Culture Documents

Cash Problems Solution

Uploaded by

Magadia Mark Jeff0 ratings0% found this document useful (0 votes)

109 views3 pagesThe Callous Company has $11.375 million in adjusted cash and cash equivalents after accounting for NSF checks, postdated checks, and outstanding checks. The Apathy Company reconciled their $93,000 adjusted book balance to the

Original Description:

Its solution for cash problem

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe Callous Company has $11.375 million in adjusted cash and cash equivalents after accounting for NSF checks, postdated checks, and outstanding checks. The Apathy Company reconciled their $93,000 adjusted book balance to the

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

109 views3 pagesCash Problems Solution

Uploaded by

Magadia Mark JeffThe Callous Company has $11.375 million in adjusted cash and cash equivalents after accounting for NSF checks, postdated checks, and outstanding checks. The Apathy Company reconciled their $93,000 adjusted book balance to the

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

Solution - Albania Company

Cash in bank 3,000,000

Time deposit – 30 days 1,000,000

Petty cash fund 20,000

I. Postdated Check (200,000)

II. Undelivered Check 250,000

III. Postdated Check 100,000

V. (450,000)

Cash and Cash Equivalents 3,720,000

Solution - Argentina Company

Cash on hand (1,000,000 – 150,000) 850,000

Petty cash fund (50,000 – 10,000 – 5,000) 35,000

Security Bank current account 2,000,000

PNB current account 1,500,000

Bond sinking fund (CA to CL) 2,500,000

Cash and Cash Equivalents 6,885,000

Solution - Armenia Company

Total Cash – Unadjusted 7,050,000

I. a. Customer NSF check (100,000)

b. Customer postdated check (150,000)

II. (10,000 + 5,000) PCF (15,000)

III. Check written undelivered 200,000

IV. Check written postdated 300,000

Total Cash – Adjusted 7,285,000

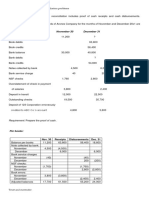

Solution - Callous Company

Cash and Cash Equivalents – Unadjusted 11,370,000

I. a. Customer check NSF (35,000)

b. Customer check postdated (15,000)

II PCF 5,000 only left (15,000)

III. a. Check written undelivered 25,000

b. Check written postdated 45,000

Cash and Cash Equivalents – Adjusted 11,375,000

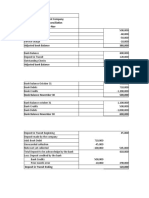

Solution - Apathy Company

Book Bank

Unadjusted Balance 65,000 108,000

Credit Memo 30,000

Debit Memo (2,000)

Deposit in Transit 80,000

Outstanding Check (95,000)

Adjusted Balance 93,000 93,000

Unadjusted Book Balance = 240,000 – 175,000 = 65,000

CM - Dec. 29 30,000

DM - Dec. 31 2,000

DIT - Dec. 31 80,000

OC - Check No. 102, 105 and 107 95,000

Solution - Sensible Company

Book Bank

Unadjusted Balance 110,000 135,000

Credit Memo 45,000

Debit Memo (15,000)

Deposit in Transit 60,000

Outstanding Check (90,000)

Book Error (27,000)

Bank Error 8,000

Adjusted Balance 113,000 113,000

Unadjusted Book Balance = 280,000 – 170,000 = 110,000

Unadjusted Bank Balance = 130,000 – 160,000 + 165,000 = 135,000

CM - Dec. 28 45,000

DM - Dec. 28 (10,000 + 5,000) = 15,000

DIT - Dec. 31 60,000

OC - Check No. 770, 775 and 777 = 90,000

Book Error

Entry Made Should Be Entry Adjusting Entry

A/P 25,000 A/P 52,000 A/P 27,000

Cash 25,000 Cash 52,000 Cash 27,000

Bank Error - Check No. 1042 8,000

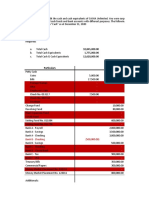

Solution - Sassy Company

June 30 July Receipts July Disbursements July 31

Balance per book 1,000,000 4,000,000 3,600,000 1,400,000

CM - Previous Month 300,000 (300,000)

CM - Current Month 500,000 500,000

DM - Previous Month (100,000) (100,000)

(4,000) (4,000)

DM - Current Month 1,000 (1,000)

Book Errors

Adjusted book balance 1,196,000 4,200,000 3,497,000 1,899,000

June 30 July Receipts July Disbursements July 31

Balance per bank 1,650,000 3,500,000 2,500,000 2,650,000

DIT - Previous Month 400,000 (400,000)

DIT - Current Month 1,100,000 1,100,000

OC - Previous Month (854,000) (854,000)

OC - Current Month 1,851,000 (1,851,000)

Bank Errors

Adjusted bank balance 1,196,000 4,200,000 3,497,000 1,899,000

Deposits in transit - June 30 400,000

Cash receipts deposited during the month 4,200,000 Adjusted Book Receipts

Deposits acknowledged by bank during the month (3,500,000)

Deposits in transit - July 31 1,100,000

Outstanding checks - June 30 854,000

Checks drawn by depositor during the month 3,497,000 Adjusted Book Disbursements

Checks paid by the bank during the month (2,500,000)

Outstanding checks - July 31 1,851,000

Solution - Beehive Company

October 31 Nov. Receipts Nov. Disbursements November 30

Balance per book 600,000 2,200,000 1,800,000 1,000,000

CM - Previous Month

CM - Current Month

DM - Previous Month

DM - Current Month

Book Errors 90,000 90,000

270,000 (270,000)

Adjusted book balance 600,000 2,290,000 2,070,000 820,000

October 31 Nov. Receipts Nov. Disbursements November 30

Balance per bank 400,000 2,500,000 1,970,000 930,000

DIT - Previous Month 300,000 (300,000)

DIT - Current Month 190,000 190,000

OC - Previous Month (100,000) (100,000)

OC - Current Month 400,000 (400,000)

Bank Errors (100,000) (100,000)

(200,000) 200,000

Adjusted bank balance 600,000 2,290,000 2,070,000 820,000

Notes: No CM and DM given

Deposits in transit - October 31 300,000

Cash receipts deposited during the month 2,290,000 Adjusted Book Receipts

Deposits acknowledged by bank during the month (2,400,000) (2,500,000 – 100,000)

Deposits in transit - November 30 190,000

Outstanding checks - October 31 100,000 Squeeze

Checks drawn by depositor during the month 2,070,000 Adjusted Book Disbursements

Checks paid by the bank during the month (1,770,000) (1,970,000 – 200,000)

Outstanding checks - November 30 400,000

You might also like

- Question 1: SolutionDocument15 pagesQuestion 1: Solutiondebate ddNo ratings yet

- Bank Reconciliation ProblemsDocument2 pagesBank Reconciliation ProblemsCris Jung80% (5)

- Proof of Cash: Irene Mae C. Guerra, CPADocument17 pagesProof of Cash: Irene Mae C. Guerra, CPAjeams vidalNo ratings yet

- Proof of Cash ProblemDocument3 pagesProof of Cash ProblemKathleen Frondozo67% (6)

- Proof of Cash FormatDocument7 pagesProof of Cash FormatnathanlagdamenNo ratings yet

- Proof of CashDocument7 pagesProof of CashMARIAN POLANCONo ratings yet

- Lecture Notes On Bank Reconciliation - Proof of Cash - 000Document1 pageLecture Notes On Bank Reconciliation - Proof of Cash - 000judel ArielNo ratings yet

- Bank Reconciliation Problems SolvedDocument7 pagesBank Reconciliation Problems SolvedJean BritoNo ratings yet

- Financial Statements British English Student Ver2Document4 pagesFinancial Statements British English Student Ver2Paulo AbrantesNo ratings yet

- Assignment 1.3 Proof of CashDocument16 pagesAssignment 1.3 Proof of CashRya Miguel AlbaNo ratings yet

- Solution Manual Ch. 1 19Document55 pagesSolution Manual Ch. 1 19Aira Mae TaborNo ratings yet

- Assignment 3Document4 pagesAssignment 3Bernadeth Adelaine DomingoNo ratings yet

- Proof of Cash Problem 3-1Document5 pagesProof of Cash Problem 3-1Coleen Lara SedillesNo ratings yet

- Padernal BSA 1A SW Problem 3 2Document3 pagesPadernal BSA 1A SW Problem 3 2Fly ThoughtsNo ratings yet

- Proof of CashDocument6 pagesProof of CashAlexander ONo ratings yet

- Calculate Bank BalanceDocument25 pagesCalculate Bank BalanceSoria Sophia AnnNo ratings yet

- Computations AE 04 2Document17 pagesComputations AE 04 2Julienne UntalascoNo ratings yet

- Bank Reconciliation Problems for Sassy, Beehive, Fabulous, and Bedlam CompaniesDocument4 pagesBank Reconciliation Problems for Sassy, Beehive, Fabulous, and Bedlam CompaniesElizabethNo ratings yet

- Module 2 ProblemsDocument15 pagesModule 2 ProblemsCristina TayagNo ratings yet

- Quiz 2B - Bank Reconciliation and Proof of CashDocument5 pagesQuiz 2B - Bank Reconciliation and Proof of CashLorence Ibañez100% (2)

- Cash and Cash Equivalents ReconciliationDocument16 pagesCash and Cash Equivalents ReconciliationNil Justeen GarciaNo ratings yet

- C3Document16 pagesC3Aaliyah Manuel100% (1)

- Quiz No. 1Document10 pagesQuiz No. 1Gerry Carabbacan100% (2)

- FInancial Accounting and Reporting1C6Document19 pagesFInancial Accounting and Reporting1C6Yen YenNo ratings yet

- Bigotry Company Proof of CashDocument4 pagesBigotry Company Proof of CashGee Lysa Pascua VilbarNo ratings yet

- Proof of CashDocument9 pagesProof of CashEDGAR ORDANELNo ratings yet

- Inacc 1 Chap 3 Act PDFDocument12 pagesInacc 1 Chap 3 Act PDFSharmin Reula50% (2)

- Quiz 1 - Audit of Cash SolutionDocument9 pagesQuiz 1 - Audit of Cash SolutionmillescaasiNo ratings yet

- Solutions To 2 1 To 2 5Document5 pagesSolutions To 2 1 To 2 5Away To PonderNo ratings yet

- Two Date Bank Reconciliation ComputationDocument11 pagesTwo Date Bank Reconciliation ComputationAdyangNo ratings yet

- Quiz 2Document7 pagesQuiz 2Fiona MiralpesNo ratings yet

- Proof of Cash123Document5 pagesProof of Cash123rufamaegarcia07No ratings yet

- Chapter 3 (Problem 3-5-13) PDFDocument9 pagesChapter 3 (Problem 3-5-13) PDFBaby MushroomNo ratings yet

- Bank Reconciliation and Adjusting EntriesDocument4 pagesBank Reconciliation and Adjusting EntriesKathleen100% (1)

- INTERMEDIATE ACCOUNTING Vol. 1 (2021 Edition) - Valix, Peralta & Valix - XLSX Chapter 3Document4 pagesINTERMEDIATE ACCOUNTING Vol. 1 (2021 Edition) - Valix, Peralta & Valix - XLSX Chapter 3Rodolfo ManalacNo ratings yet

- Proof of Cash (AutoRecovered)Document4 pagesProof of Cash (AutoRecovered)Portia SupedaNo ratings yet

- Zodiac Company: Balance Per Book, April 30Document5 pagesZodiac Company: Balance Per Book, April 30Rhea Sismo-anNo ratings yet

- Chapter 3 (IA Proof Od Cash) PDFDocument6 pagesChapter 3 (IA Proof Od Cash) PDFBaby MushroomNo ratings yet

- Credit Memo Ok Debit Memo Ok Debit MemoDocument22 pagesCredit Memo Ok Debit Memo Ok Debit MemoVea Canlas CabertoNo ratings yet

- Proof of CashDocument3 pagesProof of CashLorence Patrick LapidezNo ratings yet

- Solution To 7 4 To 7 7Document3 pagesSolution To 7 4 To 7 7Ma Theresa MaguadNo ratings yet

- Audit Cash and EquivalentsDocument16 pagesAudit Cash and EquivalentsErnest Andales0% (1)

- Solution To Quiz 1Document2 pagesSolution To Quiz 1Carmi FeceroNo ratings yet

- Proof of Cash Adjusted Balance Method: Labels 31-Jan Receipts Disbursements 28-FebDocument4 pagesProof of Cash Adjusted Balance Method: Labels 31-Jan Receipts Disbursements 28-FebNika BautistaNo ratings yet

- Padernal BSA 1A SW Problem 3 4Document2 pagesPadernal BSA 1A SW Problem 3 4Fly ThoughtsNo ratings yet

- Proof of CashDocument22 pagesProof of CashYen RabotasoNo ratings yet

- Assignment 3 ACFAR 1231 Proof of CashDocument2 pagesAssignment 3 ACFAR 1231 Proof of CashkakaoNo ratings yet

- Audit of Cash ActivityDocument13 pagesAudit of Cash ActivityIris FenelleNo ratings yet

- Audit of Cash ActivityDocument13 pagesAudit of Cash ActivityIris FenelleNo ratings yet

- AE 111 Midterm Summative Assessment 2 SolutionsDocument6 pagesAE 111 Midterm Summative Assessment 2 SolutionsDjunah ArellanoNo ratings yet

- 1.1 Cce To Proof of Cash Discussion ProblemsDocument3 pages1.1 Cce To Proof of Cash Discussion ProblemsGiyah UsiNo ratings yet

- Requirement No. 1: PROBLEM NO. 1 - Peso CorporationDocument13 pagesRequirement No. 1: PROBLEM NO. 1 - Peso CorporationDreiu EsmeleNo ratings yet

- Sol. Man. - Chapter 3 - Bank Reconciliation - Ia PartDocument15 pagesSol. Man. - Chapter 3 - Bank Reconciliation - Ia PartMike Joseph E. Moran100% (3)

- Solutions Bank Recon and ARDocument10 pagesSolutions Bank Recon and ARJaycel Yam-Yam VerancesNo ratings yet

- Bank Reconciliation and Adjusted Cash BalanceDocument10 pagesBank Reconciliation and Adjusted Cash BalanceJaycel Yam-Yam VerancesNo ratings yet

- Unit 2 Audit of CashDocument18 pagesUnit 2 Audit of CashGiulia TabaraNo ratings yet

- Espanola Far 201 QuizDocument7 pagesEspanola Far 201 QuizCINDY MAE SARAH ESPANOLANo ratings yet

- Module I SalesDocument36 pagesModule I SalesMagadia Mark JeffNo ratings yet

- Module 1-Small and Medium-Sized Entities: Standard (2015) + Q&AsDocument32 pagesModule 1-Small and Medium-Sized Entities: Standard (2015) + Q&AsAlonso GomezNo ratings yet

- Coca Cola Case StudyDocument3 pagesCoca Cola Case Studyerik151260% (5)

- Semi Final 1 PopulationDocument15 pagesSemi Final 1 PopulationMagadia Mark JeffNo ratings yet

- Maceda Law R. A. 6552Document3 pagesMaceda Law R. A. 6552Magadia Mark JeffNo ratings yet

- New Approaches To Measuring Economic DevelopmentDocument11 pagesNew Approaches To Measuring Economic DevelopmentMagadia Mark JeffNo ratings yet

- Corporate Governance: That Dictate How A Company's Board of Directors Manages and Oversees The Operations of A CompanyDocument12 pagesCorporate Governance: That Dictate How A Company's Board of Directors Manages and Oversees The Operations of A CompanyMagadia Mark JeffNo ratings yet

- Overhead Variance - PinnacleDocument2 pagesOverhead Variance - PinnacleMagadia Mark JeffNo ratings yet

- SBA Case-2Document2 pagesSBA Case-2Magadia Mark JeffNo ratings yet

- LCNRV - SolutionDocument3 pagesLCNRV - SolutionMagadia Mark JeffNo ratings yet

- Linear Programming Notes From RoqueDocument2 pagesLinear Programming Notes From Roquegiezele ballatanNo ratings yet

- The Artis and The ArtisanDocument39 pagesThe Artis and The ArtisanMagadia Mark JeffNo ratings yet

- Kant's Deontological Ethics The Duty Framework 1Document3 pagesKant's Deontological Ethics The Duty Framework 1Magadia Mark Jeff100% (1)

- The Elements of Art and Principles of Design Final HandoutDocument7 pagesThe Elements of Art and Principles of Design Final HandoutMagadia Mark JeffNo ratings yet

- Business Plan (Nacho Gwapito)Document7 pagesBusiness Plan (Nacho Gwapito)Magadia Mark JeffNo ratings yet

- All About JapanDocument20 pagesAll About JapanMagadia Mark JeffNo ratings yet

- Optional: Service BulletinDocument8 pagesOptional: Service BulletinDaniil SerovNo ratings yet

- KALAMAZOO Case Study SolutionDocument13 pagesKALAMAZOO Case Study SolutionSanskriti sahuNo ratings yet

- Quiz Manajemen Pengadaan - Nisrina Zalfa Farida - 21B505041003Document5 pagesQuiz Manajemen Pengadaan - Nisrina Zalfa Farida - 21B505041003Kuro DitNo ratings yet

- Seminar On Central Bank of IndiaDocument23 pagesSeminar On Central Bank of IndiaHarshkinder SainiNo ratings yet

- The Ultimate Guide to Achieving ISO 27001 CertificationDocument21 pagesThe Ultimate Guide to Achieving ISO 27001 CertificationTaraj O KNo ratings yet

- Agile Development: © Lpu:: Cap437: Software Engineering Practices: Ashwani Kumar TewariDocument28 pagesAgile Development: © Lpu:: Cap437: Software Engineering Practices: Ashwani Kumar TewariAnanth KallamNo ratings yet

- PPM02 Project Portfolio Prioritization Matrix - AdvancedDocument5 pagesPPM02 Project Portfolio Prioritization Matrix - AdvancedHazqanNo ratings yet

- Aditya AS 22 23 2134Document1 pageAditya AS 22 23 2134Aditya AmbwaniNo ratings yet

- Institute of Management Studies and Research: KLE Society'sDocument22 pagesInstitute of Management Studies and Research: KLE Society'sRutuja HukkeriNo ratings yet

- Market Research and Analysis of Favorite Plus Ceramic Tiles Pvt. LtdDocument46 pagesMarket Research and Analysis of Favorite Plus Ceramic Tiles Pvt. LtdMahendra PatadiaNo ratings yet

- Accounts PaperDocument2 pagesAccounts PaperRohan Ghadge-46No ratings yet

- Growth Hacking Decoded Grow Your BusinessDocument18 pagesGrowth Hacking Decoded Grow Your BusinessmeghaaNo ratings yet

- CHAPTER 1.1 Basic Concepts of ManagementsDocument15 pagesCHAPTER 1.1 Basic Concepts of ManagementsRay John DulapNo ratings yet

- Survey of Portland Cement Consumption by of Portland Cement Consumption 1stDocument45 pagesSurvey of Portland Cement Consumption by of Portland Cement Consumption 1stHimerozNo ratings yet

- Premium CH 2 Thinking Like An EconomistDocument36 pagesPremium CH 2 Thinking Like An EconomistdavidNo ratings yet

- Teachers ATM Cards As Loan Collateral: The In-Depth Look Into ATM "Sangla" SchemeDocument17 pagesTeachers ATM Cards As Loan Collateral: The In-Depth Look Into ATM "Sangla" SchemeJan Reindonn MabanagNo ratings yet

- Obligations and Contracts UPDATED HANDOUTS ON 2021Document15 pagesObligations and Contracts UPDATED HANDOUTS ON 2021Angela NavaltaNo ratings yet

- BP B1P Tests U2 LCCIDocument1 pageBP B1P Tests U2 LCCIHải NguyễnNo ratings yet

- SW One DXP Cost Sheet (4.5BHK+Utility) Phase 2Document1 pageSW One DXP Cost Sheet (4.5BHK+Utility) Phase 2assetcafe7No ratings yet

- Module 3 Consumer Strategies GuideDocument19 pagesModule 3 Consumer Strategies GuideJoana Marie CabuteNo ratings yet

- CS, PS and EfficiencyDocument45 pagesCS, PS and EfficiencySubodh MohapatroNo ratings yet

- FIN 5001 - Course Outline 2022Document8 pagesFIN 5001 - Course Outline 2022adharsh veeraNo ratings yet

- CARGO Establishment ListDocument3 pagesCARGO Establishment ListRanjith PNo ratings yet

- PEST AnalysisDocument7 pagesPEST AnalysisWaqas Ul HaqueNo ratings yet

- CV Example (Dubal Avinash)Document3 pagesCV Example (Dubal Avinash)Rajkumar KhaseraoNo ratings yet

- Quotation - Householders - LAPSONDocument1 pageQuotation - Householders - LAPSONCredsureNo ratings yet

- Stupid Data Miner Tricks Overfitting The SP 500Document12 pagesStupid Data Miner Tricks Overfitting The SP 500hpschreiNo ratings yet

- Visa Wizard - France-VisasDocument2 pagesVisa Wizard - France-VisasAbthal Tenore Al-fasnaNo ratings yet

- MBA and MSC RESEARCH PROPOSALDocument19 pagesMBA and MSC RESEARCH PROPOSALmuthomi.bookshop.storeNo ratings yet