Professional Documents

Culture Documents

Taxation Tutorial 5 Answers

Taxation Tutorial 5 Answers

Uploaded by

Kay CheungOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Taxation Tutorial 5 Answers

Taxation Tutorial 5 Answers

Uploaded by

Kay CheungCopyright:

Available Formats

TUTORIAL 5 SUGGESTED ANSWERS

Answer to Question 1

The gain will be considered as a trading profit if it can be established that she has

carried on a trade or business or an adventure in the nature of trade. Relevant factors

of badges of trade are:

(a) whether the assets being acquired were likely to be subjects of speculation or

long term investment or own personal enjoyment or use;

(b) the frequency of similar transactions;

(c) the period of holding;

(d) the motive of acquisition — whether profits making by resale or otherwise;

(e) the circumstances responsible for disposal;

(f) any supplementary work done on the assets; and

(g) how the acquisition was financed.

Commodity futures are likely to be acquired for speculation. One Board of Review case

distinguished between trading and speculation and ruled that mere speculation did not

necessarily prove that a trade or an adventure in the nature of trade has been carried out.

Ultimately, whether a trade is carried on is a question of fact to be determined by

reference to all circumstances of the particular case.

Answer to Question 2

a) Taxable-trading income

b) Not taxable-offshore income

c) Not taxable-capital gain

d) Not taxable-profit already taxed exempted in the IRO, s26

e) Not taxable-no permanent establishment in HK

Answer to Question 3

The manufacturing in Shanghai has been contracted by ABC to a sub-contractor (whether

a related party or not) and paid its subcontracting fees on an arm’s length basis, and the

involvement of ABC in the manufacturing process is minimal, the profits will not be

apportioned. Taxability of such profits will be determined on the same basis as a

commodities or goods trading business.

Answer to Question 4

a)

The sales contract is effected in Hong Kong as the purchase order is accepted in

Hong Kong by faxing the sales confirmation in Hong Kong.

The sales profits are taxable in Hong Kong.

b)

ABC Co has received and accepted US Customer B’s order in Hong Kong.

It also issues purchase order in Hong Kong to the Chinese factory.

The sale is taxable in Hong Kong

c)

the sales agreement is negotiated & concluded in Hong Kong

the sales profits are taxable in Hong Kong.

d)

Both the purchase and sales contracts are negotiated and concluded outside Hong

Kong (in China and US)

the sales profits are not subject to tax in Hong Kong.

e)

The sales profits have a foreign source as both the purchase and sales contracts

are negotiated and concluded outside Hong Kong.

Care should be taken where “the agent” is a related company.

Refer to ING Baring Case.

You might also like

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- Payslip 2023 2024 5 100000000546055 IGSL PDFDocument1 pagePayslip 2023 2024 5 100000000546055 IGSL PDFKapilNo ratings yet

- Midland Energy ReportDocument13 pagesMidland Energy Reportkiller dramaNo ratings yet

- Chapter 9: Substantive Test of Receivables and Sales The Audit of Receivables and Revenue Represents Significant Audit Risk BecauseDocument4 pagesChapter 9: Substantive Test of Receivables and Sales The Audit of Receivables and Revenue Represents Significant Audit Risk BecauseGirlie SisonNo ratings yet

- Toa 10 001Document7 pagesToa 10 001JohnAllenMarillaNo ratings yet

- Cofee Cafa Business PlanDocument32 pagesCofee Cafa Business PlanMuhammad Abdullah91% (11)

- Case Study US CMA Revenue RecognitionDocument6 pagesCase Study US CMA Revenue RecognitionG. DhanyaNo ratings yet

- IFASsDocument12 pagesIFASsrameelamirNo ratings yet

- IAS 18 Part B RevenueDocument10 pagesIAS 18 Part B RevenueKatreena Mae ConstantinoNo ratings yet

- Interactive Developmental Mathematics 1St Edition Rockswold Test Bank Full Chapter PDFDocument67 pagesInteractive Developmental Mathematics 1St Edition Rockswold Test Bank Full Chapter PDFluongsophieixvqp100% (7)

- Interactive Developmental Mathematics 1st Edition Rockswold Test BankDocument50 pagesInteractive Developmental Mathematics 1st Edition Rockswold Test Bankhoatuyenbm5k100% (28)

- MODAUD2 Unit 10 Audit of Revenues T31516Document6 pagesMODAUD2 Unit 10 Audit of Revenues T31516mimi96No ratings yet

- DLL &LP, Ifrs (Uk), Mba Email Id: Mob: 09820061049/09323061049Document52 pagesDLL &LP, Ifrs (Uk), Mba Email Id: Mob: 09820061049/09323061049ssanjitkumarNo ratings yet

- Separate Summary of Answers For Every ProblemDocument1 pageSeparate Summary of Answers For Every ProblemcpacpacpaNo ratings yet

- Theory Questions 5 PDF FreeDocument5 pagesTheory Questions 5 PDF FreeSamsung AccountNo ratings yet

- Theory QuestionsDocument5 pagesTheory Questionsjhobs100% (1)

- Mock Cpa Board Exams Rfjpia R 12 WDocument17 pagesMock Cpa Board Exams Rfjpia R 12 Wlongix100% (2)

- Business Combination Q3Document1 pageBusiness Combination Q3Sweet EmmeNo ratings yet

- Lecture SessionDocument24 pagesLecture SessionChela PruNo ratings yet

- Mock Cpa Board Exams - Rfjpia r-12 - W.ansDocument17 pagesMock Cpa Board Exams - Rfjpia r-12 - W.anssamson jobNo ratings yet

- WEEK 11 FAR T Income Revenue Net IncomeDocument5 pagesWEEK 11 FAR T Income Revenue Net IncomeJiyong OppaNo ratings yet

- Theory of Accounts - ReviewerDocument24 pagesTheory of Accounts - ReviewerKristel OcampoNo ratings yet

- L6 - Taxation of Business Income - Lecture Notes - Mar 2024Document19 pagesL6 - Taxation of Business Income - Lecture Notes - Mar 2024zhuyf.tiNo ratings yet

- Chapter 8 Revenue Recognition: 1. ObjectivesDocument16 pagesChapter 8 Revenue Recognition: 1. ObjectivesCharles MK ChanNo ratings yet

- D4Document13 pagesD4neo14No ratings yet

- Review 105 - Day 4 Theory of AccountsDocument13 pagesReview 105 - Day 4 Theory of Accountschristine anglaNo ratings yet

- Installment Sales Practice Material With SolutionDocument10 pagesInstallment Sales Practice Material With SolutionDenmar LibreNo ratings yet

- Ia Midterm PDFDocument128 pagesIa Midterm PDFsunthatburns00No ratings yet

- Financial Statements - NewDocument23 pagesFinancial Statements - NewLawraNo ratings yet

- Theory of AccountsDocument38 pagesTheory of AccountsJoovs JoovhoNo ratings yet

- Extra 2Document2 pagesExtra 2Ahmed GemyNo ratings yet

- Chapter 5 - Combined ProfitsTax-PDPADocument42 pagesChapter 5 - Combined ProfitsTax-PDPAjack hoNo ratings yet

- All Subjects - CCDocument11 pagesAll Subjects - CCMJ YaconNo ratings yet

- Jose Maria College College of Business Education: Audit TheoryDocument10 pagesJose Maria College College of Business Education: Audit TheoryMendoza Ron NixonNo ratings yet

- Theory of AccountsDocument23 pagesTheory of AccountsJoseph SalidoNo ratings yet

- Islamic Internatinal Trade Financing Jan 2018: Supply Demand Cost of LaborDocument8 pagesIslamic Internatinal Trade Financing Jan 2018: Supply Demand Cost of Laboraisyah11495No ratings yet

- Auditing-ProblemsDocument9 pagesAuditing-ProblemsTHRISHIA ANN SOLIVANo ratings yet

- Accounting For Merchandising OperationsDocument7 pagesAccounting For Merchandising OperationsRakibul HasanNo ratings yet

- Scan 0007Document2 pagesScan 0007El-Sayed MohammedNo ratings yet

- Financial Analysis Placement TestDocument15 pagesFinancial Analysis Placement TestAbigail SubaNo ratings yet

- Accounting For Government and Non Profit OrganizationsDocument8 pagesAccounting For Government and Non Profit OrganizationsKurt Morin CantorNo ratings yet

- Theory of AccountsDocument17 pagesTheory of AccountsMarites ArcenaNo ratings yet

- Merger and AcquisitionsDocument19 pagesMerger and AcquisitionsBelle B.No ratings yet

- As 9Document6 pagesAs 9abhishekkapse654No ratings yet

- Theory of Accounts-ReviewerDocument27 pagesTheory of Accounts-ReviewerJeane BongalanNo ratings yet

- Audit Questionnaire Part 2Document7 pagesAudit Questionnaire Part 2Mendoza Ron NixonNo ratings yet

- CS Executive Old Paper 3 Economic and Commercial Law SA V0.3Document25 pagesCS Executive Old Paper 3 Economic and Commercial Law SA V0.3Raunak AgarwalNo ratings yet

- 2 Heads of ChargeDocument32 pages2 Heads of Chargexiu yingNo ratings yet

- Part - 1 - Dashboard - Revenue RecognitionDocument5 pagesPart - 1 - Dashboard - Revenue RecognitionbagayaobNo ratings yet

- Integ Buscom Part 1Document4 pagesInteg Buscom Part 1Ana Sy0% (1)

- Inventories and Investment Theories v2Document10 pagesInventories and Investment Theories v2Joovs JoovhoNo ratings yet

- Intermediate Accounting Canadian Canadian 6th Edition Beechy Test Bank DownloadDocument88 pagesIntermediate Accounting Canadian Canadian 6th Edition Beechy Test Bank DownloadWarren Whaley100% (21)

- Ias 18Document11 pagesIas 18user31415No ratings yet

- Contest FARDocument31 pagesContest FARTerence Jeff Tamondong67% (3)

- Revenue RecognitionDocument9 pagesRevenue Recognitionrietzhel22No ratings yet

- Textbook of Urgent Care Management: Chapter 7, Exit Transactions: The Process of Selling an Urgent Care CenterFrom EverandTextbook of Urgent Care Management: Chapter 7, Exit Transactions: The Process of Selling an Urgent Care CenterNo ratings yet

- Sistani, Ayatollah. Islamic Law. Chapter On Khums.Document10 pagesSistani, Ayatollah. Islamic Law. Chapter On Khums.Christopher TaylorNo ratings yet

- Aqa Accn1 QP Jun12Document16 pagesAqa Accn1 QP Jun12zahid_mahmood3811No ratings yet

- Annex 1: Monthly Remittance Return of Income Taxes Withheld On Compensation DescriptionDocument2 pagesAnnex 1: Monthly Remittance Return of Income Taxes Withheld On Compensation DescriptionAlbert BernardoNo ratings yet

- Sample Computation of Capital Gains Tax On Sale of Real PropertyDocument9 pagesSample Computation of Capital Gains Tax On Sale of Real PropertyNardsdel RiveraNo ratings yet

- Financial Accounting Report: Financial Analysis of Media & Entertainment IndustryDocument61 pagesFinancial Accounting Report: Financial Analysis of Media & Entertainment IndustryJOHN VL FANAINo ratings yet

- Consumer LEADDocument47 pagesConsumer LEADRohan SanejaNo ratings yet

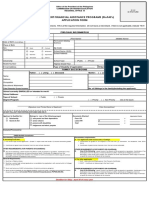

- Ched Student Financial Assistance Programs (Stufaps) Application FormDocument1 pageChed Student Financial Assistance Programs (Stufaps) Application FormLouie M LuceñoNo ratings yet

- CapSim Demonstration Student Notes SP13Document8 pagesCapSim Demonstration Student Notes SP13NRLDCNo ratings yet

- Financial LeverageDocument24 pagesFinancial LeverageCHRISTIAN FOKALIENo ratings yet

- Tax 2 - Midterm Quiz 2-ModifiedDocument6 pagesTax 2 - Midterm Quiz 2-ModifiedUy SamuelNo ratings yet

- Interview Chetan ParikhDocument11 pagesInterview Chetan Parikhpatel.prashantn8897No ratings yet

- Cost Accounting 1-3 FinalDocument21 pagesCost Accounting 1-3 FinalChristian Blanza LlevaNo ratings yet

- Tax PlanningDocument26 pagesTax Planningpuneeta chughNo ratings yet

- International Accounting Group Assignment WilkersonDocument27 pagesInternational Accounting Group Assignment WilkersonToshimichi ItoNo ratings yet

- Taxes On Natural ResourcesDocument28 pagesTaxes On Natural ResourcesObeng CliffNo ratings yet

- 1b. Cost Calculation Sheet - SINTEX Anaerobic Septic Tank (AST Model)Document1 page1b. Cost Calculation Sheet - SINTEX Anaerobic Septic Tank (AST Model)surajNo ratings yet

- Lecture 5 Cost PDFDocument39 pagesLecture 5 Cost PDFAmir Kan75% (4)

- All Subj - Board Exam-Picpa EeDocument9 pagesAll Subj - Board Exam-Picpa EeMJ YaconNo ratings yet

- MUKANDDocument2 pagesMUKANDmakrand87No ratings yet

- Financial Accounting and Reporting-IIDocument6 pagesFinancial Accounting and Reporting-IIZahidNo ratings yet

- TRS StockvalDocument2 pagesTRS StockvalUcok DedyNo ratings yet

- Alternative Investments TestDocument18 pagesAlternative Investments TestkoosNo ratings yet

- PerfumeURS Perfumes ContratiposDocument5 pagesPerfumeURS Perfumes Contratiposܚܠܕܒܪܬ ܟܗNo ratings yet

- Basics of Accounting: By: Dr. Bhupendra Singh HadaDocument84 pagesBasics of Accounting: By: Dr. Bhupendra Singh HadaAryanSinghNo ratings yet

- Group Activity Questions Buss. MathDocument1 pageGroup Activity Questions Buss. MathIreneRoseMotas100% (1)

- Ratio AnalysisDocument17 pagesRatio AnalysisPGNo ratings yet

- Property Dispositions Solutions Manual Discussion QuestionsDocument55 pagesProperty Dispositions Solutions Manual Discussion Questionstrenn1100% (5)