Professional Documents

Culture Documents

NA Typologies

Uploaded by

Subrahmanyam SiriCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

NA Typologies

Uploaded by

Subrahmanyam SiriCopyright:

Available Formats

FINRAʼs list of AML Red Flags has

gone from 25 to 97

FINRA Provides Guidance to Firms Regarding

Suspicious Activity Monitoring and Reporting

Obligations

http://www.finra.org/sites/default/files/notice_doc_file_ref/Regulatory-Notice-

19-18.pdf

May 9, 2019

FINRA issued the Notice to provide guidance to member firms regarding

suspicious activity monitoring and reporting obligations under FINRA Rule

3310 (Anti-Money Laundering Compliance Program). The guidance included

ninety-seven (97) red flags organized into six sections:

U. Potential Red Flags in Customer Due Diligence and Interactions With

Customers (19 red flags, 10 are new)

X. Potential Red Flags in Deposits of Securities (8 red flags, all are new)

Y. Potential Red Flags in Securities Trading (20 red flags, 18 are new)

Z. Potential Red Flags in Money Movements (31 red flags, 20 are new)

[. Potential Red Flags in Insurance Products (5 red flags, all are new)

]. Other Potential Red Flags (14 red flags, 10 are new)

The Notice provided that these red flags were in addition to the money

laundering red flags that appeared in Notice to Members 02-21 (NTM 02-21)

published in April 2002:

“Since NTM 02-21 was published [in April 2002], guidance detailing

additional red flags that may be applicable to the securities industry have been

published by a number of U.S. government agencies and international

organizations. FINRA is issuing this Notice to provide examples of these

additional money laundering red flags for firms to consider incorporating into

their AML programs, as may be appropriate in implementing a risk-based

approach to BSA/AML compliance.”

“This Notice is intended to assist broker-dealers in complying with their

existing obligations under BSA/AML requirements and does not create any

new requirements or expectations. In addition, this Notice incorporates the red

flags listed in NTM 02-21 so that firms can refer to this Notice only for

examples of potential red flags.”

So the twenty-five 2002 red flags are included, but not identified, within the

ninety-seven 2019 red flags. To assist compliance professionals, I have gone

through the 2002 red flags and inserted them into the 2019 red flags so that

those professionals can more easily determine whether their current programs

are covering off the “new” red flags.

2002 Red Flags

U. The customer exhibits unusual concern regarding the firmʼs compliance

with government reporting requirements and the firmʼs AML policies,

particularly with respect to his or her identity, type of business and assets,

or is reluctant or refuses to reveal any information concerning business

activities, or furnishes unusual or suspect identification or business

documents.

X. The customer wishes to engage in transactions that lack business sense

or apparent investment strategy, or are inconsistent with the customerʼs

stated business strategy.

Y. The information provided by the customer that identifies a legitimate

source for funds is false, misleading, or substantially incorrect.

Z. Upon request, the customer refuses to identify or fails to indicate any

legitimate source for his or her funds and other assets.

[. The customer (or a person publicly associated with the customer) has a

questionable background or is the subject of news reports indicating

possible criminal, civil, or regulatory violations.

]. The customer exhibits a lack of concern regarding risks, commissions, or

other transaction costs.

i. The customer appears to be acting as an agent for an undisclosed

principal, but declines or is reluctant, without legitimate commercial

reasons, to provide information or is otherwise evasive regarding that

person or entity.

j. The customer has difficulty describing the nature of his or her business or

lacks general knowledge of his or her industry.

k. The customer attempts to make frequent or large deposits of currency,

insists on dealing only in cash equivalents, or asks for exemptions from

the firmʼs policies relating to the deposit of cash and cash equivalents.

Ul. The customer engages in transactions involving cash or cash equivalents

or other monetary instruments that appear to be structured to avoid the

$10,000 government reporting requirements, especially if the cash or

monetary instruments are in an amount just below reporting or recording

thresholds.

UU. For no apparent reason, the customer has multiple accounts under a

single name or multiple names, with a large number of inter-account or

third-party transfers.

UX. The customer is from, or has accounts in, a country identified as a non-

cooperative country or territory by the Financial Action Task Force (FATF).

UY. The customerʼs account has unexplained or sudden extensive wire

activity, especially in accounts that had little or no previous activity.

UZ. The customerʼs account shows numerous currency or cashiers check

transactions aggregating to significant sums.

U[. The customerʼs account has a large number of wire transfers to unrelated

third parties inconsistent with the customerʼs legitimate business

purpose.

U]. The customerʼs account has wire transfers that have no apparent

business purpose to or from a country identified as a money laundering

risk or a bank secrecy haven.

Ui. The customerʼs account indicates large or frequent wire transfers,

immediately withdrawn by check or debit card without any apparent

business purpose.

Uj. The customer makes a funds deposit followed by an immediate request

that the money be wired out or transferred to a third party, or to another

firm, without any apparent business purpose.

Uk. The customer makes a funds deposit for the purpose of purchasing a

long-term investment followed shortly thereafter by a request to liquidate

the position and transfer of the proceeds out of the account.

Xl. The customer engages in excessive journal entries between unrelated

accounts without any apparent business purpose.

XU. The customer requests that a transaction be processed in such a manner

to avoid the firmʼs normal documentation requirements.

XX. The customer, for no apparent reason or in conjunction with other “red

flags,” engages in transactions involving certain types of securities, such

as penny stocks, Regulation “S” (Reg S) stocks, and bearer bonds, which

although legitimate, have been used in connection with fraudulent

schemes and money laundering activity. (Such transactions may warrant

further due diligence to ensure the legitimacy of the customerʼs activity.)

XY. The customerʼs account shows an unexplained high level of account

activity with very low levels of securities transactions.

XZ. The customer maintains multiple accounts, or maintains accounts in the

names of family members or corporate entities, for no apparent business

purpose or other purpose.

X[. The customerʼs account has inflows of funds or other assets well beyond

the known income or resources of the customer.

2019 Red Flags (with references to 2002 red flags)

I. Potential Red Flags in Customer Due Diligence and Interactions With

Customers

U. The customer provides the firm with unusual or suspicious identification

documents that cannot be readily verified or are inconsistent with other

statements or documents that the customer has provided. Or, the

customer provides information that is inconsistent with other available

information about the customer. This indicator may apply to account

openings and to interaction subsequent to account opening. (2002 red

flag # 1 – The customer exhibits unusual concern regarding the firm’s

compliance with government reporting requirements and the firm’s AML

policies, particularly with respect to his or her identity, type of business

and assets, or is reluctant or refuses to reveal any information

concerning business activities, or furnishes unusual or suspect

identification or business documents.)

X. The customer is reluctant or refuses to provide the firm with complete

customer due diligence information as required by the firmʼs procedures,

which may include information regarding the nature and purpose of the

customerʼs business, prior financial relationships, anticipated account

activity, business location and, if applicable, the entityʼs officers and

directors. (2002 red flag # 1 – The customer exhibits unusual concern

regarding the firm’s compliance with government reporting

requirements and the firm’s AML policies, particularly with respect to his

or her identity, type of business and assets, or is reluctant or refuses to

reveal any information concerning business activities, or furnishes

unusual or suspect identification or business documents.)

Y. The customer refuses to identify a legitimate source of funds or

information is false, misleading or substantially incorrect. (2002 Red Flag

#4 – Upon request, the customer refuses to identify or fails to indicate

any legitimate source for his or her funds and other assets. Also, 2002

red flag #3 – The information provided by the customer that identifies a

legitimate source for funds is false, misleading, or substantially

incorrect.)

Z. The customer is domiciled in, doing business in or regularly transacting

with counterparties in a jurisdiction that is known as a bank secrecy

haven, tax shelter, high-risk geographic location (e.g., known as a

narcotics producing jurisdiction, known to have ineffective

AML/Combating the Financing of Terrorism systems) or conflict zone,

including those with an established threat of terrorism.

[. The customer has difficulty describing the nature of his or her business or

lacks general knowledge of his or her industry. (2002 red flag # 8 – The

customer has difficulty describing the nature of his or her business or

lacks general knowledge of his or her industry.)

]. The customer has no discernable reason for using the firmʼs service or the

firmʼs location (e.g., the customer lacks roots to the local community or

has gone out of his or her way to use the firm).

i. The customer has been rejected or has had its relationship terminated as

a customer by other financial services firms.

j. The customerʼs legal or mailing address is associated with multiple other

accounts or businesses that do not appear related.

k. The customer appears to be acting as an agent for an undisclosed

principal, but is reluctant to provide information. (2002 red flag # 7 – The

customer appears to be acting as an agent for an undisclosed principal,

but declines or is reluctant, without legitimate commercial reasons, to

provide information or is otherwise evasive regarding that person or

entity.)

Ul. The customer is a trust, shell company or private investment company

that is reluctant to provide information on controlling parties and

underlying beneficiaries.

UU. The customer is publicly known or known to the firm to have criminal, civil

or regulatory proceedings against him or her for crime, corruption or

misuse of public funds, or is known to associate with such persons.

Sources for this information could include news items, the Internet or

commercial database searches. (2002 red flag #5 – The customer (or a

person publicly associated with the customer) has a questionable

background or is the subject of news reports indicating possible

criminal, civil, or regulatory violations.)

UX. The customerʼs background is questionable or differs from expectations

based on business activities.

UY. The customer maintains multiple accounts, or maintains accounts in the

names of family members or corporate entities, with no apparent business

or other purpose. (2002 red flag # 11 – For no apparent reason, the

customer has multiple accounts under a single name or multiple names,

with a large number of inter-account or third-party transfers. Also 2002

red flag #24 – The customer maintains multiple accounts, or maintains

accounts in the names of family members or corporate entities, for no

apparent business purpose or other purpose.)

UZ. An account is opened by a politically exposed person (PEP), particularly in

conjunction with one or more additional risk factors, such as the account

being opened by a shell company beneficially owned or controlled by the

PEP, the PEP is from a country which has been identified by FATF as

having strategic AML regime deficiencies, or the PEP is from a country

known to have a high level of corruption. (similar to 2002 red flag # 12 –

The customer is from, or has accounts in, a country identified as a non-

cooperative country or territory by the Financial Action Task Force

(FATF).)

U[. An account is opened by a non-profit organization that provides services

in geographic locations known to be at higher risk for being an active

terrorist threat.

U]. An account is opened in the name of a legal entity that is involved in the

activities of an association, organization or foundation whose aims are

related to the claims or demands of a known terrorist entity.

Ui. An account is opened for a purported stock loan company, which may

hold the restricted securities of corporate insiders who have pledged the

securities as collateral for, and then defaulted on, purported loans, after

which the securities are sold on an unregistered basis.

Uj. An account is opened in the name of a foreign financial institution, such

as an offshore bank or broker-dealer, that sells shares of stock on an

unregistered basis on behalf of customers.

Uk. An account is opened for a foreign financial institution that is affiliated

with a U.S. broker-dealer, bypassing its U.S. affiliate, for no apparent

business purpose. An apparent business purpose could include access to

products or services the U.S. affiliate does not provide.

II. Potential Red Flags in Deposits of Securities

U. A customer opens a new account and deposits physical certificates, or

delivers in shares electronically, representing a large block of thinly traded

or low-priced securities.

X. A customer has a pattern of depositing physical share certificates, or a

pattern of delivering in shares electronically, immediately selling the

shares and then wiring, or otherwise transferring out the proceeds of the

sale(s).

Y. A customer deposits into an account physical share certificates or

electronically deposits or transfers shares that:

were recently issued or represent a large percentage of the float for

the security;

reference a company or customer name that has been changed or

that does not match the name on the account;

were issued by a shell company;

were issued by a company that has no apparent business, revenues

or products;

were issued by a company whose SEC filings are not current, are

incomplete, or nonexistent;

were issued by a company that has been through several recent

name changes or business combinations or recapitalizations;

were issued by a company that has been the subject of a prior

trading suspension; or

were issued by a company whose officers or insiders have a history

of regulatory or criminal violations, or are associated with multiple

low-priced stock issuers.

Z. The lack of a restrictive legend on deposited shares seems inconsistent

with the date the customer acquired the securities, the nature of the

transaction in which the securities were acquired, the history of the stock

or the volume of shares trading.

[. A customer with limited or no other assets at the firm receives an

electronic transfer or journal transfer of large amounts of low-priced, non-

exchange-listed securities.

]. The customerʼs explanation or documents purporting to evidence how

the customer acquired the shares does not make sense or changes upon

questioning by the firm or other parties. Such documents could include

questionable legal opinions or securities purchase agreements.

i. The customer deposits physical securities or delivers in shares

electronically, and within a short time-frame, requests to journal the

shares into multiple accounts that do not appear to be related, or to sell or

otherwise transfer ownership of the shares.

j. Seemingly unrelated clients open accounts on or at about the same time,

deposit the same low-priced security and subsequently liquidate the

security in a manner that suggests coordination.

III. Potential Red Flags in Securities Trading

U. The customer, for no apparent reason or in conjunction with other “red

flags,” engages in transactions involving certain types of securities, such

as penny stocks, Regulation “S” stocks and bearer bonds, which although

legitimate, have been used in connection with fraudulent schemes and

money laundering activity. (Such transactions may warrant further due

diligence to ensure the legitimacy of the customerʼs activity.) (2002 red

flag # 22 – The customer, for no apparent reason or in conjunction with

other “red flags,” engages in transactions involving certain types of

securities, such as penny stocks, Regulation “S” (Reg S) stocks, and

bearer bonds, which although legitimate, have been used in connection

with fraudulent schemes and money laundering activity. (Such

transactions may warrant further due diligence to ensure the legitimacy

of the customer’s activity.)).

X. There is a sudden spike in investor demand for, coupled with a rising price

in, a thinly traded or low-priced security.

Y. The customerʼs activity represents a significant proportion of the daily

trading volume in a thinly traded or low-priced security.

Z. A customer buys and sells securities with no discernable purpose or

circumstances that appear unusual. (2002 red flag #2 – The customer

wishes to engage in transactions that lack business sense or apparent

investment strategy, or are inconsistent with the customer’s stated

business strategy.)

[. Individuals known throughout the industry to be stock promoters sell

securities through the broker-dealer.

]. A customer accumulates stock in small increments throughout the trading

day to increase price.

i. A customer engages in pre-arranged or other non-competitive securities

trading, including wash or cross trades, with no apparent business

purpose.

j. A customer attempts to influence the closing price of a stock by

executing purchase or sale orders at or near the close of the market.

k. A customer engages in transactions suspected to be associated with

cyber breaches of customer accounts, including potentially unauthorized

disbursements of funds or trades.

Ul. A customer engages in a frequent pattern of placing orders on one side of

the market, usually inside the existing National Best Bid or Offer (NBBO),

followed by the customer entering orders on the other side of the market

that execute against other market participants that joined the market at

the improved NBBO (activity indicative of “spoofing”).

UU. A customer engages in a frequent pattern of placing multiple limit orders

on one side of the market at various price levels, followed by the customer

entering orders on the opposite side of the market that are executed and

the customer cancelling the original limit orders (activity indicative of

“layering”).

UX. Two or more unrelated customer accounts at the firm trade an illiquid or

low priced security suddenly and simultaneously.

UY. The customer makes a large purchase or sale of a security, or option on a

security, shortly before news or a significant announcement is issued that

affects the price of the security.

UZ. The customer is known to have friends or family who work at or for the

securities issuer, which may be a red flag for potential insider trading or

unlawful sales of unregistered securities.

U[. The customerʼs purchase of a security does not correspond to the

customerʼs investment profile or history of transactions (e.g., the

customer may never have invested in equity securities or may have never

invested in a given industry, but does so at an opportune time) and there

is no reasonable explanation for the change.

U]. The account is using a master/sub structure, which enables trading

anonymity with respect to the sub-accountsʼ activity, and engages in

trading activity that raises red flags, such as the liquidation of microcap

issuers or potentially manipulative trading activity.

Ui. The firm receives regulatory inquiries or grand jury or other subpoenas

concerning the firmʼs customersʼ trading.

Uj. The customer engages in a pattern of transactions in securities indicating

the customer is using securities to engage in currency conversion. For

example, the customer delivers in and subsequently liquidates American

Depository Receipts (ADRs) or dual currency bonds for U.S. dollar

proceeds, where the securities were originally purchased in a different

currency.

Uk. The customer engages in mirror trades or transactions involving

securities used for currency conversions, potentially through the use of

offsetting trades.

Xl. The customer appears to buy or sell securities based on advanced

knowledge of pending customer orders.

IV. Potential Red Flags in Money Movements

U. The customer attempts or makes frequent or large deposits of currency,

insists on dealing only in cash equivalents, or asks for exemptions from

the firmʼs policies and procedures relating to the deposit of cash and cash

equivalents. (2002 red flag # 9 – The customer attempts to make

frequent or large deposits of currency, insists on dealing only in cash

equivalents, or asks for exemptions from the firm’s policies relating to

the deposit of cash and cash equivalents.)

X. The customer “structures” deposits, withdrawals or purchases of

monetary instruments below a certain amount to avoid reporting or

recordkeeping requirements, and may state directly that they are trying to

avoid triggering a reporting obligation or to evade taxing authorities.

(2002 red flag # 10 – The customer engages in transactions involving

cash or cash equivalents or other monetary instruments that appear to

be structured to avoid the $10,000 government reporting requirements,

especially if the cash or monetary instruments are in an amount just

below reporting or recording thresholds.)

Y. The customer seemingly breaks funds transfers into smaller transfers to

avoid raising attention to a larger funds transfer. The smaller funds

transfers do not appear to be based on payroll cycles, retirement needs,

or other legitimate regular deposit and withdrawal strategies.

Z. The customerʼs account shows numerous currency, money order

(particularly sequentially numbered money orders) or cashierʼs check

transactions aggregating to significant sums without any apparent

business or lawful purpose. (2002 red flag # 14 – The customer’s

account shows numerous currency or cashiers check transactions

aggregating to significant sums.)

[. The customer frequently changes bank account details or information for

redemption proceeds, in particular when followed by redemption

requests.

]. The customer makes a funds deposit followed by an immediate request

that the money be wired out or transferred to a third party, or to another

firm, without any apparent business purpose. (2002 red flag # 18 – The

customer makes a funds deposit followed by an immediate request that

the money be wired out or transferred to a third party, or to another firm,

without any apparent business purpose.)

i. Wire transfers are made in small amounts in an apparent effort to avoid

triggering identification or reporting requirements. (this is similar to 2002

red flag # 21 – The customer requests that a transaction be processed

in such a manner to avoid the firm’s normal documentation

requirements.)

j. Incoming payments are made by third-party checks or checks with

multiple endorsements.

k. Outgoing checks to third parties coincide with, or are close in time to,

incoming checks from other third parties.

Ul. Payments are made by third party check or money transfer from a source

that has no apparent connection to the customer.

UU. Wire transfers are made to or from financial secrecy havens, tax havens,

high risk geographic locations or conflict zones, including those with an

established presence of terrorism. (2002 red flag #16 – The customer’s

account has wire transfers that have no apparent business purpose to or

from a country identified as a money laundering risk or a bank secrecy

haven.)

UX. Wire transfers originate from jurisdictions that have been highlighted in

relation to black market peso exchange activities.

UY. The customer engages in transactions involving foreign currency

exchanges that are followed within a short time by wire transfers to

locations of specific concern (e.g., countries designated by national

authorities, such as FATF, as non-cooperative countries and territories).

UZ. The parties to the transaction (e.g., originator or beneficiary) are from

countries that are known to support terrorist activities and organizations.

U[. Wire transfers or payments are made to or from unrelated third parties

(foreign or domestic), or where the name or account number of the

beneficiary or remitter has not been supplied. (2002 red flag # 15 – The

customer’s account has a large number of wire transfers to unrelated

third parties inconsistent with the customer’s legitimate business

purpose.)

U]. There is wire transfer activity that is unexplained, repetitive, unusually

large, shows unusual patterns or has no apparent business purpose.

Ui. The securities account is used for payments or outgoing wire transfers

with little or no securities activities (i.e., account appears to be used as a

depository account or a conduit for transfers, which may be purported to

be for business operating needs). (similar to 2002 red flag # 23 – The

customer’s account shows an unexplained high level of account activity

with very low levels of securities transactions.).

Uj. Funds are transferred to financial or depository institutions other than

those from which the funds were initially received, specifically when

different countries are involved.

Uk. The customer engages in excessive journal entries of funds between

related or unrelated accounts without any apparent business purpose.

(2002 red flag #20 – The customer engages in excessive journal entries

between unrelated accounts without any apparent business purpose.)

Xl. The customer uses a personal/individual account for business purposes

or vice versa.

XU. A foreign import business with U.S. accounts receives payments from

outside the area of its customer base.

XX. There are frequent transactions involving round or whole dollar amounts

purported to involve payments for goods or services.

XY. Upon request, a customer is unable or unwilling to produce appropriate

documentation (e.g., invoices) to support a transaction, or documentation

appears doctored or fake (e.g., documents contain significant

discrepancies between the descriptions on the transport document or bill

of lading, the invoice, or other documents such as the certificate of origin

or packing list).

XZ. The customer requests that certain payments be routed through nostro or

correspondent accounts held by the financial intermediary instead of its

own accounts, for no apparent business purpose.

X[. Funds are transferred into an account and are subsequently transferred

out of the account in the same or nearly the same amounts, especially

when the origin and destination locations are high-risk jurisdictions.

X]. A dormant account suddenly becomes active without a plausible

explanation (e.g., large deposits that are suddenly wired out). (similar to

2002 red flag # 13 – The customer’s account has unexplained or

sudden extensive wire activity, especially in accounts that had little or no

previous activity.)

Xi. Nonprofit or charitable organizations engage in financial transactions for

which there appears to be no logical economic purpose or in which there

appears to be no link between the stated activity of the organization and

the other parties in the transaction.

Xj. There is unusually frequent domestic and international automated teller

machine (ATM) activity.

Xk. A person customarily uses the ATM to make several deposits into a

brokerage account below a specified BSA/AML reporting threshold.

Yl. Many small, incoming wire transfers or deposits are made using checks

and money orders that are almost immediately withdrawn or wired out in a

manner inconsistent with the customerʼs business or history; the checks

or money orders may reference in a memo section “investment” or “for

purchase of stock.” This may be an indicator of a Ponzi scheme or

potential funneling activity. (2002 red flag # 17. The customer’s account

indicates large or frequent wire transfers, immediately withdrawn by

check or debit card without any apparent business purpose.)

YU. Wire transfer activity, when viewed over a period of time, reveals

suspicious or unusual patterns, which could include round dollar,

repetitive transactions or circuitous money movements.

V. Potential Red Flags in Insurance Products

U. The customer cancels an insurance contract and directs that the funds be

sent to a third party.

X. The customer deposits an insurance annuity check from a cancelled

policy and immediately requests a withdrawal or transfer of funds.

Y. The customer cancels an annuity product within the free-look period. This

could be a red flag if accompanied with suspicious indicators, such as

purchasing the annuity with several sequentially numbered money orders

or having a history of cancelling annuity products during the free-look

period.

Z. The customer opens and closes accounts with one insurance company,

then reopens a new account shortly thereafter with the same insurance

company, each time with new ownership information.

[. The customer purchases an insurance product with no concern for the

investment objective or performance.

VI. Other Potential Red Flags

U. The customer is reluctant to provide information needed to file reports to

proceed with the transaction.

X. The customer exhibits unusual concern with the firmʼs compliance with

government reporting requirements and the firmʼs AML policies. (similar

to part of 2002 red flag #1 – The customer exhibits unusual concern

regarding the firm’s compliance with government reporting

requirements and the firm’s AML policies, particularly with respect to his

or her identity, type of business and assets, or is reluctant or refuses to

reveal any information concerning business activities, or furnishes

unusual or suspect identification or business documents.)

Y. The customer tries to persuade an employee not to file required reports or

not to maintain the required records.

Z. Notifications received from the broker-dealerʼs clearing firm that the

clearing firm had identified potentially suspicious activity in customer

accounts. Such notifications can take the form of alerts or other concern

regarding negative news, money movements or activity involving certain

securities.

[. Law enforcement has issued subpoenas or freeze letters regarding a

customer or account at the securities firm.

]. The customer makes high-value transactions not commensurate with the

customerʼs known income or financial resources. (2002 red flag #25 –

The customer’s account has inflows of funds or other assets well

beyond the known income or resources of the customer.)

i. The customer wishes to engage in transactions that lack business sense

or an apparent investment strategy, or are inconsistent with the

customerʼs stated business strategy.

j. The stated business, occupation or financial resources of the customer

are not commensurate with the type or level of activity of the customer.

k. The customer engages in transactions that show the customer is acting

on behalf of third parties with no apparent business or lawful purpose.

Ul. The customer engages in transactions that show a sudden change

inconsistent with normal activities of the customer.

UU. Securities transactions are unwound before maturity, absent volatile

market conditions or other logical or apparent reason. (similar to 2002

red flag # 19 – The customer makes a funds deposit for the purpose of

purchasing a long-term investment followed shortly thereafter by a

request to liquidate the position and transfer of the proceeds out of the

account.)

UX. The customer does not exhibit a concern with the cost of the transaction

or fees (e.g., surrender fees, or higher than necessary commissions).

(2002 red flag # 6 – The customer exhibits a lack of concern regarding

risks, commissions, or other transaction costs.)

UY. A borrower defaults on a cash-secured loan or any loan that is secured by

assets that are readily convertible into currency.

UZ. There is an unusual use of trust funds in business transactions or other

financial activity.

You might also like

- AML Red Flag IndicatorsDocument7 pagesAML Red Flag Indicators9840665940No ratings yet

- Red Flag OverviewDocument4 pagesRed Flag Overview9840665940No ratings yet

- AML Refresher COCDocument3 pagesAML Refresher COCakshay kasanaNo ratings yet

- LBA:MNLA Regulations and Red FlagsDocument5 pagesLBA:MNLA Regulations and Red Flagspascalg19No ratings yet

- Explanatory Note - Money LaunderingDocument3 pagesExplanatory Note - Money LaunderingJayson SelgaNo ratings yet

- Anti Money LaunderingDocument6 pagesAnti Money LaunderingAbin Issac John RCBSNo ratings yet

- KYC QuestionsDocument11 pagesKYC QuestionshariNo ratings yet

- Assurance and Attestation CheatsheetDocument4 pagesAssurance and Attestation CheatsheetrachmmmNo ratings yet

- Financial Monitoring UnitDocument5 pagesFinancial Monitoring UnitRabab RazaNo ratings yet

- Aml KycDocument5 pagesAml KycRaja MumtazaliNo ratings yet

- Red Flags For Transactions Suspected To Involve Money Laundering or Terrorism Financing (Life Insurance Enterprises)Document2 pagesRed Flags For Transactions Suspected To Involve Money Laundering or Terrorism Financing (Life Insurance Enterprises)Maryjane IsabedraNo ratings yet

- Zerodha PMLA PolicyDocument8 pagesZerodha PMLA PolicyAbhimanyu Yashwant AltekarNo ratings yet

- Pmla-Red FlagDocument5 pagesPmla-Red FlaganupNo ratings yet

- Retail KycDocument11 pagesRetail KycTwinkle SuriNo ratings yet

- Client Due Diligence Factsheet 0621Document4 pagesClient Due Diligence Factsheet 0621Robinson JeybarajNo ratings yet

- CTPAT's Warning Indicators July 25, 2018Document7 pagesCTPAT's Warning Indicators July 25, 2018EDUARDO HERNANDEZNo ratings yet

- Kyc - Guidelines - Ihfl9 6 15 0408232001552896472Document9 pagesKyc - Guidelines - Ihfl9 6 15 0408232001552896472Chinmay PawarNo ratings yet

- DPMS AML TrainingDocument66 pagesDPMS AML TrainingEmilioNo ratings yet

- Indicators of Suspicious TransactionsDocument3 pagesIndicators of Suspicious TransactionsArtūras CimbalistasNo ratings yet

- Kyc PPT CompleteDocument23 pagesKyc PPT CompleteNitin ChateNo ratings yet

- Anti Money Laundering PolicyDocument8 pagesAnti Money Laundering PolicysonilaNo ratings yet

- Prevention of Money Laundering PolicyDocument35 pagesPrevention of Money Laundering PolicyAkashNo ratings yet

- IAB Example Anti-Money Laundering (AML) Policy StatementDocument6 pagesIAB Example Anti-Money Laundering (AML) Policy Statementwilliamhancharek100% (2)

- Customer Verification FormDocument2 pagesCustomer Verification FormDarko SvetozarevskiNo ratings yet

- Banking Services IDocument10 pagesBanking Services ICHANDNI AGARWALNo ratings yet

- Financial Monitoring Unit - Circular 2Document4 pagesFinancial Monitoring Unit - Circular 2Sabih QureshiNo ratings yet

- SCM Company Account ApplicationDocument48 pagesSCM Company Account ApplicationjamesmcbrydeNo ratings yet

- Anti Money Laundering Policy: BackgroundDocument8 pagesAnti Money Laundering Policy: BackgroundalkasecuritiesNo ratings yet

- Anti Money Laundering Act AMLA and Know Your Customer KYCDocument23 pagesAnti Money Laundering Act AMLA and Know Your Customer KYCsherra mae monteroNo ratings yet

- Module 08: Suspicious Conduct and TransactionsDocument4 pagesModule 08: Suspicious Conduct and TransactionsFrancisco Javier BasantaNo ratings yet

- KYC and AML PolicyDocument21 pagesKYC and AML PolicySakshiNo ratings yet

- Anti Money Laundering PolicyDocument45 pagesAnti Money Laundering PolicyAkash100% (1)

- Chapter 5Document10 pagesChapter 5Rupesh SinghNo ratings yet

- Examples of Using The Techniques in Recent YearsDocument26 pagesExamples of Using The Techniques in Recent Yearsjohnson leeNo ratings yet

- Financial Statements Fraud Cases and TheoryDocument25 pagesFinancial Statements Fraud Cases and TheoryCoster Itayi MukushaNo ratings yet

- All About AML CFT Q&ADocument7 pagesAll About AML CFT Q&AkhrathaNo ratings yet

- Lecture 3 B - Errors and FraudsDocument14 pagesLecture 3 B - Errors and FraudsalooyxvNo ratings yet

- Best Practice Code FinalDocument111 pagesBest Practice Code FinalUmer SafdarNo ratings yet

- Kyc Exam TipsDocument9 pagesKyc Exam TipsVijaya ShanthiNo ratings yet

- Kyc & AmlDocument43 pagesKyc & AmlBabli PattanaikNo ratings yet

- AML Red FlagsDocument2 pagesAML Red Flagsakshay kasanaNo ratings yet

- Red Flags 26 ExamplesDocument3 pagesRed Flags 26 ExamplesRoselyn PamaNo ratings yet

- Anti-Money Laundering Law NotesDocument9 pagesAnti-Money Laundering Law NotesWinna Yu OroncilloNo ratings yet

- NFIU Suspicious Transaction ReportsDocument30 pagesNFIU Suspicious Transaction ReportsDJNiyiNo ratings yet

- Anti Money Laundering Policy: Legal DocumentationDocument5 pagesAnti Money Laundering Policy: Legal DocumentationKhalifa SamuelNo ratings yet

- Circular Re Nominees and Warehousing (2018.10.09)Document5 pagesCircular Re Nominees and Warehousing (2018.10.09)Sancho HoNo ratings yet

- Anti Money LaunderingDocument41 pagesAnti Money LaunderingGagan GoelNo ratings yet

- Wsa - Services AgendaDocument6 pagesWsa - Services AgendaDawiyd InnitNo ratings yet

- Kyc Aml QnaDocument3 pagesKyc Aml QnaThe CSMTNo ratings yet

- Know Your Customer Quick Reference GuideDocument2 pagesKnow Your Customer Quick Reference GuideChiranjib ParialNo ratings yet

- KYC and AML PolicyDocument15 pagesKYC and AML PolicyJoydeep ChatterjeeNo ratings yet

- Anti Money Laundering PolicyDocument8 pagesAnti Money Laundering PolicySumeetNo ratings yet

- Anti-Money Laundering Act BackgroundDocument45 pagesAnti-Money Laundering Act BackgroundKeith Joshua GabiasonNo ratings yet

- Anti-Money Laundering and Counter Terrorism Financing Policies Scope of The PolicyDocument3 pagesAnti-Money Laundering and Counter Terrorism Financing Policies Scope of The PolicyMaricarmen Martinez.santanaNo ratings yet

- Privacy Policy 2020Document2 pagesPrivacy Policy 2020FadiNo ratings yet

- CMASTR GuidanceNote Version 1Document5 pagesCMASTR GuidanceNote Version 1Sematimba AndrewNo ratings yet

- Ghid KycDocument8 pagesGhid KycAdina LazarNo ratings yet

- Fidelity ClauseDocument2 pagesFidelity ClauseSandeep BediNo ratings yet

- Alpari Limited AmlDocument7 pagesAlpari Limited AmlFlavianaAbreuNo ratings yet

- B3 - Retail Crowding and Consumer Decision MakingDocument2 pagesB3 - Retail Crowding and Consumer Decision MakingSubrahmanyam SiriNo ratings yet

- Legal Persons Misuse Typologies and Best PracticeDocument47 pagesLegal Persons Misuse Typologies and Best PracticeSubrahmanyam SiriNo ratings yet

- Supply Chain Management: Goa Institute of Management-GoaDocument1 pageSupply Chain Management: Goa Institute of Management-GoaSubrahmanyam SiriNo ratings yet

- Cumberland Metal IndustriesDocument2 pagesCumberland Metal IndustrieskakriakartikNo ratings yet

- Goa Institute of Management: Research MethodsDocument4 pagesGoa Institute of Management: Research MethodsSubrahmanyam SiriNo ratings yet

- Virtual Assets Red Flag IndicatorsDocument24 pagesVirtual Assets Red Flag IndicatorsSubrahmanyam SiriNo ratings yet

- Private Banking Subsector RiskAssessmentDocument52 pagesPrivate Banking Subsector RiskAssessmentSubrahmanyam SiriNo ratings yet

- Dd/Mm/Yyyy:: Work Experience (If Applicable) - Please Do List All OrganisationsDocument4 pagesDd/Mm/Yyyy:: Work Experience (If Applicable) - Please Do List All OrganisationsPanini KNo ratings yet

- Transaction LaunderingDocument12 pagesTransaction LaunderingKunwarbir Singh lohatNo ratings yet

- Clustering - IntroDocument13 pagesClustering - IntroSubrahmanyam SiriNo ratings yet

- Axis Bank ABLe 2021Document12 pagesAxis Bank ABLe 2021Shashwat ShrivastavaNo ratings yet

- Dd/Mm/Yyyy:: Work Experience (If Applicable) - Please Do List All OrganisationsDocument4 pagesDd/Mm/Yyyy:: Work Experience (If Applicable) - Please Do List All OrganisationsPanini KNo ratings yet

- What Is Strategy - Slide ShareDocument19 pagesWhat Is Strategy - Slide ShareNandula SubrahmanyamNo ratings yet

- JD Supply Chain Head 2Document2 pagesJD Supply Chain Head 2Subrahmanyam SiriNo ratings yet

- Chapter 01 Strategic Management and CompetitivenessDocument26 pagesChapter 01 Strategic Management and CompetitivenessSubrahmanyam SiriNo ratings yet

- Guide To Franchising: Kamats-Original Family Veg Restaurant, Mittal Estate, Andheri East Mumbai 400059Document48 pagesGuide To Franchising: Kamats-Original Family Veg Restaurant, Mittal Estate, Andheri East Mumbai 400059Subrahmanyam SiriNo ratings yet

- Bharti AXA JD - HRDocument4 pagesBharti AXA JD - HRSubrahmanyam SiriNo ratings yet

- Big Data Analytics in Life Insurance PDFDocument20 pagesBig Data Analytics in Life Insurance PDFSubrahmanyam SiriNo ratings yet

- Home Loan EMI Calculator Amortization ScheduleDocument4 pagesHome Loan EMI Calculator Amortization ScheduleSubrahmanyam SiriNo ratings yet

- Introduction To Big DataDocument11 pagesIntroduction To Big DatamokeNo ratings yet

- The Importance of Big Data Analytics in Business: A Case StudyDocument6 pagesThe Importance of Big Data Analytics in Business: A Case StudySubrahmanyam SiriNo ratings yet

- Digital Disruption: Embrace The Future of Work and Your People Will Embrace It With YouDocument12 pagesDigital Disruption: Embrace The Future of Work and Your People Will Embrace It With YouSubrahmanyam SiriNo ratings yet

- Case Study - PRDocument7 pagesCase Study - PRSubrahmanyam SiriNo ratings yet

- FDI and Eco GrowthDocument18 pagesFDI and Eco GrowthFernandes RudolfNo ratings yet

- Classic Pen Company - SolutionDocument1 pageClassic Pen Company - SolutionSubrahmanyam SiriNo ratings yet

- Marketing DossierDocument38 pagesMarketing DossierTigran WadiaNo ratings yet

- DeleteDocument1 pageDeleteSubrahmanyam SiriNo ratings yet

- ASDxcDocument1 pageASDxcSubrahmanyam SiriNo ratings yet

- 31 Usc 5312 We Are A Financial InstitutionDocument3 pages31 Usc 5312 We Are A Financial InstitutionMichael Focia100% (1)

- Revision Banking QDocument15 pagesRevision Banking QThảo Hương PhạmNo ratings yet

- Annex 18Document8 pagesAnnex 18Barangay TaguiticNo ratings yet

- Your Adv Safebalance Banking: Account SummaryDocument4 pagesYour Adv Safebalance Banking: Account SummaryvanminNo ratings yet

- Project Report On Online BankingDocument24 pagesProject Report On Online BankingDrSanjeev K Chaudhary100% (3)

- Philippine Education V Mauricio SorianoDocument1 pagePhilippine Education V Mauricio SorianoMaureen CoNo ratings yet

- Activity 1.2Document5 pagesActivity 1.2RITIKANo ratings yet

- IBRDDocument12 pagesIBRDNarender Saini100% (1)

- 300 Mcqs For Sbi RRB MainsDocument307 pages300 Mcqs For Sbi RRB MainsChirag MahaduleNo ratings yet

- Gujarat Technological University: InstructionsDocument1 pageGujarat Technological University: InstructionsHansa PrajapatiNo ratings yet

- AnnuityDocument10 pagesAnnuityJiru Kun0% (1)

- Principles and Practices of Banking: Study of Wholesale Banking Products & Services of CSB BankDocument9 pagesPrinciples and Practices of Banking: Study of Wholesale Banking Products & Services of CSB BankPrateek VermaNo ratings yet

- VerkoopFactuur SI200268 PDFDocument1 pageVerkoopFactuur SI200268 PDFMohd NazriNo ratings yet

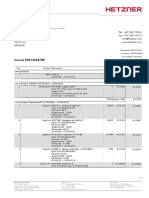

- Hetzner 2021-06-22 R0013604788Document2 pagesHetzner 2021-06-22 R0013604788Vitaliy PodobaNo ratings yet

- Key Fact Statement and MITCDocument23 pagesKey Fact Statement and MITCSumeet ShelarNo ratings yet

- Ch-29 Monetary SystemDocument13 pagesCh-29 Monetary SystemSnehal BhattNo ratings yet

- Saqib Ahmad MirDocument18 pagesSaqib Ahmad Mirsaqib mirNo ratings yet

- SCC - 0H34 - D8R - Cva PM 5000 HoursDocument4 pagesSCC - 0H34 - D8R - Cva PM 5000 HoursArifNo ratings yet

- BP-Ipoh 17feb2018 at 10.30pmDocument1 pageBP-Ipoh 17feb2018 at 10.30pmZhess BugNo ratings yet

- CCM Form PDFDocument8 pagesCCM Form PDFSenthilKumar kanagarajanNo ratings yet

- Module 7.2Document23 pagesModule 7.2Yen AllejeNo ratings yet

- Sberbank Rossii: Account StatementDocument3 pagesSberbank Rossii: Account StatementALEX PEREVERZEWNo ratings yet

- Module 5 Managing Liabilities: Types of DepositDocument9 pagesModule 5 Managing Liabilities: Types of DepositAnna-Clara MansolahtiNo ratings yet

- BDO Unibank, Inc. (Bangco de Oro)Document2 pagesBDO Unibank, Inc. (Bangco de Oro)Bevegel Sasan LlidoNo ratings yet

- Bangladesh Bank ............................, Office. Eft Mandate FormDocument2 pagesBangladesh Bank ............................, Office. Eft Mandate FormRashedShahriarRushoNo ratings yet

- FINAL Second Quarter Final Report 2024Document76 pagesFINAL Second Quarter Final Report 2024selamalex737No ratings yet

- Debt Collector Disclosure Statement For Credit Card Same As One For PDFDocument6 pagesDebt Collector Disclosure Statement For Credit Card Same As One For PDFMichael Plaster100% (4)

- IndiaBanks GoldilocksWithAMinorBump20230310 PDFDocument26 pagesIndiaBanks GoldilocksWithAMinorBump20230310 PDFchaingangriteshNo ratings yet

- Banking Operations - Questions and Answers For Bank RecruitmentDocument6 pagesBanking Operations - Questions and Answers For Bank RecruitmentRahul D'abreoNo ratings yet

- Currency News Apr 10Document12 pagesCurrency News Apr 10Laura Catalina CastañedaNo ratings yet