Professional Documents

Culture Documents

8317-Article Text-33077-1-10-20131230

Uploaded by

Sherrie ZacariasCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

8317-Article Text-33077-1-10-20131230

Uploaded by

Sherrie ZacariasCopyright:

Available Formats

American Journal Of Business Education – First Quarter 2014 Volume 7, Number 1

Miller Table Company: A Profit Analysis

Case Integrating Managerial Accounting,

Microeconomics And Marketing

Louise Miller, Robert Morris University, USA

ABSTRACT

This paper describes a unique integrative business case appropriate for use in a managerial

accounting course or other business courses related to economics or marketing. The case

describes a scenario in which a managerial accountant is assisting in business decisions relating

to factors influencing the profitability of a small manufacturing operation. Students are asked to

optimize profits for company operations given information concerning costs, quality, and

marketing options.

Keywords: Profit Optimization; Marketing; Microeconomics

INTRODUCTION

T his paper describes a business case that is based in Microsoft Excel and demonstrates an analysis that

assists with managerial decision-making. Ringelstein (2009) points out that the Excel spreadsheet, as

a teaching instrument, motivates students and provides them with the opportunity to learn computing

skills as well as accounting techniques. “The use of computer technology assists students to gain a personal

understanding of the issues and to develop a specific set of skills that are useful for management accountants”

(Ringelstein, 2009). Spreadsheets encourage students to develop critical analytical skills that are in demand by

employers. Cory and Pruske (2012) conclude that certain accounting-related skills and topics in accounting

curriculums are essential. Spreadsheet software (Excel) was ranked as the number one critical skill desired by

employers.

Spreadsheets have evolved as critical tools for business analysis. There are many examples in current

business literature of applications built in spreadsheets to support analysis of marketing decisions. Bø and

Hammervoll (2010) illustrate an MS Excel spreadsheet decision tool. They describe the development and

application of a valuable decision support tool to ensure appropriate pricing of services in the wholesale grocery

industry. Coles and Rowley (1996) discuss the potential use of spreadsheets as decision-support systems. They

illustrate some of the models that can be easily built with modern spreadsheet packages, including models to support

what-if or scenario analysis, sensitivity analysis, goal seeking and optimization. The Excel-based decision support

model presented by Fischer et al. (2012) illustrates that it is possible to determine near-optimal marketing budgets.

Their model accounts for marketing dynamics and trade-offs with respect to marketing effectiveness and profit

contribution. These examples illustrate the pervasiveness of spreadsheet modeling in business and its importance in

business curriculums.

CASE DESCRIPTION

The case described here is an example of a simple optimization model that can give students insight into

several concepts in multiple business disciplines. It can be used as a demonstration or an assignment in managerial

accounting, marketing, or economics courses. This integrative case illustrates profit analysis for a small table

manufacturing operation and requires the students to build the analysis in Microsoft Excel and use elementary

calculus to find the optimal selling price of a table. The case describes a scenario in which a managerial accountant

Copyright by author(s); CC-BY 31 The Clute Institute

American Journal Of Business Education – First Quarter 2014 Volume 7, Number 1

is assisting the Chief Financial Officer (CFO) of the manufacturing firm in a business decision related to the quality

of the tables, the advertising level and the location strategy. Students are asked to optimize profits for a product line

given information concerning costs and the marketing options. This case gives students insight into the calculus of

optimization used in business problems. This case can also be used in a microeconomics course to illustrate the

concepts of price determination in a competitive market. It can be used to illustrate that in a competitive market, the

price for a good will vary until it settles at a point where the quantity demanded by consumers at a certain price will

equal the quantity supplied by producers, resulting in an economic equilibrium for price and quantity. This case can

also be used in marketing courses to illustrate that effective pricing strategies and analysis of various options that

affect demand can greatly affect profits and ultimately affect competitive advantage. Intelligent pricing decisions

require a strong understanding of consumer demand, competing strategies and effective promotional approaches.

“Marketing budget decisions are critical and should be fact-based rather than intuitive” (Fischer et al., 2012).

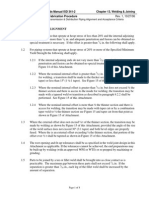

Figure 1 illustrates the spreadsheet that is provided for the students which gives instructions for the case.

Discrete variables for the quality of the tables, the advertising level and the location strategy are described and

formulas for variable and fixed expenses are provided. A table that the students can use for making calculations is

provided. (Note that only the column headings in Table 1 are supplied for the students.) Students are asked to

determine the equation for profit and then to determine the optimal set of discrete variables and selling price that

results in maximum profit. They are required to use simple calculus to find optimal prices instead of the Excel

Solver add-in or other methods.

Copyright by author(s); CC-BY 32 The Clute Institute

American Journal Of Business Education – First Quarter 2014 Volume 7, Number 1

Miller Table Company Case

You are the management accountant of the Miller Table Company.

The CFO of Miller Table Company launches a project to determine how to maximize

the profit of a particular line of tables they sell. He asks the sales and marketing

department to analyze prior sales and produce a formula for number of tables sold

based on the price of the tables and the following factors:

The QUALITY OF THE tables:

Q=1 Standard Quality

Q=2 Above Average Quality

Q=3 High Quality

The ADVERTISING LEVEL:

A= 1 LOW

A= 2 MEDIUM

A= 3 HIGH

The LOCATION STRATEGY of the tables:

X=1 Discount Stores only

X=2 Department stores

X=3 Discount stores and Online

The marketing department presents this formula to the CFO:

NUMBER OF PAIRS OF tables SOLD PER YEAR, N = 48000 + 2000(A+Q+X) - 500P

where P is the price of a table.

(Notice that this formula makes sense intuitively because the more you advertise,

the more you sell, but the higher the price, the less you sell.)

The CFO asks you to use this formula to figure out how to maximize profit.

So your job is to select the quality level of the tables, the appropriate

advertising level, the best location strategy, and the optimal price of your tables.

In other words, pick Q, A, X, and the price for the maximum profit possible.

You also are given the following about costs:

The variable cost per table is given by: V = 5 (Q + 3)

The total fixed expenses per year is given by: F = 15000A + 5000X

Your tasks are:

1) First, find an equation that specifies the profit for Miller.

Remember, profit (net operating income) is given by:

PROFIT = TOTAL REVENUE - FIXED EXPENSES - TOTAL VARIABLE EXPENSES

(Your equation should give profit in terms of Q, A, X, and P.)

2) Next, suppose the CFO tells you that he wants to set the price of the tables at $60.00.

He also wants to sell only above average or high quality tables.

For that price, what Q, A, and X will give Miller the maximum profit??

Hint: Make a table with 8 columns (started for you below) for each possible combination and the resulting profit.

3) Finally, the CFO tells you that he wants you to determine the best price and

which Q, A, and X options to select that will result in the maximum profit.

Hint: The profit equation is an upside-down parabola.

Use simple calculus to find the price that gives the maximum profit. Add columns 9 and 10 below.

TABLE 1: FOR CALCULATING PROFIT AND OPTIMAL PROFIT FOR EACH COMBINATION

Enter a price per table to calculate PROFIT column:$68.00 PROFIT

Quality Advertising Location Results calculated at the price above OPTIMAL AT OPTIMAL

Q A X Total Var Cost Fixed Cost Num Sold Sales Profit PRICE PRICE

Figure 1: Student Problem Spreadsheet

Copyright by author(s); CC-BY 33 The Clute Institute

American Journal Of Business Education – First Quarter 2014 Volume 7, Number 1

CASE SOLUTION

We start with the profit equation given in the problem:

PROFIT = Total Revenue - Fixed Expenses - Total Variable Expenses

For P = Price, N = number of tables sold, F = fixed expenses, and V = variable expense per table,

PROFIT = PN - F – VN

Students are asked to produce the profit equation for this company in terms of quality, advertising, and

location. They should substitute the formulas for expenses and number of tables sold provided in the problem. Given

that V = 5(Q + 3), N = 48000 + 2000(A+Q+X) - 500P, and F = 15000A + 5000X, the profit equations becomes:

PROFIT = P(48000 + 2000(A + Q + X) - 500P) - 15000A - 5000X – (5(Q + 3))( 48000 + 2000(A + Q + X)- 500P)

This results in the following quadratic equation:

PROFIT = -500P^2 + P[55,500+2000A + 2000X + 4500Q] + [-45000A -35,000X -270,000Q -10,000QA -

10,000Q^2 - 720,0000]

Next, the derivative of the profit equation is taken with respect to price:

dPROFIT/dP = -1000P + 55,500 +2000A +2000X + 4500Q

To find the price Popt that optimizes profit, this is set equal to zero:

0 = -1000Popt + 55,500 + 2000A + 2000X + 4500Q

Solving for the optimal price Popt:

Popt = 55.5 + 2A + 2X + 4.5Q

This equation illustrates that the optimal price is a function of the quality of the tables, the advertising level

and the location strategy. This equation is used for the "Optimal Price" column in the profit table. Students can then

use the values in this column to create a column for the profits that result from the optimal prices. This column

identifies the optimal price of a table that results in maximum profit for each possible combination of quality,

advertising level and the location strategy. Of course, Microsoft Excel’s Solver add-in can also be used to solve for

the optimal price for each combination (row), but this would be a tedious repetitive process and would not give

students insight into the calculus of optimization required in the solution of this problem. However, an instructor can

use the spreadsheet as an opportunity to illustrate the use of Solver for optimization problems in business.

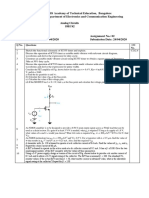

The final step in the solution of the problem is to examine the “Profit at Optimal Price” column and identify

the row with the highest profit. The optimal price, quality, advertising level and location strategy values in this row

are the answers that should be reported to the CFO of the company. The solution is shown in Table 2. For this

problem, the optimal price is $72.00 and the optimal discrete variables are standard quality tables, high advertising

level, and a location strategy of selling in a combination of discount stores and online.

Copyright by author(s); CC-BY 34 The Clute Institute

American Journal Of Business Education – First Quarter 2014 Volume 7, Number 1

TABLE 2: CASE SOLUTION

Enter a price per table to calculate PROFIT column:$68.00 PROFIT

Quality Advertising Location Results calculated at the price above OPTIMAL AT OPTIMAL

Q A X Total Var Cost Fixed Cost Num Sold Sales Profit PRICE PRICE

1 1 1 $400,000 $20,000 20,000 $1,360,000 $940,000 $64.00 $948,000

1 1 2 $440,000 $25,000 22,000 $1,496,000 $1,031,000 $66.00 $1,033,000

1 1 3 $480,000 $30,000 24,000 $1,632,000 $1,122,000 $68.00 $1,122,000

1 2 1 $440,000 $35,000 22,000 $1,496,000 $1,021,000 $66.00 $1,023,000

1 2 2 $480,000 $40,000 24,000 $1,632,000 $1,112,000 $68.00 $1,112,000

1 2 3 $520,000 $45,000 26,000 $1,768,000 $1,203,000 $70.00 $1,205,000

1 3 1 $480,000 $50,000 24,000 $1,632,000 $1,102,000 $68.00 $1,102,000

1 3 2 $520,000 $55,000 26,000 $1,768,000 $1,193,000 $70.00 $1,195,000

1 3 3 $560,000 $60,000 28,000 $1,904,000 $1,284,000 $72.00 $1,292,000

2 1 1 $550,000 $20,000 22,000 $1,496,000 $926,000 $68.50 $926,125

2 1 2 $600,000 $25,000 24,000 $1,632,000 $1,007,000 $70.50 $1,010,125

2 1 3 $650,000 $30,000 26,000 $1,768,000 $1,088,000 $72.50 $1,098,125

2 2 1 $600,000 $35,000 24,000 $1,632,000 $997,000 $70.50 $1,000,125

2 2 2 $650,000 $40,000 26,000 $1,768,000 $1,078,000 $72.50 $1,088,125

2 2 3 $700,000 $45,000 28,000 $1,904,000 $1,159,000 $74.50 $1,180,125

2 3 1 $650,000 $50,000 26,000 $1,768,000 $1,068,000 $72.50 $1,078,125

2 3 2 $700,000 $55,000 28,000 $1,904,000 $1,149,000 $74.50 $1,170,125

2 3 3 $750,000 $60,000 30,000 $2,040,000 $1,230,000 $76.50 $1,266,125

3 1 1 $720,000 $20,000 24,000 $1,632,000 $892,000 $73.00 $904,500

3 1 2 $780,000 $25,000 26,000 $1,768,000 $963,000 $75.00 $987,500

3 1 3 $840,000 $30,000 28,000 $1,904,000 $1,034,000 $77.00 $1,074,500

3 2 1 $780,000 $35,000 26,000 $1,768,000 $953,000 $75.00 $977,500

3 2 2 $840,000 $40,000 28,000 $1,904,000 $1,024,000 $77.00 $1,064,500

3 2 3 $900,000 $45,000 30,000 $2,040,000 $1,095,000 $79.00 $1,155,500

3 3 1 $840,000 $50,000 28,000 $1,904,000 $1,014,000 $77.00 $1,054,500

3 3 2 $900,000 $55,000 30,000 $2,040,000 $1,085,000 $79.00 $1,145,500

3 3 3 $960,000 $60,000 32,000 $2,176,000 $1,156,000 $81.00 $1,240,500

CONCLUSION

Optimization problem solutions are critically important for the analysis of decisions related to resource

allocations and the analysis of future profit projections. This paper described a unique management accounting case

appropriate for use in marketing courses, introductory microeconomics courses, or introductory or upper level

managerial accounting courses. A spreadsheet model is used to assist in decisions concerning factors influencing the

profitability of a small table manufacturing operation. This case involves the analysis of uncertainties in factors

affecting future profits and is an illustration of Excel-based analysis that provides useful information for decision-

makers. This case illustrates to students that in real-world complex business operations, decisions regarding

uncertainties and the allocation of resources are important and affect the profit outcomes of a business.

The specific learning objectives (functional competencies) of this case are for students to:

1. Understand the importance of the use of spreadsheets to create and evaluate decision-support models.

2. Understand that profit optimization analysis can be a valuable decision-making process for business

managers concerned with future business success.

3. Understand that in real-world manufacturing operations, decisions regarding quality and the allocation of

resources affect the profit outcomes of a company.

4. Gain an understanding of the fundamentals of the calculus of optimization used in business problems.

5. Understand that in a competitive market, there is an economic equilibrium for price and quantity demanded

and that effective pricing strategies and analysis of various options that affect demand can greatly affect

profits.

Copyright by author(s); CC-BY 35 The Clute Institute

American Journal Of Business Education – First Quarter 2014 Volume 7, Number 1

By mapping the case activities to functional competencies and directly measuring multiple outcomes in

these activities, these competencies can be assessed in the course as prescribed in the business department’s

assessment plan.

AUTHOR INFORMATION

Dr. Louise Miller has a PhD in Management Science, an MBA and a BS degree in Electrical Engineering. Her

research interests include accounting information systems and the integration of technology into accounting

education. Dr. Miller also enjoys painting, web site design and programming. She teaches for Robert Morris

University in Moon Township, Pennsylvania. E-mail: millerl@rmu.edu

REFERENCES

1. Bø, E., & Hammervoll, T. (2010). Cost-based pricing of transportation services in a wholesaler–carrier

relationship: An MS Excel spreadsheet decision tool. International Journal of Logistics: Research and

Applications, 13(3), 197-210.

2. Coles, S., & Rowley, J. (1996). Spreadsheet modeling for management decision making. Industrial

Management & Data Systems, 96(7), 17-23.

3. Cory, S. N., & Pruske, K. A. (2012). Necessary skills for accounting graduates: An exploratory study to

determine what the profession wants. Proceedings of the American Society of Business and Behavioral

Sciences, 19(1), 208-218.

4. Fischer, M., Albers, S., Wagner, N., & Frie, M. (2012). Dynamically allocating the marketing budget: How

to leverage profits across markets, products, and marketing activities. GfK Marketing Intelligence Review,

4(1), 50-59.

5. Lau, M. A., & Sugden, S. J. (Eds.). (2011). Applications of spreadsheets in education-the amazing power of

a simple tool. Bentham Science Publishers.

6. Ringelstein, D. (2009.) An activity-based costing assessment task: Using an excel spreadsheet. e-Journal of

Business Education & Scholarship of Teaching, 3(1), 25-35.

Copyright by author(s); CC-BY 36 The Clute Institute

You might also like

- Strategic Frameworks - The Cascade Guide 01Document60 pagesStrategic Frameworks - The Cascade Guide 01Sherrie ZacariasNo ratings yet

- RG Future Value Drivers Case Studies May 2018Document13 pagesRG Future Value Drivers Case Studies May 2018Sherrie ZacariasNo ratings yet

- RG Scenario Planning Case Study May 2018Document13 pagesRG Scenario Planning Case Study May 2018Sherrie ZacariasNo ratings yet

- RG Process Based Management Case Study 1 ACME May 2018Document12 pagesRG Process Based Management Case Study 1 ACME May 2018Sherrie ZacariasNo ratings yet

- RG Business Model Design Case Study 1 Nespresso May 2018Document12 pagesRG Business Model Design Case Study 1 Nespresso May 2018Sherrie ZacariasNo ratings yet

- 8317-Article Text-33077-1-10-20131230Document6 pages8317-Article Text-33077-1-10-20131230Sherrie ZacariasNo ratings yet

- RG Future Value Drivers Case Studies May 2018Document13 pagesRG Future Value Drivers Case Studies May 2018Sherrie ZacariasNo ratings yet

- RG Business Model Design Case Study 1 Nespresso May 2018Document12 pagesRG Business Model Design Case Study 1 Nespresso May 2018Sherrie ZacariasNo ratings yet

- RG Scenario Planning Case Study May 2018Document13 pagesRG Scenario Planning Case Study May 2018Sherrie ZacariasNo ratings yet

- Kenjutsu Syllabus 2012Document8 pagesKenjutsu Syllabus 2012Sherrie ZacariasNo ratings yet

- RG Process Based Management Case Study 1 ACME May 2018Document12 pagesRG Process Based Management Case Study 1 ACME May 2018Sherrie ZacariasNo ratings yet

- Improving small business efficiencyDocument1 pageImproving small business efficiencySherrie ZacariasNo ratings yet

- Bugei - Kenjutsu - Martial Arts - Sword ArtsDocument19 pagesBugei - Kenjutsu - Martial Arts - Sword ArtsMinhngoduc100% (6)

- Advantages and Dis Advantages Og DumpingDocument1 pageAdvantages and Dis Advantages Og DumpingSherrie ZacariasNo ratings yet

- Perpetual Inventory System Journal EntriesDocument1 pagePerpetual Inventory System Journal EntriesSherrie ZacariasNo ratings yet

- Chapter 2 Obligations of PartnersDocument35 pagesChapter 2 Obligations of PartnersSherrie Zacarias100% (1)

- Psed 118 SolivenDocument1 pagePsed 118 SolivenSherrie ZacariasNo ratings yet

- Types of Trade BarriersDocument2 pagesTypes of Trade BarriersSherrie ZacariasNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Managing Digital Transformations - 1Document105 pagesManaging Digital Transformations - 1RamyaNo ratings yet

- System Design, Implementation and SupportDocument29 pagesSystem Design, Implementation and SupportPrecious WaseniNo ratings yet

- Mortgage Agreement Upheld Despite IrregularitiesDocument79 pagesMortgage Agreement Upheld Despite Irregularitiescarrie navaNo ratings yet

- Project On SpicesDocument96 pagesProject On Spicesamitmanisha50% (6)

- CW 3 - Non-Profit Making Organisation Sekolah Harapan Bangsa ACADEMIC YEAR 2020/2021Document3 pagesCW 3 - Non-Profit Making Organisation Sekolah Harapan Bangsa ACADEMIC YEAR 2020/2021Adrian WensenNo ratings yet

- Asme B31.8Document8 pagesAsme B31.8deepndeepsi100% (1)

- Operation - Manual Cubase 5Document641 pagesOperation - Manual Cubase 5Samiam66682% (17)

- 12 THINGS TO KNOW FOR A SWEDISH MASTER'S SCHOLARSHIPDocument51 pages12 THINGS TO KNOW FOR A SWEDISH MASTER'S SCHOLARSHIPEmmanuel GeraldNo ratings yet

- Factory Act Gujarat PDFDocument2 pagesFactory Act Gujarat PDFKeith100% (1)

- Integrated Weed Management 22.11.2021Document8 pagesIntegrated Weed Management 22.11.2021Izukanji KayoraNo ratings yet

- Cape Notes Unit 2 Module 2 Content 1 2Document13 pagesCape Notes Unit 2 Module 2 Content 1 2Jay B GayleNo ratings yet

- 2 - Civil Liberties Union Vs Executive SecretaryDocument3 pages2 - Civil Liberties Union Vs Executive SecretaryTew BaquialNo ratings yet

- Interpretation of StatutesDocument10 pagesInterpretation of StatutespyriadNo ratings yet

- 090 - IRS Levys and LiensDocument4 pages090 - IRS Levys and LiensDavid E RobinsonNo ratings yet

- Ansoff Matrix of TescoDocument2 pagesAnsoff Matrix of TescoMy GardenNo ratings yet

- C2601 Maintenance Manual V1 - 1Document45 pagesC2601 Maintenance Manual V1 - 1Tenri_Dio_9619No ratings yet

- Delivery For OutSystems Specialization Sample Exam - enDocument8 pagesDelivery For OutSystems Specialization Sample Exam - enmahesh manchalaNo ratings yet

- Carbon Fiber 395GPA Structural Ansys ReportDocument13 pagesCarbon Fiber 395GPA Structural Ansys ReportKrish KrishnaNo ratings yet

- Subgrade Preparation in Earth CutDocument3 pagesSubgrade Preparation in Earth Cutusama buttNo ratings yet

- (2022) 5 SCC 661Document43 pages(2022) 5 SCC 661Swati PandaNo ratings yet

- JSS Academy of Technical Education, Bangalore Department of Electronics and Communication Engineering Analog Circuits AssignmentDocument2 pagesJSS Academy of Technical Education, Bangalore Department of Electronics and Communication Engineering Analog Circuits AssignmentSamarth SamaNo ratings yet

- RESEARCH TEMPLATE 2023 1 AutoRecoveredDocument14 pagesRESEARCH TEMPLATE 2023 1 AutoRecoveredMark Lexter A. PinzonNo ratings yet

- LECTURE 11-Microalgal Biotechnology-Biofuels N BioproductsDocument16 pagesLECTURE 11-Microalgal Biotechnology-Biofuels N BioproductsIntan Lestari DewiNo ratings yet

- LGC CasesDocument97 pagesLGC CasesJeshe BalsomoNo ratings yet

- Mergers and Acquisitions in Pharmaceutical SectorDocument37 pagesMergers and Acquisitions in Pharmaceutical SectorAnjali Mehra100% (2)

- Python Lab10 Report SummaryDocument8 pagesPython Lab10 Report SummaryVivekananda ParamahamsaNo ratings yet

- Manipulative and Interactive Media GuideDocument25 pagesManipulative and Interactive Media Guidetyron plandesNo ratings yet

- S.No Company Name Location: Executive Packers and MoversDocument3 pagesS.No Company Name Location: Executive Packers and MoversAli KhanNo ratings yet

- RRB Alp Tech. CBT 2 Master Question Paper Electrician Trade Date 22 1 2019 Shift 1Document58 pagesRRB Alp Tech. CBT 2 Master Question Paper Electrician Trade Date 22 1 2019 Shift 1arpitrockNo ratings yet

- Isbn 978-602-61467-0-0Document20 pagesIsbn 978-602-61467-0-0Sofhiya LbNo ratings yet