Professional Documents

Culture Documents

l1 - Post Test - Job Order Costing

l1 - Post Test - Job Order Costing

Uploaded by

lalalalaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

l1 - Post Test - Job Order Costing

l1 - Post Test - Job Order Costing

Uploaded by

lalalalaCopyright:

Available Formats

L1- POST TEST- JOB ORDER COSTING

1.) a. If overhead is applied on the basis of DLHs, what predetermined OH rate was in effect

during the company’s 2019–2020 fiscal year?

Applied Overhead ₱ 127,680

Divided by: direct labor hours 7,600

Predetermined Overhead Rate ₱ 16.80

b. What was the average direct labor rate per hour?

Direct Labor Costs ₱ 159,600

Divided by: direct labor hours 7,600

Direct labor rate per hour ₱ 21.00

c. What amount of direct material cost was in the beginning balance of WIP Inventory?

Work in Process Inventory, beginning balance ₱ 916,650

Less: Direct labor cost contained in WIP Inventory, beg.

Direct labor hours 15,200

Multiplied by direct labor rate 21 (319,200)

Direct material cost in beginning WIP Inventory ₱ 597,450

d. What was the balance in WIP Inventory at the end of January?

Direct Material ₱ 73,250

Direct labor cost : Direct labor hours 2,850

Multiplied by direct labor rate 21 59,850

WIP Inventory, ending ₱ 133,100

e. What was the total cost of jobs manufactured in January?

Beginning WIP Inventory ₱ 916,650

Add: Direct Materials ₱ 589,670

Direct Labor 159,600

Applied Overhead 127,680 ₱ 876,950

Total ₱ 1,793,600

Less: Ending WIP Inventory (133,100)

Total cost of jobs manufactured ₱ 1,660,500

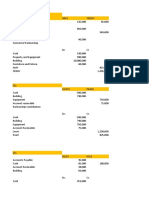

2.) a. What was the total cost of Job #920 as of the end of June 2020?

Direct Material ₱ 2,850

Direct Labor 800

Applied Overhead:

POHR ₱ 17

Multiplied by: DLH (P800/20 per DLH) 40 680

Total cost of Job #920 ₱ 4,330

b. What was the cost of goods manufactured for June 2020?

Beginning WIP Inventory:

Direct material ₱ 8,250

Direct Labor 500

Applied Overhead:

POHR ₱ 17

Multiplied by: DLH 25 425

₱ 9,175

Add: Direct Materials ₱ 21,650

Direct Labor 6,300

Applied Overhead:

POHR ₱ 17

(P6,300/20 per

Multiplied by: DLH DLH)= 315 5,355 ₱ 33,305

Total ₱ 42,480

Less: Ending WIP Inventory (4,330)

Cost of jobs manufactured ₱ 38,150

c. If actual overhead for June was P5,054, was the overhead underapplied or overapplied

for the month? By how much?

Actual overhead ₱ 5,054

Applied overhead (5,355)

Overappliead ₱ 301

3.)

How much is the unadjusted cost of goods sold on the Schedule of Cost of Goods Sold?

Finished Goods Inventory, beginning ₱ 33,000

Cost of goods manufactured:

Work in Process Inventory, beginning ₱ 56,000

Add: Direct material ₱ 23,000

Direct Labor 58,000

Manufacturing overhead applied

to WIP 92,000 173,000

Total manufacturing costs 229,000

Less: Work in Process Inventory, ending (69,000) ₱ 160,000

Goods available for sale ₱ 193,000

Less: Finished Goods Inventory, ending (36,000)

Unadjusted cost of goods sold ₱ 157,000

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Chapter 7aDocument14 pagesChapter 7aKanton Fernandez100% (6)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- On December 1 2015 Athabasca Building Supplies LTD Abs PurchasedDocument1 pageOn December 1 2015 Athabasca Building Supplies LTD Abs PurchasedMiroslav GegoskiNo ratings yet

- #9499Document1 page#9499lalalalaNo ratings yet

- #9498Document1 page#9498lalalalaNo ratings yet

- #9002Document2 pages#9002lalalalaNo ratings yet

- #9004Document1 page#9004lalalalaNo ratings yet

- PRACTICE PROBLEMS in CVP ANALYSIS - Boter - Jesseca - BSA-2CDocument2 pagesPRACTICE PROBLEMS in CVP ANALYSIS - Boter - Jesseca - BSA-2ClalalalaNo ratings yet

- The Credit Approval Process Involves Which of The Following?Document9 pagesThe Credit Approval Process Involves Which of The Following?June KooNo ratings yet

- Inventory ValuationDocument10 pagesInventory ValuationKritika RajNo ratings yet

- PDF Warren SM ch07 FinalDocument26 pagesPDF Warren SM ch07 FinalBerliana MustikasariNo ratings yet

- WDFM Session1Document15 pagesWDFM Session1Lavanya ManojNo ratings yet

- Binder1 Last Final 1Document93 pagesBinder1 Last Final 1Habteweld EdluNo ratings yet

- Determining The Optimal Level of Product AvailabilityDocument74 pagesDetermining The Optimal Level of Product AvailabilitydevendrasinghchavhanNo ratings yet

- Audit of InventoriesDocument2 pagesAudit of InventoriesWawex DavisNo ratings yet

- Homework On Inventories Problem 1 (Borrowing Cost ConceptsDocument3 pagesHomework On Inventories Problem 1 (Borrowing Cost ConceptsJazehl Joy ValdezNo ratings yet

- Seatwork On Global Supply ChainDocument2 pagesSeatwork On Global Supply Chainvenice cambryNo ratings yet

- Reflection PAPER in REO WEBINARDocument4 pagesReflection PAPER in REO WEBINARKyla Joy T. SanchezNo ratings yet

- 6091fd8f6f2df151707cb223 1620184992 Big Picture C Inventory ManagementDocument7 pages6091fd8f6f2df151707cb223 1620184992 Big Picture C Inventory ManagementChi BellaNo ratings yet

- Ridgely Manufacturing Company Production Report Jul-92 Quantity of ProductionDocument3 pagesRidgely Manufacturing Company Production Report Jul-92 Quantity of ProductionJessa BasadreNo ratings yet

- Inventory Control NotesDocument1 pageInventory Control NotesravindranathNo ratings yet

- 2nd Final Project of KS&DLDocument86 pages2nd Final Project of KS&DLamitkumarchaubey167% (3)

- Unit 4Document13 pagesUnit 4fekadegebretsadik478729No ratings yet

- Account For MaterialDocument25 pagesAccount For Materialshrestha.aryxnNo ratings yet

- Week05 PPT 2022 Before ClassDocument98 pagesWeek05 PPT 2022 Before Class罗上宗No ratings yet

- SCM Jattaoi Rice MillDocument2 pagesSCM Jattaoi Rice MillAhmedNo ratings yet

- Stores and Inventory ManagementDocument19 pagesStores and Inventory Managementjagdeep_naidu92% (50)

- Activity Forecasted Transaction and OptionsDocument2 pagesActivity Forecasted Transaction and OptionsSantiago BuladacoNo ratings yet

- EMBA - Lecture 8Document8 pagesEMBA - Lecture 8Shariq EjazNo ratings yet

- Revenue Generation RRLDocument3 pagesRevenue Generation RRLWyler AkiNo ratings yet

- Advanced Financial Accounting and Reporting (CPALE Review)Document3 pagesAdvanced Financial Accounting and Reporting (CPALE Review)Micko LagundinoNo ratings yet

- Cost and Management AccountingDocument2 pagesCost and Management AccountingSantosh ThakurNo ratings yet

- Yaba, Brixzel's AssignmentDocument4 pagesYaba, Brixzel's AssignmentYaba Brixzel F.No ratings yet

- Stock ManagementDocument5 pagesStock ManagementAounaiza AhmedNo ratings yet

- Philippine Accounting Standards: InvetoriesDocument21 pagesPhilippine Accounting Standards: InvetoriesCASTILLO JOSIAH ANDREI V.No ratings yet

- Cma Pac Inventory Valuation Test SolDocument2 pagesCma Pac Inventory Valuation Test SolHassan TanveerNo ratings yet