Professional Documents

Culture Documents

Taxes Payable - Personal: Summary of Federal Tax Calculation Special Calculations

Uploaded by

arianxxxOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

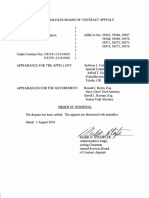

Taxes Payable - Personal: Summary of Federal Tax Calculation Special Calculations

Uploaded by

arianxxxCopyright:

Available Formats

eBook Summary – Chapter 19

Taxes Payable – Personal

Definition Summary of federal tax calculation Special calculations

Marginal tax rate: Total federal income tax on taxable income $xxx Special calculations for:

tax rate that is payable on an Subtract Non-refundable tax credits xxx Medical expenses

-

additional dollar of income. Federal dividend tax credit - xxx Donation tax credit

Non-refundable tax credits: Basic federal tax $xxx Dividend tax credit

direct reduction of tax Subtract Federal foreign tax credit - xxx Foreign business and non-

payable; cannot be carried Federal political tax credit - xxx business income tax credit

forward if not used in the year. Other federal tax credits - xxx Political contribution tax credit

Federal tax before OAS clawback or other $xxx

Refundable tax credits: repayment

direct reduction of tax Add OAS clawback + xxx

payable; if tax payable is nil, EI repayment + xxx

any leftover credit is refunded. CPP payable on self-employment earnings xxx

+

Total federal tax $xxx

Common non-refundable credits

CPP/QPP if amount paid

Basic — all individuals EI — if amount paid Home accessibility — if >65 and

Age — if age 65 prior to end of Canada employment — if eligible for disability credit

taxation year earning employment income Home buyers’ amount — if

Spousal — if supports spouse or Disability — impairment acquire a qualifying home

common law partner restricting basic activity of daily Pension — if >65 and have

Eligible dependant — if not living eligible pension

entitled to spousal but supports Adoption — if adopt a child Interest on student loans — if

an eligible dependent Medical — for expenses of self, amount paid, no max

Canada caregiver — if spouse and children <18 Tuition — if eligible tuition

supporting an infirm adult relative Medical expenses of other

CPP/QPP if amount paid dependents

EI – if amount paid

Canada Employment – if earning

© 2019 Chartered Professional Accountants of Canada

employment income

Disability – impairment restricting

You might also like

- Tax Free Retirement WebinarDocument28 pagesTax Free Retirement Webinarphillies1111No ratings yet

- Icc OpinionsDocument19 pagesIcc OpinionsJhoo AngelNo ratings yet

- Bentham Anarchical Fallacies SummaryDocument3 pagesBentham Anarchical Fallacies SummaryYing Han100% (3)

- Chapter 5Document26 pagesChapter 5Reese Parker33% (3)

- Hawkeye 360 Commercialising Space-Based Precision RF Detection and AnalyticsDocument13 pagesHawkeye 360 Commercialising Space-Based Precision RF Detection and AnalyticsCORAL ALONSONo ratings yet

- Becker REG - Chapter 1 OutlineDocument5 pagesBecker REG - Chapter 1 OutlineCassandra TangNo ratings yet

- CH 04Document65 pagesCH 04engarbangarNo ratings yet

- Lecture Slides For Mod C WK 5Document44 pagesLecture Slides For Mod C WK 5hcjycjNo ratings yet

- 16 - Income TaxDocument44 pages16 - Income Taxayushagarwal23No ratings yet

- 17 - Corporation TaxDocument7 pages17 - Corporation Taxayushagarwal23No ratings yet

- Common-Taxes - Income-Tax VAT OPT WT v2Document52 pagesCommon-Taxes - Income-Tax VAT OPT WT v2kayelineNo ratings yet

- Bermuda Taxation & Global Compliance: Scott Stallard Photography Headin' Out For de CatchDocument8 pagesBermuda Taxation & Global Compliance: Scott Stallard Photography Headin' Out For de CatchRG-eviewerNo ratings yet

- AUSTRALIAN TAXATION - Parteng TatloDocument1 pageAUSTRALIAN TAXATION - Parteng TatloVero EntertainmentNo ratings yet

- Filing Status: Family:: Tax Planning Client Data WorksheetDocument3 pagesFiling Status: Family:: Tax Planning Client Data WorksheetkeithNo ratings yet

- Module 4Document9 pagesModule 4Beaumont RiegoNo ratings yet

- CH 20Document50 pagesCH 20engarbangarNo ratings yet

- Chapter 7 - I. Income From Property DefinedDocument4 pagesChapter 7 - I. Income From Property DefinedvashdanqueNo ratings yet

- ACTAX-3153-N002-Intro To Income Taxation PDFDocument5 pagesACTAX-3153-N002-Intro To Income Taxation PDFJwyneth Royce DenolanNo ratings yet

- ItemizedDocument7 pagesItemizedzel100% (1)

- Rent Income: Dividend Income Other IncomeDocument1 pageRent Income: Dividend Income Other IncomeLhorene Hope DueñasNo ratings yet

- Income Tax TheoryDocument28 pagesIncome Tax Theorynextgensolution44No ratings yet

- A. Employment Expenses: 1. Registered PlansDocument2 pagesA. Employment Expenses: 1. Registered PlansAndi RavNo ratings yet

- Topic 12 - Income Tax PlanningDocument32 pagesTopic 12 - Income Tax PlanningArun GhatanNo ratings yet

- Fabm2 q2 Module 4 TaxationDocument17 pagesFabm2 q2 Module 4 TaxationLady HaraNo ratings yet

- Isp 3025aDocument2 pagesIsp 3025aAkhtar AshrafNo ratings yet

- Individual Income TaxDocument12 pagesIndividual Income TaxNica Jane MacapinigNo ratings yet

- Rule:: Revenue From Sales Revenue From ProfessionDocument2 pagesRule:: Revenue From Sales Revenue From Profession在于在No ratings yet

- Lesson 3 - CopopopopopDocument2 pagesLesson 3 - Copopopopop在于在No ratings yet

- Module 09 - Compensation IncomeDocument35 pagesModule 09 - Compensation Incomeairwaller rNo ratings yet

- FABM2 12 Q2 M5 Income and Business Taxation V5 PDFDocument19 pagesFABM2 12 Q2 M5 Income and Business Taxation V5 PDFLady Hara100% (1)

- Overlooked Tax DeductionsDocument4 pagesOverlooked Tax Deductionsskumar1965No ratings yet

- Estimated Taxes: Save $ and Experience The DifferenceDocument2 pagesEstimated Taxes: Save $ and Experience The DifferenceFinn KevinNo ratings yet

- Module 11 Retirement PlanningDocument33 pagesModule 11 Retirement PlanningmohebqasNo ratings yet

- Liftfund Monthly Financial WorksheetDocument4 pagesLiftfund Monthly Financial WorksheetUmair KamranNo ratings yet

- ACCT101 NotesDocument19 pagesACCT101 NotesAngelica RubiosNo ratings yet

- South Western Federal Taxation 2016 Comprehensive 39th Edition Hoffman Solutions ManualDocument33 pagesSouth Western Federal Taxation 2016 Comprehensive 39th Edition Hoffman Solutions Manualngocalmai0236h100% (32)

- South Western Federal Taxation 2016 Comprehensive 39th Edition Hoffman Solutions ManualDocument38 pagesSouth Western Federal Taxation 2016 Comprehensive 39th Edition Hoffman Solutions Manualihlemadonna100% (13)

- Document 1510 4516Document54 pagesDocument 1510 4516rubyhien46tasNo ratings yet

- TaxationDocument5 pagesTaxationHyuga NejiNo ratings yet

- College of Accountancy & Business Administration Taxation I: Santiago City, PhilippinesDocument3 pagesCollege of Accountancy & Business Administration Taxation I: Santiago City, PhilippinesVel JuneNo ratings yet

- Tax Accounting Study GuideDocument4 pagesTax Accounting Study Guides511939No ratings yet

- Economics of TaxationDocument21 pagesEconomics of TaxationNikka DelovergesNo ratings yet

- Approaches To International Compensation: There Are Two Main Options in The Area of International CompensationDocument24 pagesApproaches To International Compensation: There Are Two Main Options in The Area of International CompensationPraveen KumarNo ratings yet

- Byrd and Chens Canadian Tax Principles Canadian 1st Edition Byrd Test Bank 1Document36 pagesByrd and Chens Canadian Tax Principles Canadian 1st Edition Byrd Test Bank 1matthewmannocjqnixymt100% (24)

- 2007 Year-End Tax Planning Considerations: Synergy Financial GroupDocument4 pages2007 Year-End Tax Planning Considerations: Synergy Financial GroupgvandykeNo ratings yet

- Income Tax Return 2021 (Incorporating Med 1) - Form 12S: Your PPS Number (PPSN)Document16 pagesIncome Tax Return 2021 (Incorporating Med 1) - Form 12S: Your PPS Number (PPSN)Manikandan SivakumarNo ratings yet

- Module 4: Income Tax On Individuals - Part 2 Learning Objectives 2. Additional Personal Exemptions (APE)Document14 pagesModule 4: Income Tax On Individuals - Part 2 Learning Objectives 2. Additional Personal Exemptions (APE)Sh1njo SantosNo ratings yet

- Iaet ReviewerDocument2 pagesIaet ReviewerEsperoma ArtNo ratings yet

- Wassim Zhani Federal Taxation For Individuals (Chapter 3)Document20 pagesWassim Zhani Federal Taxation For Individuals (Chapter 3)wassim zhaniNo ratings yet

- 21 Inclusion and Exclusion of GiDocument15 pages21 Inclusion and Exclusion of GiAlmineNo ratings yet

- Regulation MyNotesDocument50 pagesRegulation MyNotesaudalogy100% (1)

- Tax and Pensions: Made EasyDocument10 pagesTax and Pensions: Made Easymails4vipsNo ratings yet

- US Internal Revenue Service: I1040sse - 1997Document3 pagesUS Internal Revenue Service: I1040sse - 1997IRSNo ratings yet

- Chapter 13 REGULAR ALLOWABLE ITEMIZED DEDUCTIONSDocument3 pagesChapter 13 REGULAR ALLOWABLE ITEMIZED DEDUCTIONSAlyssa BerangberangNo ratings yet

- Bench - Self-Employed Tax Organizer ChecklistDocument1 pageBench - Self-Employed Tax Organizer Checklistamy.hartinNo ratings yet

- CPA Regulation Notes Chapter 2 20101001Document11 pagesCPA Regulation Notes Chapter 2 20101001Regulation2010No ratings yet

- 5-Deductions From Gross IncomeDocument7 pages5-Deductions From Gross IncomeMs. ANo ratings yet

- Tax Penalty Fact SheetDocument2 pagesTax Penalty Fact SheetOutboundEngineNo ratings yet

- TIF Problems 11 21 2019 PDFDocument360 pagesTIF Problems 11 21 2019 PDFomar mcintoshNo ratings yet

- RH TrainingDocument10 pagesRH Trainingjoseph borketeyNo ratings yet

- Name: Course: Prepared By: Dr. Jessie N. DiazDocument11 pagesName: Course: Prepared By: Dr. Jessie N. DiazPrince Isaiah JacobNo ratings yet

- Capital Gains and Losses: Ebook Summary - Chapter 12Document1 pageCapital Gains and Losses: Ebook Summary - Chapter 12arianxxxNo ratings yet

- Deferred Income Plans (RRSP, TFSA, RESP) : Comparison RRSP - Special CircumstancesDocument1 pageDeferred Income Plans (RRSP, TFSA, RESP) : Comparison RRSP - Special CircumstancesarianxxxNo ratings yet

- OR0326E TXN Other Deductions Personal SUMDocument1 pageOR0326E TXN Other Deductions Personal SUMarianxxxNo ratings yet

- Real Analysis Is Useful Only For MathematiciansDocument1 pageReal Analysis Is Useful Only For MathematiciansarianxxxNo ratings yet

- The Foreign Policy of Park Chung Hee (1968 - 1979)Document217 pagesThe Foreign Policy of Park Chung Hee (1968 - 1979)Viet NguyenNo ratings yet

- Original For Recipient: Order Number: RDF15750659Document2 pagesOriginal For Recipient: Order Number: RDF15750659Rajat DawraNo ratings yet

- CSF 02aDocument1 pageCSF 02aLuffy11No ratings yet

- C274 Parts Catalog: Need Machine Image For CoverDocument83 pagesC274 Parts Catalog: Need Machine Image For CoverJesimiel GouveiaNo ratings yet

- Pass Amazon AWS Certified Solutions Architect - Associate Certification Exam in First Attempt Guaranteed!Document5 pagesPass Amazon AWS Certified Solutions Architect - Associate Certification Exam in First Attempt Guaranteed!Jan Rey AltivoNo ratings yet

- Elliot Dukke UsDocument7 pagesElliot Dukke UsNguyễn Phan Khánh LinhNo ratings yet

- Chapter-1: Fundamentals of Research A. Meaning and Definition of ResearchDocument29 pagesChapter-1: Fundamentals of Research A. Meaning and Definition of ResearchpunitjiNo ratings yet

- 6.2 Labour Law IIDocument6 pages6.2 Labour Law IIDevvrat garhwalNo ratings yet

- First National Commission On LabourDocument2 pagesFirst National Commission On Labournitish kumar twariNo ratings yet

- Jose Rizal's Martyrdom: Execution: Presented By: Jasmine Kaye RoblesDocument16 pagesJose Rizal's Martyrdom: Execution: Presented By: Jasmine Kaye RoblesJERSIE MANALONo ratings yet

- Worksheet 3-4 P. 2Document1 pageWorksheet 3-4 P. 2briandmcneillNo ratings yet

- Corporate Finance SlidesDocument38 pagesCorporate Finance SlidesHaymaan Rashid DarNo ratings yet

- Repalle MAUD MS298Document6 pagesRepalle MAUD MS298Venkat MacharlaNo ratings yet

- SIP Report Atharva SableDocument68 pagesSIP Report Atharva Sable7s72p3nswtNo ratings yet

- Ch4 Completing The Accounting Cycle ACC101Document9 pagesCh4 Completing The Accounting Cycle ACC101Muhammad KridliNo ratings yet

- Mount Sinai Eye and Ear 2018 FinancialsDocument47 pagesMount Sinai Eye and Ear 2018 FinancialsJonathan LaMantiaNo ratings yet

- 859 - By71h6kcls - Fire - Wordings For Add On Covers ClausesDocument9 pages859 - By71h6kcls - Fire - Wordings For Add On Covers ClausesShivNo ratings yet

- Knowledge Through SixDocument10 pagesKnowledge Through Sixzaki77100% (1)

- Moneymax X Citibank GCash Exclusive Campaign T&CsDocument3 pagesMoneymax X Citibank GCash Exclusive Campaign T&CsProsserfina MinaoNo ratings yet

- Mack The Knife (Arr. Rick Stitzel) - Tenor Sax 1 Sheet Music Bobby Darin Jazz EnsembleDocument1 pageMack The Knife (Arr. Rick Stitzel) - Tenor Sax 1 Sheet Music Bobby Darin Jazz EnsembleAlan MackieNo ratings yet

- Ipa RasaDocument3 pagesIpa RasaText Texts50% (2)

- Bout Verdict: Albert Dayan's Letter To Judge ScheindlinDocument2 pagesBout Verdict: Albert Dayan's Letter To Judge ScheindlinGeorge MappNo ratings yet

- F.miklosich - Chronica NestorisDocument258 pagesF.miklosich - Chronica NestorisДжу ХоNo ratings yet

- Lakeshore Toltest Corporation, A.S.B.C.A. (2016)Document2 pagesLakeshore Toltest Corporation, A.S.B.C.A. (2016)Scribd Government DocsNo ratings yet

- Ancient GreeceDocument26 pagesAncient GreeceGiuseppe De CorsoNo ratings yet

- Safety and Security of Guest and BelongingsDocument7 pagesSafety and Security of Guest and Belongingsstephen rrNo ratings yet

- Rights of The AccusedDocument9 pagesRights of The AccusedVeah CaabayNo ratings yet